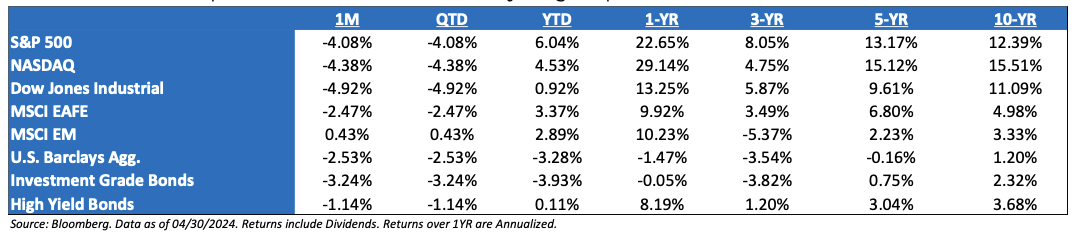

April ‘24 Market Recap – Staircase Up, Elevator Down: It was April showers as it was the worst month since September. April has given back much of the Q1 gains as 10-year Treasury yields increased from 4.2% to over 4.6%. S&P 500 has given back ~40%, Midcap ~70%, and Small cap over 100% of its YTD gains through March. Remember, the market tends to witness three (3) 5%+ pullbacks during a year, on average – pullbacks are healthy and should not cause concern. But, market concentration continues to be high – even if market pundits aren’t speaking about it – as 77% of the YTD performance has been driven by mega caps.

What Caused the Recent Pullback? Stocks dropped this past month – the first official pullback of 2024 (-4.1%) on higher yields, hawkish Fed rhetoric, and mixed earnings results that are leading nervous investors to turn not just cautious, but potentially negative. Despite the pullback in stocks, however, the outlook for stocks hasn’t really changed that much at the end of April. What has changed is that investors no longer have unrealistic expectations about steadily falling inflation, near-term Fed rate cuts, and, to a much lesser extent, impervious earnings.

Jerome Powell Said that He Sees No “Stag” or “’Flation” In the Market: In the simplest form, stagflation is defined as three things occurring at the same time: 1) Slower than average growth, 2) High Unemployment, and 3) Increasing inflation. Though, it may sound hip to state that stagflation is real and occurring, it’s much cooler to look at the facts. Yes; inflation might be plateauing, but employment remains very strong and GDP is hitting above its historical average. Don’t get caught up in a narrative.

Moving Forward, It’s All About Growth: Inflation around 3% isn’t a threat to the market or economy by itself, but the Fed’s response to that sticky inflation could be to keep rates “higher for longer” and the impact of that will be increased chances for an economic slowdown—which remains a real risk to this rally. Bottom line, focus on growth. Growth is the rally killer.

The Fed Wasn’t Wrong → Market Consensus Was Wrong: In the last 2 months of 2023, the market added an additional percentage point of rate cuts to its year-end 2024 expectation, taking the total quantity of quarter-point rate cuts priced into seven. Looking back, most consensus forecasters pointed to Jay’s “dovish pivot” and the new FOMC December dot plot calling for one additional 2024 cut as the primary drivers for this heightened exuberance on rates. Fast-forward through the first four months of 2024 and all of those extra cuts have been wiped out from market expectations, plus a little bit more. The reset caused the market to post its first decline (albeit modest) in April in six months. Over the past few years, the consensus continues to be wrong.

The Market Loves Themes: This year has seen a very strong year for ‘thematics’ as the promise of rate cuts (and/or a no-landing scenario) has allowed investors to focus on what can go ‘right’ in this equity market (compared to a range-bound rates market and trendless small caps) – stand-out themes this year have been: A.I., GLP-1, Energy & Infrastructure, Japan, Onshoring, et al. While there is no reason to expect an immediate change here, it’s worth noting that valuations are less favorable than they once were and it is possible that this multi-theme market eventually gets replaced by a singularly themed market (the US Election) going into the 2H of the year.

The Fed and What the Market is Saying: In sum, the Fed has no choice but to wait to see how the data come out – the market is currently going to the latter part of the following phrase – “Higher for longer”. Economies do not slow with strong employment growth and above-average nominal earnings. If there are no cuts, however, this is not necessarily bad news for the markets as it is a signal of sustained growth. The equity market is already relaying that signal.

The Presidential Election Year: Since ‘52, the S&P 500 has not declined in a year in which an incumbent president was running for re-election (avg. return of 10%). Stocks have declined in presidential election years, but in each of those cases, it was a year in which there was an open election with no incumbent running (‘60, ‘00, and ‘08). Presidents want to be re-elected and will use whatever policy levers are needed to boost the US economy. In fact, every president who avoided a recession two years before their re-election went on to win the election. And every president who had a recession in the two years before their re-election went on to lose.

S&P 500 EPS: ’25 (Exp.) EPS = $277. ‘24 EPS = $244 (+10.7%). 2023 = $220 (+0.5%). 2022 = $219 (+7.4%). 2021 = $204.*

Valuations: S&P 500 Fwd. P/E (NTM): 20.0x, EAFE: 14.4x, EM: 12.1x, R1V: 15.6x, and R1G: 25.8x.*

*Source: Bloomberg and FactSet, Data as of 04/30/24

Disclosures

Aptus Capital Advisors, LLC is a Registered Investment Advisor (RIA) registered with the Securities and Exchange Commission and is headquartered in Fairhope, Alabama. Registration does not imply a certain level of skill or training. For more information about our firm, or to receive a copy of our disclosure Form ADV and Privacy Policy call (251) 517-7198 or contact us here. Information presented on this site is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy.

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

The S&P 500® is widely regarded as the best single gauge of large-cap U.S. equities. There is over USD 11.2 trillion indexed or benchmarked to the index, with indexed assets comprising approximately USD 4.6 trillion of this total. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

The Nasdaq Composite Index measures all Nasdaq domestic and international based common type stocks listed on The Nasdaq Stock Market. To be eligible for inclusion in the Index, the security’s U.S. listing must be exclusively on The Nasdaq Stock Market (unless the security was dually listed on another U.S. market prior to January 1, 2004 and has continuously maintained such listing). The security types eligible for the Index include common stocks, ordinary shares, ADRs, shares of beneficial interest or limited partnership interests and tracking stocks. Security types not included in the Index are closed-end funds, convertible debentures, exchange traded funds, preferred stocks, rights, warrants, units and other derivative securities.

The Dow Jones Industrial Average® (The Dow®), is a price-weighted measure of 30 U.S. blue-chip companies. The index covers all industries except transportation and utilities.

The MSCI EAFE Index is an equity index which captures large and mid-cap representation across 21 Developed Markets countries*around the world, excluding the US and Canada. With 902 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

The MSCI Emerging Markets Index captures large and mid-cap representation across 26 Emerging Markets (EM) countries*. With 1,387 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

Investment-grade Bond (or High-grade Bond) are believed to have a lower risk of default and receive higher ratings by the credit rating agencies. These bonds tend to be issued at lower yields than less creditworthy bonds.

Non-investment-grade debt securities (high-yield/junk bonds) may be subject to greater market fluctuations, risk of default or loss of income and principal than higher-rated securities.

Nasdaq-100® includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. This includes Treasuries, government-related and corporate securities, mortgage-backed securities, asset-backed securities, and collateralized mortgage-backed securities. ACA-2405-13.