Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

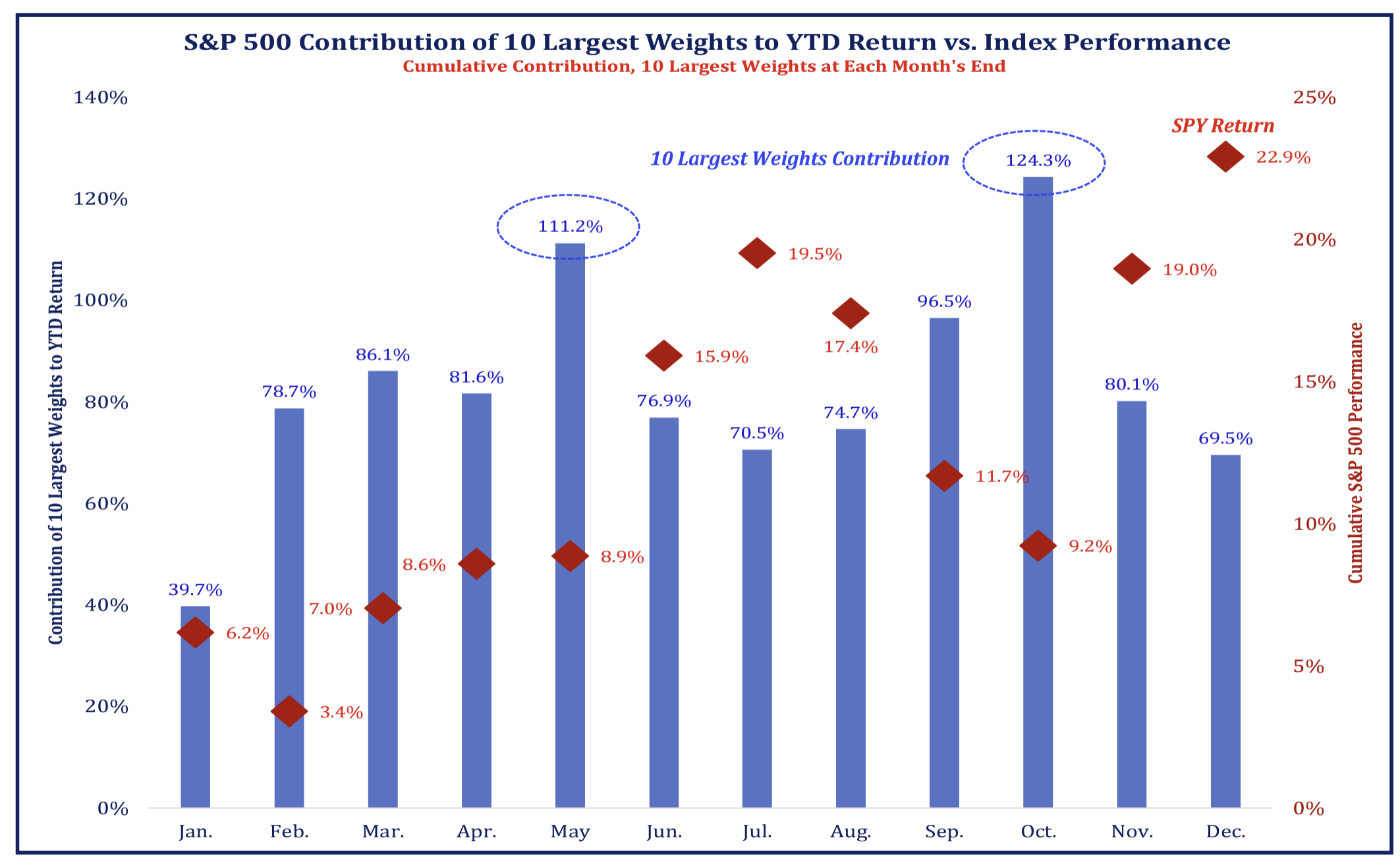

Dave: With the absurd dominance of the megacap names having retreated to merely “dominant”, we hope to retire this type of graphic

Source: Strategas as of 12.19.2023

Source: Strategas as of 12.19.2023

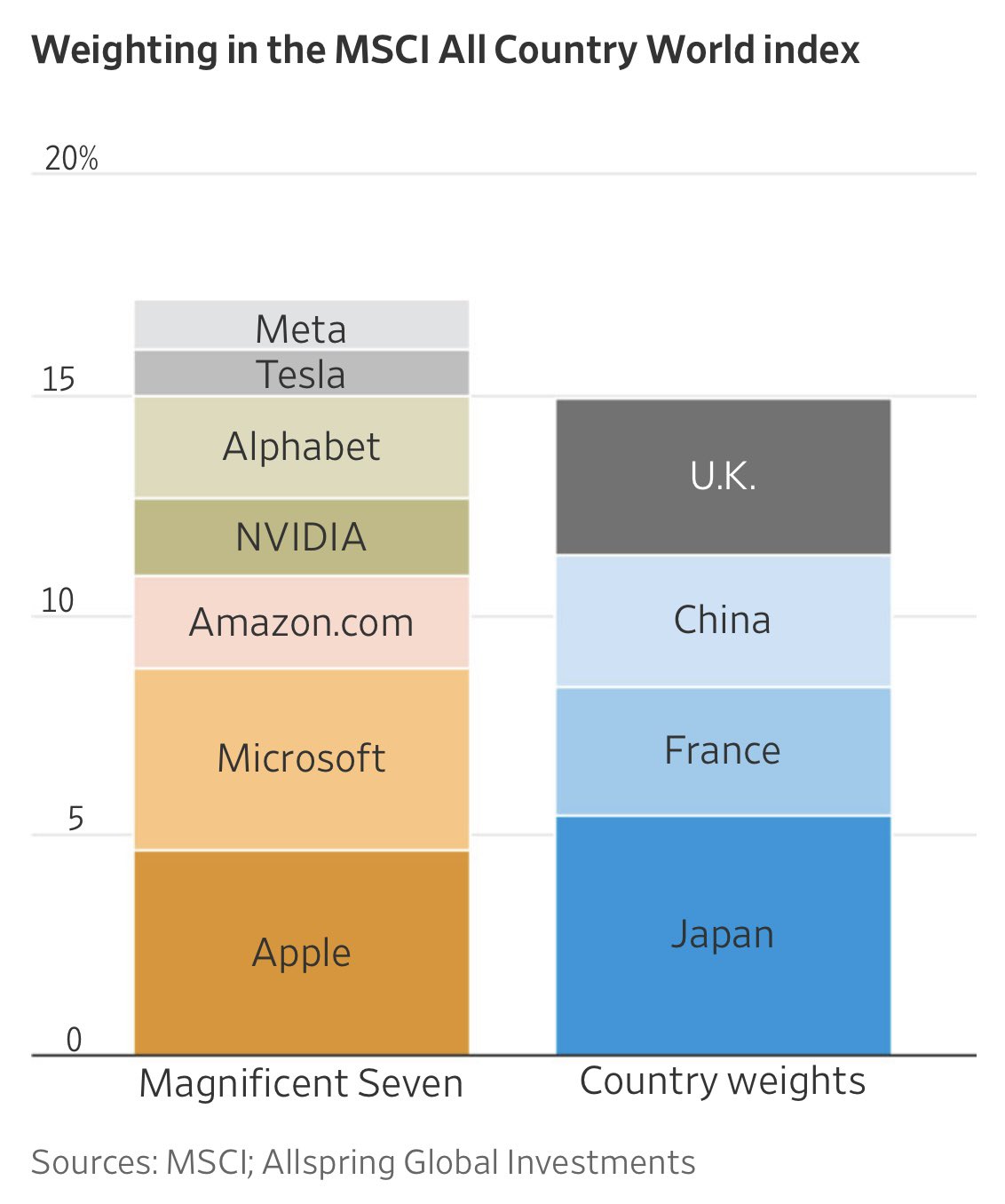

Brian: but not before we share one more crazy point of reference

Via Twitter @NateGeraci as of Dec 2023

Via Twitter @NateGeraci as of Dec 2023

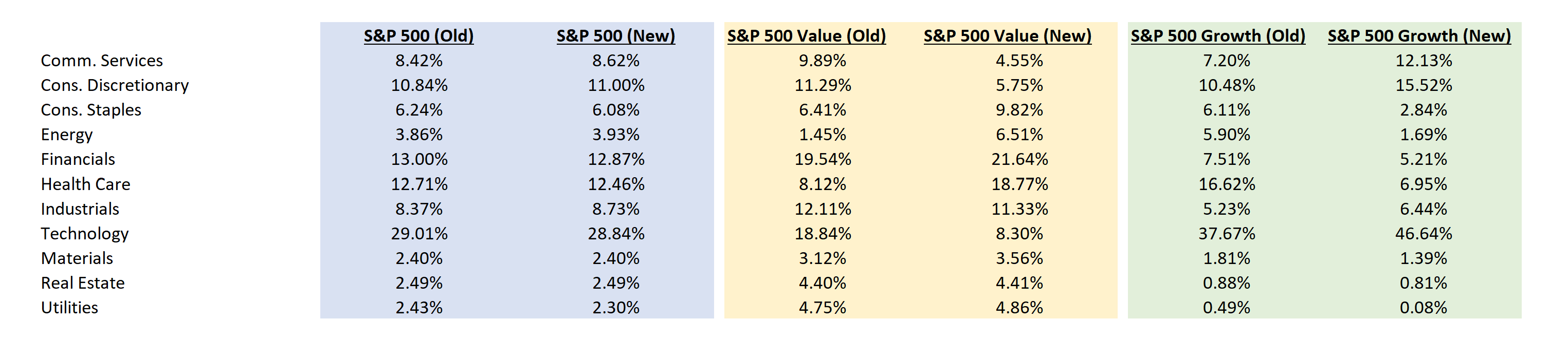

Dave: The annual S&P 500 reconstitution of the value and growth indexes is pretty funny, with the Growth and Value basically swapping 10% of Healthcare for Tech

Source: Aptus via Bloomberg 12.13.2023

Source: Aptus via Bloomberg 12.13.2023

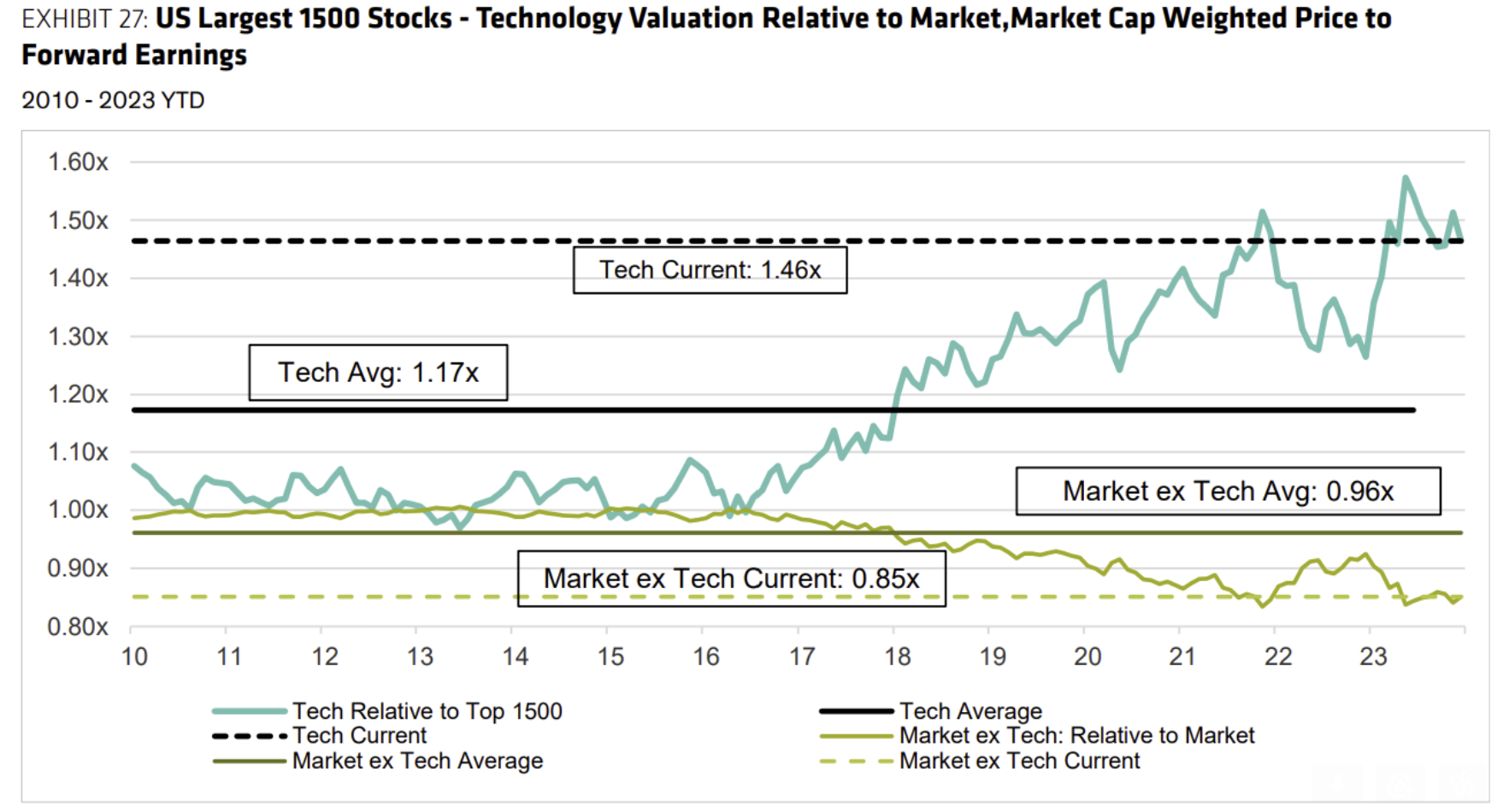

Beckham: with tech trading at a significant premium to other sectors

Source: Bernstein as of 12.18.2023

Source: Bernstein as of 12.18.2023

Brad: and a pretty vivid image of 2023’s obsession with AI and expected winners/losers of Ozempic

Source: Bernstein as of 12.22.2023

Source: Bernstein as of 12.22.2023

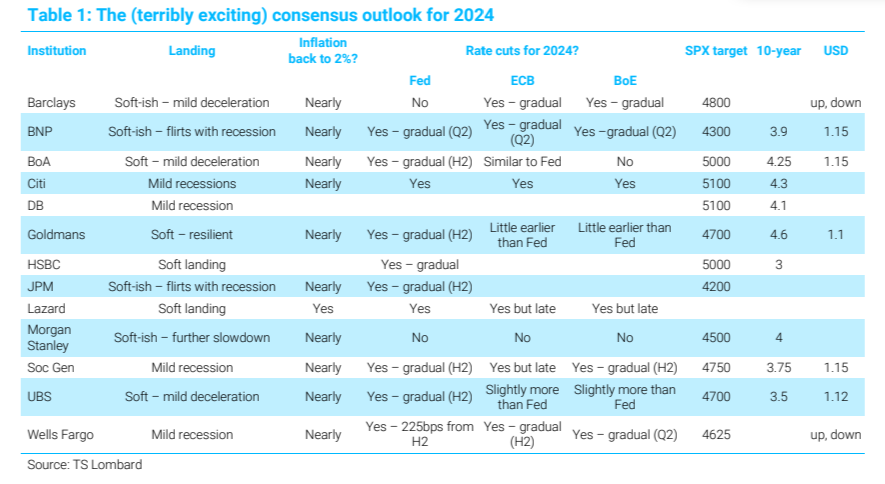

John Luke: Strategist forecasts for 2024 are out

Data as of 12.15.2023

Data as of 12.15.2023

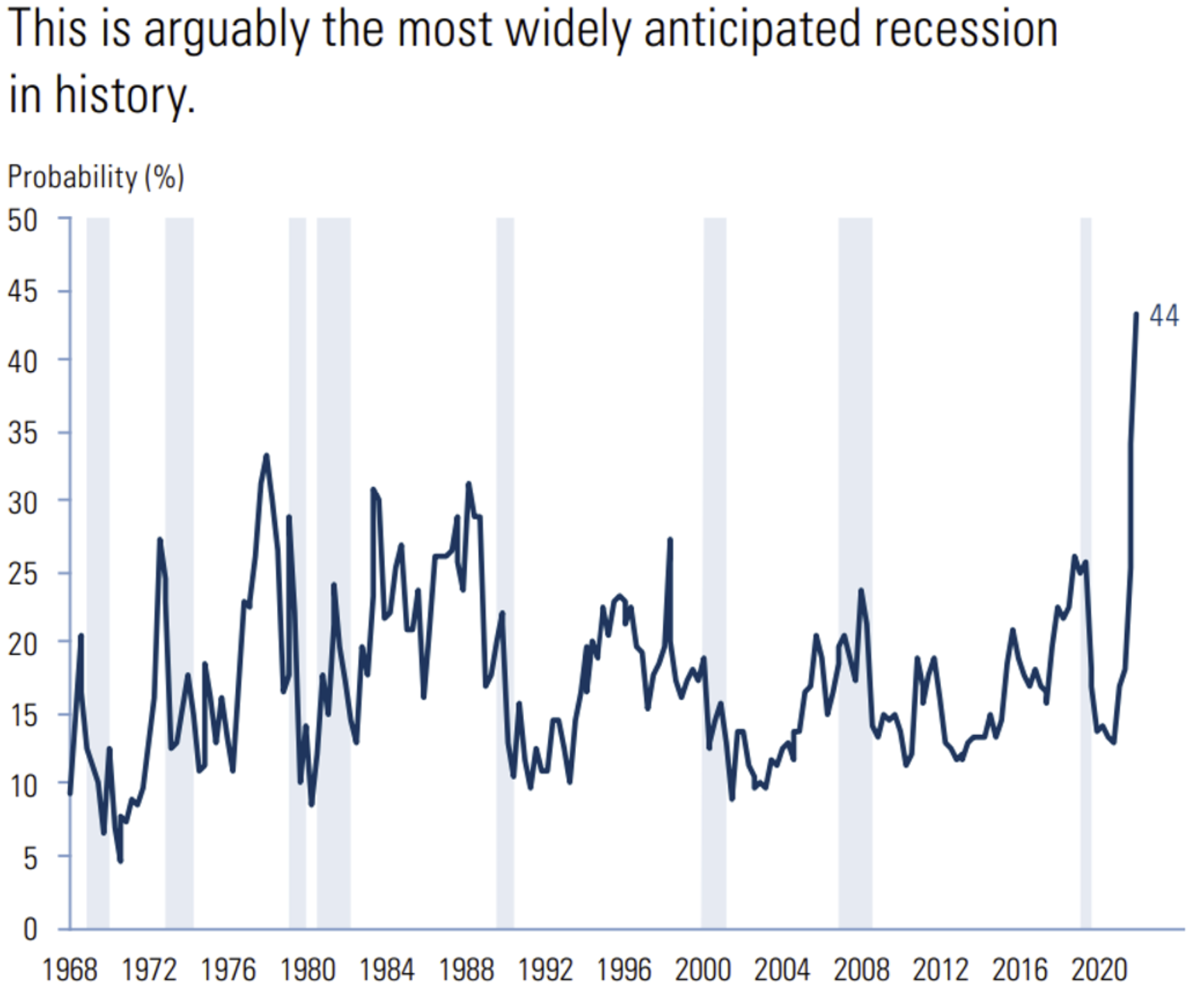

Dave: which makes it a good time to look back at the most common 2023 view from a year ago

Source: Goldman Sachs as of Dec 2022

Source: Goldman Sachs as of Dec 2022

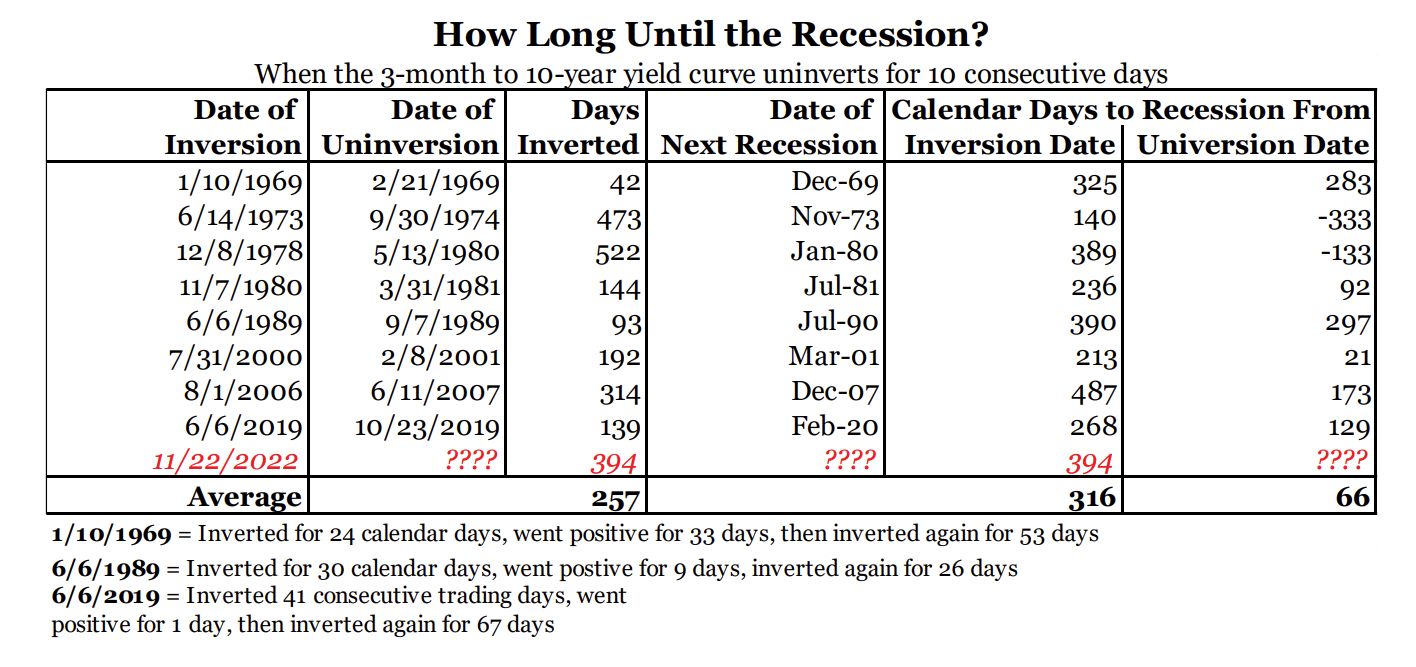

John Luke: Sarcasm aside, inverted yield curves have eventually led to recessions in the past

Source: Bianco as of 12.19.2023

Source: Bianco as of 12.19.2023

John Luke: and stock market rallies after inversions have given back their gains

Source: MKM Partners as of 12.15.2023

Source: MKM Partners as of 12.15.2023

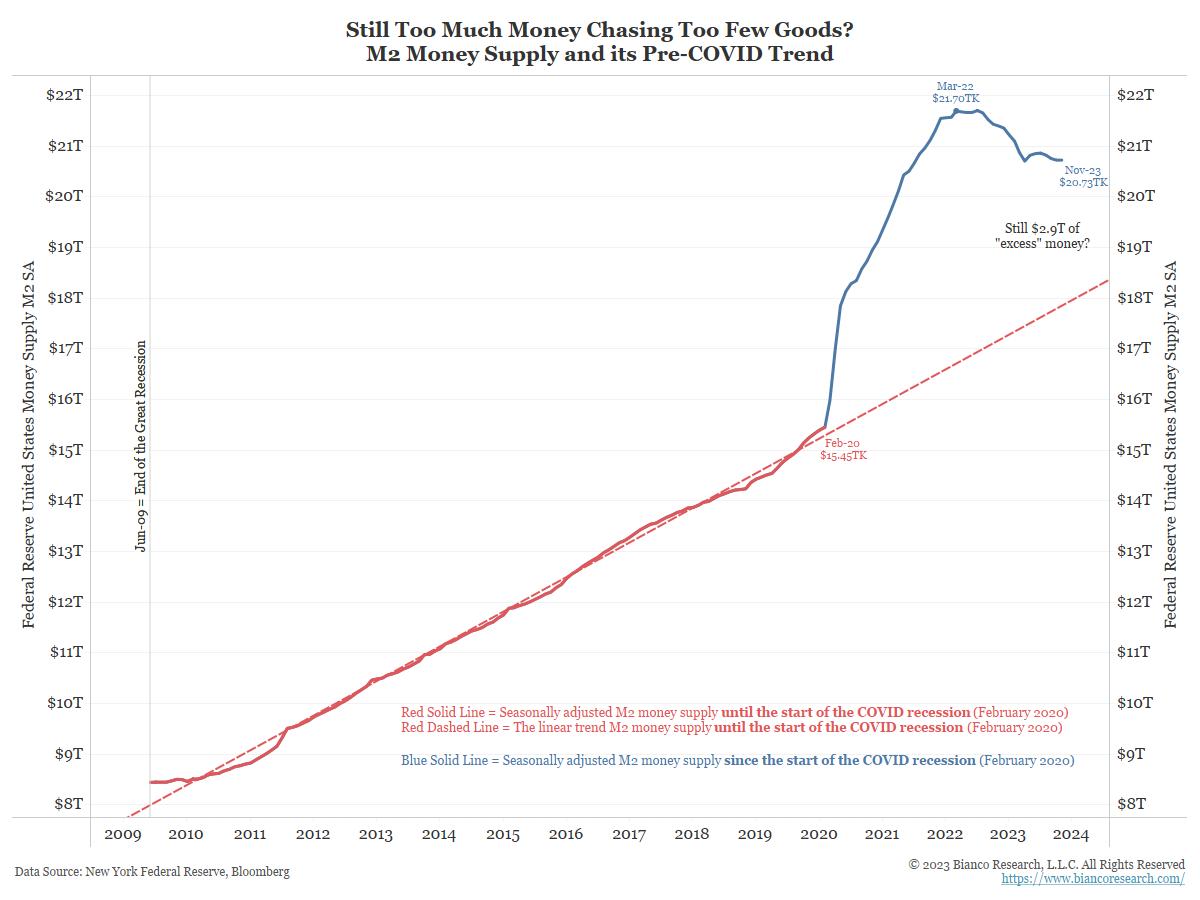

John Luke: but what’s been consistently underestimated by forecasters has been the amount of stimulus still in the system

Data as of November 2023

Data as of November 2023

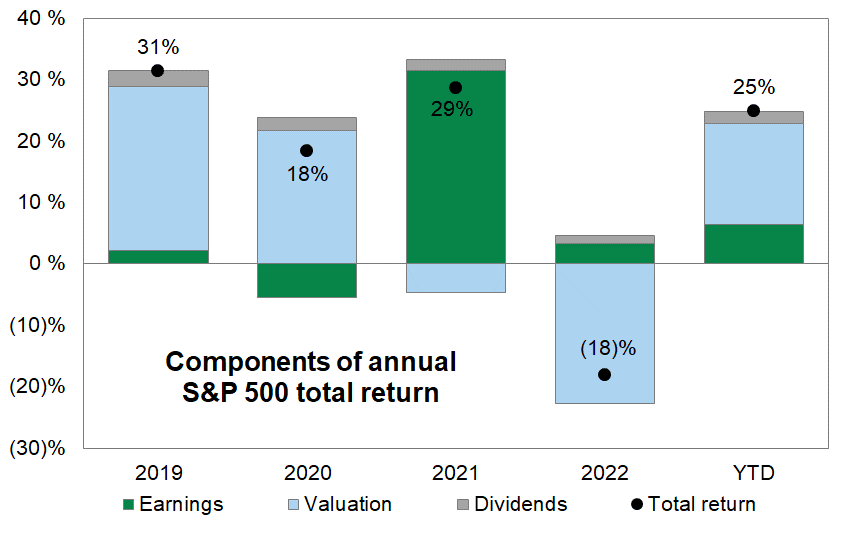

Brett: Market valuations have been the primary force behind the movements of the past few years

Source: Goldman as of December 2023

Source: Goldman as of December 2023

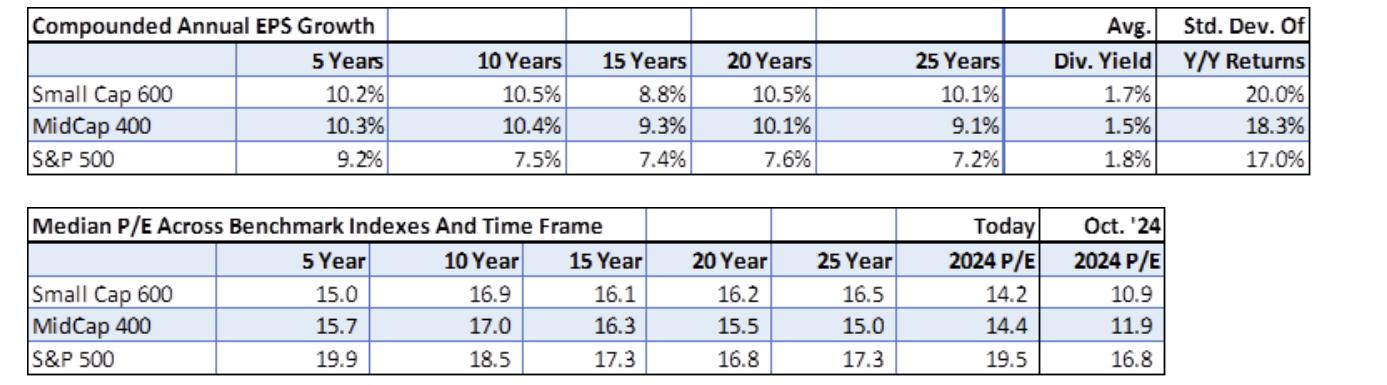

Dave: but the ability of corporate earnings to consistently grow earnings has been seen across all company sizes

Source: Raymond James as of 12.22.2023

Source: Raymond James as of 12.22.2023

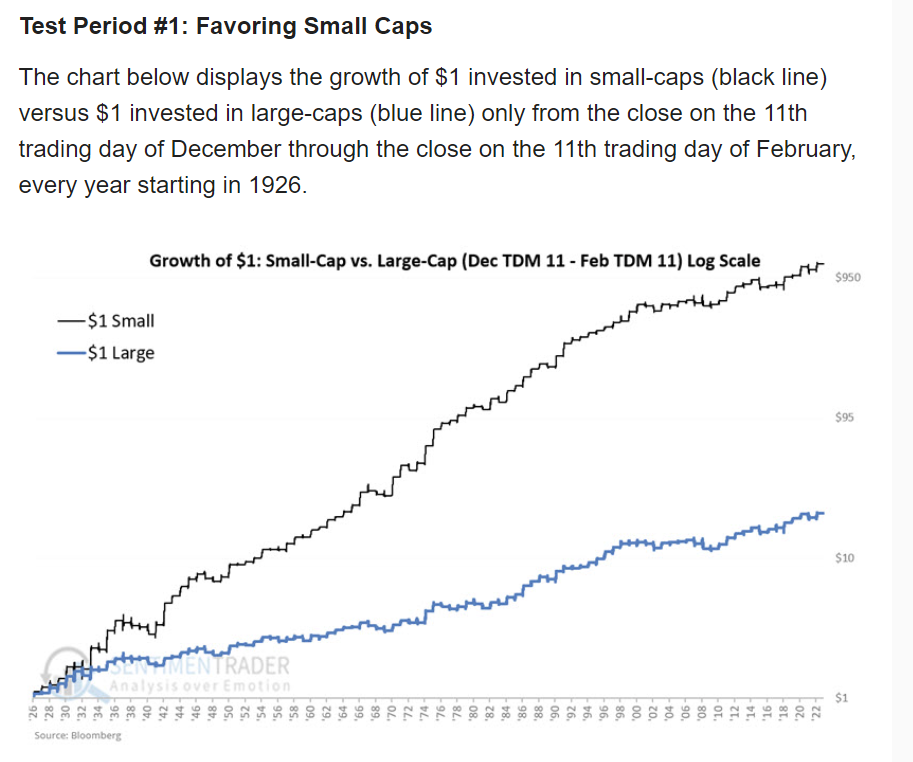

Joseph: We’re in a historically strong period for small-cap stocks relative to large-caps

Source: Sentimentrader as of 12.15.2023

Source: Sentimentrader as of 12.15.2023

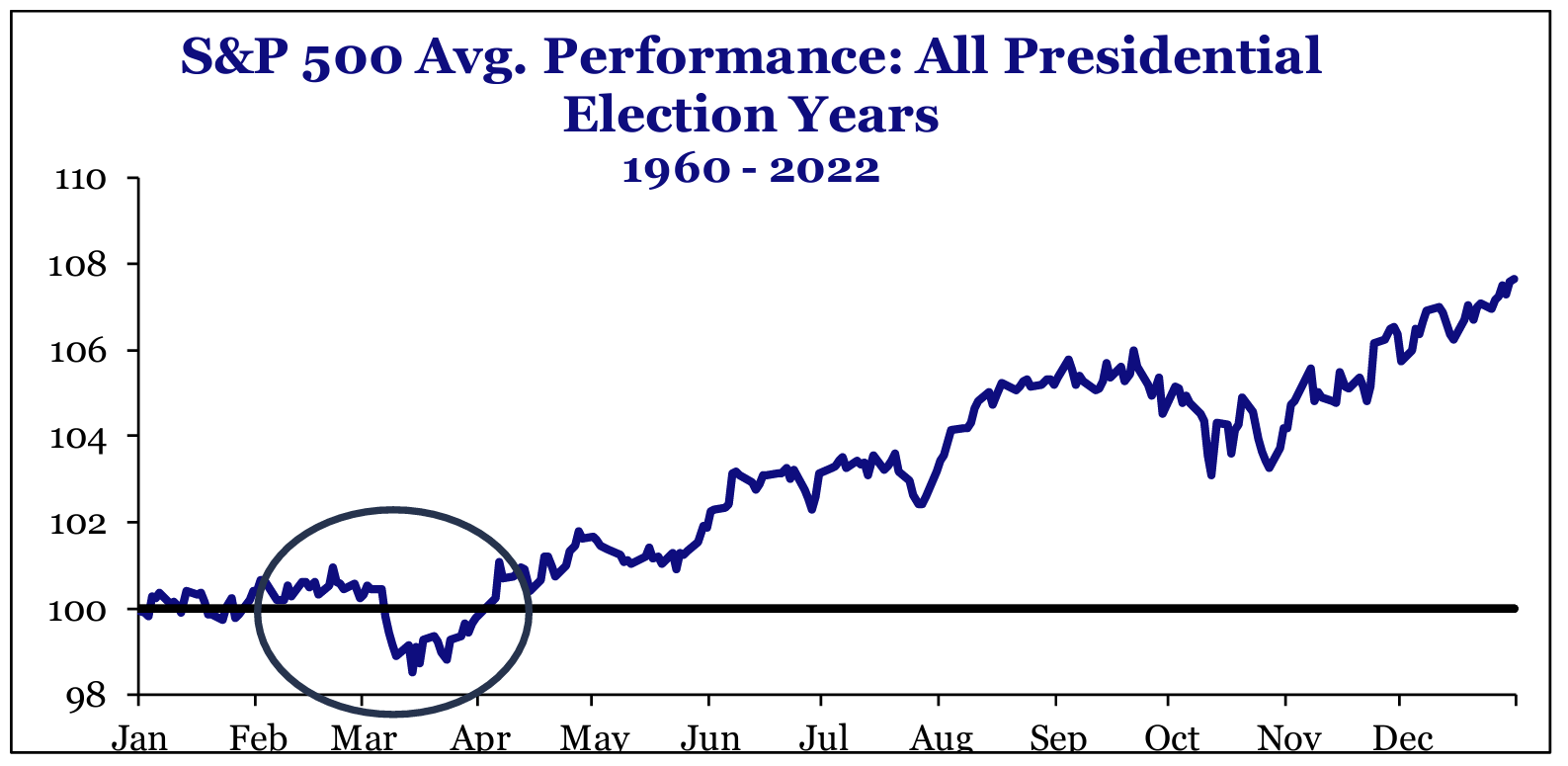

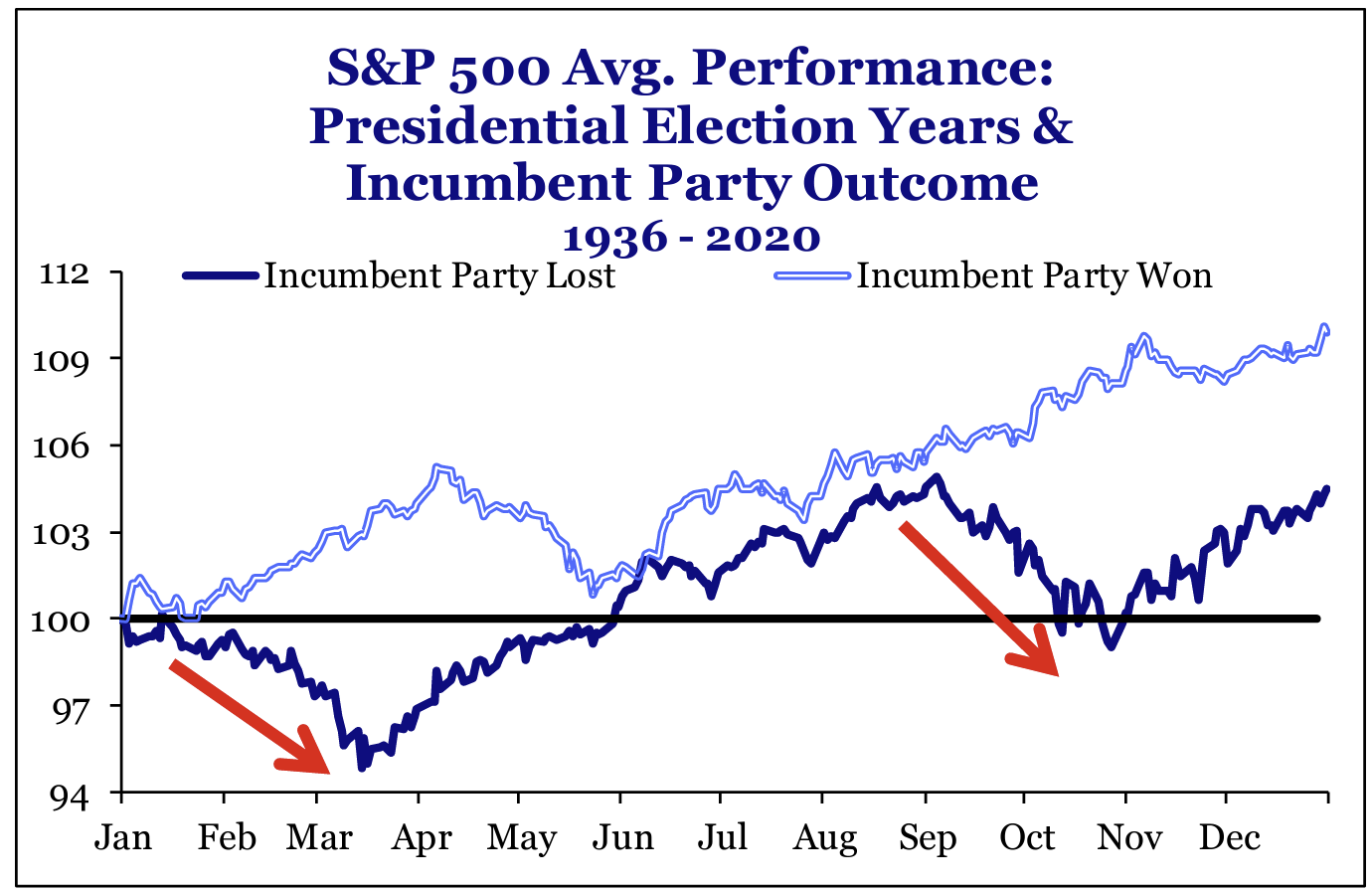

Dave: which may end up coinciding with a historically weak period for large-caps in election years

Source: Strategas as of December 2023

Source: Strategas as of December 2023

Dave: which has been amplified in years when an incumbent faces challenges

Source: Strategas as of December 2023

Source: Strategas as of December 2023

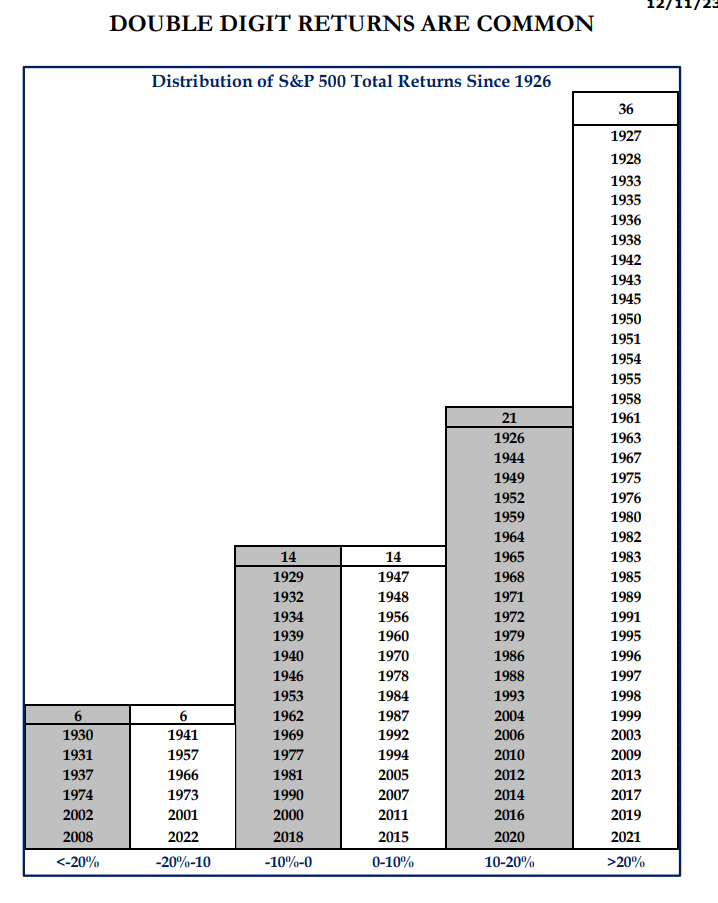

JD: Forecasts aside, it’s important to look through short-term noise and remember that most stock market “tails” are on the good side!

Source: Strategas as of December 2023

Source: Strategas as of December 2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2312-26.