Let’s talk about the last couple weeks in the market and what we are doing about it.

Not to provide homework, but if you haven’t read the following links, please do. The positioning of portfolios and the thoughts about our positioning will be much more effective.

How and When Can Hedges Be Effective?

Recent Market Activity

The S&P 500 hit lows in the back half of May. Since then, two things have happened:

- The Index has risen around 9%

- The market’s measure of volatility (The VIX) has dropped back below 25.

Keep those two things in mind as we continue along with the simple truth that the time to buy home insurance is before it catches on fire…not while it’s on fire.

Your Portfolios

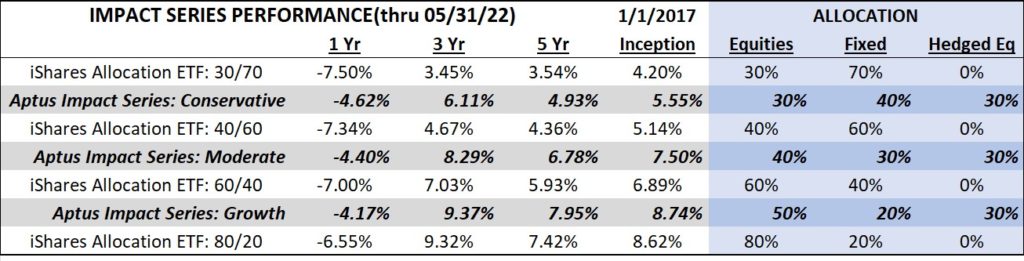

Asset allocation is the most important decision we make. We’ve long said, the shift we think is crucial to preserving/growing wealth in today’s market is avoiding bonds in favor of more stocks, but with protection. Using the car analogy, we don’t think managing risk through bonds is prudent…we don’t see them having an engine to drive returns. Why own something if it can’t produce returns?

The big theme at Aptus is our allocations consists of more stocks (a stronger engine), less bonds (a weaker engine), and market hedges (better brakes). If we want to drive fast, we need better brakes.

We’ve been deploying this approach in portfolios for over 5 years now, helping portfolios in that time and we believe even more beneficial in the years ahead. More detail about that here.

The performance data represents past performance & does not guarantee future results. Investment return & principal value of an investment will fluctuate, so an investor’s shares may be worth more or less than original cost when sold. Current performance may be higher or lower than quoted performance. Returns are expressed in US dollars, & periods >1 year are annualized. Returns are calculated net of all fund fees and expenses. Net returns shown include the deduction of the highest sub-advisory fee charged to our clients in sub-advisory arrangements, 0.15%. This is the maximum subadvisory fee paid during the time periods presented, and individual accounts may pay a lower effective fee. For our fee schedule please refer to Form ADV 2A, which is available upon request . Actual client results may be lower based on imposition of additional advisory fees, platform fees, & custodial fees charged by firms. iShares Core Allocation ETFs are designed as diversified core portfolios based on the specific risk consideration of the investor. For performance through most recent month end, please call (251) 517-7198 or visit impact-series.com/fact-sheets

More importantly, I want to cover what actions we’ve taken in the bounce, with the S&P rising and volatility dropping. In order to do that, let’s walk through a simple example.

Convexity is Key

Let’s assume you have the following positions:

- $100,000 in an S&P 500 fund

- This is simply long exposure to stocks

- $500-$1000 in a .02 delta put option on the S&P 500 in a notional amount $500,000

- This is a hedge, designed to protect your stock position

Jogging your memory from the earlier linked posts, you remember that a delta of .02 means that for each dollar move in the SPY, your position only moves two cents. Delta simply measures the change in the price of your hedge vs the change in the price of the underlying security it is protecting…in this case the SPY.

In dollar terms, your current position (your hedge) will protect only $10,000 from an initial drop in the S&P 500. (.02 x $500,000). Not very attractive, right?

Well, what happens if the market starts dropping and this turns into a .20 delta option? Let’s run that math.

If you have a put that’s protecting $500,000 of notional exposure and is a 20 delta option, in dollar terms your position will protect $100,000 (.20 x $500,000). That’s 100% of your position. Meaning you would not feel the effects of ANY move lower. Fully protected.

See how powerful a rising delta can be, especially when you have more than 100% of your exposure protected?

Before we move on, let’s think about one more question. What causes deltas to rise and how quickly will they rise?

Without getting complicated, you will experience a rise in deltas if SPY drops in price and/or volatility increases.

How quickly an option’s delta moves is a critical piece to understanding the effectiveness of the hedge. The rate of change of your delta is…convexity!

Lower delta options carry much higher convexity and lower near-term effectiveness. But, they are cheaper, much cheaper. So, you can buy more of them, which increases the amount of notional protection you can buy.

In contrast, higher delta options are more expensive, have less convexity, but greater near-term effectiveness.

See the give and take between convexity and a hedge’s effectiveness?

Portfolio Level

You have exposure to market hedges. Not all of these hedges are the same. Some are very convex with big payouts in real market stress, but be barely noticeable on shallower drops while VIX stays contained. Some are less convex but will protect much quicker if markets fall.

The main point here is to communicate that as prices in the market have bounced, and volatility has been sucked out of this market, we’ve increased our exposure to hedges and the protection they could provide.

We’ve done this because they’ve gotten cheaper.

Not a lot has changed over two weeks from a market standpoint. The things that have spooked the market this year have not gone away.

If there’s more upside to be had, we are confident in our allocations’ ability to participate.

If there’s more downside to be had, I’m sure glad we are loaded up with hedges and the potential payoff of that convexity.

When the rest of the market is buying protection, their portfolios are usually on fire (and VIX is rising). The cost of protection ain’t cheap in those moments.

We prefer to buy our protection before things catch fire…it’s usually cheaper that way and allows us some peace of mind when their payoff is actually needed.

Thanks for reading and for your trust. Please don’t hesitate to reach out with any questions at all.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

The VIX Index is a calculation designed to produce a measure of constant, 30-day expected volatility of the U.S. stock market, derived from real-time, mid-quote prices of S&P 500® Index (SPX℠) call and put options. On a global basis, it is one of the most recognized measures of volatility — widely reported by financial media and closely followed by a variety of market participants as a daily market indicator.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2206-7.