Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

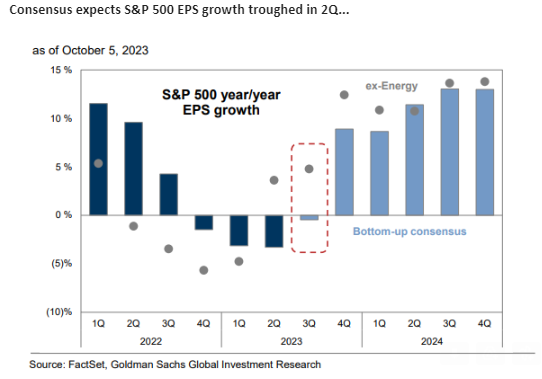

Beckham: Earnings estimates show a turn, with the cuts now in the rearview mirror

Data as of 10.05.2023

Data as of 10.05.2023

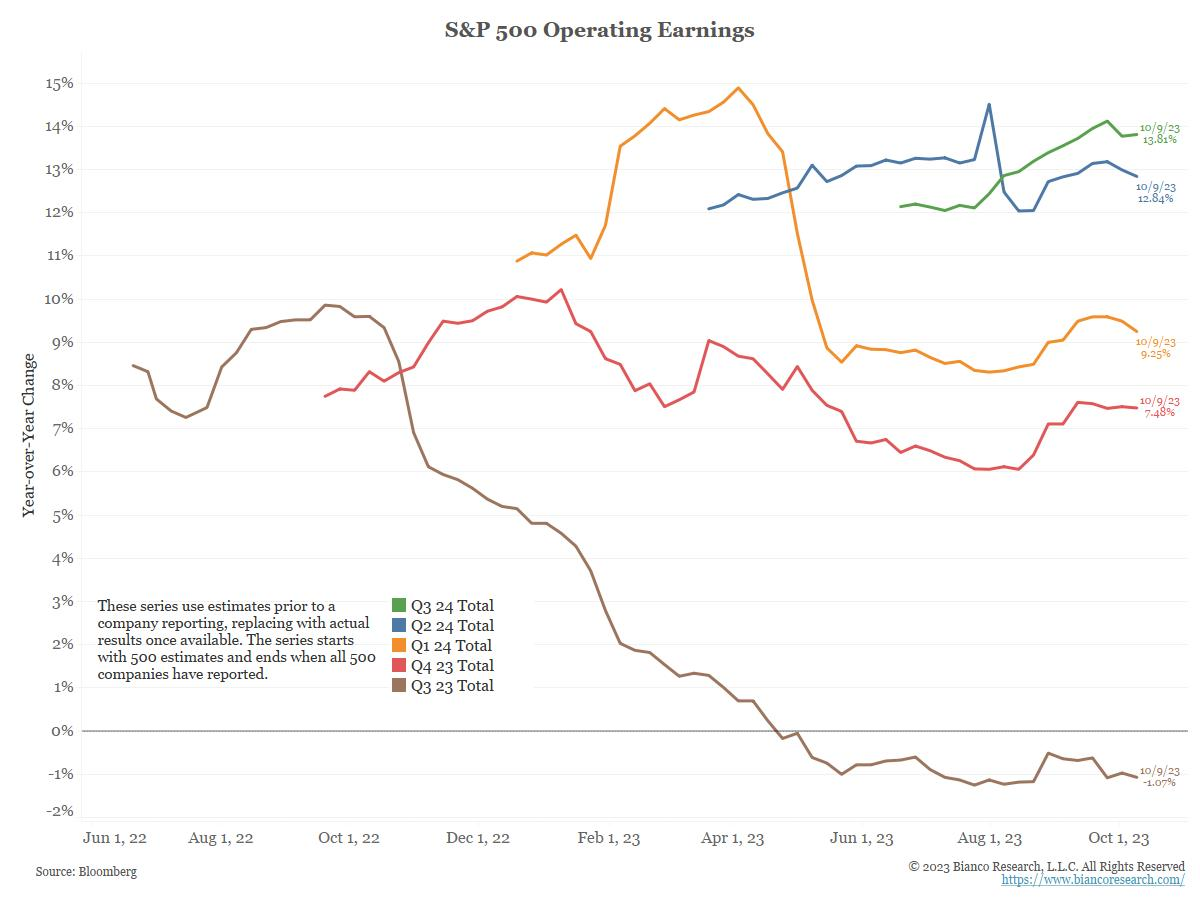

Dave: but it’s interesting to note that estimates further out were never really cut

Source: Bianco as of 10.09.2023

Source: Bianco as of 10.09.2023

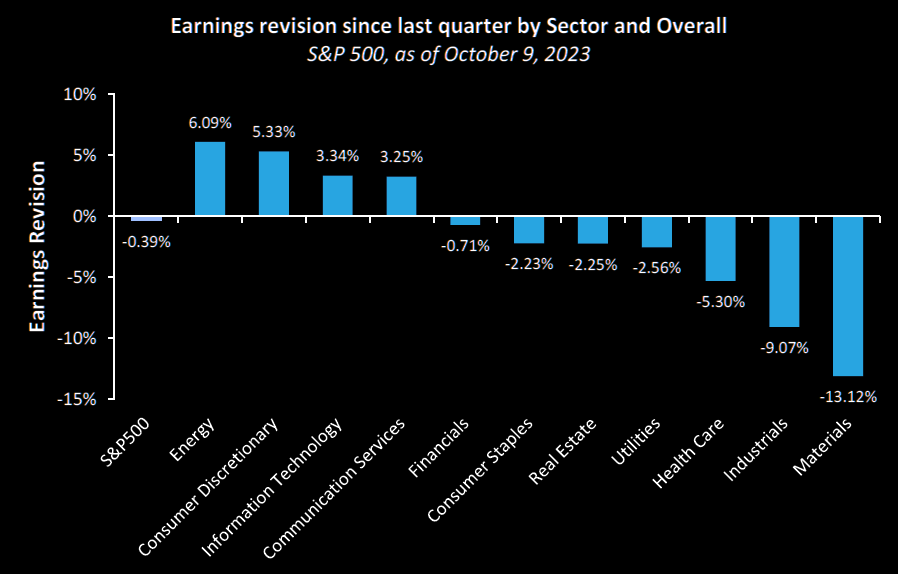

John Luke: and trends going into this season are really divided, depending on the sector

Source: Bernstein

Source: Bernstein

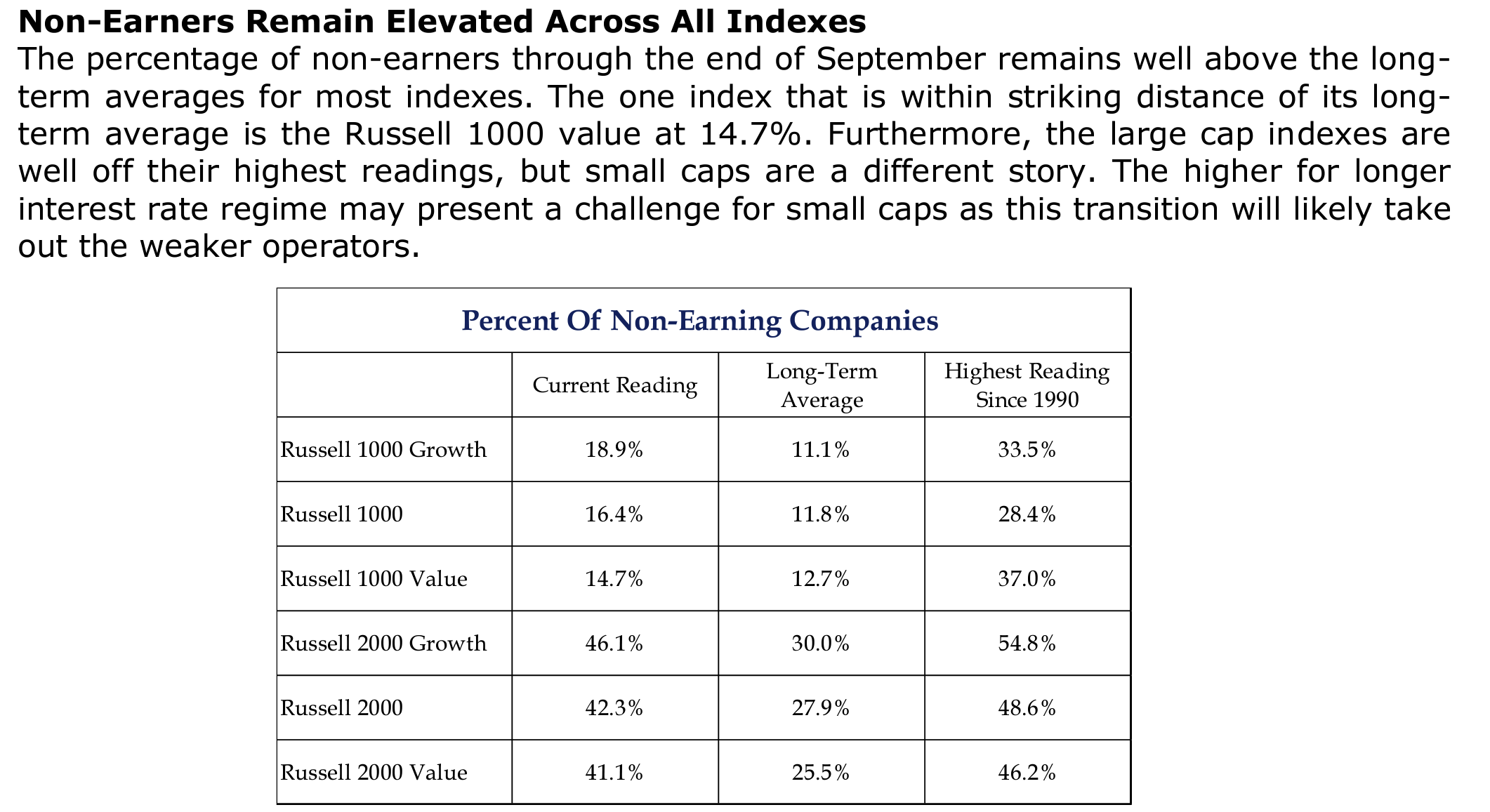

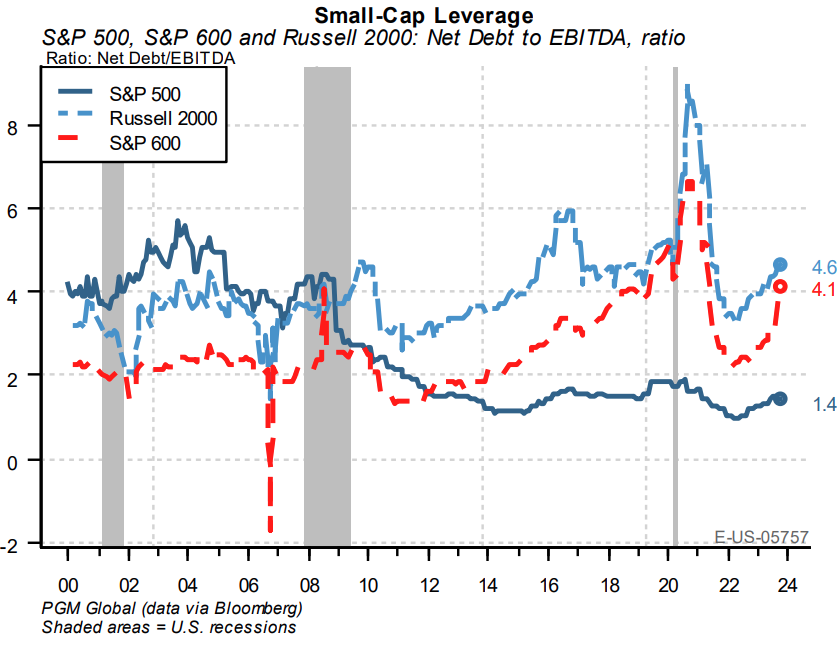

Brad: It’s also important to distinguish by size, as the rate hikes have impacted smaller companies much more than larger ones

Source: Strategas as of 10.10.2023

Source: Strategas as of 10.10.2023

Joseph: which accelerates the trend we’ve seen since the GFC in large caps staying more lean than small caps

Source: PGM as of 10.09.2023

Source: PGM as of 10.09.2023

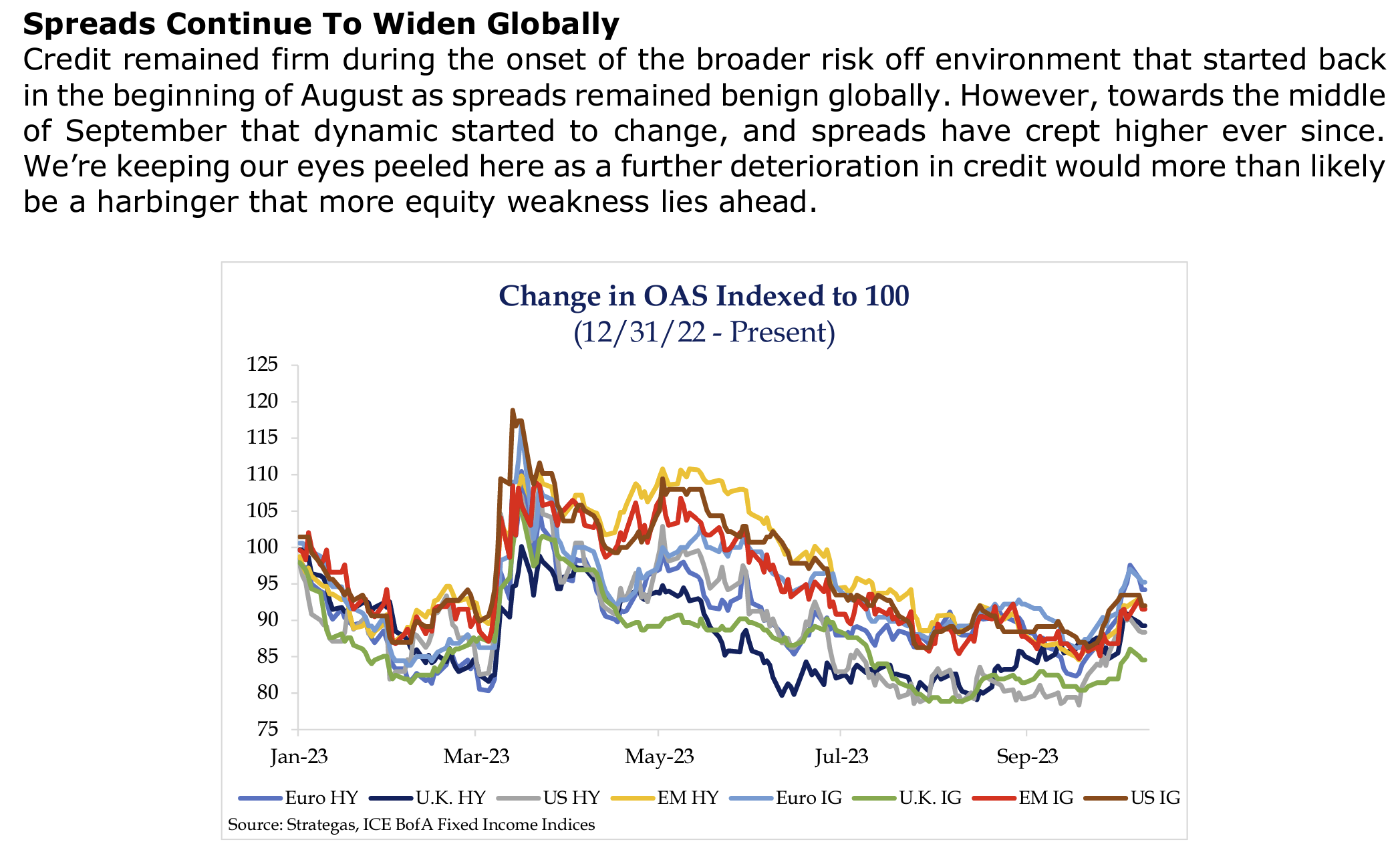

Dave: Credit spreads can be a canary in the coal mine, bouncing a bit but still near historic lows

Source: Strategas as of 10.12.2023

Source: Strategas as of 10.12.2023

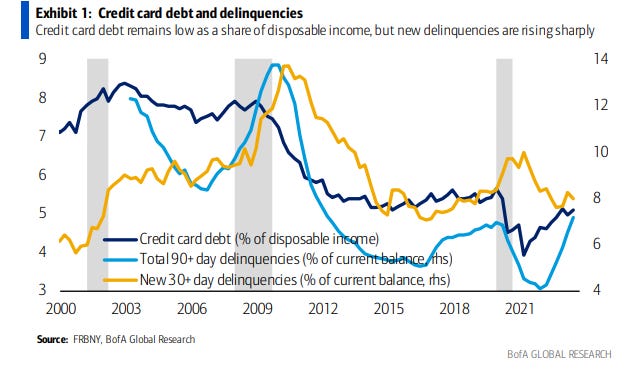

Dave: same with consumer credit, delinquencies bouncing from lows but general debt levels are low

Source: BofA as of 10.10.2023

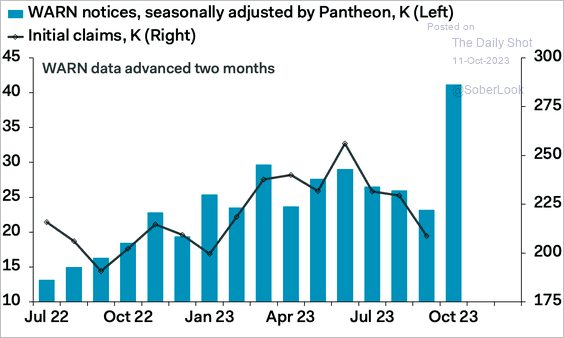

Brett: also watching jobless claims, they remain low but one leading indicator warrants a closer look

Source: Pantheon Macro via Daily Shot as of 10.12.2023

Source: Pantheon Macro via Daily Shot as of 10.12.2023

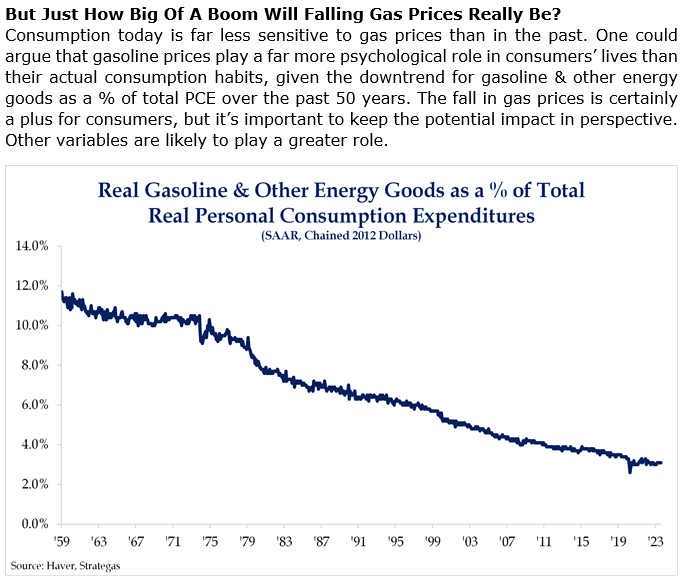

Brad: The price of gas gets all of the Main Street chatter, but its impact has consistently fallen over time

Data as of September 2023

Data as of September 2023

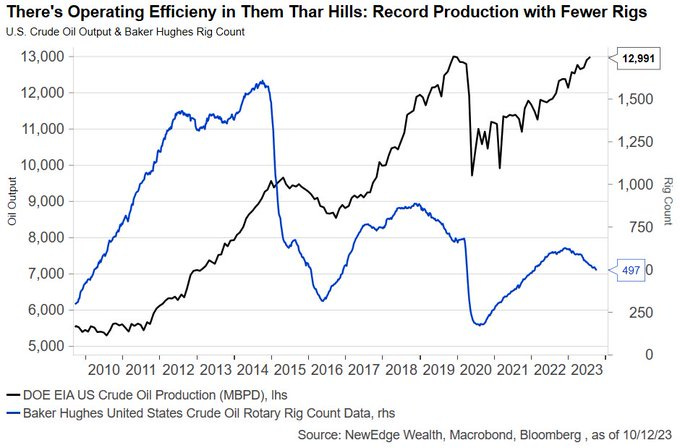

Joseph: and US energy producers have used technology to crank out extra oil per rig in recent years

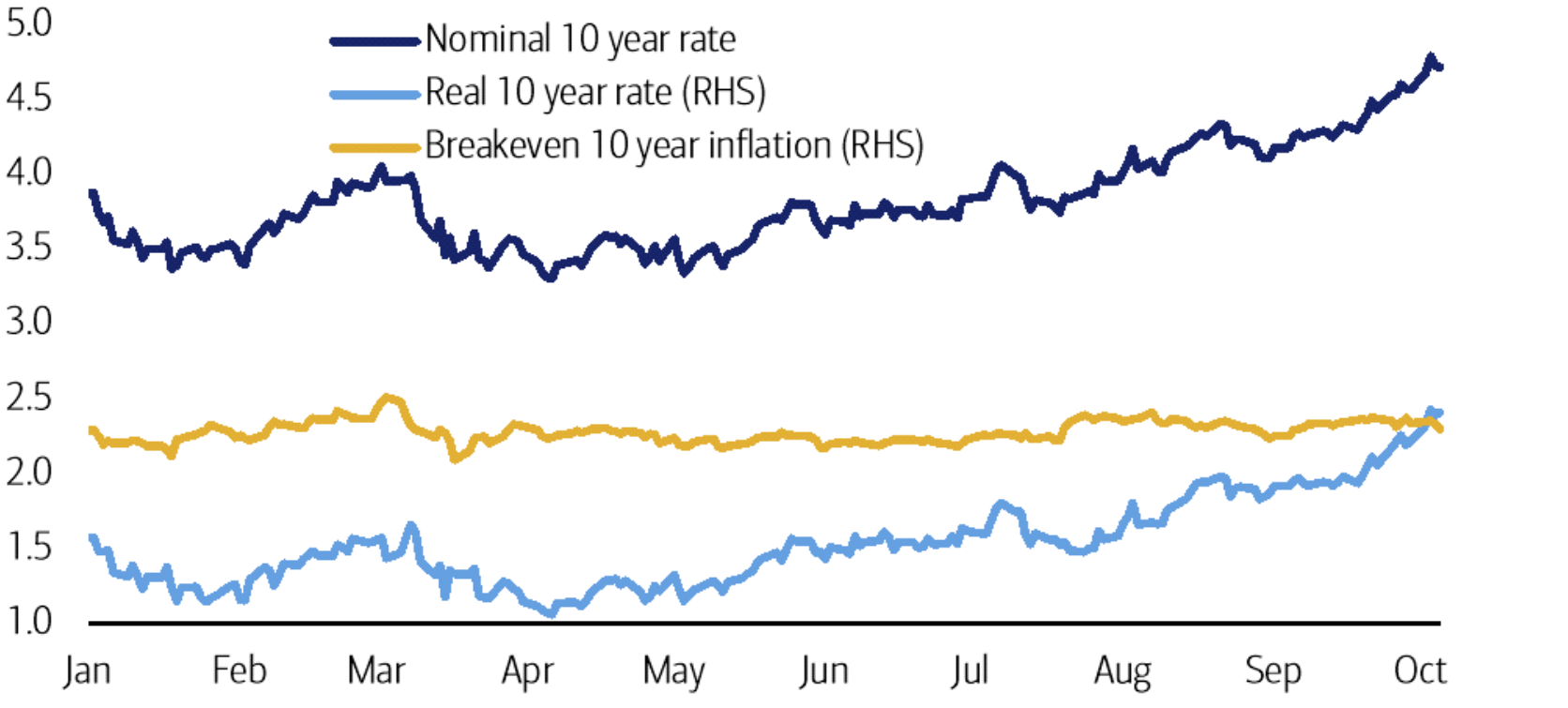

Dave: Rising real rates have been the story of the past year, as long-term inflation expectations haven’t budged

Source: BofA as of 10.09.2023

Source: BofA as of 10.09.2023

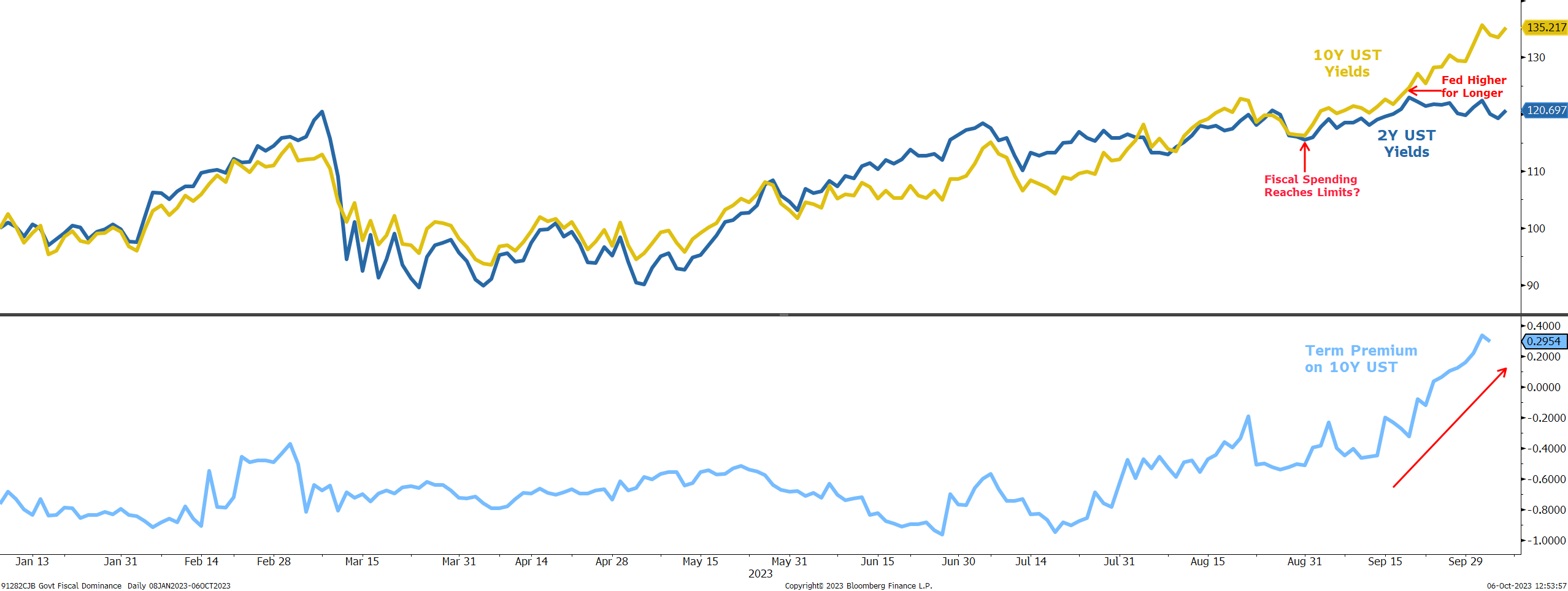

Dave: and the bond vigilantes are back, pushing the Federal government to slow its spending growth

Source: Morgan Stanley as of 10.06.2023

Source: Morgan Stanley as of 10.06.2023

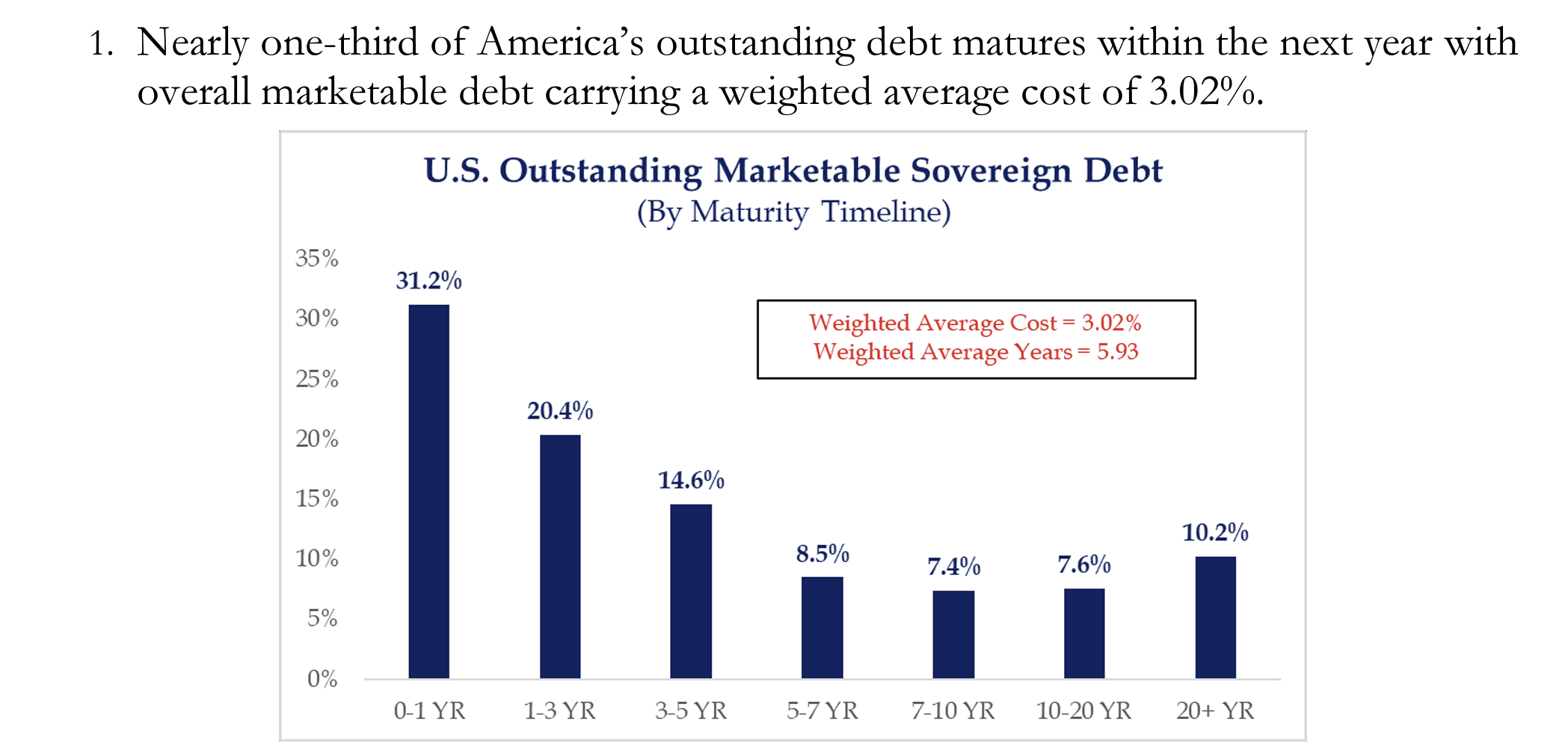

Dave: as if the looming wall of maturing federal debt shouldn’t already be putting the spenders on alert

Source: Strategas as of September 2023

Source: Strategas as of September 2023

Beckham: Take note, our chosen industry is the one deemed most ripe for artificial intelligence (AI) impact

Data as of September 2023

Data as of September 2023

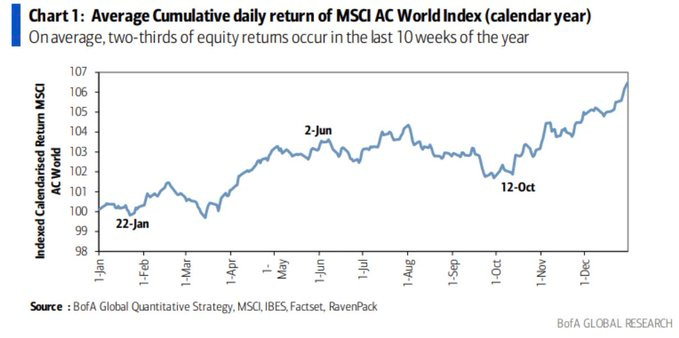

Brad: We don’t make our decisions based on the calendar, but mid-October through the end of the year has historically had a positive impact on returns

Data as of September 2023

Data as of September 2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2310-20.