Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

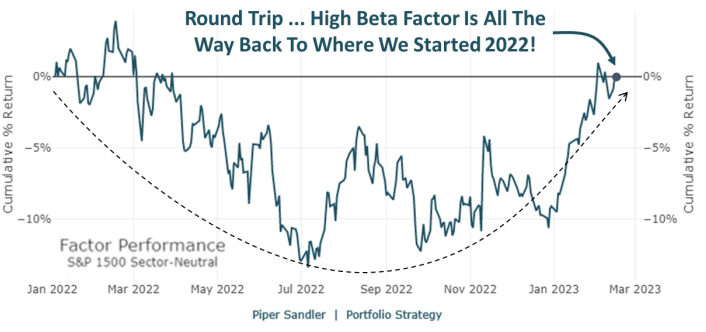

Brad: The early 2023 rally brought beta all the way back from the depths of 2022 underperformance

Data as of 02.22.2023

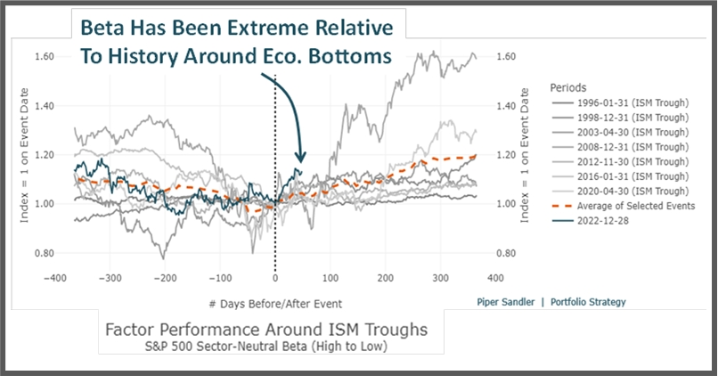

Dave: yet there seems to be no justification beyond a technical bounce

Data as of 02.22.2023

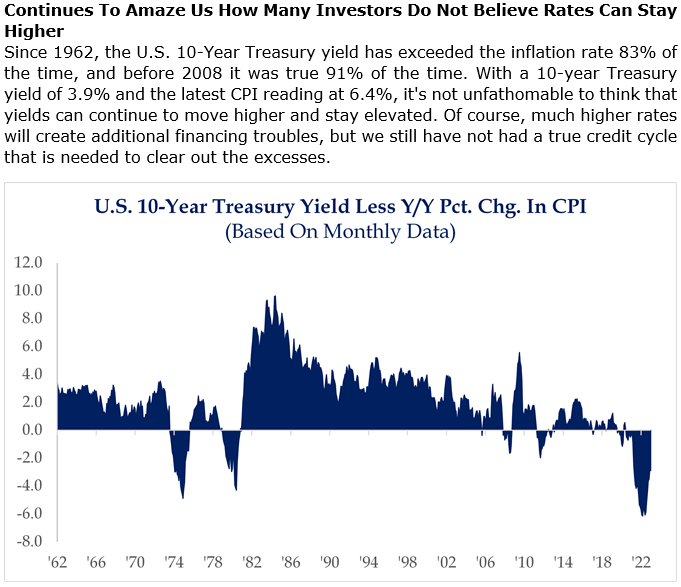

Brad: Real 10 year yields remain historically low relative to CPI

Source: Strategas as of 02.22.2023

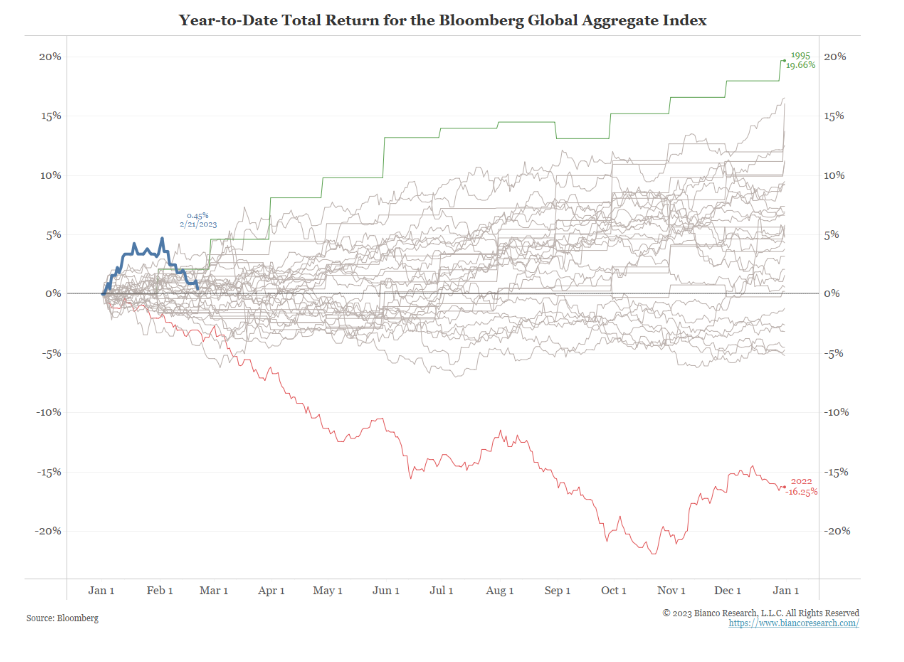

John Luke: and the early year bond rally appears to have run out of gas

Data as of 02.21.2023

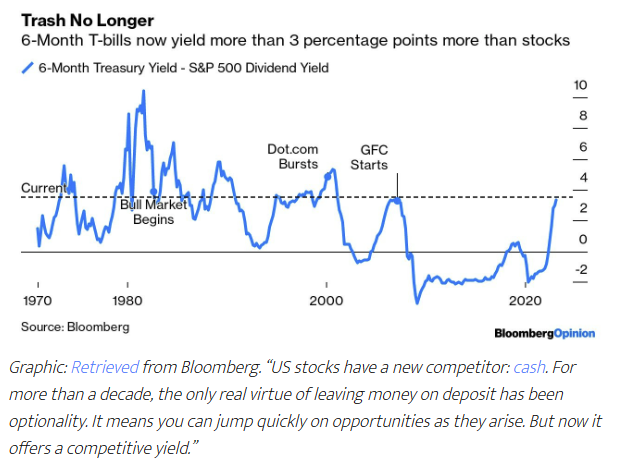

John Luke: Unlike the past two decades, T-Bills offer a viable alternative to stock dividends

Data as of 02.17.2023

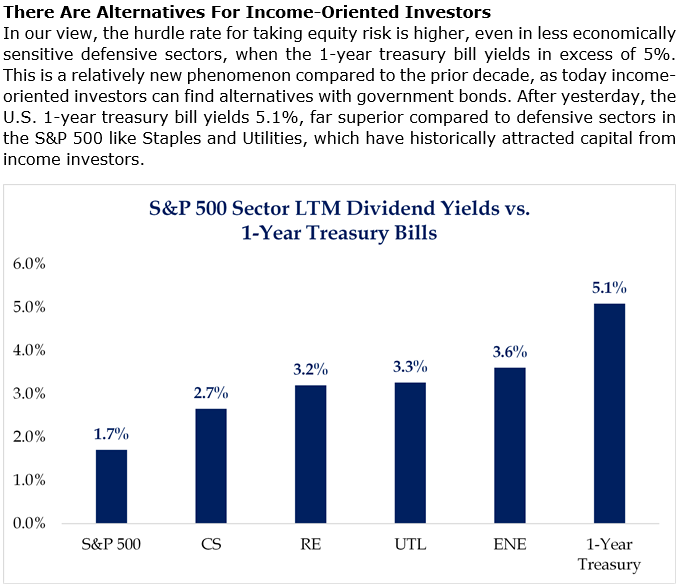

Brad: with even traditional areas of yield falling well short

Source: Strategas as of 02.22.2023

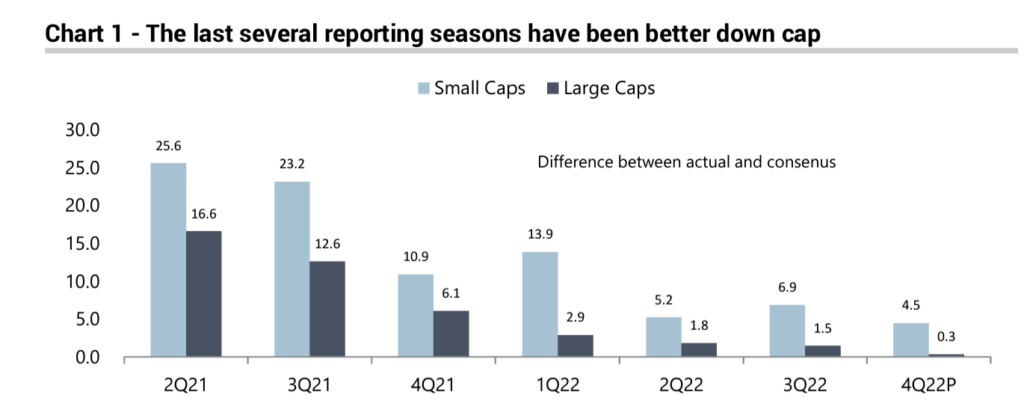

Dave: Small cap earnings have been faring much better than large cap, relative to expectations

Source: Jefferies as of 02.22.2023

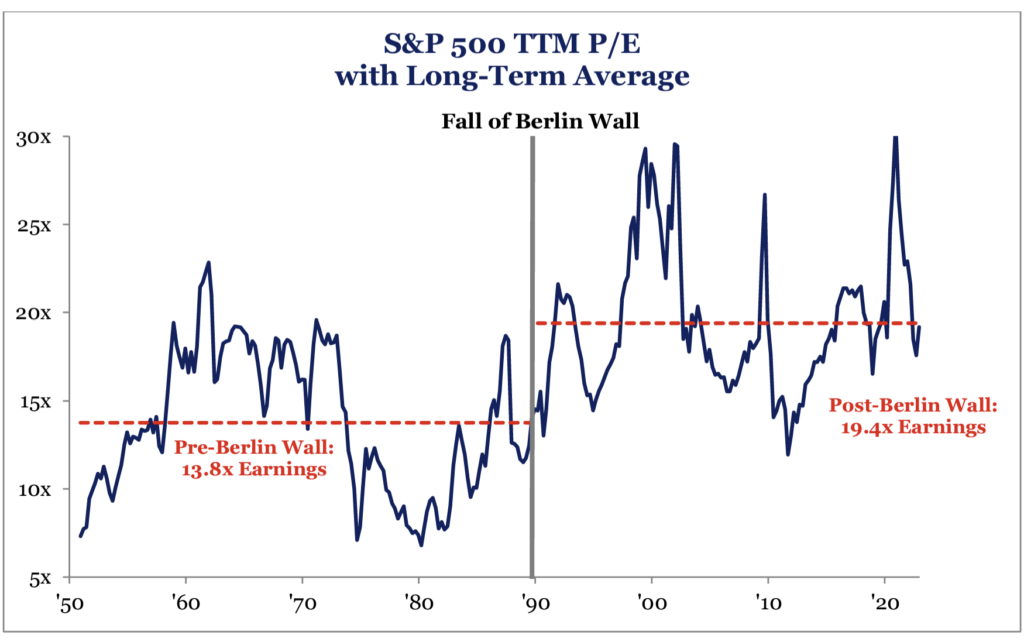

Dave: and large cap valuations have retreated from historically extreme valuations

Source: Strategas as of 02.22.2023

Source: Strategas as of 02.22.2023

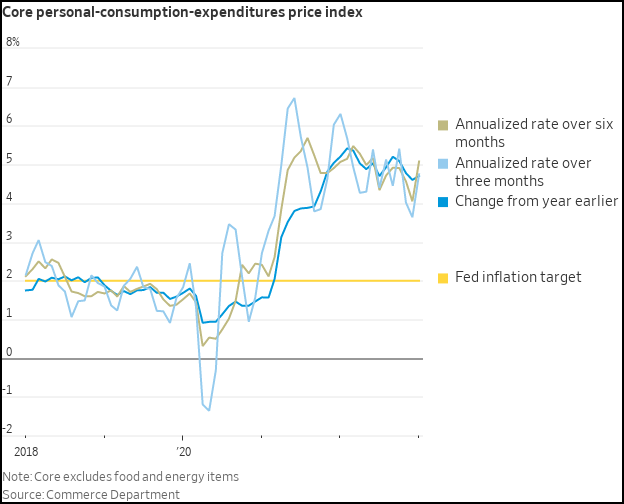

John Luke: The Fed’s supposed favorite inflation indicator, Core PCE, staying pretty sticky and well above their stated 2% target

Source: WSJ as of 02.24.2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2302-25.