Think Different – Be Different

Day in and day out, our time is spent in the trenches with financial advisors and their end clients. Some are new relationships; some we’ve had the privilege to work with for years. We aim to be a valuable relationship and extend our resources where it makes sense. One area of focus is the investment piece of the wealth management puzzle – obviously. We have funds, models, and services that all give us more than a glimpse into the broader wealth management space.

The overwhelming majority of portfolios we see are a version of a “60/40” view on markets. Recent decades have created the rise of set it and forget it portfolios. We’d argue this rise has been driven by industry wide incentives and market action.

On the incentive side, there’s been mass adoption by advisors to free them up for more value-add activities. We see advisors spending less time picking stocks, bonds, or funds, to spend more time with people. That’s a beneficial feature we can get behind. After all, the wealth management business is and will always be a people and relationship business. Advisors spending more time with clients is a win.

The market side of things is where it gets dangerous. The last couple of decades in the markets have cemented the ‘set it and forget it’ portfolio mentality. Recent performance has created a mentality that investments are a commodity service as everybody adopted some form of a BlackRock, Vanguard, etc. blended allocation.

It’s worked, without a doubt, but why?

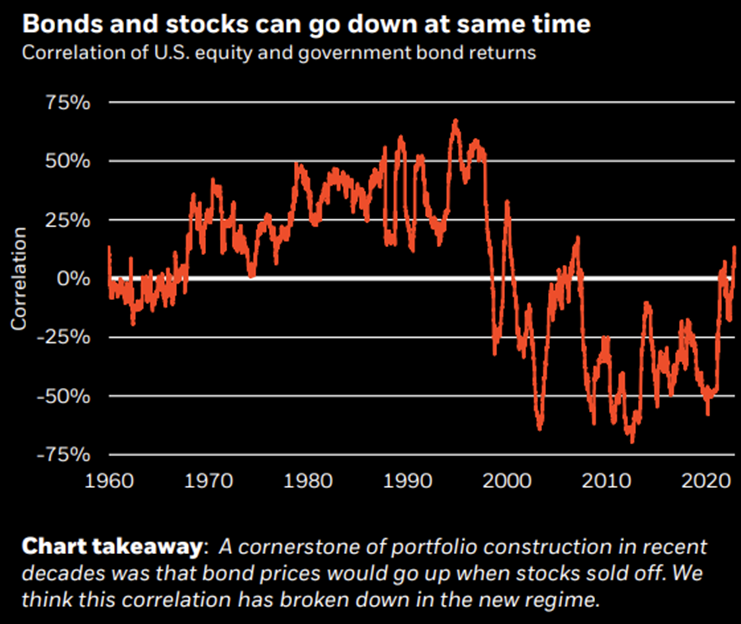

Look at the chart below. For 20+ years you’ve had zero or negative correlation between stocks and bonds while enjoying strong returns in both… of course it worked.

Source: BlackRock as of 12.29.2022

As the performance chasing machines we are, the financial services ecosystem has ingrained the recent rearview look into the most popular strategies of today. Blended allocation, target date funds, risk-based allocation…what’s your age, what’s your risk tolerance, great… here’s a version of the 60/40 for you.

History suggests that the correlation benefits of the recent past may not be normal. Couple that with disinflation, falling rates, and an incredibly accommodative Federal Reserve, you end up with asset prices rising. Will the default portfolios, which are built on the most recent decades in markets, perform as well as they have in the recent past if the environment is far from the same?

We are not so sure they will.

Today’s Market

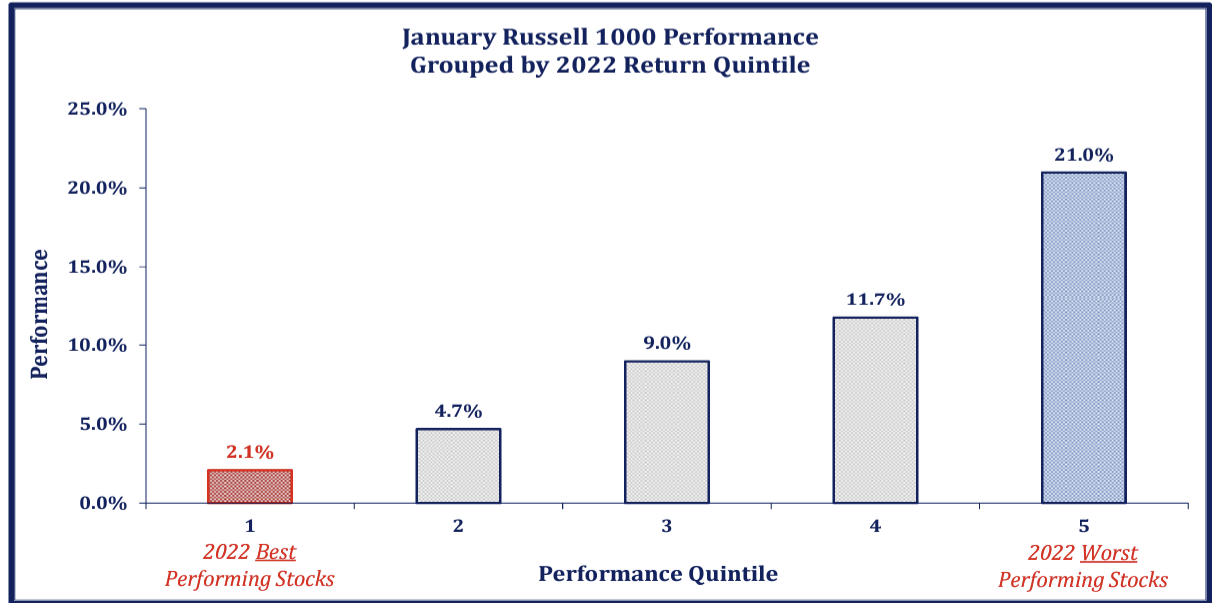

As we are typing today, January just wrapped up and look at what led the way.

Source: Strategas as of 02.01.2023

Source: Strategas as of 02.01.2023

The ‘junkier’ areas of the market ripped higher while quality was left in the dust. What took it on the chin in 2022 came roaring back in January.

The market appears to be pricing in a soft-landing for the Fed where inflationary fires are totally stomped out, unemployment gradually rises, and earnings remain resilient. JL wrote a nice piece discussing the difference in what markets are expecting from the Fed and what the Fed is telling us. It’s worth the read.

The VIX is back to a 17 handle…who needs protection. The appetite for risk increased in January without a doubt. We witnessed S&P 500 multiples expand back to 18x 2023 earnings. We feel markets are positioned in a way that if inflation surprises to the upside moving forward, the data may be poorly received.

Your Client’s Objectives

Hurdle rates of return that keep a financial plan on track are not astronomical. This is great news given the market backdrop. For most plans, if we can compound capital in the 6% to 12% range, all is well. That’s our objective…to position portfolios for returns that keep plans on track. We want to empower advisors to deliver consistently around the following three questions:

- Am I going to be ok?

- Can I maintain my family’s quality of life?

- Can I improve it?

We are making portfolio shifts and creating new strategies to aid in our best effort to position based on the windshield and not the rearview.

Our take on portfolio construction is not dependent on the most recent decade of market performance and correlation to continue. We are building portfolios to help keep financial plans on track. We see too many risks embedded in a ‘set it and forget it’ allocation today. More and more advisors are seemingly agreeing with us.

Our Positioning

We believe the importance of yield is elevated, as growth and valuation expansion both face headwinds for the foreseeable future.

Volatility is an asset class to us, and a tool we can harness to help alter portfolios to better position for future returns. We are leaning into ways we can harness volatility to:

- Mitigate risk

- Enhance yield

- Capture upside

We think the 21st century approach to portfolio construction, relying on the recent relationship of stocks and bonds, is broken. The full historical picture shows that correlation regimes shift; 2022 showed us what that can look like.

Chuck Prince, the CEO of Citigroup infamously said in 2007, “…as long as the music is playing, you’ve got to get up and dance.” We are still dancing, but conservatively with plenty of defensive exposure if indeed it’s required. Traditional allocations may not have the protection they expect. For the record, Chuck’s Citigroup lost nearly 98% of it’s value shortly after his quote.

As always, thank you for your trust and please don’t hesitate to reach out.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The content and/or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material we recommend the citation, be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2302-4.