Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

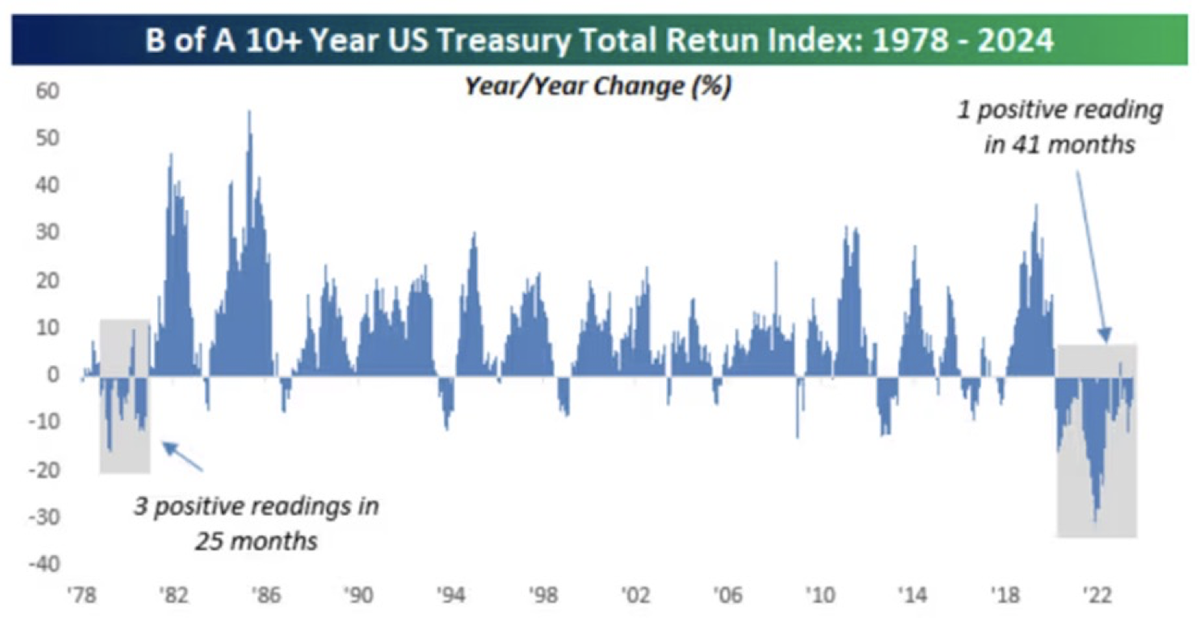

John Luke: The US Treasury Index has shown only one positive reading in the last 41 months. This is a rare occurrence, reminiscent of the late 1970s when there were only three positive months in 25. This trend highlights the persistent challenges in the bond market and the impact of prolonged low-interest rates

Source: Bespoke as of 06.30.2024

Source: Bespoke as of 06.30.2024

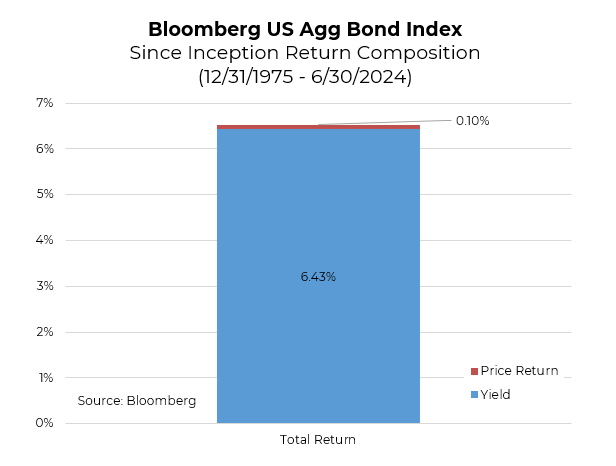

Brian: The recent underperformance of bonds has pushed the long-term dominance of yield over price changes in the Bloomberg Aggregate Bond Index, where 99% of long-run returns are now driven by yield, emphasizing the difficulty in achieving capital gains especially in a low-interest-rate or high inflationary environment

Source: Bloomberg, Aptus

Source: Bloomberg, Aptus

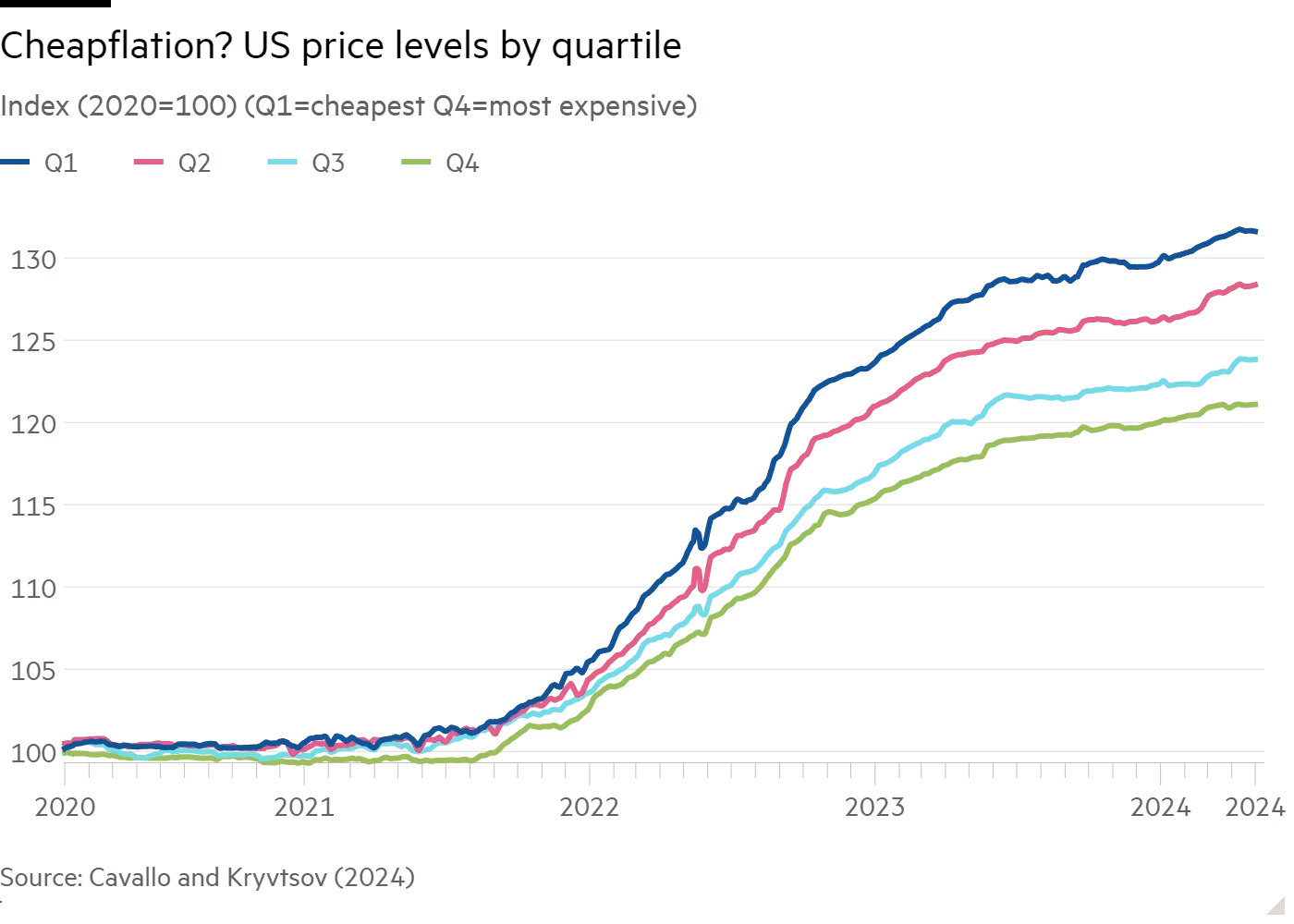

Brett: The shift higher in yields emerged from higher inflation, which has not been uniform; the price levels of the cheapest goods are rising the most. This indicates that inflation is hitting lower-income consumers harder, exacerbating economic inequalities and affecting consumption patterns

Source: Bianco Research as of 07.01.2024

Source: Bianco Research as of 07.01.2024

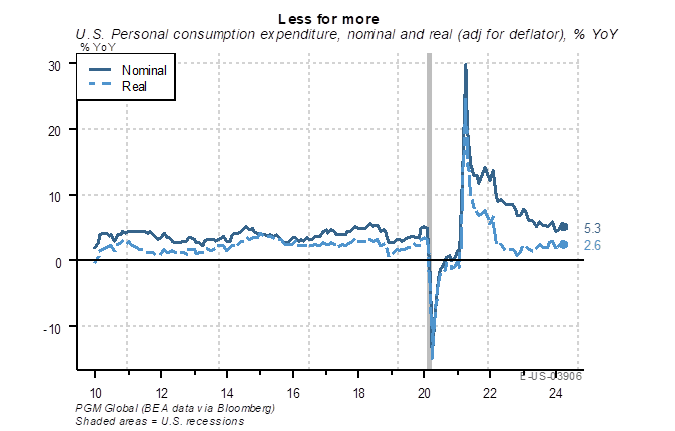

John Luke: Inflationary trends has caused a dislocation between real consumption, which has normalized, and nominal spending, which remains elevated, illustrating that inflationary pressures are not solely supply-driven

Data as of 06.25.2024

Data as of 06.25.2024

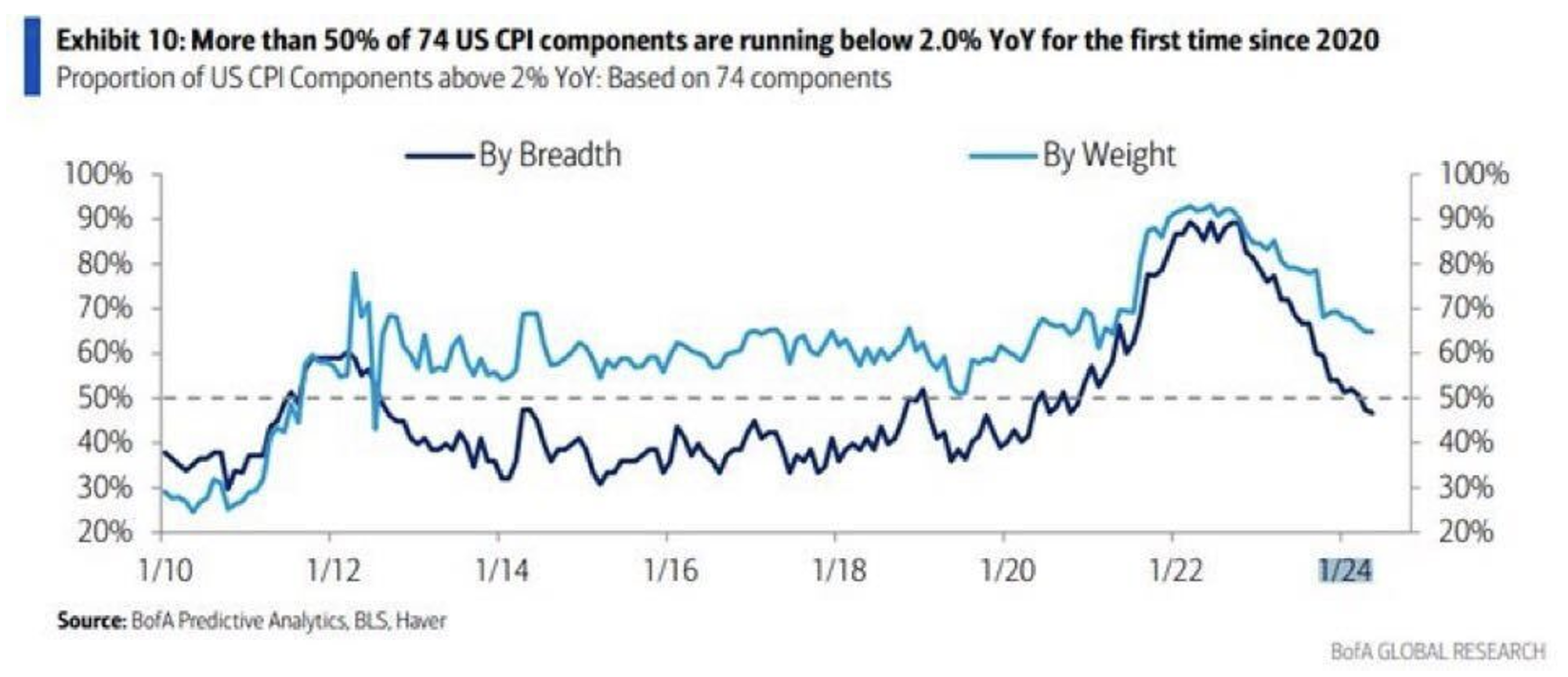

John Luke: Prices finally do seem to be easing in many areas, with more than half of CPI components below 2% for the first time since COVID

Source: BofA ML as of 06.28.2024

Source: BofA ML as of 06.28.2024

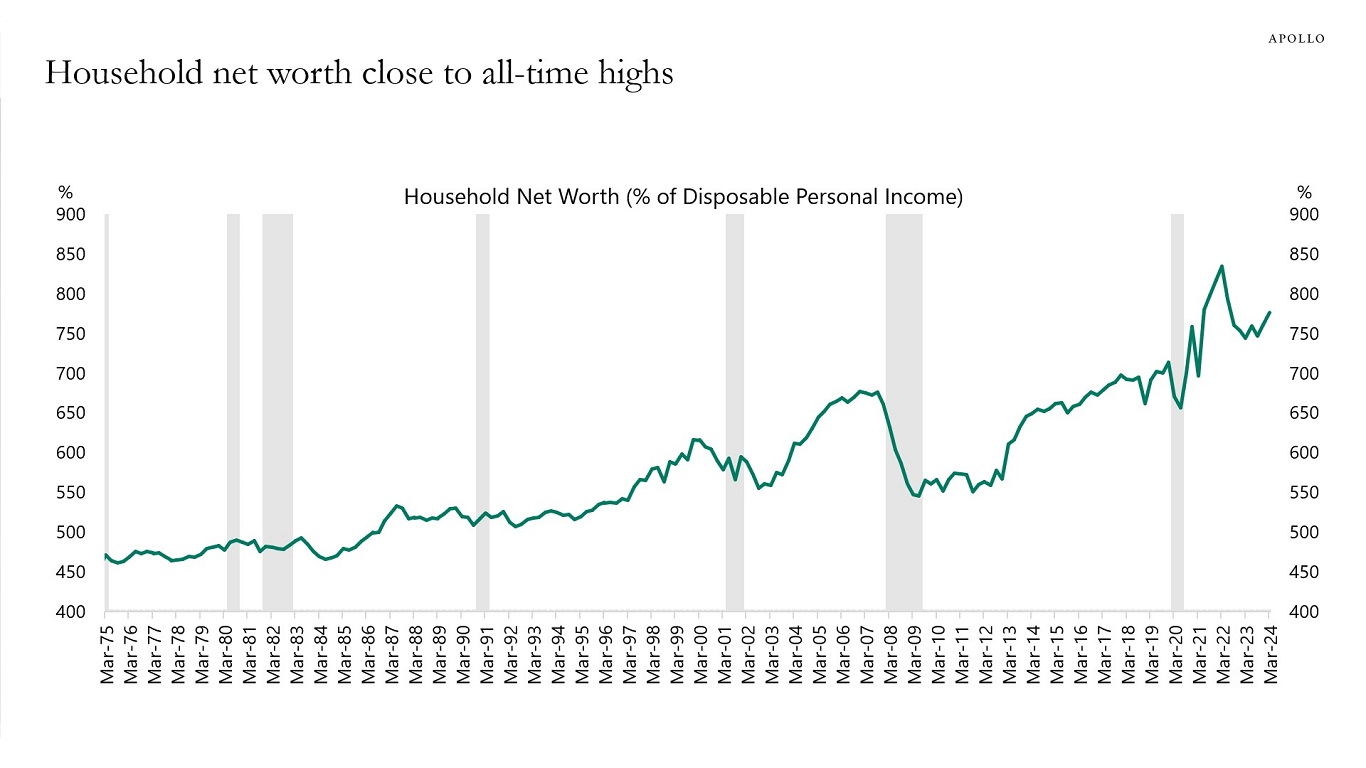

John Luke: Household net worth has reached nearly eight times disposable income, setting a new record. This surge in wealth, driven by rising asset prices, has significant implications for consumption and investment behavior

Data as of 06.27.2024

Data as of 06.27.2024

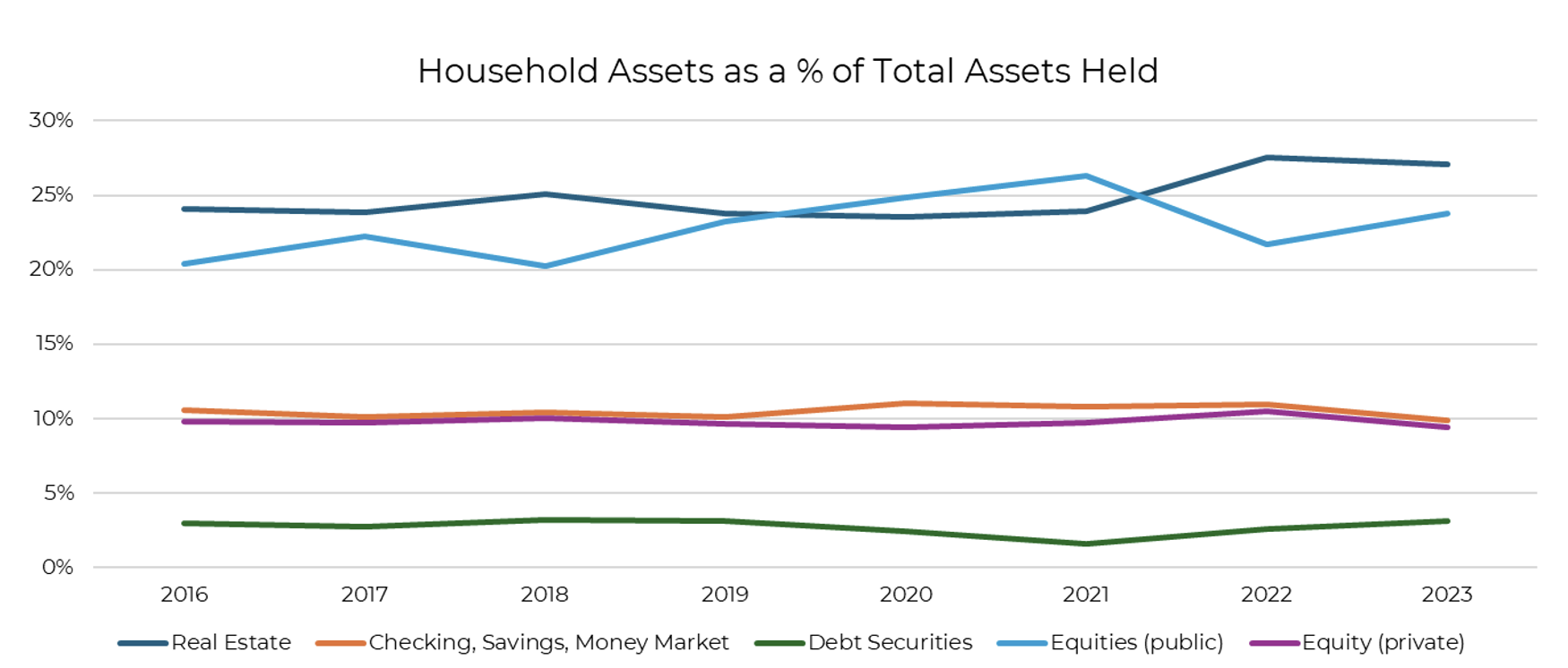

Brian: Despite headlines claiming otherwise, while households are holding more cash and equities in dollar terms, they aren’t holding more than usual as a percent of total assets. This stability in household balance sheets suggests a measured approach to financial management, even in uncertain times

Source: Federal Reserve, Aptus 12.31.2023

Source: Federal Reserve, Aptus 12.31.2023

Dave: The S&P 500 had a robust first half of 2024, contrasting sharply with the S&P 600, which has struggled. This divergence highlights the strength of large-cap stocks and the challenges faced by smaller companies

Source: Bloomberg as of 06.30.2024

Source: Bloomberg as of 06.30.2024

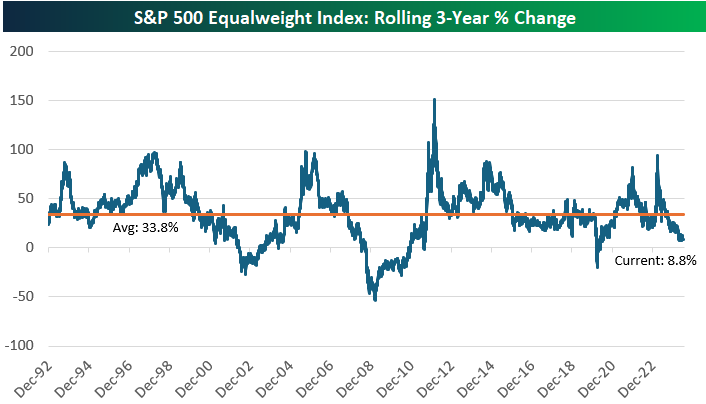

Beckham: The rolling three-year change in the S&P 500 equal-weighted index shows much lower-than-typical performance, despite the strength in the market cap-weighted S&P 500. This indicates that gains are concentrated in a few large stocks rather than being broad-based

Source: Bespoke as of 07.01.2024

Source: Bespoke as of 07.01.2024

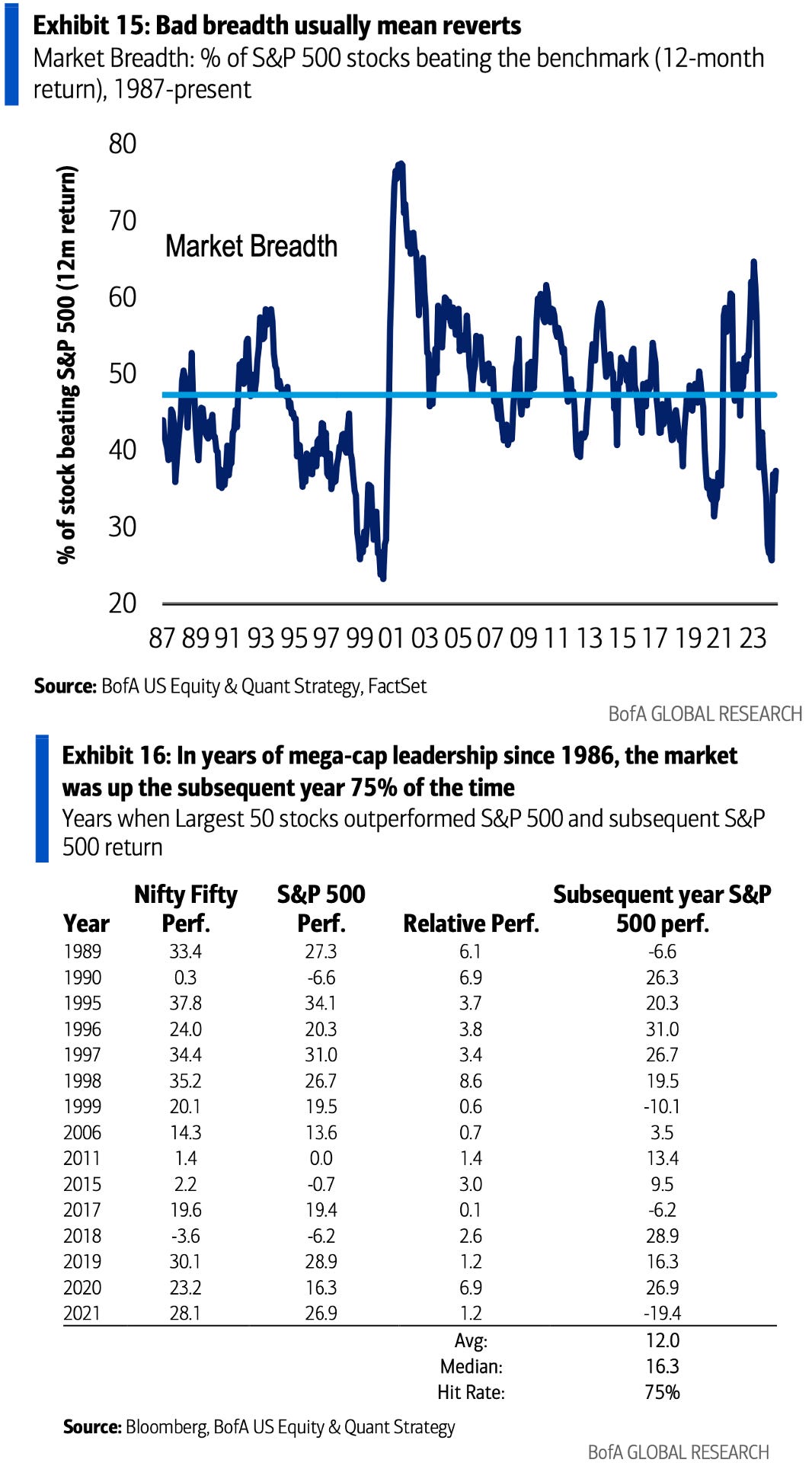

Arch: The underperformance of an equal weighted basket is a function of the poor breadth of the S&P 500, which has been as weak as we’ve seen in 40 years. While a few large stocks are driving current gains, if the broader market catches up it could result in future strength

Source: BofA as of 06.30.2024

Source: BofA as of 06.30.2024

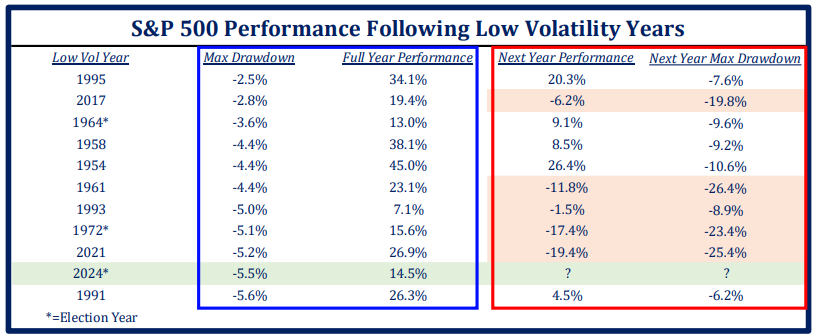

Brett: On the other hand, following years of low market volatility, the S&P 500 often exhibits mixed and generally weaker performance. This historical pattern suggests a cautious outlook for the near term

Source: Strategas as of 07.01.2024

Source: Strategas as of 07.01.2024

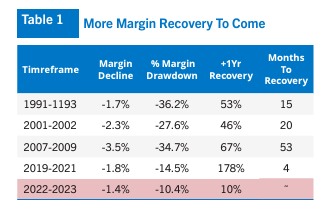

Dave: The saving grace for stocks could be earnings growth led by improving profit margins, as this cycle has room to run when comparing with past earnings troughs

Source: Alpine Macro as of June 2024

Source: Alpine Macro as of June 2024

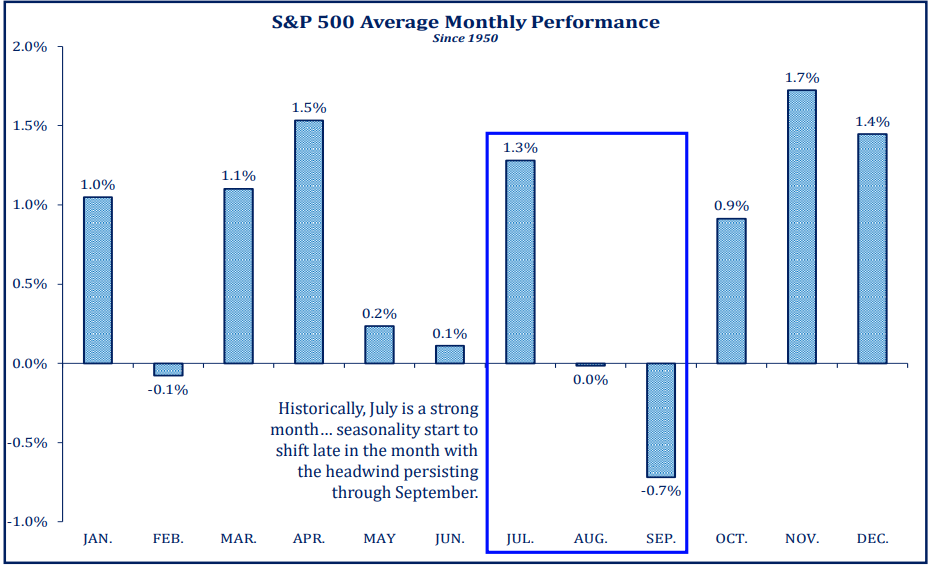

Dave: Shorter-term, July has been a strong month for the S&P 500 especially its first halves, followed by seasonal weakness in August and September. Investors should be mindful of these trends as they navigate the coming months

Source: Strategas as of 07.01.2024

Source: Strategas as of 07.01.2024

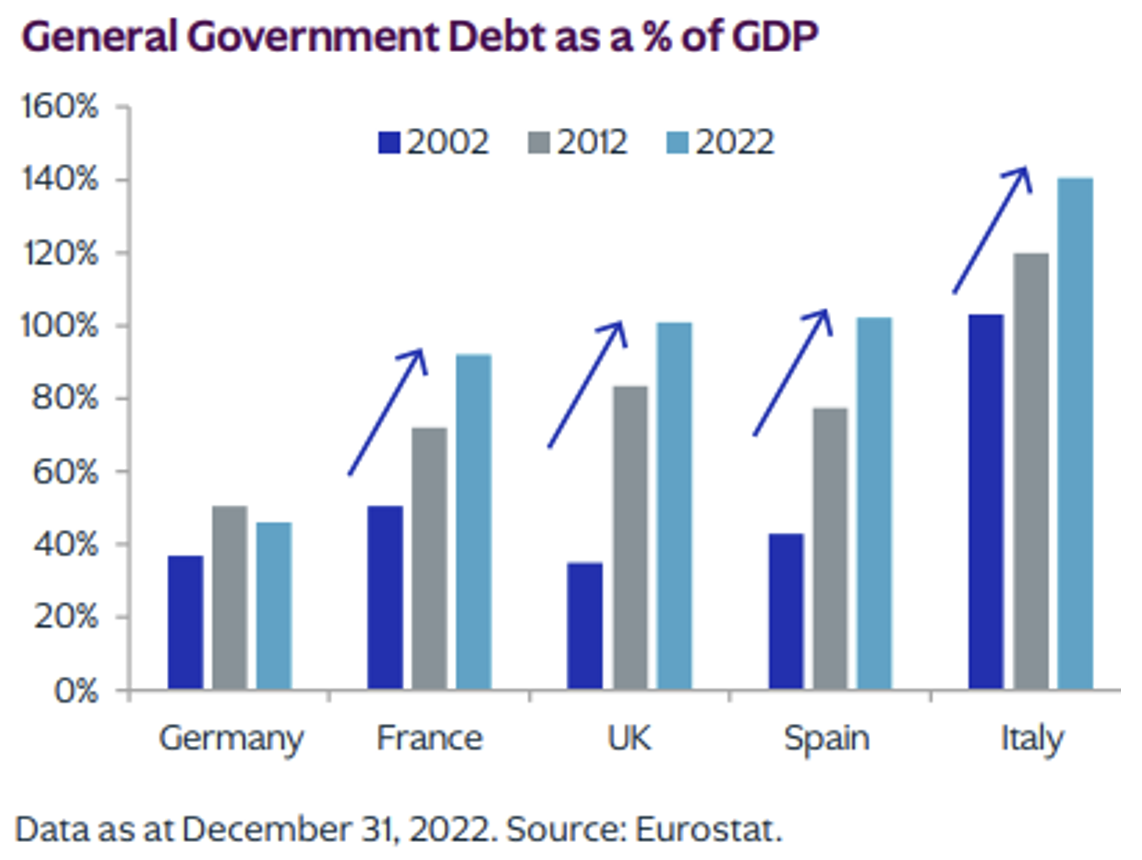

JD: Government debt as a percentage of GDP is increasing in nearly every country, except Germany. This rising debt burden poses long-term risks to economic stability and highlights the fiscal challenges faced globally

Source: KKR, Eurostat

Source: KKR, Eurostat

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2407-6.