Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

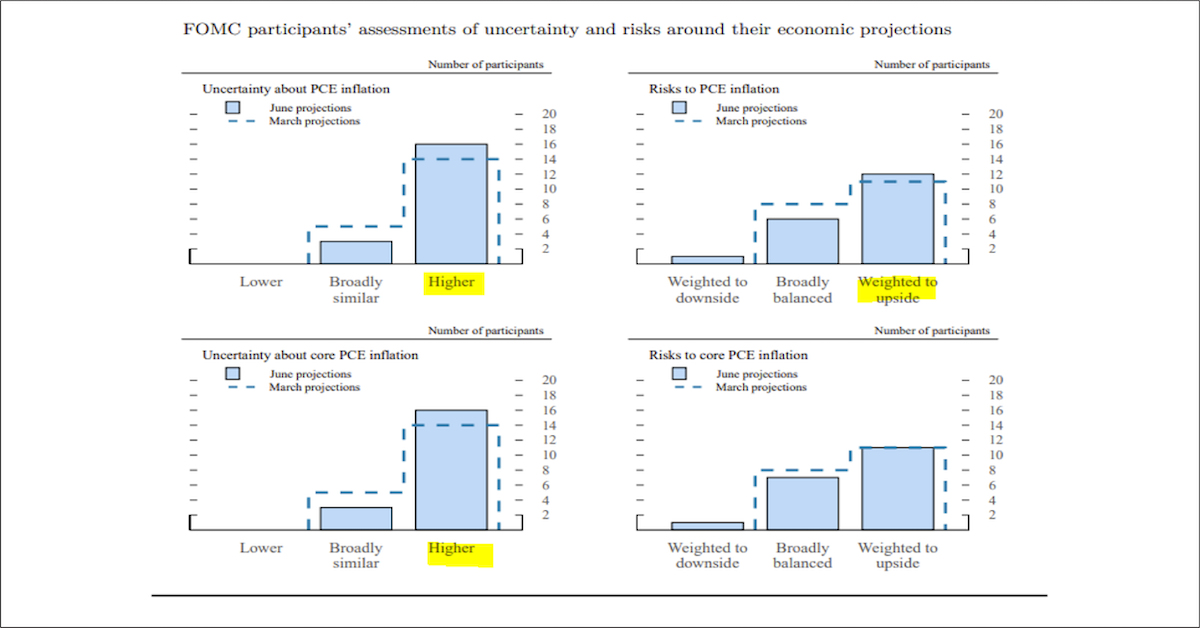

John Luke: FOMC members have very little confidence in their inflation outlooks

Source: FOMC as of 06.12.2024

Source: FOMC as of 06.12.2024

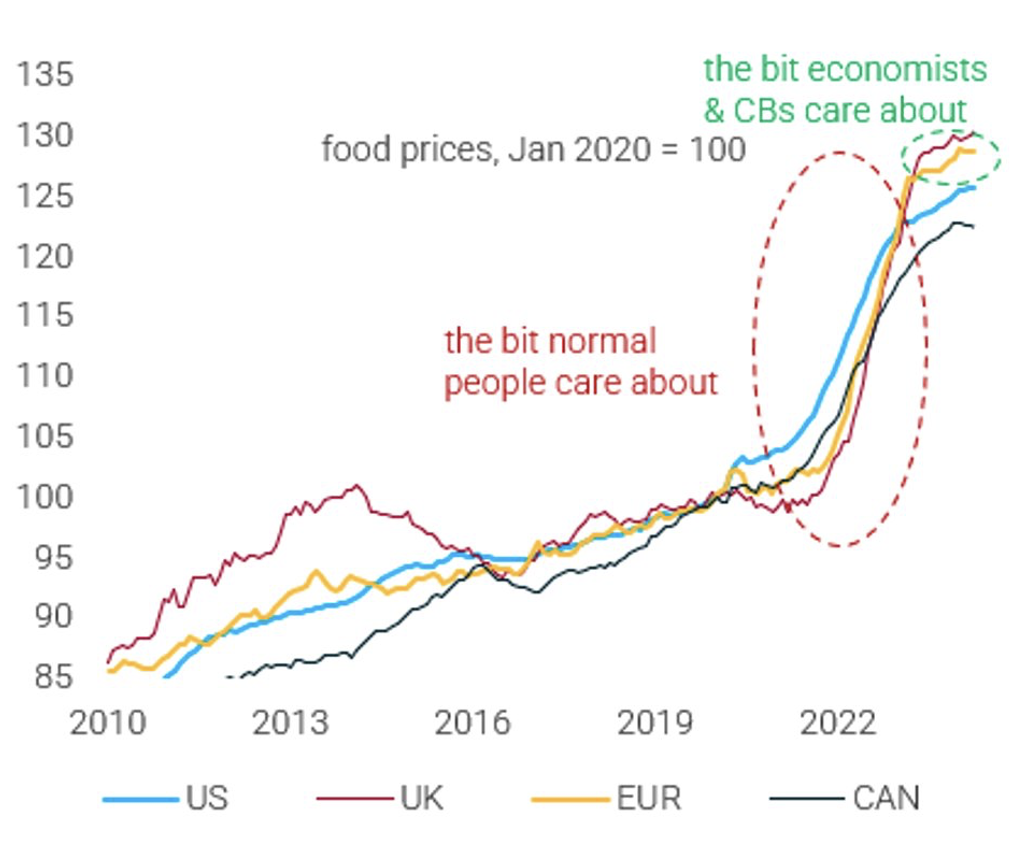

Beckham: but we know that the typical consumer is looking at the cumulative impact of the past few years, not what happens month-to-month

Source: TS Lombard as of 06.11.2024

Source: TS Lombard as of 06.11.2024

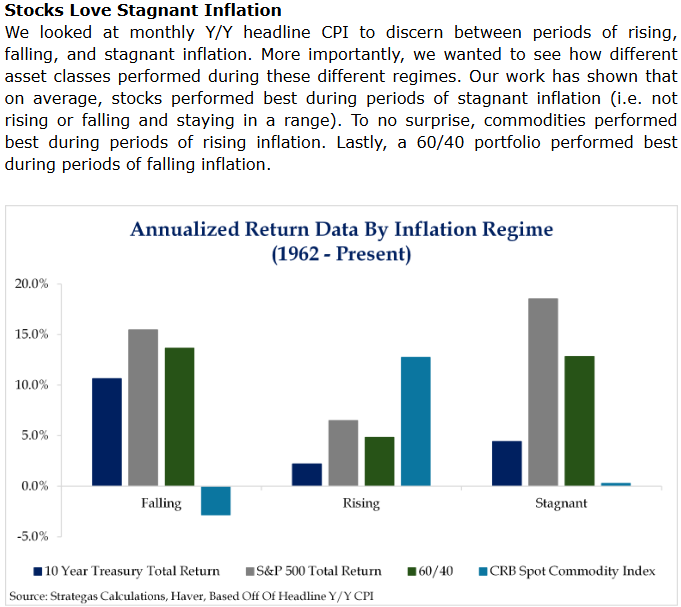

Brad: thankfully, stocks have historically done well when inflation flattened out

Data as of 06.12.2024

Data as of 06.12.2024

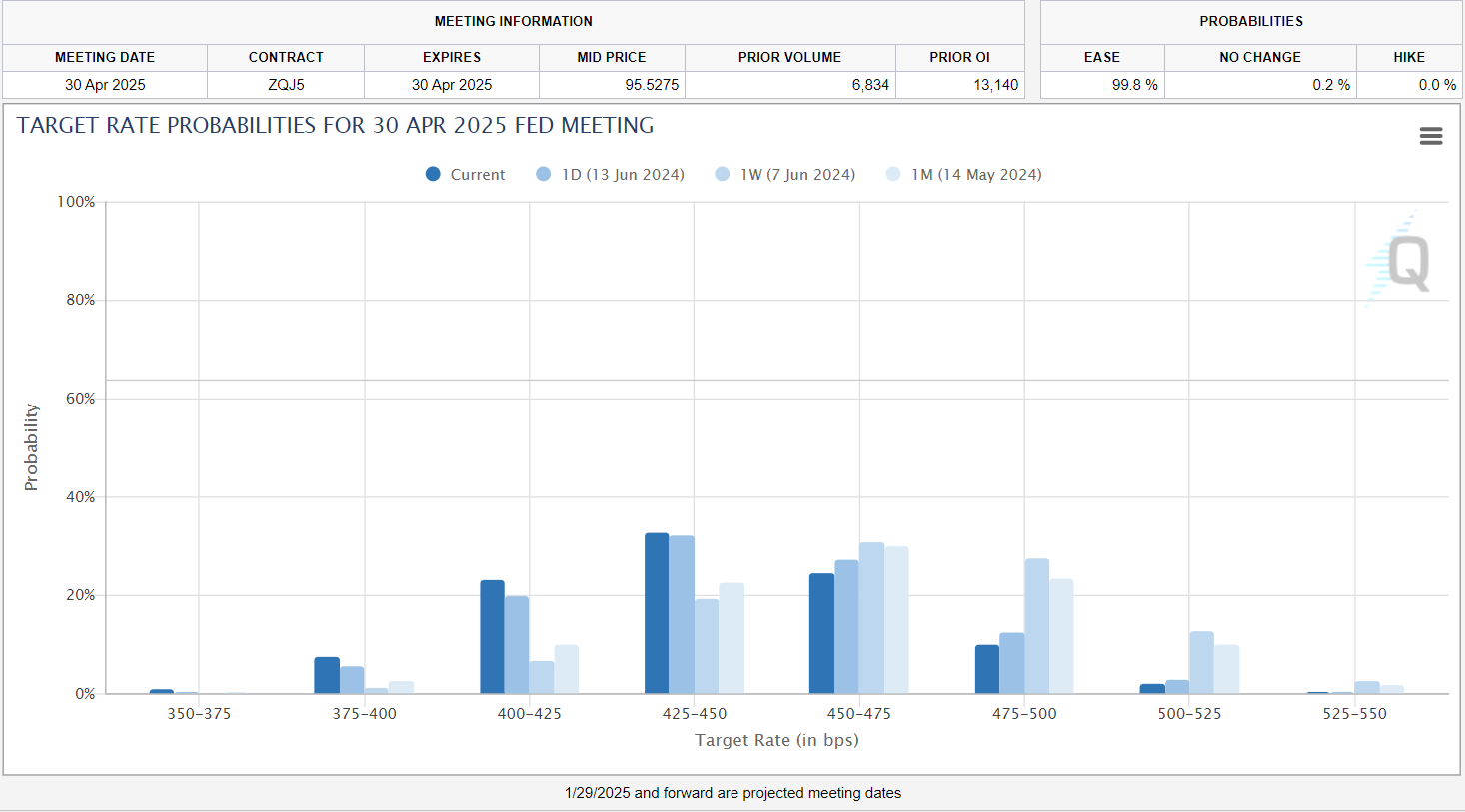

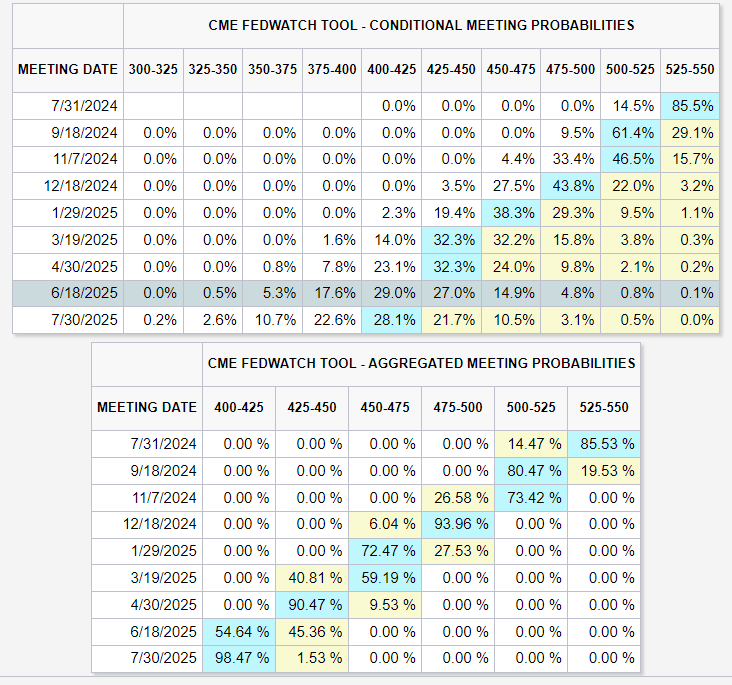

John Luke: Armed with this week’s tame inflation data and dovish FOMC comments, markets have shifted rate forecasts lower for the year ahead

Source: CME FedWatch Tool

Source: CME FedWatch Tool

John Luke: landing on a consensus of a full percentage point of rate cuts by April of next year

Data as of 06.14.2024

Data as of 06.14.2024

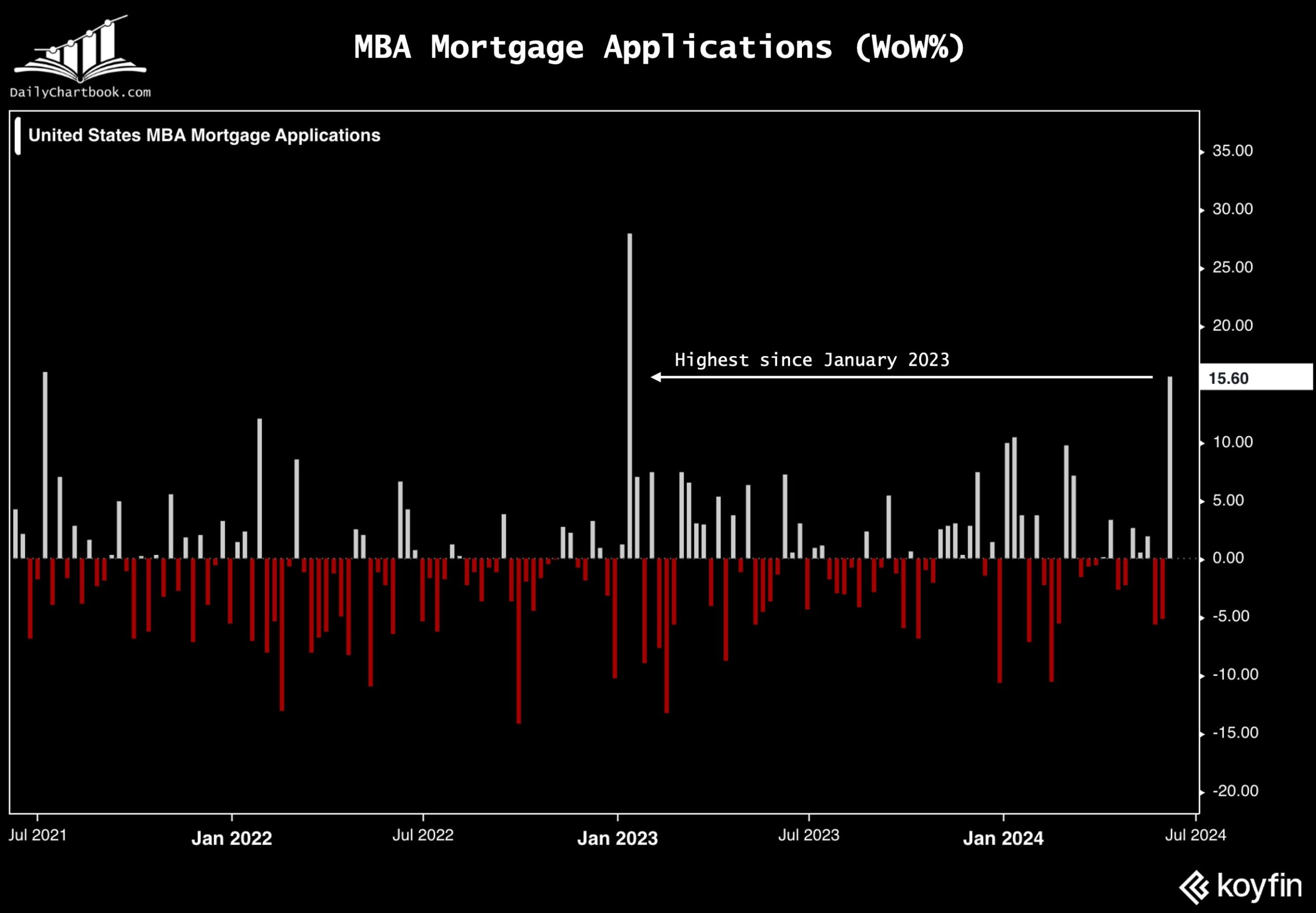

Joseph: All it took was a slight fall in mortgage rates to see a huge bump in new applications

Source: Daily Chartbook as of 06.12.2024

Source: Daily Chartbook as of 06.12.2024

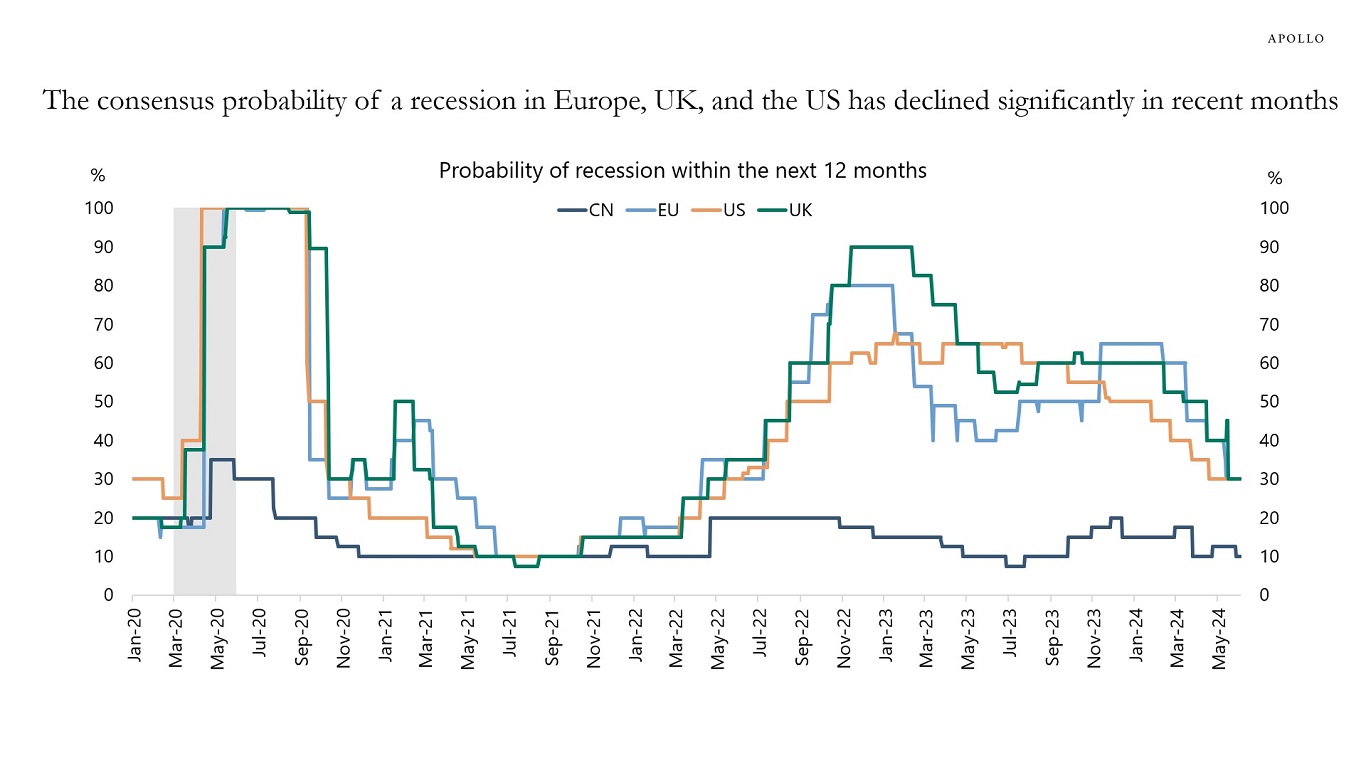

Brian: which can hopefully confirm the recent fall in recession odds

Source: Apollo as of 06.07.2024

Source: Apollo as of 06.07.2024

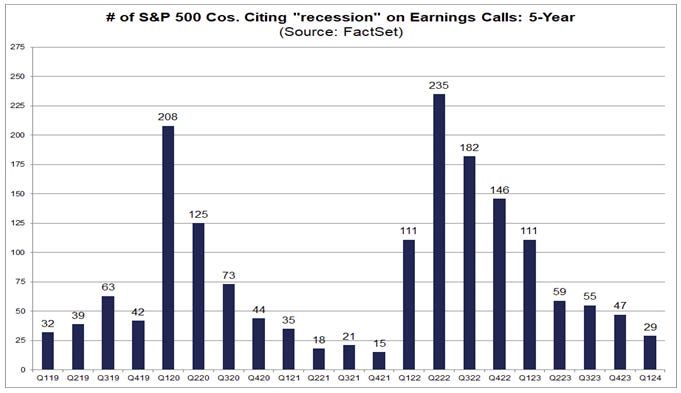

Dave: also being reinforced by comments from corporate CEOs

Data as of 06.07.2024

Data as of 06.07.2024

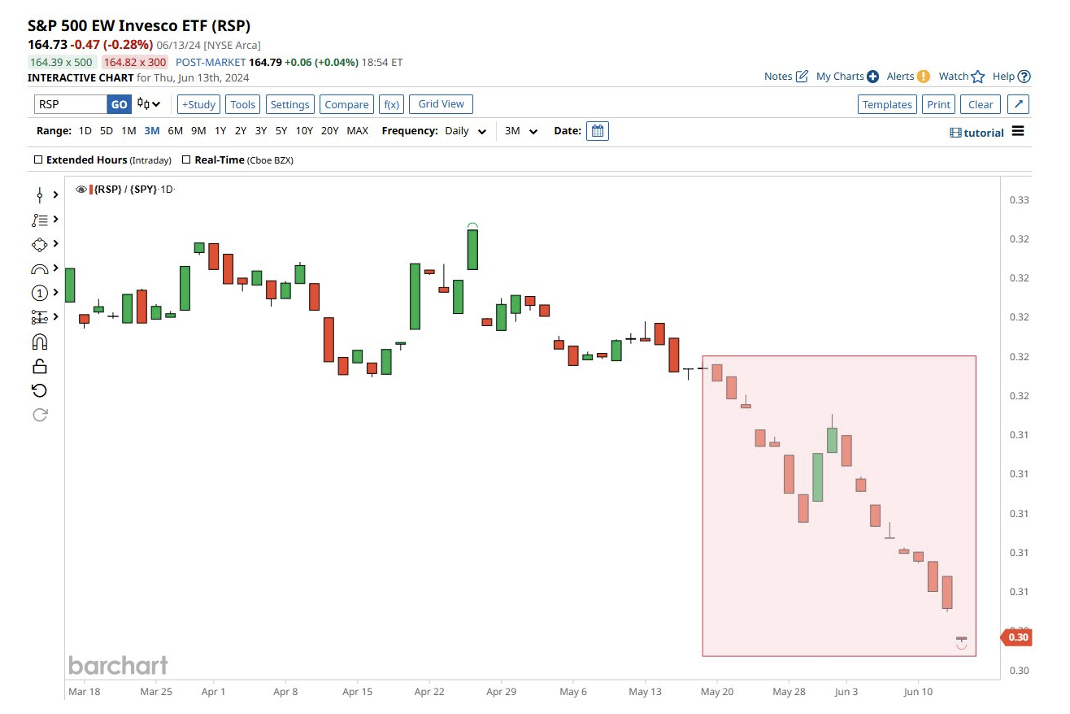

Brett: The broader market continues to lag what’s happening at the top end of market capitalization

Source: Barchart as of 06.13.2024

Source: Barchart as of 06.13.2024

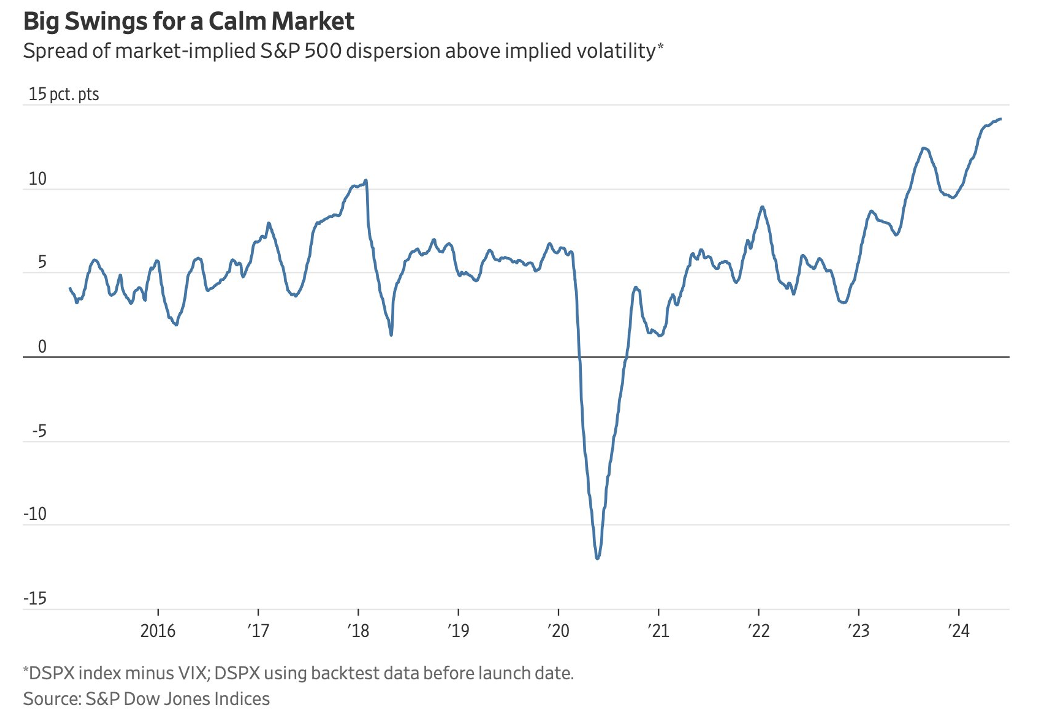

Arch: and we’re seeing a wide range of outcomes at the individual stock level

Data as of 06.10.2024

Data as of 06.10.2024

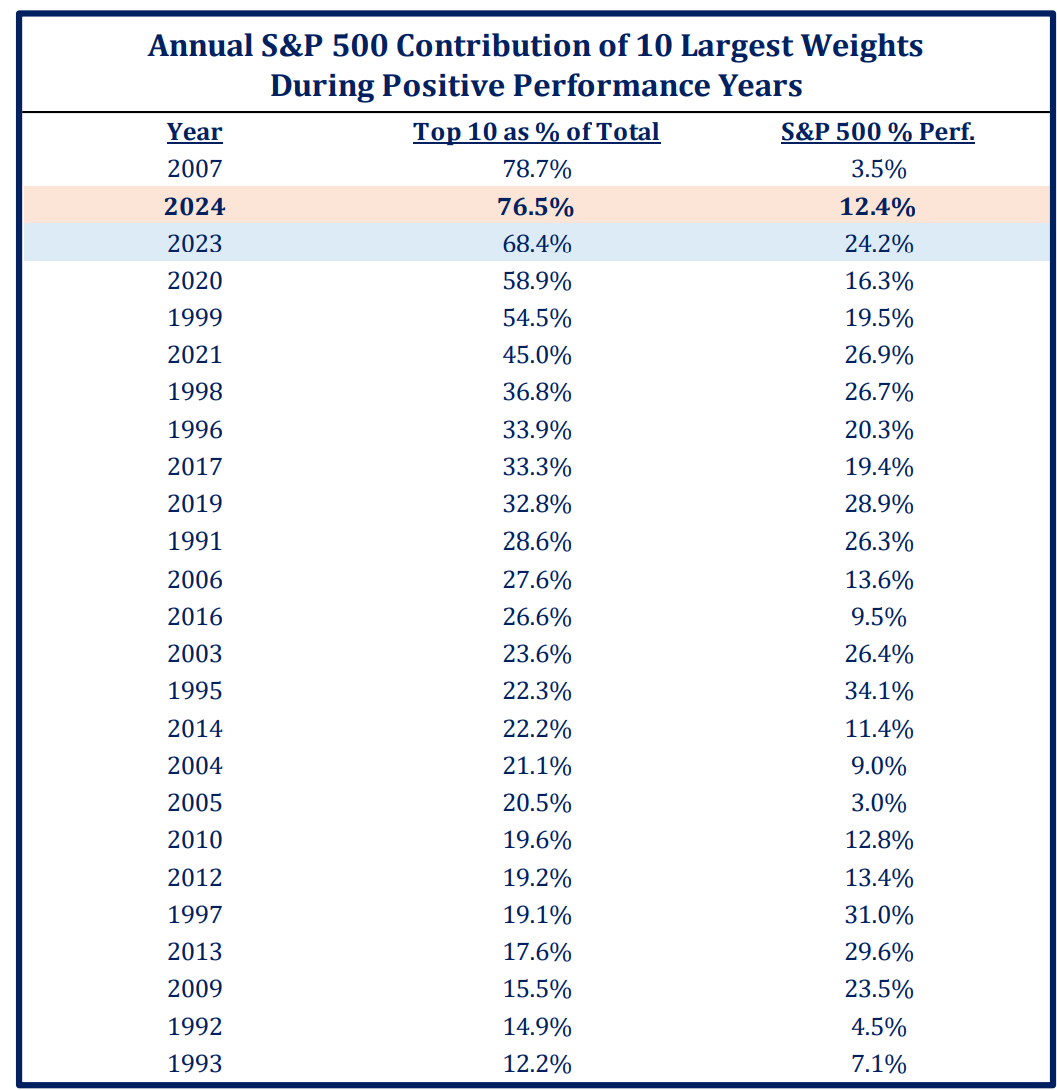

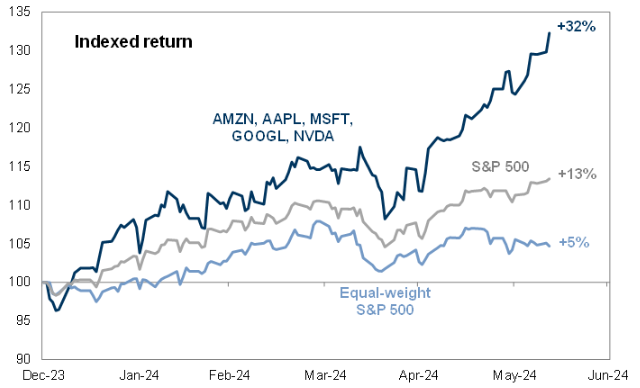

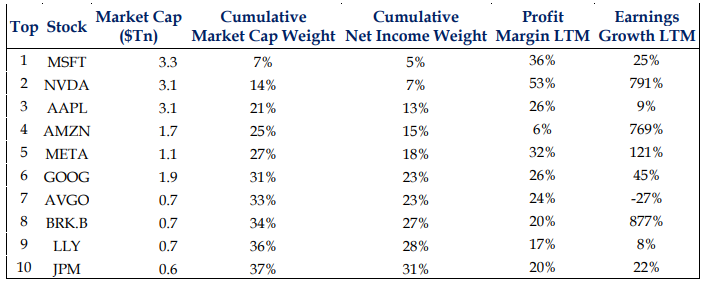

Dave: We continue to see performance dominance by the biggest of the big

Source: Strategas as of 06.10.2024

Source: Strategas as of 06.10.2024

Dave: and not only a continuation but an actual acceleration

Source: Goldman Sachs as of 06.12.2024

Source: Goldman Sachs as of 06.12.2024

Dave: that said, the dominance is not totally unjustified, as the largest companies are also delivering the best business performance

Source: Strategas as of 06.14.2024

Source: Strategas as of 06.14.2024

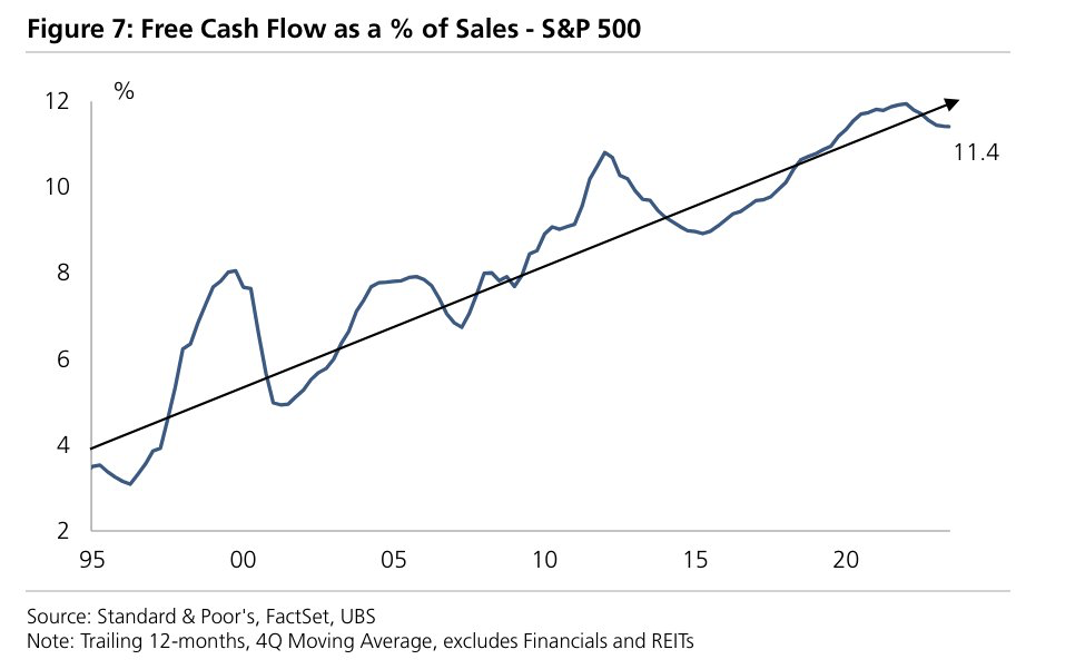

Brad: and as a whole, the S&P 500 valuation increase has run parallel with high cash flow generation as asset-light models expand

Data as of May 2024

Data as of May 2024

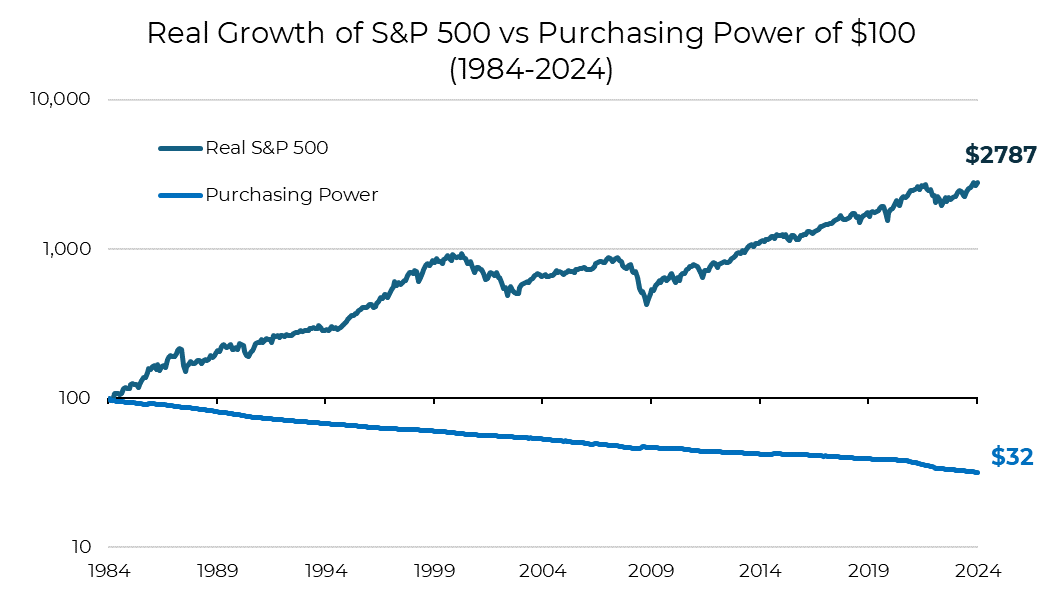

Brian: “T-Bill and Chill” sounds great until you see your purchasing power erode year after year!

Source: Aptus via Bloomberg

Source: Aptus via Bloomberg

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2406-17.