Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

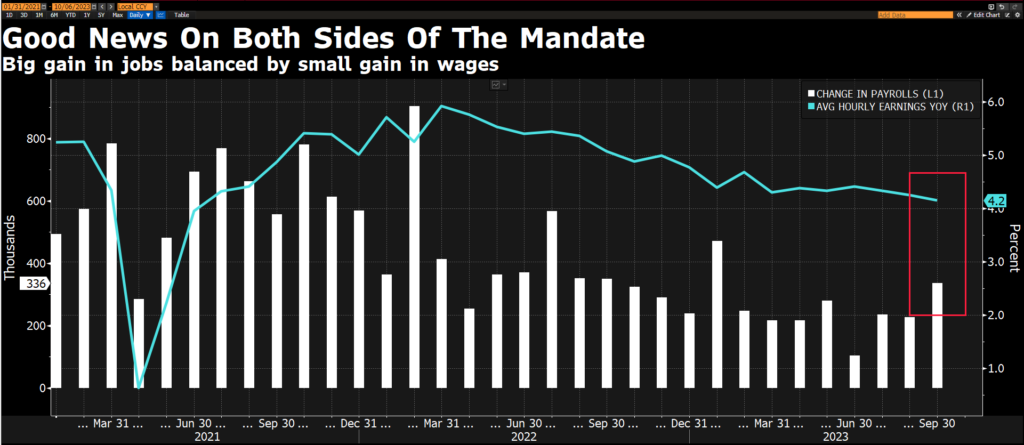

John Luke: The first reaction to the jobs report was to sell, but continued slowing of wage growth became a bullish takeaway

Source: Bloomberg as of 10.06.2023

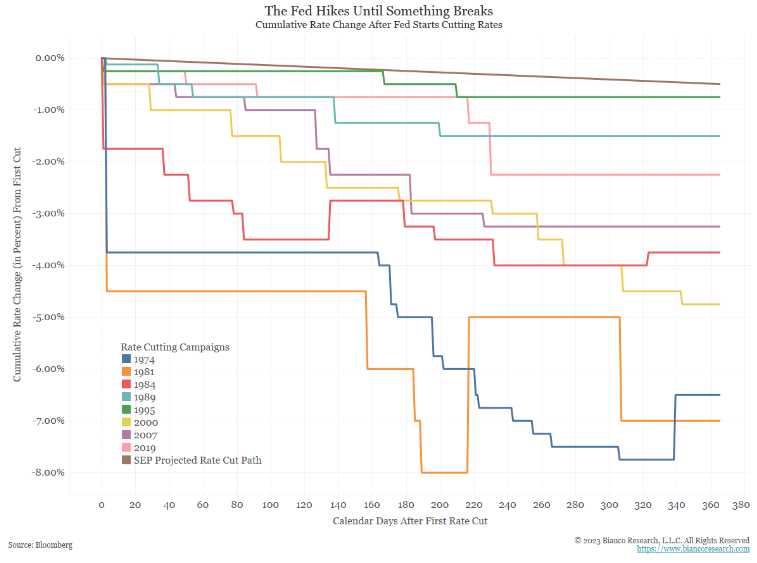

Joseph: even with the slowing wage growth, it would be out of the norm to just ease rates lower without a crisis

Data as of October 2023

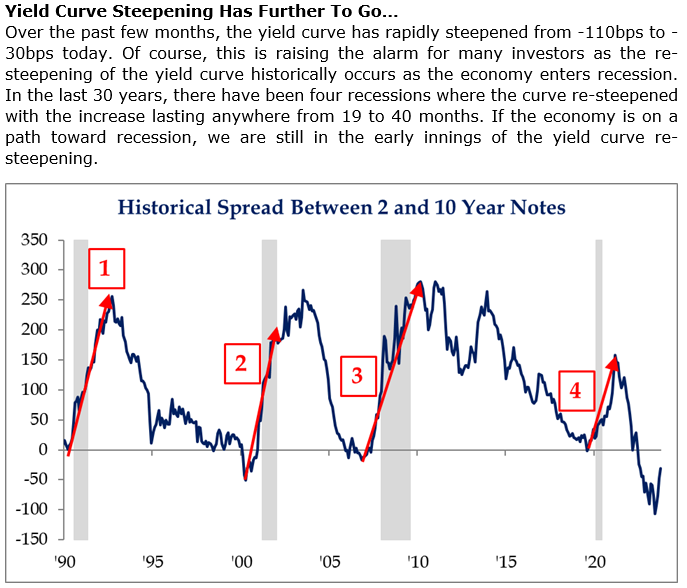

Brad: The inverted yield curve has been historic but the past few weeks have seen a shrink in its extremeness

Source: Strategas as of 10.04.2023

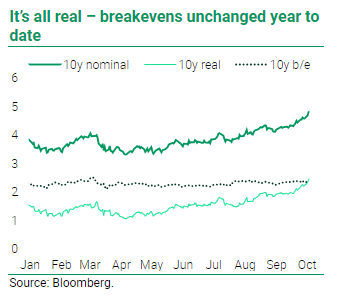

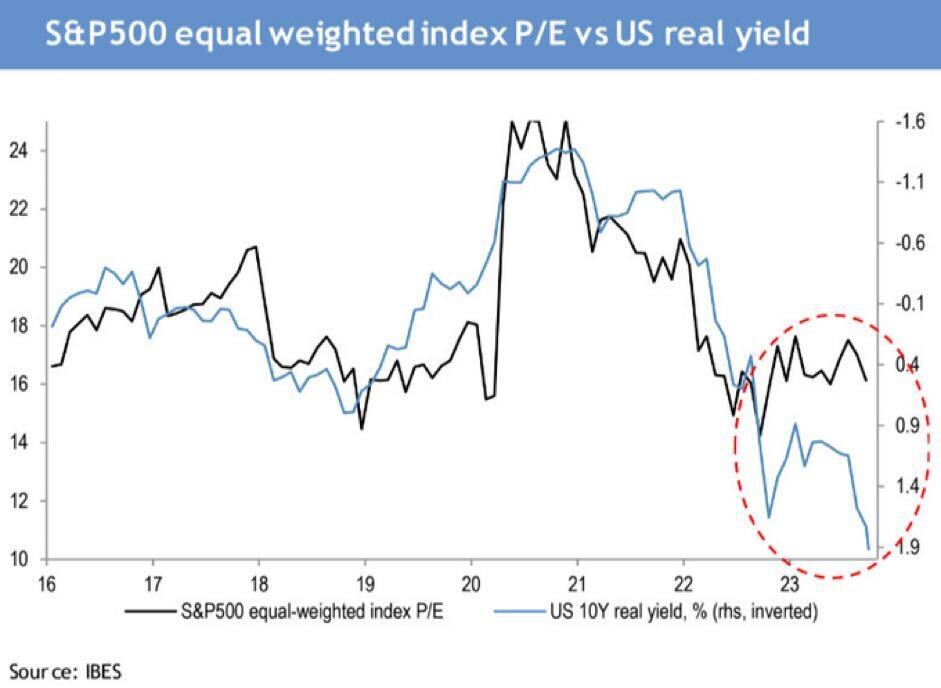

Joseph: It’s been real yields driving this year’s bump in rates, not expectations for higher long-term inflation

Source: TS Lombard as of 10.02.2023

John Luke: and rising real yields have historically been a contributor to lower valuations for stocks

Data as of October 2023

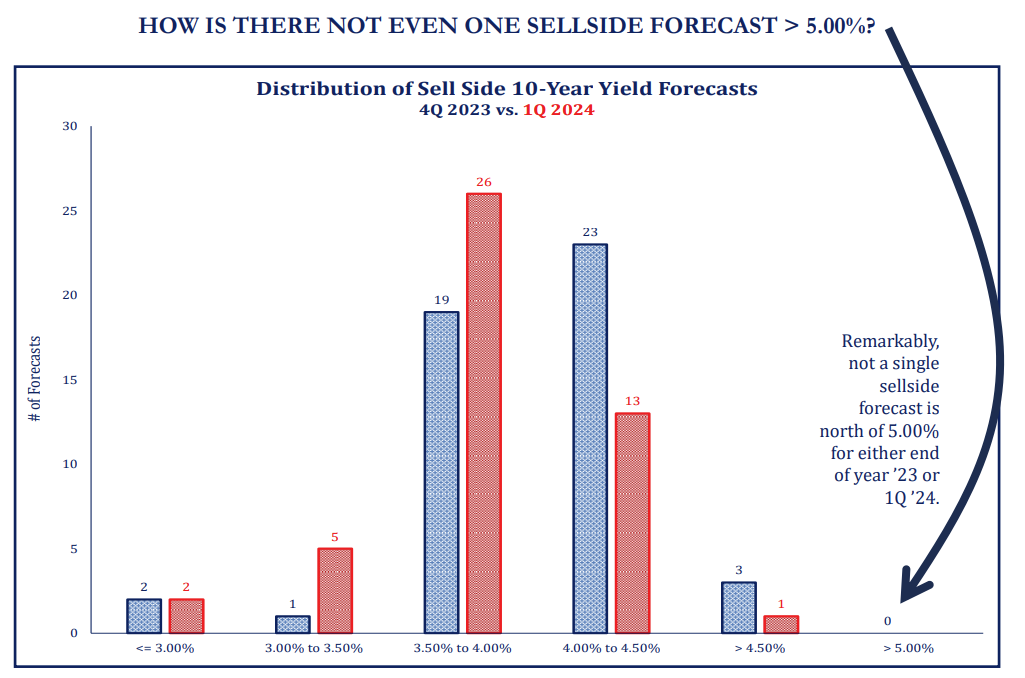

Dave: Despite the swift rise, no reporting analyst sees much more upside for 10 year rates

Source: Strategas as of 10.02.2023

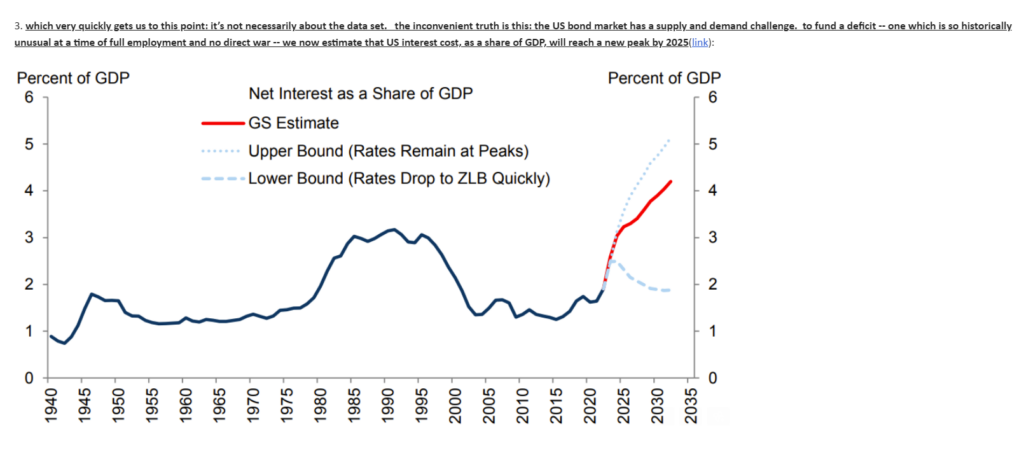

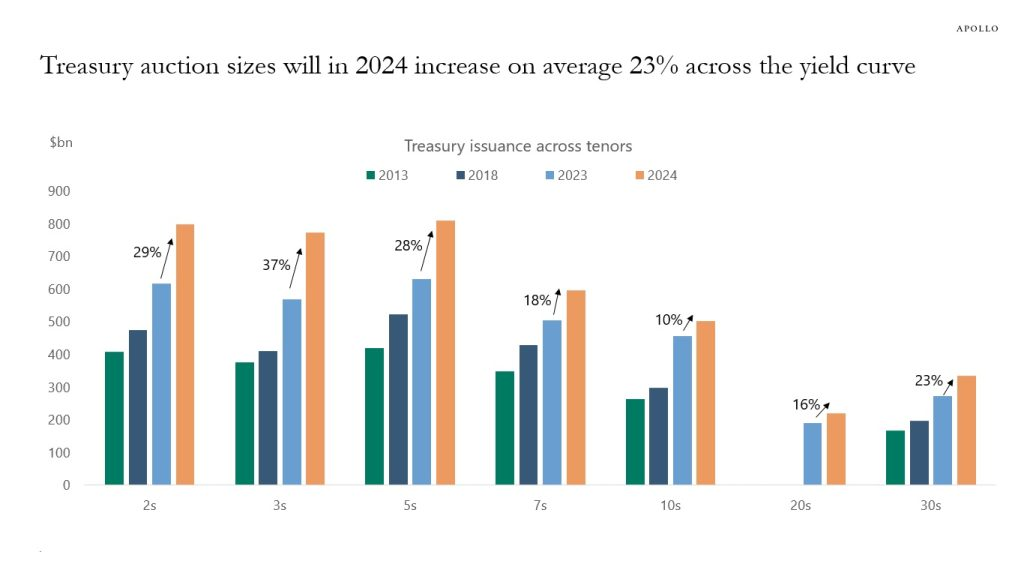

Mark: A rising concern for investors has been the steep rise in future interest expense for the US government

Source: Goldman Sachs as of September 2023

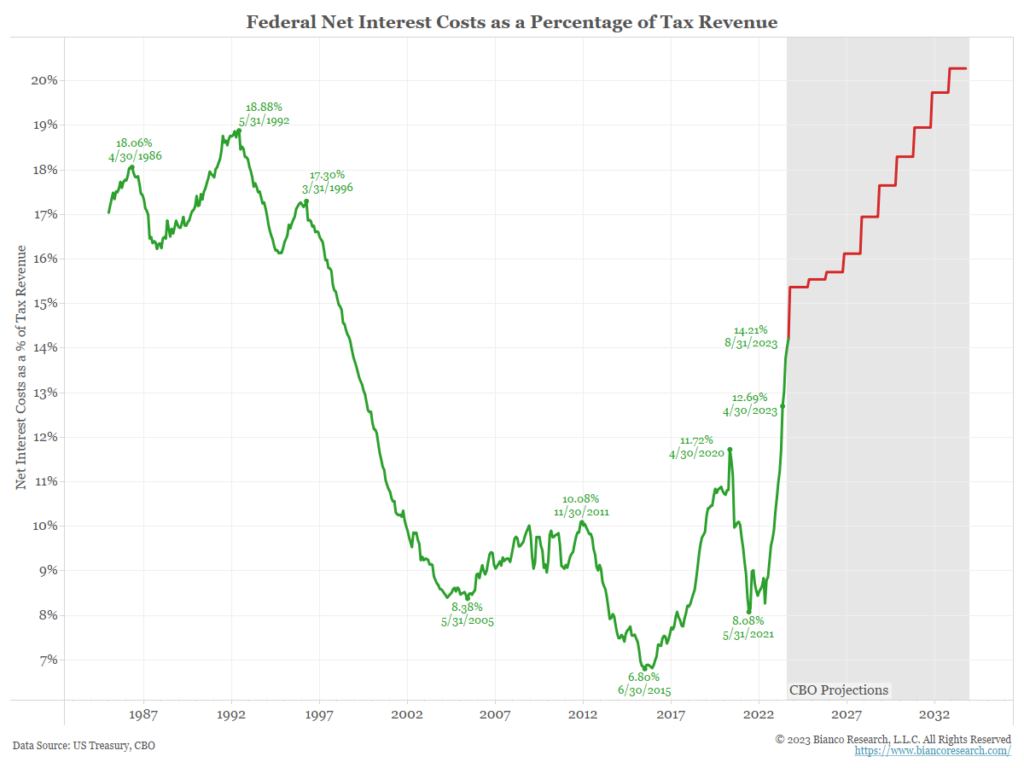

John Luke: also seen in debt costs in relation to tax revenues

Data as of September 2023

John Luke: resulting from higher rates but also higher government spending

Source: Apollo as of 10.04.2023

Source: Apollo as of 10.04.2023

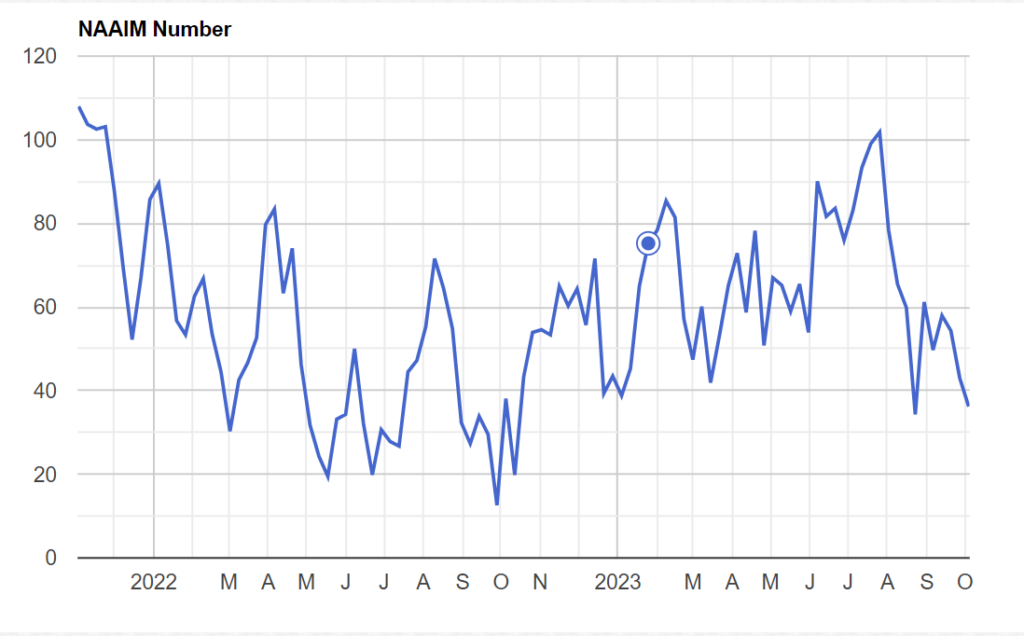

Beckham: Like clockwork, investment managers grow more cautious about stocks as prices fall

Source: NAAIM as of 10.02.2023

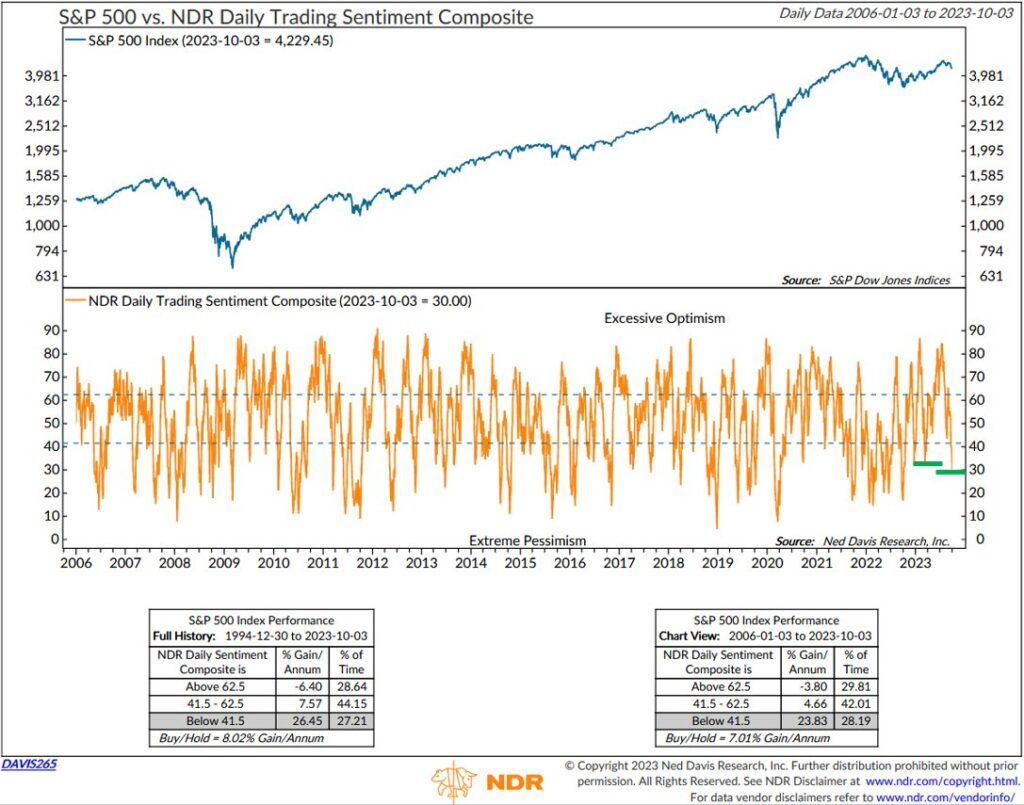

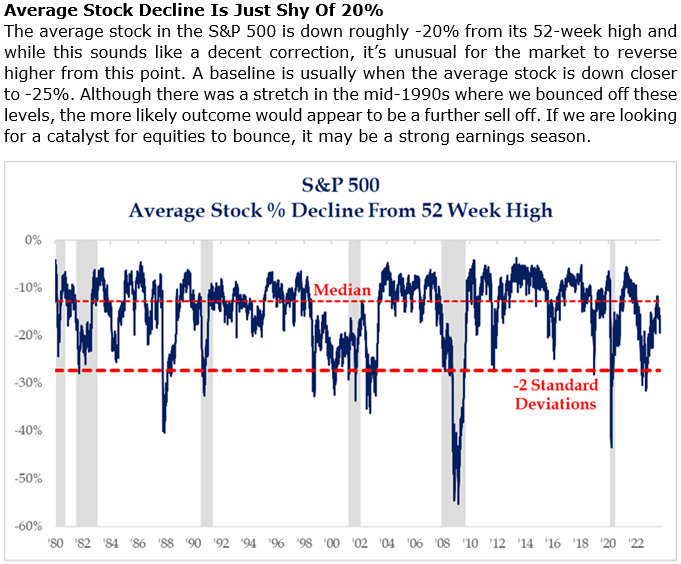

Beckham: Laying the groundwork for the next wall of worry for stocks

Data as of 10.03.2023

Dave: Earnings estimates as a whole have been rising from the spring lows

Source: Bernstein as of September 2023

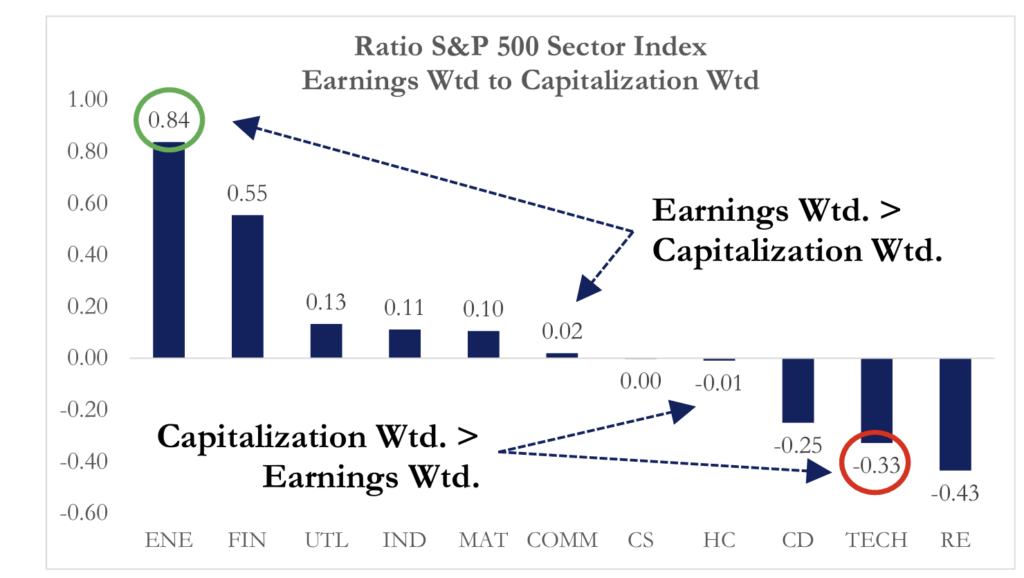

Dave: but there’s a wide range of contributors depending on which sector you’re watching

Source: Strategas as of 10.04.2023

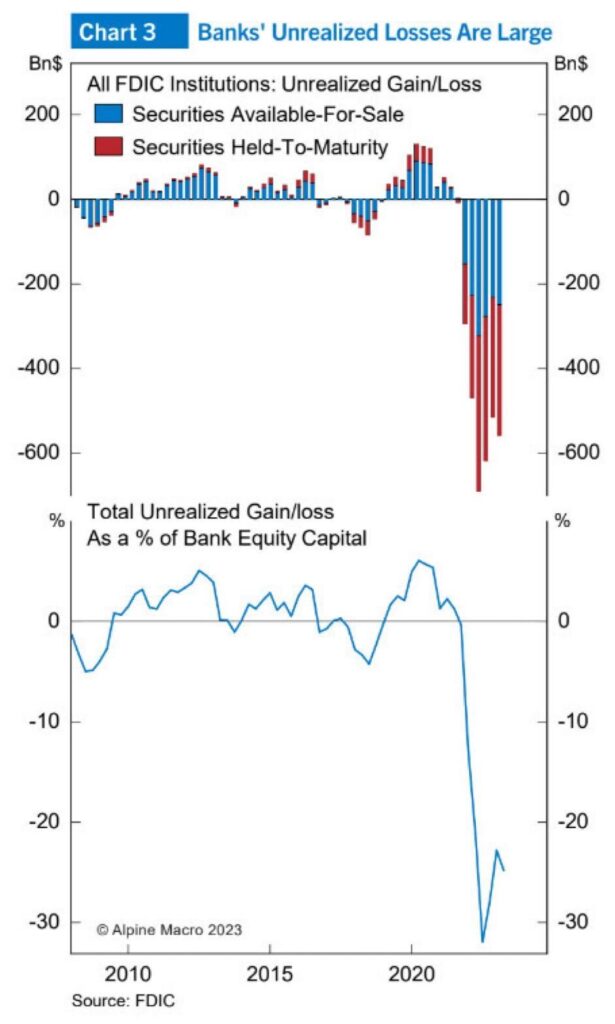

John Luke: Banks are a perfect example of the economic debate, sitting on large losses on their bond holdings

Data as of September 2023

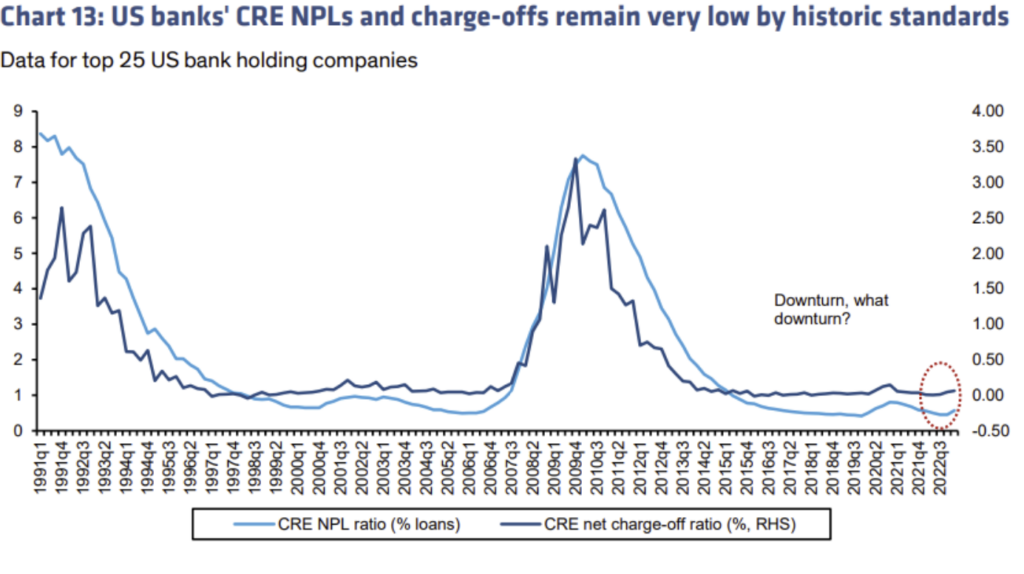

Dave: but taking very few charge offs on commercial real estate despite the obvious secular headwinds

Source: JP Morgan as of September 2023

Source: JP Morgan as of September 2023

Brad: This is probably what will define the next market leg…does market breadth align through a Magnificent 7 fall, or a broader rally?

Source: Strategas as of 10.02.2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2310-09.