Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

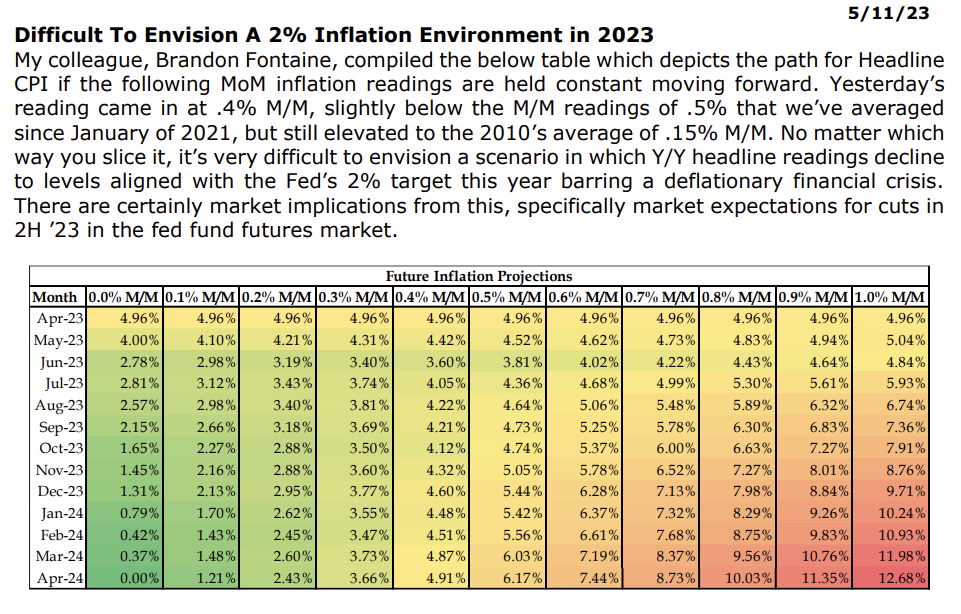

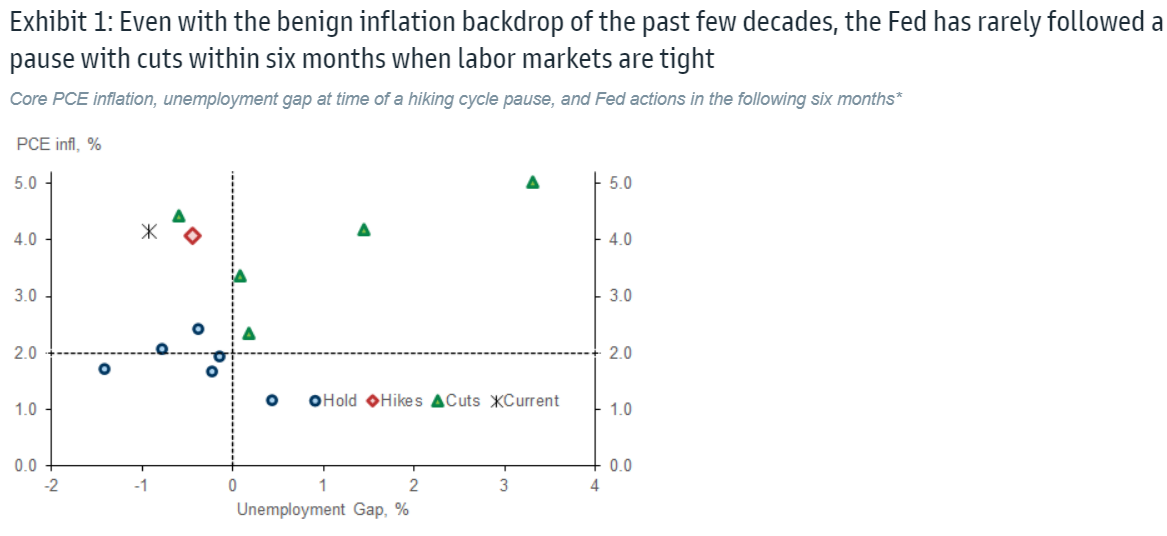

John Luke: Tough to see how inflation can get down to the Fed’s stated 2% target

Source: Strategas

Source: Strategas

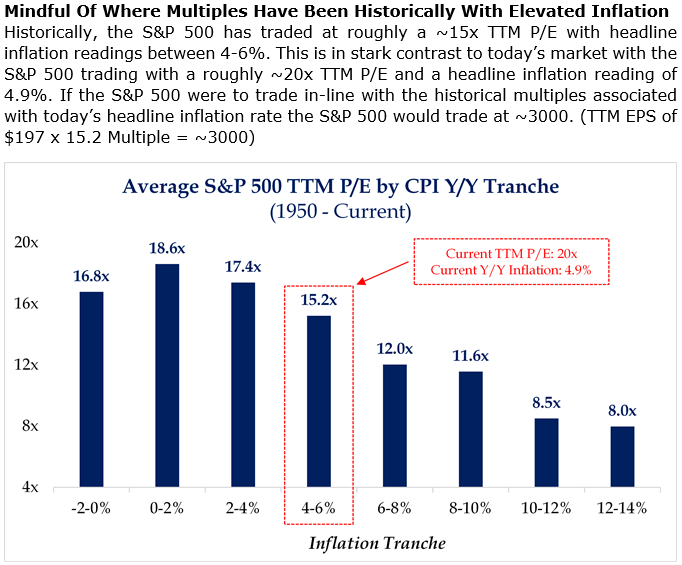

Brad: which would make it tough to get valuation support for already-expensive stocks

Source: Strategas as of 05.09.2023

Source: Strategas as of 05.09.2023

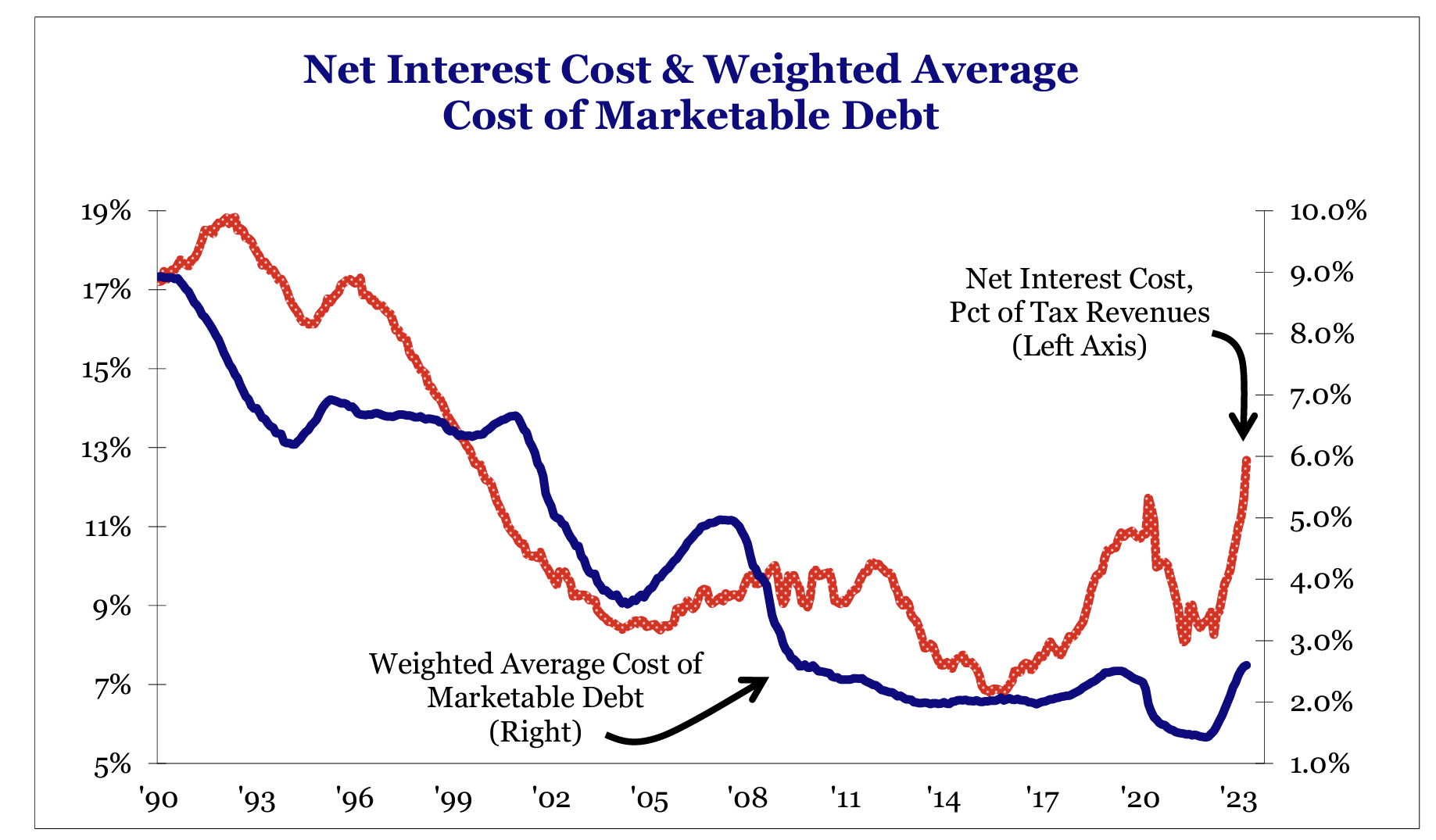

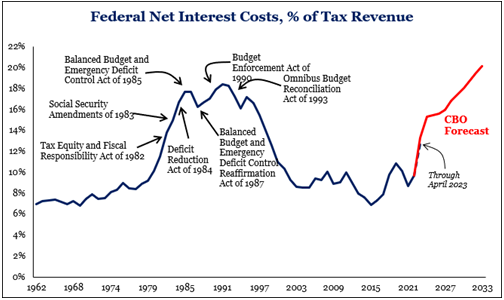

Dave: Net interest costs are rising significantly for the federal government

Source: Strategas as of 05.09.2023

Source: Strategas as of 05.09.2023

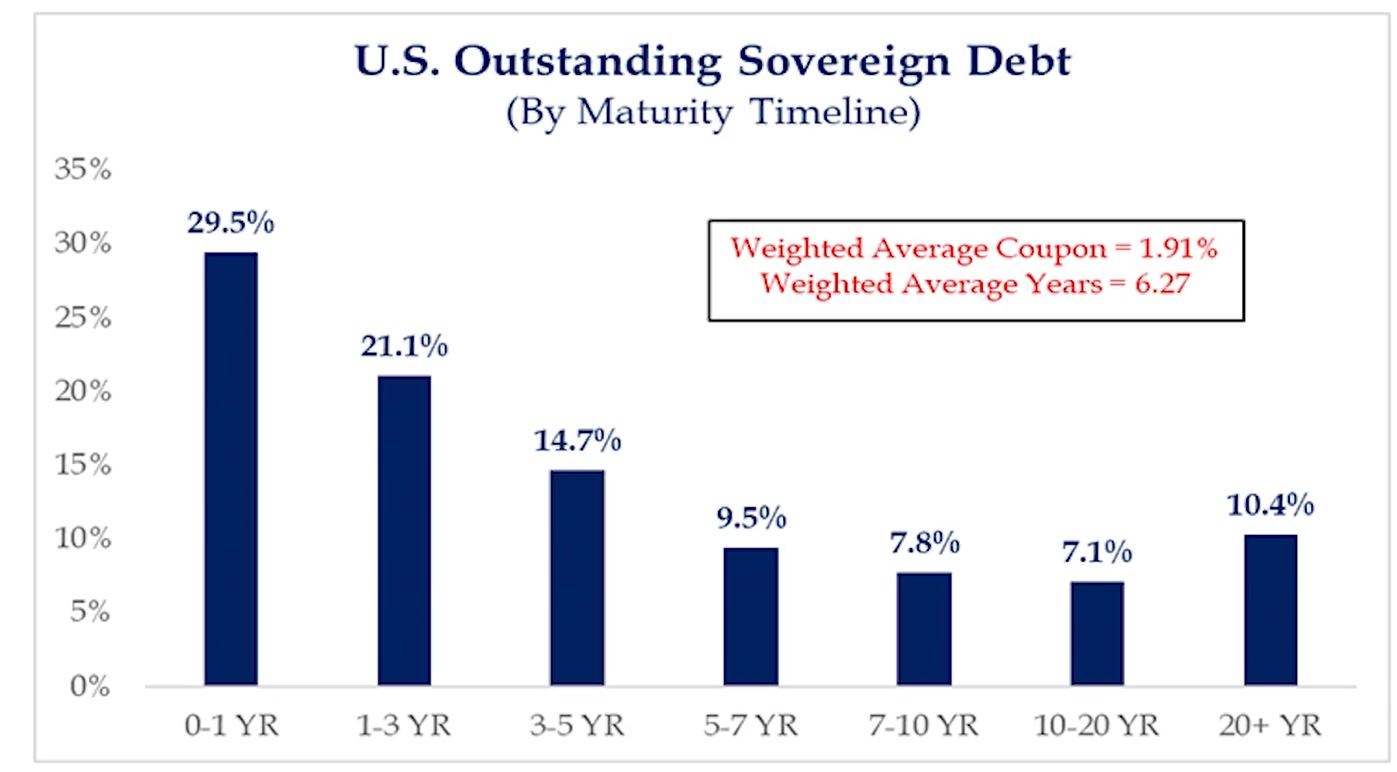

Dave: as low rate Treasuries mature and get replaced by higher borrowing costs

Source: Strategas as of 05.09.2023

Source: Strategas as of 05.09.2023

Brad: leading to a significant expense for the federal budget

Source: Strategas as of 05.09.2023

Source: Strategas as of 05.09.2023

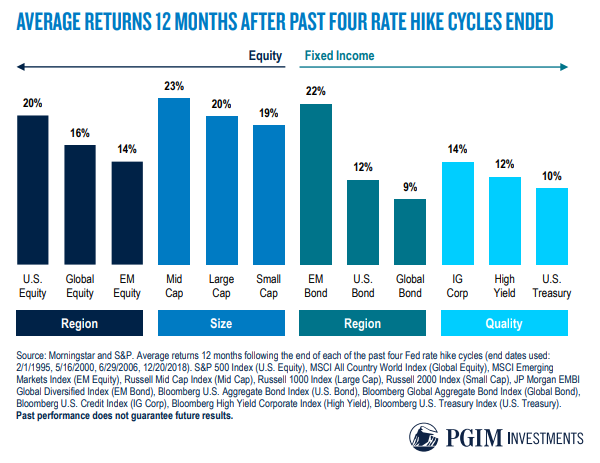

John Luke: The end of last 4 hiking cycles have ushered in a healthy period for both stocks and bonds

Data as of 05.08.2023

Data as of 05.08.2023

John Luke: but recent market optimism regarding coming rate cuts seems misguided

Source: Goldman Sachs as of 05.08.2023

Source: Goldman Sachs as of 05.08.2023

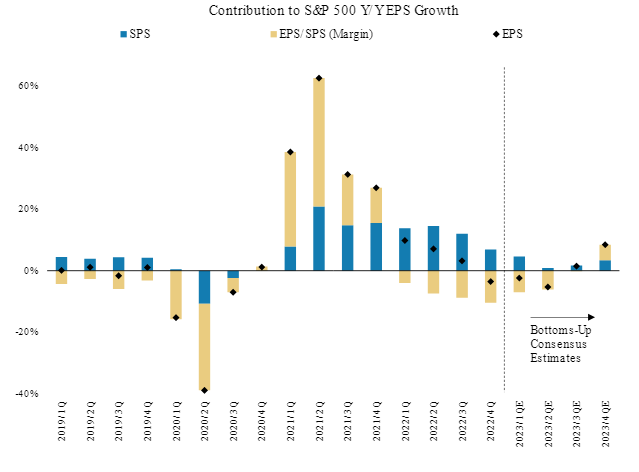

Dave: Earnings have been widely reported as “better than expected” but much of that is from reduced expectations coming in

Source: Morgan Stanley as of 05.09.2023

Source: Morgan Stanley as of 05.09.2023

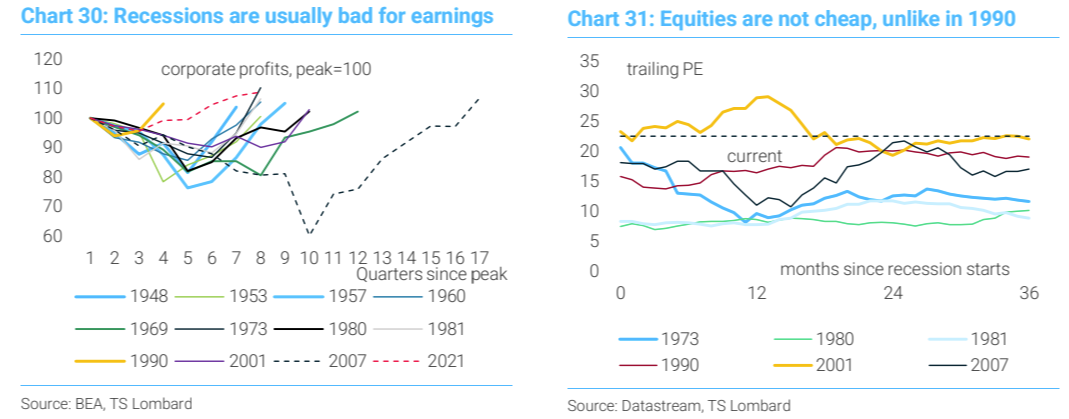

Joseph: with hopes that the earnings trough is behind us seemingly at odds with history

Source: TS Lombard as of 05.09.2023

Source: TS Lombard as of 05.09.2023

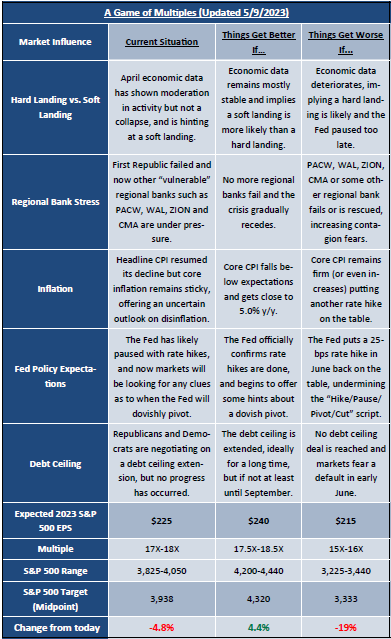

Brad: and even the most optimistic scenarios not exactly inspiring for stocks

Source: Sevens Report

Source: Sevens Report

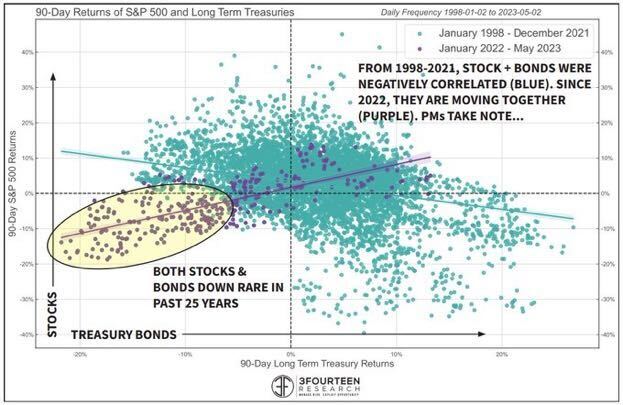

John Luke: Correlation regimes can last a long time, and the positive correlation b/w stocks and bonds is still young compared to the prior regime

Source: 3 Fourteen Research as of 05.06.2023

Source: 3 Fourteen Research as of 05.06.2023

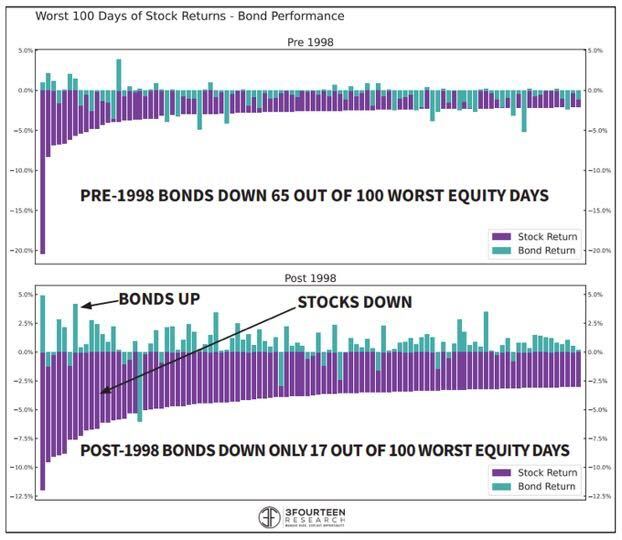

John Luke: which could lead to continued ineffectiveness for bonds as a hedge for stocks

Source: 3 Fourteen Research as of 05.08.2023

Source: 3 Fourteen Research as of 05.08.2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2315-16.