Good reminder that bonds are not always the “safe” asset we all want them to be. A recent Content Hub post from JD, thought it made sense to share in case you missed…

We talk constantly about the two main risks we help advisors defend against:

Drawdown: sharp drops that interrupt compounding and trigger client fear

Longevity: insufficient returns that put clients at risk of outliving their money

Let’s focus on Longevity.

The perspective we provide on longevity risk tends to be negative. What do the negative consequences look like? It looks like running out of money, or having to decrease the desired spending amount, or having to work longer. There are only so many levers to pull when it comes to a successful financial plan. If compounded returns are insufficient, the responsibility is borne by the investor in the form of a sacrifice.

I said compounded returns for a reason.

Longevity can be thought of as endurance or durability. Those are the things we want to inject into a portfolio. The greater the longevity of a portfolio, the less you have to worry about required sacrifices by the investor.

What’s the path towards improved endurance? More stocks.

Morgan Housel, one of my favorite financial writers, illustrates this every now and then with a simple book idea:

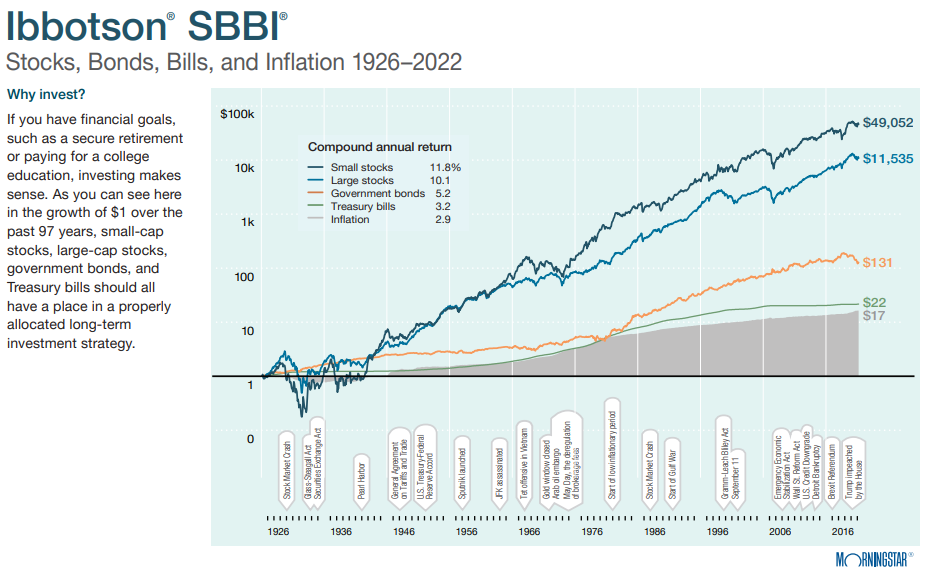

Here’s a little more detailed history on stocks vs. bonds:

From an investment standpoint, the allocation decisions we make matter far more than anything else. If you get the allocation right, you can disguise mistakes in other areas. The highest-level allocation decision is the % of stocks to own versus bonds.

It seems obvious that owning more stocks and less bonds is a solid long-term decision. We’d make the argument that if you take a 60/40 portfolio and compare it to a 75/25 portfolio, over the long term, the latter will outperform the former.

The problem in this simplicity is that more stocks and less bonds come with more volatility. More volatility creates a mess of problems mathematically (volatility tax) and behaviorally (fear and greed).

Aptus exists to help make this shift while keeping these problems at bay.

Our Portfolio Approach

We tend to build risk-based target exposures. It’s traditional in the sense that conservative portfolios own more bonds than aggressive portfolios.

Where we deviate is in our exposures vs. traditional benchmarks. Our approach is to over-allocate to equities, while providing a buffer against the additional volatility that gets felt by the holder.

Additional equity exposure is designed to increase longevity and durability of financial plans through higher returns at the portfolio level.

The additional risk is managed by owning hedges and other exposures that can benefit from markets experiencing higher volatility.

When returns are broken down into Yield, Growth, or multiples expanding, we are focused on the combination of yield and growth of our portfolios. Each strategy we launch is designed to either enhance portfolio yield or provide greater access to growth. If we improve the collective Y + G in each portfolio, the likelihood of success for our advisors and their clients improves.

Takeaway

We understand the caution clients feel about their nest egg, and the interest in “safe” investments. But we think asking an inferior engine (bonds), to do a job it’s not equipped to do, brings risks as well. To us, balancing a strong engine (stocks) with strong brakes (hedges) is the ideal formula to help clients comfortably reach their goals.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies, and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2310-18.