Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

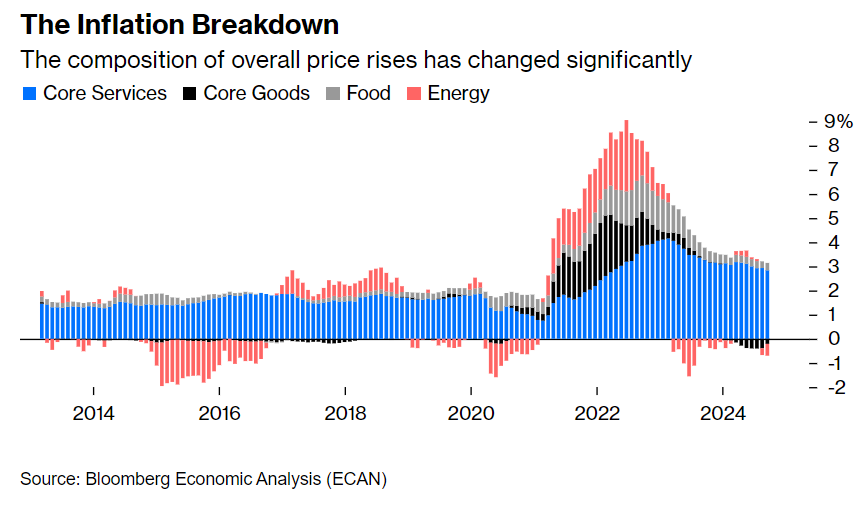

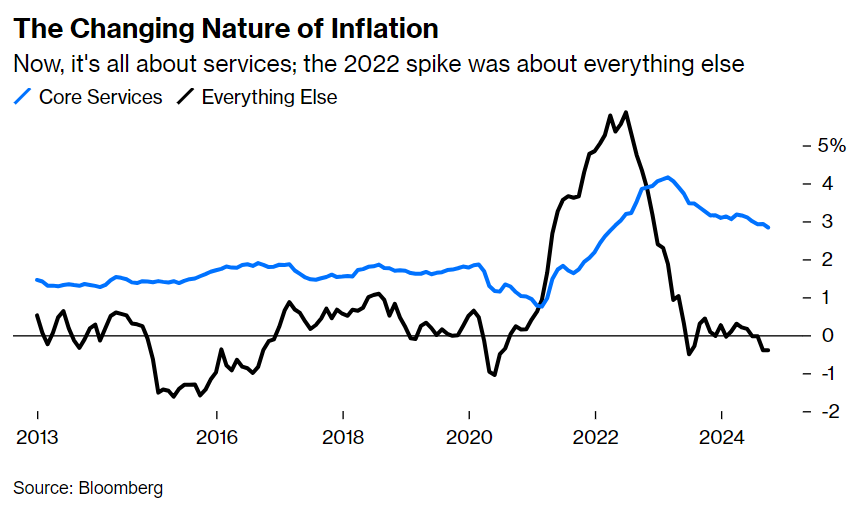

John Luke: The past few years have seen a change in the leading contributors to inflation, first goods and now services

Data as of 10.10.2024

Data as of 10.10.2024

Brett: with the overall cost of goods now flat year-over-year by government measures

Data as of 10.10.2024

Data as of 10.10.2024

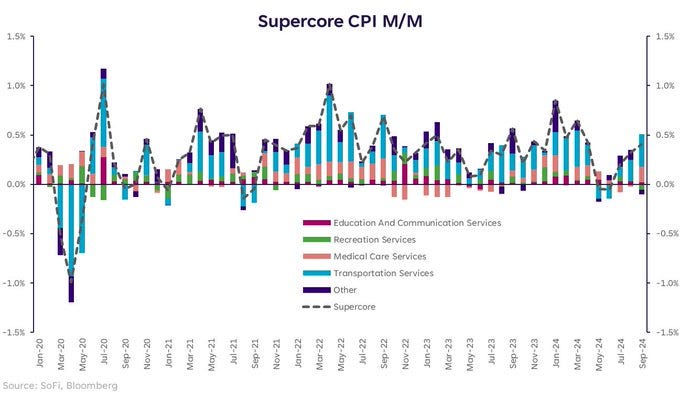

John Luke: and the “supercore” services components now re-accelerating after hopes this favored FOMC measure would track towards their 2% target

Data as of 10.10.2024

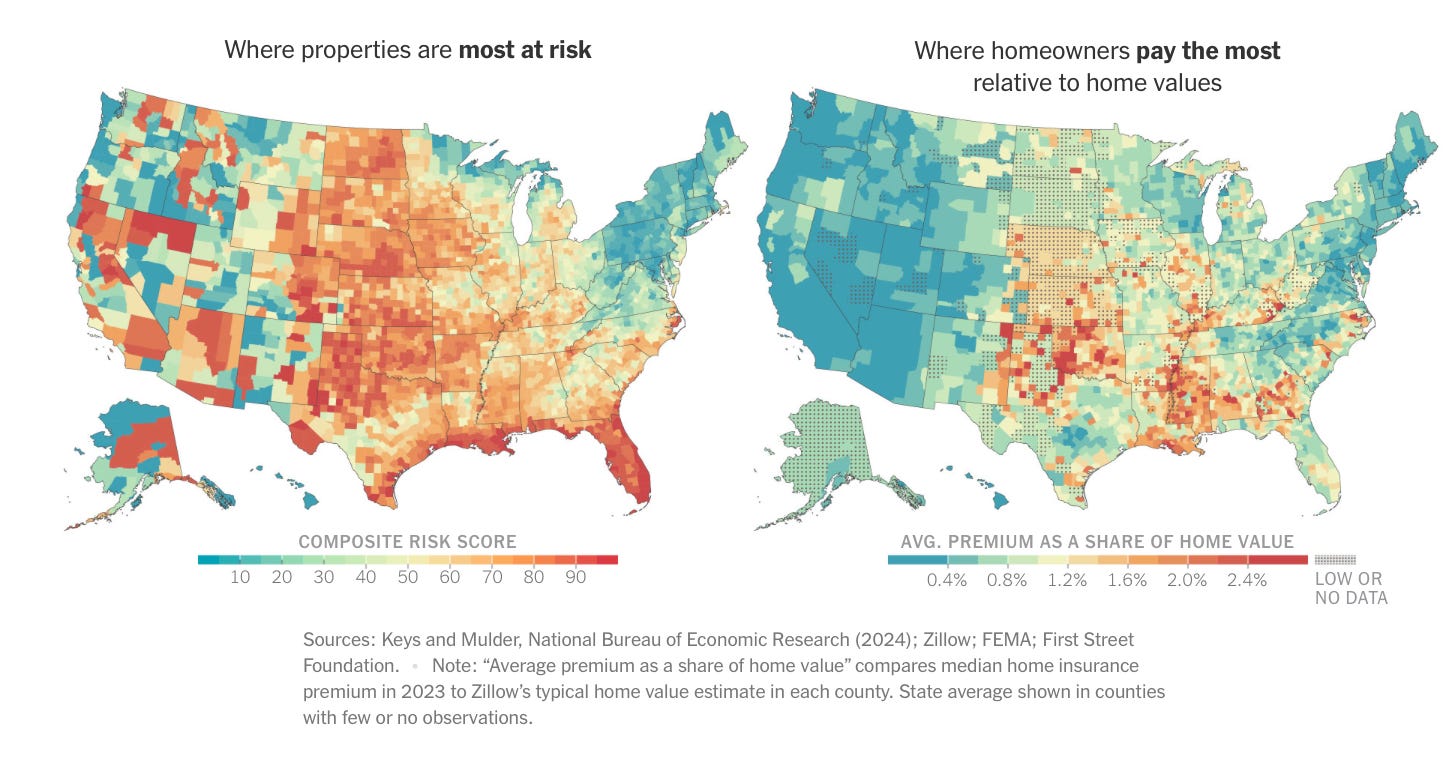

Arch: Homeowners insurance is becoming an acute pain point for consumers, even those away from the most obvious hot spots

Data as of September 2024

Data as of September 2024

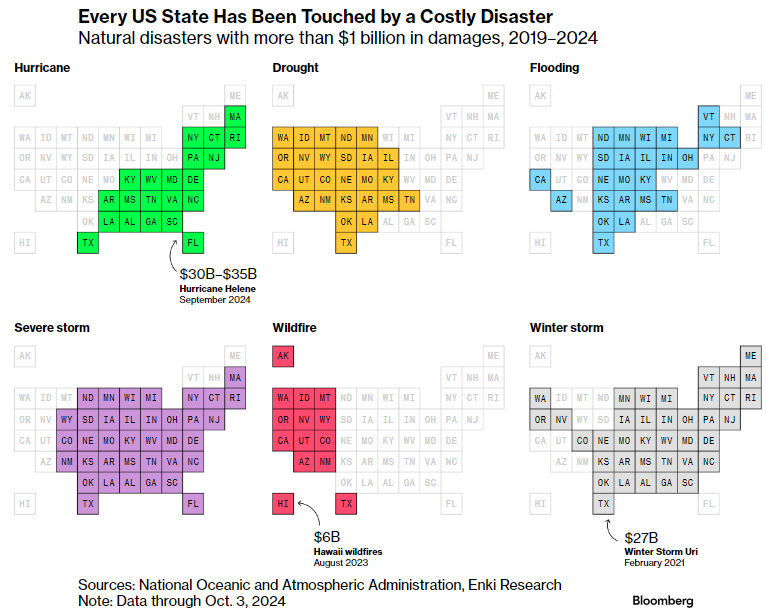

Joseph: though as we’re seeing, there are really no areas completely safe from Mother Nature’s impact

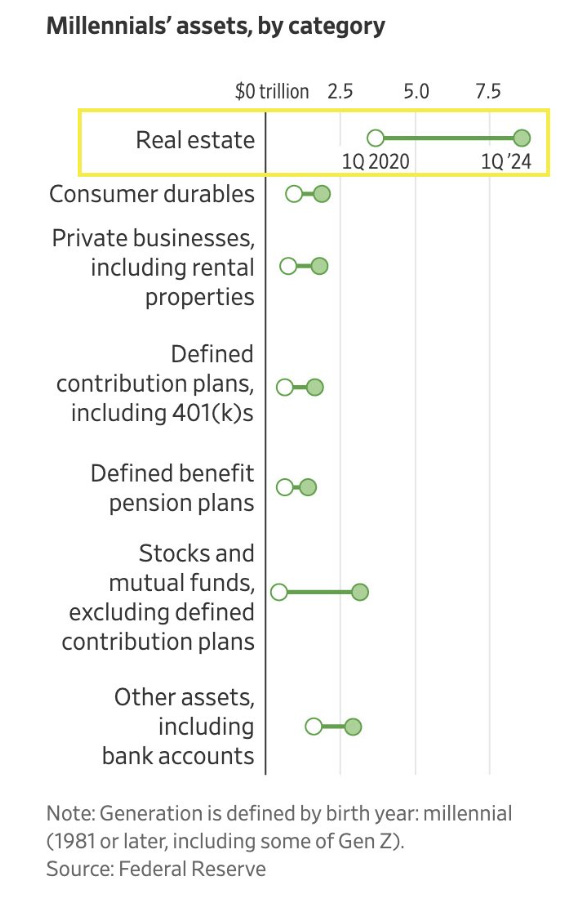

Beckham: and the value of those homes being insured has risen dramatically in the past few years

Data as of July 2024

Data as of July 2024

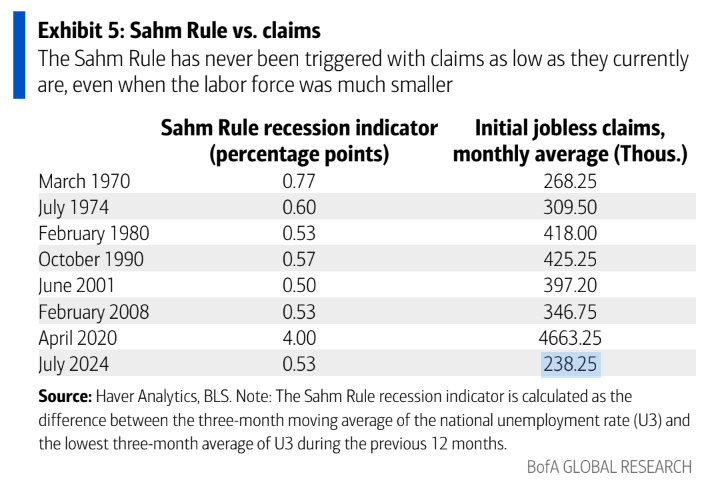

John Luke: Despite a job market that’s less tight than it was a year or two ago, the employment situation is nowhere near recession levels

Data as of August 2024

Data as of August 2024

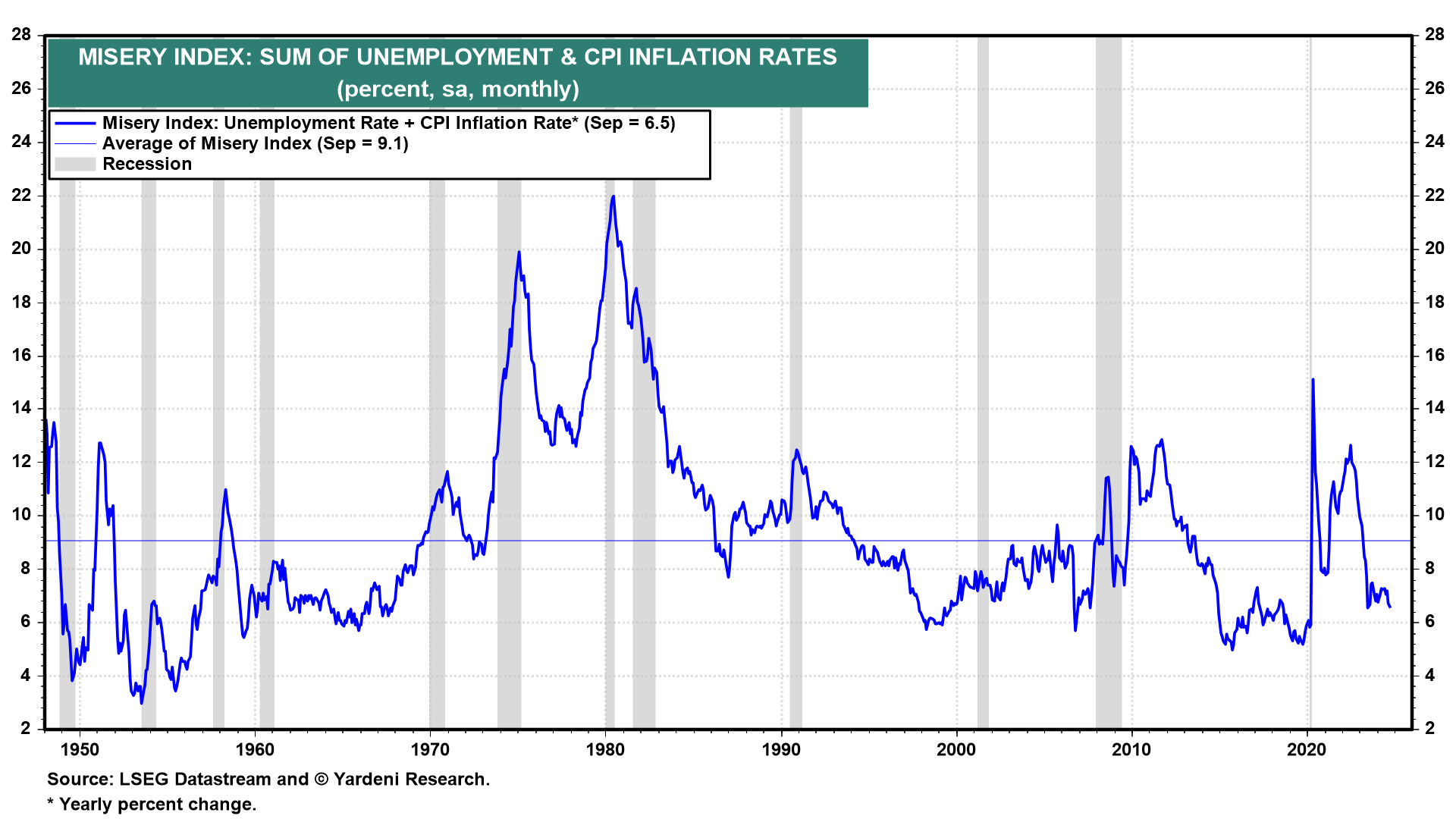

Brad: and general measures that have often driven consumer despair remain at healthy levels

Data as of 10.10.2024

Data as of 10.10.2024

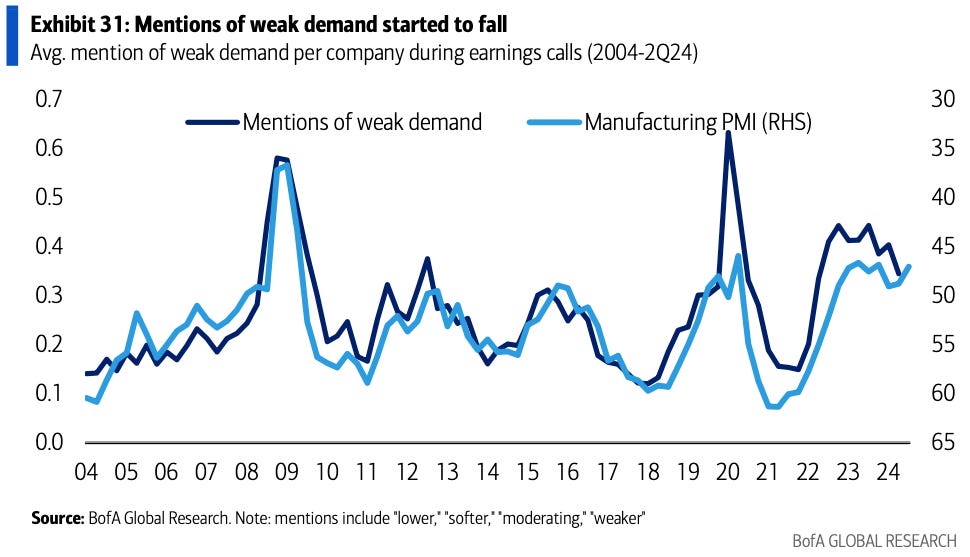

Brian: but it will be interesting to see what corporations say about the levels of customer demand

Data as of July 2024

Data as of July 2024

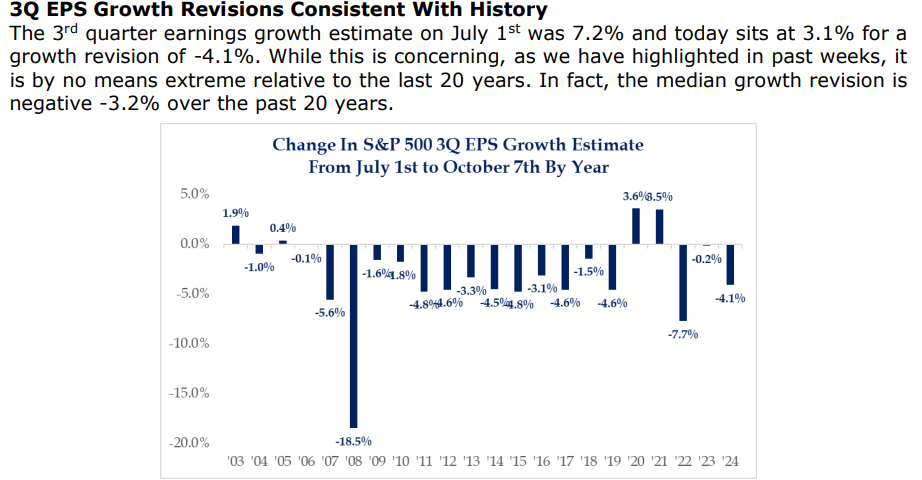

Dave: In typical fashion, Q3 earnings estimates have been falling throughout the quarter

Source: Strategas as of 10.07.2024

Source: Strategas as of 10.07.2024

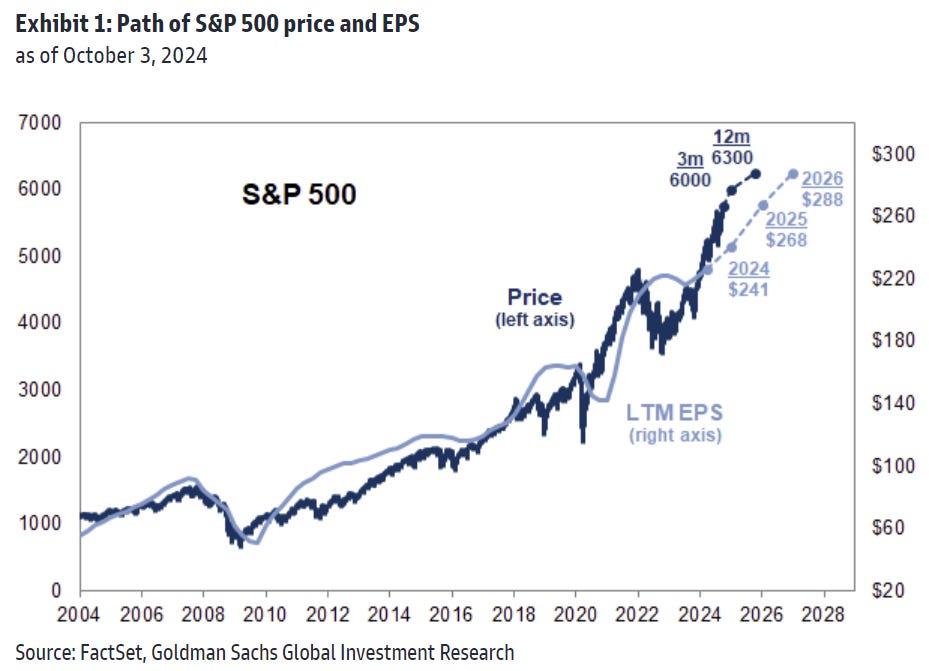

Brad: though that’s not stopping strategists from lifting estimates into 2025 and 2026

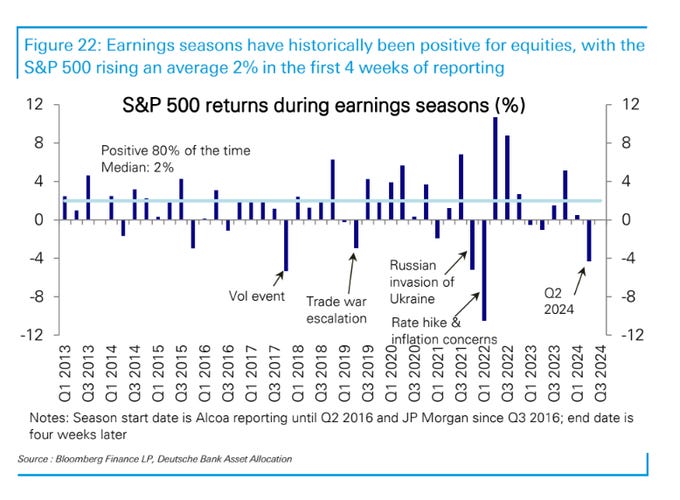

Joseph: also notable, stocks have a history of rising during this early phase of earnings seasons

Data as of July 2024

Data as of July 2024

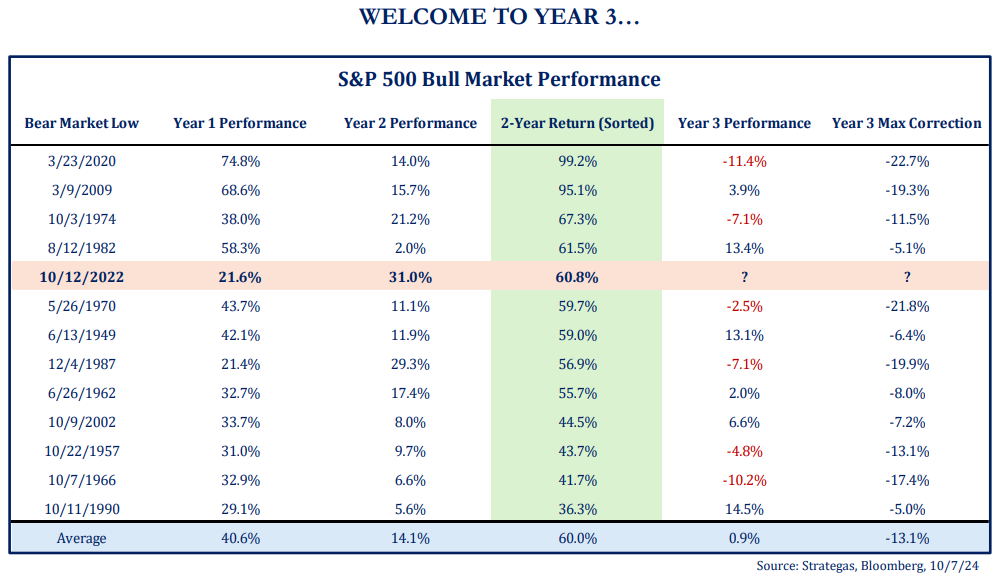

Dave: We’re just about two full years into this bull run, one of the better in recent times

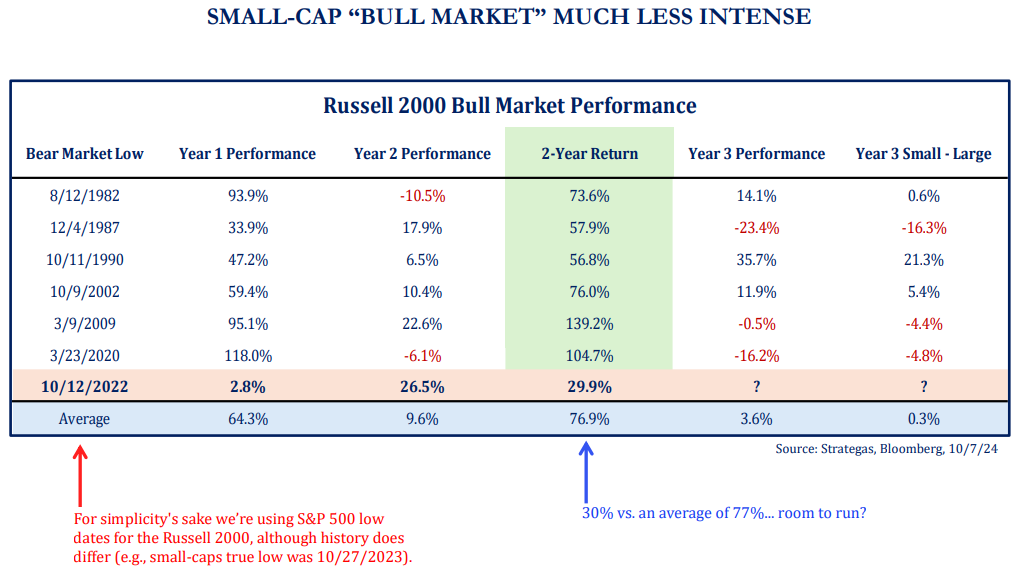

Dave: though as we all know, small caps have been a serious laggard in this one

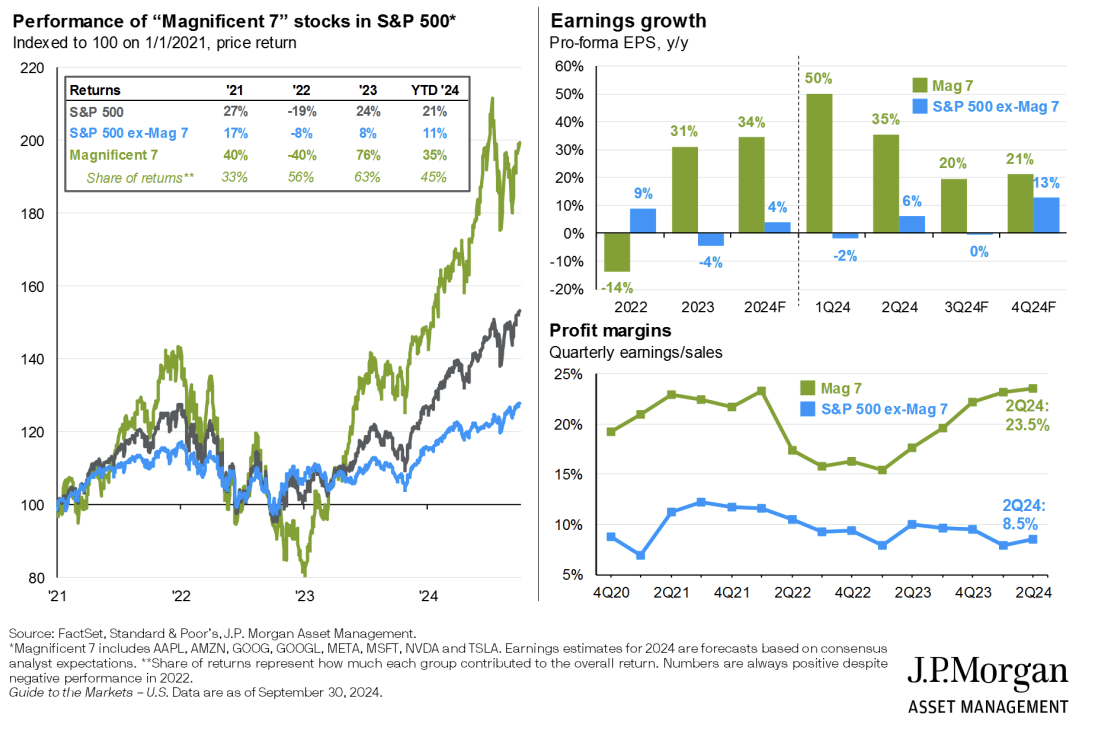

John Luke: On the other end of the spectrum, the biggest of the big have had huge gains backed up by business fundamentals

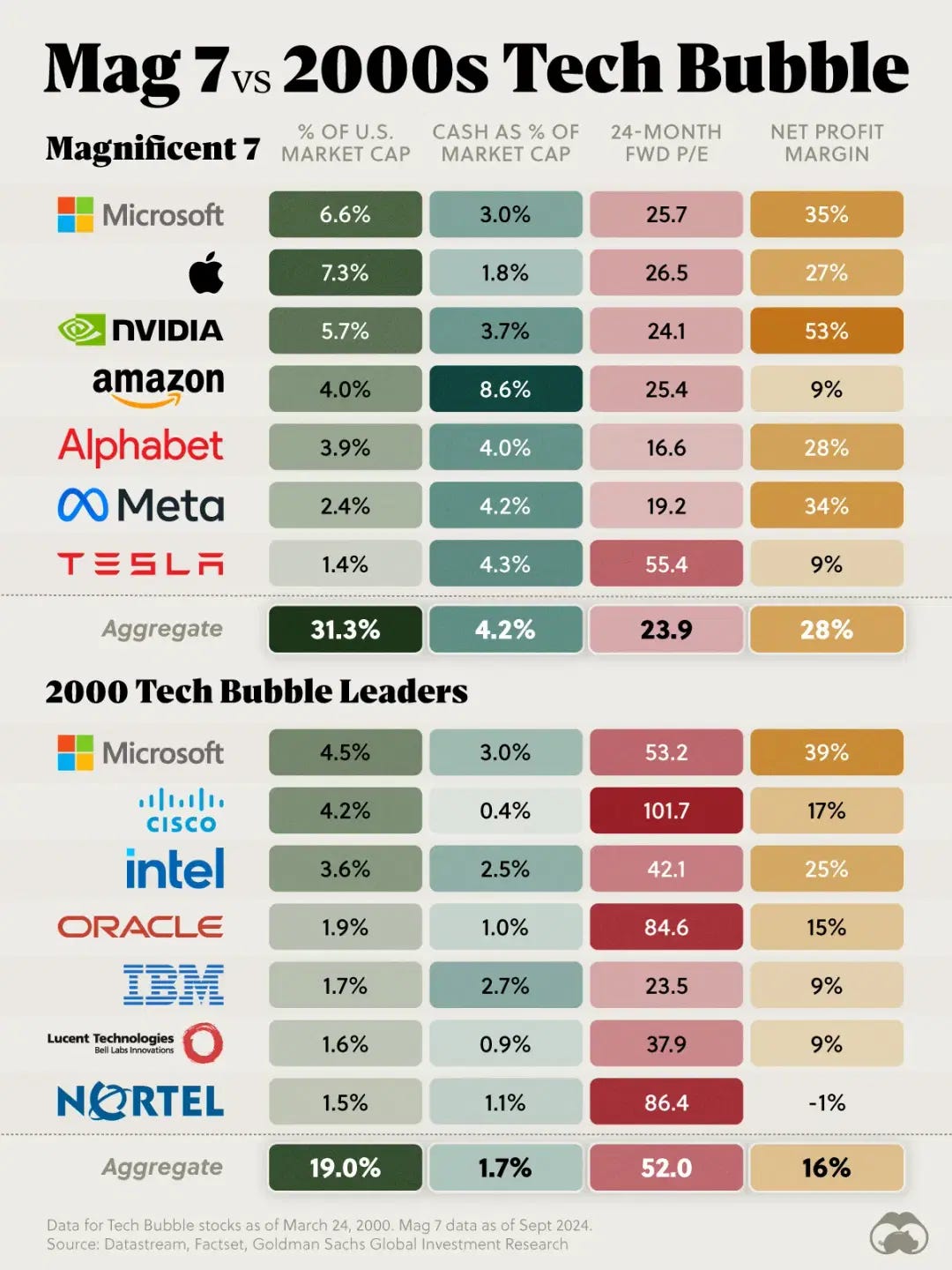

Arch: and despite comparisons to the dot-com bubble, those fundamental measures don’t illustrate similar levels of crazy

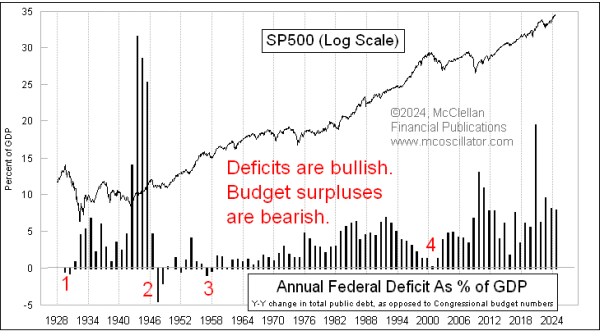

JD: We talk about this a lot; the way to protect against government spending is by owning more risk assets, with guardrails

Data as of September 2024

Data as of September 2024

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2410-22.