We thought AQR did a great job describing the history of hedges and the high cost of carry. Their conclusion is that hedges have proven too costly to be worth using. But what about the cost of owning bonds?

Isn’t that where we are now? Surely a retiree portfolio is not sticking to 40/60 because they expect the 60 to deliver income. It’s a habit borne in the rear-view mirror; there can’t be many who feel confident about meeting 4% withdrawal rates from bond coupons. Back to the AQR study…put options DO cost money, and if held passively can be a drag. But the intent isn’t to allocate 20% to them in search of growth or income, as we would stocks or bonds. The intent is to get huge offsetting asymmetry using what, 1-2% of a portfolio? And to then be in position to shed the dead weight of bonds in favor of more stocks! Those bonds may still have some income, but not much. And as shown below, the past 60 years have shown a solid tie between today’s yields (now <1%) and tomorrow’s returns.

Data as of 11.30.2020

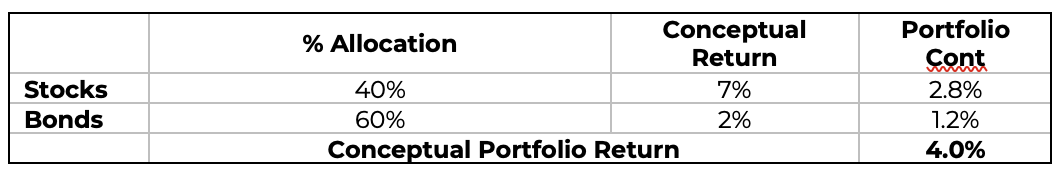

Let’s be generous and give Bonds a 2% conceptual return over the coming decade. And let’s use base rate assumptions of a 5% Equity Risk Premium to give Stocks a 7% conceptual return. In a conservative 40% stocks/60% bonds portfolio that leads us to:

Traditional Conservative

*Conceptual Illustration: Information presented is for illustrative purposes only and should not be interpreted as actual performance of any investor’s account. These figures are entirely assumed to illustrate the concept of discounting future cash flows. As these are not actual results and completely assumed, they should not be relied upon for investment decisions. Actual results of individual investors will differ due to many factors, including individual investments and fees, client restrictions, and the timing of investments and cash flows. The Conceptual Portfolio Return is shown for information purposes only and should not be interpreted as actual forecasts by Aptus Capital Advisors, LLC. Clients should not rely solely on this or any other illustrations when making investment decisions.

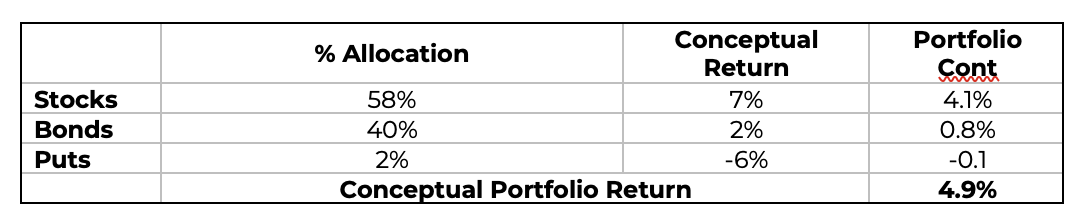

Not all that exciting, or comforting, for a retiree is using the popular 4% withdrawal rate. Those bonds may contribute a bit of return, but not much. And with no guarantee that they’ll really smooth out the sequence of returns like they have in the recent past. What if we could use those hideous, expensive put options as cover to raise our equity allocation? Unlike the bonds that we hope will soften the blow of a correction, we KNOW the puts will zig to the zag of our newly upsized equity allocation. How might that math look by comparison?

Conservative, with Hedged Equities

*Conceptual Illustration: Information presented is for illustrative purposes only and should not be interpreted as actual performance of any investor’s account. These figures are entirely assumed to illustrate the concept of discounting future cash flows. As these are not actual results and completely assumed, they should not be relied upon for investment decisions. Actual results of individual investors will differ due to many factors, including individual investments and fees, client restrictions, and the timing of investments and cash flows. The Conceptual Portfolio Return is shown for information purposes only and should not be interpreted as actual forecasts by Aptus Capital Advisors, LLC. Clients should not rely solely on this or any other illustrations when making investment decisions.

These numbers are all guesses, but not outrageous. Some might argue stocks will do better, or worse. Some might say the same for bonds. And an option trader will tell us they can hack away a ton of that bleed. The point is, we think the religion around owning bonds for income and protection is dated. Monte Carlo simulations may build in past returns for bonds, but maybe the safer input is today’s yields not yesterday’s juiced returns? And if you’re reaching beyond Treasuries for yield? Well, your equity allocation is really a bit higher than you think anyway. Why not pursue the full upside potential of stocks if you’re taking company/country risk anyway? There are way more factors to consider…smoother sequence of returns from a truly negatively correlated asset, rebalance opportunity in market selloffs, currently higher yields in stocks than bonds, etc. But it seems crazy that AQR did a 12-page paper assailing the cost of puts and waited ‘til the 3rd-to-last paragraph to give passing mention of the real story: “Yet, the documented return drag may be mitigated if the tail hedge allows an investor to take more equity risk and earn a premium for it.” And might that make the 2% allocation to puts a cheaper diversifier than that extra 20% in bonds?

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed. This commentary offers generalized research, not personalized investment advice and contains information and links to third party sites not affiliated with Aptus Capital Advisors “ACA”. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible. Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2011-29.