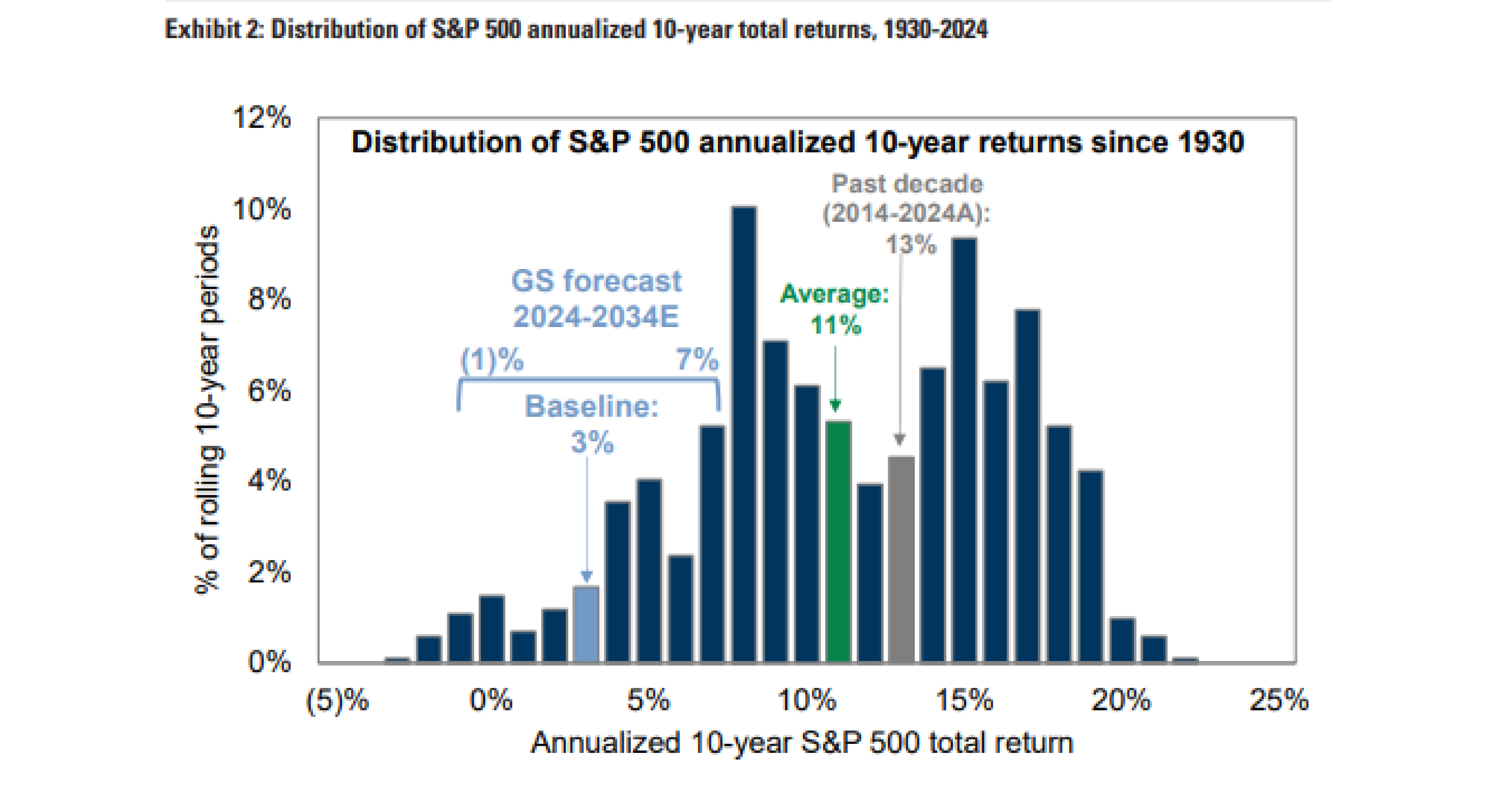

We’ve continued to speak to the fact that the market is witnessing a “right tail” event, as the S&P 500 is +40%+ since the recent market bottom of 10/27/2023. Yet, right tails occur more than you think. If you zoom out to a rolling 10YR timeframe, the current period hasn’t been as much of an outlier as one would think.

Source: Goldman Sachs as of 10.21.2024

Source: Goldman Sachs as of 10.21.2024

The 13% annualized stock market return during the past ten years exceeded the long-term average of 11%. However, the distribution of 10-year returns since 1930 has not been symmetrically distributed. Instead, it exhibits a modest left tail reflecting stretches of poor forward equity returns during the 1930s, 1960s and the start of the 2000s. Conversely, periods of strong and sustained forward equity returns throughout the 1940s, 1950s, and 1980s are reflected in the sizable right portion of the return distribution. This historical distribution reflects the negative skewness generally observed in equity returns (a longer left tail than right tail with the bulk of observations falling above the mean) and excess kurtosis (“fat tails”) compared with a normal distribution

We are officially two weeks away from the Presidential Election – I’ll have a musing out next week on this topic. Hit me individually if there is anything that you’d like me to touch on.

Q3 2024 Earnings Preview

Let’s start with the bigger picture and then work our way down to the upcoming quarter:

- S&P 500 Annual EPS

- S&P Q3 2024 EPS

- The Margin Story

- Are Earnings Broadening Out?

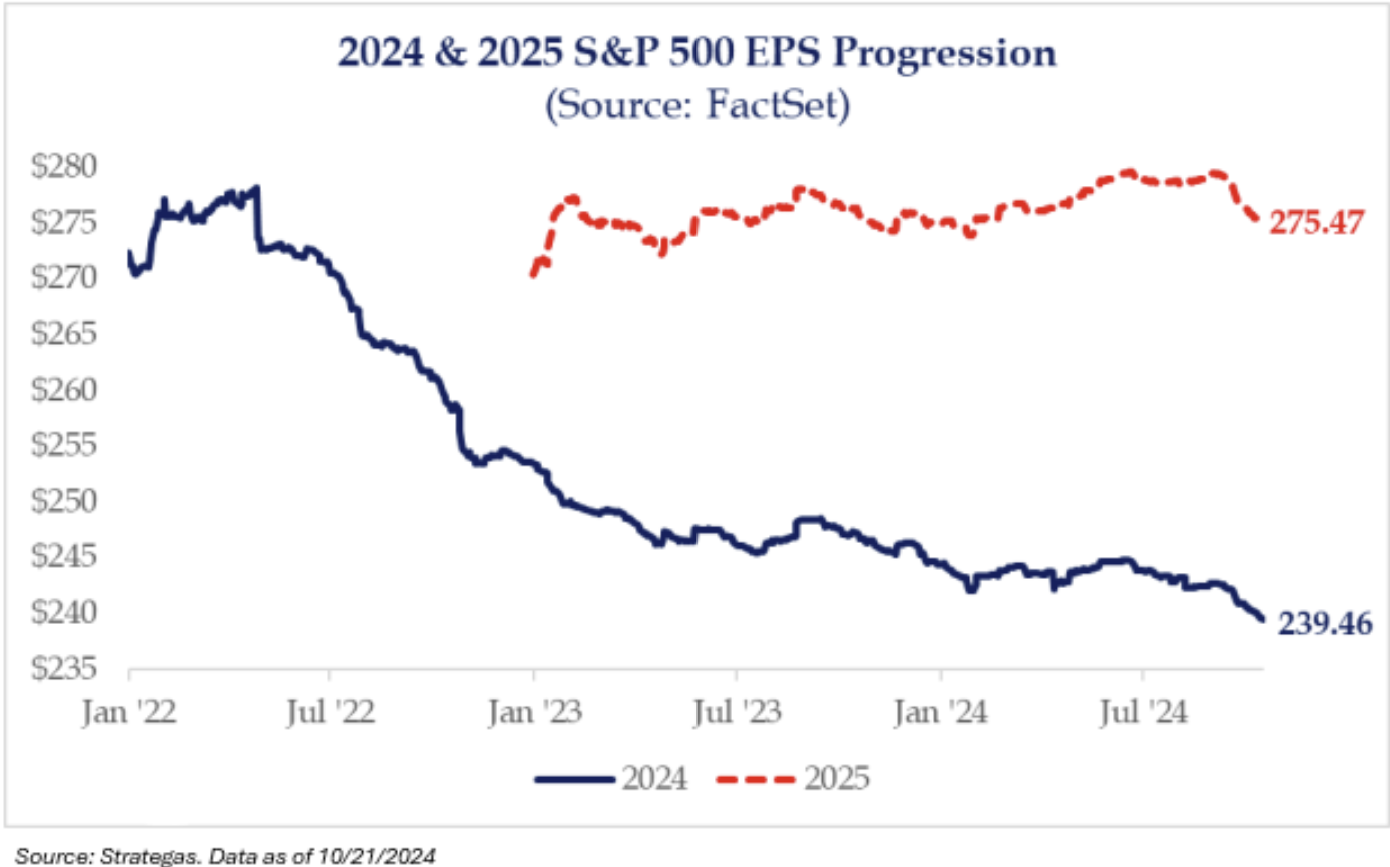

S&P 500 Annual EPS

Annual EPS continues to fall for CY 2024, due to Q3 expectations (more on this below), but the growth rate of 15% remains the same for next year. Both the 2024 and 2025 annual EPS figures have seen notable revisions lower over the last two weeks with the 2024 number now sitting at ~$240 and the 2025 EPS figure sitting at $276. Since the estimates have moved down in lockstep, the growth rate for 2025 remains near 15%.

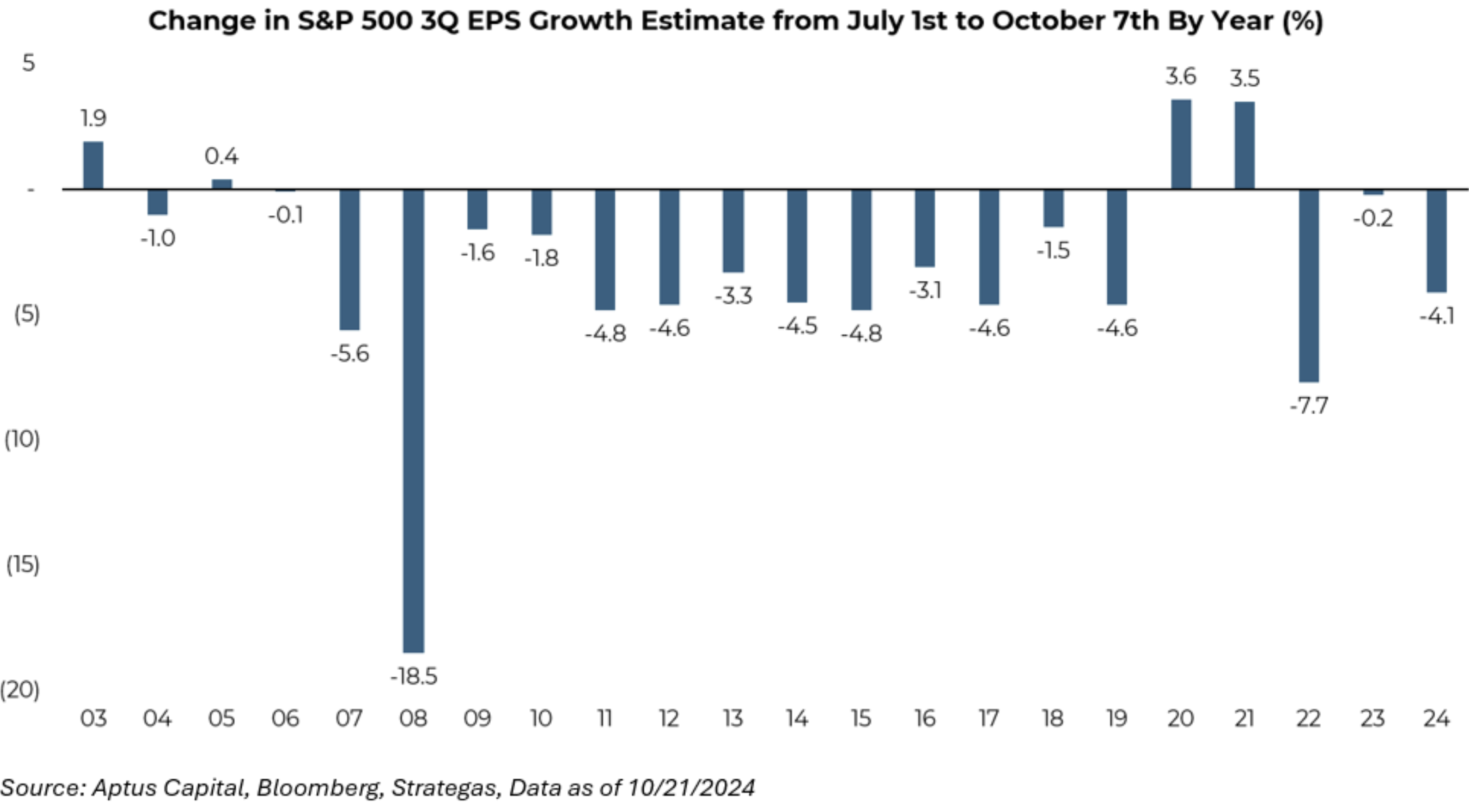

S&P 500 Q3 2024 EPS

It’s no secret that earnings expectations come down throughout the year – that’s normal. And this quarter is no exception. The 3rd quarter earnings growth estimate on July 1st was 7.2% and today sits at 3.1% for a growth revision of -4.1%. While this is concerning, it is by no means extreme relative to the last 20 years. In fact, the median growth revision is negative -3.2% over the past 20 years.

During this quarter’s earnings, we should get a little more guidance into next year, as investors will be focusing on a few things:

- Management teams tend to revise current year earnings guidance more often during Q3 than any other quarter, as the year is 75% complete and they have a more clear picture of where results will shake out

- Management teams will begin to give guidance and commentary for the following year,

- Investors will be looking to Q3 results for a signal about the outlook for corporate spending. S&P 500 cash spending grew by 15% YoY in 1H 2024. However, the top 10 S&P 500 spenders increased cash spending by 36% YoY in 1H 2024, while the other 490 stocks increased spending by a more modest 7%. Looking into 2025, cash spending will likely broaden, as the gap in earnings growth between mega-cap tech and the median stock is expected to narrow and capex spending growth among the hyperscalers is likely to decelerate.

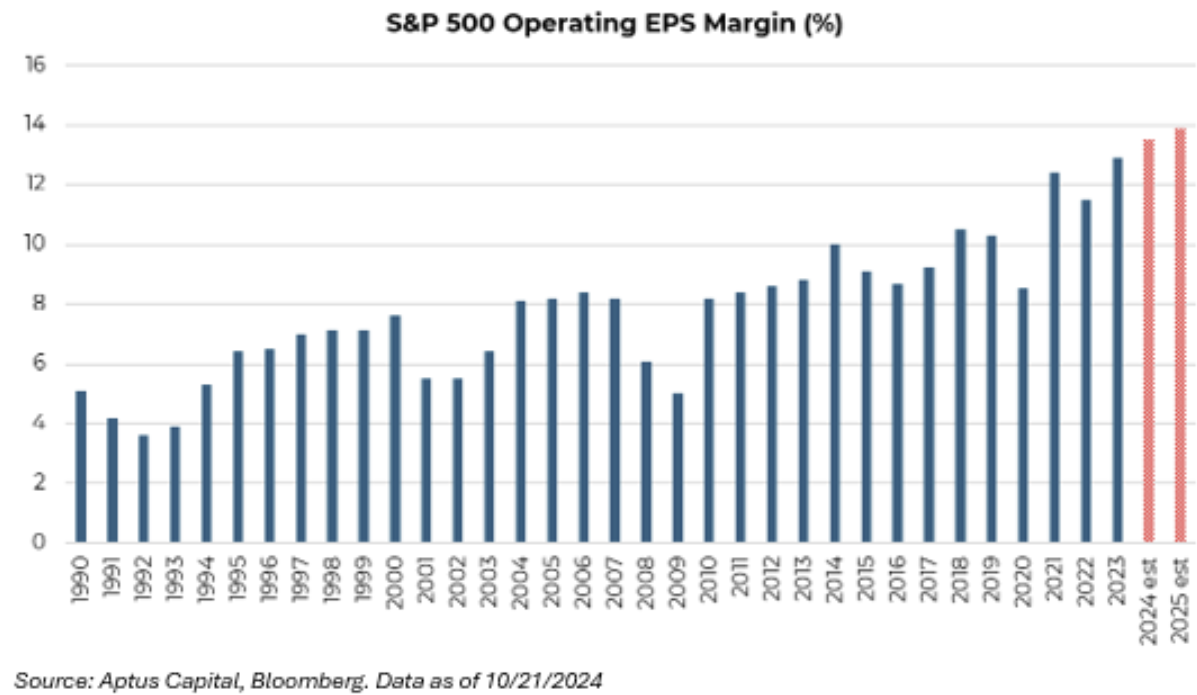

Focus on Margins

This is where investors should be focusing their attention. If someone dissects the 15% EPS growth for 2025, they’ll realize that 5% is coming from top-line (revenue) growth and that the remainder (10%) is coming from margin expansion. In fact, if this margin profile is achieved, it will be one of the highest margin profiles for the S&P 500 ever. This fact alone makes people question the earnings growth. But, the large-cap domestic market of today is very different from 40 years ago. The market is more of an operating leverage juggernaut. Said another way, the market can see economies of scale on earnings growth if revenue growth remains healthy and that one input of revenue growth will create > 1 input of earnings growth.

And this is exactly what is happening. Looking at margins over the next 12 months, much of the indexes’ elevated levels can be attributed to the technology sector. Tech operating margins are expected to reach an all-time high of 33%, and they continue to climb. This alone is allowing the market to trade at a historically high valuation.

A Broadening Market

If you’ve heard any of our equity commentary from this quarter, it’s that the market has continued to find new highs, off of different “whys”. Meaning, that during the past quarter, the market has started to broaden out, as the more cyclical and rate-sensitive areas of the market have started to outperform the tech-proxies (i.e., Magnificent Seven).

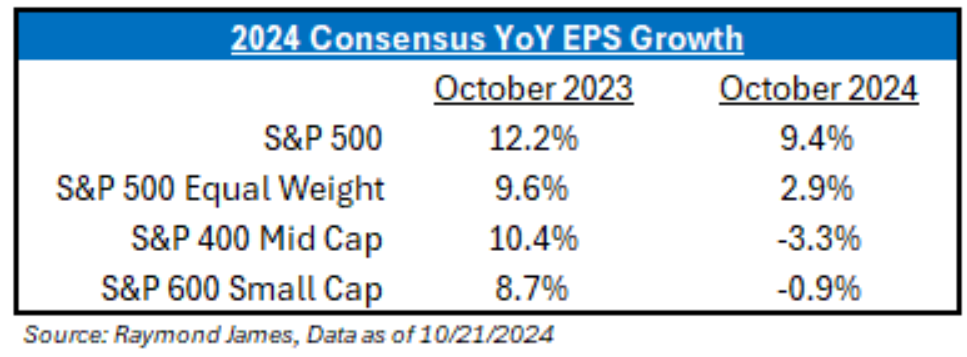

But the broadening is more of a narrative than a fundamental reality at this point. No investor would argue that the market has not been in a bull rally over the past year, but it hasn’t been a bull market for EPS. As of today, it looks like Small- and Mid-Cap indices will have lower EPS YoY in 2024, and S&P 500 Equal Weight will only be up just slightly.

This is something that we will be keeping an eye on throughout the quarter, as we have a stellar small cap PM team that keeps their ear to the ground in this space.

As always, please reach out if you have any questions.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2410-27.