Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

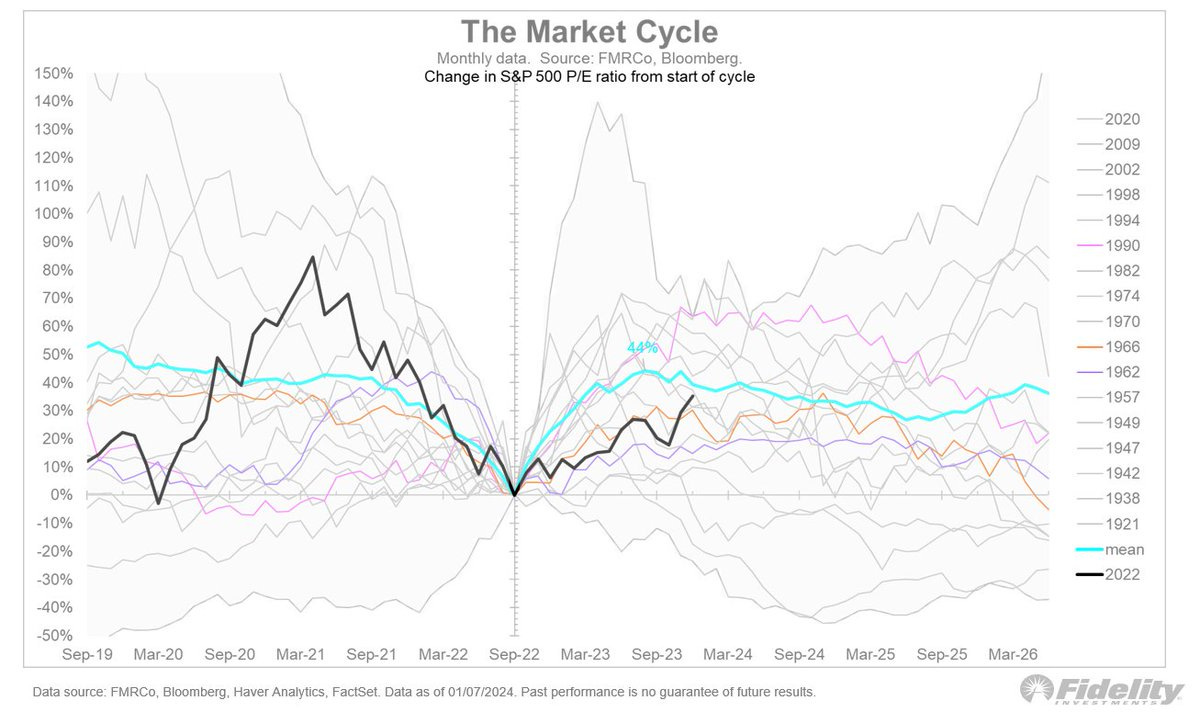

Beckham: Equity valuations have done their usual post-low lift from late 2022, it now seems to be on earnings to carry future progress

Data as of 01.09.2023

Data as of 01.09.2023

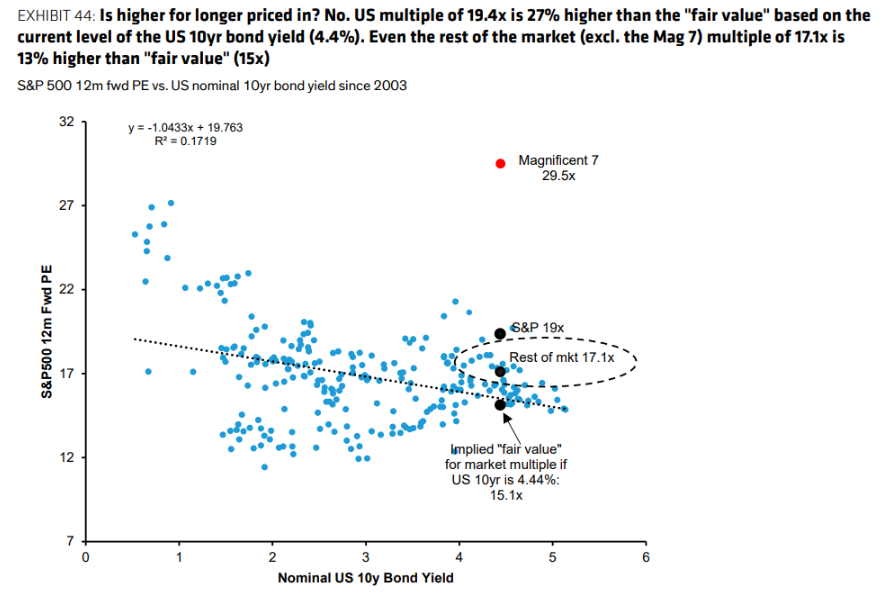

Dave: and with valuations not historically cheap at these interest rates

Source: Bernstein as of 01.10.2024

Source: Bernstein as of 01.10.2024

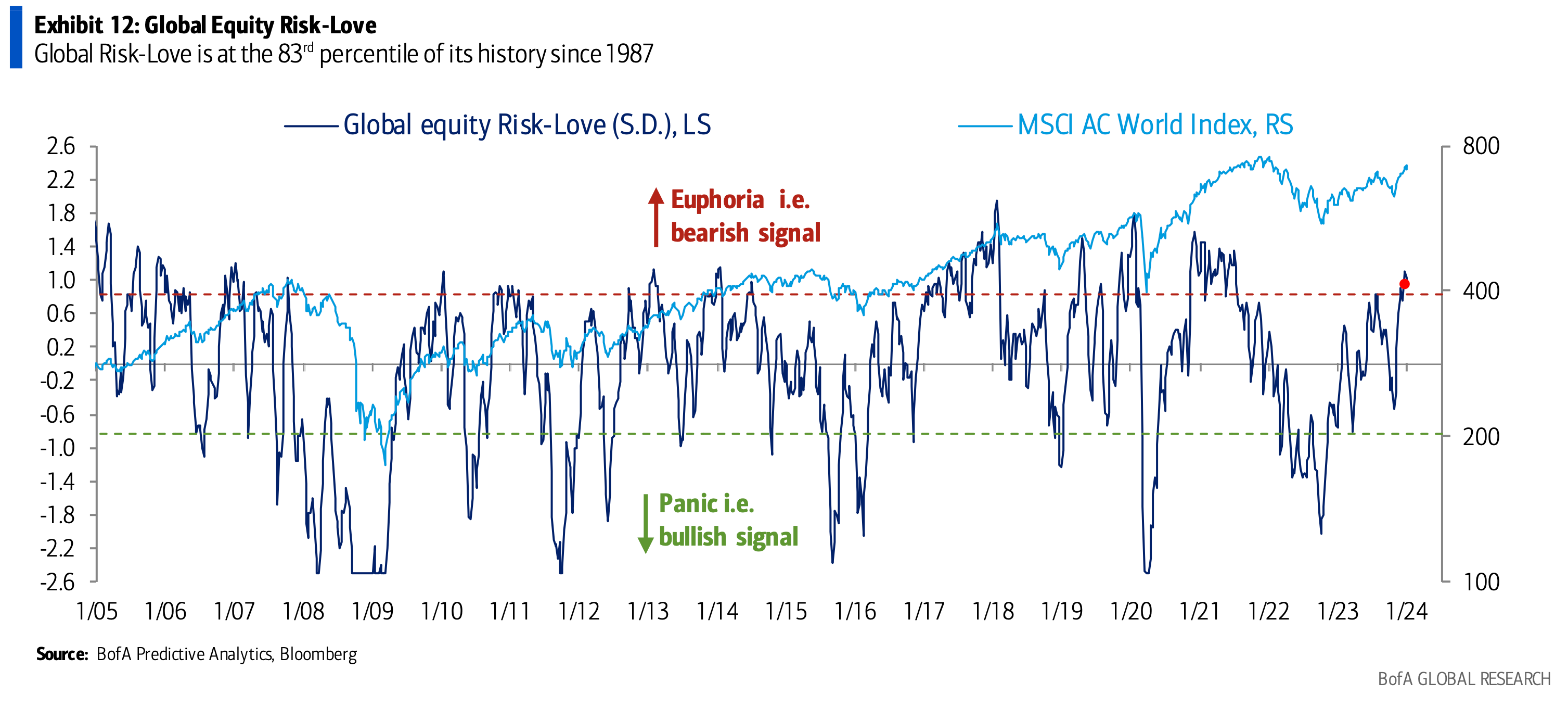

Brett: and with the summer/fall wall of worry eating some of its upside fuel

Data as of 01.08.2023

Data as of 01.08.2023

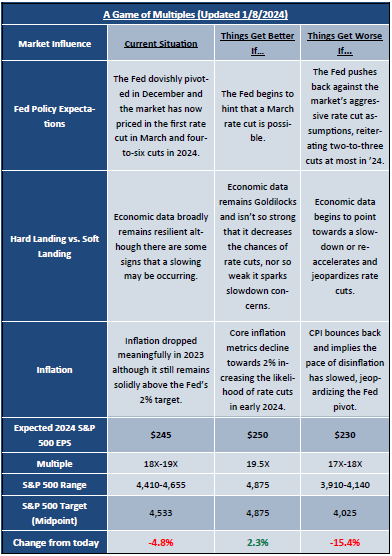

Brad: it may pay to have more restrained expectations and/or find unique spots of more reasonable value

Source: Sevens Report

Source: Sevens Report

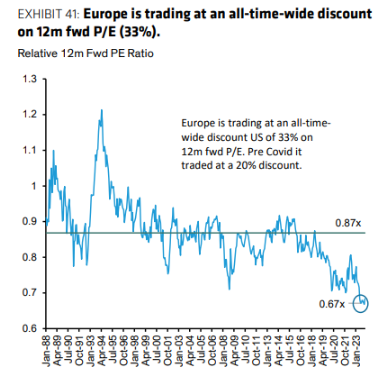

Dave: with perhaps a chance for overseas markets to attract some money given lower valuations

Source: Bernstein as of 01.09.2023

Source: Bernstein as of 01.09.2023

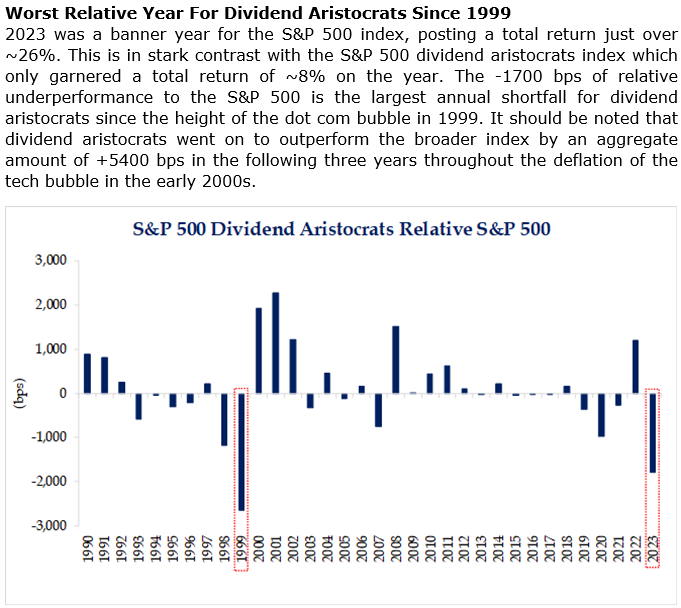

Brad: An area of the market that suffered a major lag in 2023 was the group of long-time dividend payers

Source: Strategas as of Dec 2023

Source: Strategas as of Dec 2023

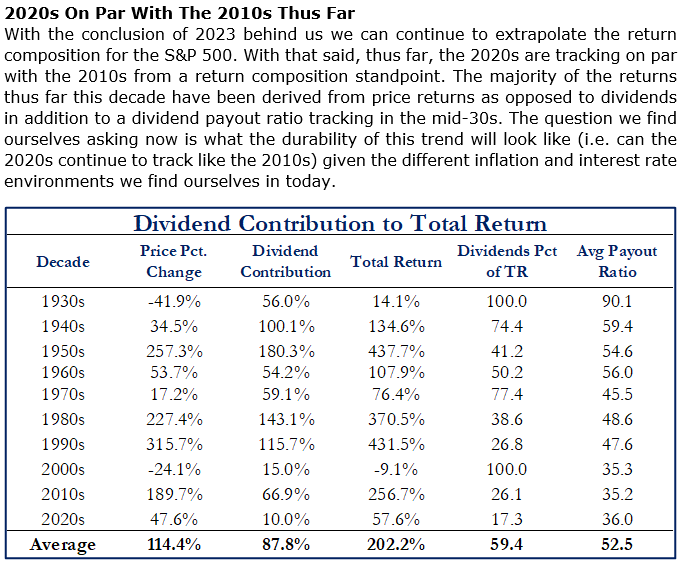

Dave: with dividends in general remaining underappreciated in the past decade relative to historical norms

Source: Strategas as of 01.08.2023

Source: Strategas as of 01.08.2023

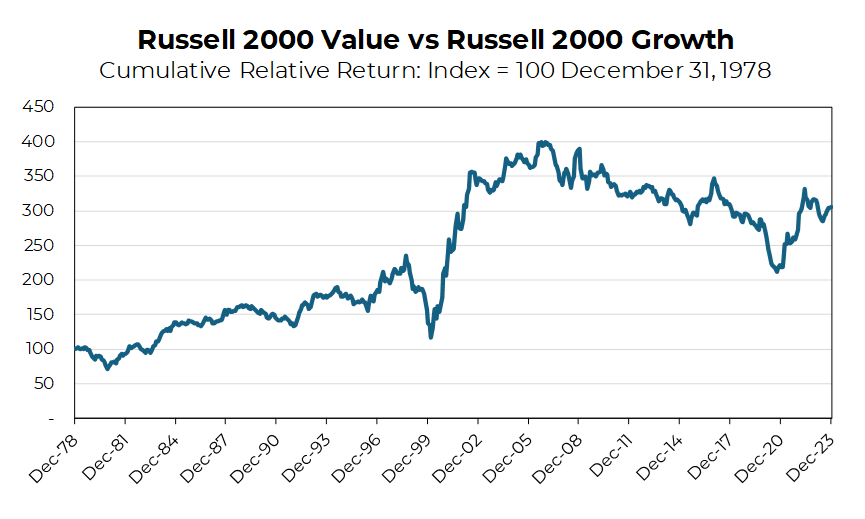

Brian: We all know the struggles of both small and value stocks vs. large growth in recent years, but long-term comps remain favorable

Source: Aptus as of 12.31.23

Source: Aptus as of 12.31.23

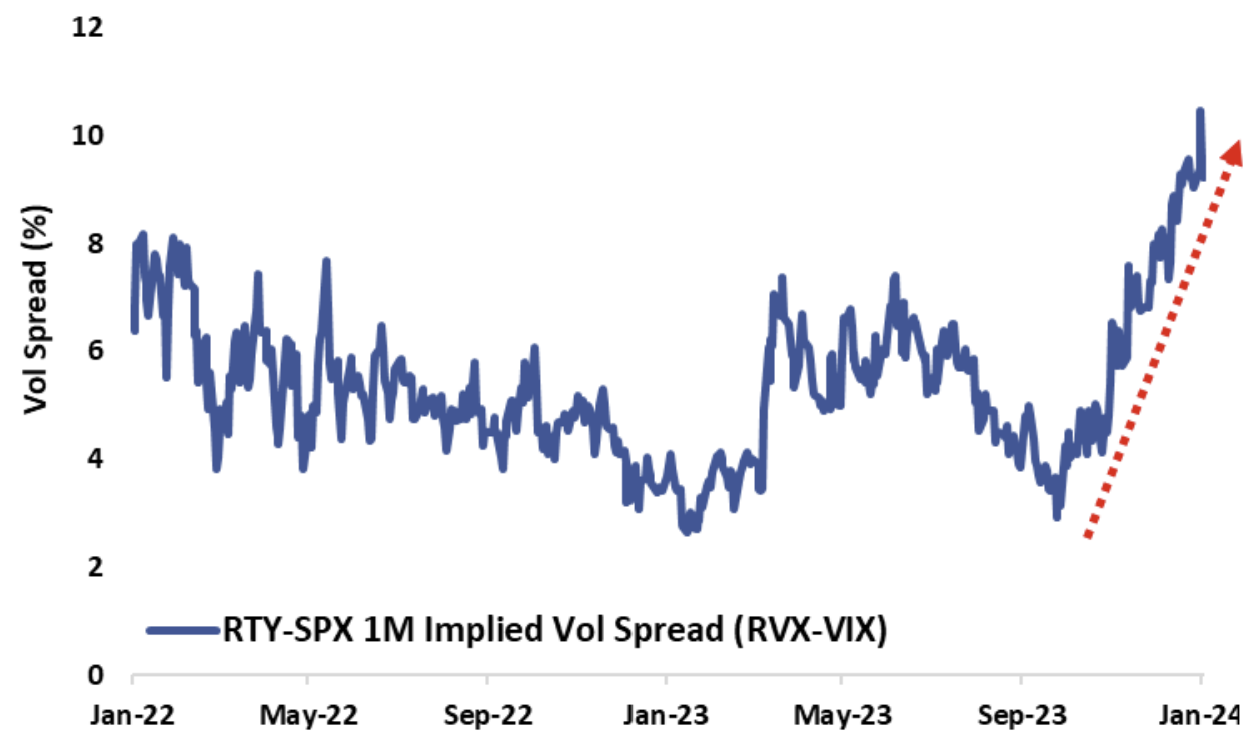

Mark: and options markets are implying higher potential for moves in smaller stocks relative to large?

Source: CBOE as of 01.08.2024

Source: CBOE as of 01.08.2024

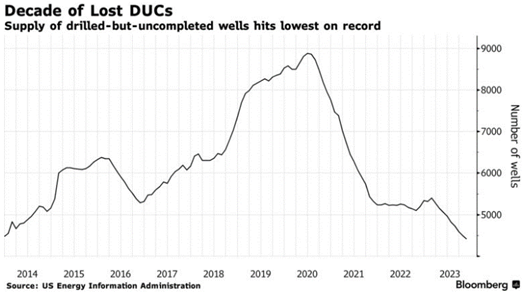

Joseph: Energy companies have been able to keep production higher than expected, using technology to extract from depleting wells

Data as of December 2023

Data as of December 2023

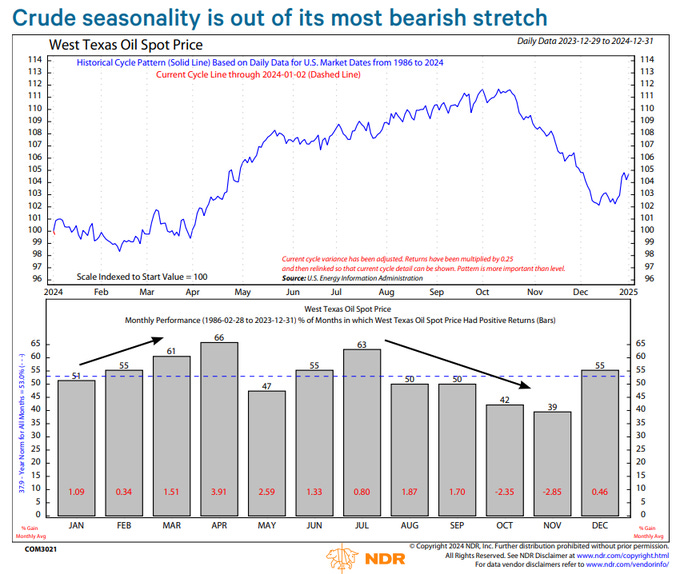

John Luke: and with supply generally fading, perhaps seasonality can put a floor under crude prices for a bit

Data as of 12.31.2023

Data as of 12.31.2023

Brian: For all of its supposed growth, China stocks are barely above their levels of the early 1990s

Source: Aptus via Curvo as of 01.08.2023

Source: Aptus via Curvo as of 01.08.2023

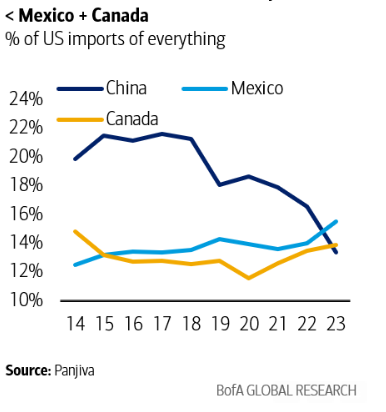

Dave: and it’s steadily losing its biggest economic engine as exports fade, at least to the United States

Data as of December 2023

Data as of December 2023

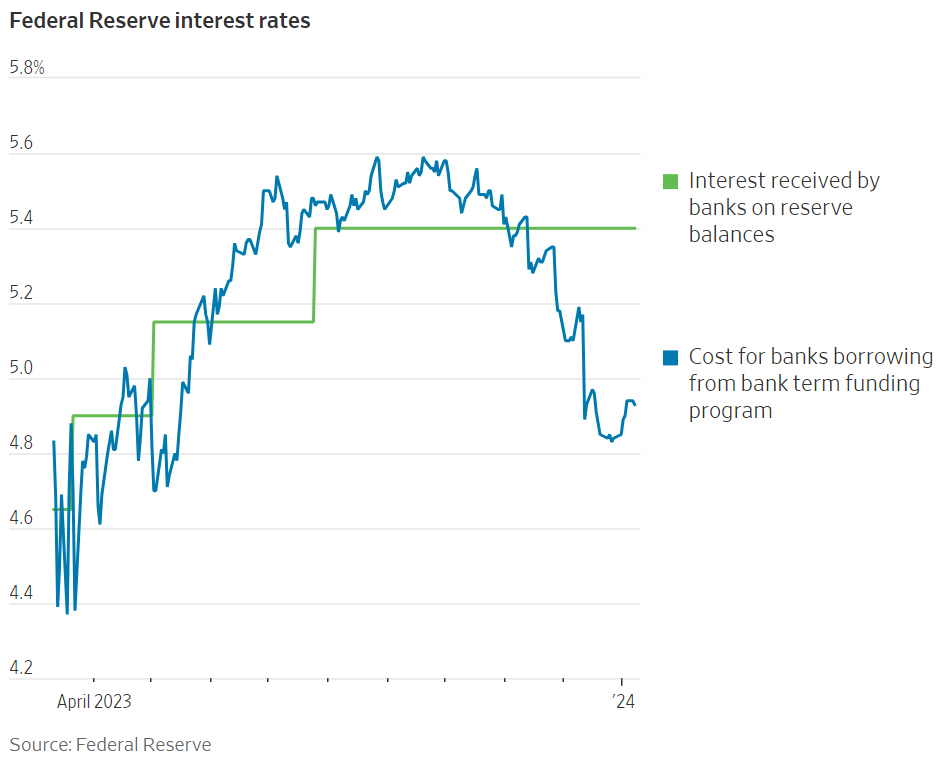

John Luke: Interesting arbitrage going on for US banks to profit from cheap government funding

Source: WSJ as of 01.06.2023

Source: WSJ as of 01.06.2023

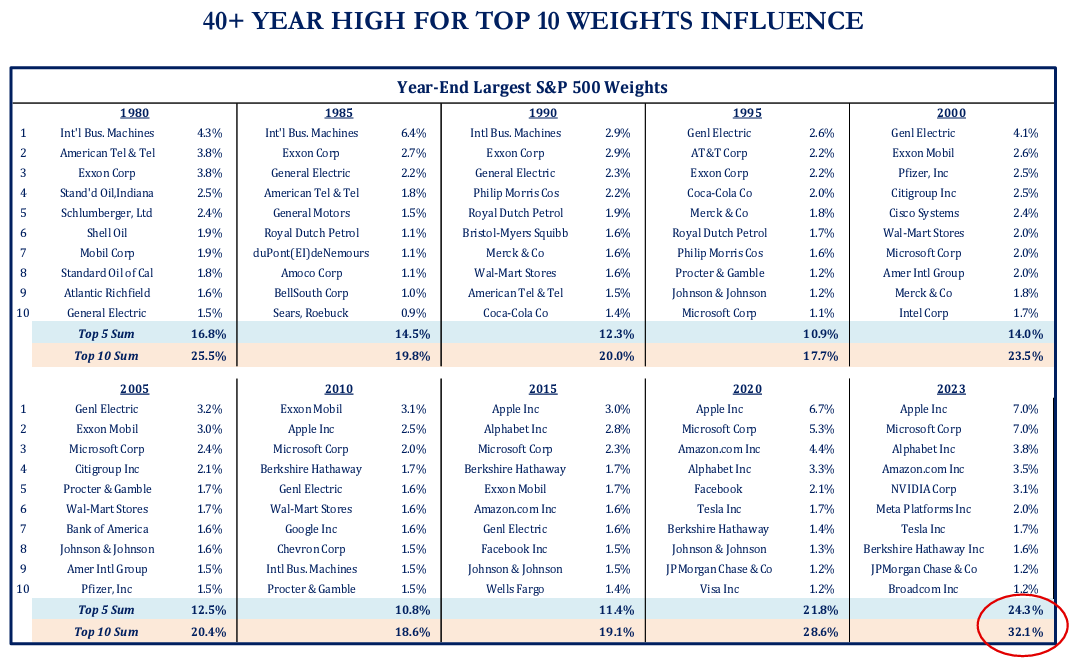

Brad: Reminder that stock market leadership is not permanent

Source: Strategas as of Dec 2023

Source: Strategas as of Dec 2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2401-25.