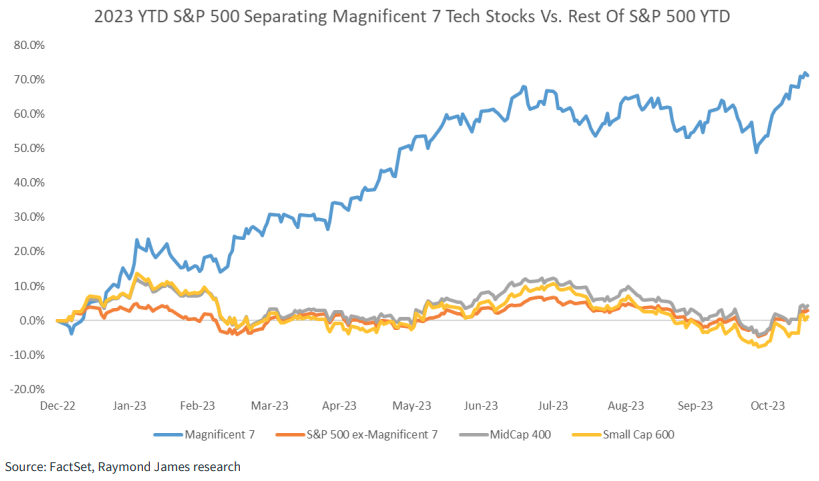

Many came into 2023 expecting a recession, and accordingly, bearish on equities. While the economic data has been much better than expected (particularly employment), it hasn’t reflected the robust return profile seen in the S&P 500 year-to-date. At +20.8% through November, one would think all is fine. However, upon further inspection, you find that the market-cap weighted S&P 500 has been carried by its heaviest hitters, the top 7 largest constituents known now as the “Magnificent 7.”

Source: Bloomberg, LP; SPX Index = S&P 500 (market-cap weighted), SPXEWTR Index = S&P 500 (even-weighted), BM7T Index (market-cap weighted index of AAPL, MSFT, GOOGL/GOOG, AMZN, NVDA, TSLA, META)

Source: Bloomberg, LP; SPX Index = S&P 500 (market-cap weighted), SPXEWTR Index = S&P 500 (even-weighted), BM7T Index (market-cap weighted index of AAPL, MSFT, GOOGL/GOOG, AMZN, NVDA, TSLA, META)

Presented differently:

Source: Raymond James Institutional Equity Strategy 2024 Outlook, as of 11.30.2023

Source: Raymond James Institutional Equity Strategy 2024 Outlook, as of 11.30.2023

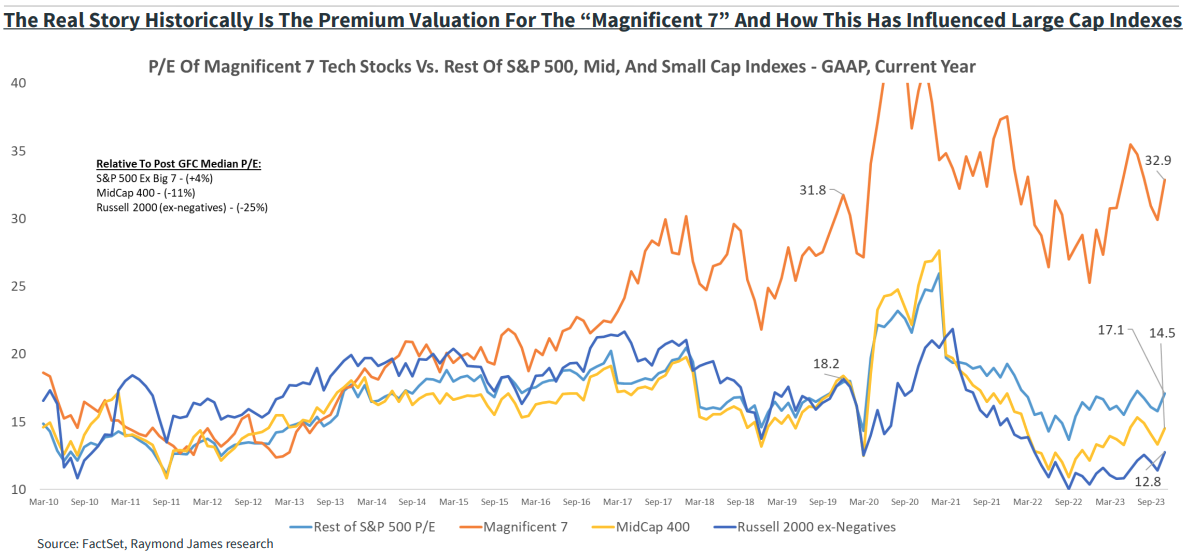

Valuation

One complaint many market participants have regarding equities is their high valuation. However, like this year’s performance, it seems that the largest names are inflating the index valuation – strip out those holdings and it becomes a more palatable price-to-earnings ratio.

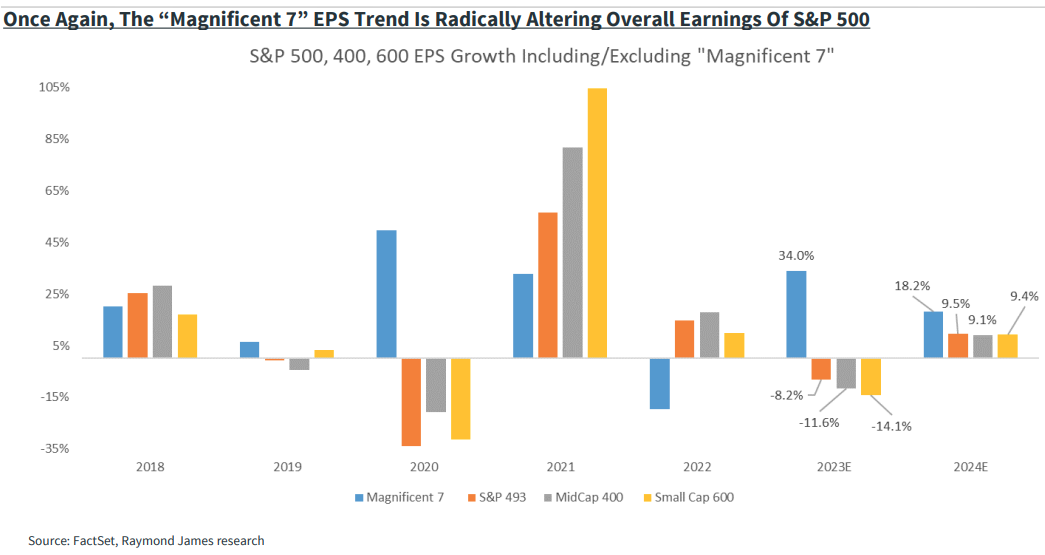

Earnings

So, index returns have been strong, driven in part by soaring valuation multiples in the largest names… but is it justified? That is a matter of opinion, but the earnings story seems to say “yes.” As seen below, negative 2023 year-over-year earnings for all stocks outside of the Magnificent 7 reflect the dour economic picture that so many predicted this time last year. It was those seven names, aided by strong demand, cost-cutting measures, and no small part from the renaissance in artificial intelligence (“AI”), that carried the brunt of the earnings load. To a lesser extent, this is projected to happen in 2024 as well.

Source: Raymond James Institutional Equity Strategy 2024 Outlook, as of 11.30.2023

Source: Raymond James Institutional Equity Strategy 2024 Outlook, as of 11.30.2023

Conclusion

2023 has been about seven stocks: Apple, Microsoft, Google, Amazon, Nvidia, Tesla and Meta. To what extent you owned those names determined the fate of your investment returns. Their success has vaulted them to eye-watering valuations, but these appear to be supported by continued favorable earnings outlooks. The law of large numbers says this can’t happen infinitely, but for the time being, it is the way of the market.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2312-5.