This year’s election feels unprecedented – that’s because it is. It is coming against the backdrop of a severe recession, a global pandemic, elevated unemployment, and social unrest. Not to mention, in the background of many investors head is the heated 2016 election, where Trump won the Electoral College but lost the popular vote to Hillary Clinton.

So, what do we know right now?

- We know that the election hinges on six battleground states.

- We know that no president has ever won re-election if the economy has been in a recession on Election Day, like we technically are right now.

- We know that since 1952, no party has retained the White House when there was either a 20% decline or a recession during an election year, like we’ve seen this year.

But, this election is unique because the cause of the 2020 recession was an exogenous event. Ultimately, we believe that the course of the pandemic will be the driving force behind who gets elected.

So, this bodes the question that voters must answer: will Americans blame President Trump for his handling of the pandemic and the current state of the economy? If the answer is yes, then the President may have some difficulty getting re-elected on November 3rd. If we start to get some sort of normalcy, then we have quite the race on our hands.

Like we’ve said, given the unknown backdrop in this election, we are in unprecedented times. This is data point number one for everybody – we’ve never seen anything like it.

So here are the things that we believe really matter to investors:

The outcome of this election, one way or another, does not mean that it’s the end of the world. There are actually silver linings to both candidates. With that said, we believe our portfolios are prepared for both outcomes. A Trump or Biden victory.

How do we know that? Well, during periods of volatility and unknown, much like what we will see in this election season, high quality assets significantly outperform assets that are considered lower quality. This is a cornerstone investment philosophy for everything we own in your portfolios. We want to own what we believe to be the highest quality, the best assets, and you know what? We believe we do. We believe we own and buy the best.

From our perspective, your portfolios are ready to withstand whatever may happen on November 3rd.

Election Update

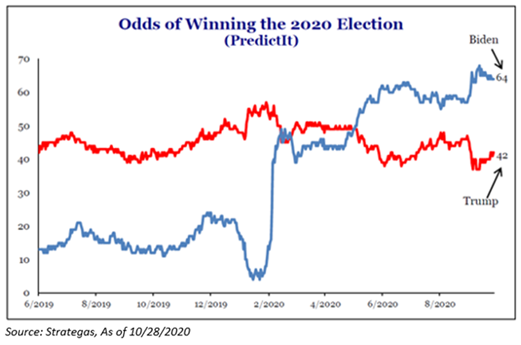

With less than a week to go before the election, more than 60 million Americans have already voted, which is more than 50% of the total turnout in the 2016 election. As of month-end, the consensus view expects a Biden victory and a Democratic Senate, i.e., a “Blue Sweep”. But on the margin, that consensus view has narrowed over the last week with the odds of the Democrats controlling the Senate starting to fall a bit. President Trump is also improving with his national deficit falling two points last week and his swing state deficit nearing the polling error of 2016. We believe Trump has a lot more wood to chop, but his momentum was extraordinarily strong into the close in 2016. A similar move this time around will raise the prospects of a contested election and the probability of Republicans keeping the Senate.

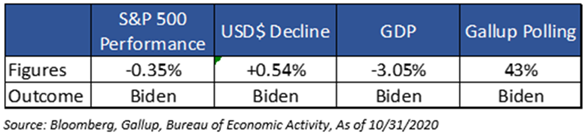

Much like the previous two election write-ups, we continue to update you on the four factors that have historically predicted the president election. Let’s recap these factors:

- S&P 500 is higher in the 3-month Period Preceding the Election = Incumbent Win

- USD Decline in the 3-months Before an Election = Incumbent Win

- GDP Expansion = Incumbent Win

- Gallup Presidential Approval Rating > 50% = Incumbent Win

Over the last three months, the above four factors have basically told us that the election results will be a toss-up. In classic election fashion, last week was a wildcard scenario, as markets retraced all of the gains since August 3rd, which also resulted in a strengthening dollar, to a point where it flipped its signal from Trump to Biden. Secondly, we saw the strongest ever quarterly GDP figure on Thursday (10/29), but it was not enough to pull us out of a contraction year-to-date. To sum this up, entering last week, the score was tied 2-2, but ended the week with a clear Biden win.

Contested Election

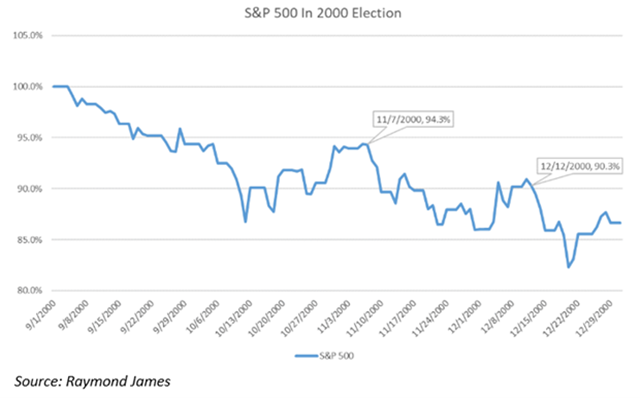

First, if there is no clear winner emerging on election day and the election is contested – it’s not the end of the world for investors. Secondly, this would not be the first time that this has happened – think Bush vs. Gore in 2000. Americans did not have a clear winner until the beginning of December and the market was only down about 5% during this period of unknown. And, not to mention, investors were not expecting a contested election in 2000 – this was a surprise. In 2020, investors are expecting one – potentially already pricing a contested election into current market values.

So, given this information, what’s the possible market reaction? Obviously, we do not know for sure, but ultimately markets know a contested election is only a temporary phenomenon – at one point, there will be closure. Though, this may not stop a knee-jerk reaction of selling – but again, we didn’t see a knee-jerk reaction in selling in 2000 and investors weren’t expecting some unknown outcome on that election day.

What Happens if There is No Clear-Cut Winner on Election Day:

The concern over this outcome stems from an expected historic number of mail-in ballots in multiple states, due to fears of contracting COVID-19 at polling places. The number of mail-in ballots could be so large that they:

- Prevent a state from being called for one candidate or the other, or

- “Flip” a state that had previously been called once all the mail-in ballots had been processed.

Focus in the media lately has been on Trump’s refusal to explicitly say he’ll facilitate a peaceful transfer of power, but the real risk for markets is that we don’t know the election outcome until mid-December. Other than just creating confusion over future policy expectations, election drama will likely consume Washington and prevent stimulus from being passed, potentially pushing back that legislation into early 2021, or until the new Congress and president are seated, i.e., January 20, 2021.

Here are the most important dates to consider:

- December 8 – This is the day when states must resolve any election disputes.

- December 14 – Electors in the Electoral College cast their ballots for the presidency.

- January 6, 2021 – Congress counts the electoral votes and a winner is declared.

For reference, the Bush vs. Gore drama ended on December 11 with the Supreme Court ruling that Florida’s 25 electoral votes should remain with Bush, effectively delivering the presidency.

What’s the Probability of a Contested Election?

Perhaps we are being optimistic here, but we view the probability of a long, strung-out contested election as much lower than the slowly building media hysteria would imply. Here’s why:

If the election is going to be close, it may come down to the results of a handful of swing states: Florida, Wisconsin, North Carolina, Michigan, Pennsylvania and Ohio.

Of those six states, four (Pennsylvania, Wisconsin, Florida and Michigan) have Election Day deadlines for all mail-in ballots. So, there likely won’t be a “wave” of mail-in ballots that would cause any major surprises in those states.

However, North Carolina and Ohio allow mail-in ballots to be received three and 10 days after the election, respectively. So, there is the potential for a reversal days after November 3. But in order for that reversal to occur, the election results would have to be very, very close.

Per the rules, the levels that cause mandatory recounts in most of the swing states mentioned above, in order for there to be a recount where the mail-in ballots would be contested, the margin of victory needs to be less than one half of one percent (or 0.50%).

For 2016, only two states fell within that threshold, Michigan (0.3%) and New Hampshire (0.4%). Most results, even in battleground states, saw a margin of over 1%.

The point being most elections can’t be challenged (at least not legitimately) unless there’s a recount. For there to be a recount, the margin will have to be less than 0.50% in most of the swing states. And, those swing states will need to represent enough votes to turn the election. That’s not impossible, but it’s very unlikely, and simply not a high probability event. But it’s 2020, so anything is possible!

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase of sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment and tax professional before implementing any investment strategy.

Aptus Capital Advisors, LLC is a Registered Investment Advisor (RIA) registered with the Securities and Exchange Commission and is headquartered in Fairhope, Alabama. Registration does not imply a certain level of skill or training. More information about the advisor, and its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. The Funds are distributed by Quasar Distributors LLC, which is not affiliated with Aptus Capital Advisors, LLC. The information provided is not intended for trading purposes and should not be considered investment advice. Please carefully read the prospectus before making an investment decision. ACA-2010-29.