First and foremost, I hope everyone takes time to reflect on the events of 23 years ago and pray for those who lost their lives, fought for our country, risked their lives to save others, and for the safety and unity of everyone in our country. These events didn’t just make a lasting mark on our country, but also on our investment industry. One example of our bravest: The Man in the Red Bandana

Baseball and Is America

James Earl Jones passed away this past Monday. In my view, he had one of the most distinctive, powerful, emotional, and evocative voices in the last 50 years (yes, outside of Morgan Freeman). Amazingly, he overcame a stutter as a child so bad he refused to speak.

The baseball monologue in Field of Dreams is one of the greatest descriptions of the value of baseball in history. As many of the Musing’s readers know, I put on an annual Field of Dreams Wiffle Ball game at my farm. Below are a couple of photos from this past year’s event, held in August. I’m always willing to share more!

“Is this Heaven? No; it’s Lindale, OH”

Not Quite as United

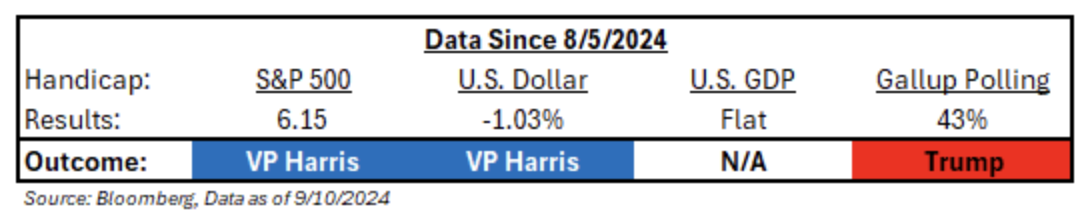

Tough shift to politics, but this is an investing blog and there are items to discuss. Let’s dig into our “Market Indicators” that have historically helped handicap the outcome:

- S&P 500 is higher in the 3-month period preceding the election = Incumbent Win,

- If the USD is in decline in the 3-months before an election = Incumbent Win,

- GDP Expansion = Incumbent Win, and

- Gallup Presidential Approval Rating > 50% = Incumbent Win

The Market and the Election

The Debate:

As of yesterday, we are 8 weeks out from the election. And, per my previous musing, the market tends to start fixating on the Presidential election after Labor Day, as the rubber tends to meet the road regarding policy expectations (even if last night was lacking this aspect).

It’s no secret that I’ve made the point that the market has already witnessed 4 “Black Swan” events over the past 6 months, so it’s hard for me to state that this debate was as consequential as the last debate. But, heading into the debate, in my opinion, the night probably mattered more for Harris than Trump, but it is important to remember that less than 15% of voters likely watched last night.

The best analogy that I heard on the debate was (in Aptus Fashion), “It’s tough to get mad at the basketball referees if you are missing open jump shots.”

Trump: There was no real argument put forward to make the race a referendum on the first four years of the Biden-Harris Administration. Trump had a real shot to frame Harris with voters still unfamiliar with her. Former President Trump missed a lot of easy jumpers last night.

Harris: In my opinion, she was evasive and vague. Her policy agenda remains unknown, but she made a great introduction to many voters since she hasn’t done many TV interviews.

It looks as though Harris has united the Democratic Party, raised all the money she will need, and convinced the public to give her a fresh look (favorability ratings up). My view has been that the honeymoon was going to come to an end at some point and voters will think about what a Harris Presidency day-to-day would be like – that’s the most important thing about the debate last night. For both candidates, their goal was to make the opponent the candidate of chaos while touting themselves as the candidate of change.

At the end of the day, there remain a number of variables that could easily tip the election at this point, including the debates: unforeseen geopolitical events, candidate statements or actions, or the proverbial “October surprise.” Said another way, it’s hard to make any investment decision based on policy at this current juncture. As I’ve continued to state, it’s tough to short this market ahead of the election due to the amount of fiscal and monetary liquidity set to buoy the market into year-end, despite the historical weak seasonality of September.

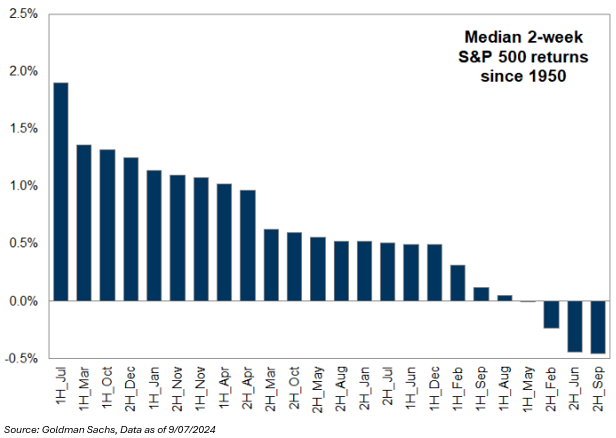

Quick Facts on the Upcoming Seasonality:

The second half of September is the worst two-week trading period of the year for the S&P 500.

Since 1928, ~100 years of data, the median S&P return is negative in the last 10 out of 11 days to close out September. The annual weakness in September can be explained by the flow of funds.

In addition, the last four September’s for S&P 500 (-4.87%, -9.34%, -4.76%, -3.92%) and NDX (-5.07%, -10.60%, -5.73%, and -5.72%) will likely bring out some recent risk-off memories of back to school trading.

As always, reach out to us if you have any questions on how our holistic allocations are prepared for both situations: 1) A liquidity boom driving the market higher, or 2) Seasonality that depresses stock valuations. See our Aptus Asset Allocation Presentation.

Focusing On Taxes:

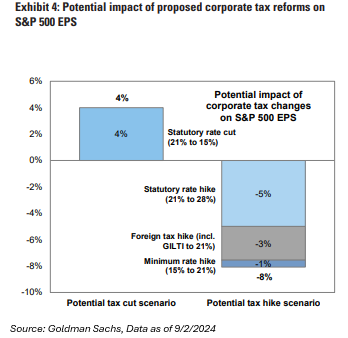

Regarding the markets, the most important thing to me is the corporate tax situation. While each presidential candidate has proposed changes to the corporate tax code, changes are not a given. Prediction markets show a substantial probability that the next US president will not have control over Congress, and campaign proposals do not always translate into legislative reality. However, if enacted, tax reform would likely shift the outlook for S&P 500 EPS relative to current forecasts. We all know that Growth rules everything around us, and tax policy can quickly dictate movement in earnings revisions.

If you are an advisor, here’s the easiest way to deflect this question on the potential tax changes: A lot of the conversation about taxes (unrealized gain tax, etc.) is all speculative because Republicans are likely to control the Senate. Republicans are likely to win West Virginia and Montana, giving Republicans the majority. This will limit the size and level of tax increases if it happens.

But, let’s dive into the weeds. The current US statutory corporate tax rate on domestic income is 21% (down from 35% in 2017), but the total effective tax rate paid by the typical S&P 500 company is 19%. Many of the individual cuts from the Tax Cuts and Jobs Act (“TCJA”) in 2017 will sunset in 2025, but the corporate tax rate will not change.

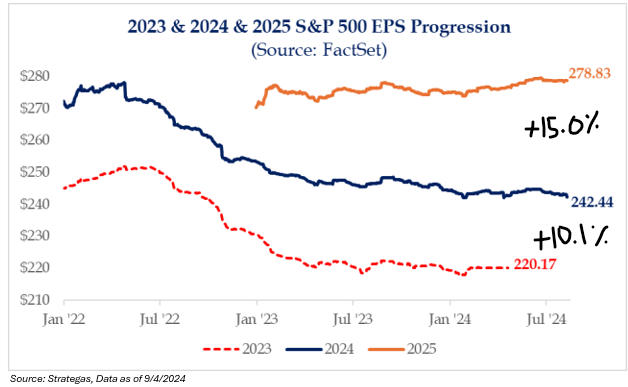

Goldman Sachs estimates that if the “domestic corporate tax rate declines from 21% to 15%, it would arithmetically boost S&P 500 earnings by about 4%. A tax hike scenario in which the rate rises to 28% would reduce earnings by about 5%. Combined with additional proposed changes to the taxation of foreign income and an increase in the alternative minimum tax rate from 15% to 21%, this scenario could reduce S&P 500 EPS by about 8%.”

Below are the current earnings growth expectations (before potential tax ramifications). Simply said, if tax policy was enacted to increase the corporate tax level, and if analyst estimates are correct, the S&P 500 could still witness positive earnings growth in 2025.

What we learned from the TCJA in 2017 was that the S&P 500 rallied by roughly the same amount as the earnings boost it ultimately received. From November 2017 to January 2018, the market rallied 10%, as earnings were expected to get a one-time boost of 11%. To me, this suggests that it is too early to make a tangible investment call solely due to taxes, as investors will prefer to wait for legislation clarity before fully adjusting portfolios to reflect any change in policy.

Heading into next year, once we finally know the winner of the election, we’ll dive more into taxes, specifically on the individual side of the ledger.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2409-13.