Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

Brad: If you don’t recall this kind of volatility in the rate market, well…it’s been awhile

Source: Strategas as of 08.01.2023

Source: Strategas as of 08.01.2023

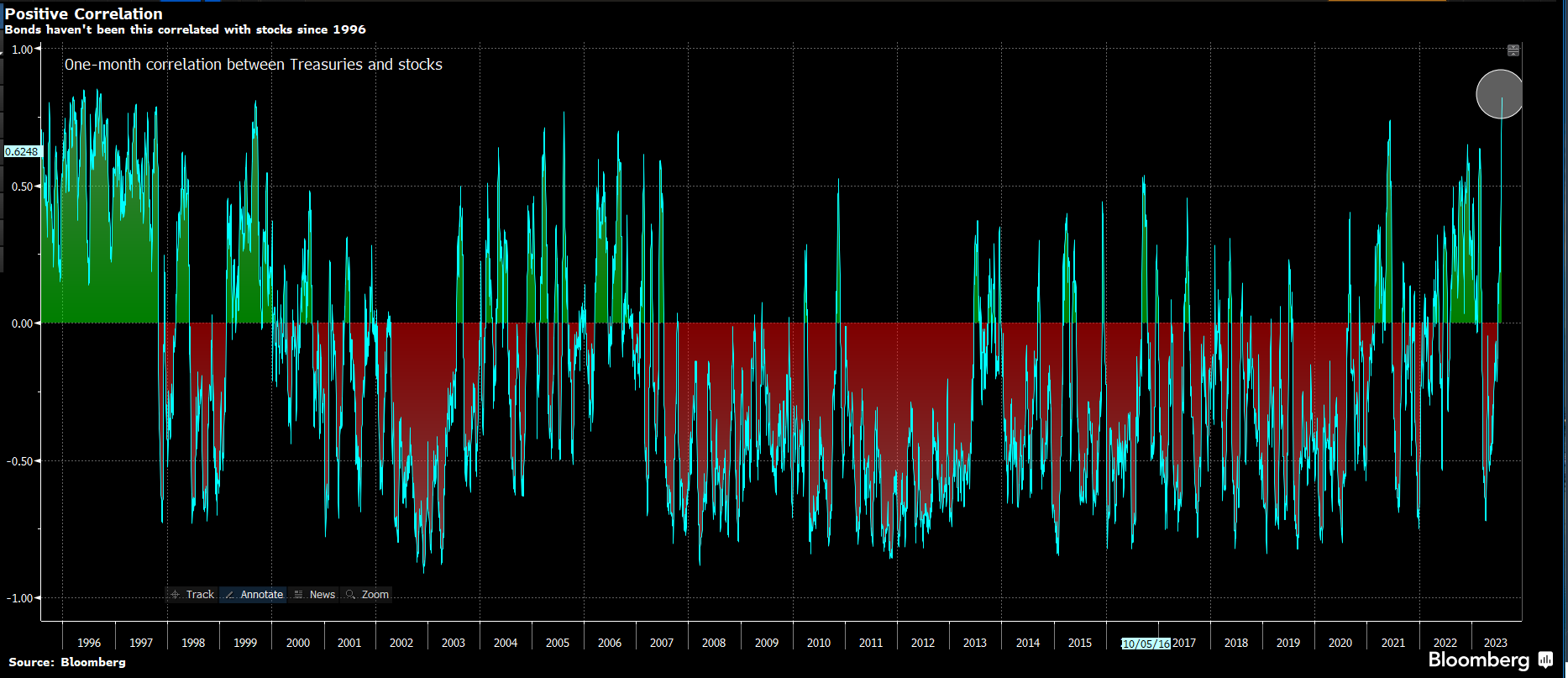

John Luke: and the correlation with stocks is whipping around as well

Source: Bloomberg as of 08.02.2023

Source: Bloomberg as of 08.02.2023

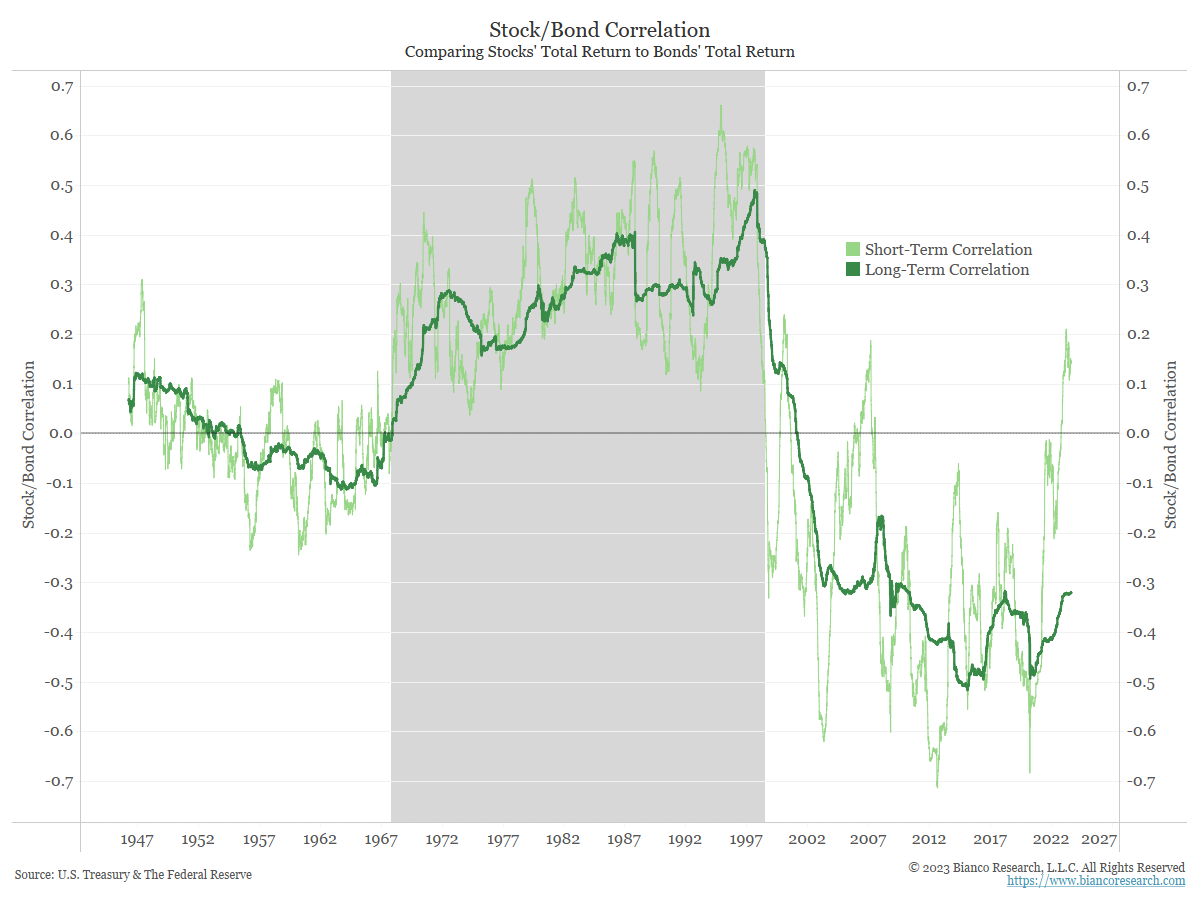

John Luke: the big question is, are we moving out of the stock/bond correlation regime that persisted for 25 years

Source: Bianco as of July 2023

Source: Bianco as of July 2023

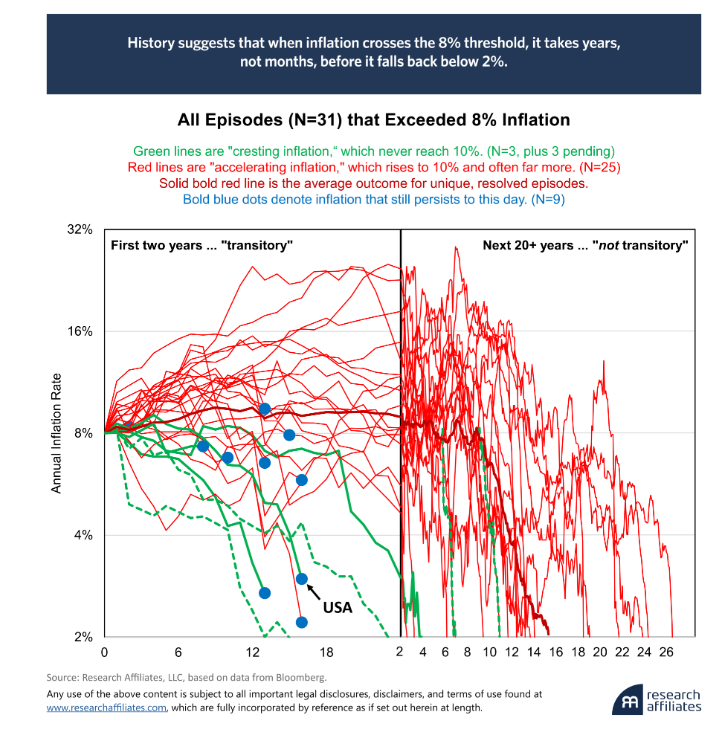

John Luke: The history of inflation spikes doesn’t provide evidence of the inflation going away and staying away

Data as of July 2023

Data as of July 2023

John Luke: and at least as far as interest expenses go, the federal government is facing its own rising prices

Data as of July 2023

Data as of July 2023

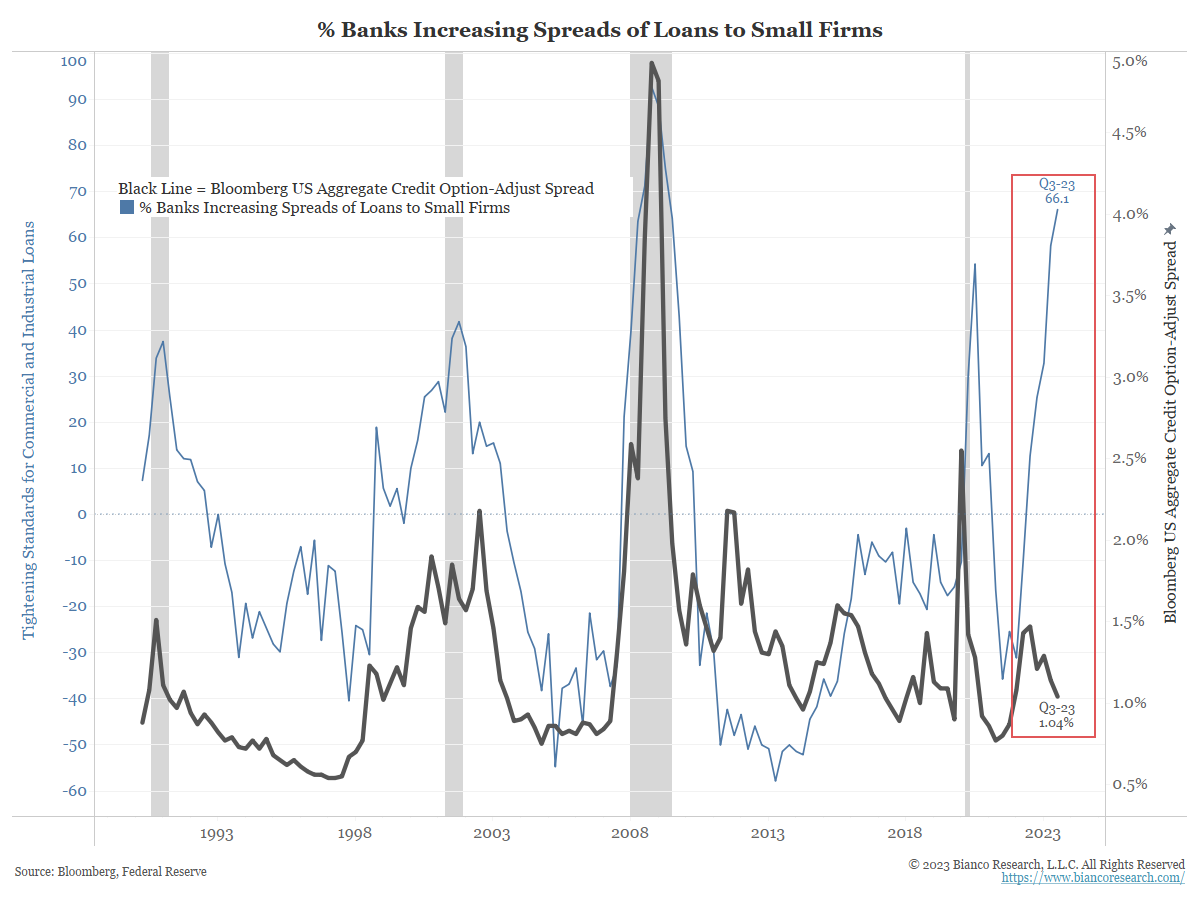

John Luke: Credit spreads are staying tight but banks are getting tougher on loans

Source: Bianco as of July 2023

Source: Bianco as of July 2023

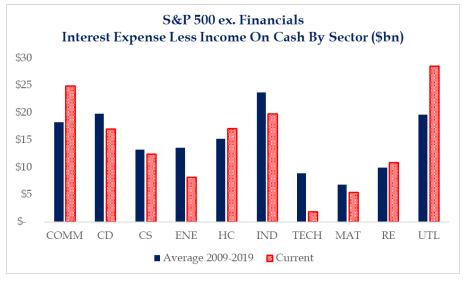

John Luke: and among larger publicly-traded companies, some sectors are benefiting from the rise in rates while others suffer

Source: Strategas as of 08.01.2023

Source: Strategas as of 08.01.2023

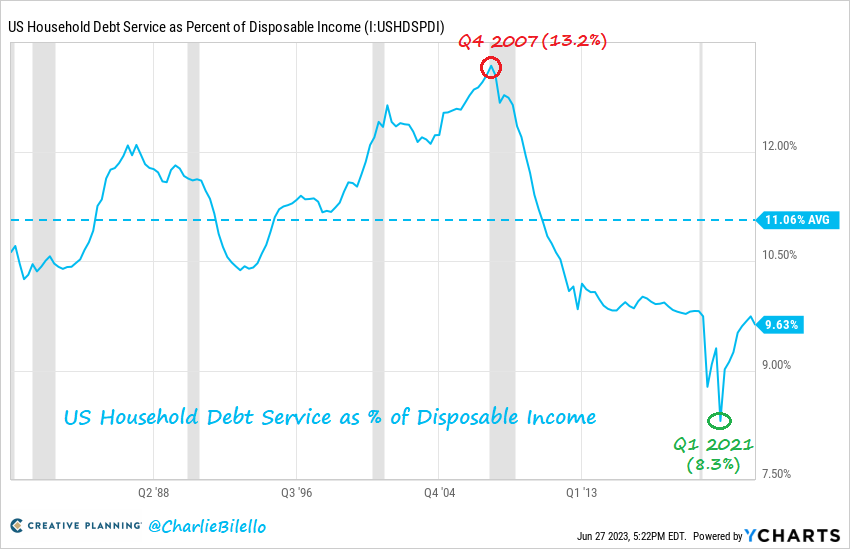

Derek: though no one has benefitted more than pre-2022 mortgage holders, locking in low long-term rates and picking up higher short-term savings rates

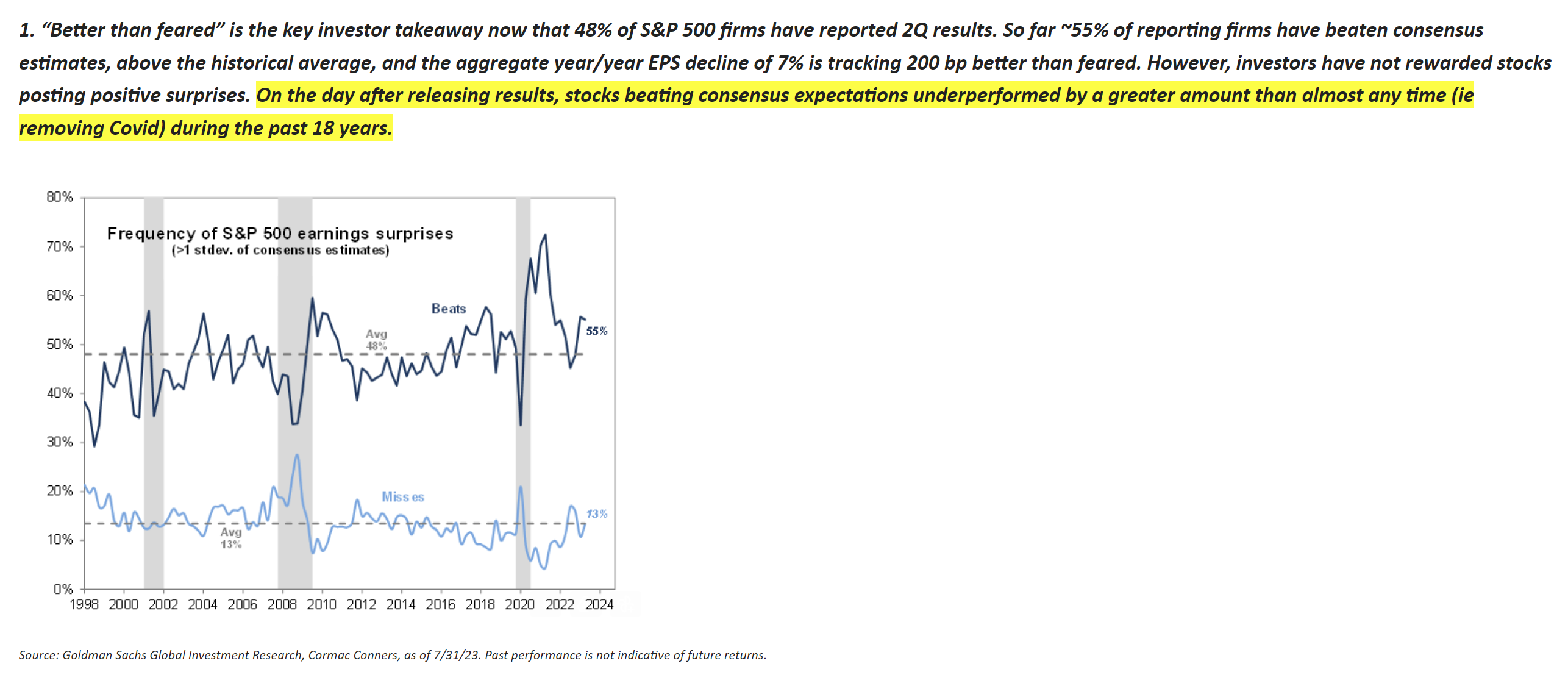

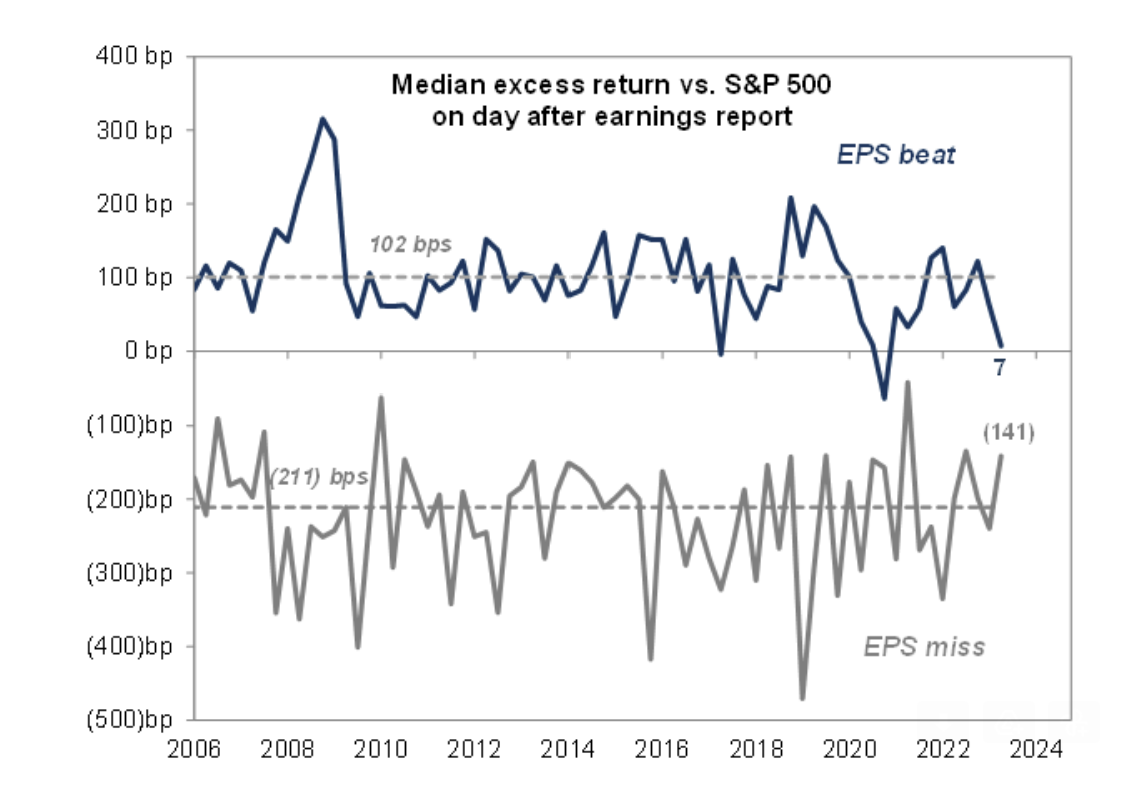

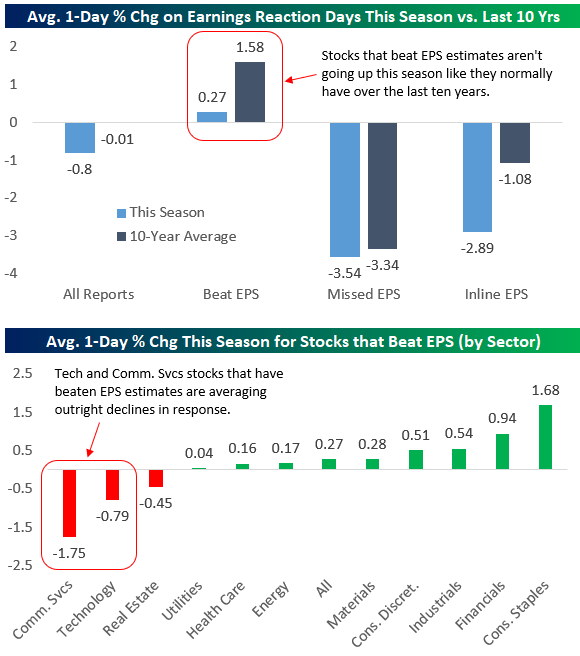

Dave: Earnings beats haven’t had great reactions this quarter

Dave: yet misses have

Source: Goldman Sachs as of 08.01.2023

Source: Goldman Sachs as of 08.01.2023

Joseph: with leading groups like Tech and Communications the biggest “victims” into high expectations

Source: Bespoke as of 08.02.2023

Source: Bespoke as of 08.02.2023

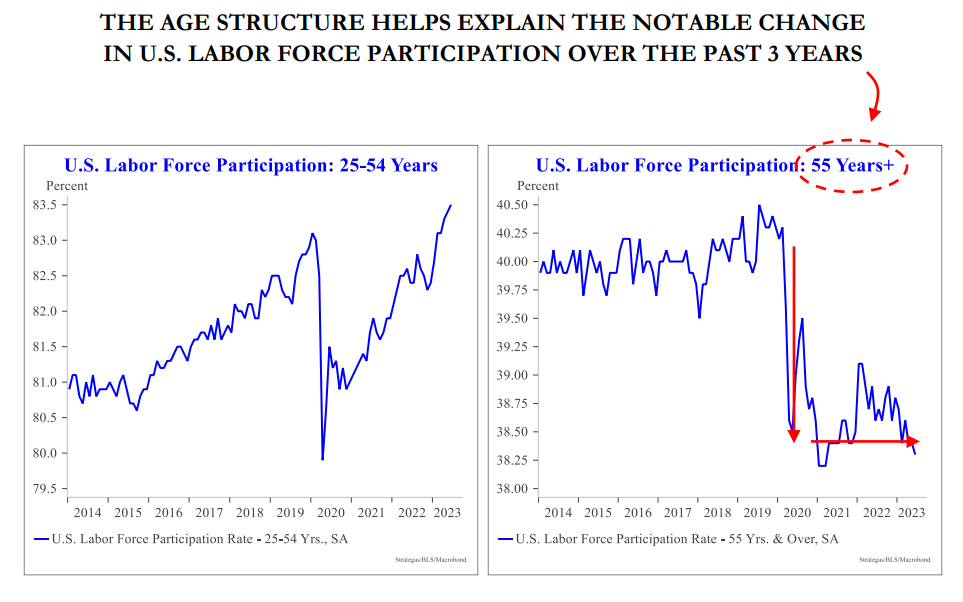

John Luke: The current labor supply quandary in a nutshell

Source: Strategas as of 08.01.2023

Source: Strategas as of 08.01.2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2308-10.