“O Muse!,

Sing in me, and through me, tell the story,

Of that skilled investor, in all ways of contending,

An asset allocation, searching for alpha years on end…”

An Invocation of Muse serves as a prologue of events to come, or an outlook in this case, famously used by Homer when writing his two major epic poems, the Iliad, and the Odyssey. Now, in modern times, used by the Coen Brothers in their satirical comedy, O Brother Where Art Thou?

The movie, at its core, is a work of comparative mythology, blended with the American South. The protagonist, Ulysses Everett McGill, leader of the Soggy Bottom Boys, led two fellow jailbirds across Mississippi in pursuit of a treasure, all while evading the evil Sheriff Cooley, who was hot on their trail.

Investors themselves are on their own archetypal journey as they try to navigate the market, seeking the treasure of risk parity. Except, there are multiple evil Sheriff Cooley’s in the form of rising inflation expectations, a potential earnings recession, coupled with a monetary policy change that has no comparative period. These factors are the microcosm as to why traditional fixed income securities have been unable to provide safety this year to an overall asset allocation.

But, like any archetypal journey, there will be lessons learned along the way – this year was no different. And in a year in which macroeconomic factors were the lead determinant, i.e., interest rates and the Fed, it’s very easy to get enamored with forecasting and guessing what each data point would be. We take very little stock in doing this because most investors cannot accurately model what macro events lie ahead or, more importantly, how the markets will react to the things that do happen. Long time investor, Bruce Karsh, has emphasized that it is very difficult to know what expectations regarding certain events are already incorporated into security prices, which will ultimately drive price movements.

This is one of the main reasons as to why most people cannot predict the future well enough to repeatably produce superior performance – we believe it’s a losing game.

One of the most influential things we’ve all learned is that short-term events do not matter. In the moment, they will feel like they do, but they simply will not add value over longer periods of time.

Howard Marks mirrors our sentiment in this example:

“…in late 2015, virtually the only question I got was “When will the first rate increase occur?” My answer was always the same: “Why do you care? If I say ‘February,’ what will you do? And if I later change my mind and say ‘May,’ what will you do differently? If everyone knows rates are about to rise, what difference does it make which month the process starts?” No one ever offered a convincing answer. Investors probably think asking such questions is part of behaving professionally, but I doubt they could explain why. “

This view is also why Aptus’ Investment Methodology engages in Simple beats Complex. Investors need to focus on what they can control and prepare for what they cannot. It is not about maximizing opportunity, but more about minimizing the losses.

Focusing on the day-to-day noise can put investors in a tight spot, as many can lose sight of the big picture. This is why advisors know that the first level of defense for a portfolio is the asset allocation, allowing them to prepare for what they cannot control.

In this outlook, we’ll do our best to not focus on the individual data points, but rather on themes that we believe could matter moving forward.

The Recap – Investors May Need to Curb Their Enthusiasm in 2022

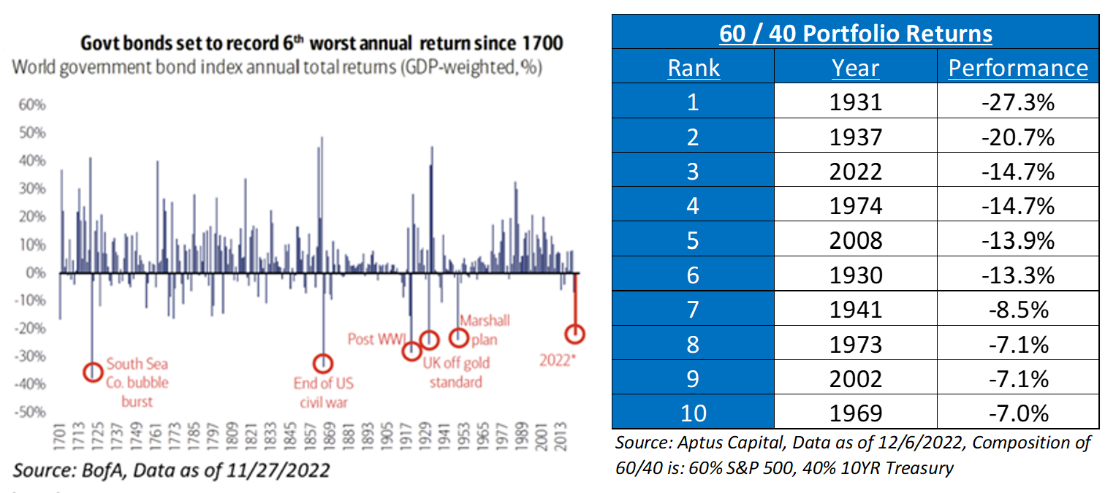

Being an investor in this market has left many people feeling like they’ve been hit by a train. But, per Penny, Ulysses’ wife, lots of respectable people have been hit by trains. In fact, the S&P 500 marked an all-time high on the very first trading day of ‘22, and the time since has seen one of the worst periods in history for a linear combination of stocks and bonds.

Heading into ‘22, the past ten years rewarded households with arguably what could be the best stock return spreads of their lifetime. Moreso, the three-year annualized returns for the S&P 500 and U.S. Barclays Agg were 26.0% and 4.8%, respectively – and this time frame included a global economic shutdown.

Given where valuations and interest rates were, we believed that there would be a need for investors to Curb their Enthusiasm heading into 2022.

And this is exactly what happened creating a perfect storm for portfolios, as it wasn’t your average mom and dad recession. And for many, it wasn’t even your normal grandma and grandpa recession.

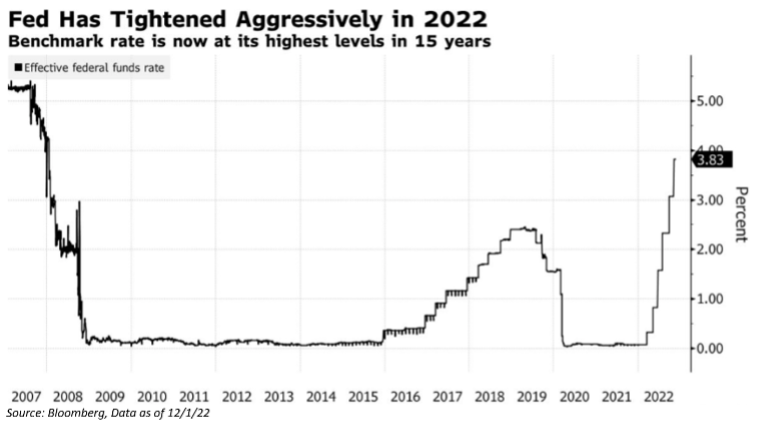

The high velocity spike in interest rates this year has been the reason for both equity and bond performance. Higher rates have hurt longer duration fixed income investments, as reinvestment risk is introduced. For equities, higher rates mean a higher discount rate, compressing valuations. In our opinion, rates have been driving the market’s performance all year, and may not likely change in the interim.

Now that ‘22 is in the rearview, let’s focus on next year.

Enter 2023 – A Market Potentially in Constant Sorrow

2021: The Path of Least Resistance is Up, But We May Encounter some Volatility

2022: Investors May Need to Curb Their Enthusiasm Moving Forward

2023: A Market in Constant Sorrow

We’ll be the first to admit, this year’s theme may be a bit more draconian than one would imagine after the year that risk-parity has had, but we’d emphasize the word “constant” in this phrase, more than “sorrow”. Yes; we may expect less pain next year (price volatility), but that doesn’t always translate into gain (market returns).

We believe that the market will begin a transition on where it will focus its attention in the future:

- Initially, the market will continue to be fixated on the Fed and the likelihood of a pivot or slowdown in rate hiking, continuing to cause volatility in valuations and rates.

- Thereafter, the market will start to focus on the possibility of a recession, i.e., inflation to growth frustration.

This will create a momentous shift from the Fed to the real economy.

One of the largest surprises for us over the last year has been that the “rate shock” and “inflation shock” caused a historic bear market on Wall Street, but no “recession shock” on Main Street. Thus, we need to focus on the duration of resiliency for the consumer this year and when it could begin affecting the nominal economy.

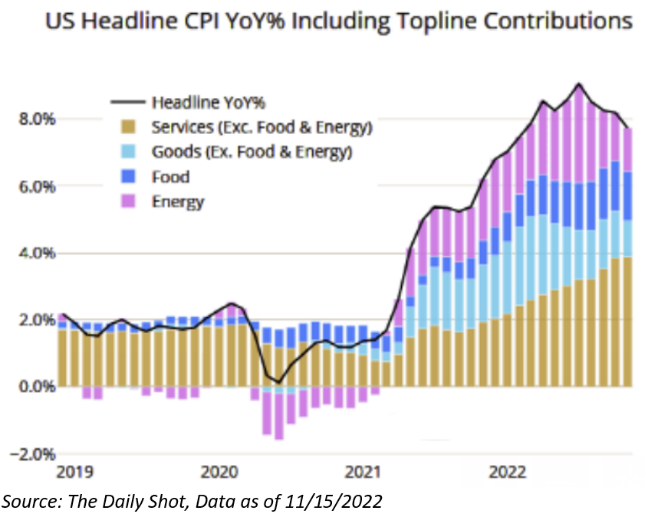

Given our focus on the real economy, coupled with the inversion of the yield curve intensifying both in magnitude and in totality, we remain focused on the same framework when assessing the health of the market: 1) Expectations around the anchoring of future inflation, and 2) Identifying growth drivers that will incentivize private capital to invest in the real economy.

Collectively, success on inflation and valuation should help stocks to stop going down and, either begin a period of repair, or start going up. The durability of any advance would, in turn, be predicated on the emergence of organic drivers of growth as we transition into the second half of next year.

Said another way, without depressed valuations, for the markets to trough, investors need to see a peak in inflation and rates, or a trough in economic activity.

We believe that a policy error has already been committed by the Fed. The real and long-lasting policy error would be if inflation were to become unanchored, thus the emphasis on the market focusing on price stability, specifically wage inflation, in the near-term.

History shows us that markets are a sprint lower and a marathon higher. With the potential for slowing global growth and a less accommodative Fed, this marathon may include more hills than plains, which could create constant volatility in the market.

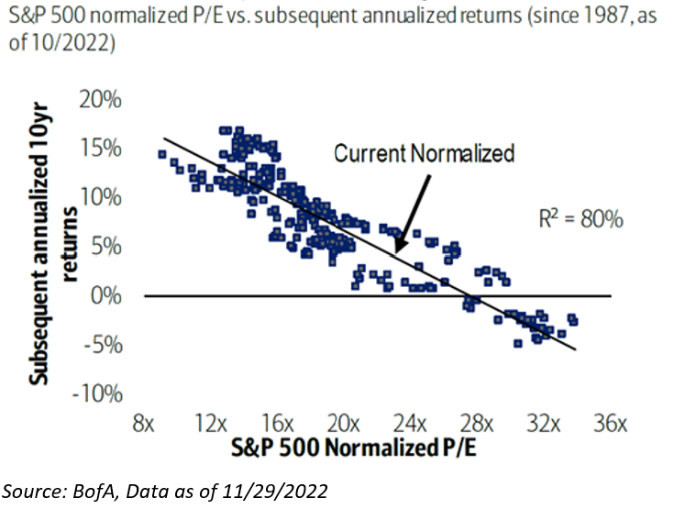

Ultimately, we do believe that the market has become more rational for longer-term investors, as valuations and rates have become more palatable than where we were just one year ago.

In the near-term, we do not think that investors have been given the all clear sign to seek the treasure. Much like in The Odyssey and O Brother Where Art Thou, market participants will continue to be tempted by different sirens, luring investors off course during their quest for financial independence. The market has been looking for any sign to believe that the Fed will “pivot”, and we believe, in the near-term, that this term will likely be revered as the new “transitory”.

Given that we are not looking to make specific calls on the market, we’d prefer to focus on what we believe could be three recurring themes next year. In fact, they directly correspond to our Yield + Growth Framework, but in reverse order.

- Valuation: The Initial Focus – Assessment of Fed Policy Driving Investor Sentiment

- Growth: The Latter Focus – Inflation to Growth Frustration

- Yield: The Year of the Yield

The Sentiment Gauge: The Fed and Policy Moving Forward

The market is likely coming closer to the final stages of the Fed’s tightening move. During this year, there have been nearly 400bps of short rate tightening. Add to that, $95B/per month in Quantitative Tightening, leading the Fed to start watching the long and variable lags associated with this very aggressive tightening.

Jerome Powell, the leader with the capacity for abstract thought, has completed the heavy policy lifting of this tightening schedule, allowing the rest of his “brain trust” the ability to slow down policy response before fine tuning it in ’23. We believe that a Fed policy pivot will have nothing to do with Wall Street, rather, it will come from successfully anchoring long-run inflation expectations. The timing of this remains unknown, given the stickiness of wage inflation.

Specifically, we believe that markets should understand that sharp risk-asset rallies on any policy pivot expected by the market could be leaned against. After last year’s snafu that inflation is transitory, the Fed’s credibility on not allowing inflation to “R-U-N-N-O-F-T”, i.e., anchoring inflation, continues to be front and center. We expect policy response to remain heightened to avoid the “stop-and-go” mistake of the 1970s. This alternative approach of “hike-and-hold”, allowing rates to marinate, as effects tend to be lagging, could require time, keeping policy in restrictive territory.

As we begin to look towards 2023, focus of the markets will eventually turn towards the economy and earnings, specifically to learn how much growth will slow and earnings will fall. But before that can occur, the Fed must “finish” its rate hike campaign. So for the interim, we believe that the single biggest influence on the market remains the Fed and the impending rate hikes.

The Growth: Inflation to Growth Frustration

As the market transitions into the latter half of the next year, and policy from the Fed becomes more clear, we believe that investors will ultimately shift their attention to slowing growth. Economic price levels, vis-à-vis the “money illusion,” may continue to mask the impact slowing activity has, and will have, on corporate revenue and earnings because operating margins provide important visibility into the acute pressure corporate operators could potentially be under.

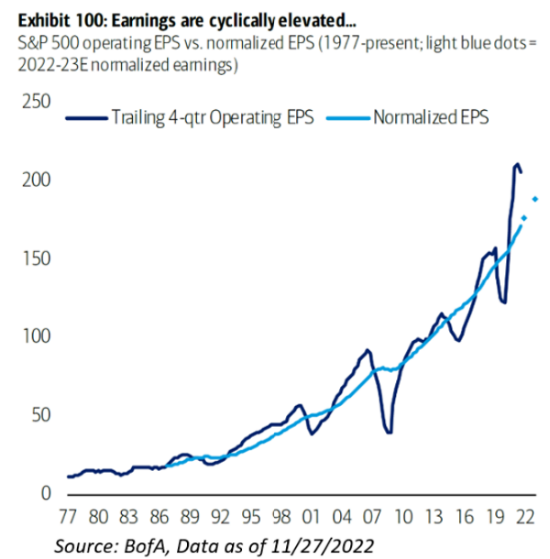

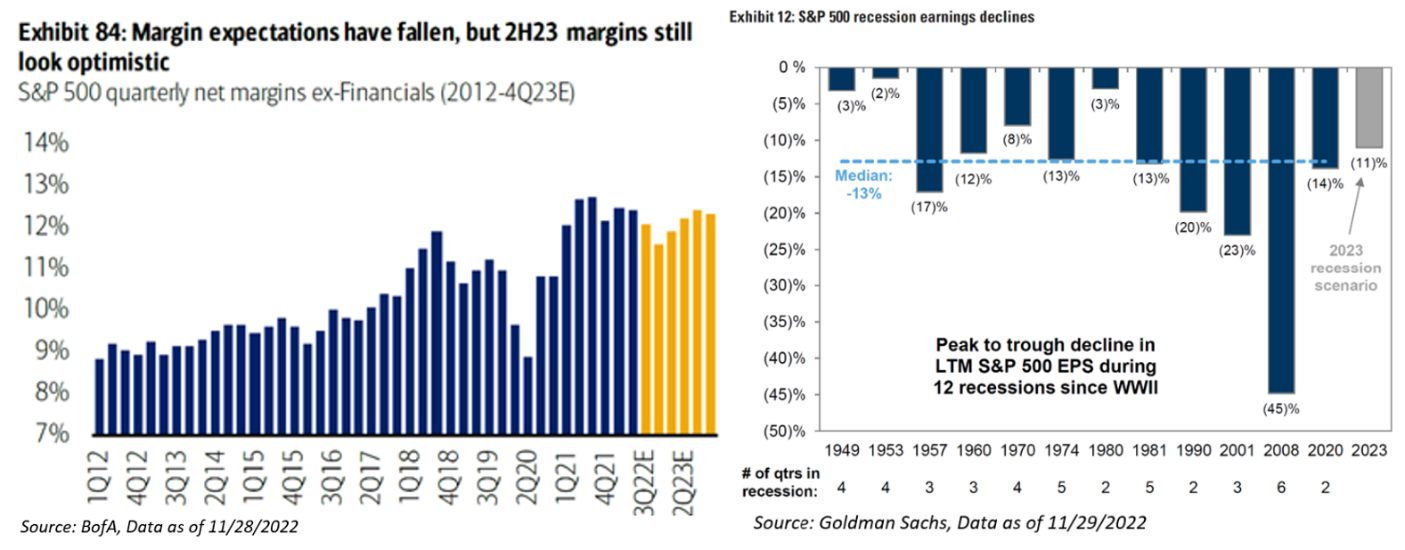

Over the next year, we don’t believe that market expectations fully reflect the potential for an earnings recession or the resulting drag on corporate profitability, as companies will no longer be able to pass on price increases. At present, while near-term growth has been resilient, consensus forecasts of growth for next year continue to decrease.

Historically, during a recession, earnings have declined almost 13% from previous year’s end. So far, in 2022, earnings for next year are still 5.0% above beginning of the year levels. Not only that, but 2024 still has the expectations that earnings will grow over 14%.

We know that a robust economy is fundamental to achieving healthy returns from financial markets –everything from monetary policy, to interest rates to company earnings are linked to this. Ultimately, we believe the market will start to discount the potential for a decline in earnings estimates, as inflation will turn into growth frustration.

The Year of Yield

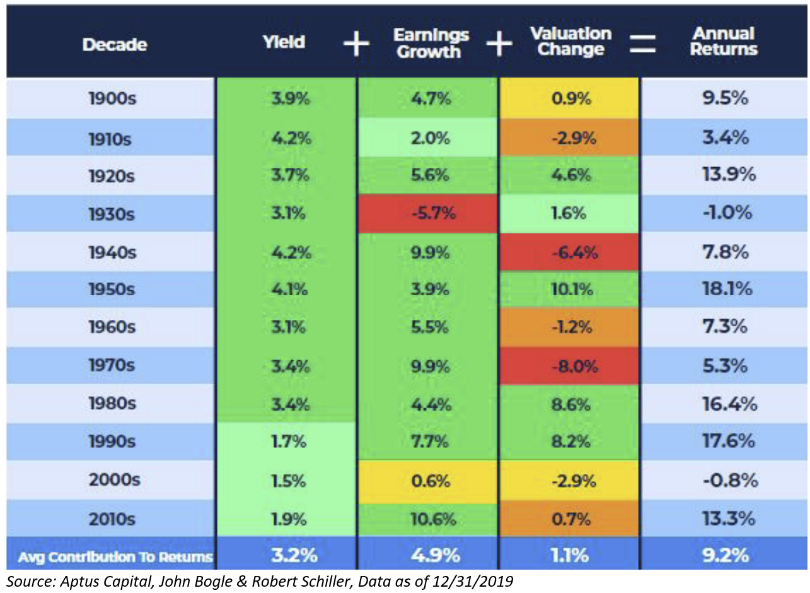

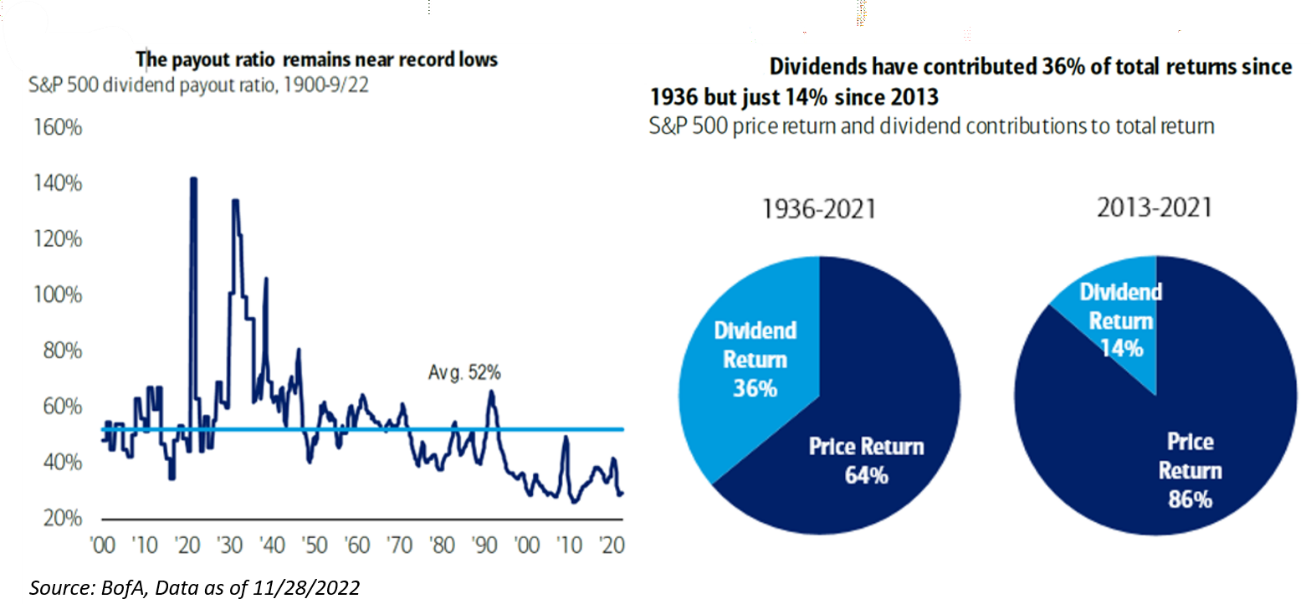

For the first time since the financial crisis, investors have finally been given the chance to take the yield bird in hand over the two growth birds in the bush. In a world of free money and cheap capital, a.k.a., quantitative easing, yield tends to be a less contributing factor to total return. As the market continues to transition into a higher-for-longer environment, we would put more emphasis on sustainable yield, than growth.

To this point, historically, yield has contributed to 36% of total return. Yet, in the 2010s, it only contributed 14%. It’s not the fact that we believe yield will be the sole contributor to performance itself, but also because the other two components of total return, growth and valuation, appear to be a difficult area for potential appreciation in the near future.

As investors wait for the near-term headwinds to abate, income is a space that they should embrace, an opportunity that has not presented itself for a very long time.

Bringing it All Together

Over the course of the year, investors have begun to realize that as the market evolves, you must evolve with it, or get left behind. The route to being successful this year was taking the road not often taken, and we believe that to be true moving forward. This road may or may not be smoother relative to last year, but investors need to remain tactical and make choices without regret. We’ve said that there may be less pain, but that doesn’t always translate to gains.

While we remain cautious on the markets, there is a silver lining that can make long-term investors once again a suitor. Throughout the year, the market has had a reset not just on valuations, which entered the year at 21.5x forward earnings, but also on interest rates not seen since 2007. The broad landscape appears much healthier than where it was to begin the year.

Fixed income broadly offers more attractive risk/reward. Bonds should become less positively correlated with equities and provide some diversification benefit, but until central banks stop hiking and inflation normalizes, bonds are unlikely to be a reliable buffer for risky assets.

We remain cautious on equities given that we don’t believe pricing fully reflects a recession expectation and the resulting drag on corporate earnings. Strategically, we expect the overall return of stocks to be greater than fixed income over the coming decade because we think central banks will ultimately live with some inflation. Staying invested in stocks is one of the best ways to get exposure to this trend.

Over long periods of time, valuation do matter. In fact, valuations explain ~80% of subsequent 10YR returns for the S&P 500. In our view, this year’s bear market provides an attractive opportunity for long-term investors.

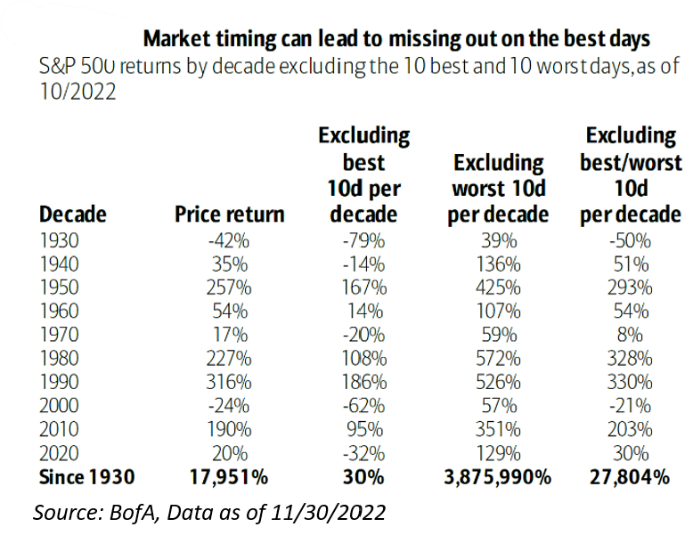

Moreover, the best arbitrage opportunity for stocks is time. Lengthening one’s time horizon has been a recipe for loss avoidance. This is a benefit unique to stocks. Remember, market timing is very difficult, as an investor needs to be correct twice – once on the purchase and once on the sale. Not only that, panic selling can result in outsized opportunity costs, as the best market days often follow the worst days.

It is near impossible to predict the future, that’s why it’s important to plan and prepare. The advantage of owning volatility as an asset class gives investors the chance to take the road less traveled. By doing so, it gives one the opportunity to makes choices, yet minimizes regret and mistakes.

We believe the market will continue to tempt investors with different sirens, luring investors off course during their quest for real returns. What those exact sirens will be are unknown. Preparation is the key to success, and we believe it gives you the advantage to make sure that you won’t be living in a Market of Constant Sorrow.

Let’s Put Things into Perspective

As we do every single year, we want to leave you with a big picture investment thought alongside an uplifting message that makes us all take a deep breath and look at things from the perspective of life outside of finance.

- Market Perspective: We’re about to break rule #1 for us – quoting Warren Buffett. There are already 1 million charlatans out quoting him, so we don’t want to be one. It’s no secret that there is volatility all around us – market, geopolitical, societal, etc., and while it may be difficult to see how today’s situation resolves itself in a tidy fashion, let’s conclude with a little bit of optimism. Warren Buffett wrote this in a 2008 annual letter:

“In the 20th century alone, we dealt with two great wars (one of which we initially appeared to be losing); a dozen or so panics and recessions; virulent inflation that led to a 21.5% prime rate in 1980; and the Great Depression of the 1930s, when unemployment ranged between 15% and 25% for many years. America has had no shortage of challenges. without fail, however, we’ve overcome them. in the face of those obstacles — and many others — the real standard of living for Americans improved nearly seven-fold during the 1900s, while the Dow Jones Industrials rose from 66 to 11,497.”

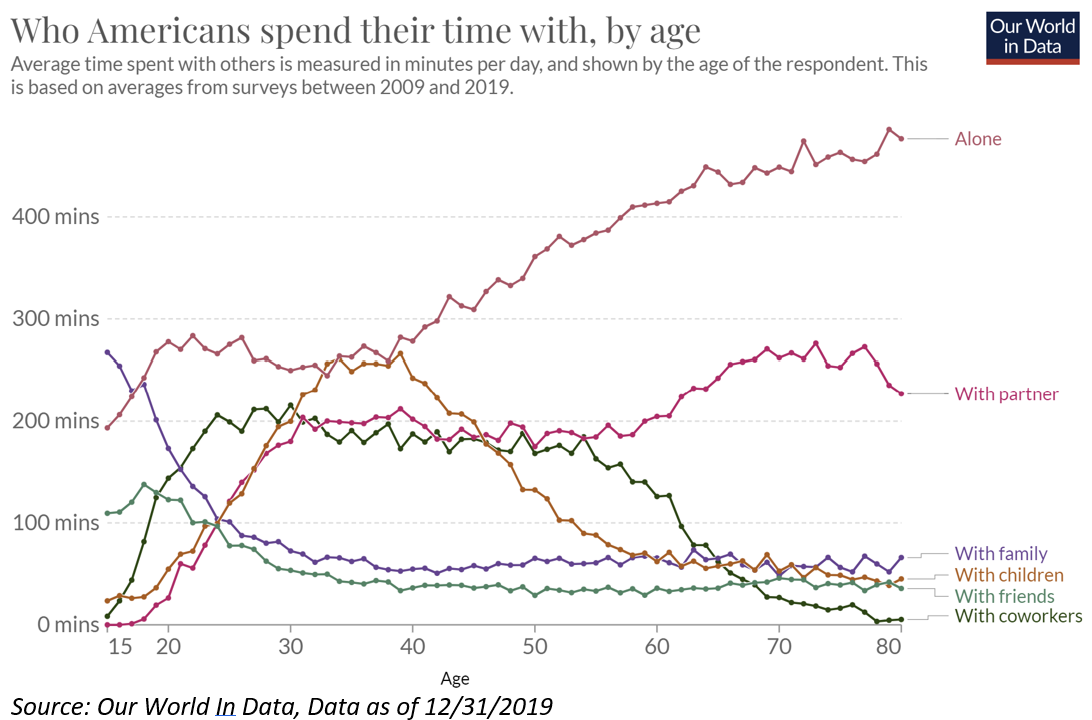

- Life Perspective: Coinciding with last year’s message of “Time Billionaire”, we want to focus on how people spend their time. Don’t worry, we won’t tell you where to spend it. As we go through life, we build personal relationships with different people – family, friends, coworkers, partners. These relationships, which are deeply important to all of us, evolve with time. As we grow older, we build new relationships while others transform or fade, and towards the end of life many of us spend a lot of time alone.

Viewing the evidence together, the message is not that we should be sad about the prospect of aging, but rather that we should recognize the fact that social connections are complex. We often tend to look at the quantity of time spent with others as a marker of social well-being; but it’s the quality of time spent with others that contribute to our feelings of connection or loneliness.

At Aptus, we are privileged to partner with every one of you. We are blessed to have all of our new relationships, and for those relationships that we’ve had for a long time – we would not be who we are without each and every one of you. Each of you reading this outlook is the life blood of our company, and we couldn’t be prouder of everyone being a part of our lives.

We wish everyone a safe and healthy new year.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

When a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material we recommend the citation, be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2212-10.