Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

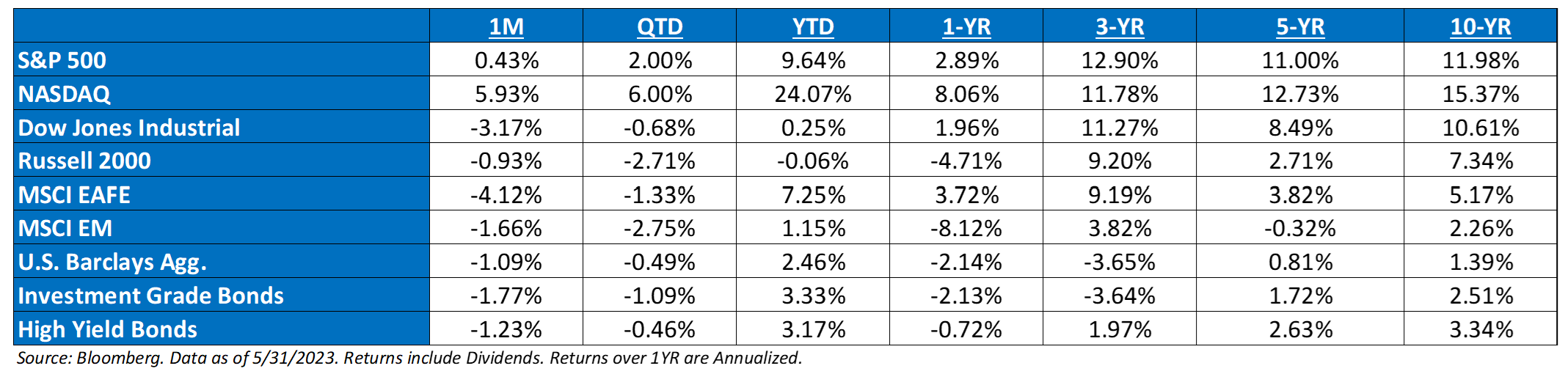

Dave: Technically an up month for stocks, but only if you’re concentrated in megacap tech

John Luke: as you go outside of tech, not many positive outcomes

Source: Strategas as of 06.01.2023

Source: Strategas as of 06.01.2023

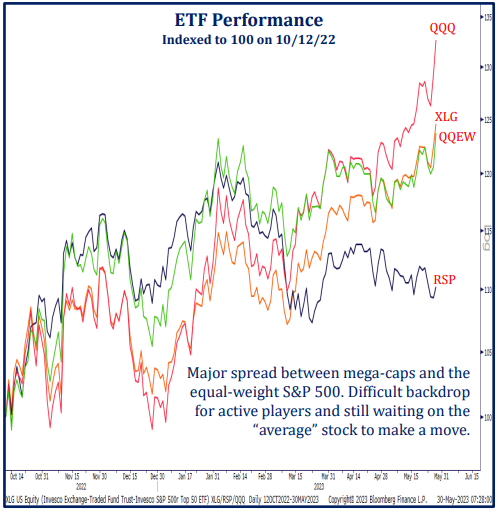

John Luke: which is a continuation of the theme since the lows last fall

Source: Strategas as of 05.27.2023

Source: Strategas as of 05.27.2023

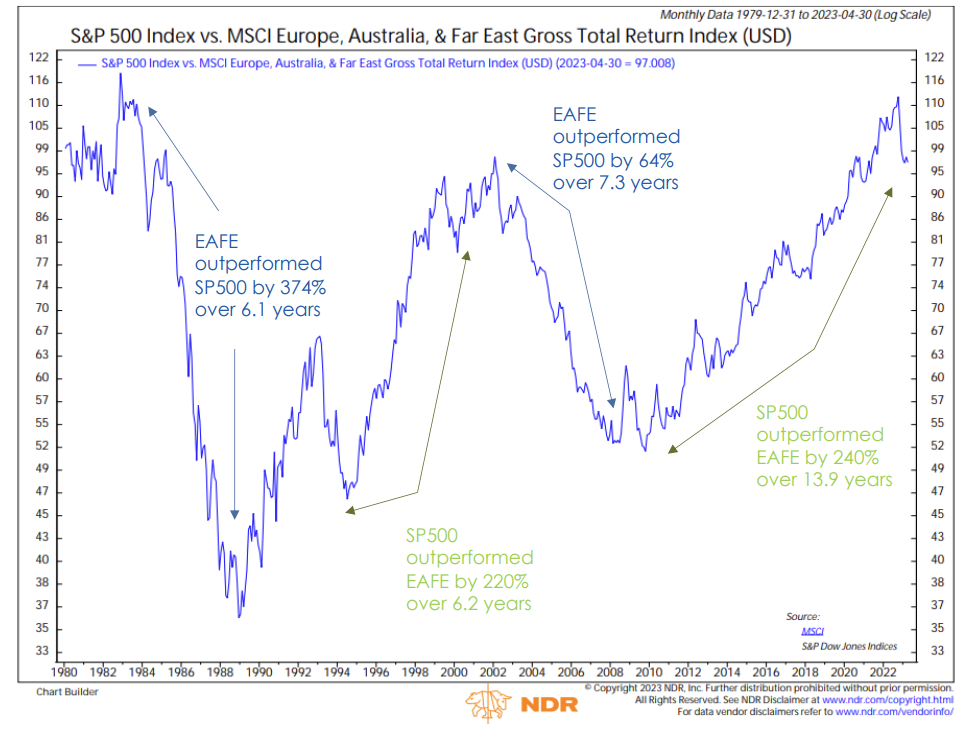

John Luke: Speaking of dispersion, US and foreign markets have historically had long cycles of outperforming one another

Source: Ned Davis Research as of May 2023

Source: Ned Davis Research as of May 2023

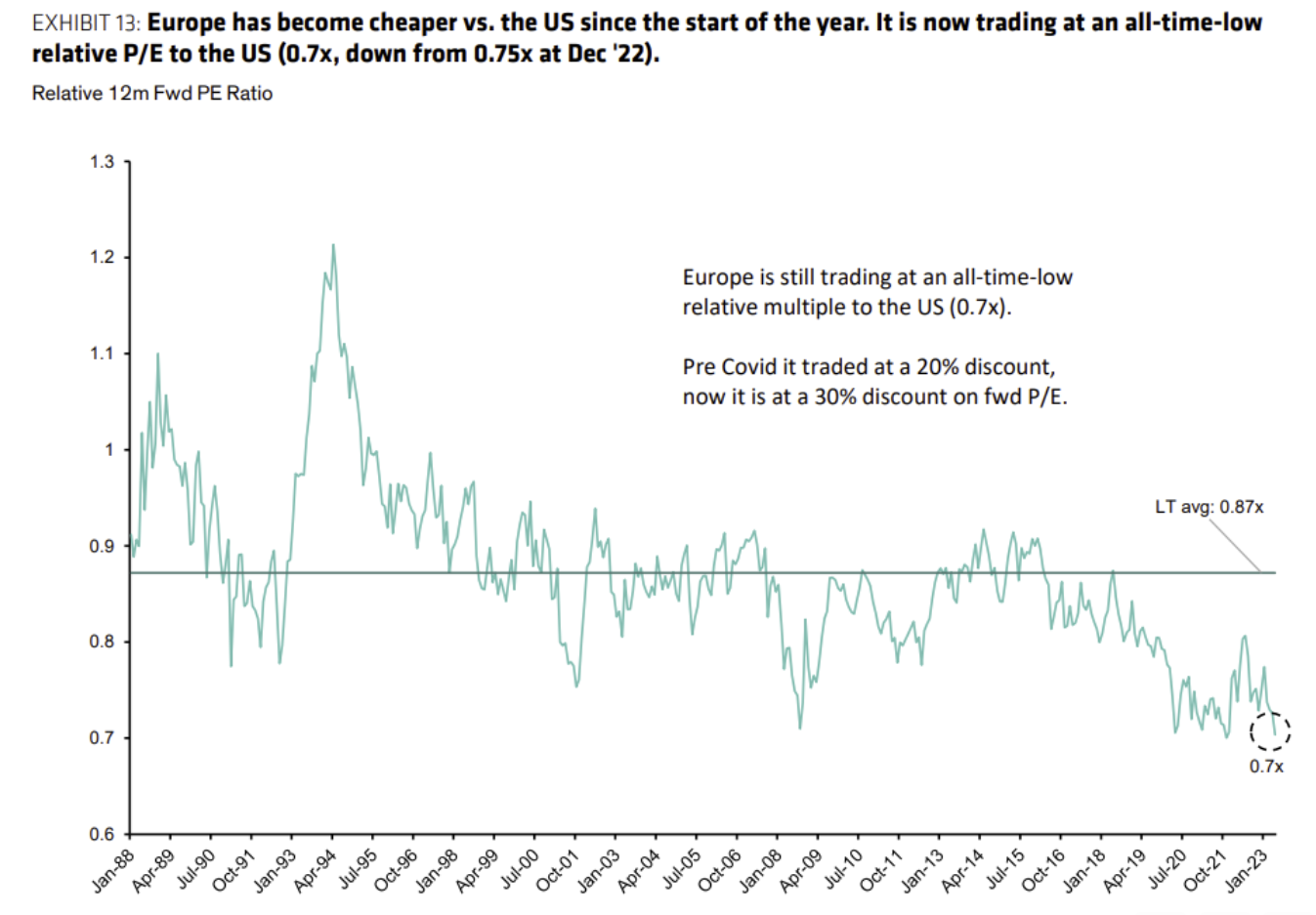

Dave: and regions such as Europe are particularly inexpensive versus valuations in the U.S.

Source: Bernstein as of 05.29.2023

Source: Bernstein as of 05.29.2023

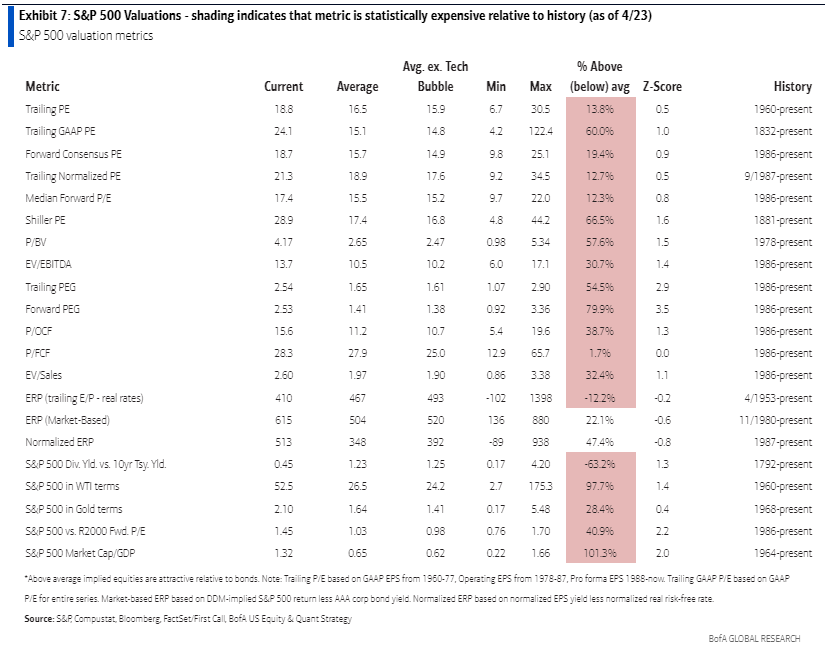

Brad: but is it “Europe undervalued” or “US overvalued”?

Data as of April 2023

Data as of April 2023

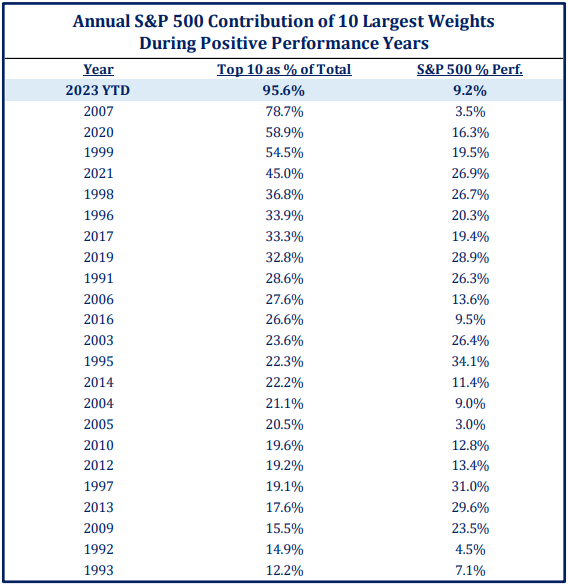

John Luke: Unprecedented domination by the largest S&P 500 components

Source: Strategas as of 05.27.2023

Source: Strategas as of 05.27.2023

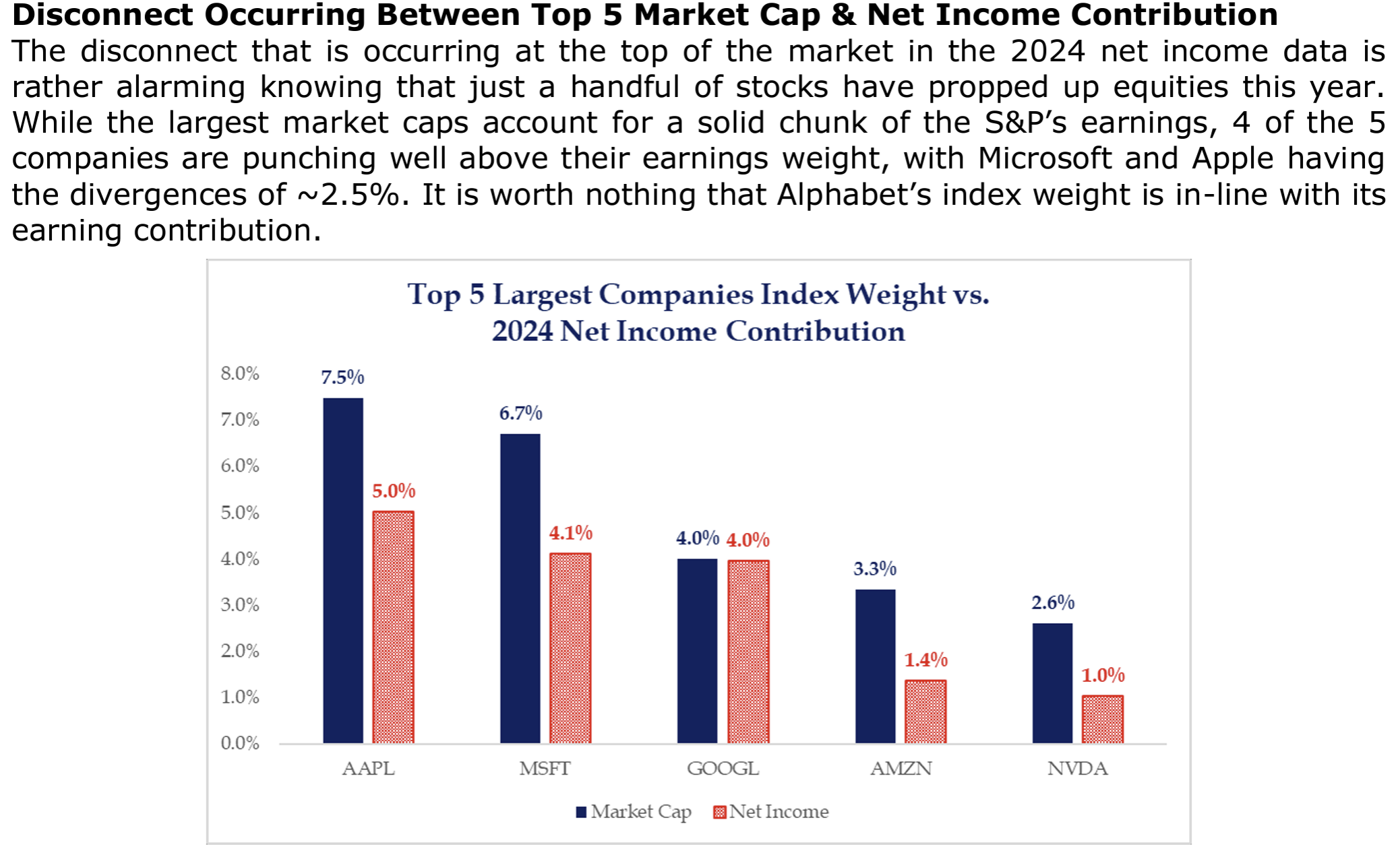

Dave: the dominance of which is more supported by popularity than the actual business results of those companies

Source: Strategas as of 05.27.2023

Source: Strategas as of 05.27.2023

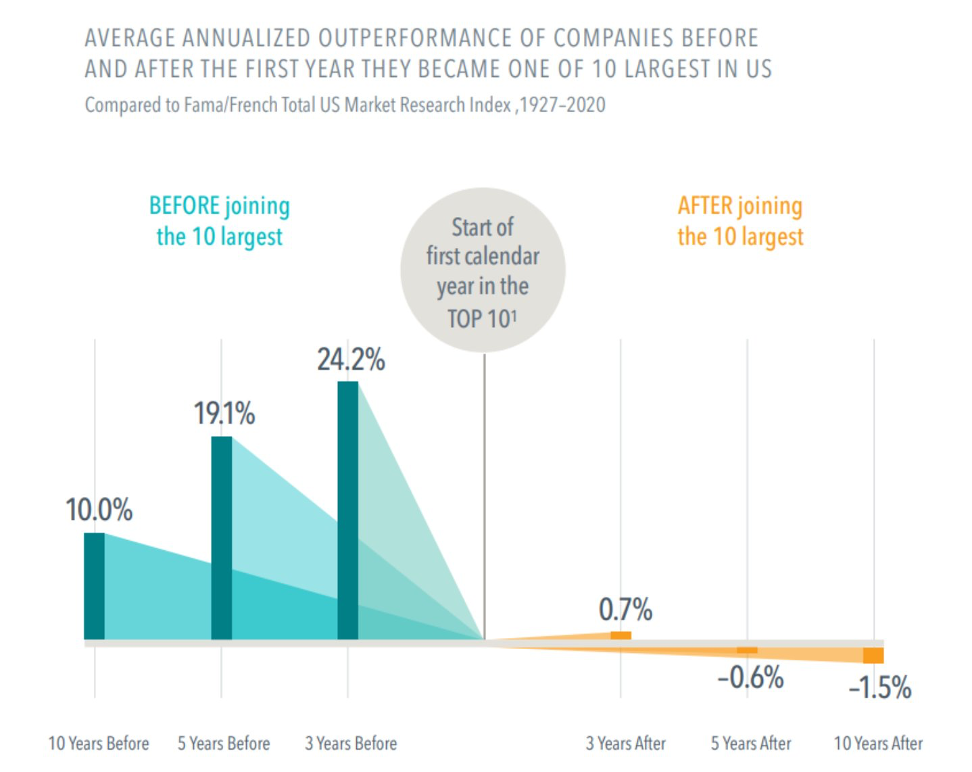

Brad: History tells us these heavy hitters haven’t fared well historically after reaching these heights

Source: Dimensional as of 2022 HT @mebfaber

Source: Dimensional as of 2022 HT @mebfaber

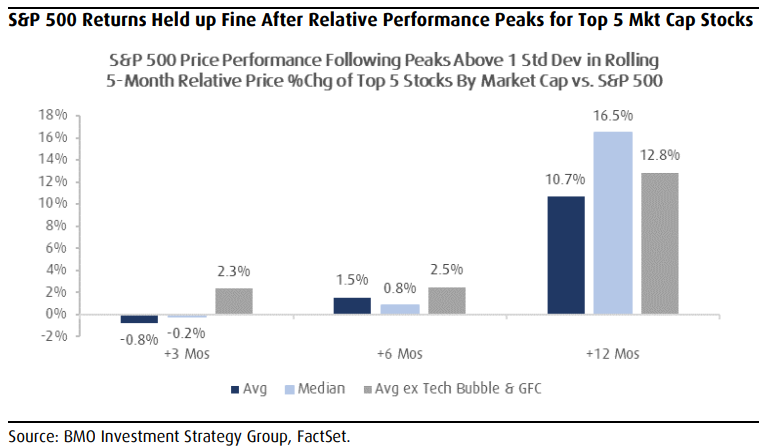

Derek: but maybe instead of flowing out of the market, those profits can just get spread into the broader market of stocks?

Data as of May 2023

Data as of May 2023

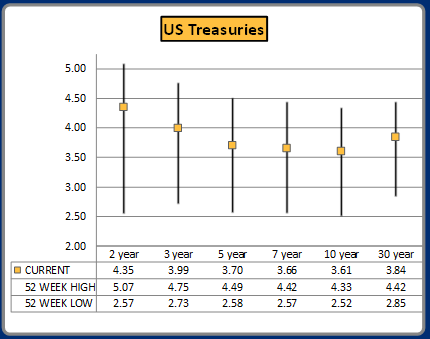

John Luke: Treasury yields have had quite the range over the past year, especially at the short end of the curve

Source: SouthState Bank as of 05.31.2023

Source: SouthState Bank as of 05.31.2023

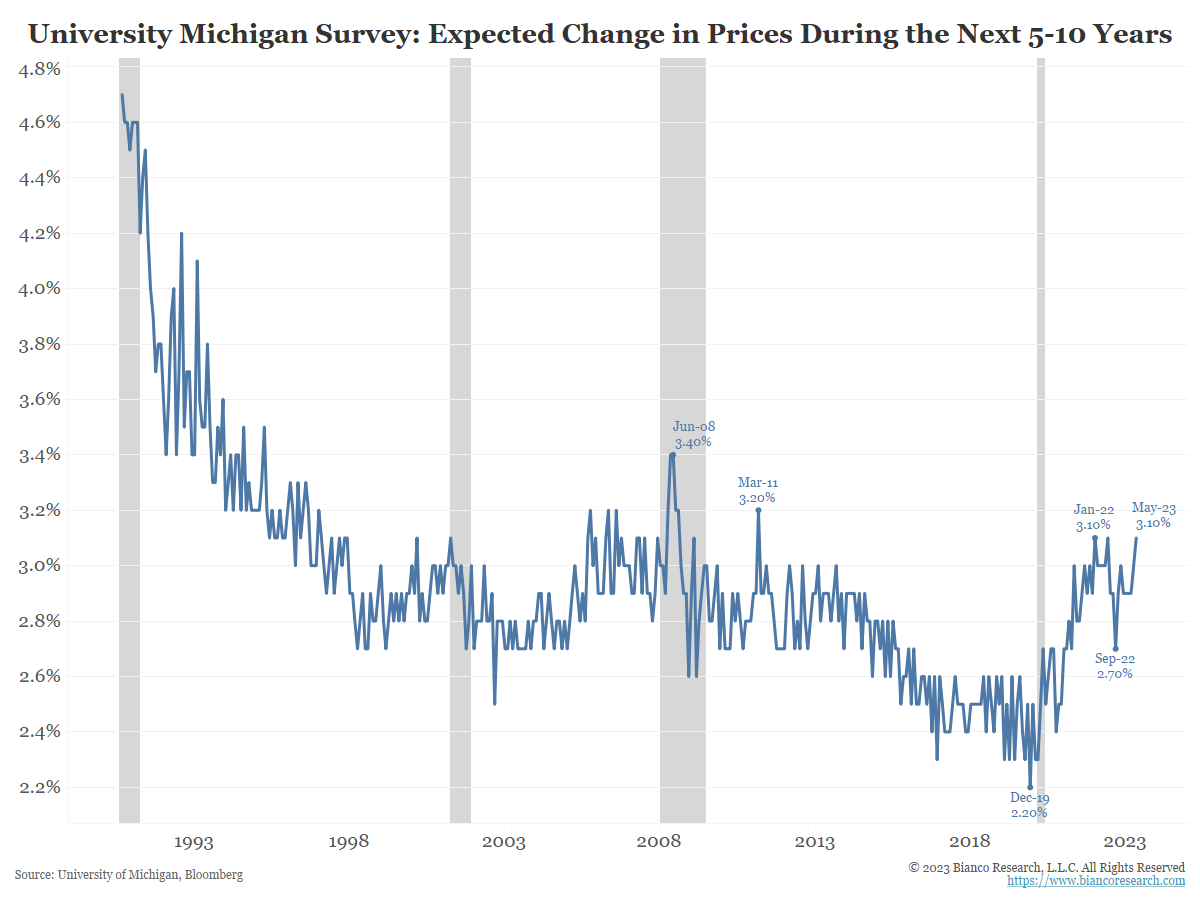

John Luke: as inflation expectations have adjusted higher from historical lows

Data as of May 2023

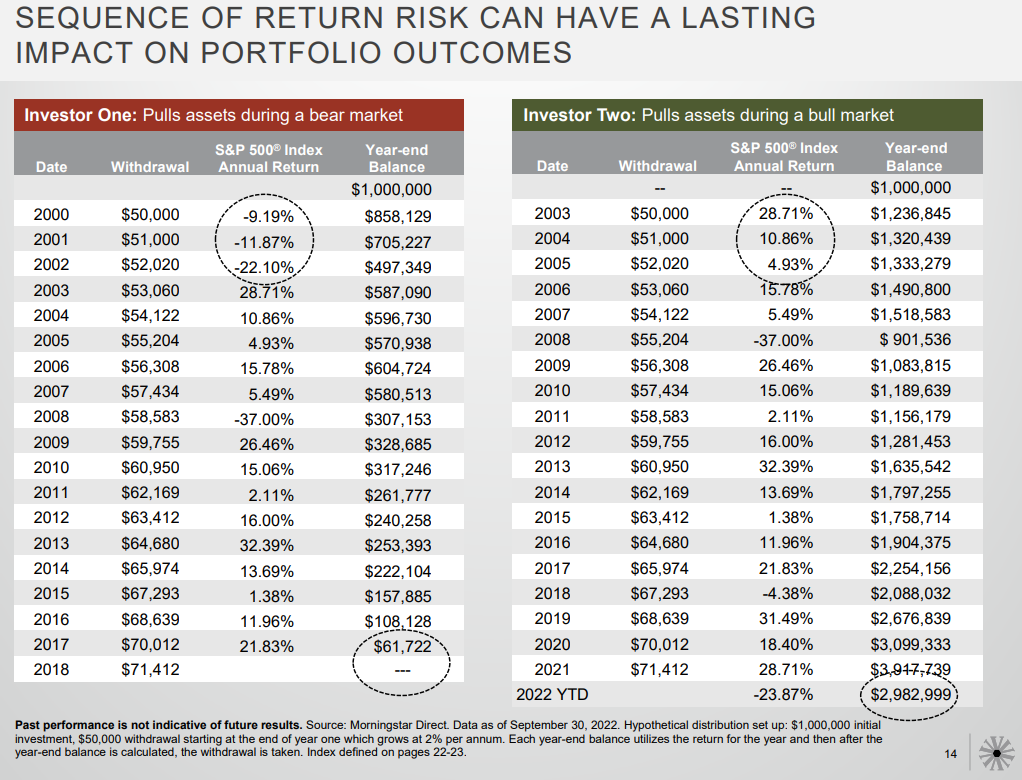

John Luke: The good or bad luck of one’s retirement date can make a huge difference in the chance they’ll have sufficient funds for future needs

Source: Virtus as of October 2022

Source: Virtus as of October 2022

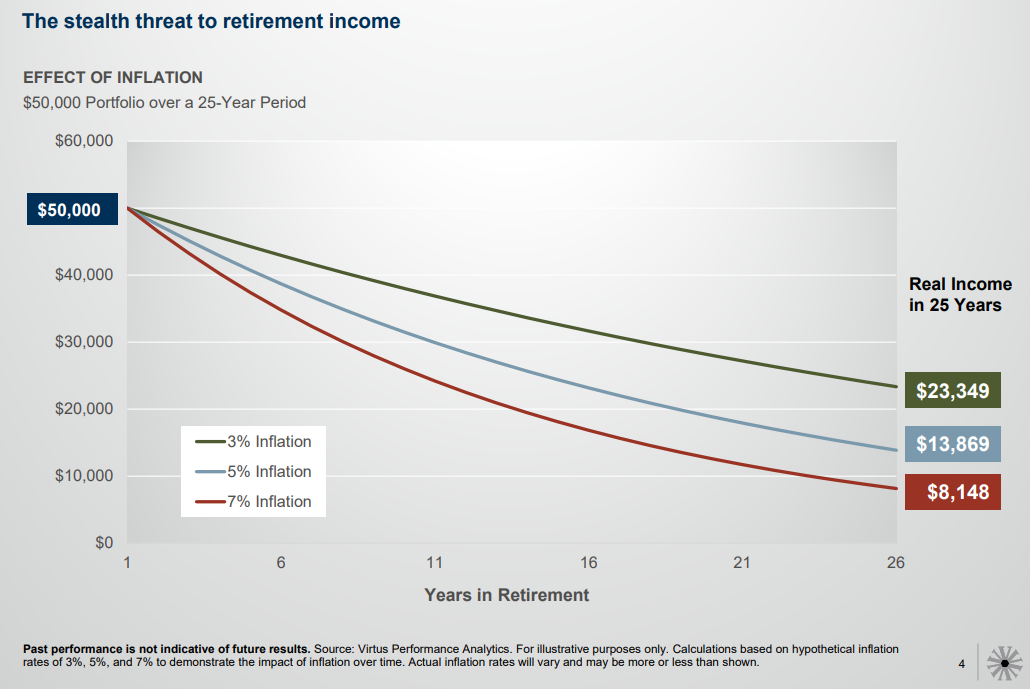

John Luke: but it’s also important to allocate enough to growth vehicles in order to reduce the sneaky “longevity risk” of outliving one’s savings

Source: Virtus as of 2022

Source: Virtus as of 2022

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2306-3.