Our experience in the options market is what underpins our investment process. Options are the vehicle to inject ownership of volatility, and it’s this ownership that allows our allocations to shift away from bonds and towards stocks. In our view, this can position portfolios for higher return potential. Some math to think about…

Current yield of the 10-year treasury bond is roughly 2%. That means for every $100 dollars you get $2 annually in interest for the next 10 years and that $2 will not go up.

The current rate of inflation is 7.5%, and while we could argue it’s higher, let’s stick with that for now. 7.5% inflation means a dollar in your pocket is currently losing 7.5% of it’s purchasing power annual. What’s the worst thing to hold in an inflationary environment? Anything with a fixed payment – like a bond!

So, using the current 10-year treasury as our baseline example, bonds are currently generating a negative 5.5% return…no bueno.

As Derek pointed out in his recent note, Protect and Participate, we want to accomplish two simple objectives with our portfolios:

- To know our money has some resistance to falling markets

- To know we can benefit from rising markets

The shift towards stocks helps with #2, but it’s our exposure to volatility through options that helps with #1. It’s this exposure that helped us navigate the volatility of 2020 the way that we did. It’s this exposure that gives us confidence moving forward.

Options 101 – Put Options

To get to the answer to the opening question, we have to start here.

A put option is simply the right to sell something at a certain price. For example, if you bought a put option on Stock ABC with a strike price of $100 and an expiration date of March 18th, 2022…you could ‘exercise’ your right to sell stock ABC for $100 anytime before or on 3/18.

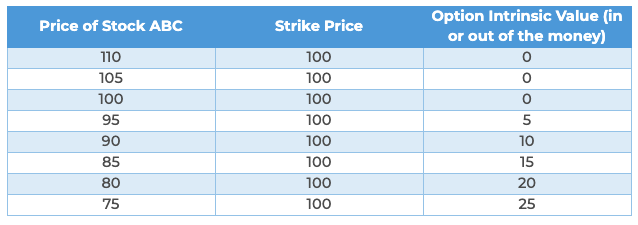

There is value in this right if stock ABC drops below $100. Let’s say it drops to $90. At that point, your right to sell at $100 is worth $10 (100 – 90). That’s called intrinsic value or the option being ‘in the money’. There’s intrinsic value in a put option anytime the underlying security (Stock ABC in this example) is below the strike price (the price you have a right to sell at).

Keep in mind, the price you’d have to pay for this right is only equal to the intrinsic value the second of expiration. Until that conclusion, there are multiple factors (including time) impacting the price you have to pay for this right to sell the security at $100.

We don’t need to worry about that stuff for the purpose of today’s note. The point I’m making is that a put option goes up in value when the underlying security goes down.

We Use Puts to Hedge, Not Speculate

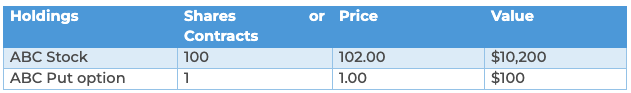

Your right to sell stock ABC at $100 cost you something. You had to pay a premium for this right. Let’s assume your cost for this option was $1.00 and the stock of ABC is currently at $102.

Notice a couple of things:

- Your option is the right to sell at $100 with the stock at $102 so there’s ZERO intrinsic value in your option as it is out of the money

- You still had to pay a premium of $1.00

Let’s assume you bought this put option not to speculate that stock ABC is going down, but to protect your current position of 100 shares of ABC stock. Here’s what you own:

*Each option contract carries a multiplier of 100. So, 1 contract gives you exposure to 100 shares.

You have 100 shares of stock ABC you are protecting with 1 put option. Your put position covers 100% of your stock position once it’s below $100.

Your current set up is a perfect hedge minus your cost to buy the hedge once Stock ABC gets below your strike of $100.

For example, if at the expiration of the option, Stock ABC is worth $90 your option’s value would increase by an offsetting amount to perfectly protect your position from $100 to $90.

You would have lost $12 (102-90) on your stock position which comes out to be $1200. But you would have gained $10 (Strike of 100 minus current prices of 90) on your option or $1000 minus the $100 you paid to own the option. All in, you’ve showed a loss of $1200 on the stock but a net gain of $900 on the option. Losing a total of $300 in total value as your stock lost nearly 12% of value is not bad!

Introducing Delta

Before you start this section, repeat 5 times:

Options Deltas are Dynamic not Static

We laid the foundation above so we can discuss the delta of an option…the entire purpose of today’s note.

An option’s delta is simply a measure of how much the price of the option changes relative to the price of the underlying.

For example, a 40 delta option would move 40 cents for every 1 dollar move of the underlying. In our example, let’s assume your put option to be a 40-delta put option. If the underlying stock moves from 102 to 101, your option price would move higher from 1.00 to 1.40. Put options move higher as the underlying moves lower as intrinsic value (or the chance for it) becomes greater.

The important things to note:

- As the underlying moves lower and lower, the delta of that put will get higher and higher. In other words, the effectiveness of your hedge will become greater and greater as the underlying moves lower

- At expiration, your option will approach a delta of 1, or 0. If there’s intrinsic value, it’s 1. If there’s not, its 0

A Built-In Braking System

Hopefully, the color in today’s note helps explain why we say our hedges will become more and more effective if prices continue to drop.

Typically, we are dealing with hedges that are roughly 40-delta. The first 10% or so down the effectiveness of those hedges are one thing. The next 10% down, they are an entirely different thing as we will begin to ‘realize more delta’.

As stock prices fall, 40 delta puts become 50 delta puts, then 60, 70, etc. So the acceleration of a fall in prices creates an acceleration in the value of the puts you own. A set of brakes to resist danger, just when you really need them.

In closing, let’s answer the question we opened with – how and when will hedges be effective?

Your Portfolio and Today’s Market

Our hedges will be very effective at keeping us out of the majority of market downside from here. That’s because our equity strategies have more hedged exposure than we’ve had in a long time. We will not avoid all volatility, but we will avoid most of it…especially if it happens quickly.

As mentioned, our hedges have already been effective, but the effectiveness will become even more clear on further market downside. The ‘when’ could be right around the corner if the market were to experience a sharp sell off.

We try and refrain from discussing option Greeks like delta, but I feel like it was needed today. The world feels even more uncertain than usual, and we wanted to remind you with more detail that we believe we have protection in place.

As always, thank you for your trust and please reach out to discuss anything in this note and how it relates to your specific portfolio.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The opinions expressed are those of Aptus Capital Advisors, LLC. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions. The investment strategy or strategies discussed may not be suitable for all investors. Investors must make their own decisions based on their specific investment objectives and financial circumstances.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2203-4.