Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

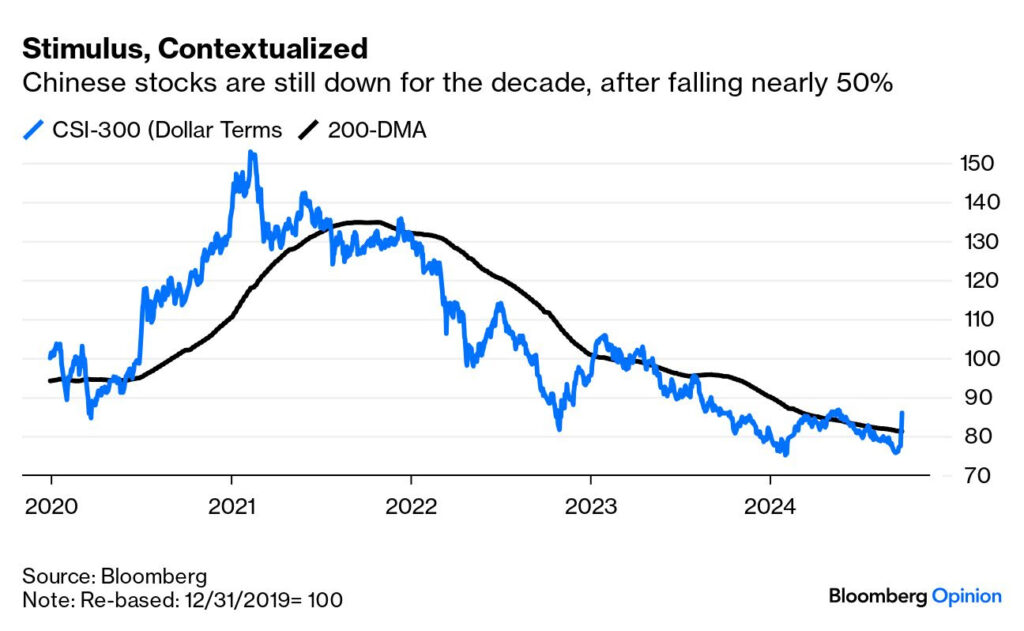

Brett: The massive stimulus announcements out of China were the story of the week

Data as of 09.26.2024

Brian: though it will take a lot more to undo the damage done to portfolios over the years

Data as of 09.26.2024

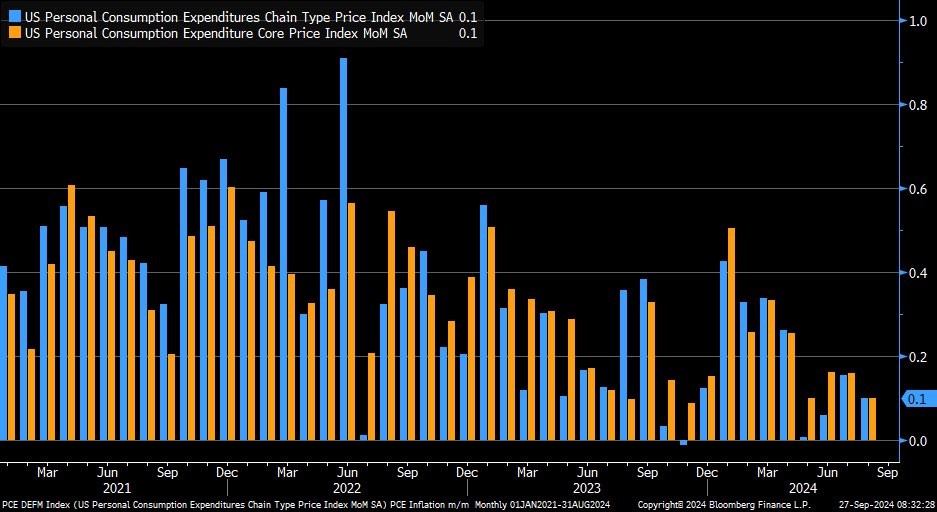

John Luke: Government inflation measures continue to trend lower

Source: @LizAnnSonders as of 09.27.2024

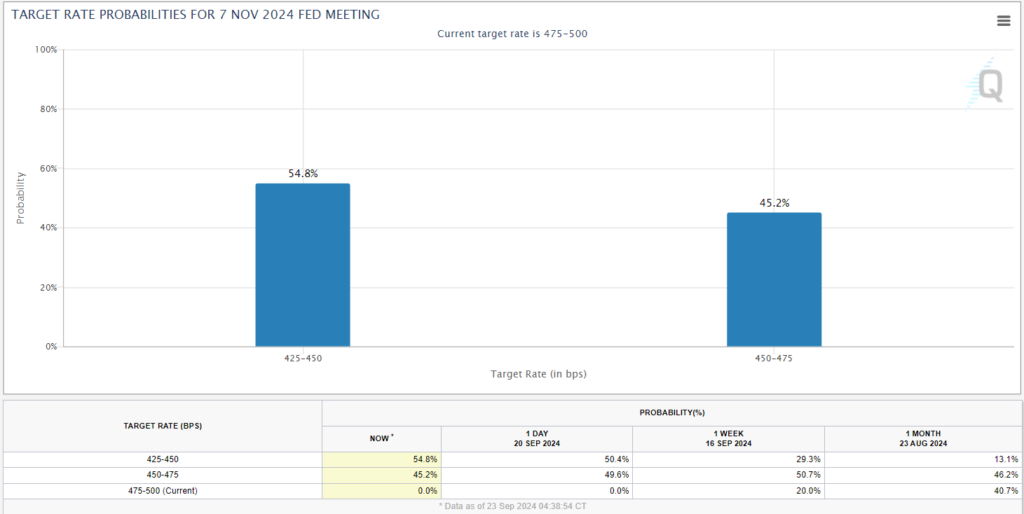

Arch: leading to increasing expectations of another 50 basis point cut in the Fed Funds rate

Source: CME FedWatchTool

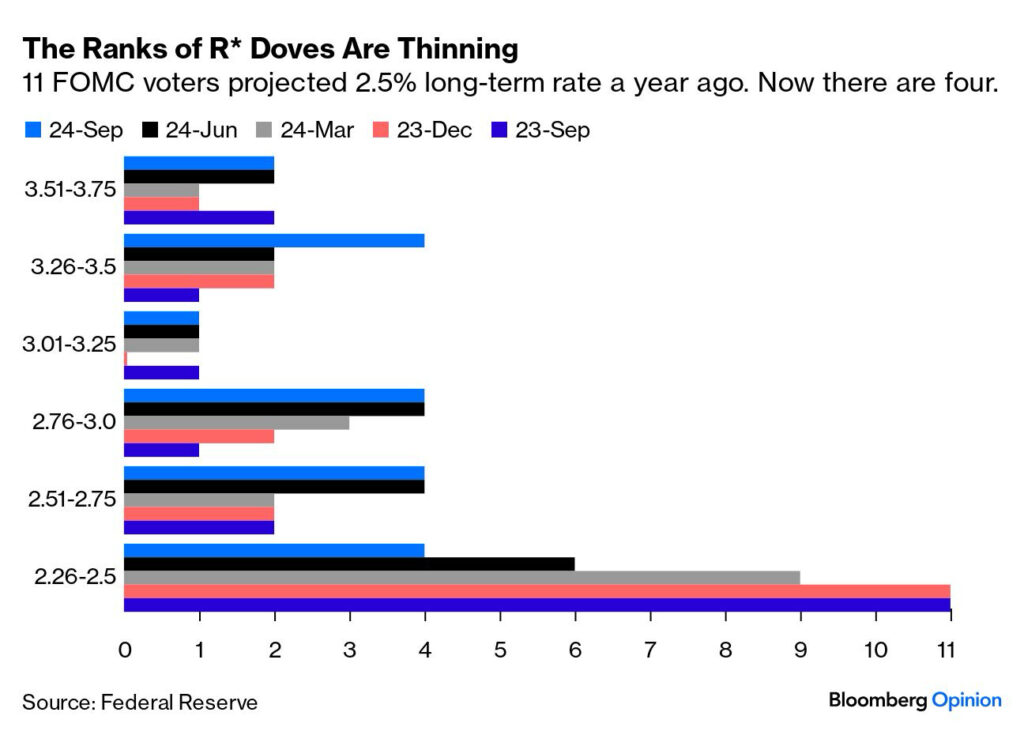

John Luke: though the “terminal rate” is creeping higher versus the expectations from a year ago

Data as of 09.24.2024

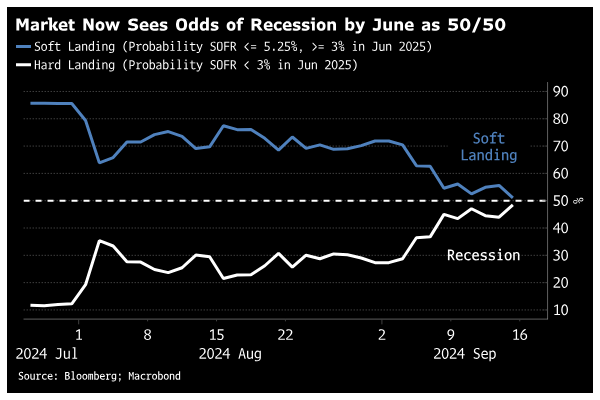

Brad: Recession vs. soft landing is turning into a tossup at least as far as the rates market is concerned

Data as of 09.23.2024

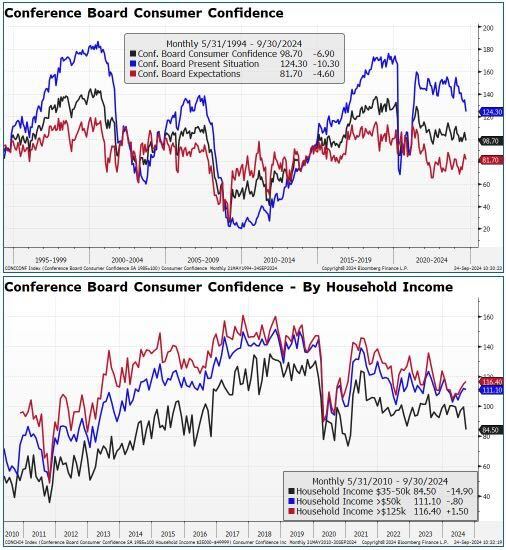

John Luke: Right now, we’re seeing two different economies depending on the income level of the consumer

Source: @samuelrines as of 09.25

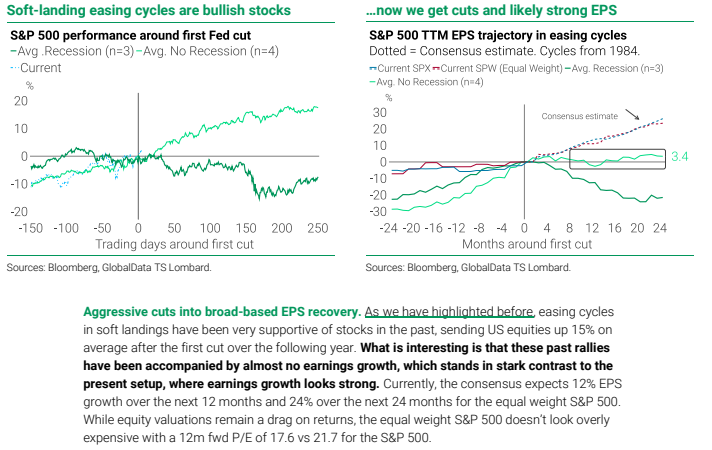

Beckham: At the corporate level, the unusual presence of earnings growth at the start of the cutting cycle

Data as of 09.25.2024

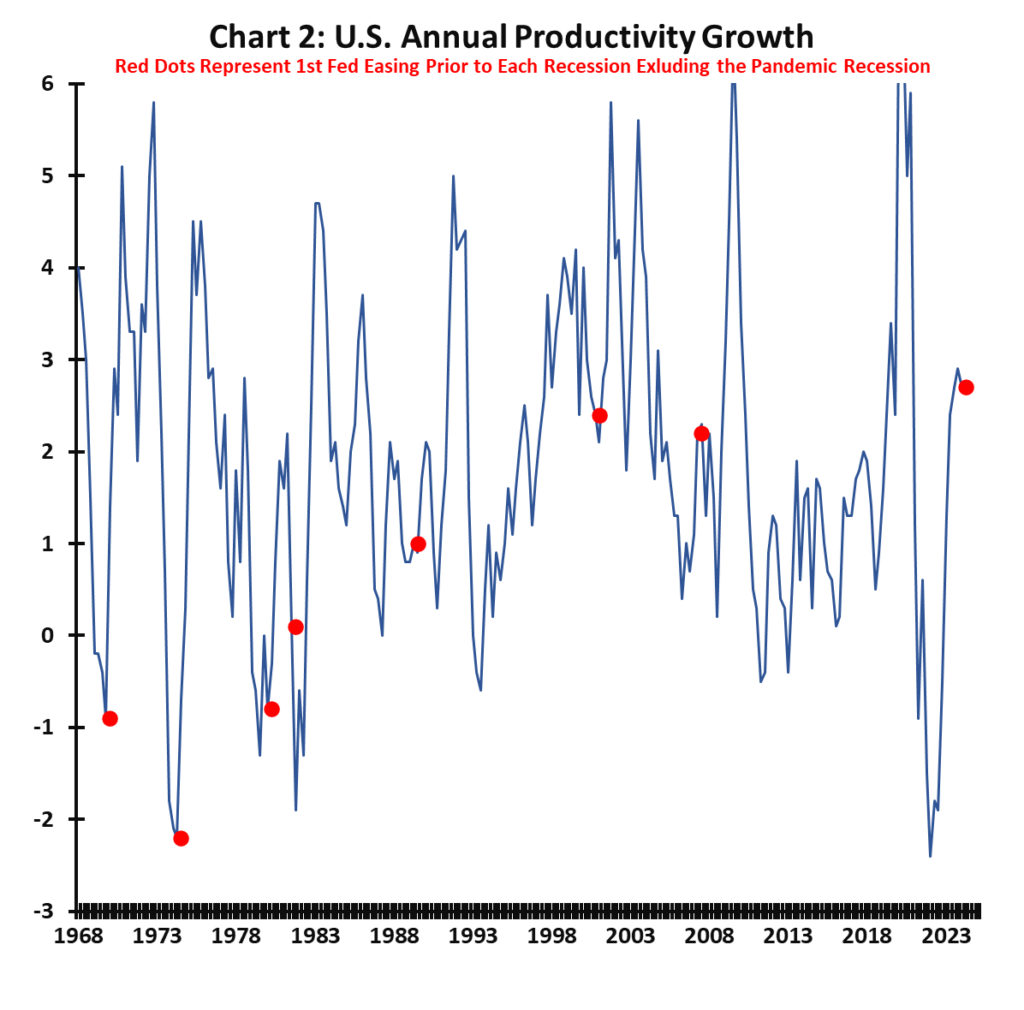

Brad: We also see a level of productivity relative to the start of some past cutting cycles

Source: Paulsen Perspectives as of 09.24.2024

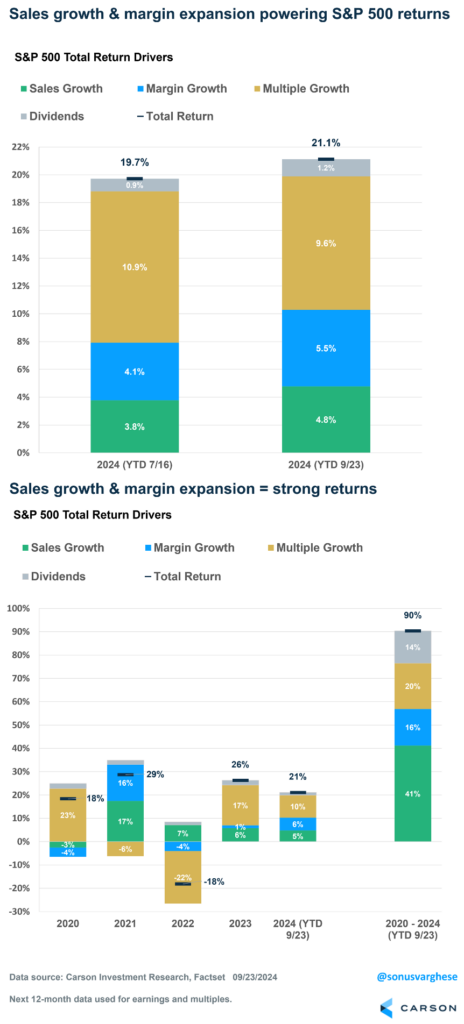

Dave: and the presence of strong sales and margin growth since the start of the decade

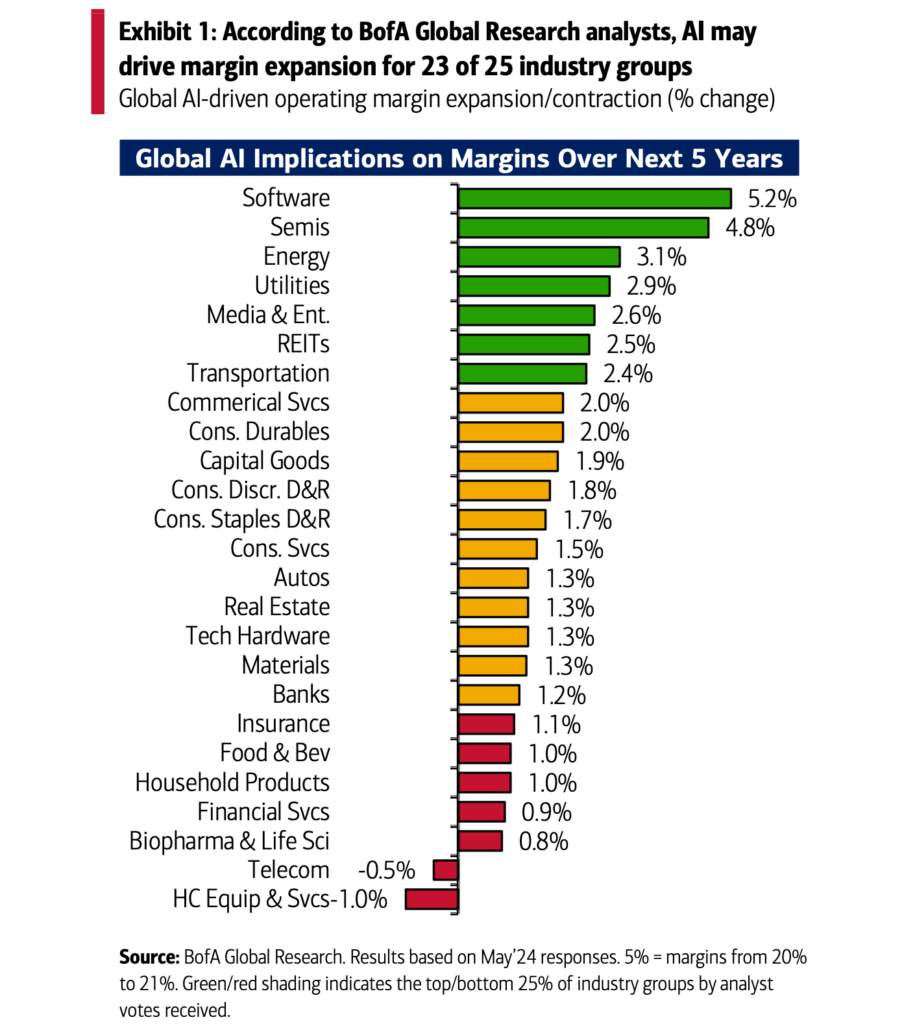

Beckham: with additional possibilities for margin expansion in the years ahead

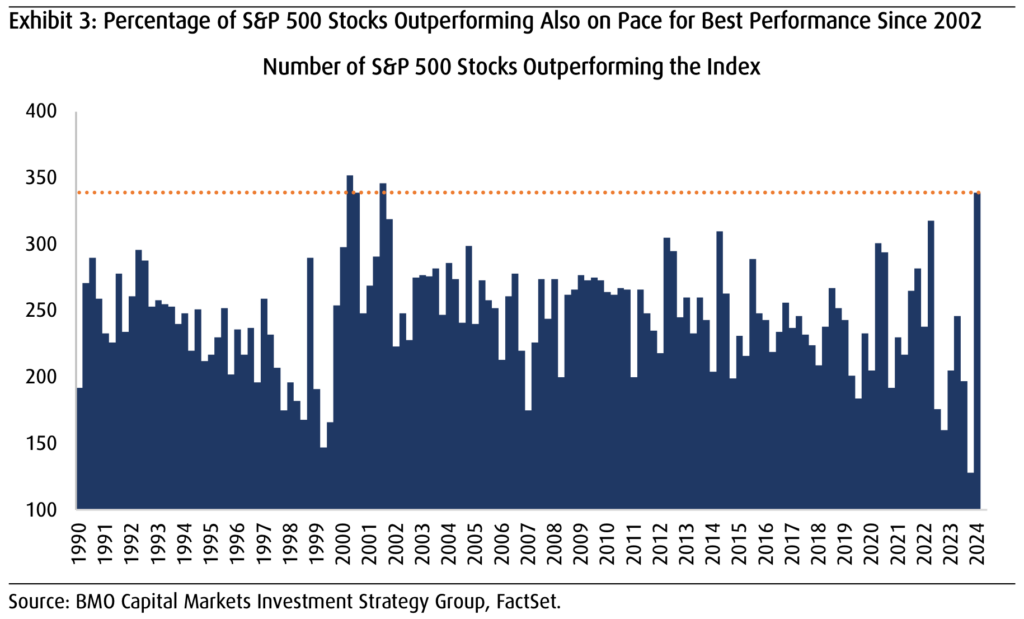

Brad: We’re also seeing improvement from the broader list of stocks, vs. prior dominance by megacap tech

Data as of 09.18.2024

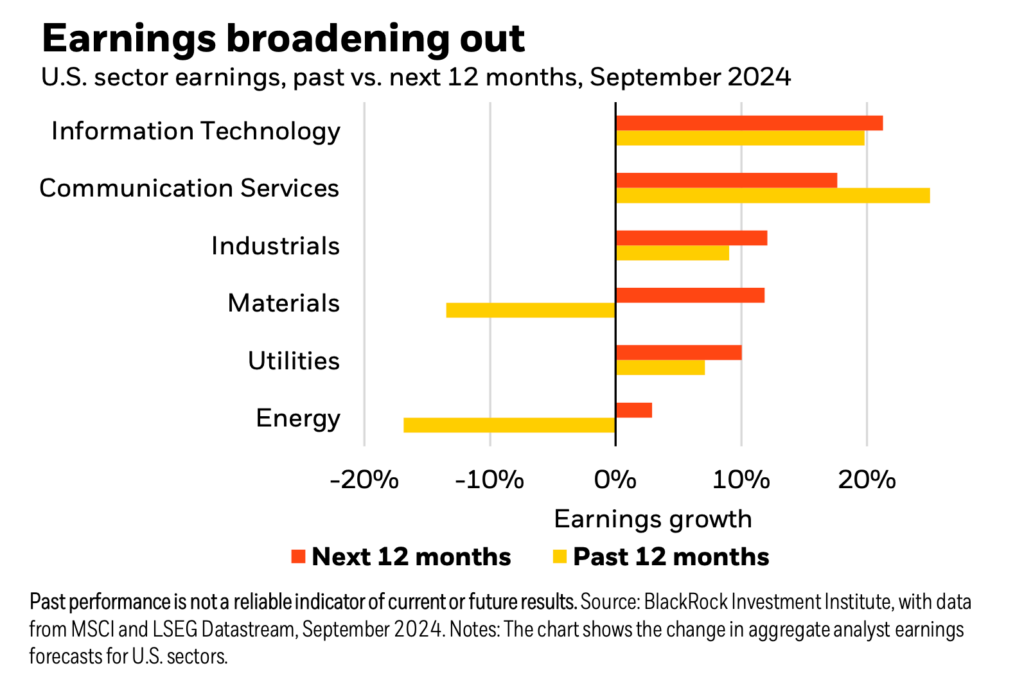

Dave: driven in part by hopes of better earnings growth in sectors that had been lagging

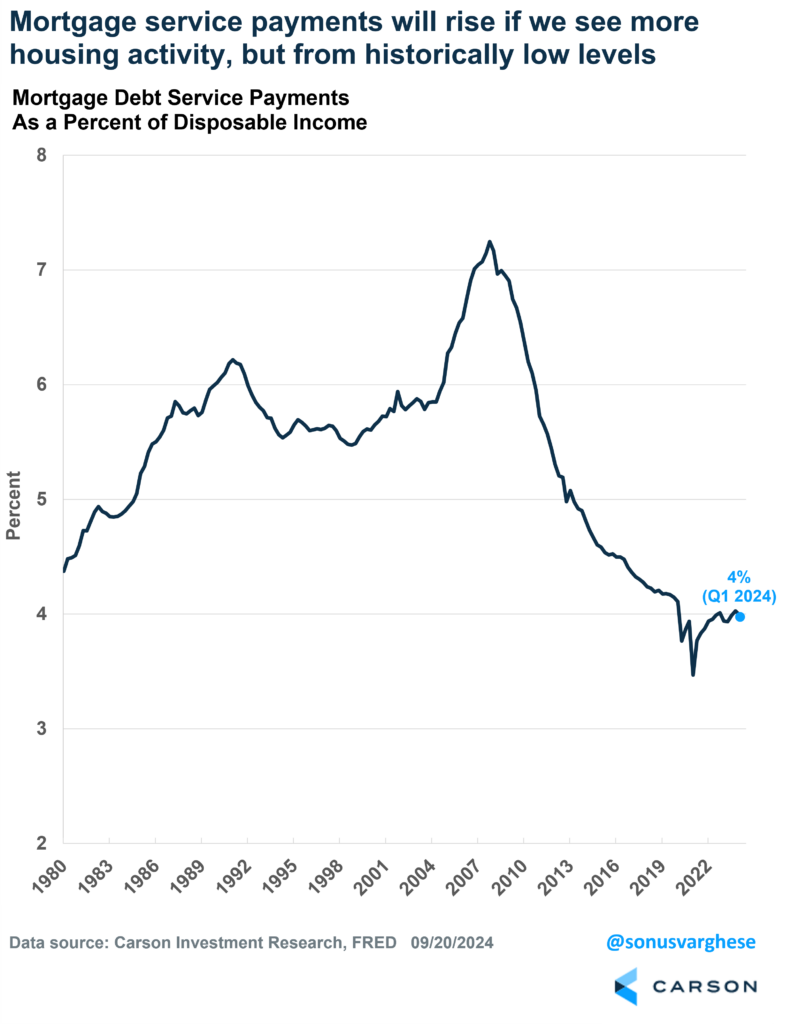

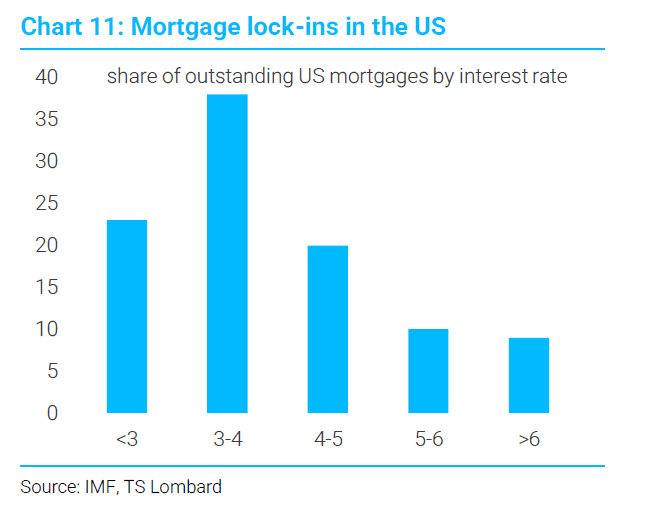

JD: One area that’s been hugely supportive of the economy this decade has been the low cost of existing mortgages

John Luke: and while mortgage originations have slowed dramatically in this rate-hiking cycle, the recent fall in rates could trigger some fresh activity

Data as of August 2024

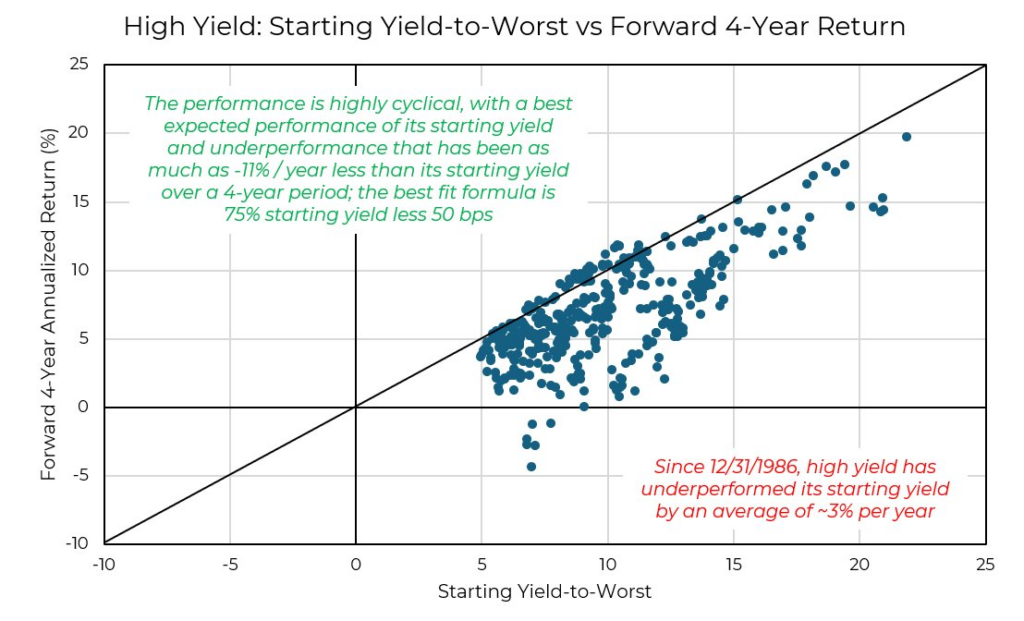

Brian: High-yield bonds have been less than ideal as a strategic allocation

Source: Aptus as of 09.25.2024

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2409-29.