Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

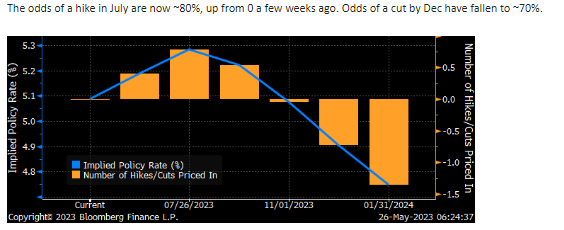

Beckham: The idea that the Fed is going to cut rates continues to move farther into the future

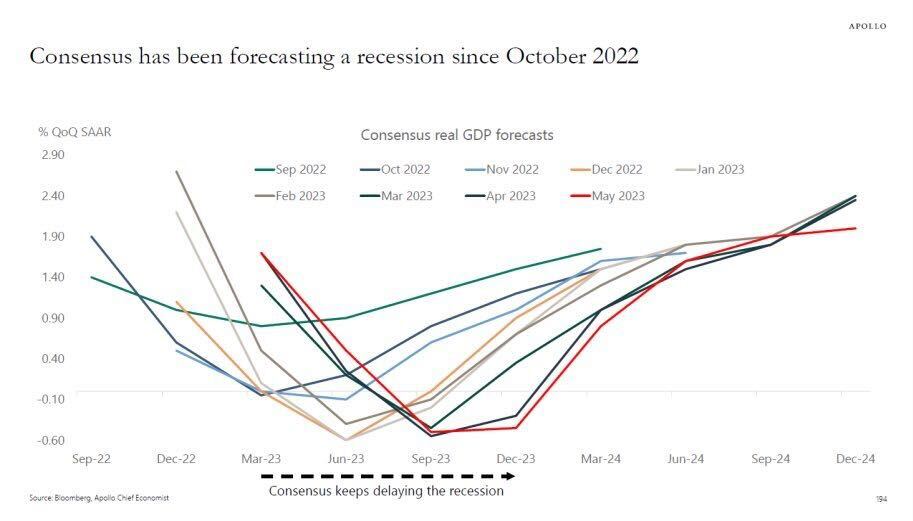

John Luke: mirroring the continued push-out of the “looming recession”

Source: Apollo as of 05.22.2023

Source: Apollo as of 05.22.2023

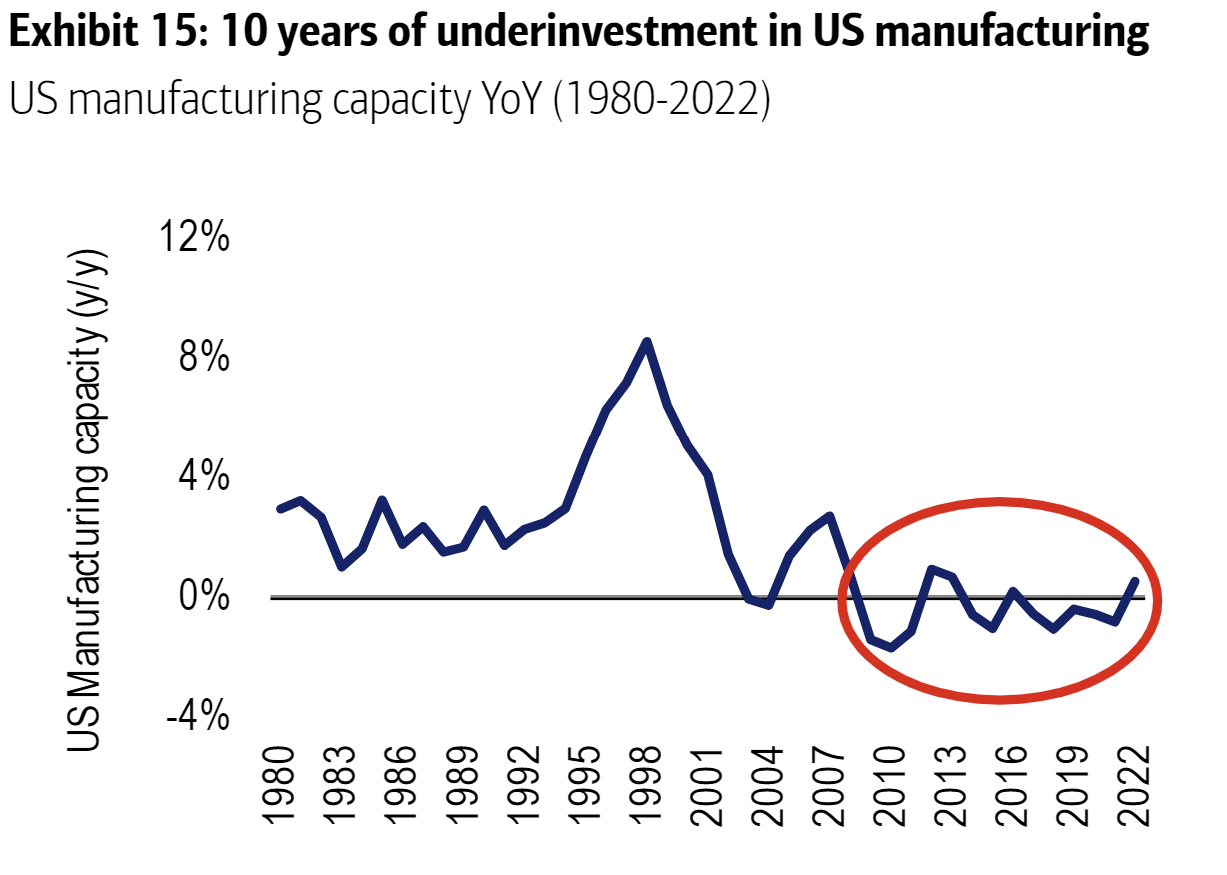

Dave: at a time when actual capital spending seems to have stabilized from multi-year lows

Source: BofA as of 05.22.2023

Source: BofA as of 05.22.2023

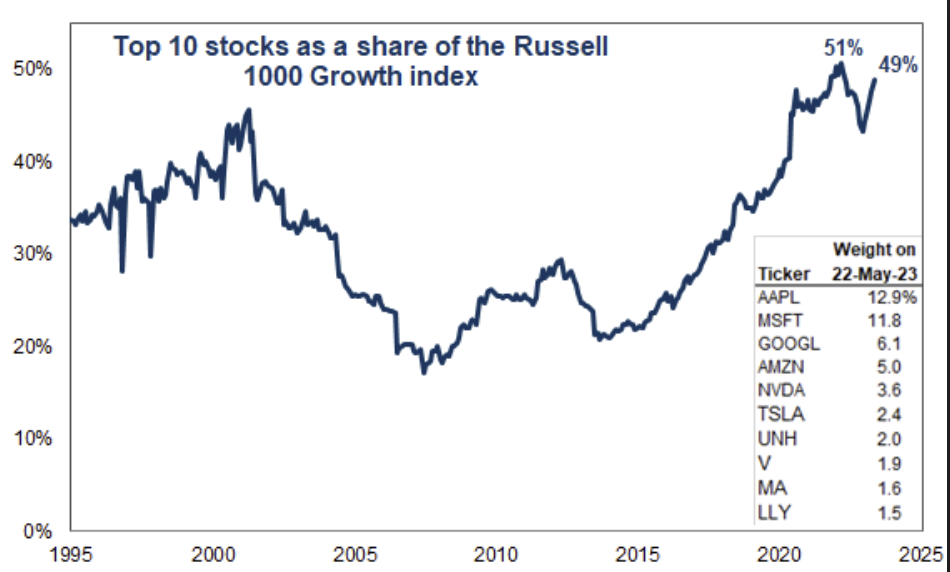

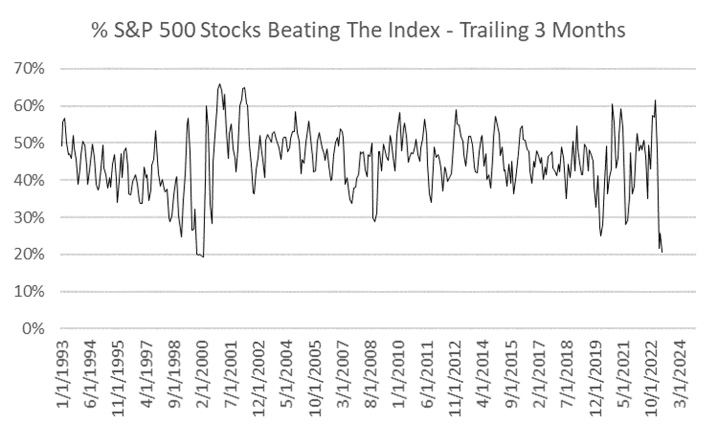

Dave: Narrow leadership is THE story of the past few months

Source: Goldman Sachs as of 05.22.2023

Source: Goldman Sachs as of 05.22.2023

Dave: as the average stock just can’t keep up with the megacap tech leaders

Source: Raymond James as of 05.22.2023

Source: Raymond James as of 05.22.2023

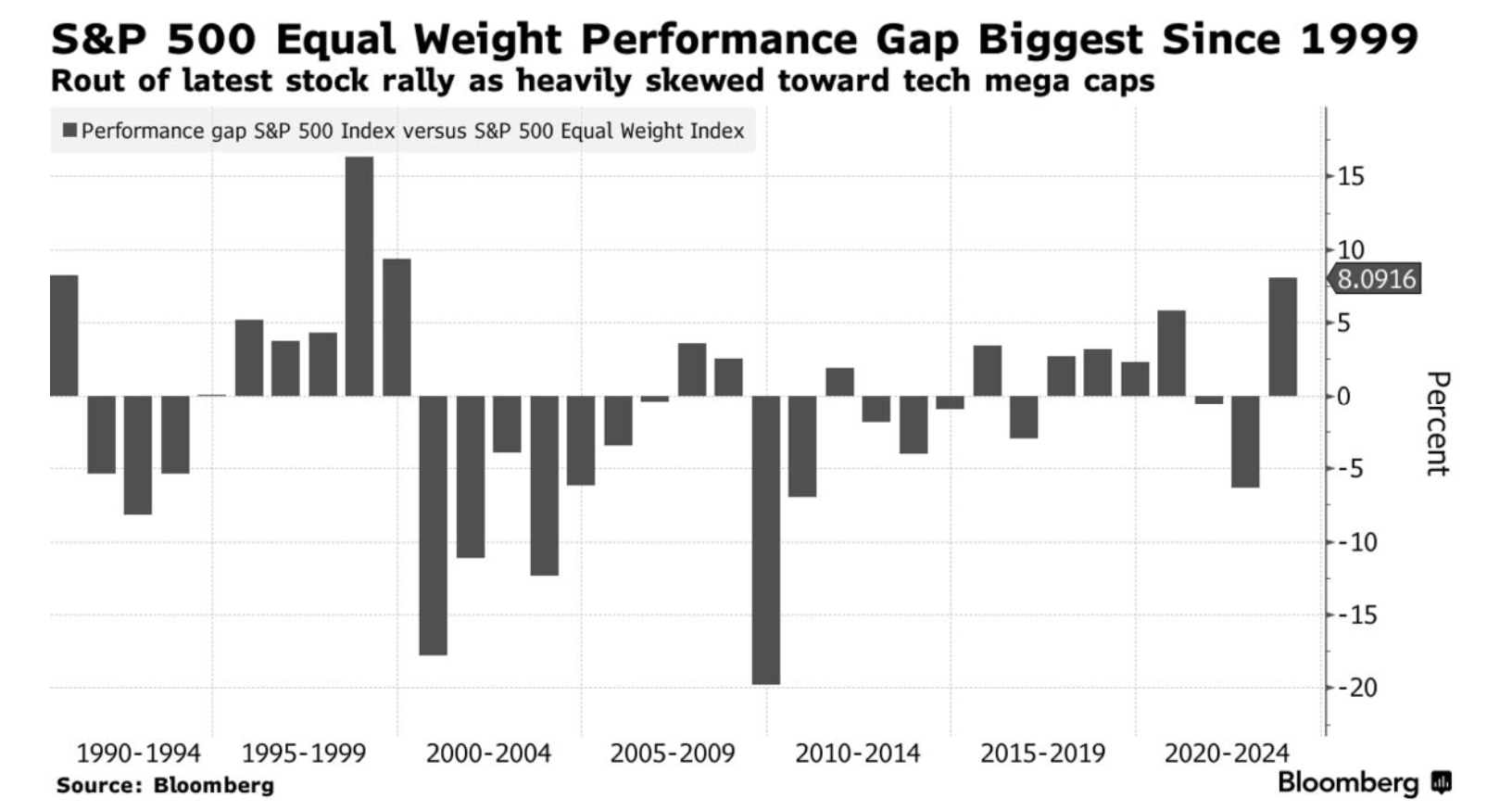

Dave: and equal-weighting is trailing market-cap weighting by the most in two decades

Data as of 05.23.2023

Data as of 05.23.2023

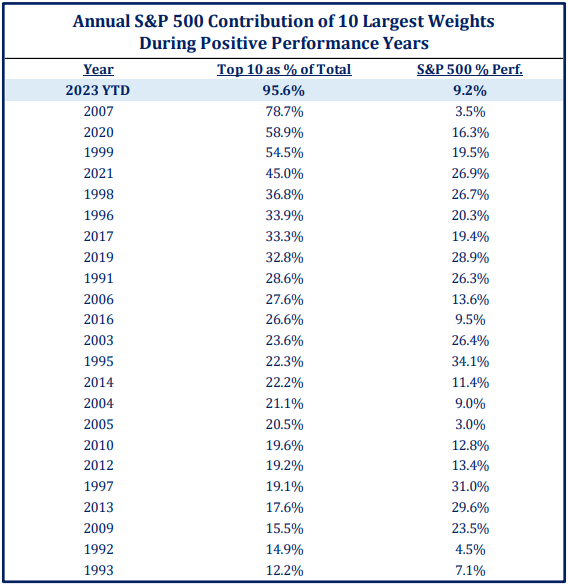

Brad: resulting in a historic reliance on a few names to carry stocks higher

Source: Strategas as of 05.24.2023

Source: Strategas as of 05.24.2023

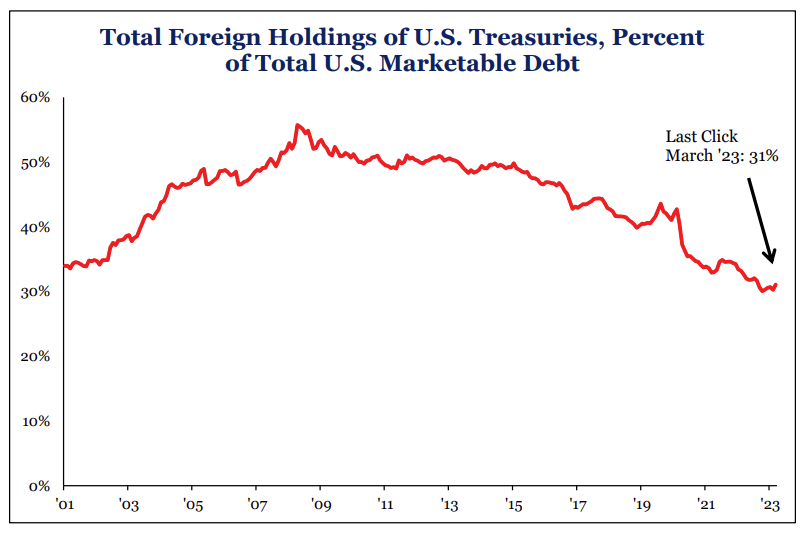

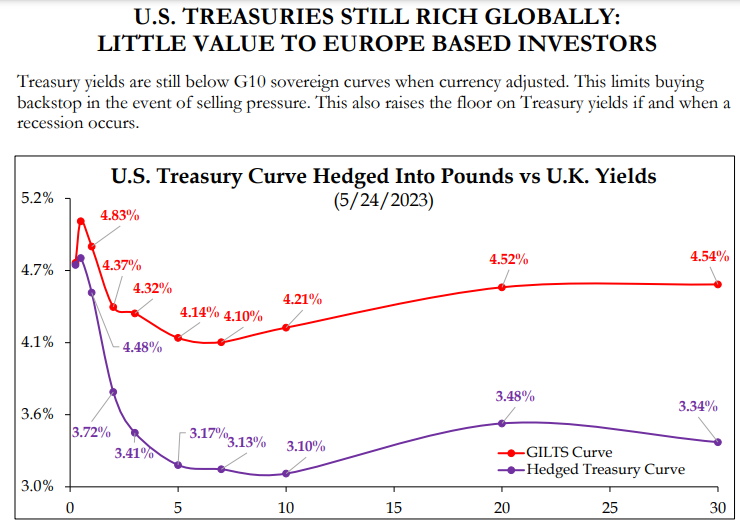

John Luke: U.S. Treasuries have become less and less useful to foreigners in recent years

Source: Strategas as of 05.22.2023

Source: Strategas as of 05.22.2023

John Luke: for not only geopolitical reasons, but also because they’re just not that attractive

Source: Strategas as of 05.24.2023

Source: Strategas as of 05.24.2023

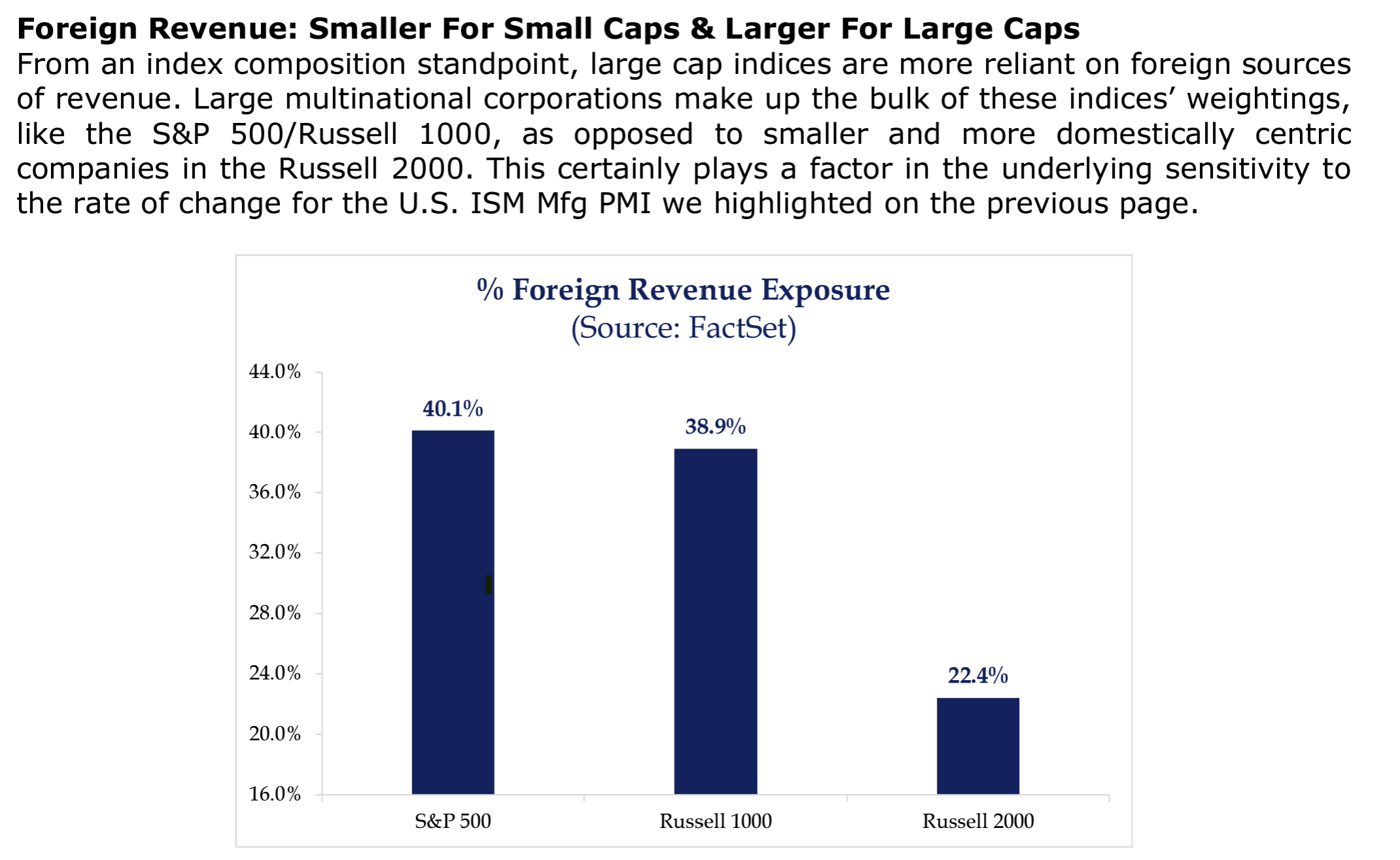

Dave: Speaking of foreign business exposure, it’s much higher for larger US companies than for the smaller ones

Source: Strategas as of 05.23.2023

Source: Strategas as of 05.23.2023

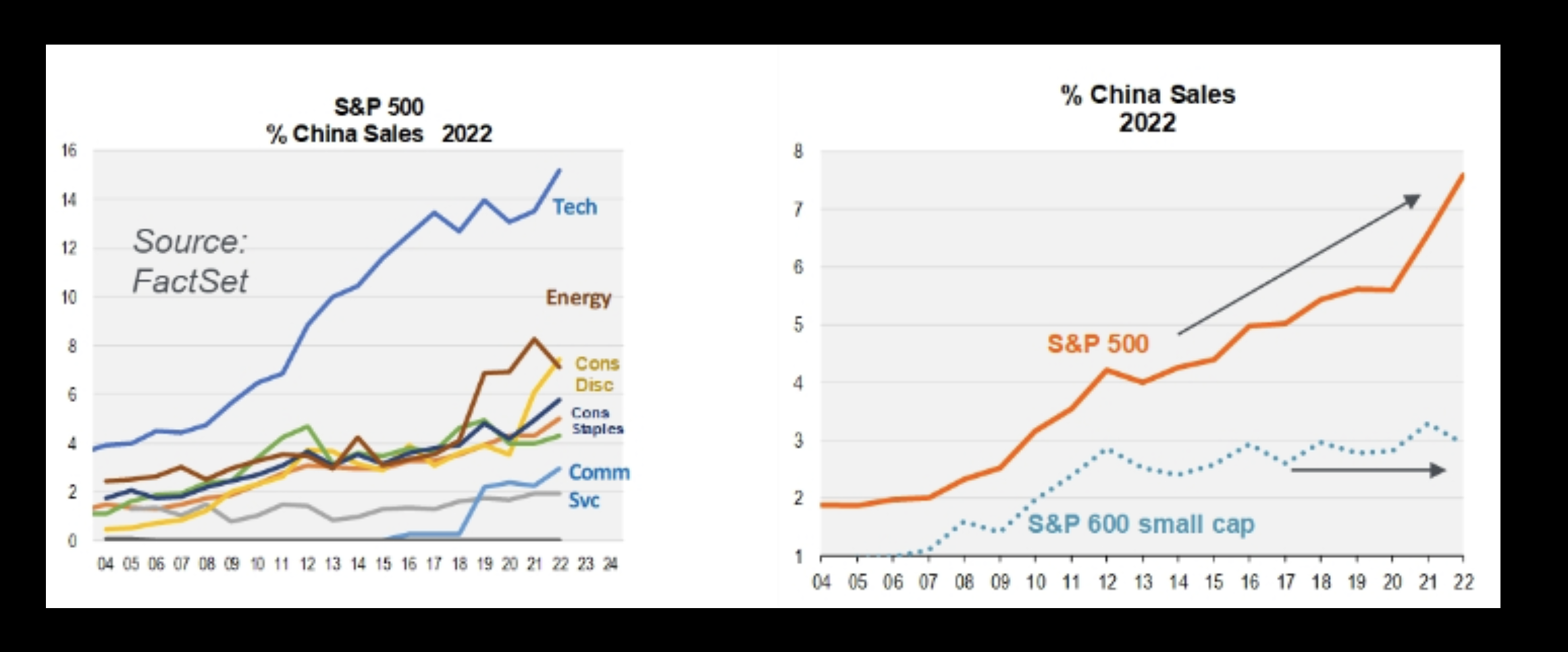

Dave: creating a tricky situation for those large companies who’ve become more reliant on non-friendly regions

Source: PSC as of 05.22.2023

Source: PSC as of 05.22.2023

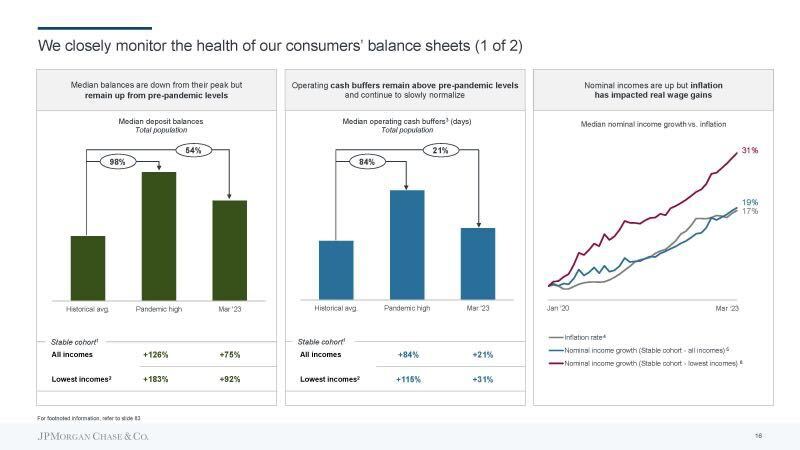

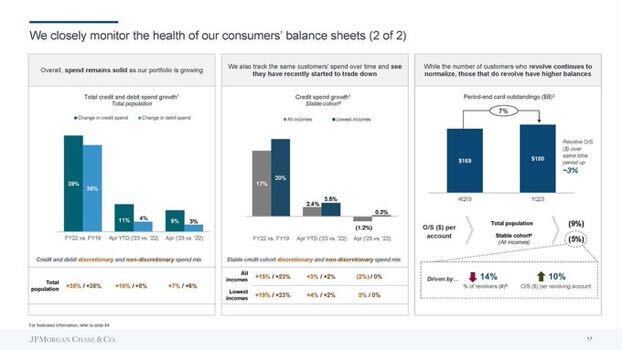

John Luke: On a positive note for the economy, consumers remain decently liquid despite some hits from higher prices

Data as of May 2023

Data as of May 2023

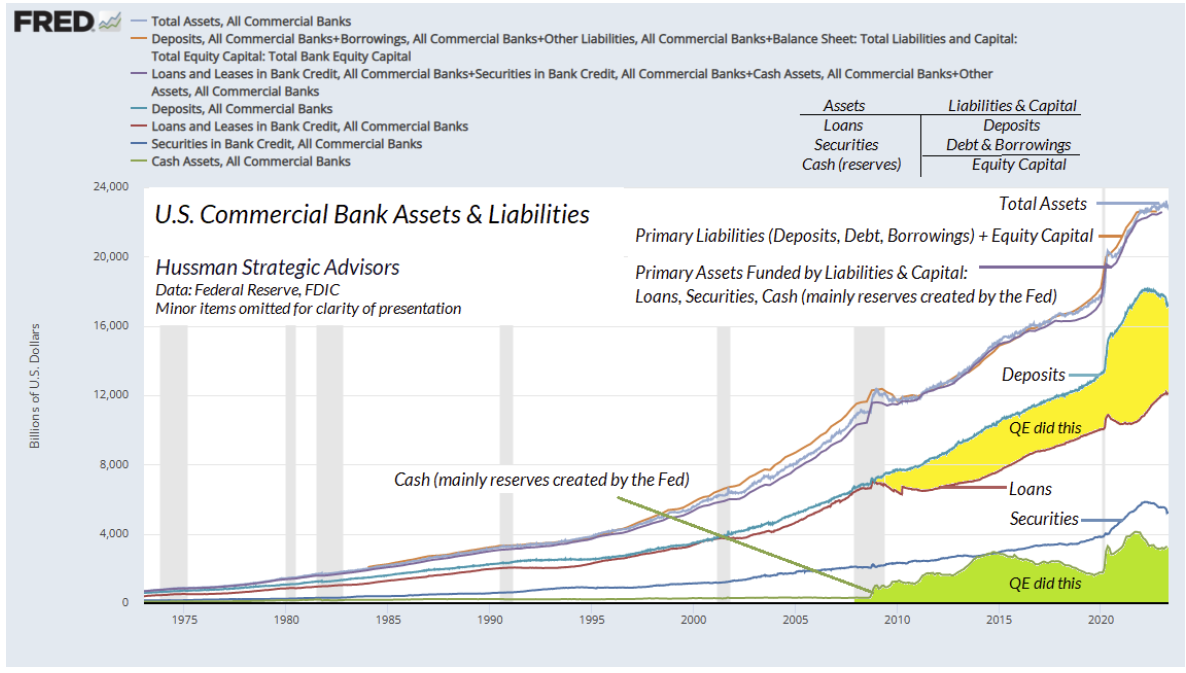

John Luke: The question with all of this is, how will things change if the Fed truly ends (or even slows) its long period of stimulus

Data as of May 2023

Data as of May 2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2305-30.