Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

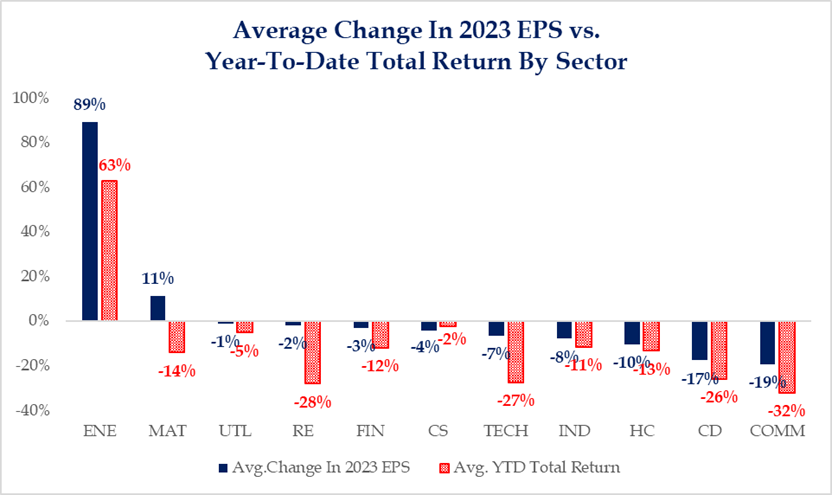

JL: stock prices have generally tracked earnings revisions this year, with a clear bias towards compressing valuations

Source: Strategas as of 11.07.2022

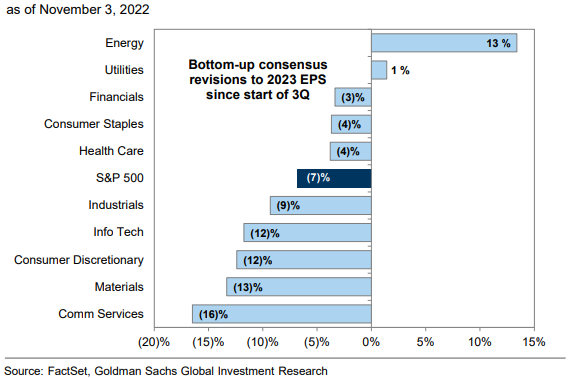

Brad: and the energy sector continues to be immune from 2023 estimate cuts

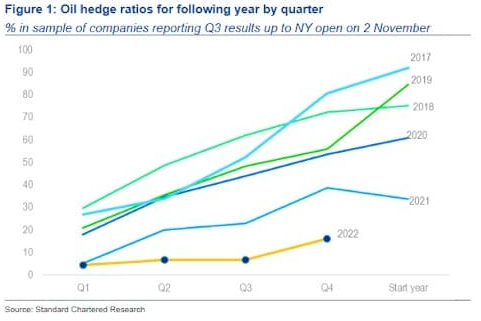

Joseph: while the companies themselves have been confirming that trend, with much lighter hedges than in recent years

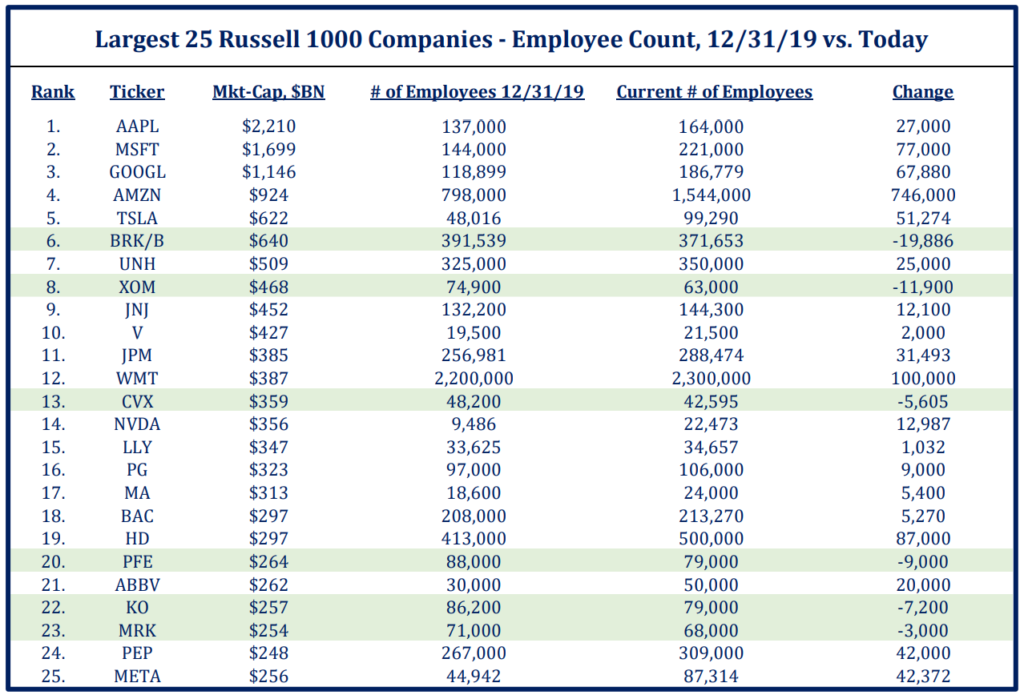

Dave: while also keeping employee count much more restrained vs. other sectors

Source: Strategas as of 11.07

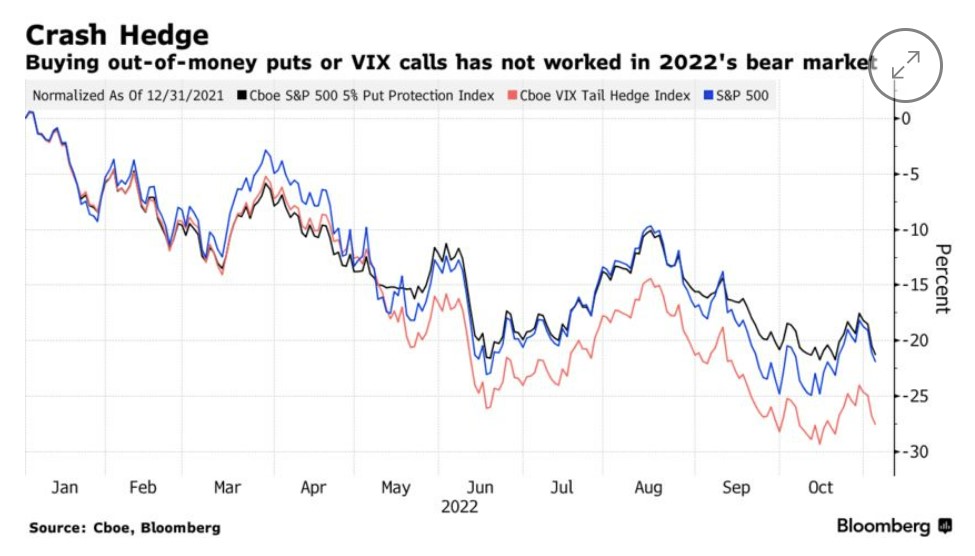

JD: speaking of restrained, the cost of hedging against sharp equity selloffs has gone nowhere this year

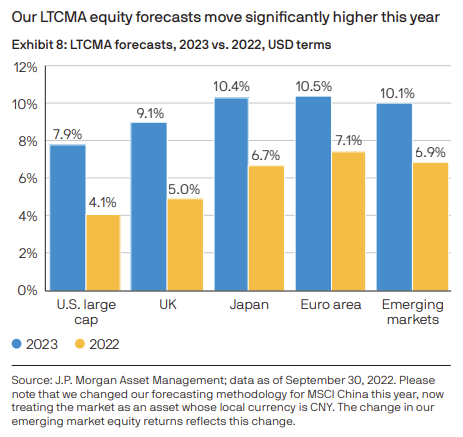

JL: though the good side of lower valuations is higher potential returns in the future

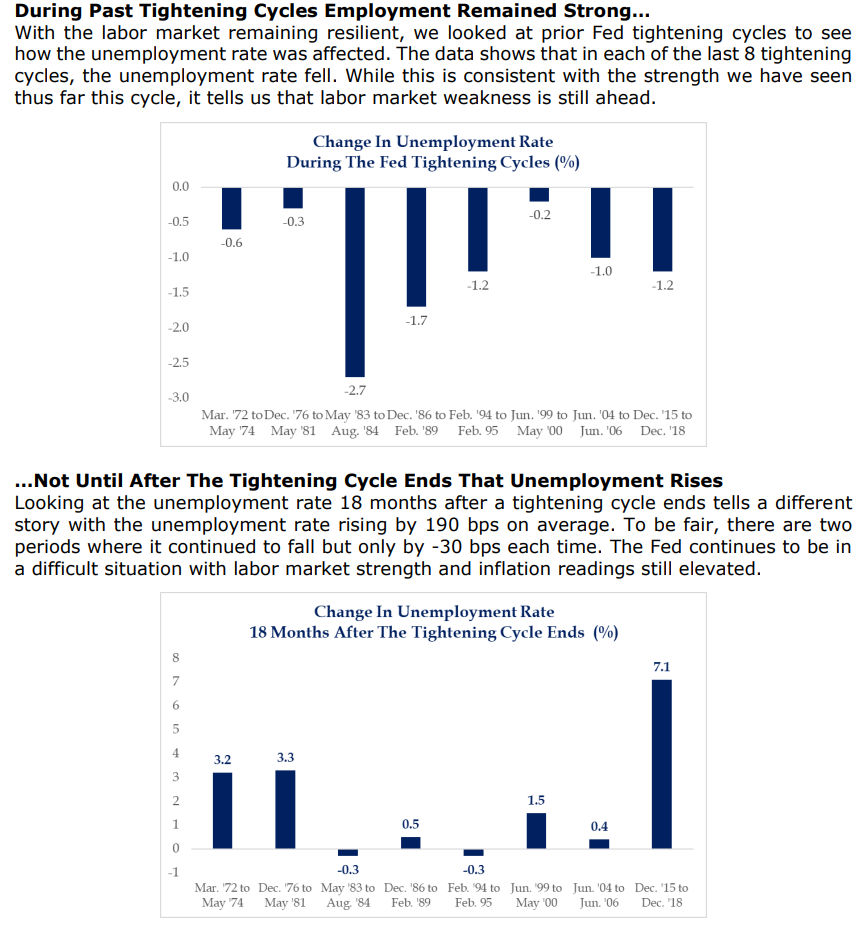

Dave: everyone is watching employment, but in recent cycles job losses haven’t come until well after the Fed stops hiking

Source: Strategas as of 09.30.2022

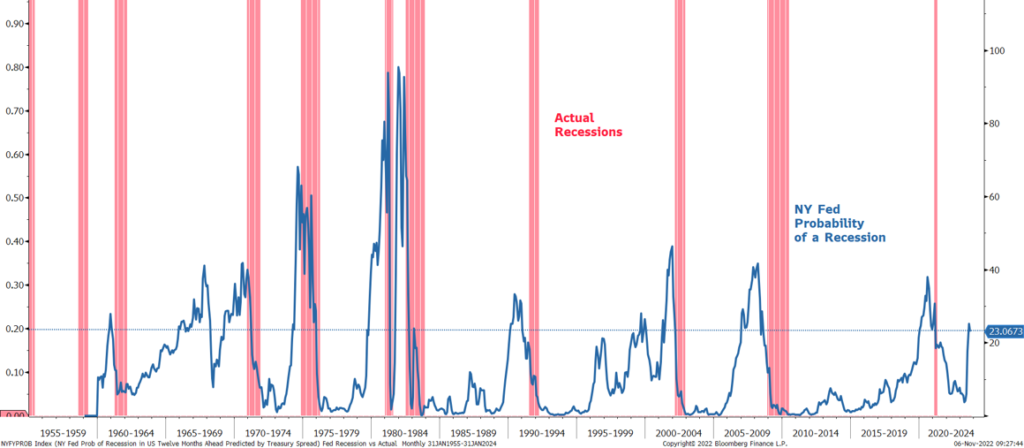

Dave: the NY Fed’s “recession model” is showing increased risk of a recession

Source: Morgan Stanley as of 11.07.2022

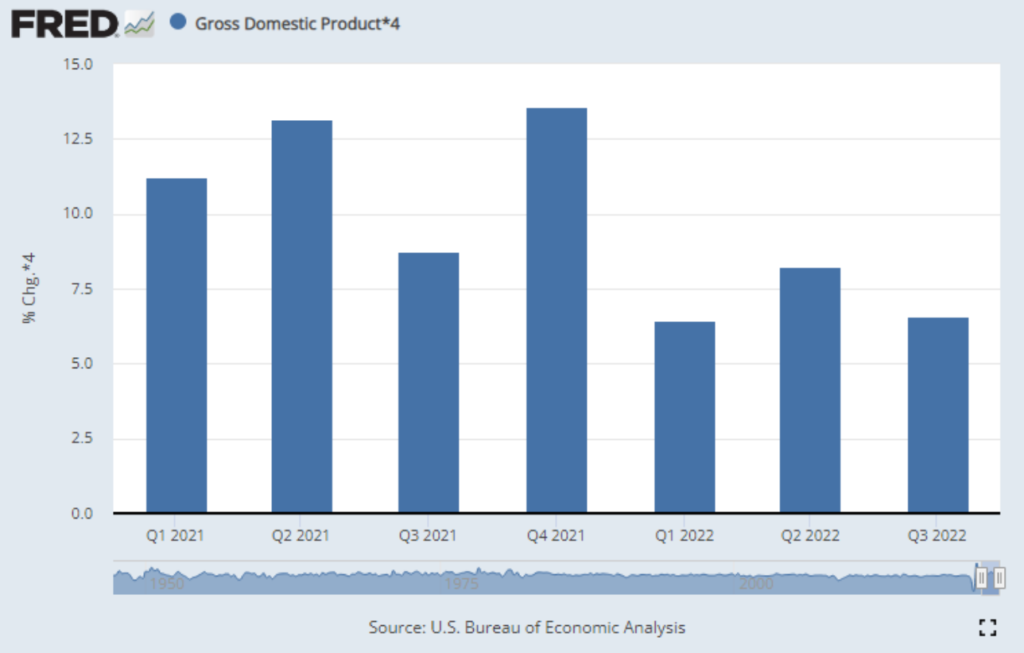

JL: yet nominal GDP is cruising along

Data as of 10.15.2022

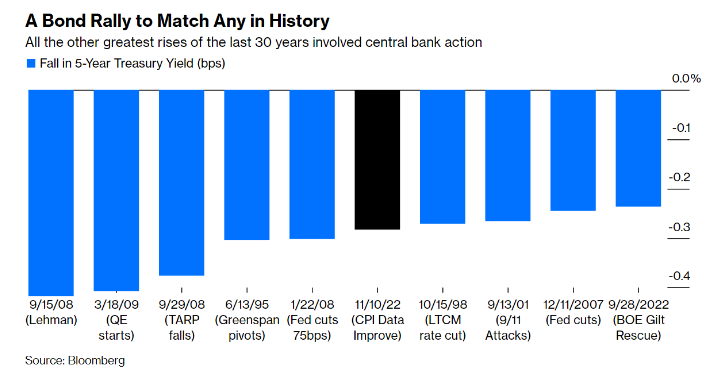

JL: Thursday’s CPI report sent shockwaves through the rates market

Data as of 11.10.2022

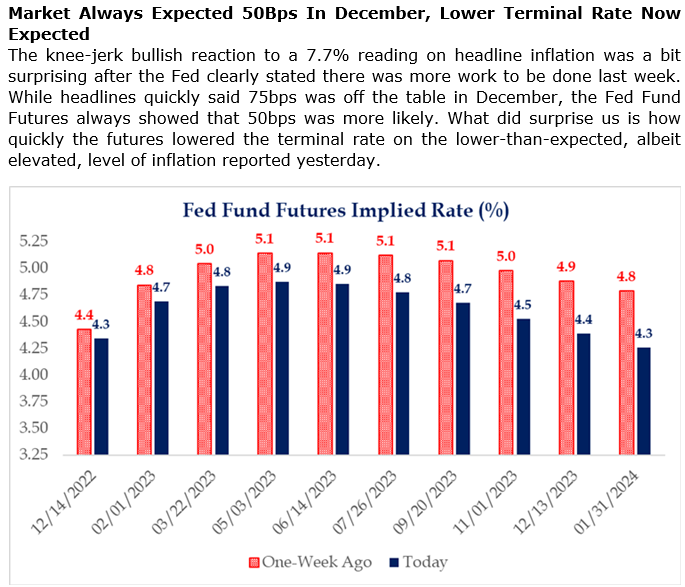

Brad: with future Fed Funds expectations reacting immediately across the board

Source: Strategas as of 11.10.2022

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed. Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Created by the Chicago Board Options Exchange (CBOE), the Volatility Index, or VIX, is a real-time market index that represents the market’s expectation of 30-day forward-looking volatility. Derived from the price inputs of the S&P 500 index options, it provides a measure of market risk and investors’ sentiments.

The Russell 1000® Index measures the performance of the large cap segment of the U.S. equity universe. The Russell 1000 Index is a subset of the Russell 3000® Index, representing approximately 90% of the total market capitalization of that index. It includes approximately 1,000 of the largest securities based on a combination of their market capitalization and current index membership.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

When a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material we recommend the citation, be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2211-12.