Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

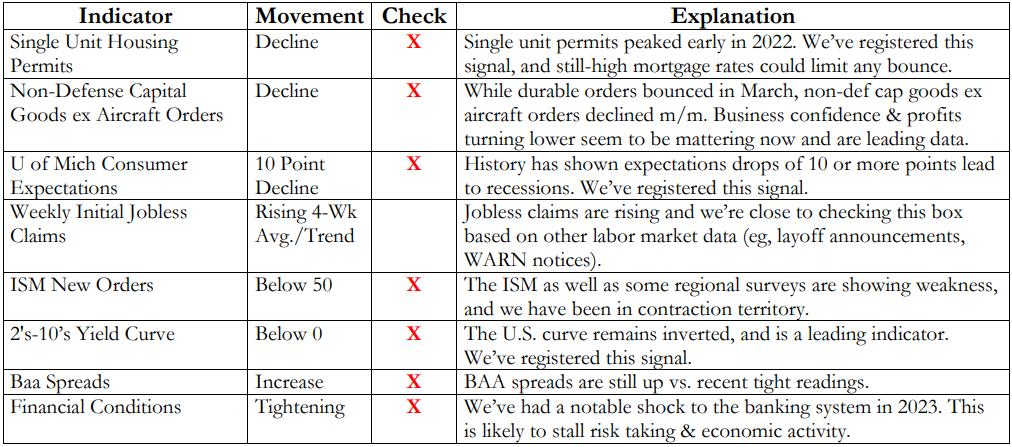

Brad: The recession playbook has mostly filled in and markets seem to be adjusting

Source: Strategas as of 04.24.2023

Source: Strategas as of 04.24.2023

John Luke: though even a perfect economic forecast doesn’t lead to better investment forecasting

Source: Bloomberg as of 04.24.2023

Source: Bloomberg as of 04.24.2023

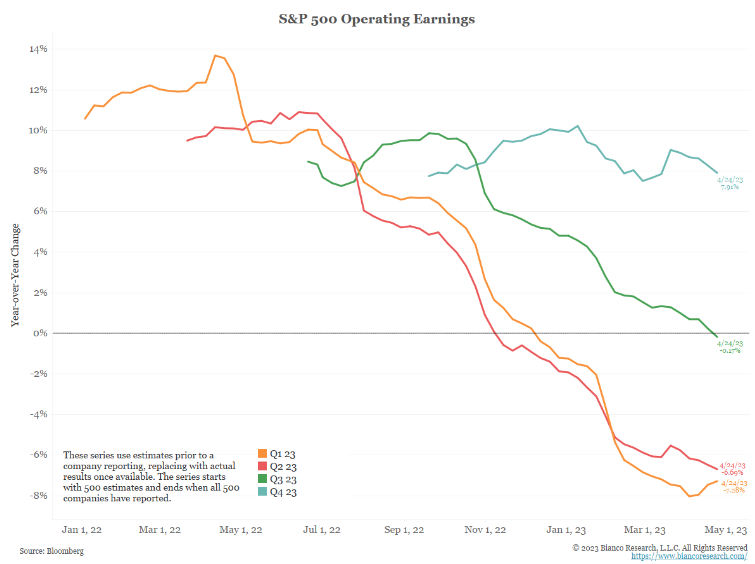

Joseph: As often happens in slowdowns, analysts are banking on the back end of the year to make up for early-year weakness

Source: Bloomberg as of 04.24.2023

Source: Bloomberg as of 04.24.2023

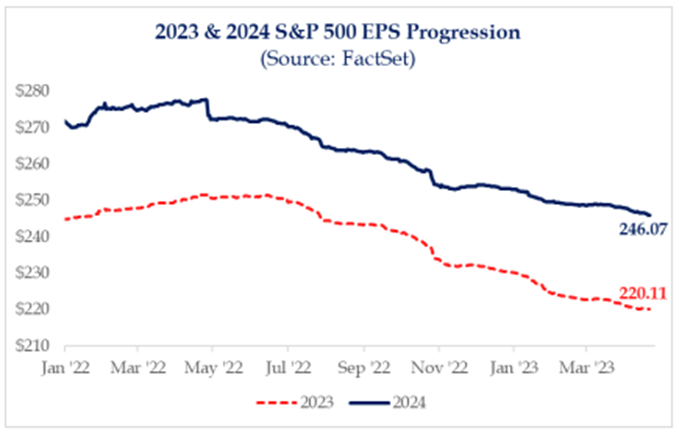

Joseph: but it’s hard to envision what might reverse the direction of the past 12 months

Source: Strategas as of 04.24.2023

Source: Strategas as of 04.24.2023

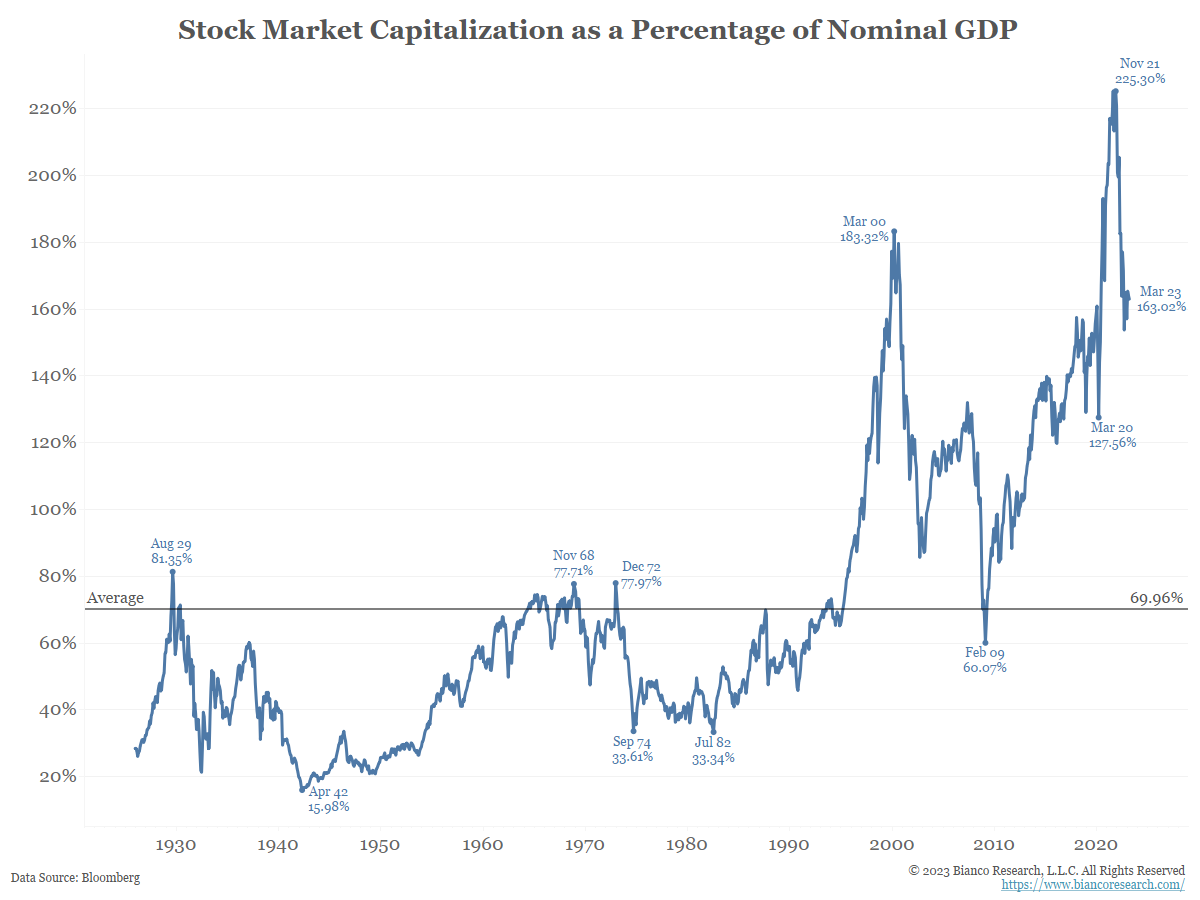

John Luke: Stocks as a % of GDP are cheaper than at the peak but by no measure are they “cheap”

Source: Bianco as of 04.02.2023

Source: Bianco as of 04.02.2023

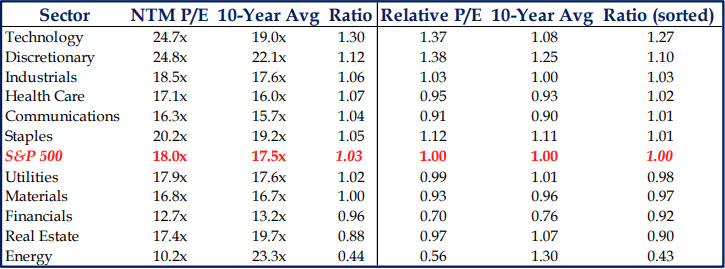

Joseph: though when breaking down by sector there are significant differences across the universe

Source: Strategas as of 04.26.2023

Source: Strategas as of 04.26.2023

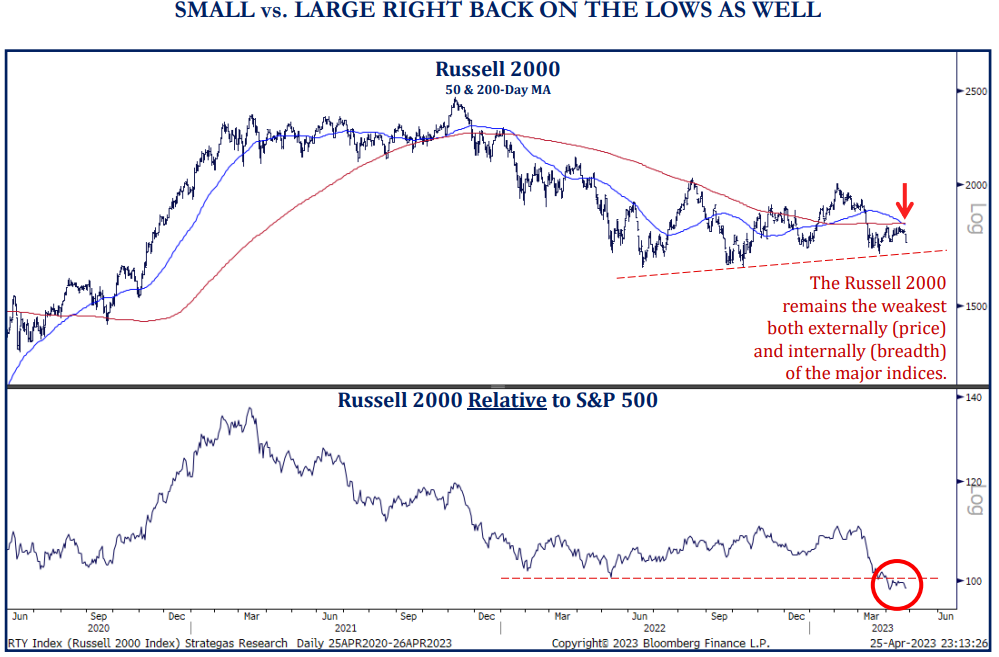

Brad: and small cap stocks are at historically extreme cheapness relative to large cap

Source: Strategas as of 04.25.2023

Source: Strategas as of 04.25.2023

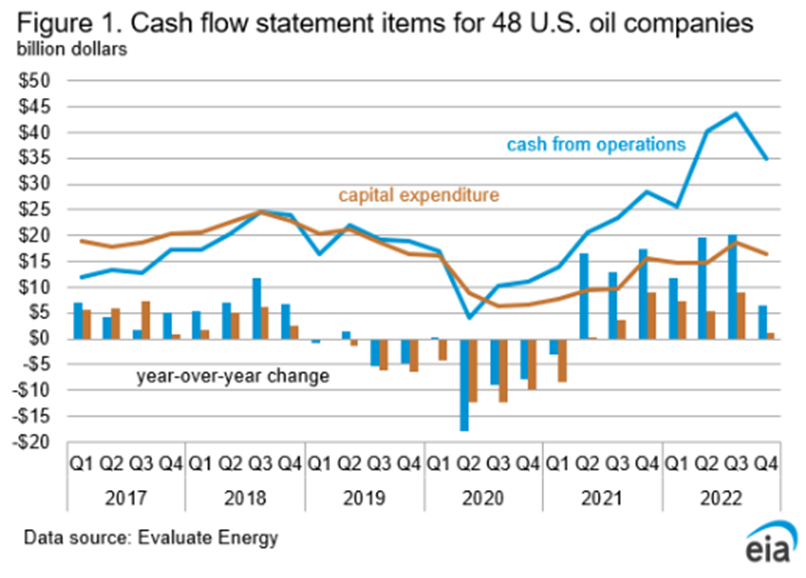

Joseph: Energy companies have transformed themselves into cash-flow machines in recent years

Source: EIA as of January 2023

Source: EIA as of January 2023

Joseph: perhaps putting future energy sources at risk but giving shareholders a much better experience

Source: EIA as of January 2023

Source: EIA as of January 2023

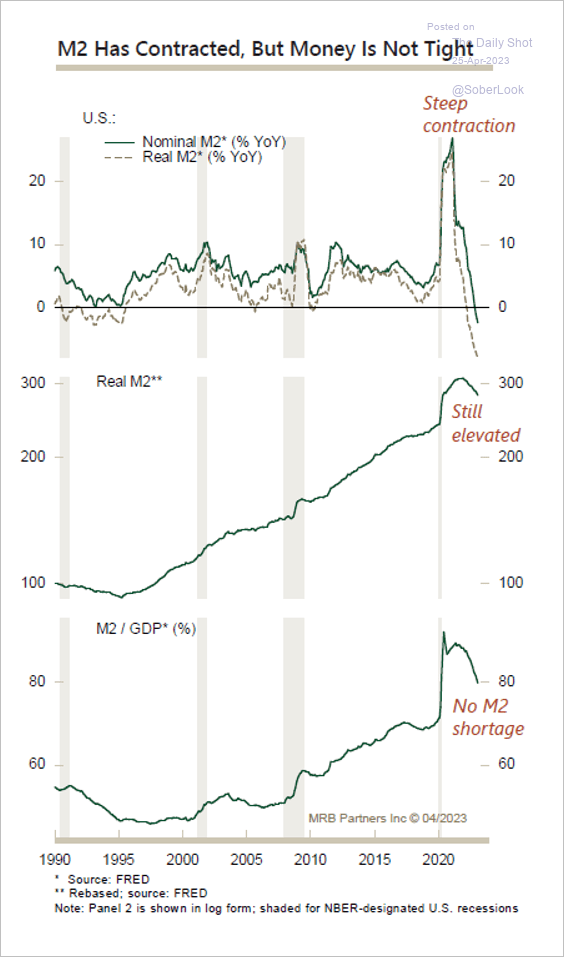

John Luke: A lot of talk about M2 crashing but in the grand scheme there is still plenty of money sloshing around

Source: Daily Shot as of 04.25.2023

Source: Daily Shot as of 04.25.2023

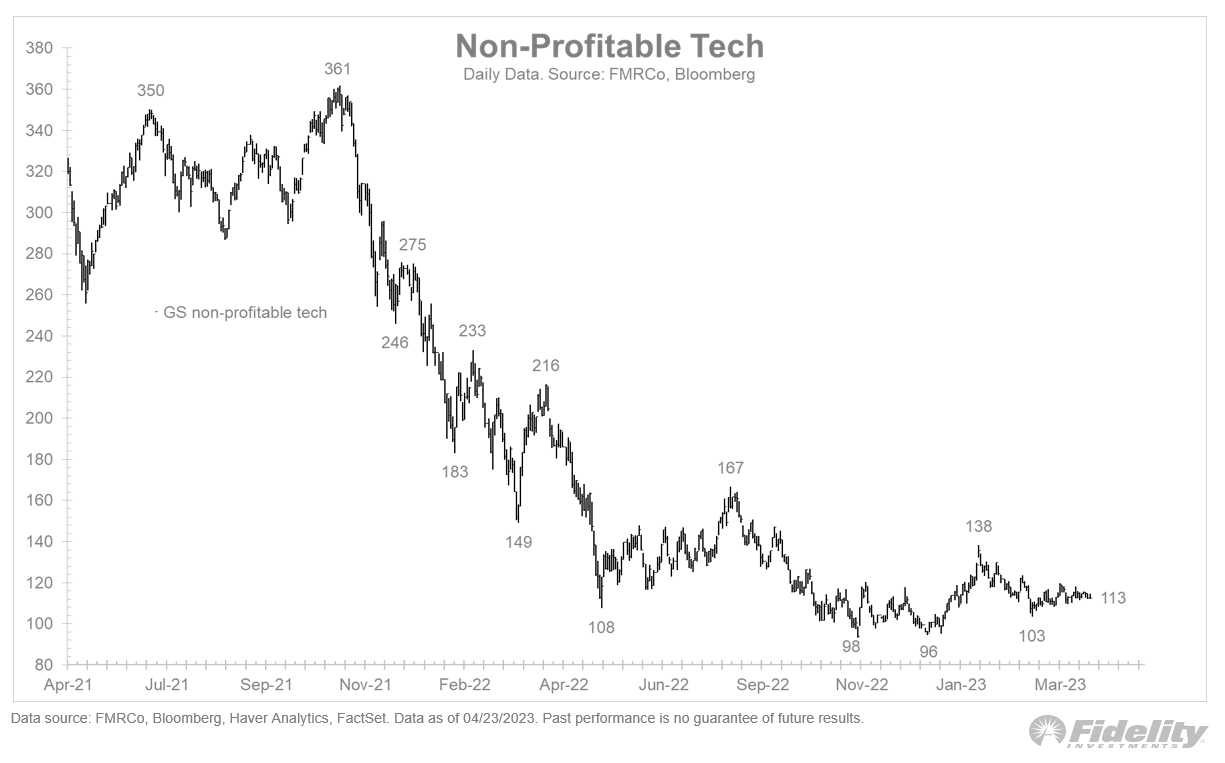

Derek: it just may not be flowing into questionable areas

Source: Fidelity as of 04.24.2023

Source: Fidelity as of 04.24.2023

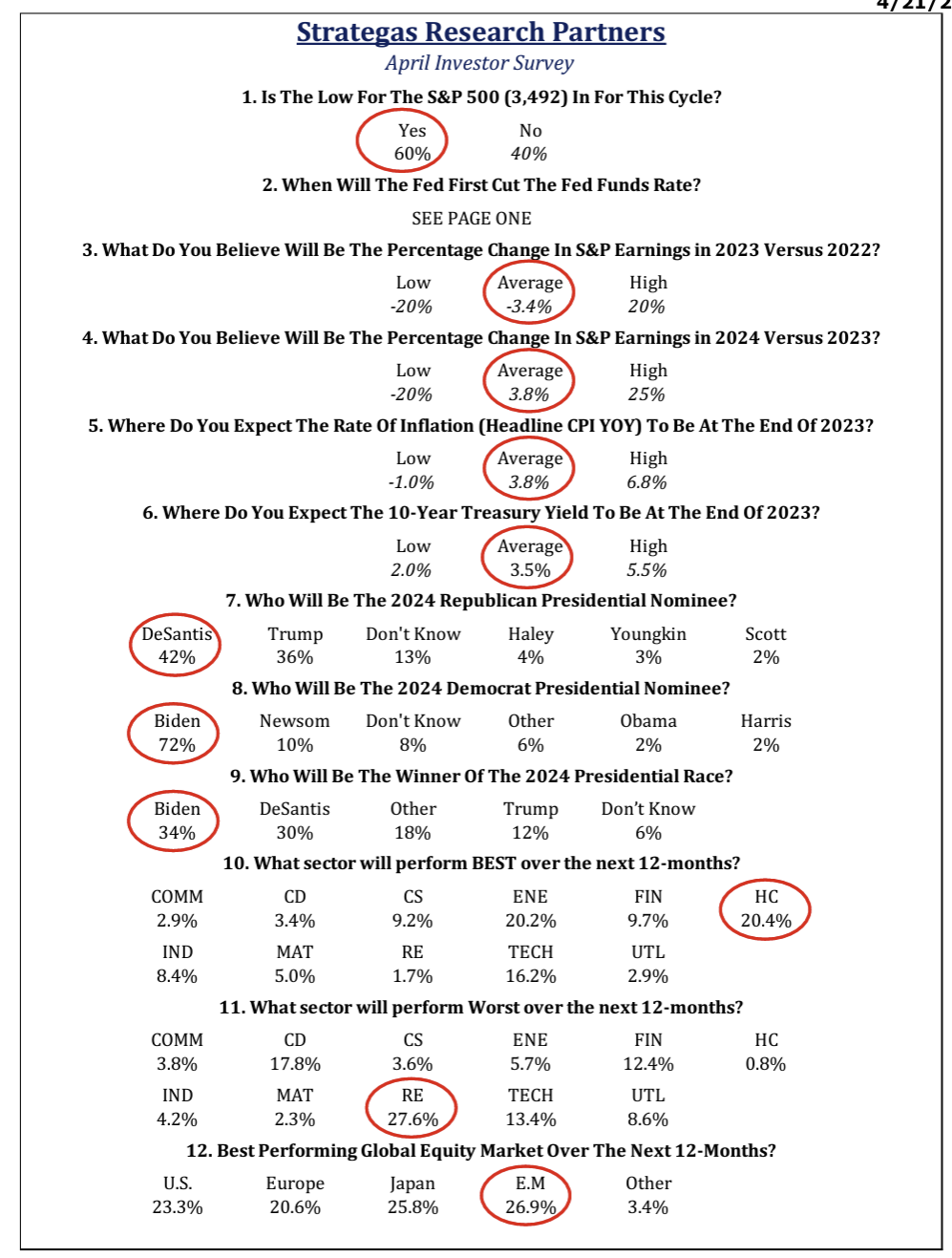

John Luke: Interesting to see the range of investor thoughts about current conditions and what may unfold

Source: Strategas as of 04.21.2023

Source: Strategas as of 04.21.2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2304-30.