Our favorite fund manager David Dredge made a return visit to the Macro Hive podcast, and again it was a joy to hear him discuss better ways to pursue compounding wealth. Two years ago we wrote Protect and Participate to share our common thinking about the investment world.

His comparisons to auto racing and soccer remain the best we’ve heard, and no matter how many times we hear it there’s no reason we can’t repeat it. His words slamming “Sharpe World” will sound familiar, starting with the following:

“Don’t try to estimate future curves and drive at the average speed so that you won’t crash. You’re missing opportunities in the straightaways, and you’re taking way too much risk in unforeseen future curves. Just put good brakes on your car so you can drive faster.”

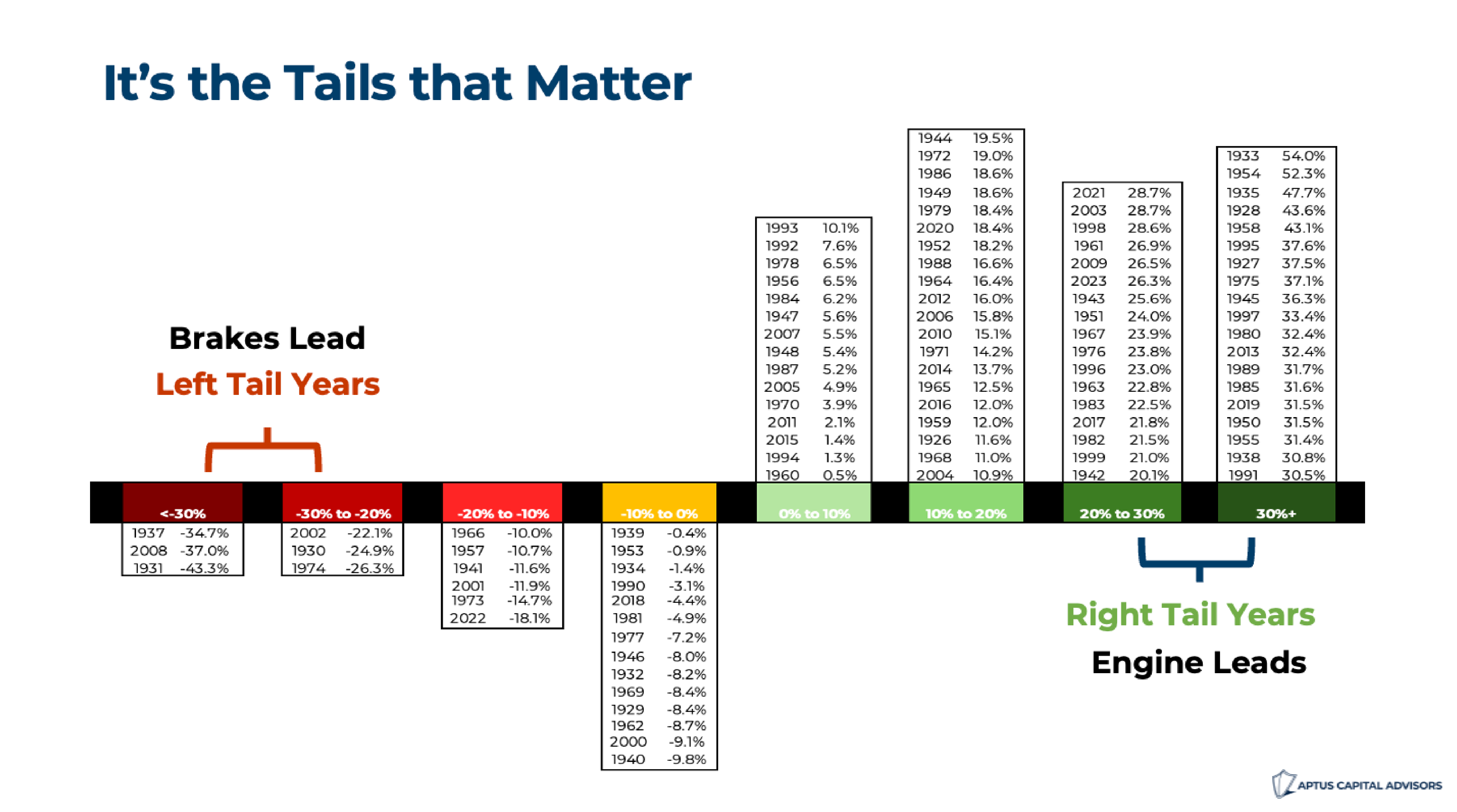

As you know, stocks have gone up somewhere around 10%/year in the past 100 years, but they rarely go up 10% in any given year. Proper capture of the outliers is the deciding factor in the magic of compounding…year-to-year, equity returns look more like this:

Source: Aptus as of March 2024

“Free money up from things that neither participate nor protect.”

You’re probably sick of hearing us say “More Stocks, Less Bonds” but to be clear… it’s not a macro call it’s a math call. As JD likes to say, 60/40 is like a 1990s Toyota Corolla; it has 4 cylinders and no airbags. You’ll move in the direction of your goal but your passenger/client will eventually ask you two questions:

- Great market – why are we so far behind everyone else?

- Terrible market – why are we losing even with these “safe” bonds?

Owning a traditional weighting in bonds ensures nothing when stocks go down, but it’s a safe bet your upside capture will look awfully lame when stocks have a banner year.

“They’ve decided to define as important that which they can measure as opposed to measuring what’s important.” – David Dredge quoting Friedrich Hayek

Quoting a Sharpe Ratio will not save you from losing a disappointed client. While most should never be comparing their portfolio to the S&P 500, the reality is that they’re human beings who read, watch, and talk to other human beings. Comparison may be the thief of joy, but good luck retaining the client who had a high 5-year Sharpe Ratio but compounded for 5 years at 5% when the S&P compounded at 12%.

Our industry loves to converge around theories that worked in the past, but we think both your clients and your business are better served with a splash of thinking differently. We’re all pursuing the same destination, but Dredge reminds us that the “average” speed is neither safe nor acceptable, and that a better engine with reliable brakes may be a better path.

There’s another post ahead about best use of goalkeepers and goalscorers; like the racing example, our industry fails to explain the unique benefits of each and focuses on the noise in the middle of the field. Again, the link for you to hear it yourself: Macro Hive with David Dredge. We found minutes 22 through 29 to be pure gold.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2403-31.