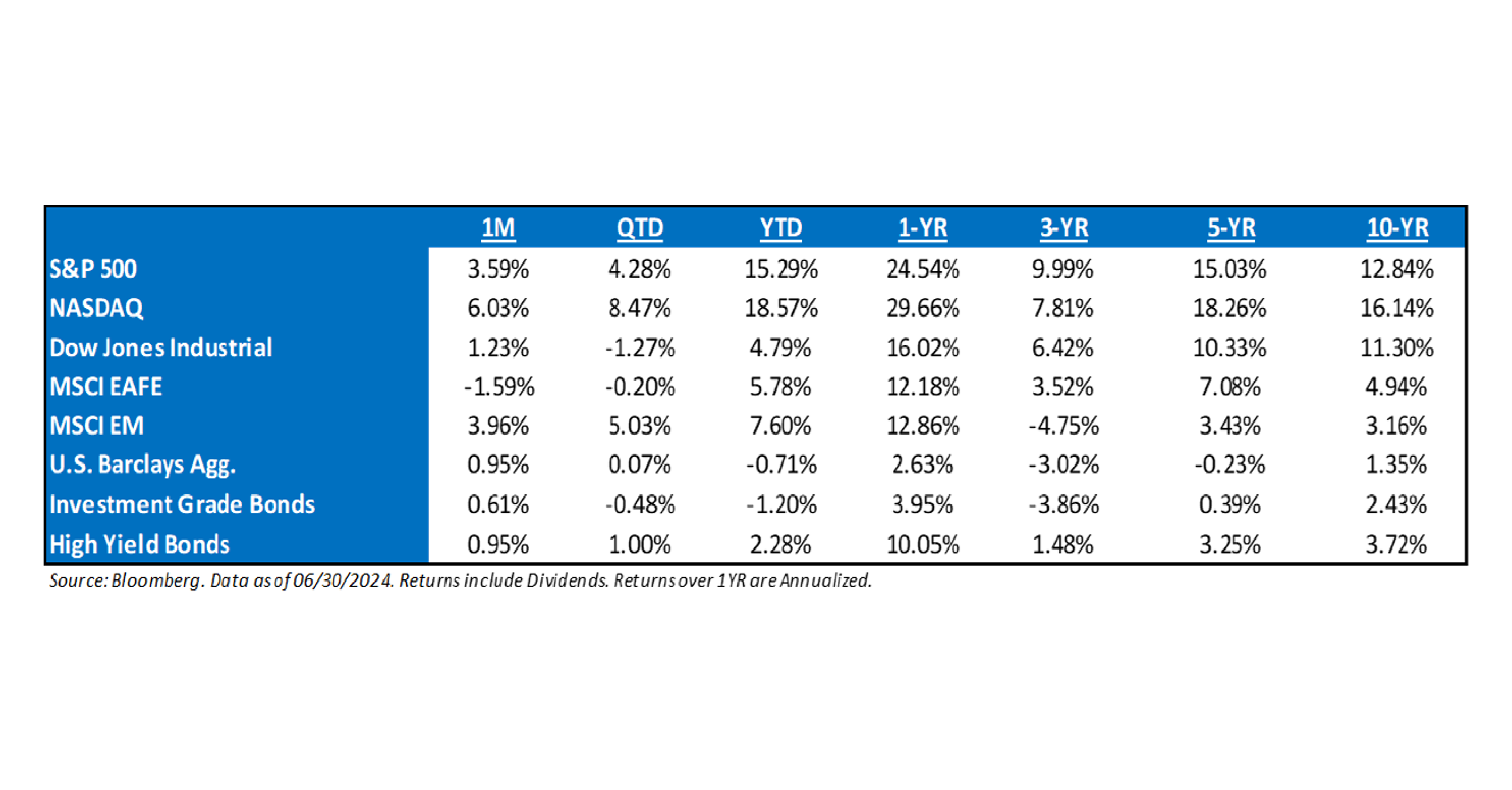

June ‘24 Market Recap – Let the Good Times Roll: The S&P 500 had its 32nd all-time high this year during the month – ending June slightly off the potential for a 33rd. That is 32 all-time highs out of 125 trading days or 1 ATH every 4 trading days. This year has been the best start to any election year on record and a good 1H tends to mean that the remaining 6 months will also have strong footing. It has been 343 days since the S&P 500 recorded a decline of -2% or greater, which is the largest stretch since February 2018. For the quarter, it was about extreme narrowness around the world. The average equity in the U.S. was down ~3%, while the S&P 500 was up 3.9% and growth indexes were up high-single digits. Globally, this narrowness also pervaded performance with most global indexes down low-single digits for the quarter, but U.S. large-cap, India, and a few tech-dominated Asian indexes up meaningfully.

Over-Focusing on Economic Data: We suspect very little has changed in the economy this year (it’s been slowing consistently with improving inflation since 2022), but government data skewed “hotter” in Q1 and “softer” in Q2 from those hotter levels. The year-over-year numbers look remarkably consistent with steady slowing.

Over-Focusing on Economic Data: We suspect very little has changed in the economy this year (it’s been slowing consistently with improving inflation since 2022), but government data skewed “hotter” in Q1 and “softer” in Q2 from those hotter levels. The year-over-year numbers look remarkably consistent with steady slowing.

The Caveat to Rate Cuts: The Fed reached its peak overnight rate in July of last year (12 months now), but keep in mind it was stuck for 15 months in 2006/2007 before a slowdown was evident, and ~20 months for job losses to become consistently negative. For those who don’t know, 2006/2007 looked like a soft landing too, for a while. Obviously, the imbalances in the economy are much more benign today than in 2007, but it just goes to show that inflation cooling and rates coming down doesn’t always mean equities just rally endlessly, due to the lagged impact of higher rates on the economy. At some point, earnings may become a bigger fear as the year progresses as the full impact of the rate cycle simply has not been felt yet. But for now, the equity market wants a soft landing, and no obvious reason to fight this trend until earnings trends weaken.

Market Vol is Not Volatile: The worst day in June for the S&P 500 was a 0.31% drop. This would be the smallest worst day of any month since Feb ’17 at -0.26%. In fact, since 1928, this month would rank as the 5th smallest worst day of any month ever.

Consumer Continued: There’s about ~$5T in retail savings/money market accounts in the US. Just two years ago, these were earning zero percent. With higher rates, they are now pouring ~$250B annually into the pockets of generally high-income/high-net-worth consumers. So as the low end continues to struggle, the high end has had an offset to higher rates. But we are now lapping peak rates, so YoY, there is no longer an incremental ~$250M YoY entering the economy from higher interest income (we’re lapping it). We’re not sure if it matters or whether this will mean more of the rate hikes will show up in slowing at the macro level, but it’s clearly been one of the reasons the economy has been more resilient than typical to higher rates. By the way, that’s ~1.5% of consumer spending annually.

The Fed Wasn’t Wrong → Market Consensus Was Wrong: In the last 2 months of 2023, the market added an additional percentage point of rate cuts to its year-end 2024 expectation, taking the total quantity of quarter-point rate cuts priced into seven. Looking back, most consensus forecasters pointed to Jay’s “dovish pivot” and the new FOMC December dot plot calling for one additional 2024 cut as the primary drivers for this heightened exuberance on rates. Fast-forward through the first six months of 2024 and all of those extra cuts have been wiped out from market expectations, plus a little bit more. The reset caused the market to post its first decline (albeit modest) in April in six months yet rebounded after earnings in May and June. Over the past few years, consensus continues to be wrong.

The Presidential Election Year: Since ‘52, the S&P 500 has not declined in a year in which an incumbent president was running for re-election (avg. return of 10%). Stocks have declined in presidential election years, but in each of those cases, it was a year in which there was an open election with no incumbent running (‘60, ‘00, and ‘08). Presidents want to be re-elected and will use whatever policy levers are needed to boost the US economy. In fact, every president who avoided a recession two years before their re-election went on to win the election. And every president who had a recession in the two years before their re-election went on to lose.

S&P 500 EPS: ’25 (Exp.) EPS = $280. ‘24 EPS = $244 (+10.9%). 2023 = $220 (+0.5%). 2022 = $219 (+7.4%). 2021 = $204.*

Valuations: S&P 500 Fwd. P/E (NTM): 21.2x, EAFE: 14.3x, EM: 12.2x, R1V: 15.7x, and R1G: 28.1x. *

*Source: Bloomberg and FactSet, Data as of 06/30/24

Disclosures

Aptus Capital Advisors, LLC is a Registered Investment Advisor (RIA) registered with the Securities and Exchange Commission and is headquartered in Fairhope, Alabama. Registration does not imply a certain level of skill or training. For more information about our firm, or to receive a copy of our disclosure Form ADV and Privacy Policy call (251) 517-7198 or contact us here. Information presented on this site is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy.

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

The S&P 500® is widely regarded as the best single gauge of large-cap U.S. equities. There is over USD 11.2 trillion indexed or benchmarked to the index, with indexed assets comprising approximately USD 4.6 trillion of this total. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

The Nasdaq Composite Index measures all Nasdaq domestic and international based common type stocks listed on The Nasdaq Stock Market. To be eligible for inclusion in the Index, the security’s U.S. listing must be exclusively on The Nasdaq Stock Market (unless the security was dually listed on another U.S. market prior to January 1, 2004 and has continuously maintained such listing). The security types eligible for the Index include common stocks, ordinary shares, ADRs, shares of beneficial interest or limited partnership interests and tracking stocks. Security types not included in the Index are closed-end funds, convertible debentures, exchange traded funds, preferred stocks, rights, warrants, units and other derivative securities.

The Dow Jones Industrial Average® (The Dow®), is a price-weighted measure of 30 U.S. blue-chip companies. The index covers all industries except transportation and utilities.

The MSCI EAFE Index is an equity index which captures large and mid-cap representation across 21 Developed Markets countries*around the world, excluding the US and Canada. With 902 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

The MSCI Emerging Markets Index captures large and mid-cap representation across 26 Emerging Markets (EM) countries*. With 1,387 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

Investment-grade Bond (or High-grade Bond) are believed to have a lower risk of default and receive higher ratings by the credit rating agencies. These bonds tend to be issued at lower yields than less creditworthy bonds.

Non-investment-grade debt securities (high-yield/junk bonds) may be subject to greater market fluctuations, risk of default or loss of income and principal than higher-rated securities.

Nasdaq-100® includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. This includes Treasuries, government-related and corporate securities, mortgage-backed securities, asset-backed securities, and collateralized mortgage-backed securities. ACA-2407-2.