Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

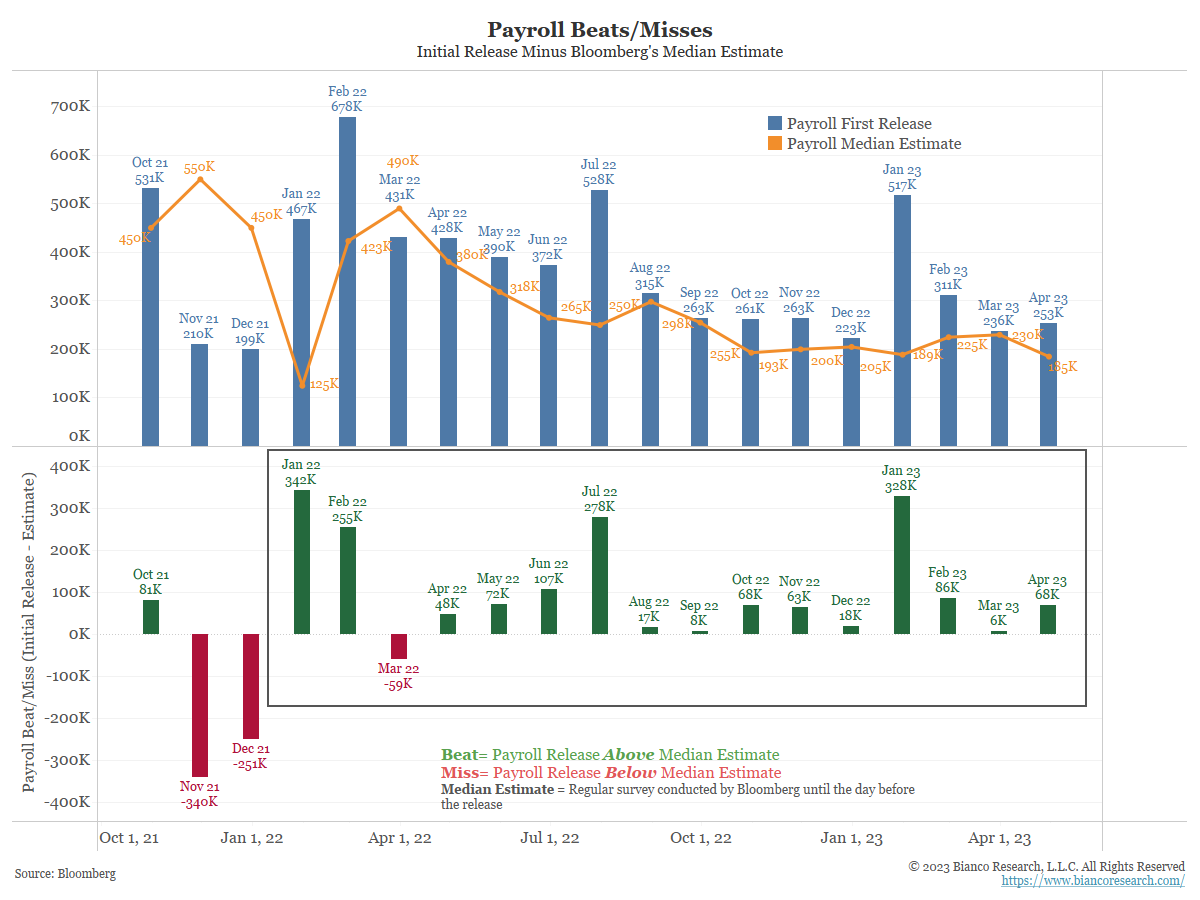

John Luke: Demand for labor continues to surpass economist expectations

Data as of 05.05.2023

Data as of 05.05.2023

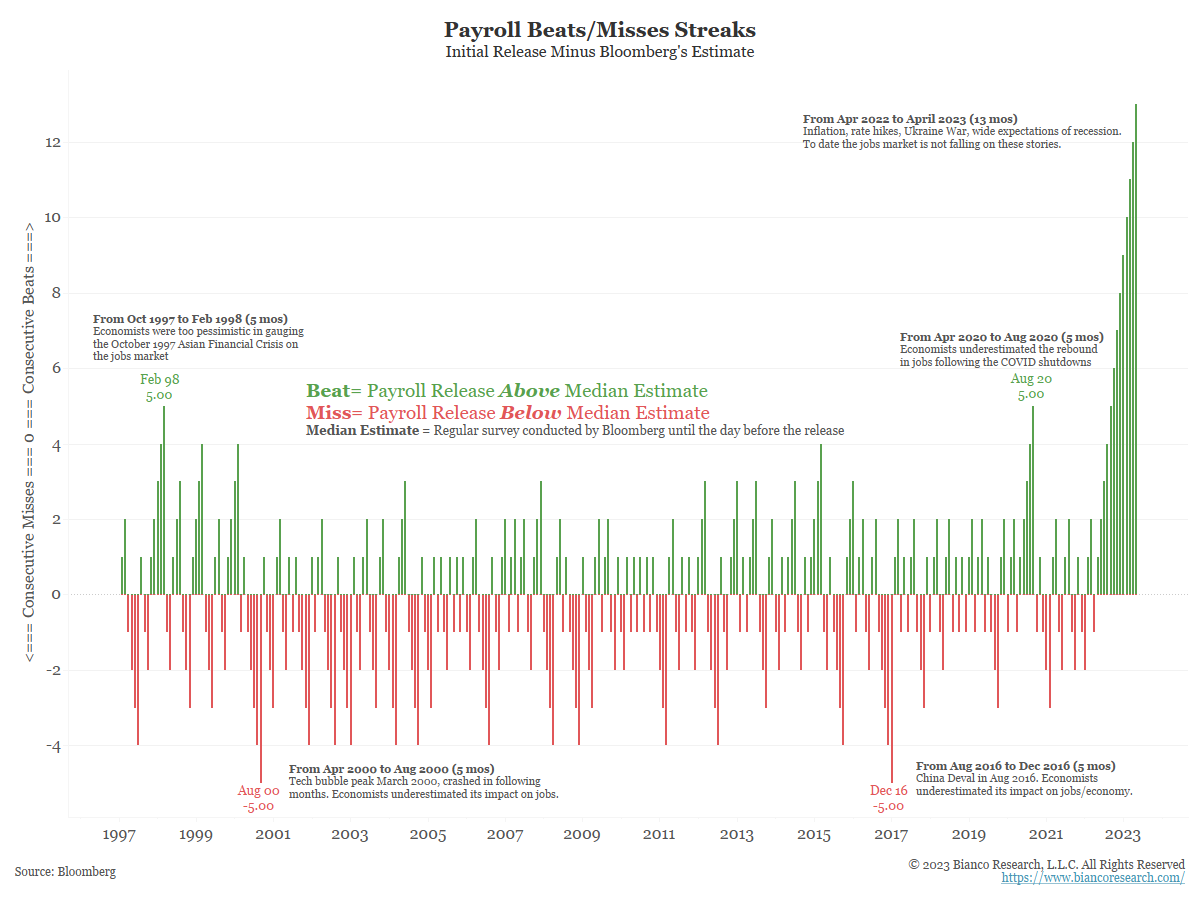

John Luke: with a streak of “beats” not seen in recent decades

Data as of 05.05.2023

Data as of 05.05.2023

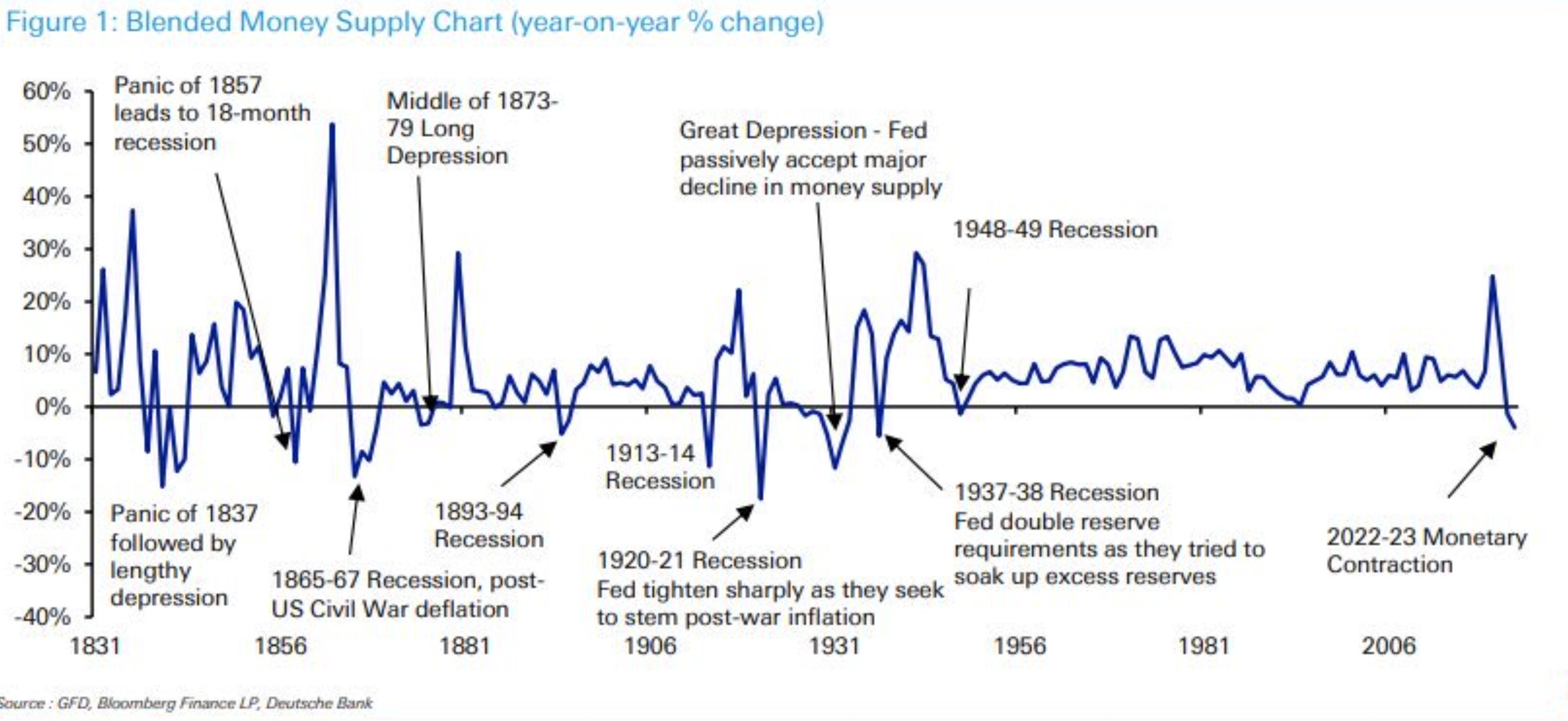

John Luke: This despite a significant contraction in money supply

Source: Deutsche Bank as of 04.30.2023

Source: Deutsche Bank as of 04.30.2023

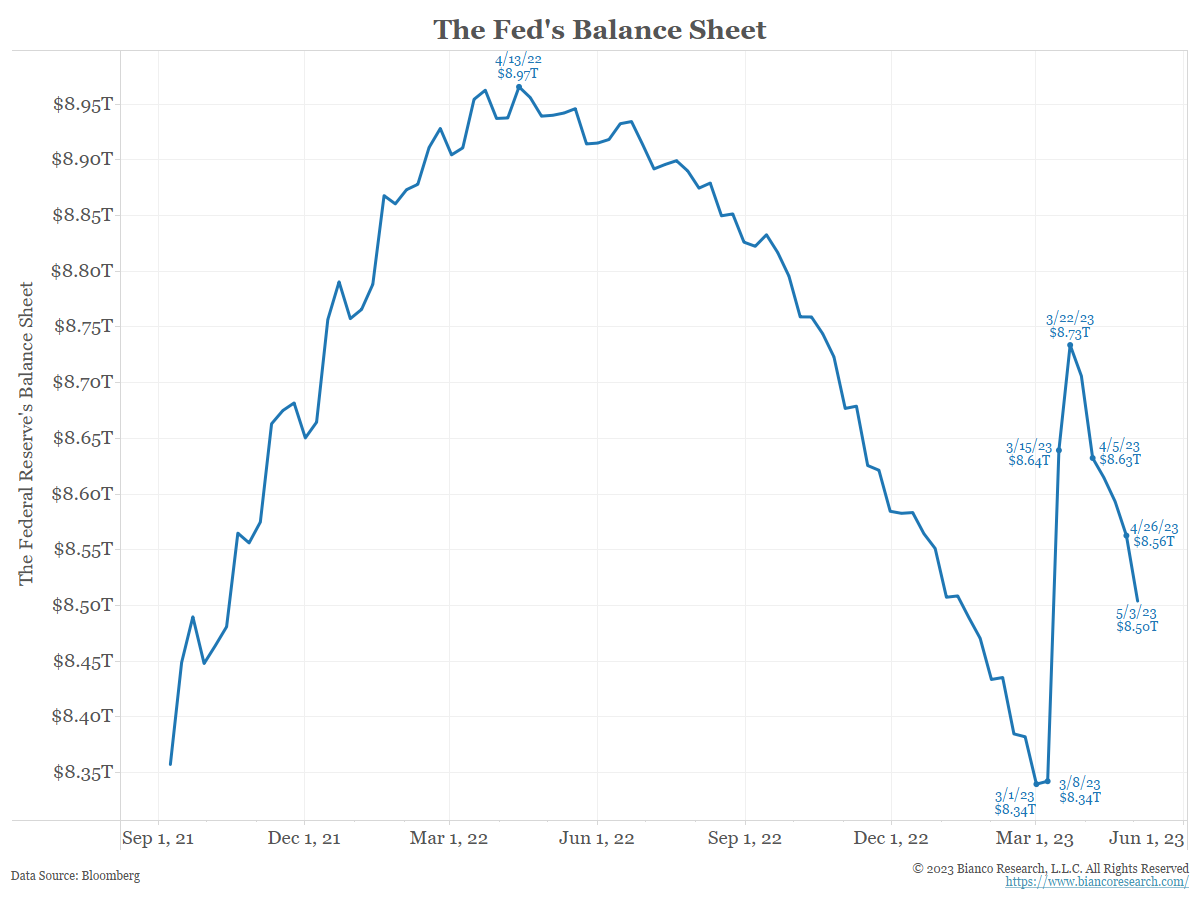

John Luke: and a commitment to quantitative tightening (QT) by our Federal Reserve

Data as of 05.03.2023

Data as of 05.03.2023

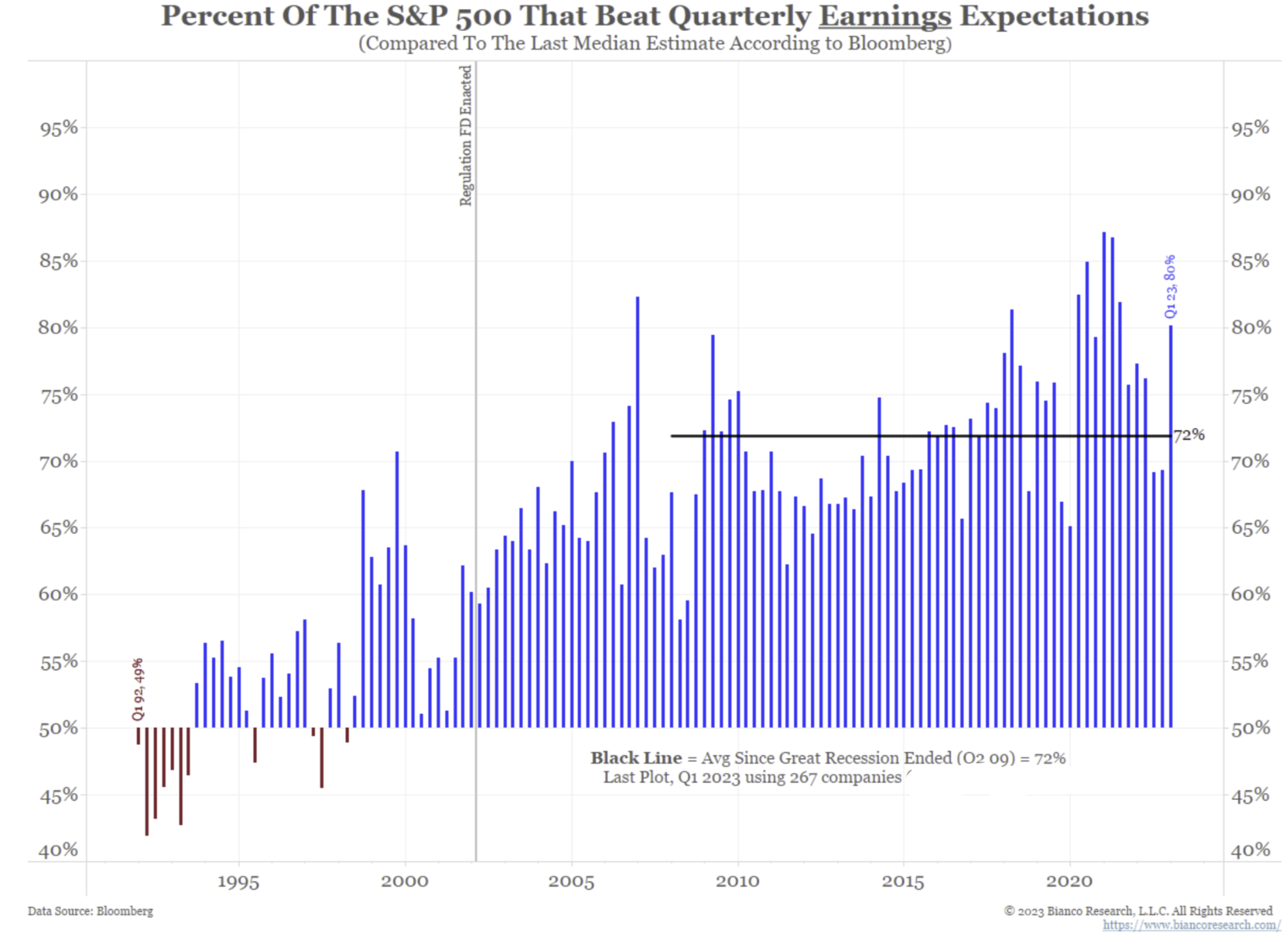

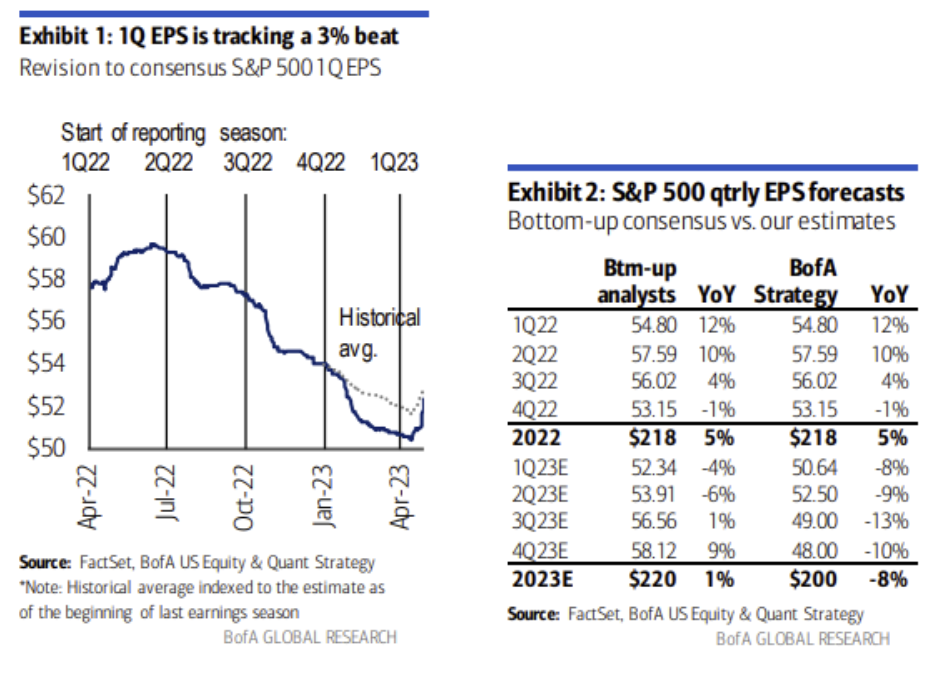

Dave: Where we’re NOT seeing contraction is in Q1 earnings results

Data as of 05.01.2023

Data as of 05.01.2023

Dave: quite different from 2022 when earnings estimates were cut repeatedly

Data as of 05.01.2023

Data as of 05.01.2023

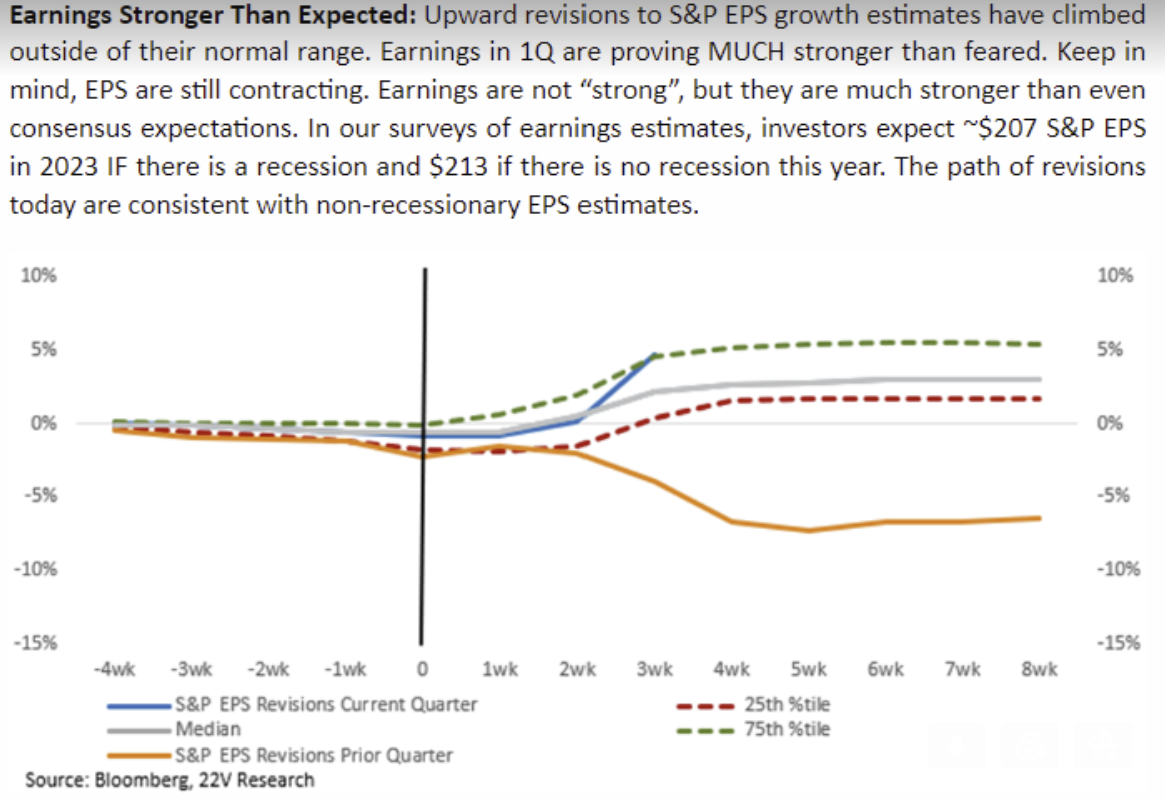

Dave: but not strong enough to be described as “growing”

Source: 22V Research as of 05.01.2023

Source: 22V Research as of 05.01.2023

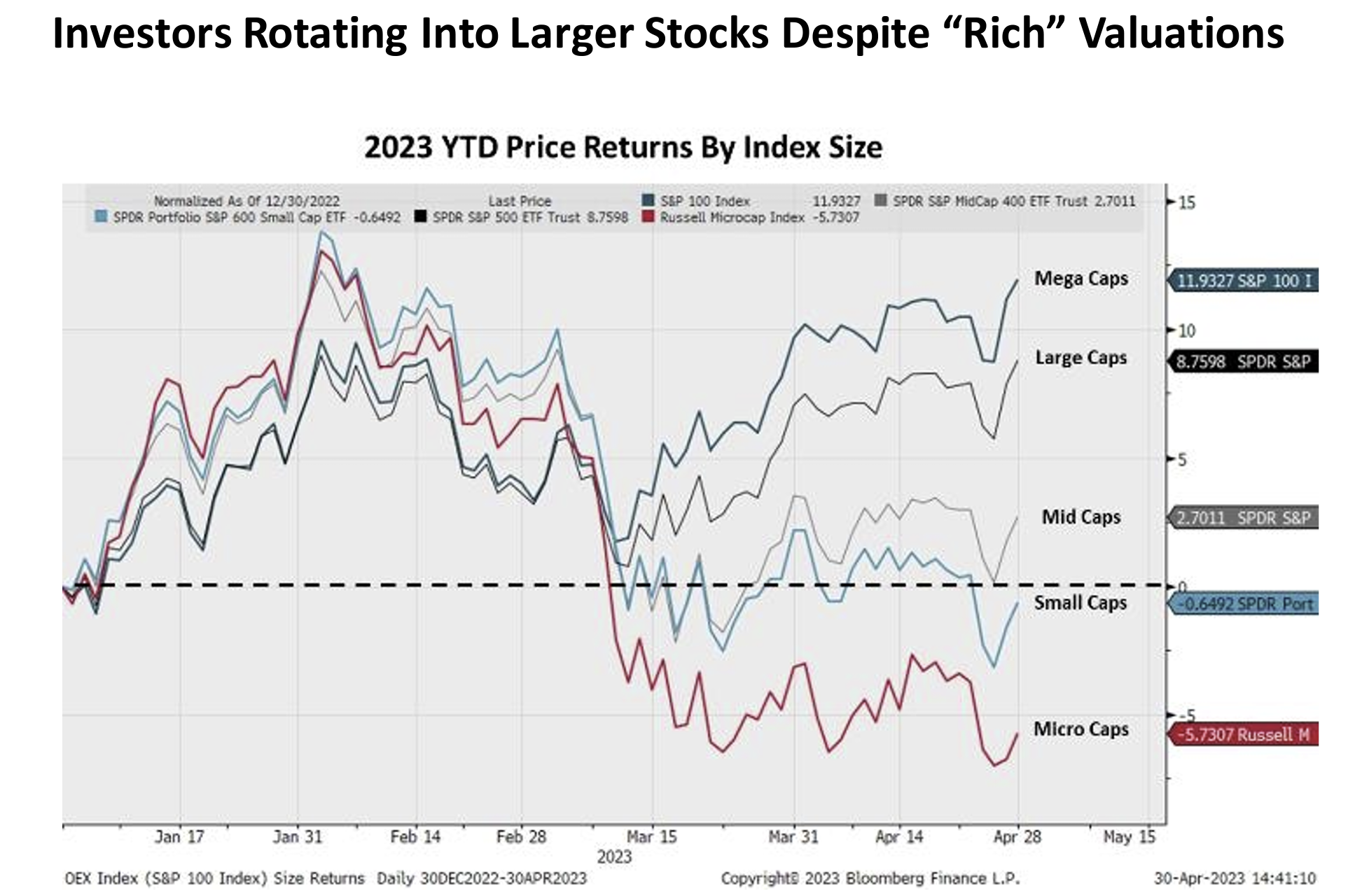

Dave: We’ve seen significant performance differences based on company size, with megacaps dominating and microcaps floundering

Source: PSC as of 04.30.2023

Source: PSC as of 04.30.2023

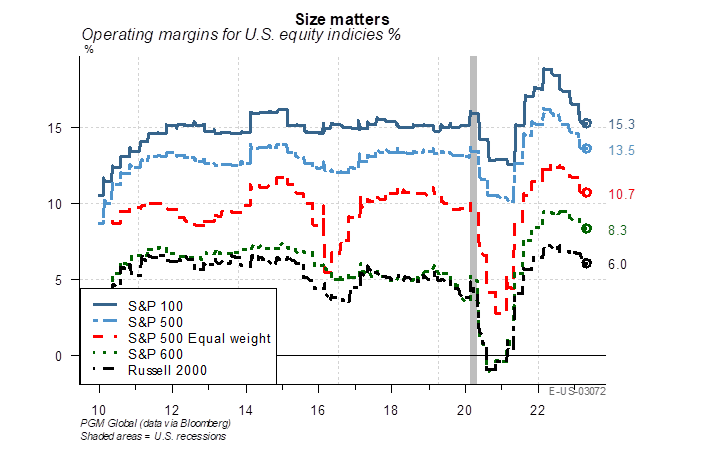

John Luke: perhaps partly driven by differences in operating margins

Source: PGM Global as of 04.30.2023

Source: PGM Global as of 04.30.2023

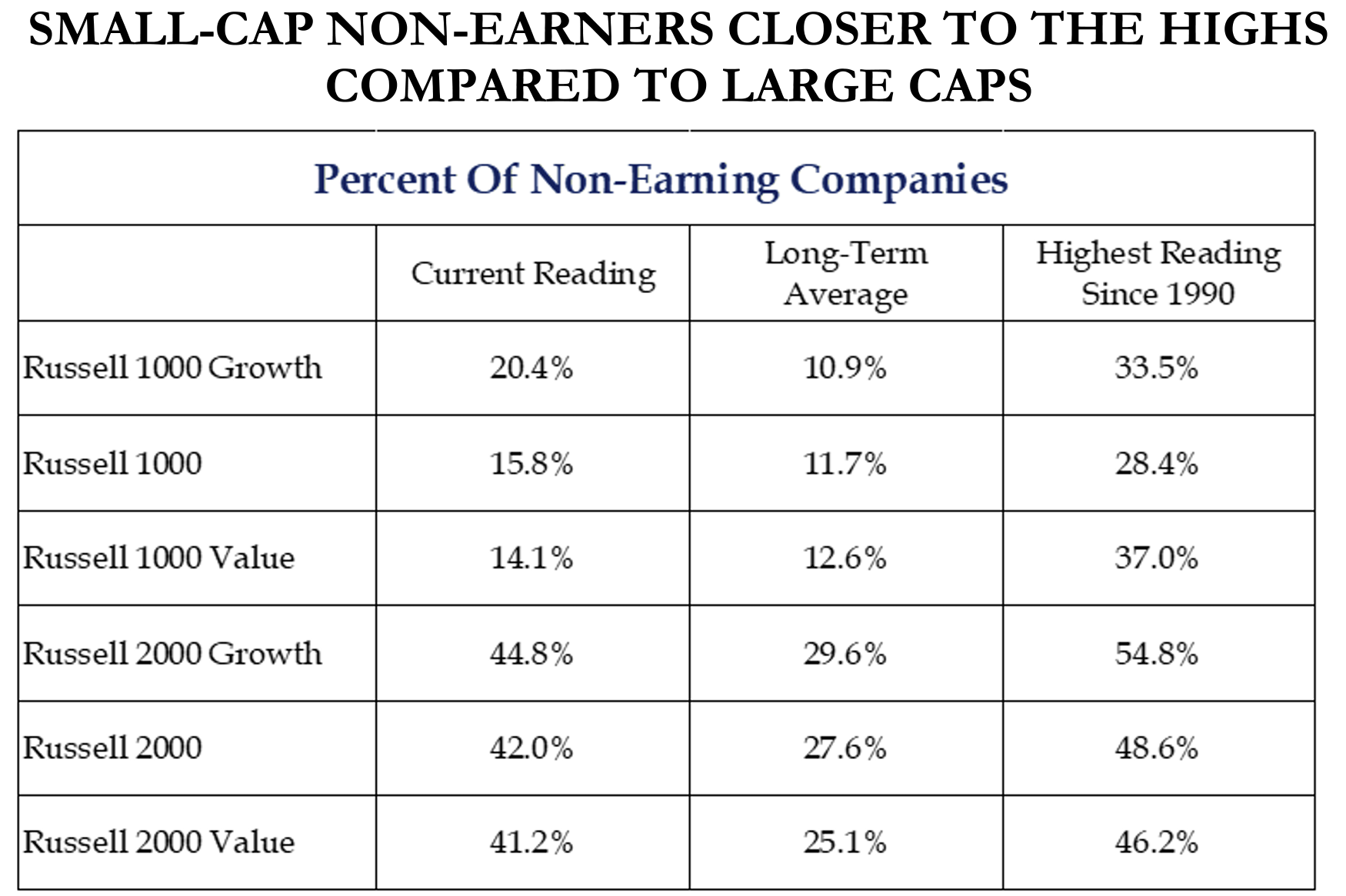

Dave: and many smaller cap companies lacking earnings entirely

Source: Strategas as of 04.30.2023

Source: Strategas as of 04.30.2023

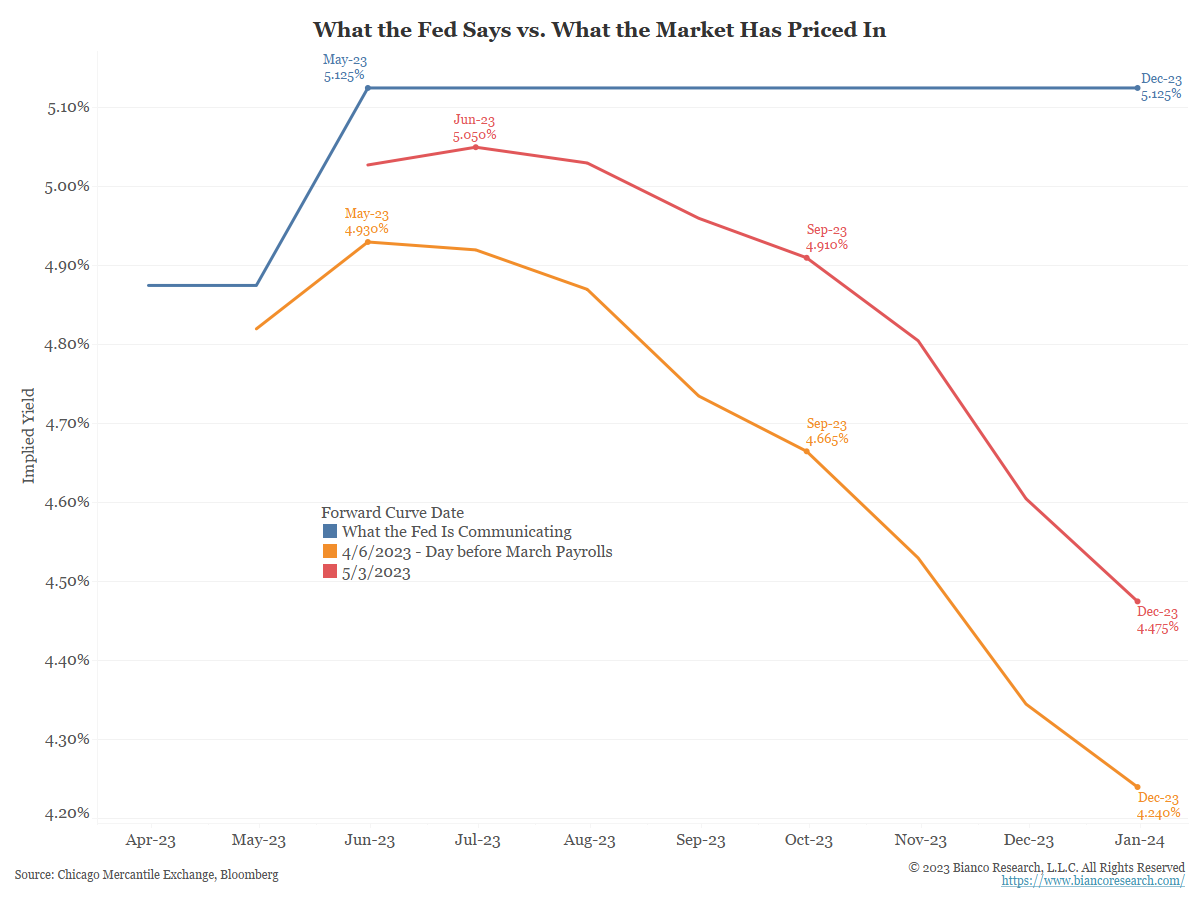

John Luke: These contrasting pieces of evidence continue to confuse investors, who still aren’t buying the Fed’s story about future rates

Source: Bianco as of 05.03.2023

Source: Bianco as of 05.03.2023

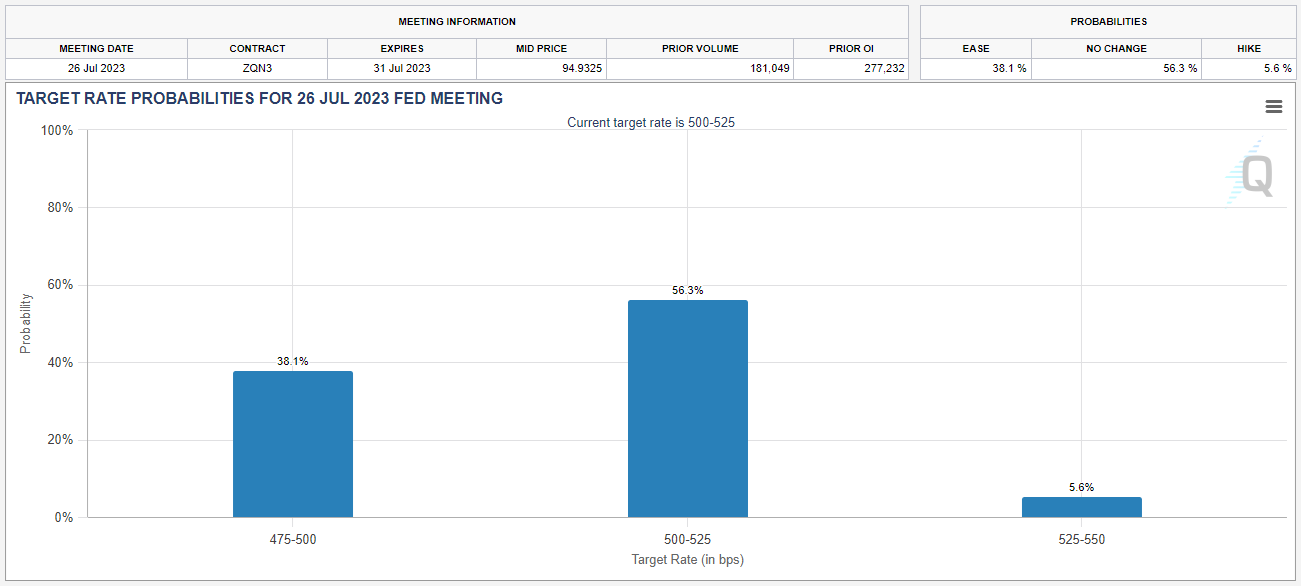

John Luke: as seen by the 1/3 of polled investors who expect a cut at the July FOMC meeting

Source: FedWatch Tool as of 05.05.2023

Source: FedWatch Tool as of 05.05.2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2305-11.