Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

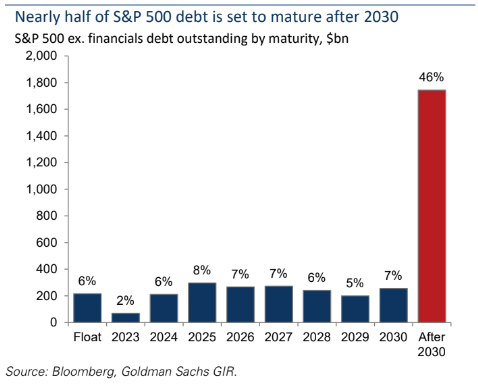

Mark: The ability of US corporations to sit patiently with long-term debt has been one of the unique attributes of this rate-hiking cycle

Data as of July 2023

Data as of July 2023

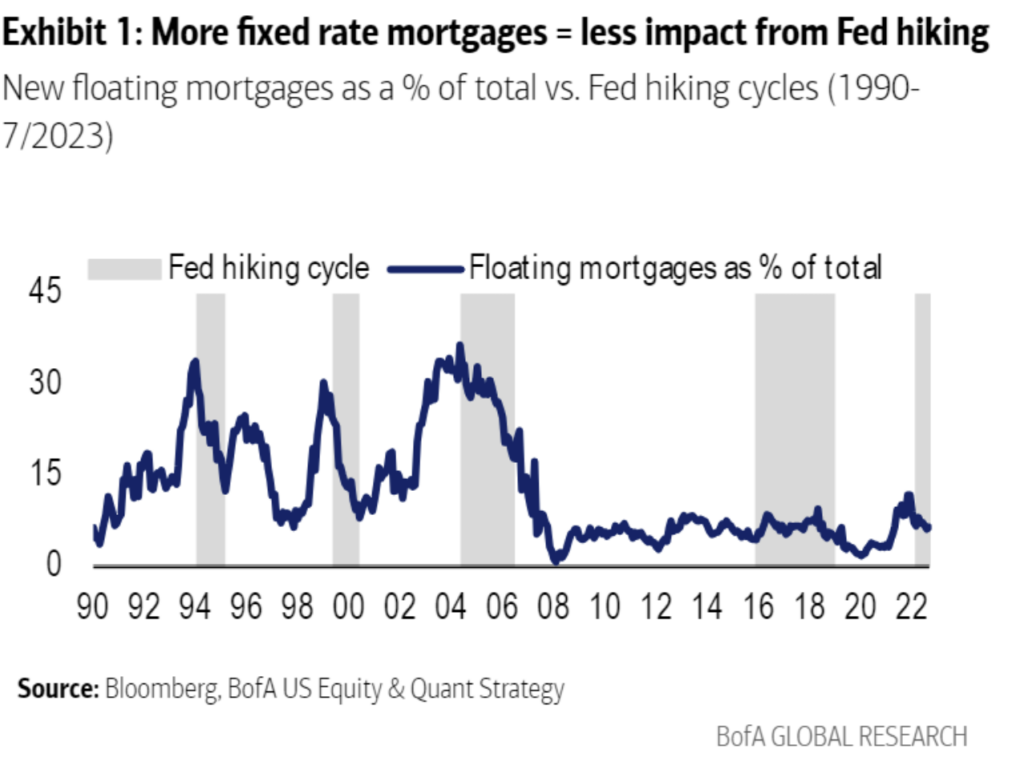

Dave: and current homeowners sit with that same luxury

Data as of July 2023

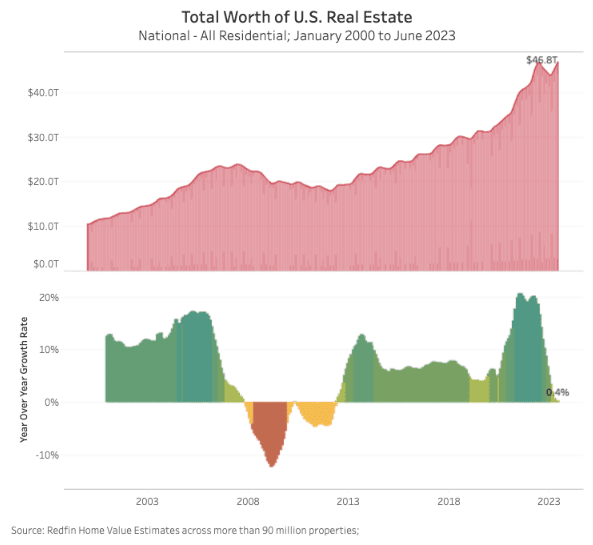

John Luke: combined with the rise in home prices, prospective homebuyers are fighting to find a way in

Data as of July 2023

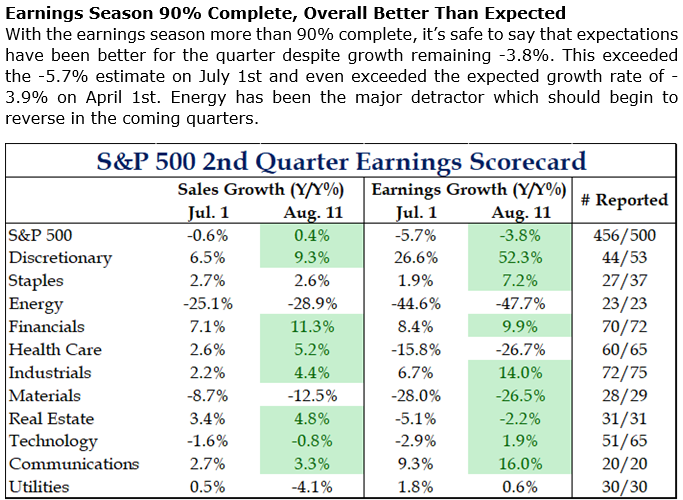

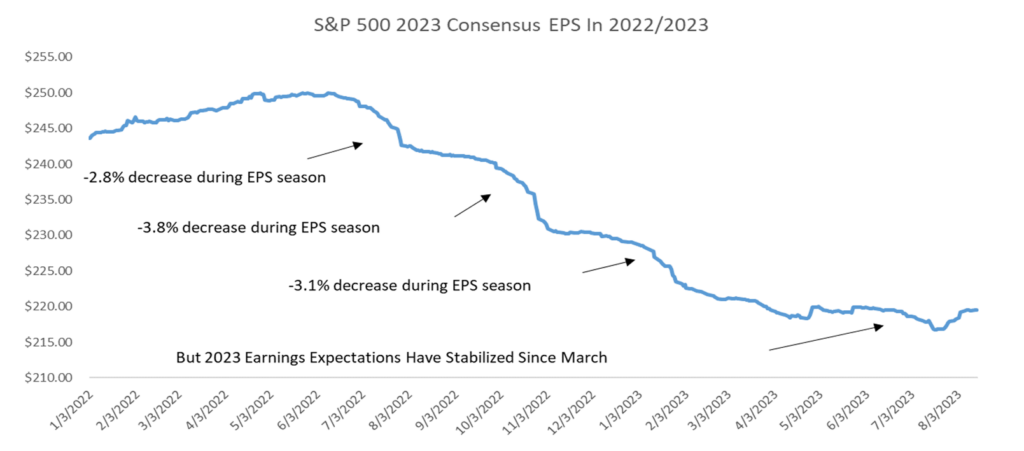

Brad: Q2 earnings mostly over, better than expectations that had been reduced throughout the year

Source: Strategas as of 08.14.2023

Dave: leading to a stabilization in consensus estimates after a 12 month stretch in which estimates fell by over 10%

Source: Raymond James as of 08.16.2023

Source: Raymond James as of 08.16.2023

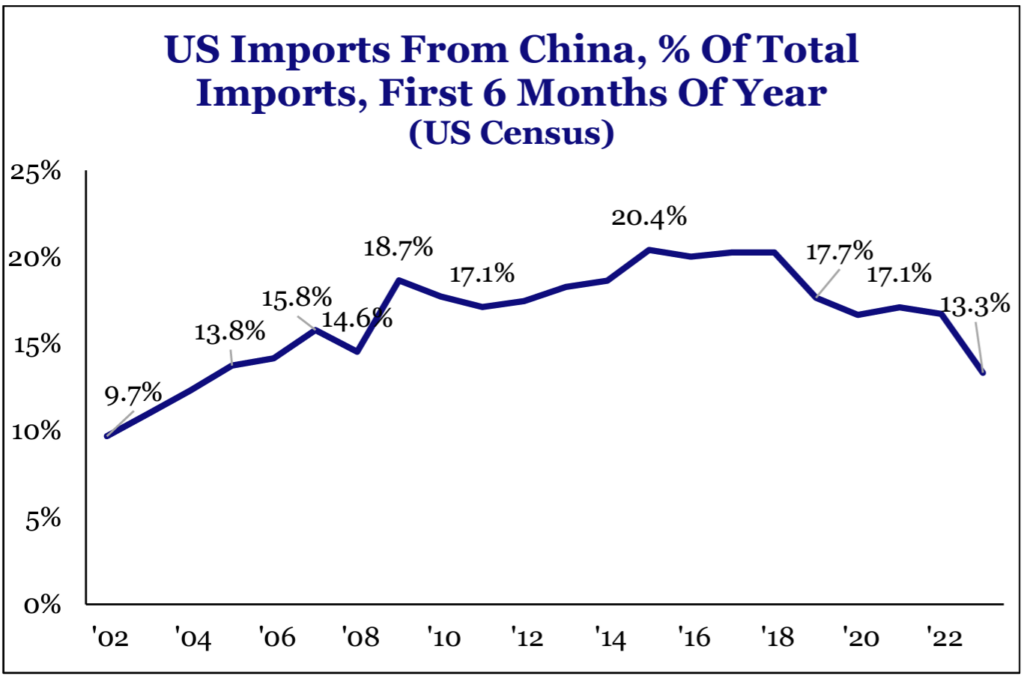

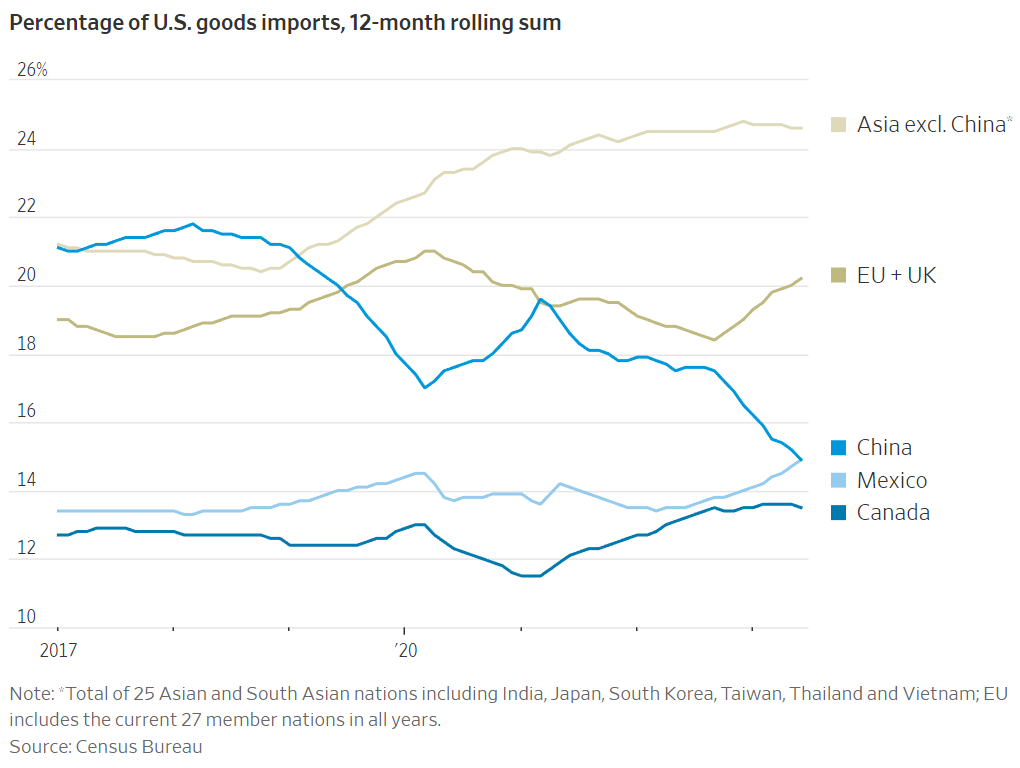

Dave: Supply chain reliance on China continues to fall

Source: Strategas as of July 2023

John Luke: with growth from Mexico and EU/UK offsetting up much of the recent decline

Data as of July 2023

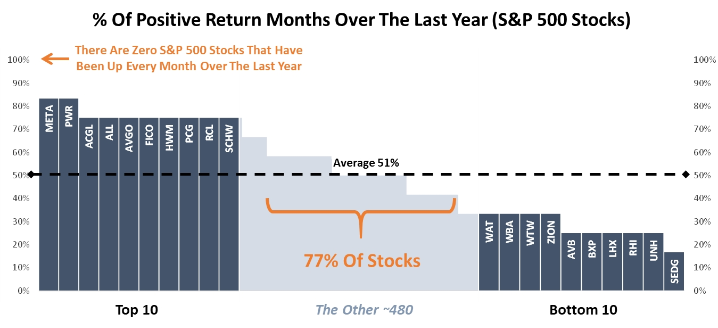

Dave: Large-cap growth has become as concentrated at the top as it was in the dot-com bubble

Dave: but rotation month-to-month has been useful in keeping the recovery alive

Source: PSC as of 08.15.2023

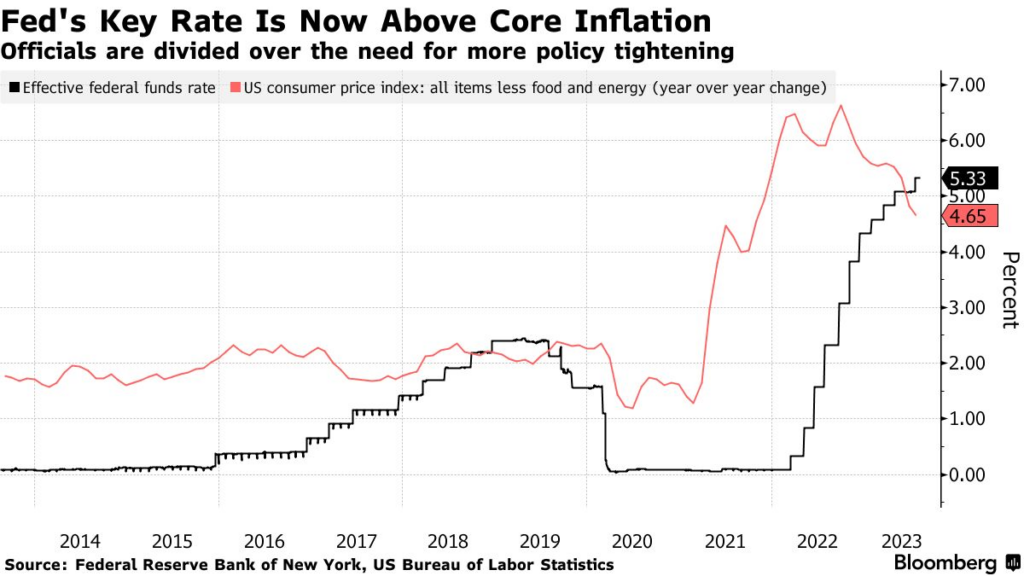

John Luke: Fed Funds has finally overtaken core inflation

Data as of 08.14.2023

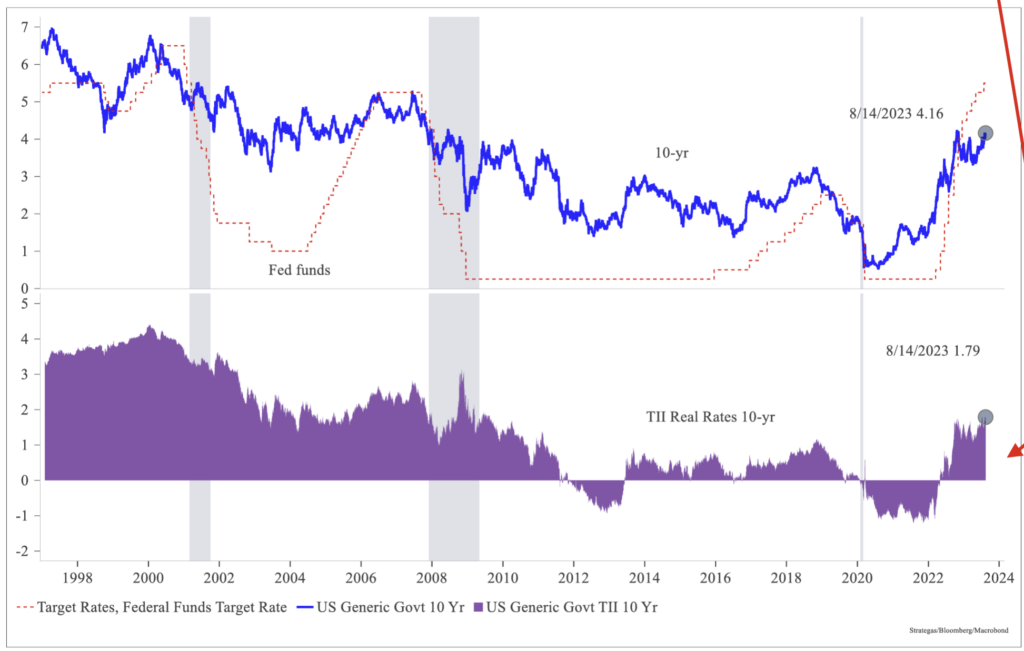

John Luke: with real rates now reaching levels not seen since before the global financial crisis

Source: Macrobond as of 08.14.2023

Source: Macrobond as of 08.14.2023

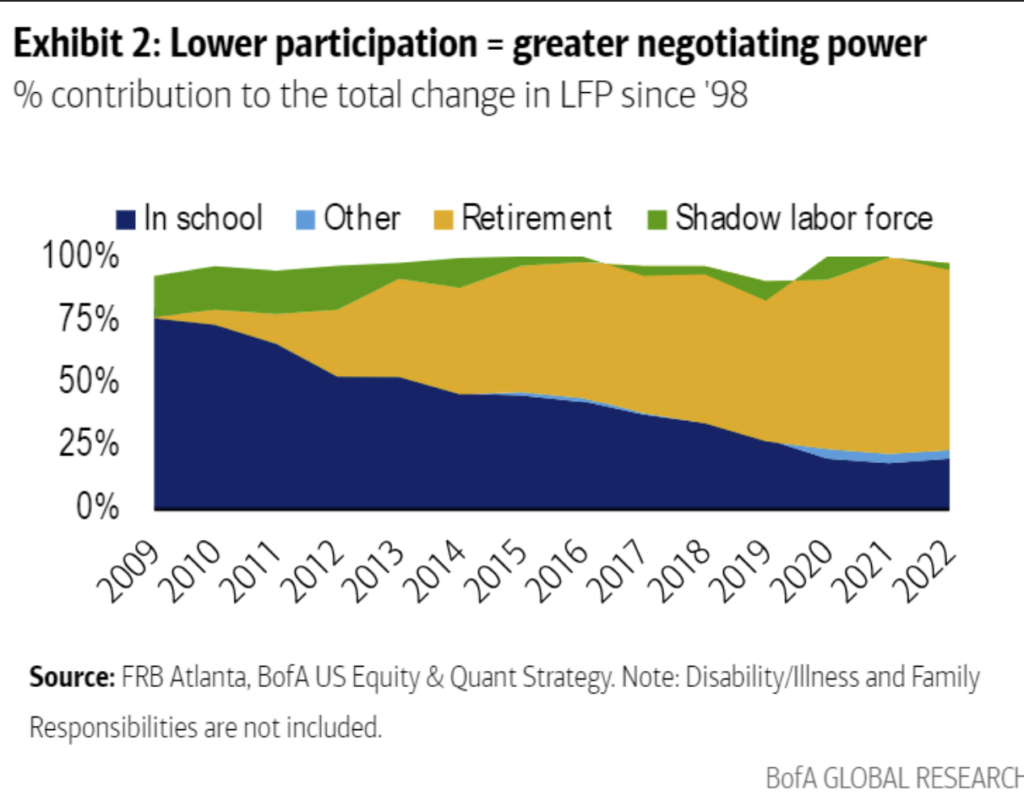

John Luke: but will the hikes to date be enough to offset the shrinking labor supply as workers continue to retire in record numbers?

Data as of June 2023

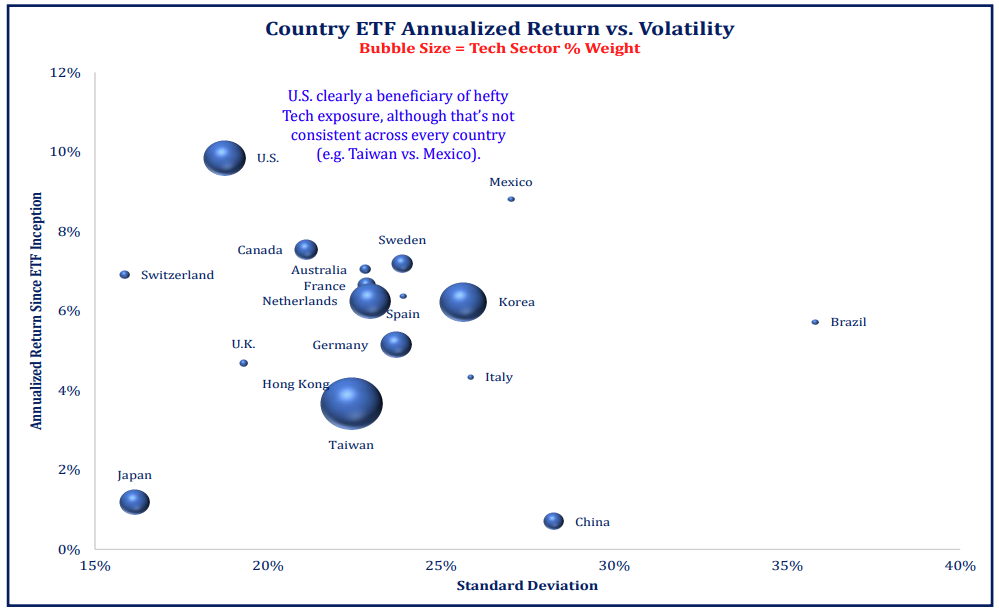

Joseph: The US stock market has stood out in recent decades, or high risk-adjusted returns. Tech has played a key role but it’s not the sole factor

Source: Strategas as of 08.14.2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2308-17.