Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

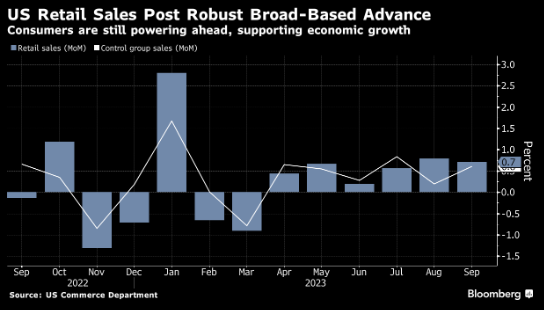

John Luke: September retail sales were too hot for the bond market’s liking, with the weakness spilling into equity valuations

Source: Bloomberg as of 10.17.2023

Source: Bloomberg as of 10.17.2023

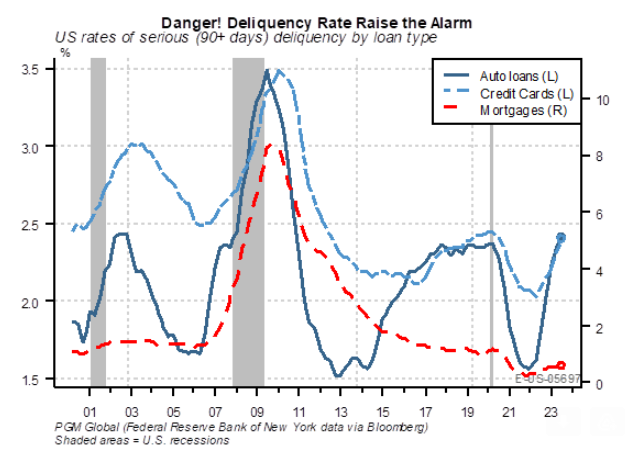

Beckham: but the tricky part now is that some areas are finally seeing weakness, like auto loans

Source: Pavilion as of 10.18.2023

Source: Pavilion as of 10.18.2023

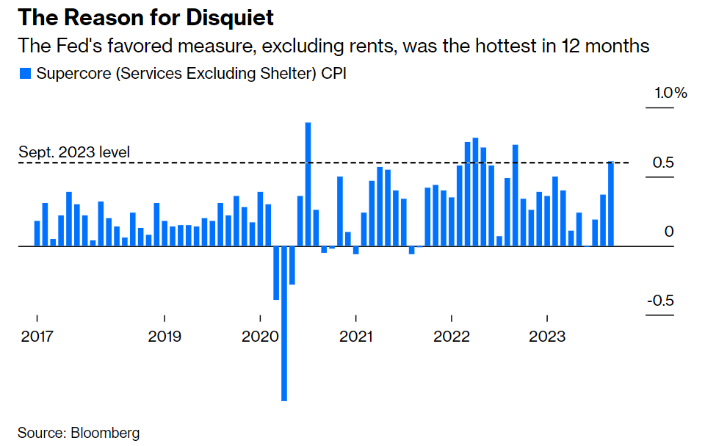

John Luke: Overall, the “Supercore CPI” remains higher than the Fed seems to want

Data as of 10.16.2023

Data as of 10.16.2023

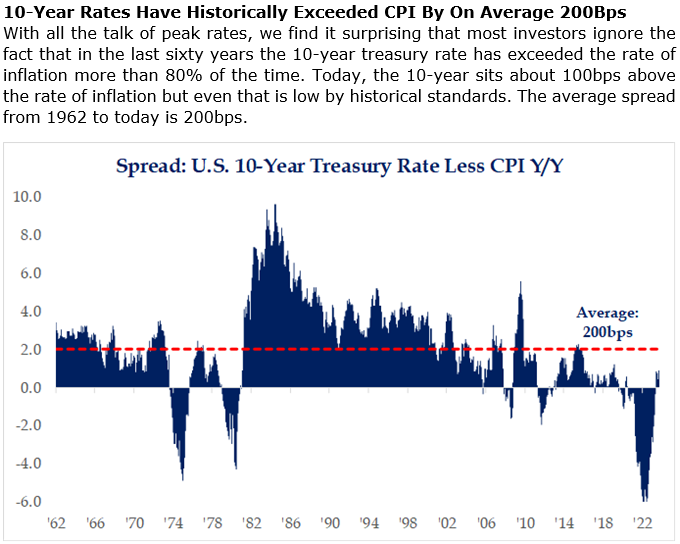

Beckham: and historically, 10 year bonds have yielded a good bit higher than CPI

Source: Strategas as of 10.17.2023

Source: Strategas as of 10.17.2023

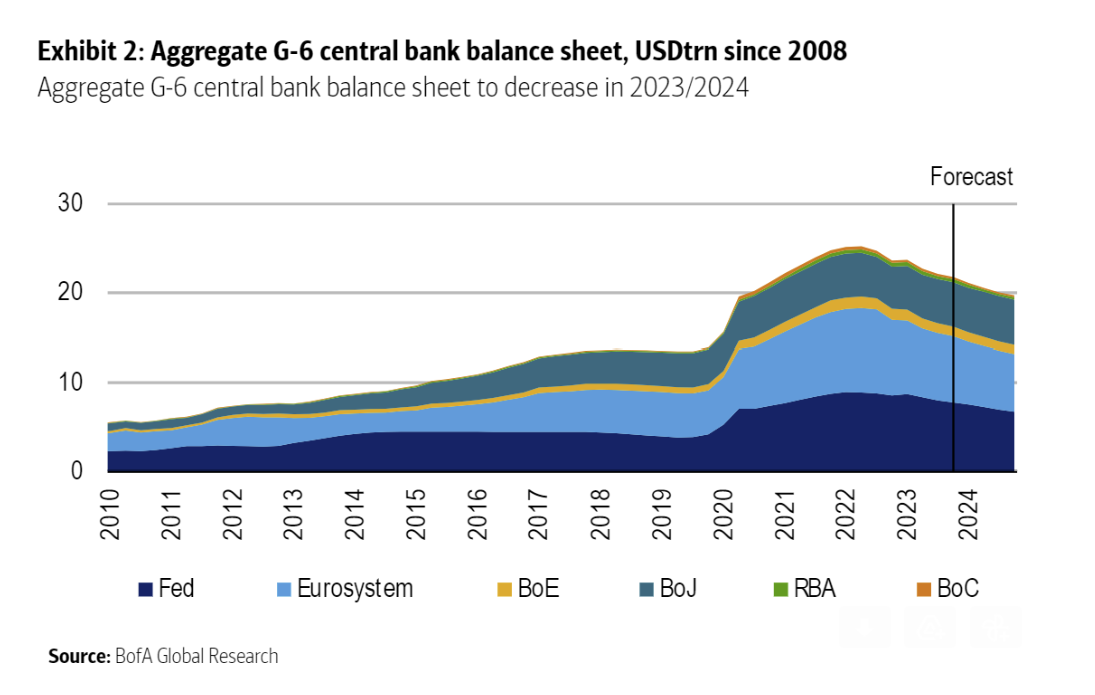

Dave: Globally, central bank balance sheets have been reversing the large expansion since the GFC

Data as of October 2023

Data as of October 2023

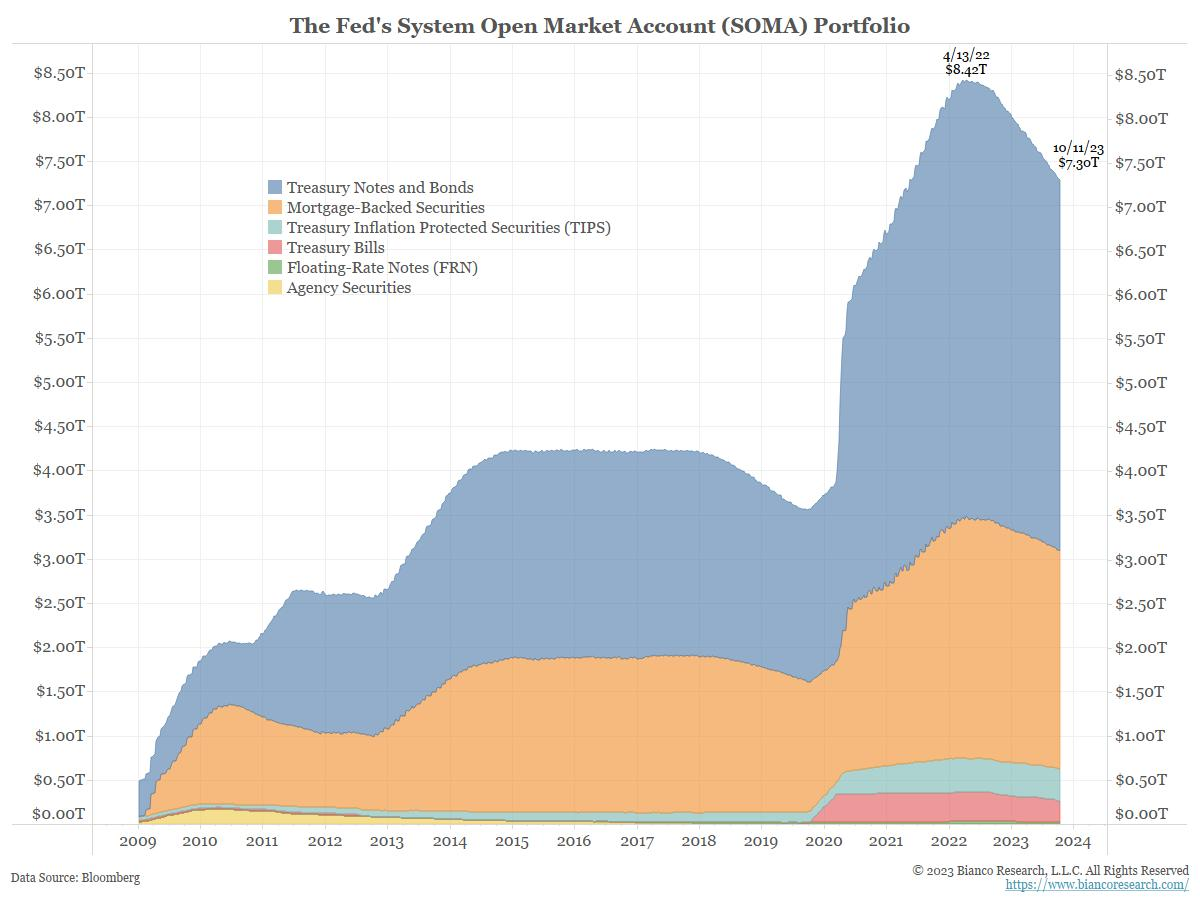

John Luke: with the US leading the way in both expansion and contraction

Source: Bianco as of 10.12.2023

Source: Bianco as of 10.12.2023

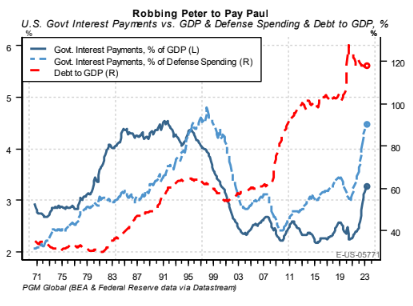

John Luke: Interest expense as a % of overall US government spending is expanding rapidly

Source: Pavilion as of September 2023

Source: Pavilion as of September 2023

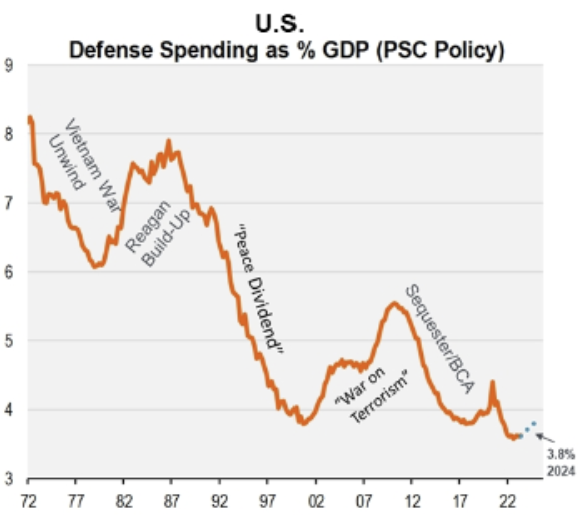

John Luke: at a time when defense spending is starting to grow from a trough

Source: Piper Sandler as of September 2023

Source: Piper Sandler as of September 2023

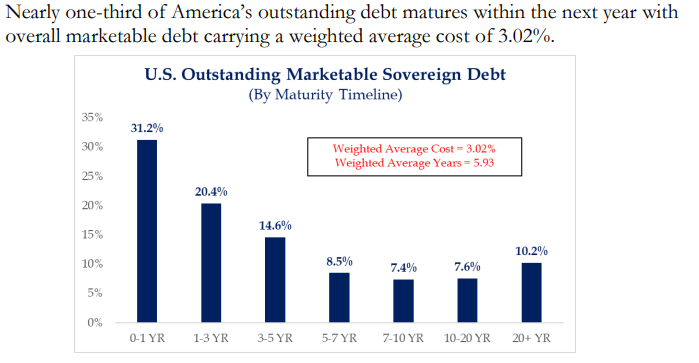

John Luke: with these expenses coming at a time when huge amounts of US government debt are coming due

Source: Strategas as of 10.16.2023

Source: Strategas as of 10.16.2023

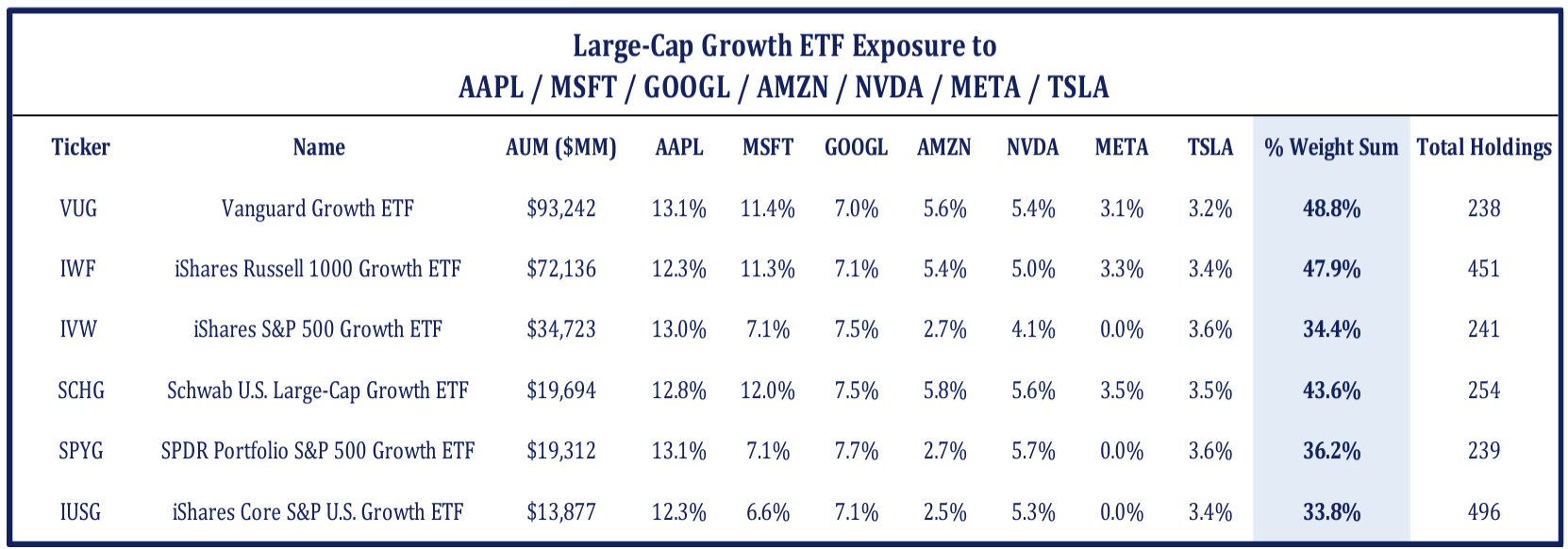

Dave: The heavily-discussed “Magnificent Seven” make up close to half of the widely-owned US growth funds

Source: Strategas as of 10.16.2023

Source: Strategas as of 10.16.2023

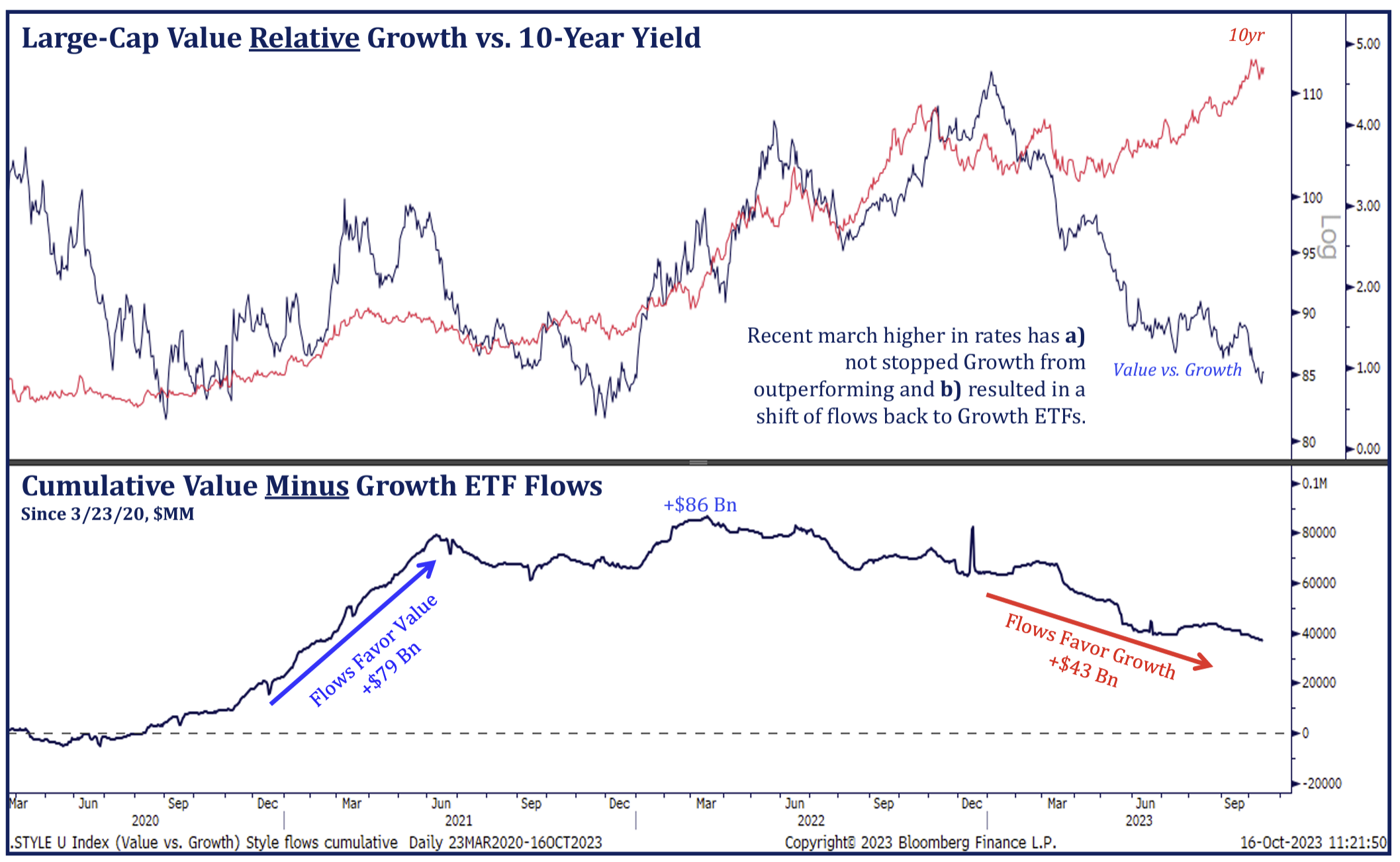

Dave: part of which is due to the nonstop money flows into growth funds vs. value funds

Source: Strategas as of 10.16.2023

Source: Strategas as of 10.16.2023

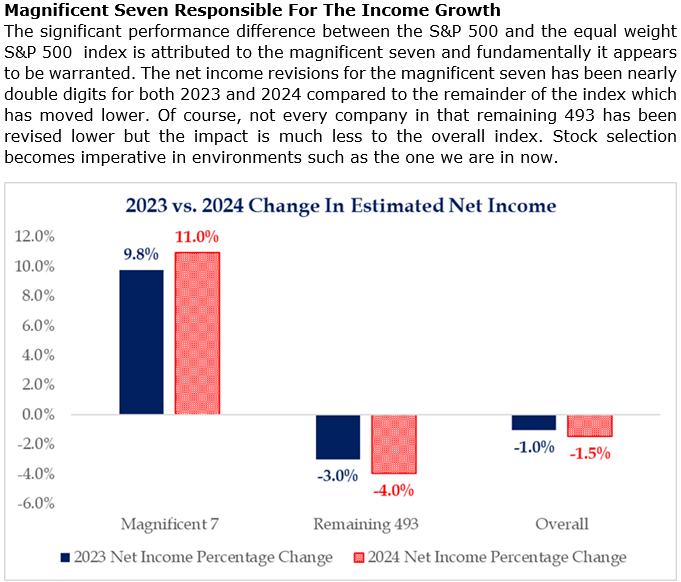

Brad: That said, those companies have indeed performed better at a business level

Source: Strategas as of 10.17.2023

Source: Strategas as of 10.17.2023

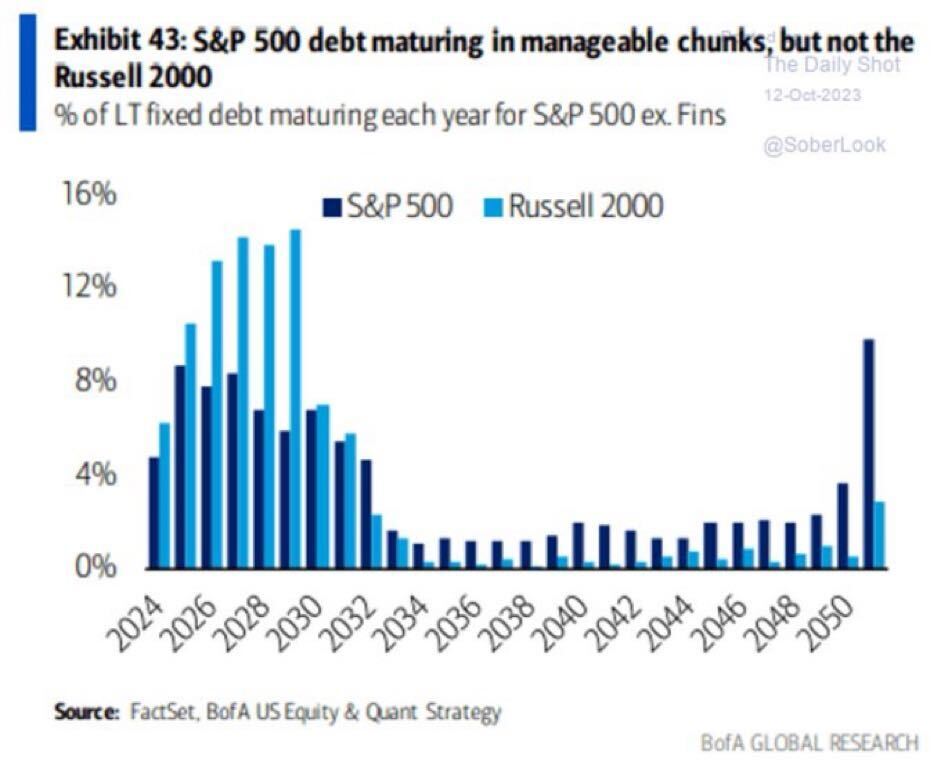

Brett: also seen in the use of debt by smaller companies vs. larger ones

Data as of October 2023

Data as of October 2023

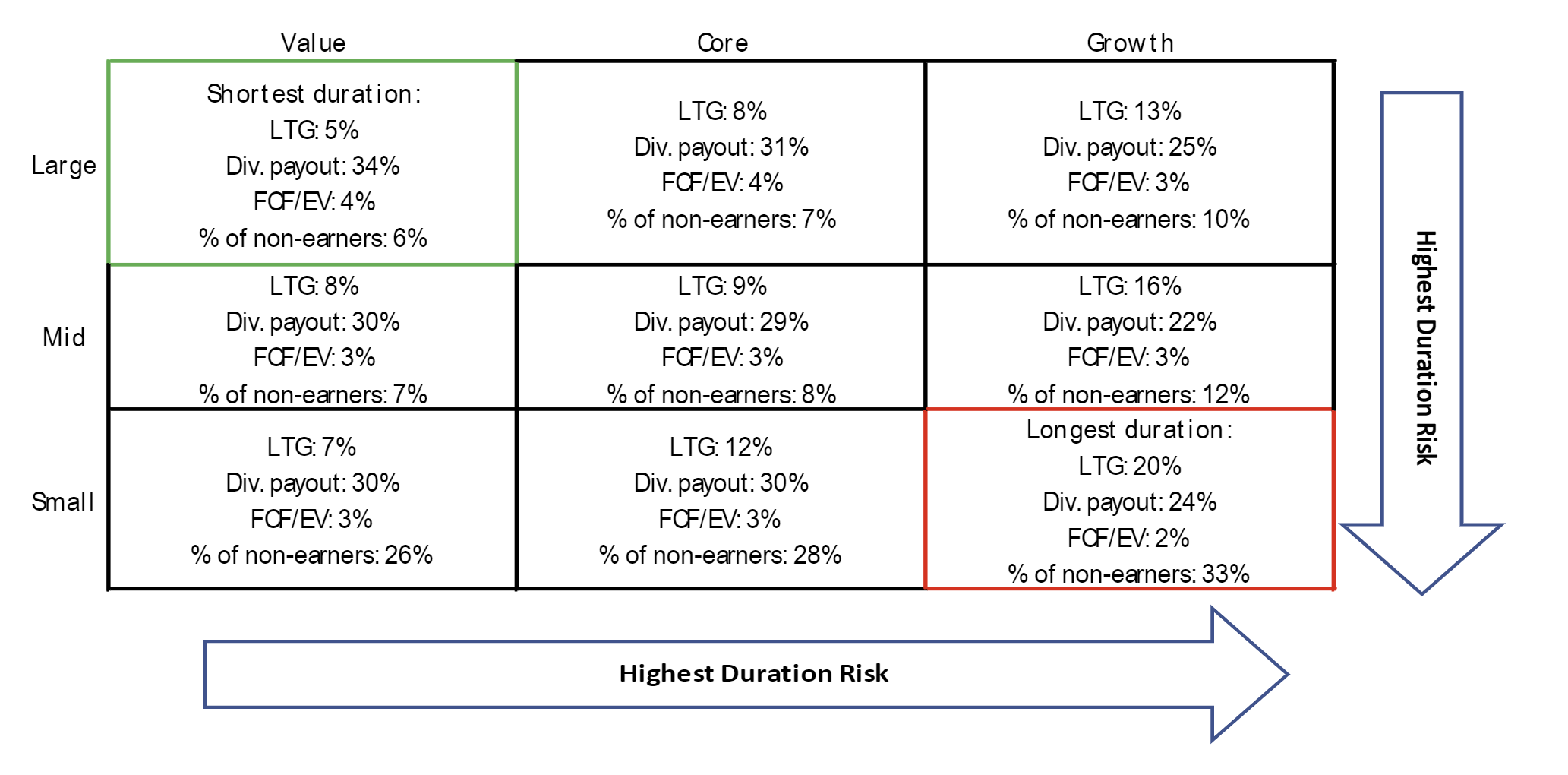

Dave: Can’t label companies as good/bad only by size, but there are some real differences in quality when you break out by size and style

Source: BofA as of September 2023

Source: BofA as of September 2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2310-20.