Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

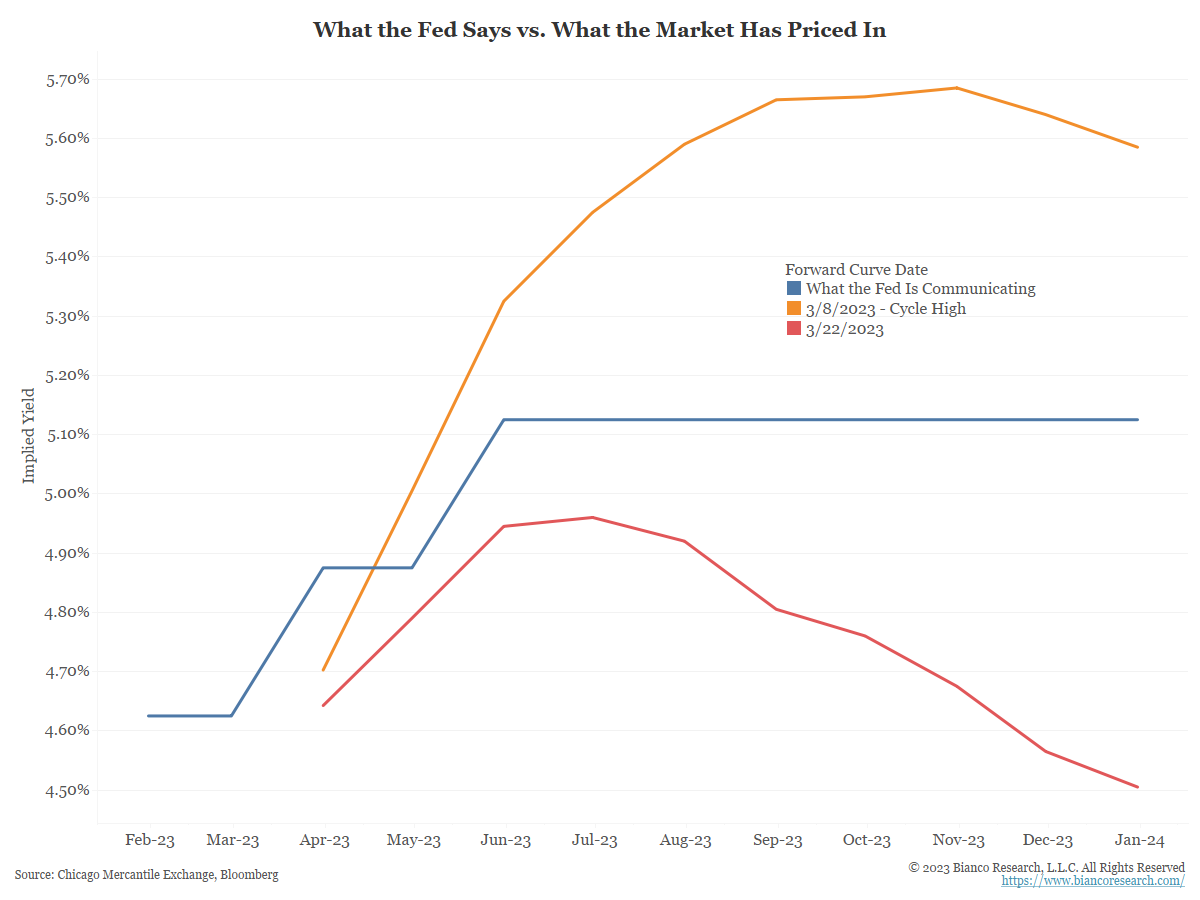

John Luke: The market sure seems to think the Fed is done hiking

Source: Bianco as of 03.22.2023

Source: Bianco as of 03.22.2023

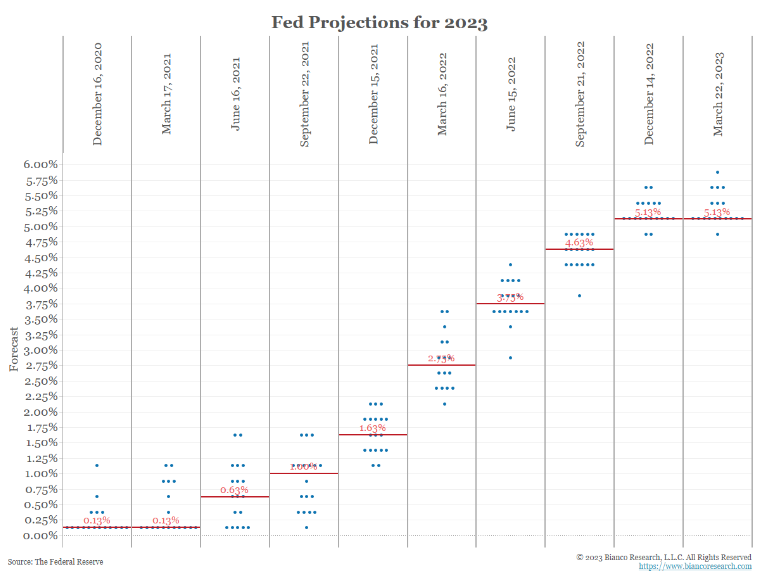

Joseph: and with the Fed’s forecasting record, it might make sense to follow the market’s lead

Source: Bianco as of 03.21.2023

Source: Bianco as of 03.21.2023

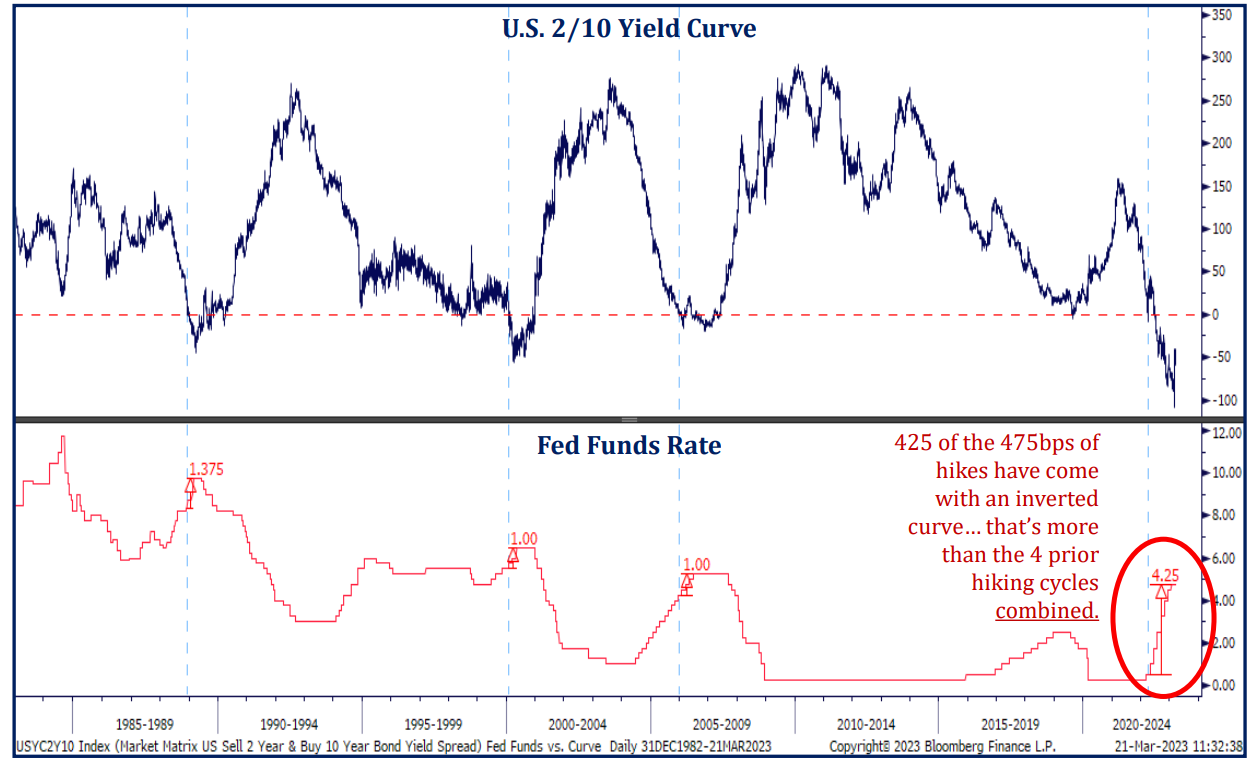

John Luke: After an unprecedented series of hikes into an inverted yield curve

Source: Strategas as of 03.21.2023

Source: Strategas as of 03.21.2023

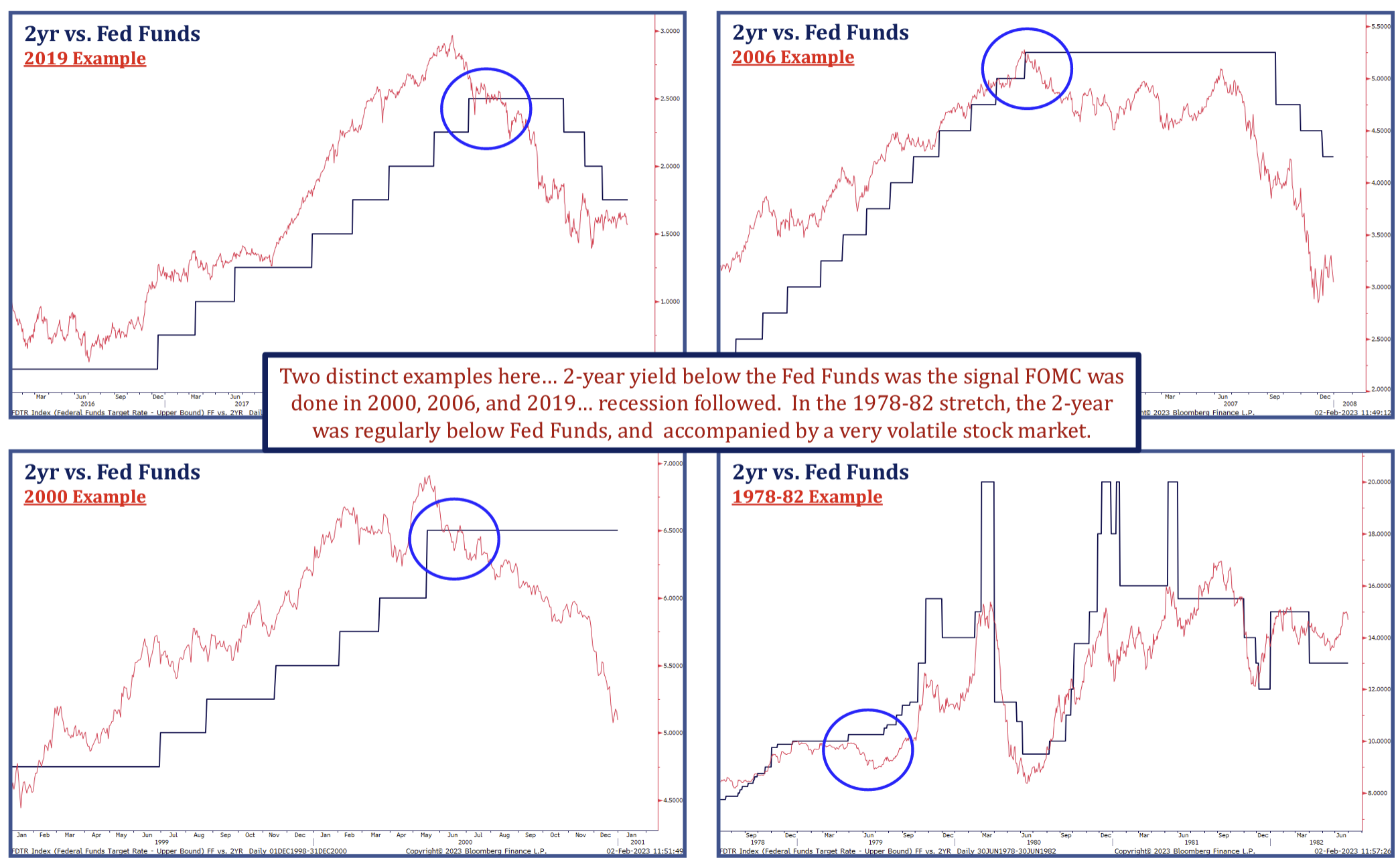

Dave: markets now face the challenge of the backside of a hiking cycle

Source: Strategas as of 03.22.2023

Source: Strategas as of 03.22.2023

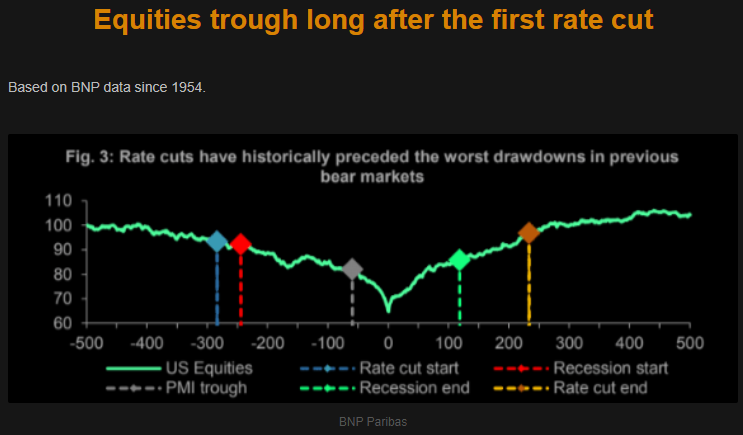

Beckham: and a “not yet” potential easing cycle

Source: BNP Paribas as of 03.17.2023

Source: BNP Paribas as of 03.17.2023

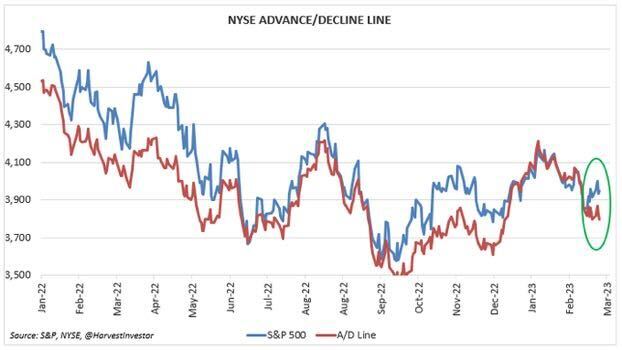

John Luke: Market breadth is separating to the downside from the S&P 500

Source: Harvest Investor as of 03.20.2023

Source: Harvest Investor as of 03.20.2023

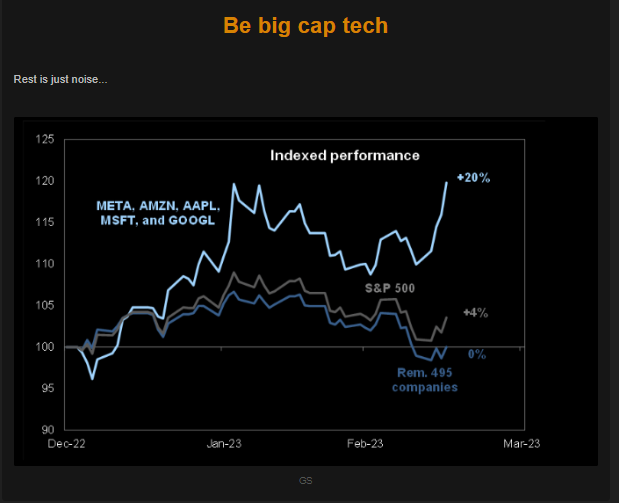

John Luke: as investors flock to the old MAGA names

Source: Goldman Sachs as of 03.21.2023

Source: Goldman Sachs as of 03.21.2023

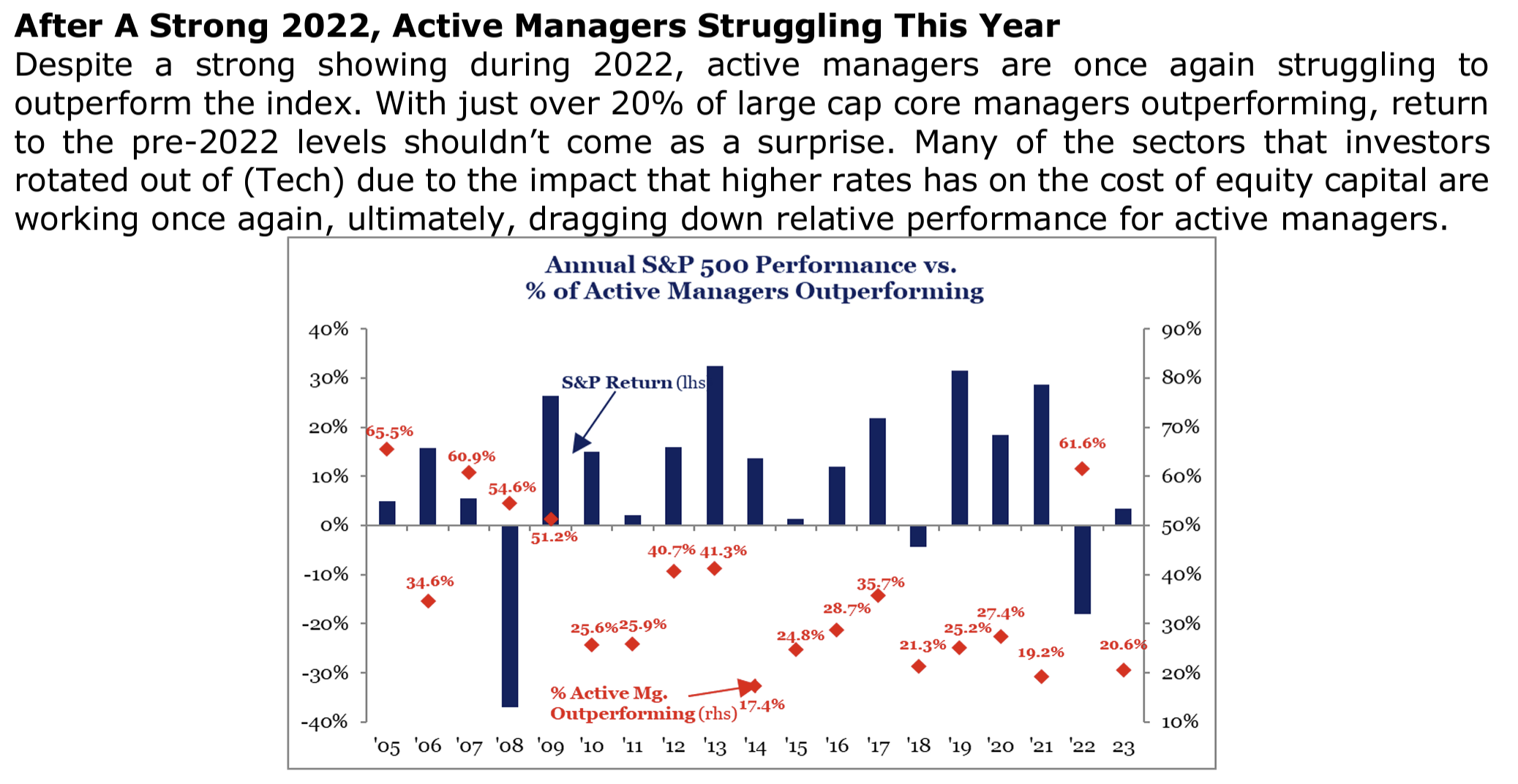

Dave: and active fund managers resume their position trailing behind major indices

Source: Strategas as of 03.21.2023

Source: Strategas as of 03.21.2023

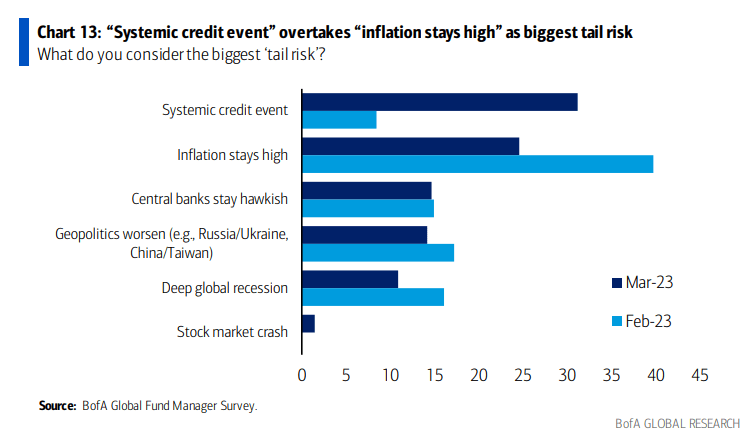

John Luke: The fears of those fund managers have flipped from rising rates to a credit crash

Source: BofA as of 03.21.2023

Source: BofA as of 03.21.2023

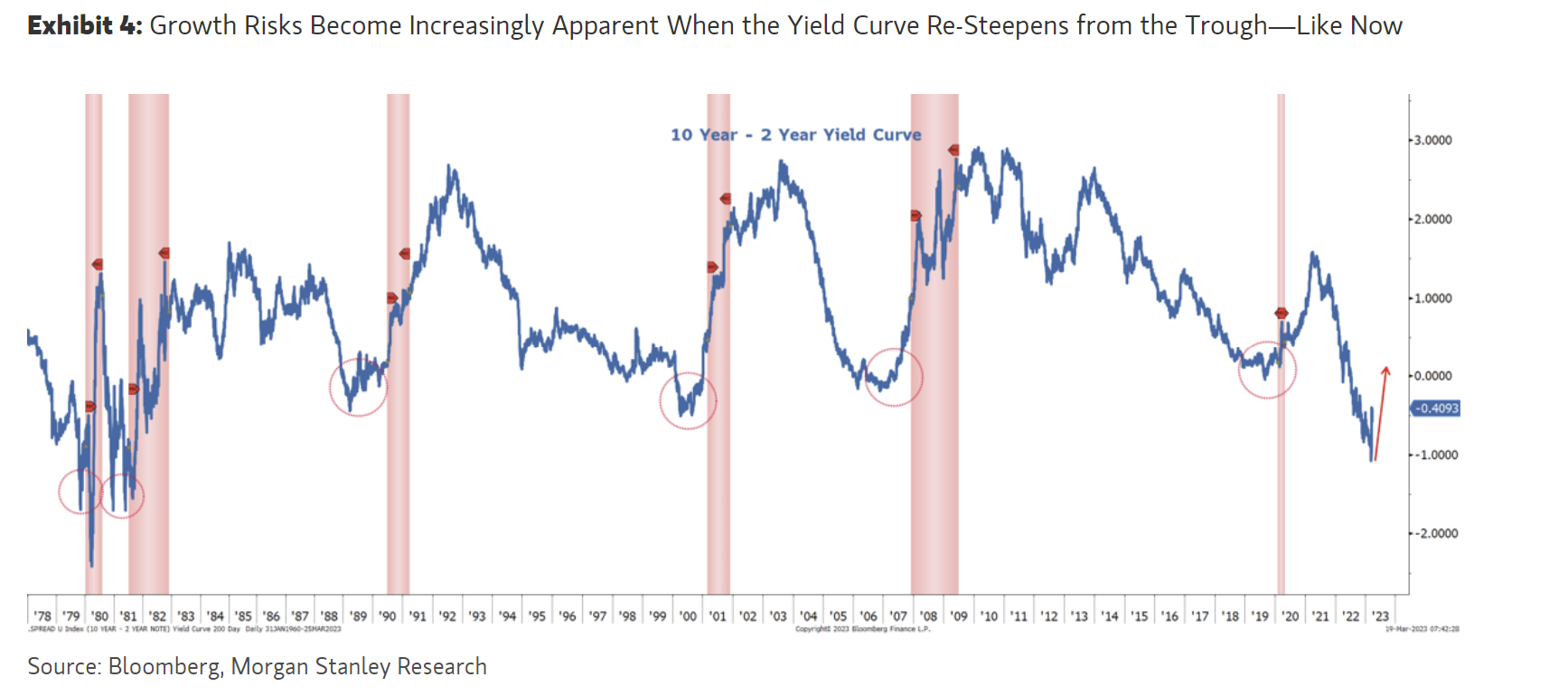

Dave: with this particular phase of the economy having a history of struggles

Data as of 03.21.2023

Data as of 03.21.2023

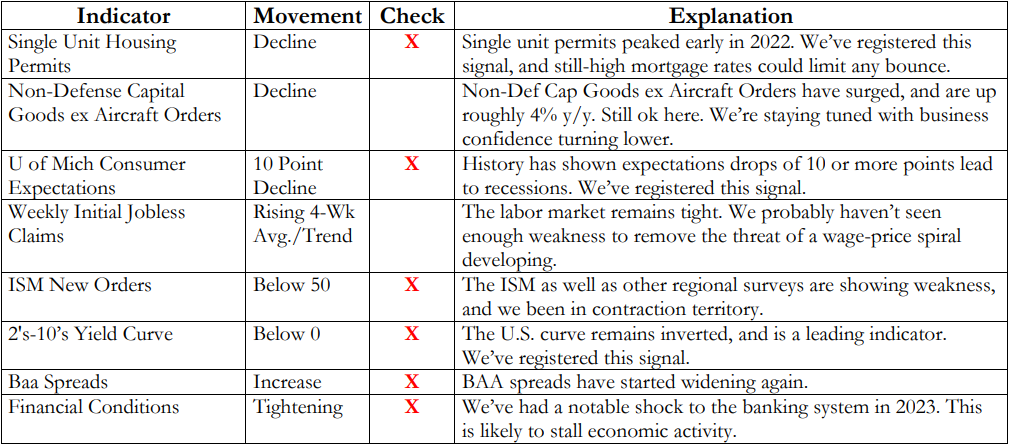

Brad: and historical recession warning lights flashing clearly

Source: Strategas as of 03.22.2023

Source: Strategas as of 03.22.2023

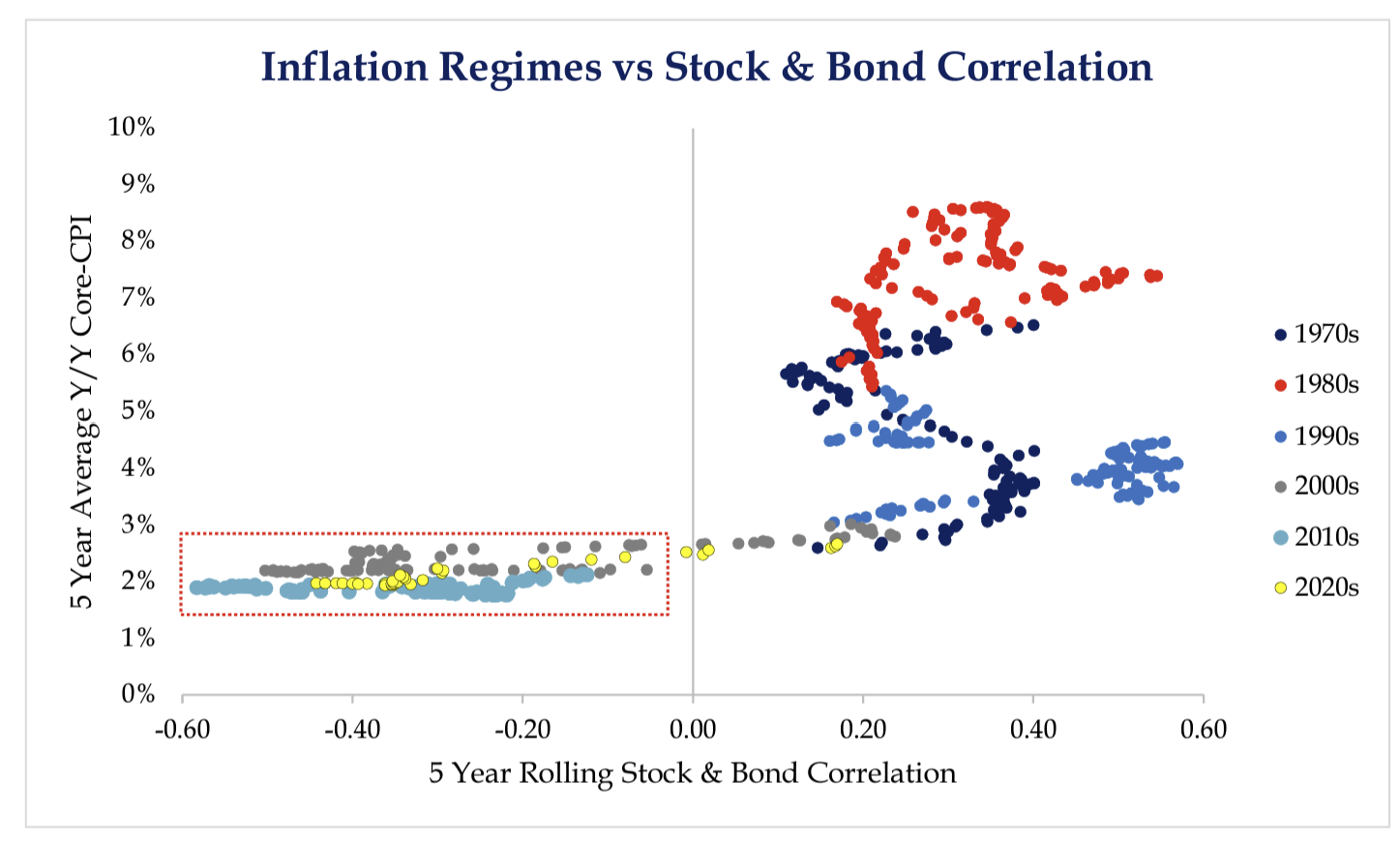

Dave: 2022 looks to have ushered in an environment providing less cover than the negatively-correlating zig-zagging of bonds vs. stocks

Source: Strategas as of 03.20.2023

Source: Strategas as of 03.20.2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2303-26.