Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

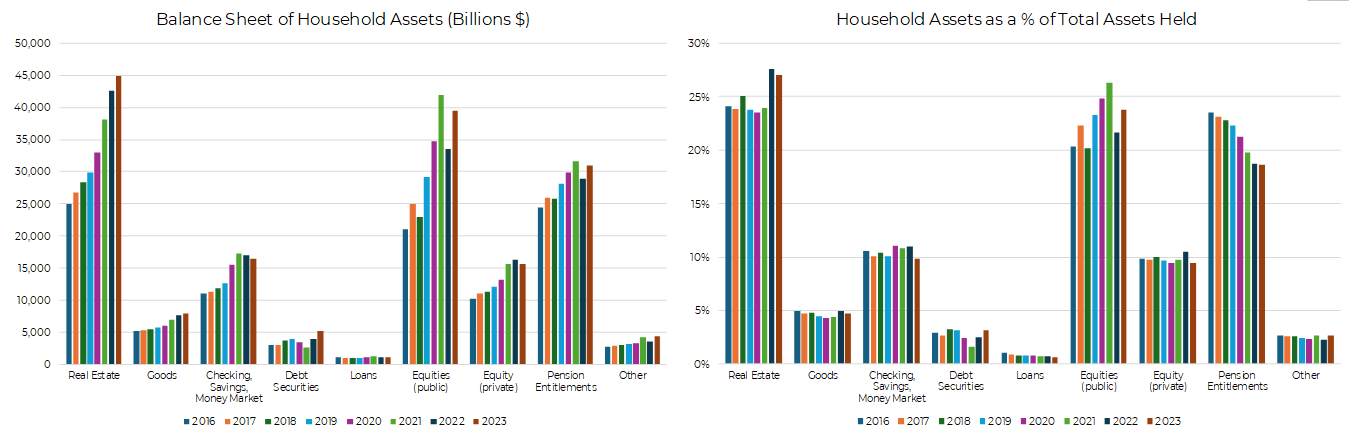

Brian: The story of US economic strength has been the growing wealth of the consumer

Source: Aptus via Federal Reserve Data as of March 2024

Source: Aptus via Federal Reserve Data as of March 2024

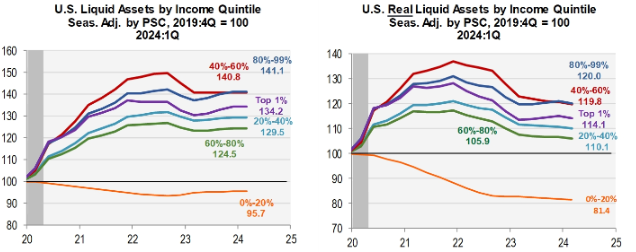

Dave: with liquid assets staying high for all but the lowest-income group

Source: Piper Sandler as of April 2024

Source: Piper Sandler as of April 2024

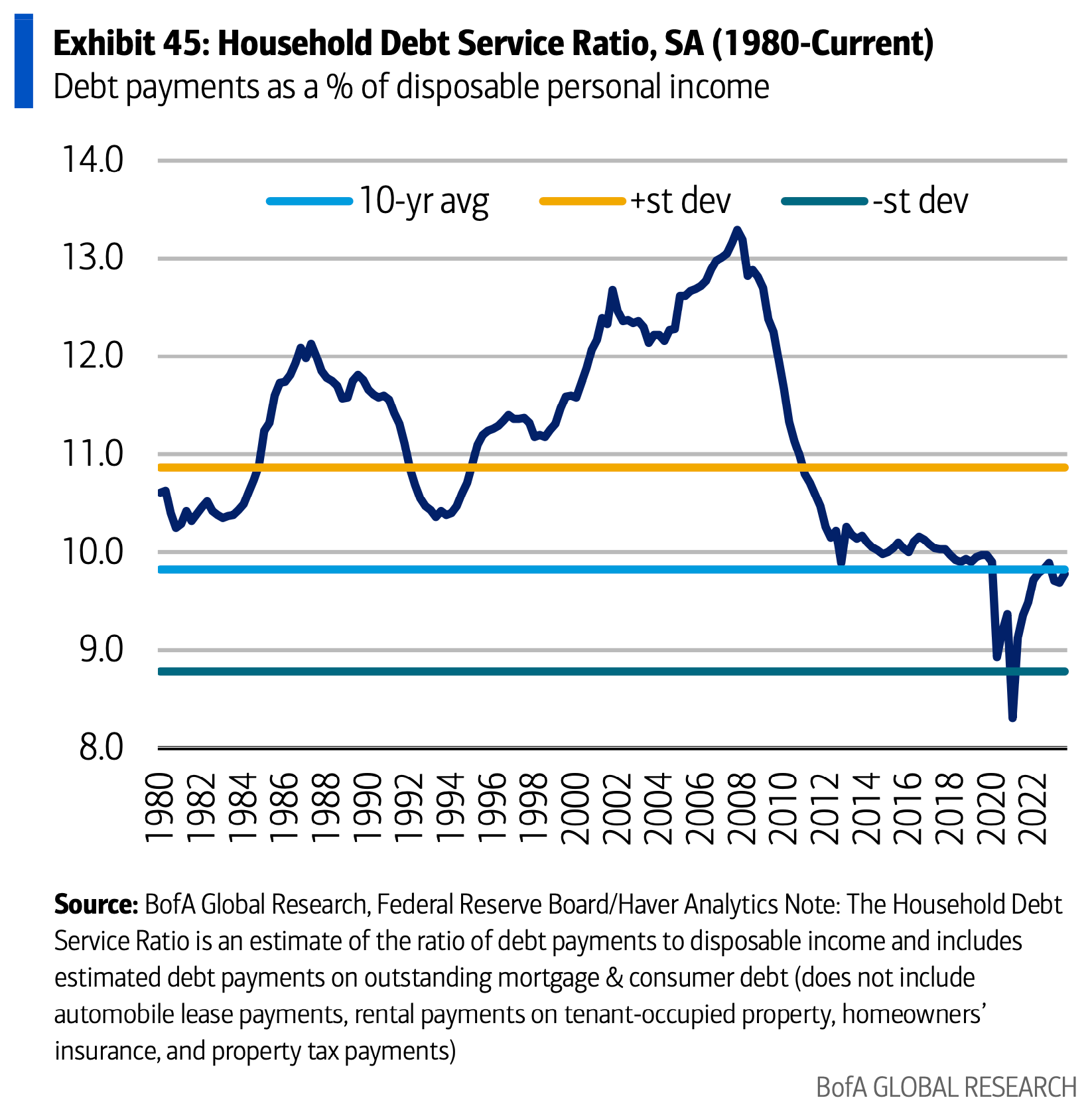

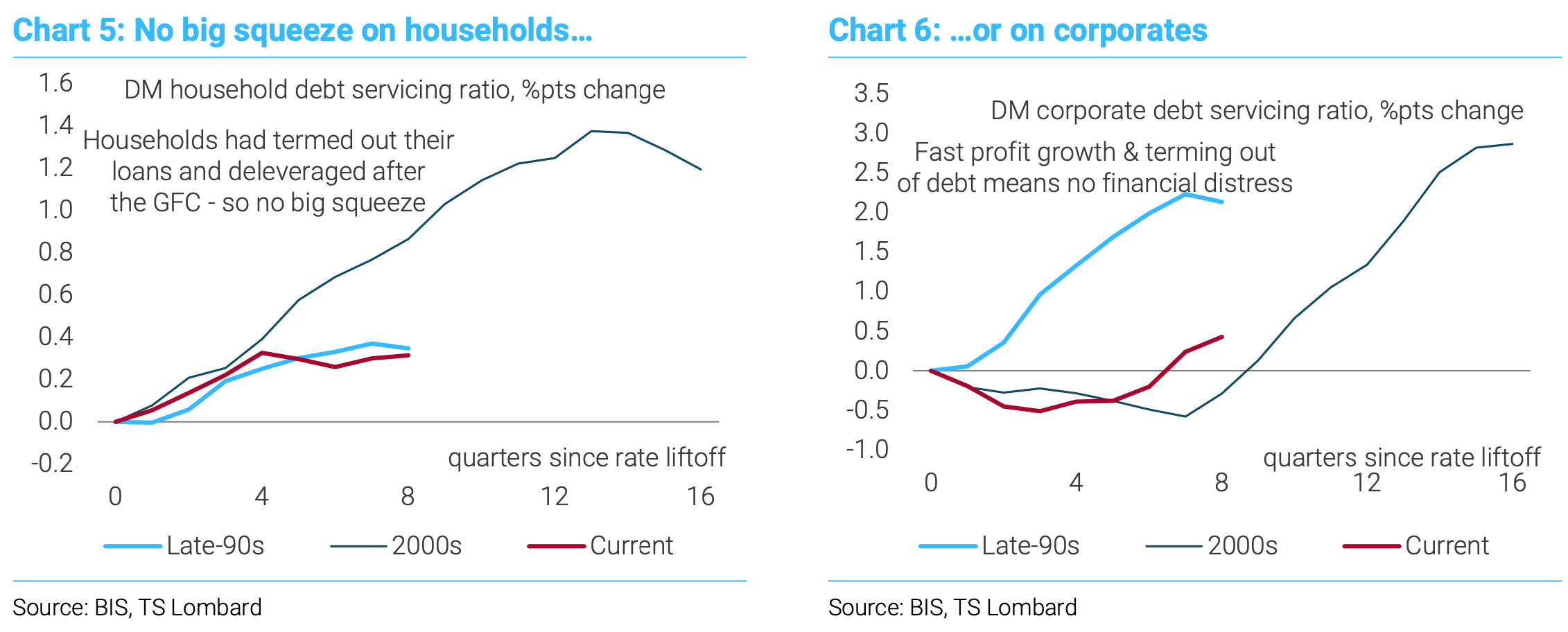

Beckham: and debt service running at low levels

Data as of May 2024

Data as of May 2024

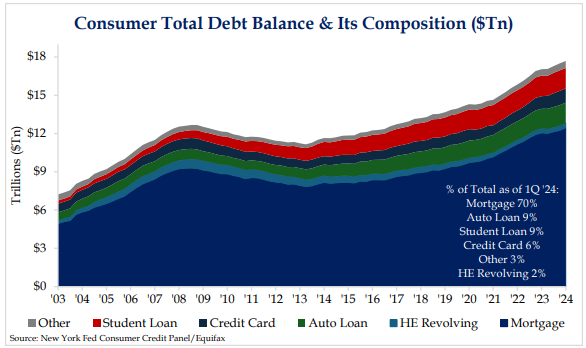

Dave: as most of the debt is tied to fixed (lower) interest rates

Source: Strategas as of 06.21.2024

Source: Strategas as of 06.21.2024

Brett: all of which has seemingly made this FOMC tightening cycle less effective than normal

Data as of 06.26.2024

Data as of 06.26.2024

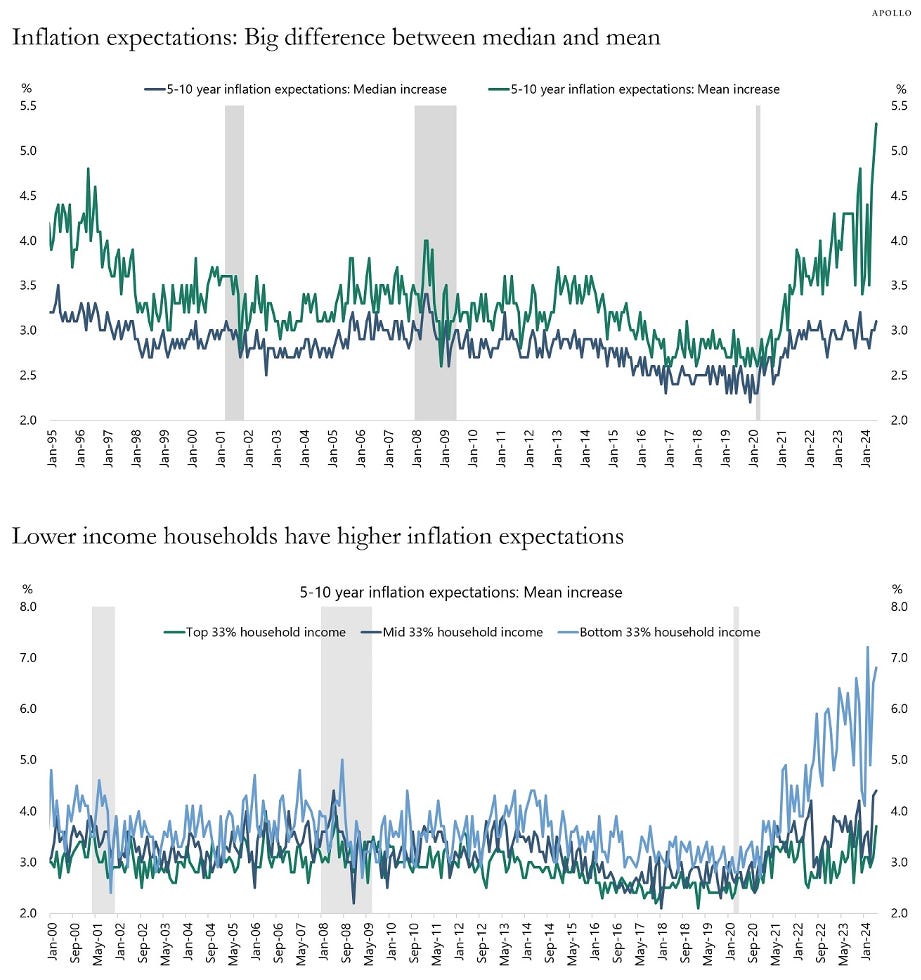

Joseph: Adding to the Fed’s resistance to cutting rates is the sharp rise in consumer beliefs on inflation, especially for lower-income groups

Source: Apollo as of May 2024

Source: Apollo as of May 2024

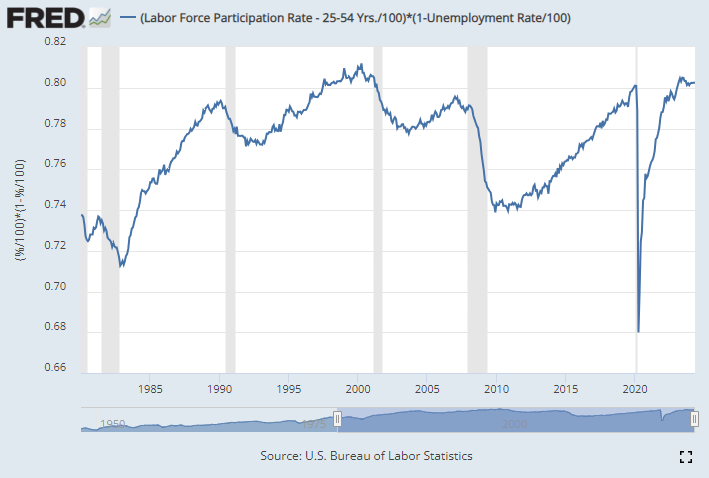

John Luke: and a tight labor market that doesn’t seem to need stimulus

Data as of June 2024

Data as of June 2024

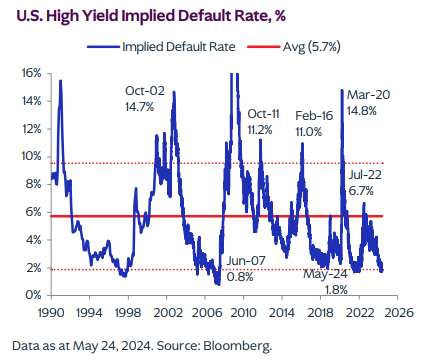

John Luke: with a credit market priced for low corporate defaults

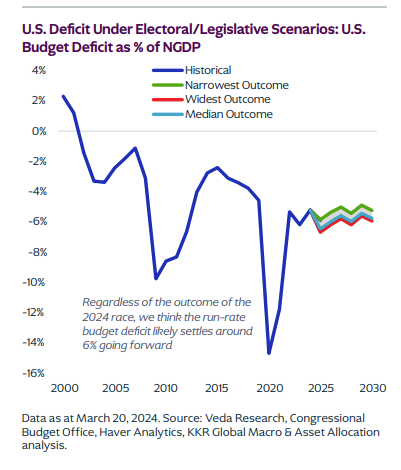

Source: KKR

Source: KKR

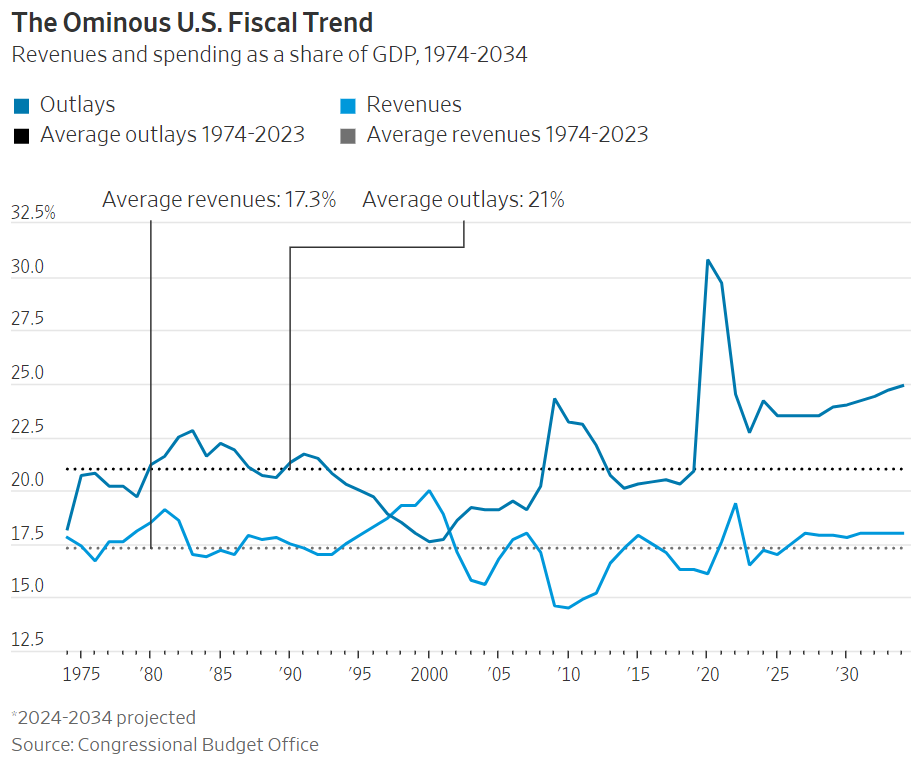

John Luke: Where potential trouble exists is in the US federal budget

John Luke: where outlays are pulling higher, away from revenues

Source: WSJ as of 06.22.2024

Source: WSJ as of 06.22.2024

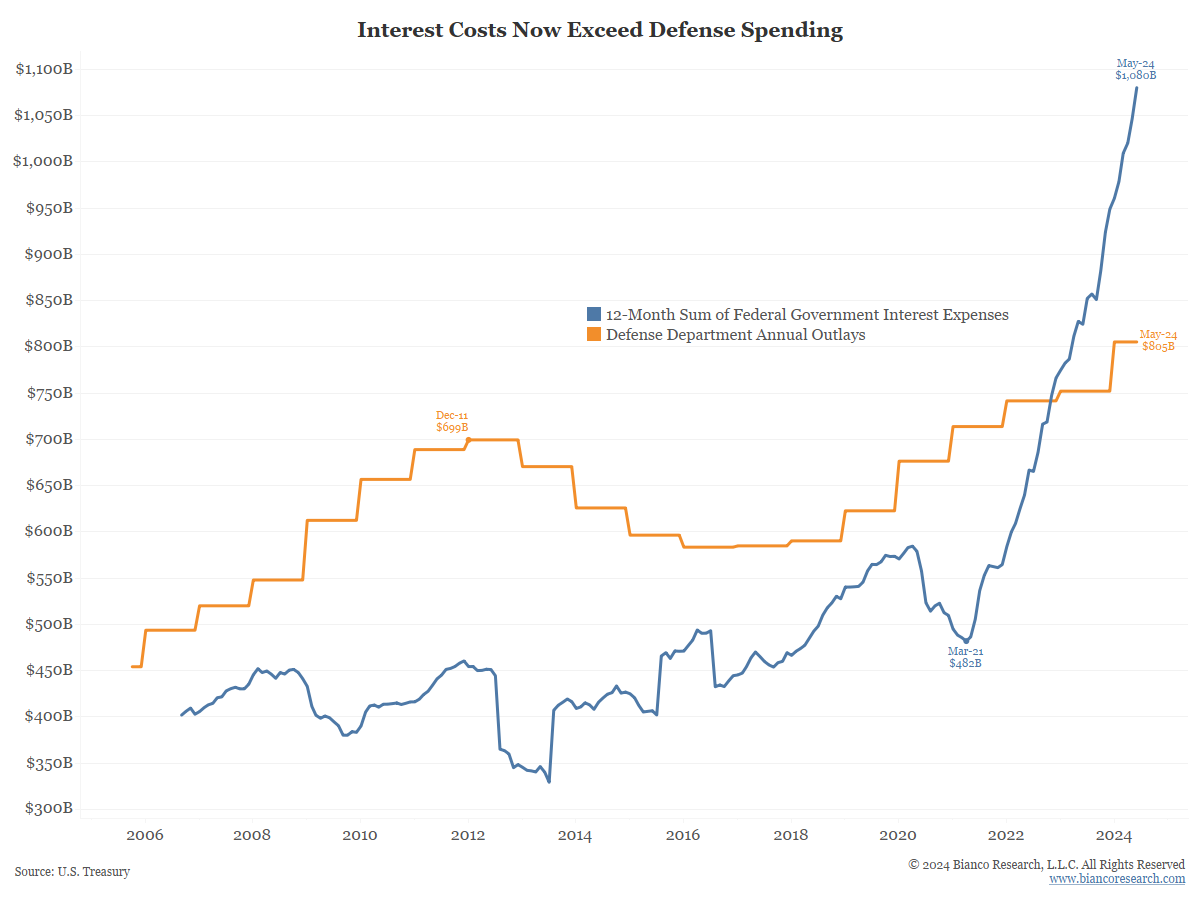

John Luke: and interest expense now exceeds the amount spent on defense

Data as of May 2024

Data as of May 2024

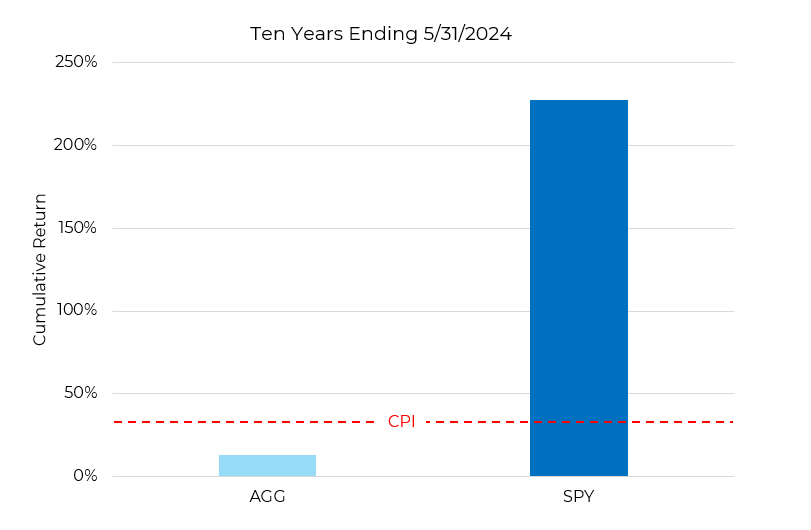

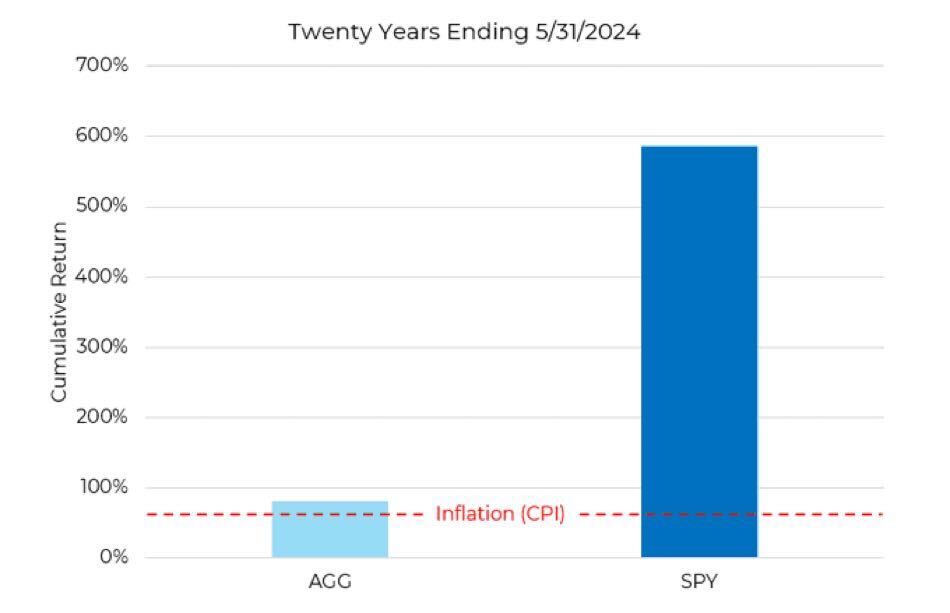

Brian: The consistent deficits have seemingly contributed to an environment favoring stocks over bonds

Source: Aptus via Bloomberg as of 05.31.2024

Source: Aptus via Bloomberg as of 05.31.2024

Brian: which has only accelerated the trend going back before the global financial crisis

Source: Aptus via Bloomberg as of 05.31.2024

Source: Aptus via Bloomberg as of 05.31.2024

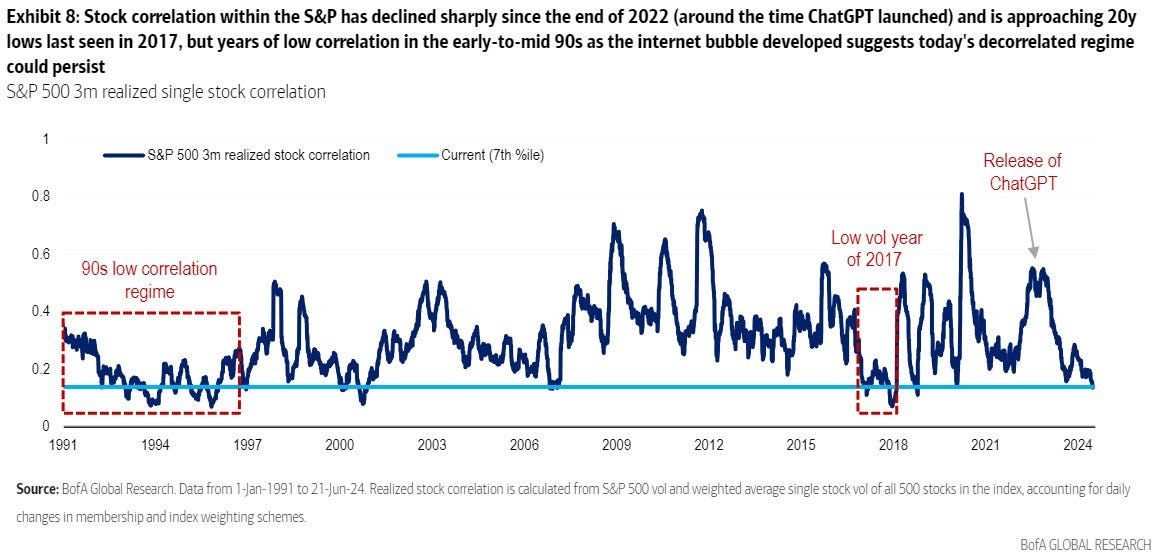

Arch: The environment of late has been towards divergent outcomes across stocks and sectors

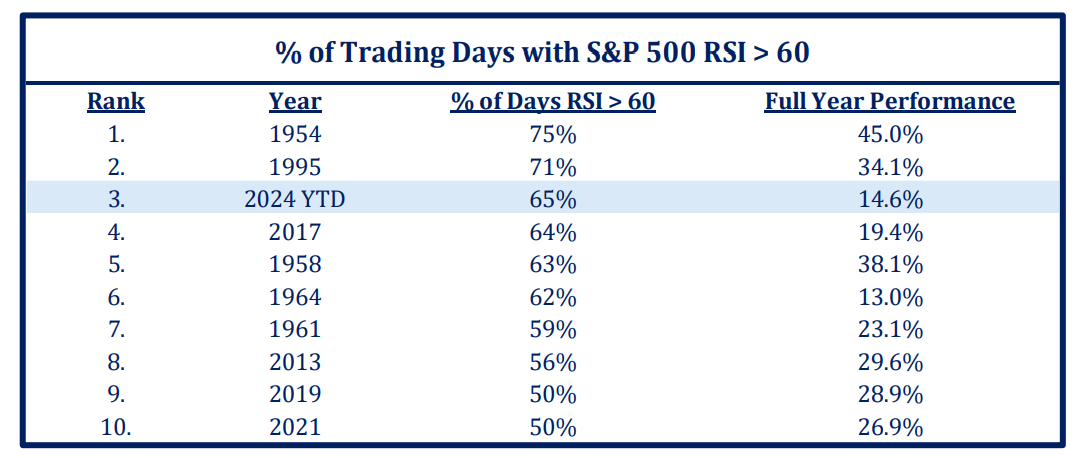

Dave: but there’s been enough strength across larger names to support a continuation of the S&P 500’s advance

Source: Strategas as of 06.25.2024

Source: Strategas as of 06.25.2024

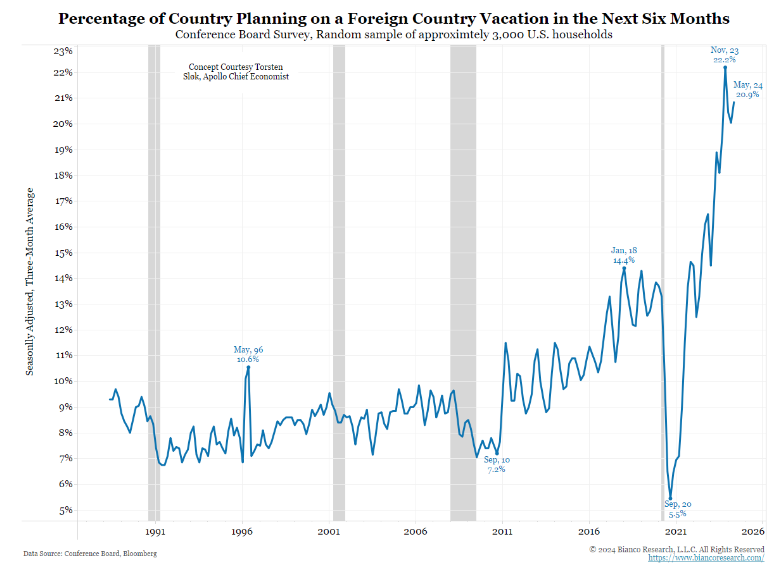

Joseph: However US consumers feel about the state of the economy, they sure are making plans to expand their travel

Source: Strategas as of 06.27.2024

Source: Strategas as of 06.27.2024

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2406-25.