Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and how they help fill the puzzle of evidence:

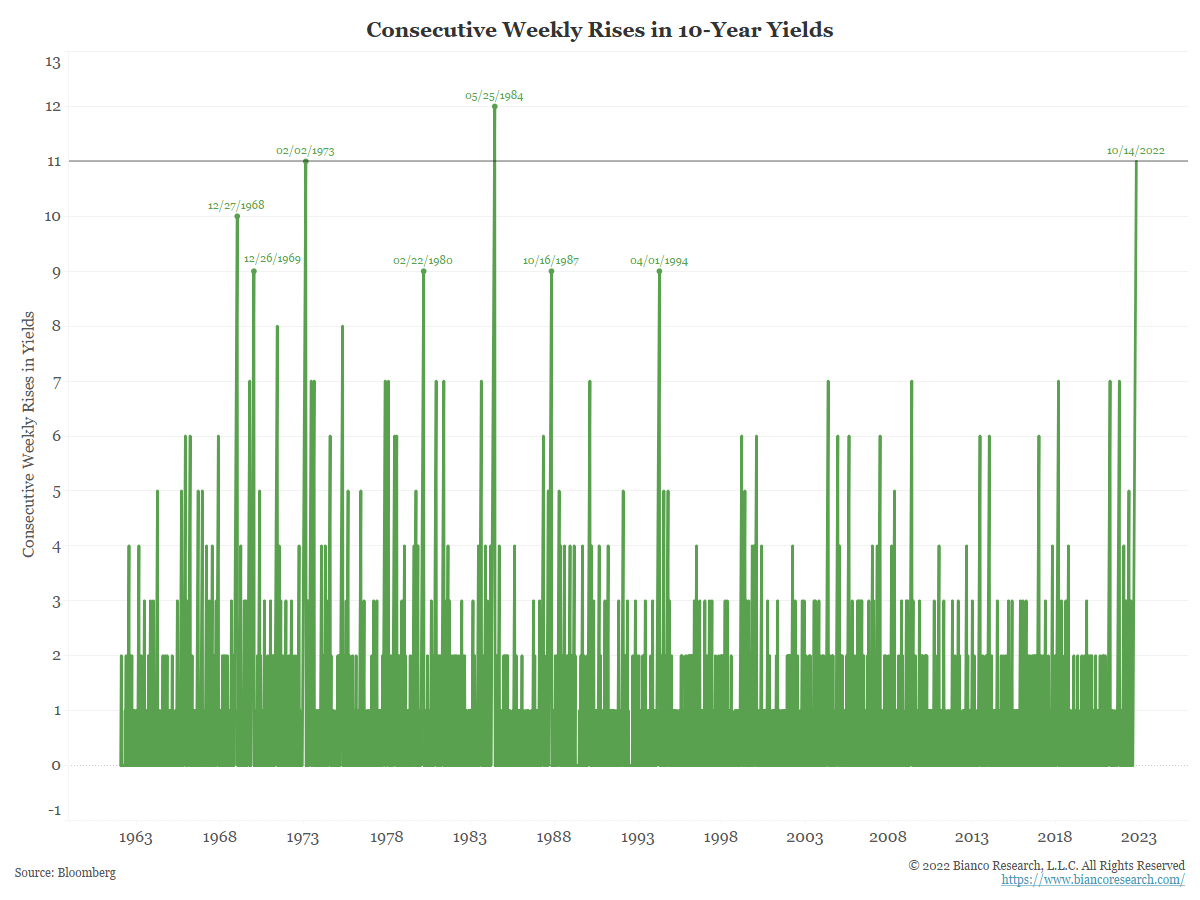

John Luke: “Unprecedented” has been the word of the year in markets, pushing for another here as we reach 12 straight weeks of rising yields

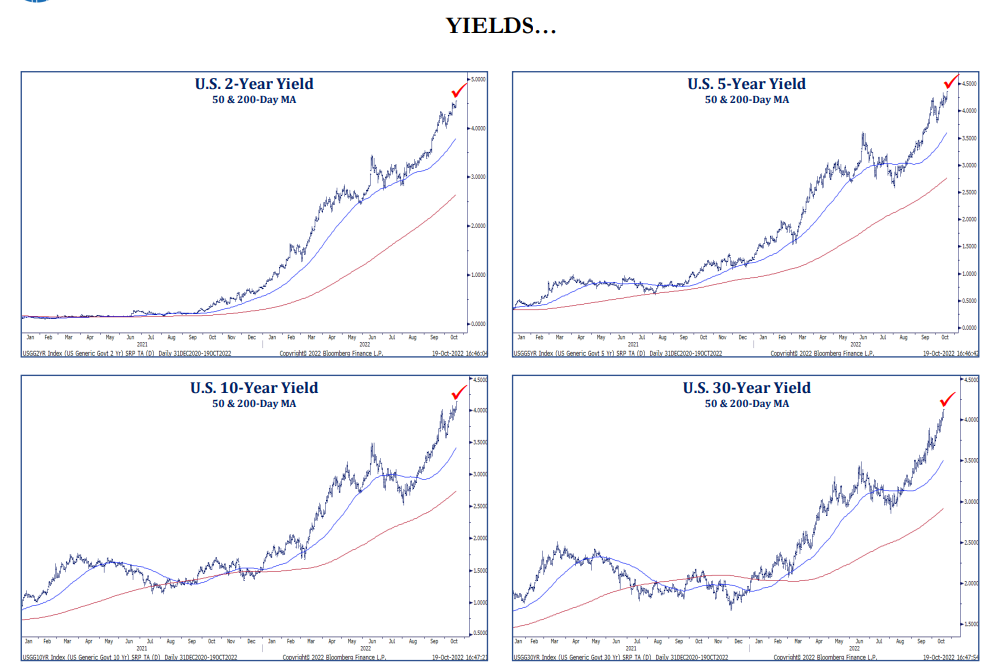

JD: and with the persistence of the rising yields across the curve

Source: Strategas as of 10.20.2022

Source: Strategas as of 10.20.2022

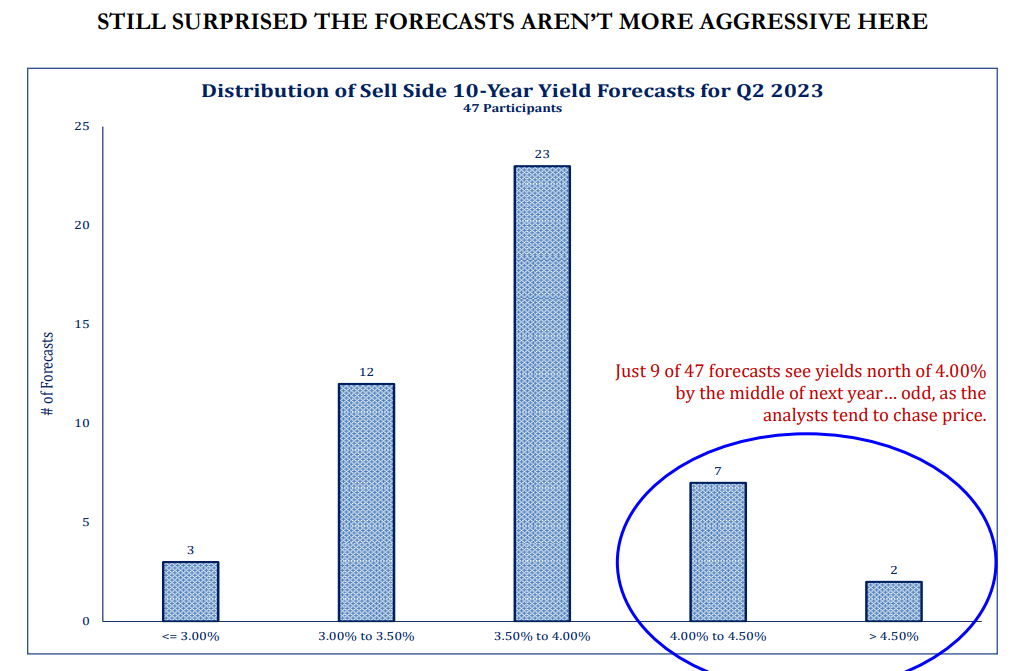

John Luke: economists are still hesitant to extrapolate continued rate rises

Data: Strategas as of 10.19.2022

Data: Strategas as of 10.19.2022

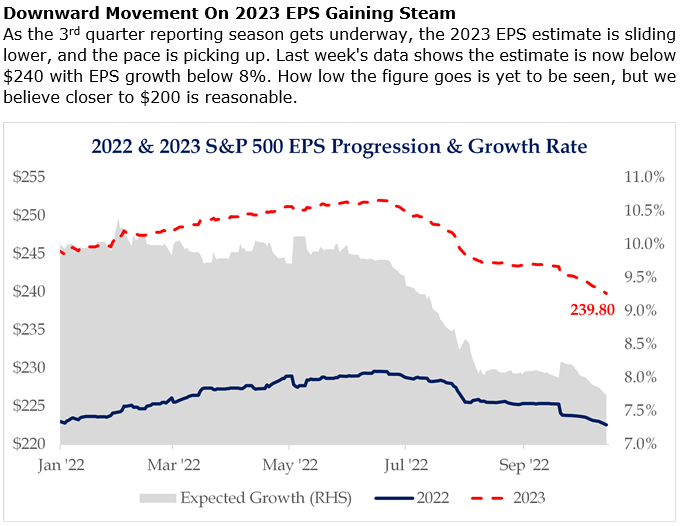

Beckham: and Wall Street strategists continue to default to their “Today plus 8-12%” methodology

Source: Bloomberg as of 10.19.2022

Brad: Earnings estimates are finally starting to come down

Source: Strategas as of 10.14.2022

Source: Strategas as of 10.14.2022

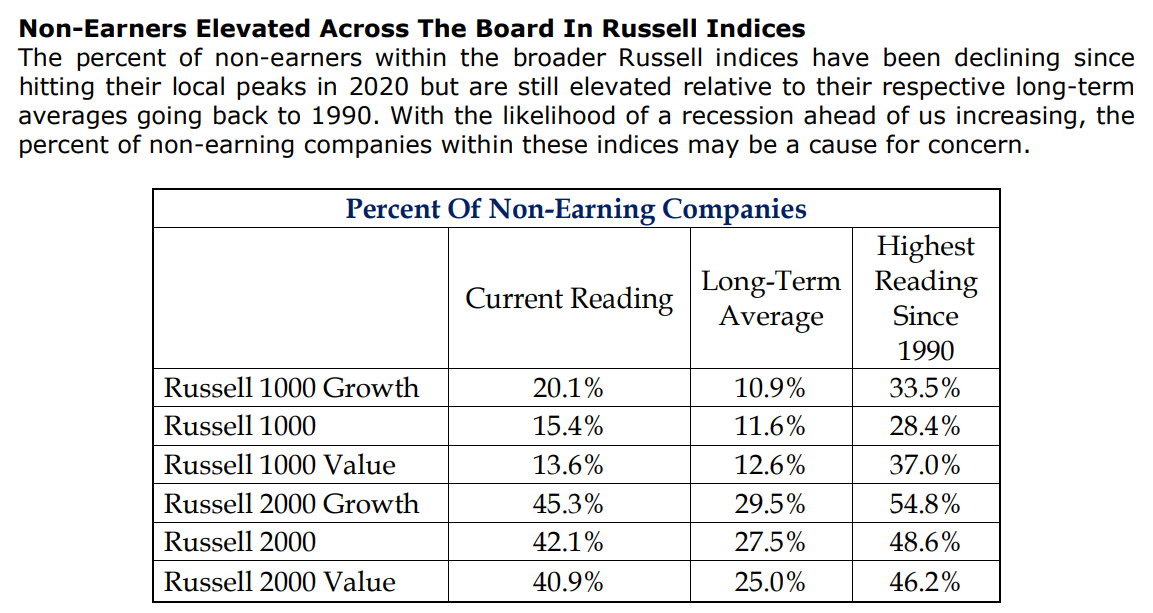

Brad: and the proportion of non-earners remains high but well off the craziness of 2020-21

Source: Strategas as of 10.18.2022

Source: Strategas as of 10.18.2022

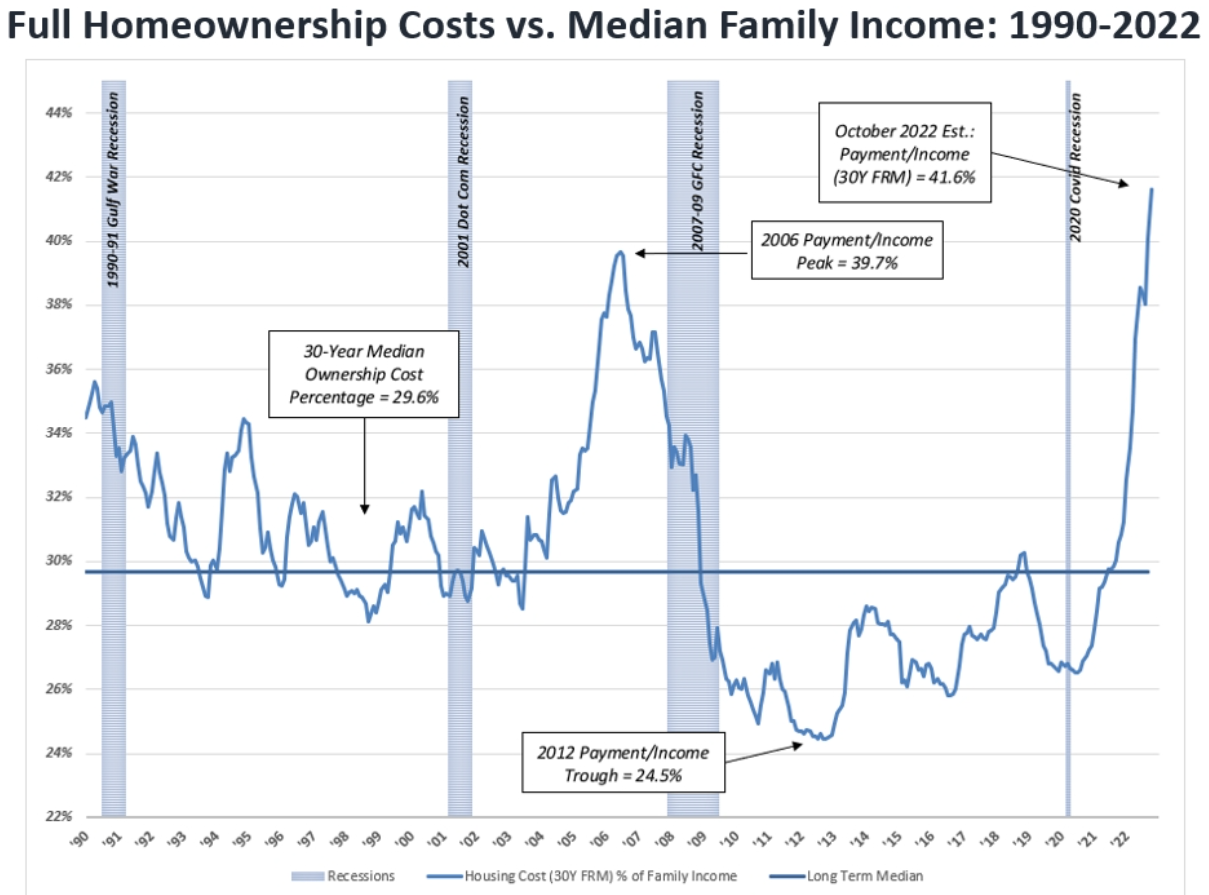

Dave: The world is split b/w those with low-rate mortgages and those without

Source: Raymond James as of 10.20.2022

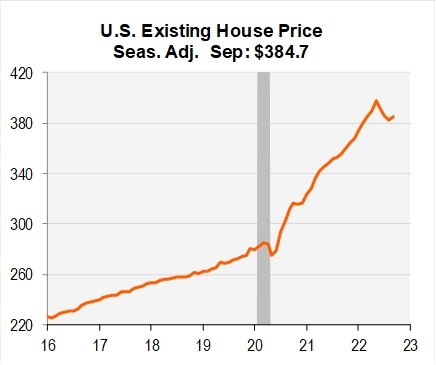

John Luke: and prices are still substantially higher than just a few years ago

Source: Piper Sandler as of 10.19.2022

Source: Piper Sandler as of 10.19.2022

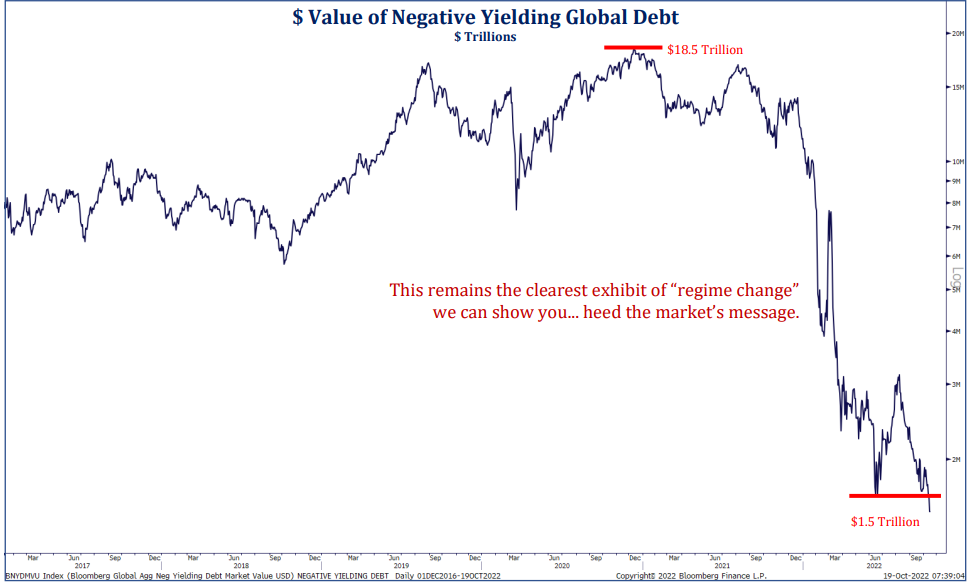

John Luke: Remember negative-yielding debt? How was that a thing?

Source: Strategas as of 10.19.2022

Source: Strategas as of 10.19.2022

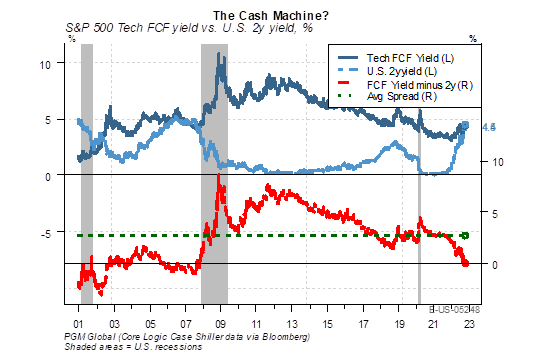

John Luke: Short-term Treasuries are finally providing real competition to the “There is No Alternative” regime

Source: Pavilion as of 10.19.2022

Source: Pavilion as of 10.19.2022

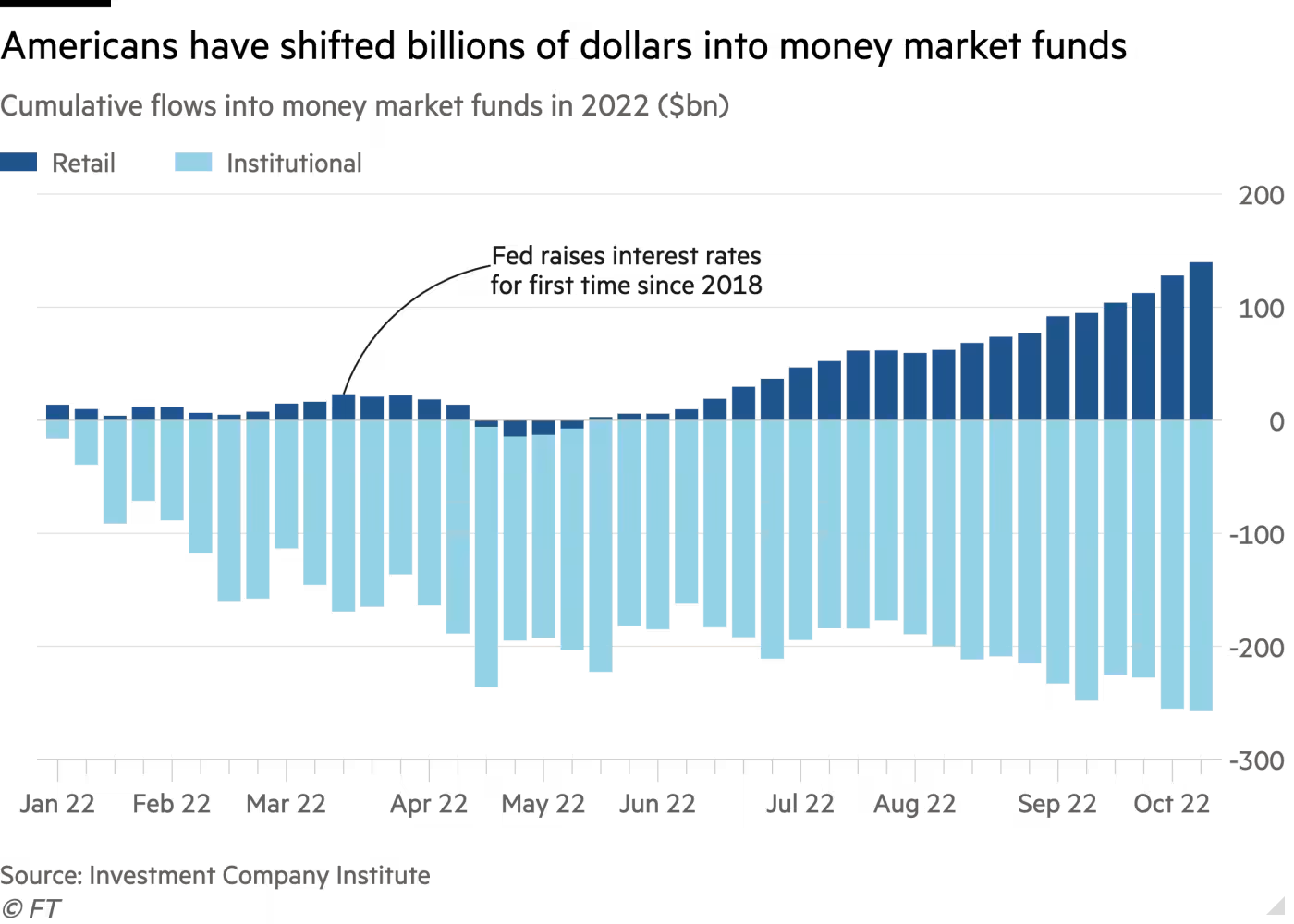

John Luke: and it’s showing up with assets flooding into money-market funds

Data as of 10.19.2022

Data as of 10.19.2022

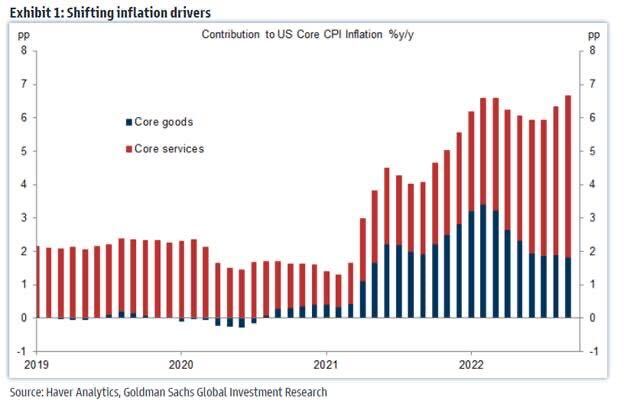

John Luke: What is worrying markets right now is the stickiness of services inflation

Data as of 10.19.2022

Data as of 10.19.2022

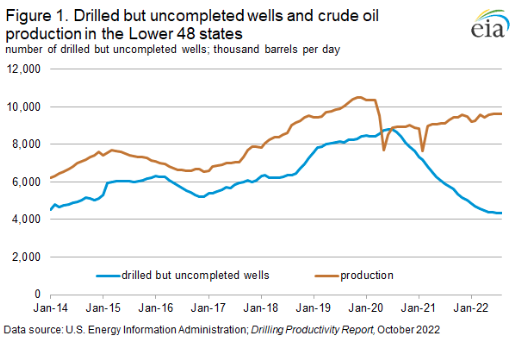

Joseph: and what happens when our lack of supply emerges as a renewed trend higher in energy prices?

Data as of 10.14.2022

Data as of 10.14.2022

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed. Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

The Russell 1000® Index measures the performance of the large cap segment of the U.S. equity universe. The Russell 1000 Index is a subset of the Russell 3000® Index, representing approximately 90% of the total market capitalization of that index. It includes approximately 1,000 of the largest securities based on a combination of their market capitalization and current index membership.

The Russell 2000® Index measures the performance of the small cap segment of the U.S. equity universe. The Russell 2000 Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership.

The 10 Year Treasury Rate is the yield received for investing in a US government issued treasury security that has a maturity of 10 year. The 10 year treasury yield is included on the longer end of the yield curve. Many analysts will use the 10 year yield as the “risk free” rate when valuing the markets or an individual security.

The Consumer Price Index (CPI) measures the change in prices paid by consumers for goods and services. The CPI reflects spending patterns for each of two population groups: all urban consumers and urban wage earners and clerical workers.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2210-25.