Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

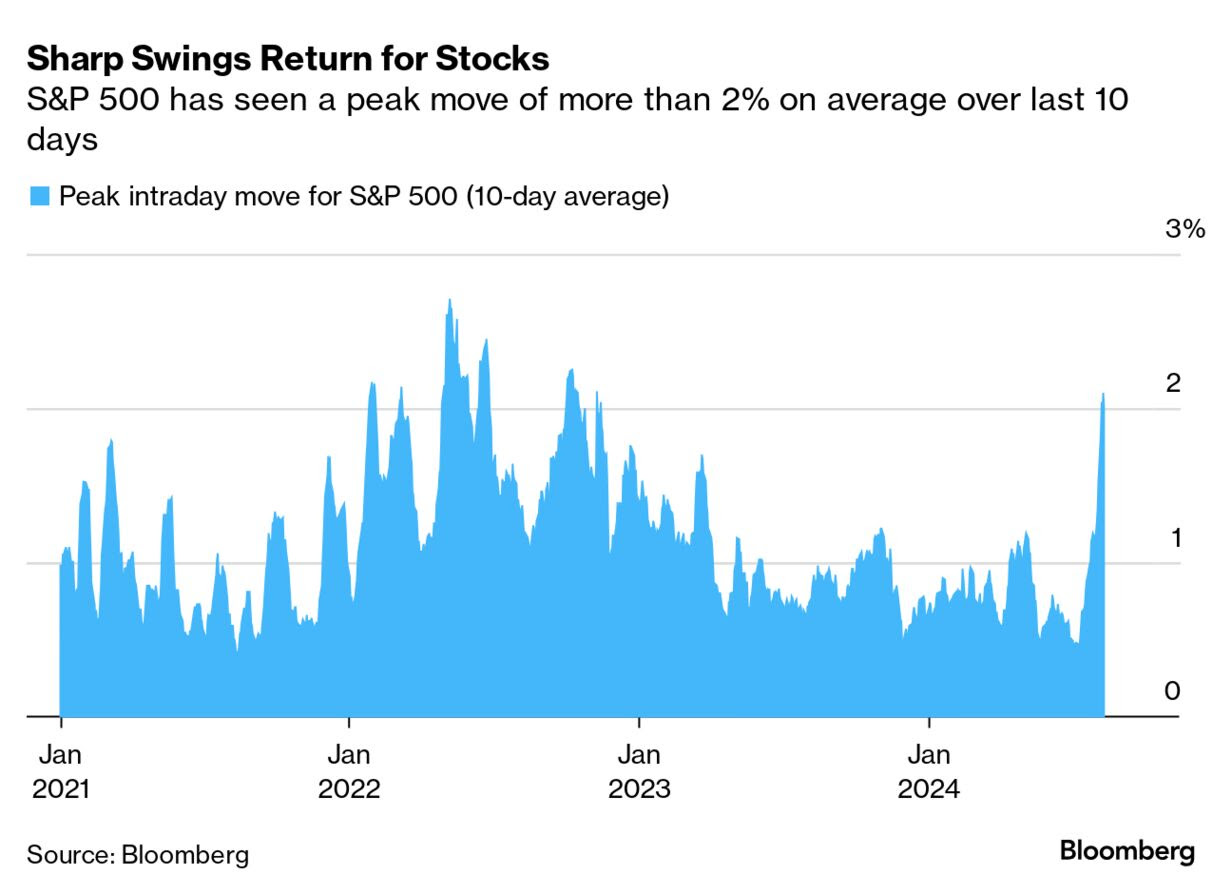

Beckham: The sharp rise in daily volatility came after 18 months of extremely subdued movement in equity indices

Data as of 08.12.2024

Data as of 08.12.2024

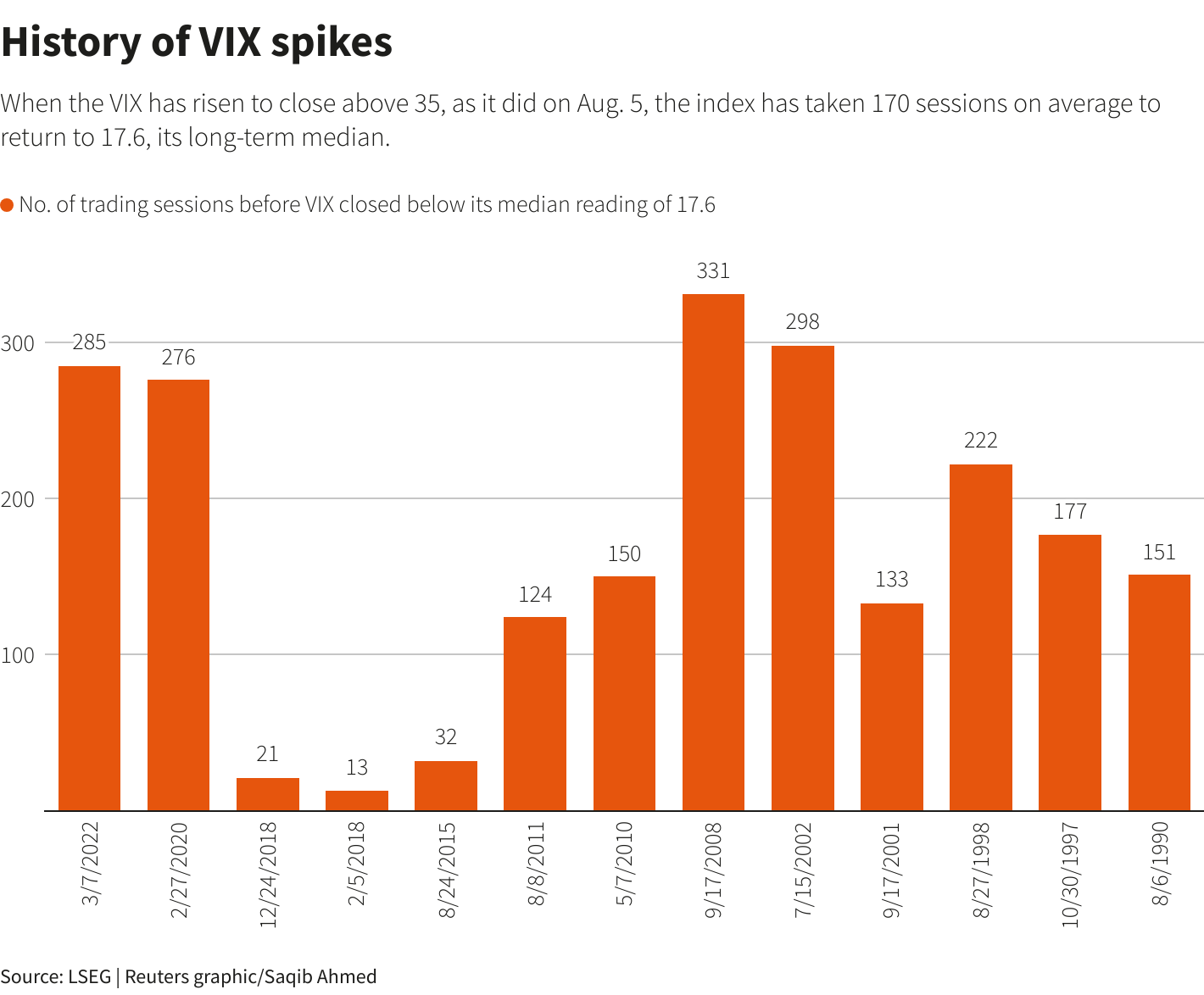

John Luke: and the VIX spike and reversal was one for the record books, back to the median in only 7 days!

Data as of 08.13.2024

Data as of 08.13.2024

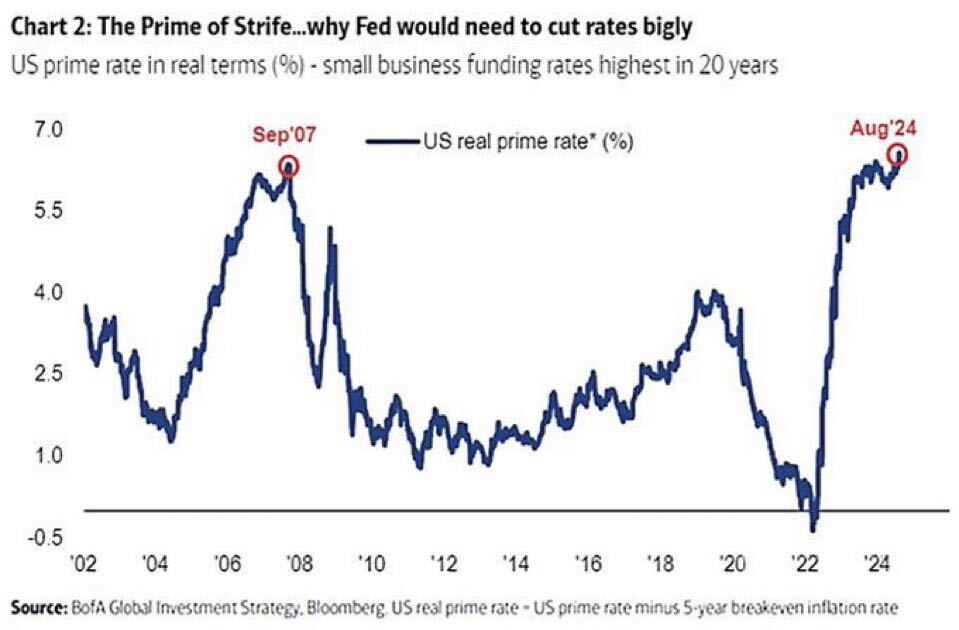

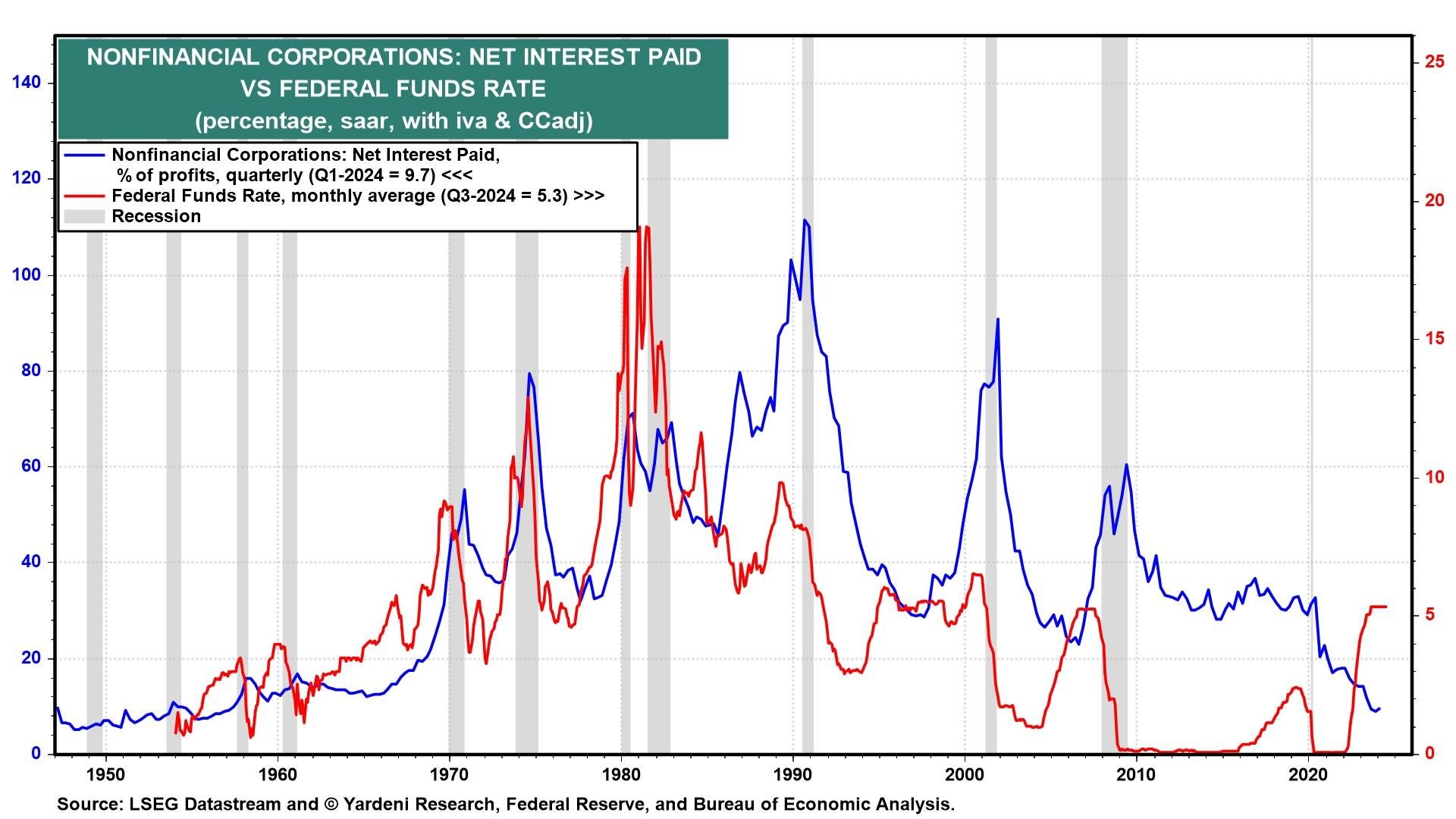

John Luke: While rates sit at restrictive levels vs. recent years

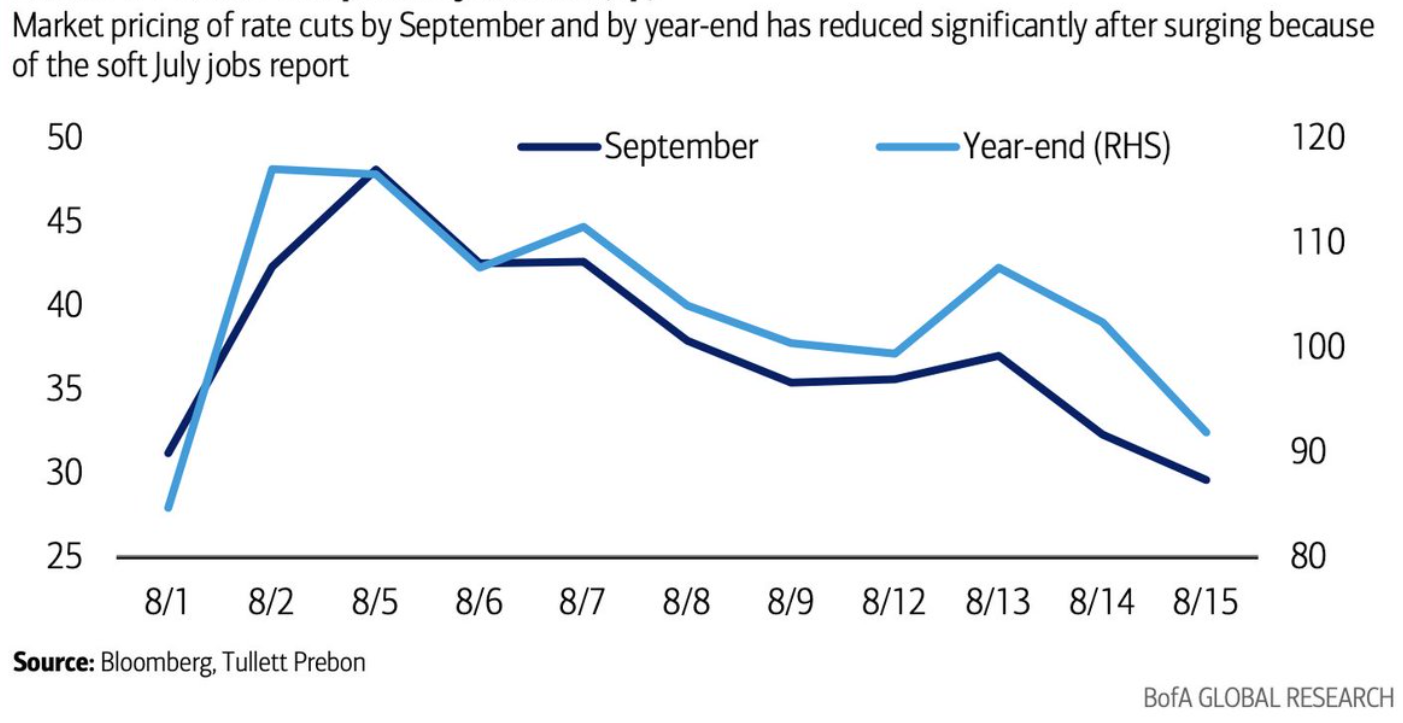

Brett: the expectation that the FOMC would immediately cut aggressively has been pared back on better economic data

Data as of 08.14.2024

Data as of 08.14.2024

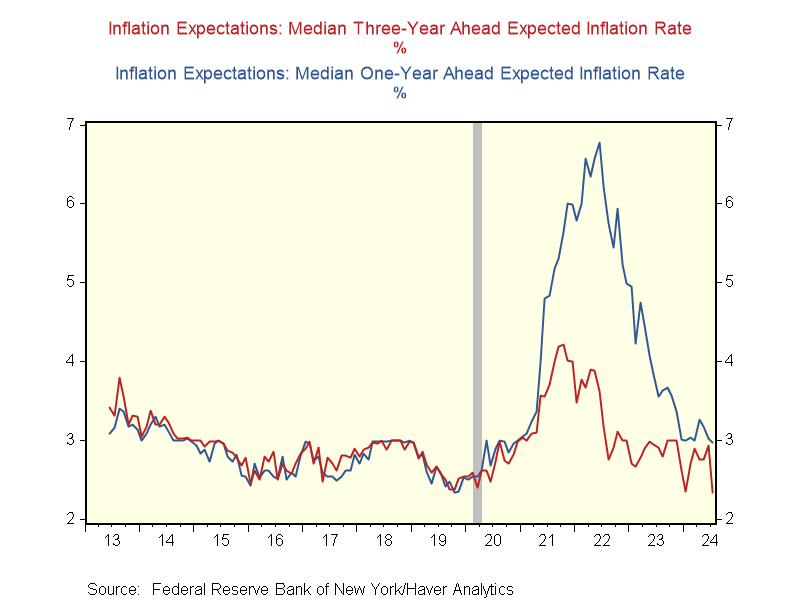

Arch: Consumer inflation expectations have plummeted from the 2022 peak

Data as of 08.12.2024

Data as of 08.12.2024

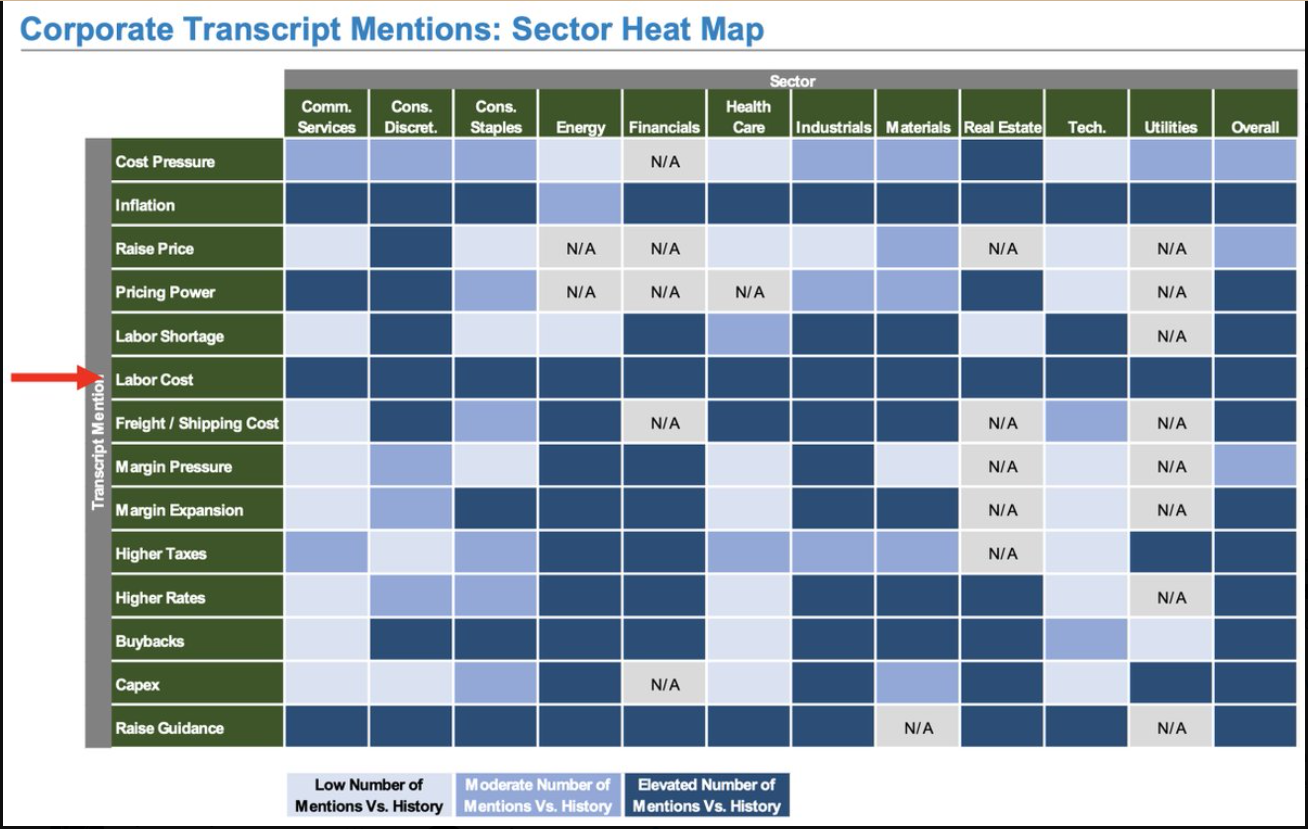

Joseph: but corporations across sectors are still citing labor costs as a concern for their businesses

Source: Morgan Stanley as of 08.15.2024

Source: Morgan Stanley as of 08.15.2024

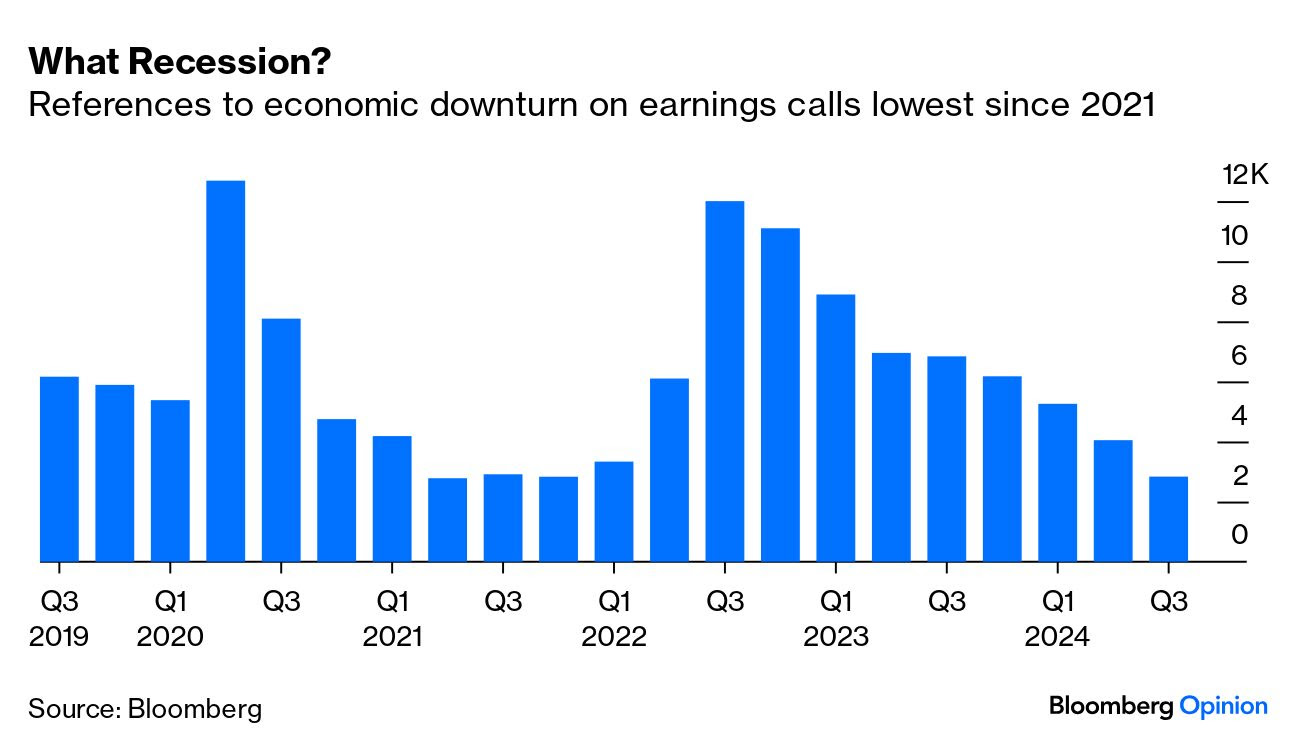

Brad: What’s not coming up on earnings calls are mentions of concerns about a U.S. recession

Source: as of 08.09.2024

Source: as of 08.09.2024

Dave: even for smaller companies, who have seemed to benefit less from the economic tailwinds

Data as of 08.16.2024

Data as of 08.16.2024

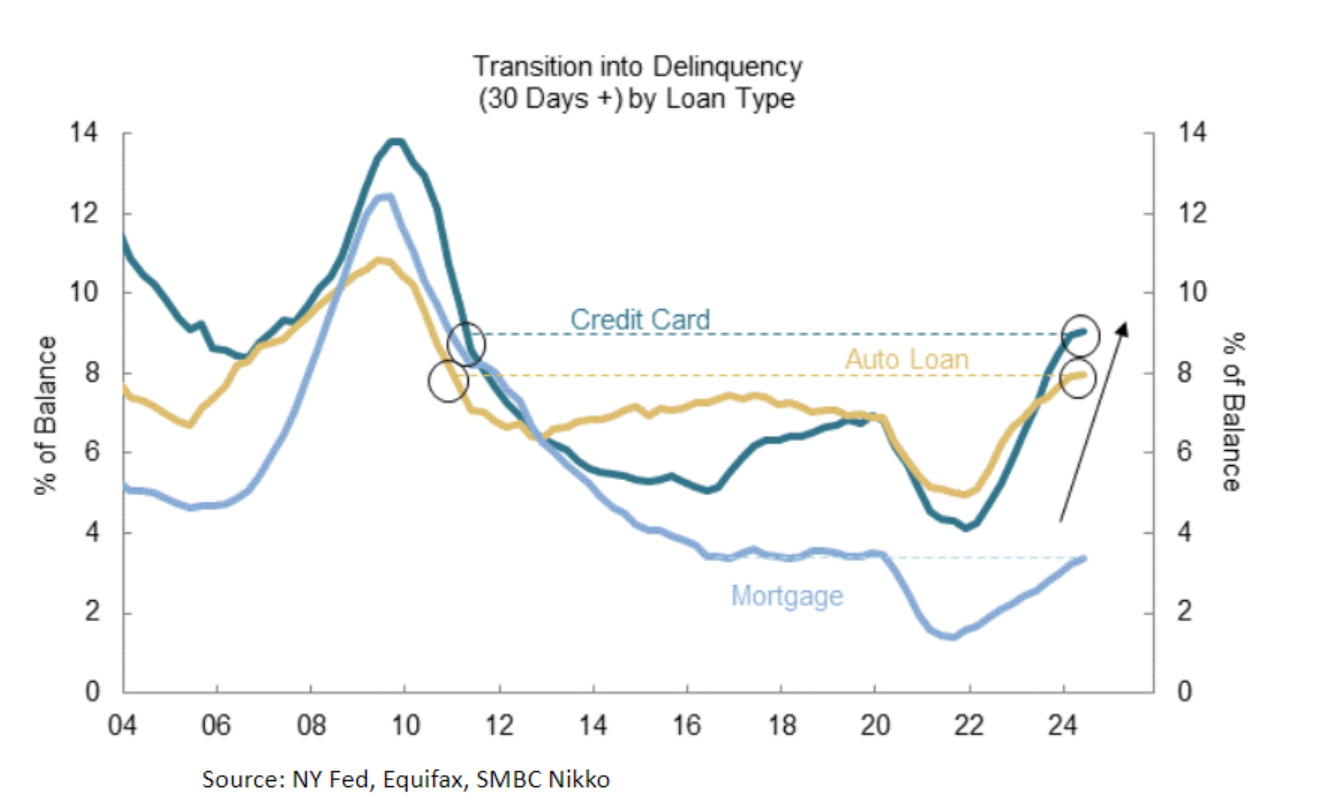

Beckham: While consumer delinquencies might be creeping a bit higher

Data as of 08.07.2024

Data as of 08.07.2024

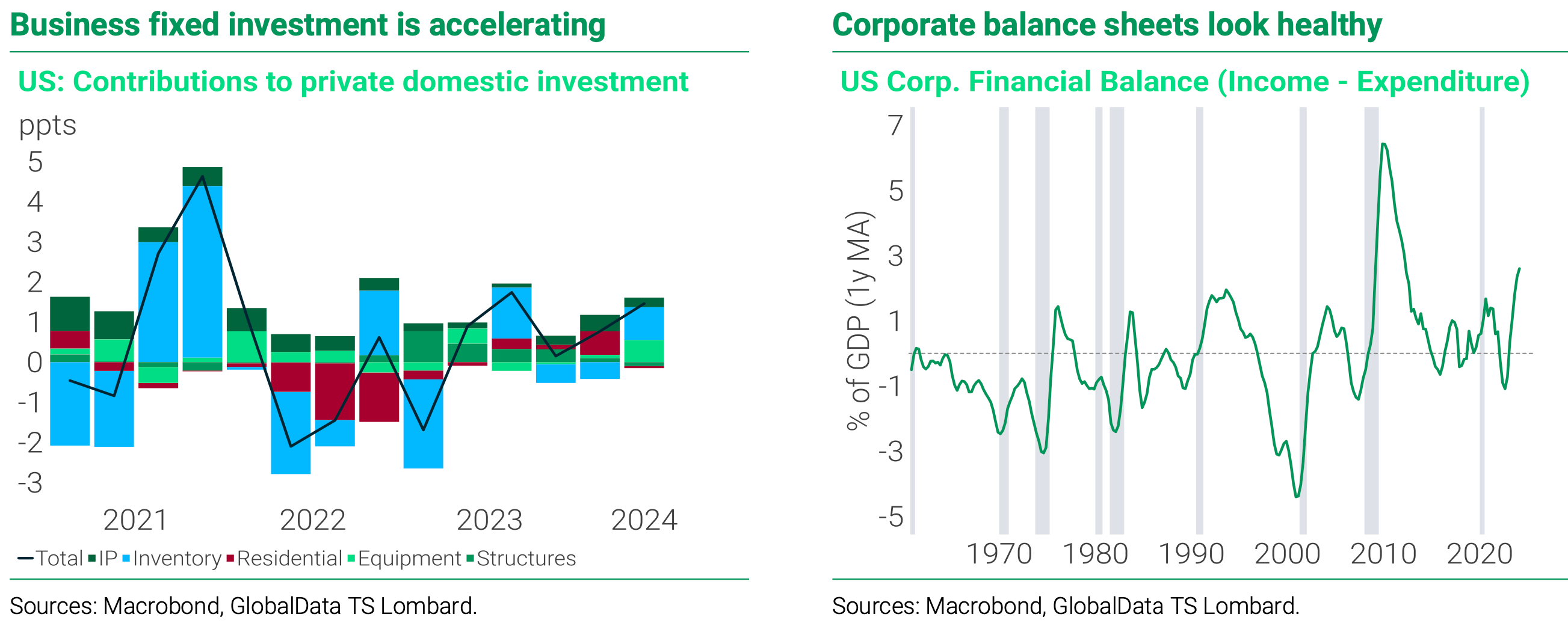

John Luke: the aggressive balance sheet work done by US corporations puts them in a uniquely strong position

Data as of July 2024

Data as of July 2024

Joseph: and no sign yet of a falloff in large-scale projects

Data as of 08.12.2024

Data as of 08.12.2024

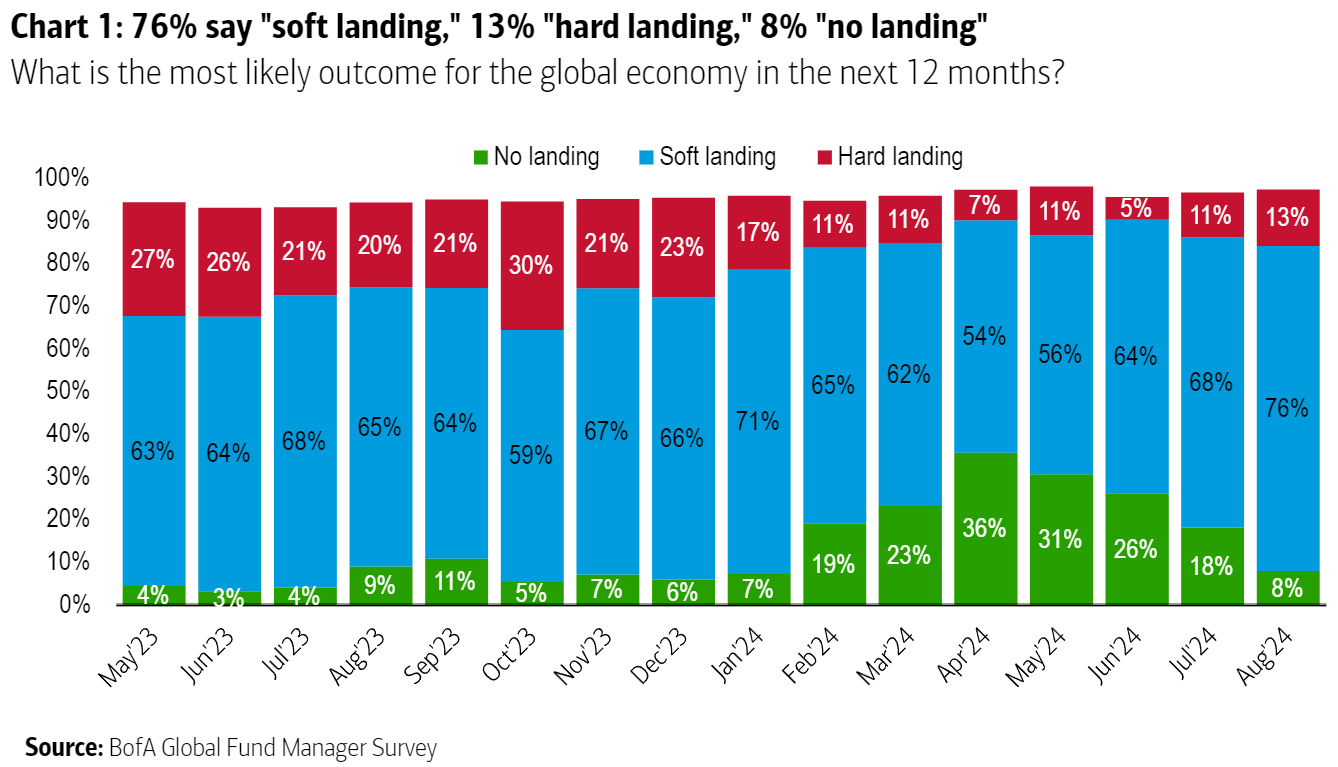

JD: so the soft landing expected by fund managers remains the most likely bet

Data as of 08.12.2024

Data as of 08.12.2024

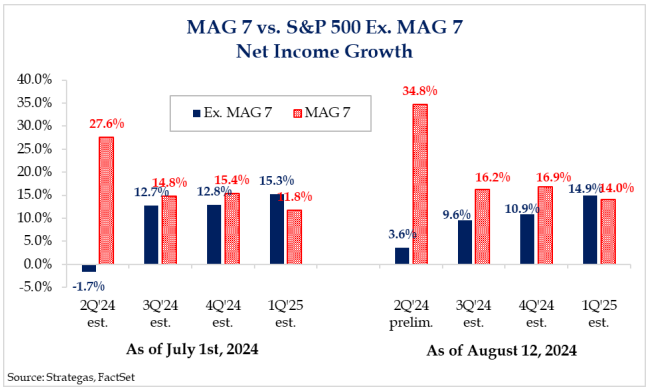

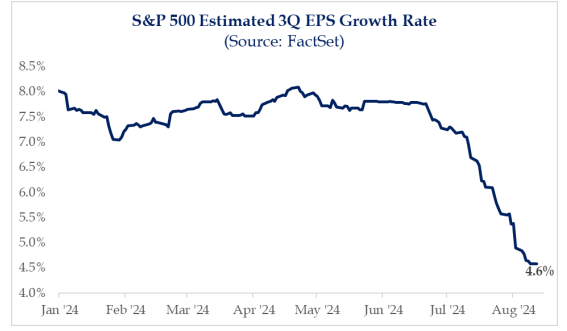

Dave: The hoped-for broadening of earnings by the “493” hasn’t yet kicked in

Dave: and despite decent results, estimates for Q3 earnings are being pulled back in recent weeks

Source: Strategas as of 08.13.2024

Source: Strategas as of 08.13.2024

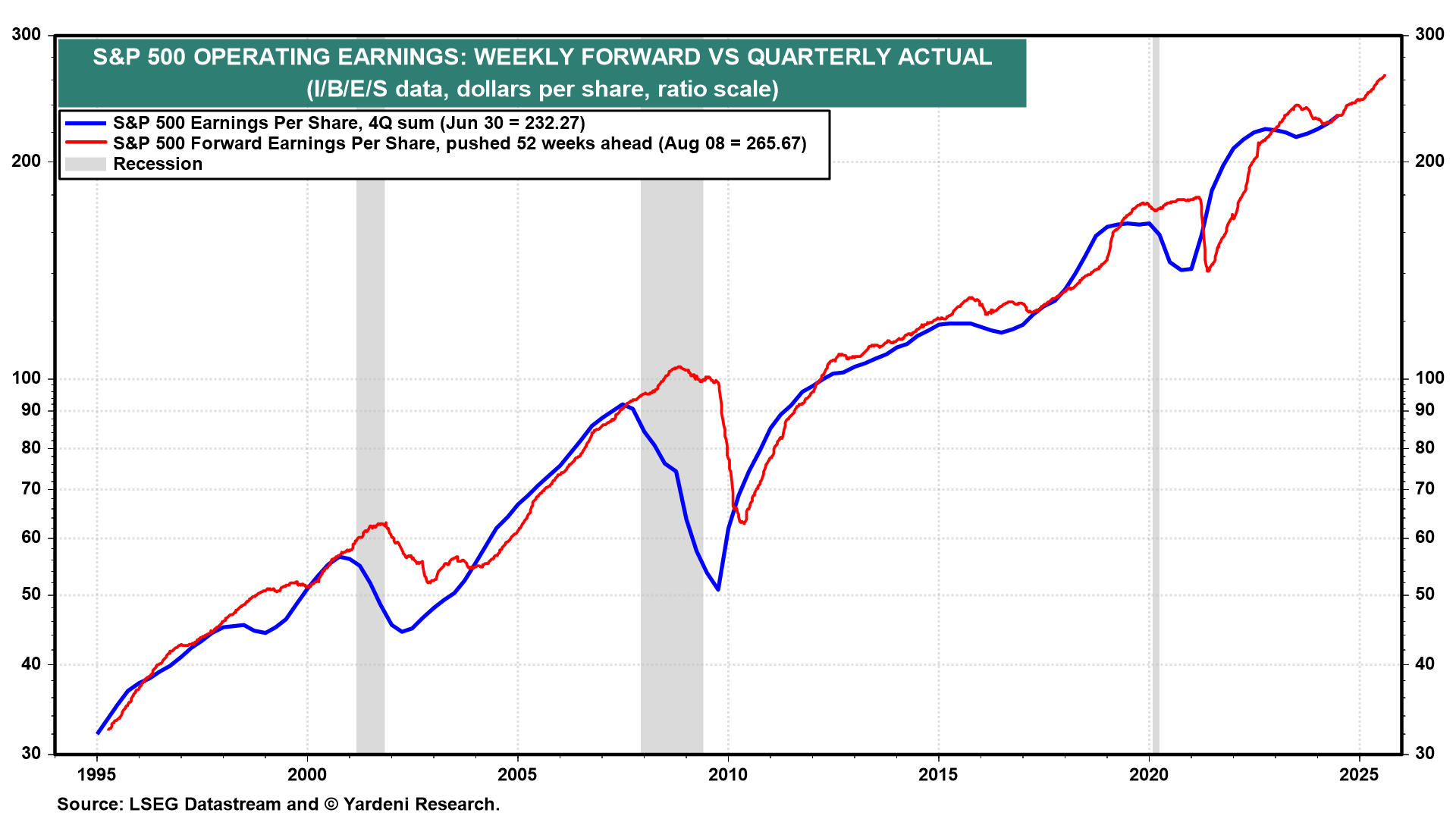

Brett: that said, the overall trend remains solidly higher and a continuation will be key for market outcomes

Data as of 08.12.2024

Data as of 08.12.2024

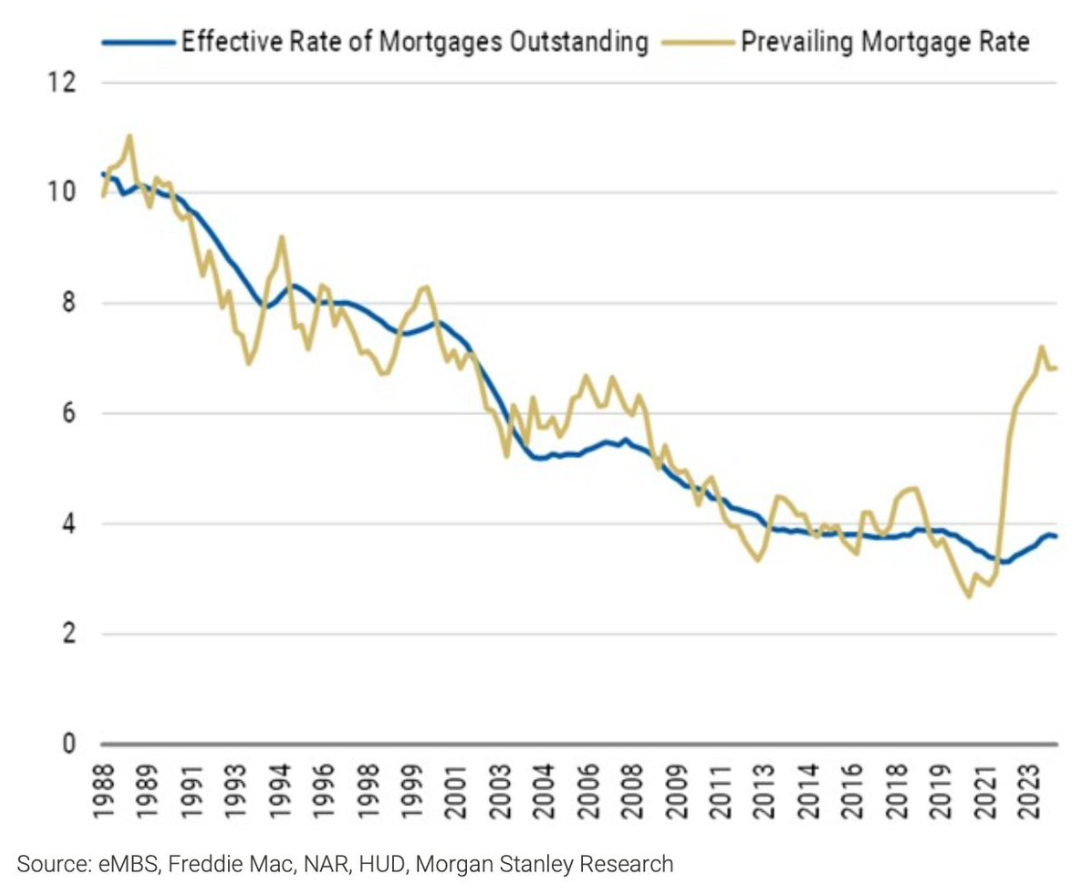

John Luke: The mostly hotly debated area of the economy be housing, where homeowners have been reluctant to give up their historically cheap mortgages

Data as of July 2024

Data as of July 2024

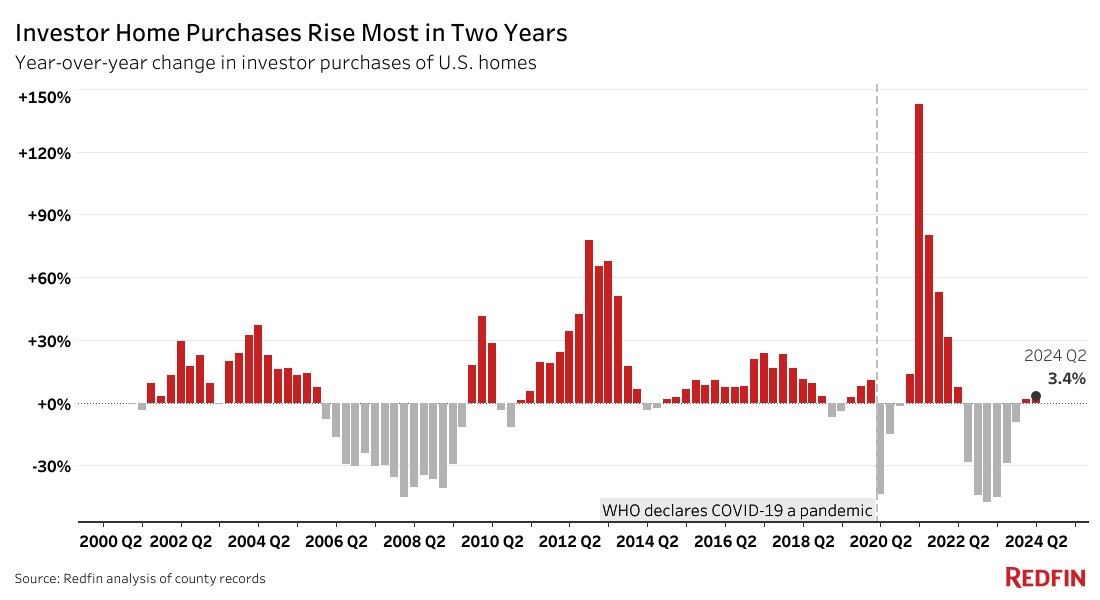

Brian: but investors have started to re-enter the market after a period of absence

Data as of 08.15.2024

Data as of 08.15.2024

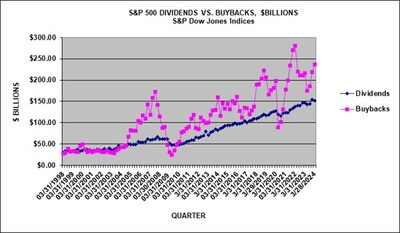

Brian: Stock buybacks have been a reliable source of price support in recent decades

Source: S&P Global as of April 2024

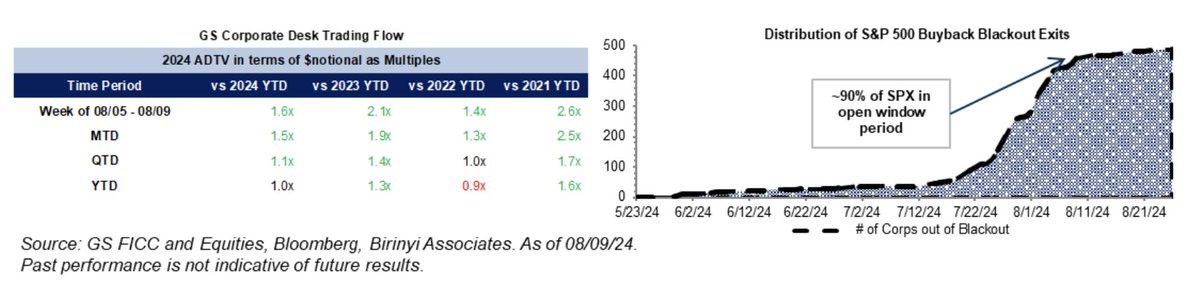

Beckham: and the quarterly buyback window just happened to reopen as stocks fell under selling pressure in early August

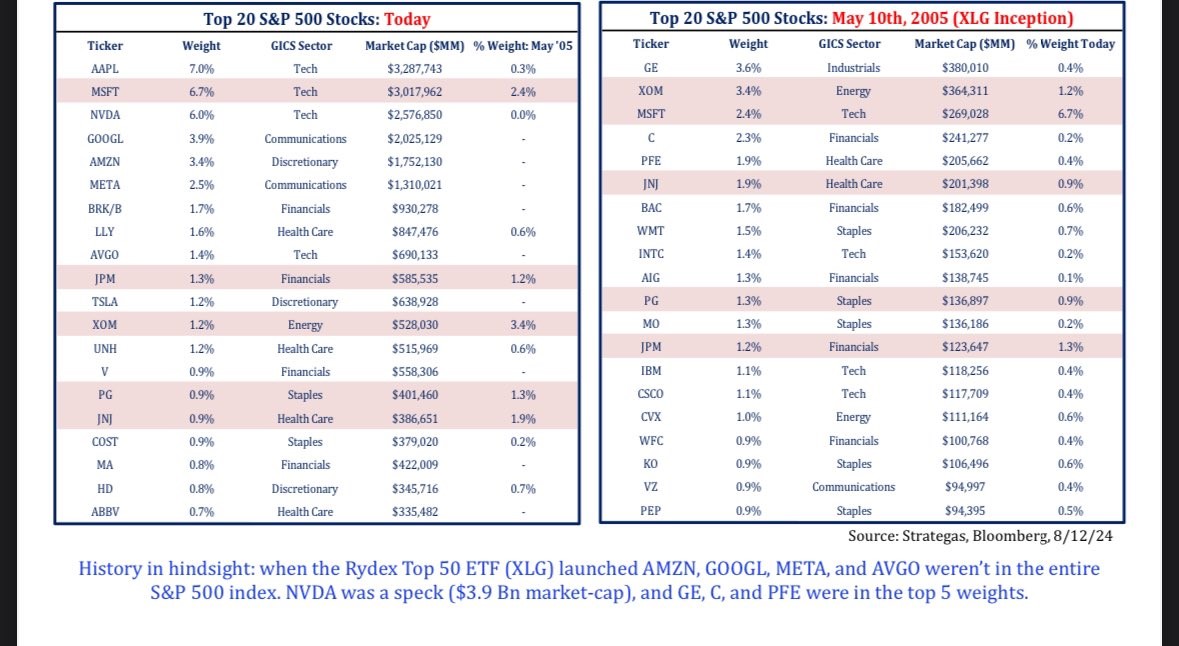

Brad: If you’re ever concerned the Mag 7 will be the only way forward for stocks, remember the only constant for markets has been change

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2408-20.