Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

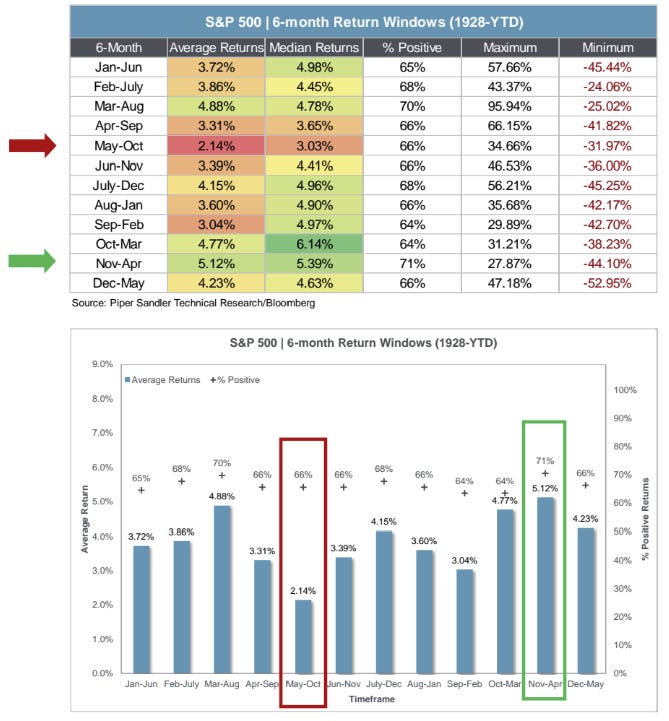

Brian: We’re in the strongest time of the year, and stocks aren’t letting anyone down

Data as of October 2024

Data as of October 2024

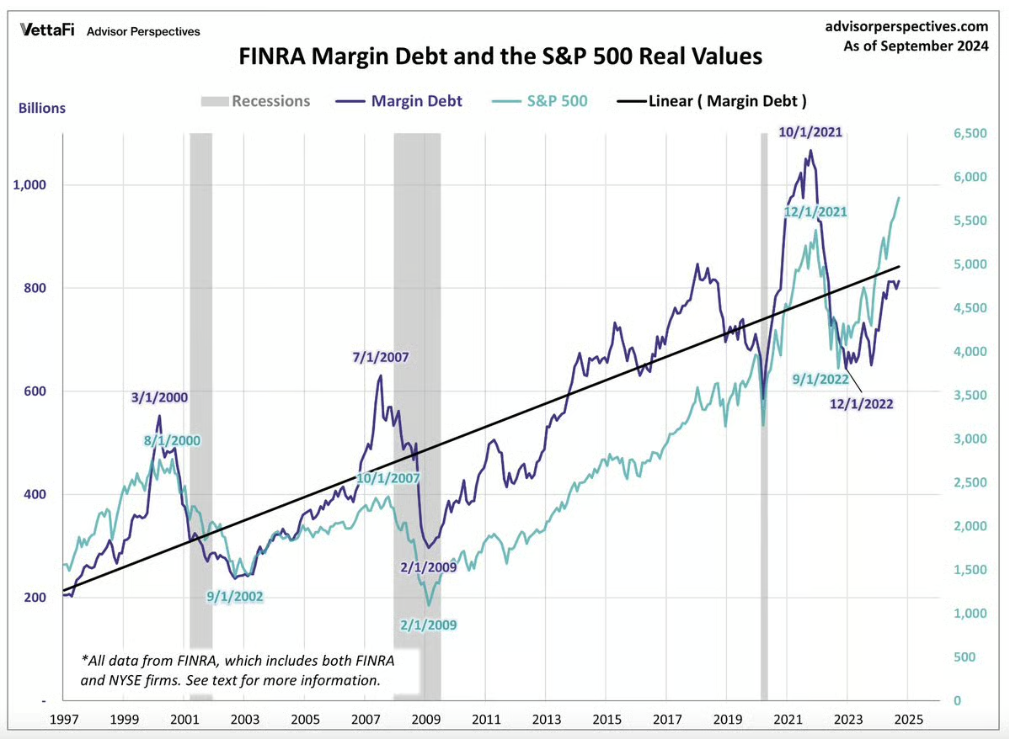

Brett: and despite recent success, equity investors are much less tied to margin debt than they were in the post-COVID rally

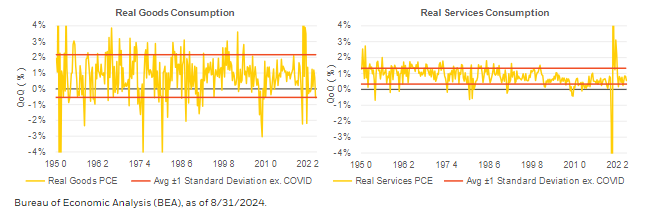

Brad: The US economy has become more tied to services than goods in recent years, resulting in less volatile swings

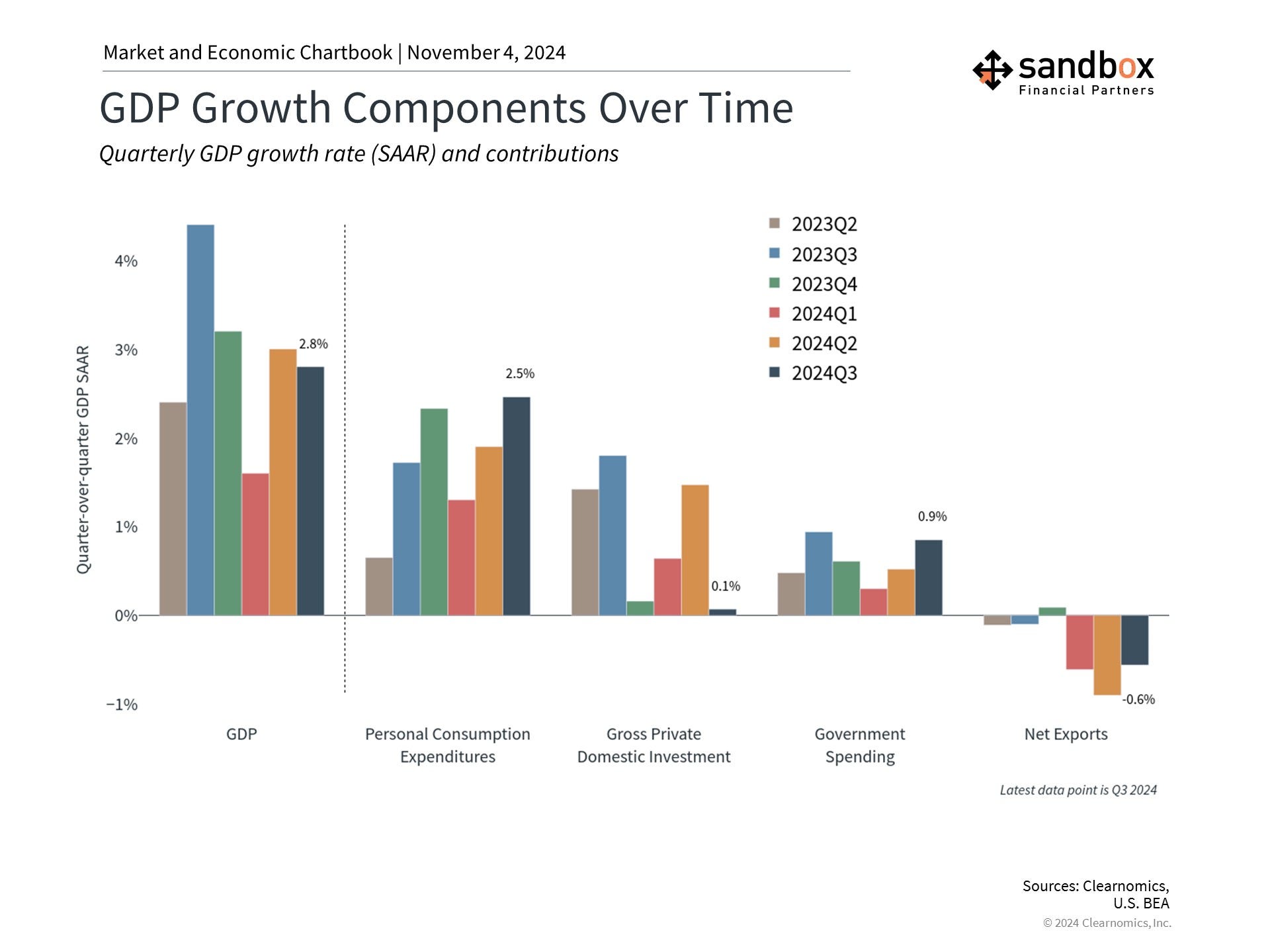

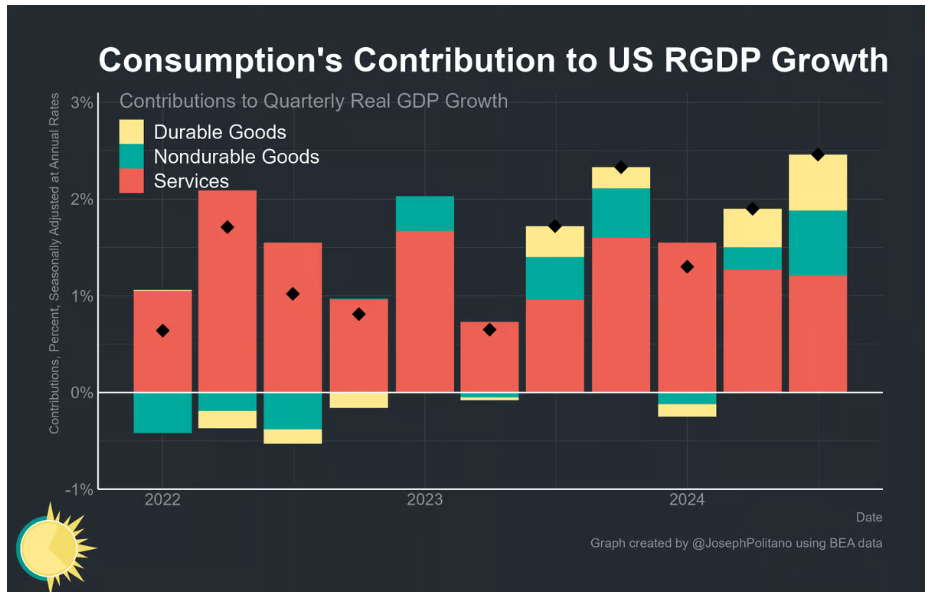

Beckham: and the U.S. consumer remains a steadying force

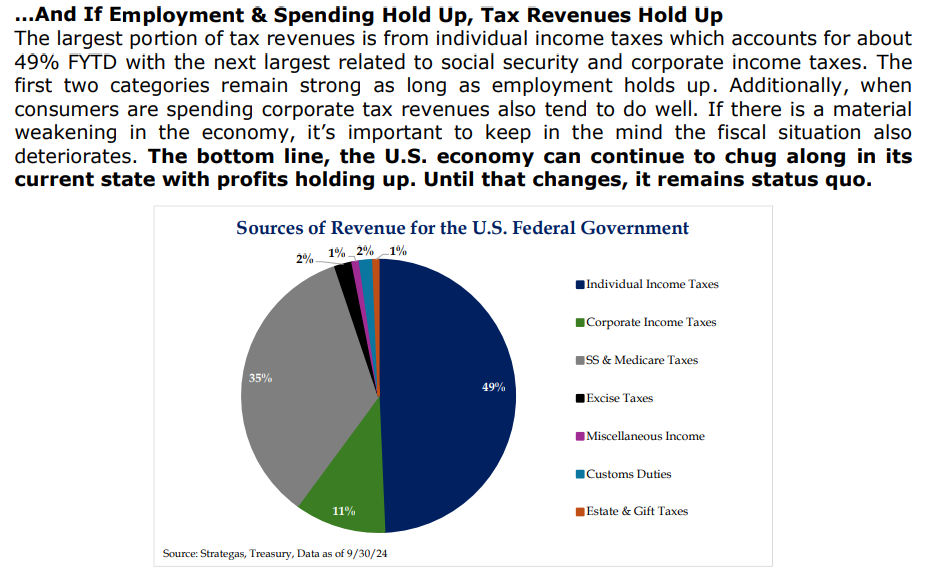

Dave: As long as income tax collections from those consumers remain strong, it’s hard to see widespread difficulties in the economy

John Luke: and right now, individual consumption of services shows it to be a steadying force

Data as of 10.28.2024

Data as of 10.28.2024

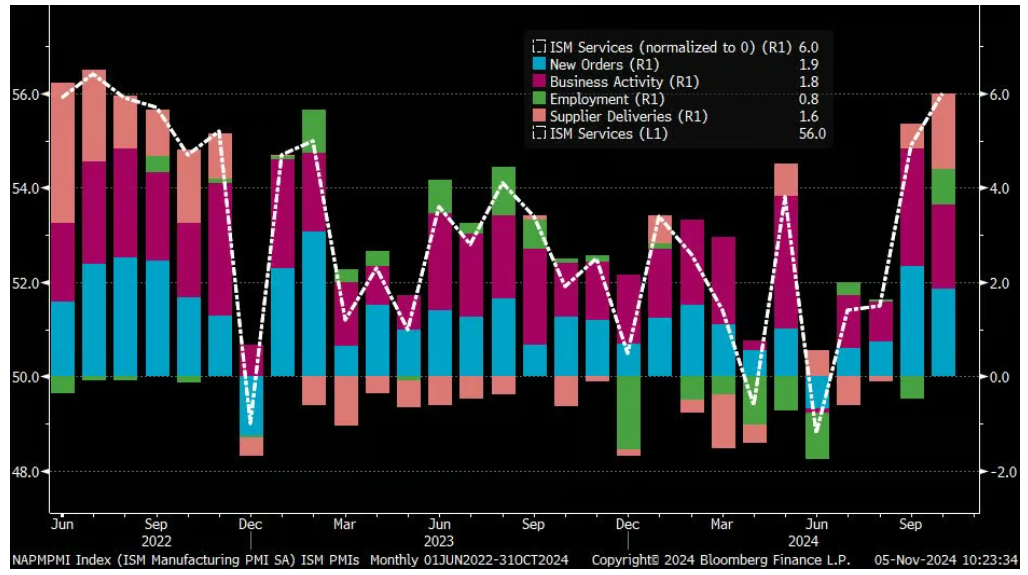

Dave: Not only is this spending happening at the consumer level, but corporate buyers are also feeling good about future deliveries

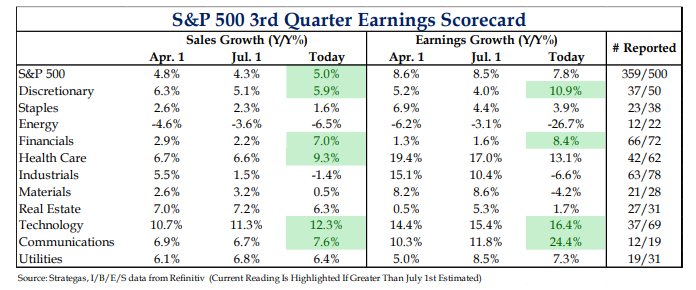

Source: Strategas as of 11.05.2024

Source: Strategas as of 11.05.2024

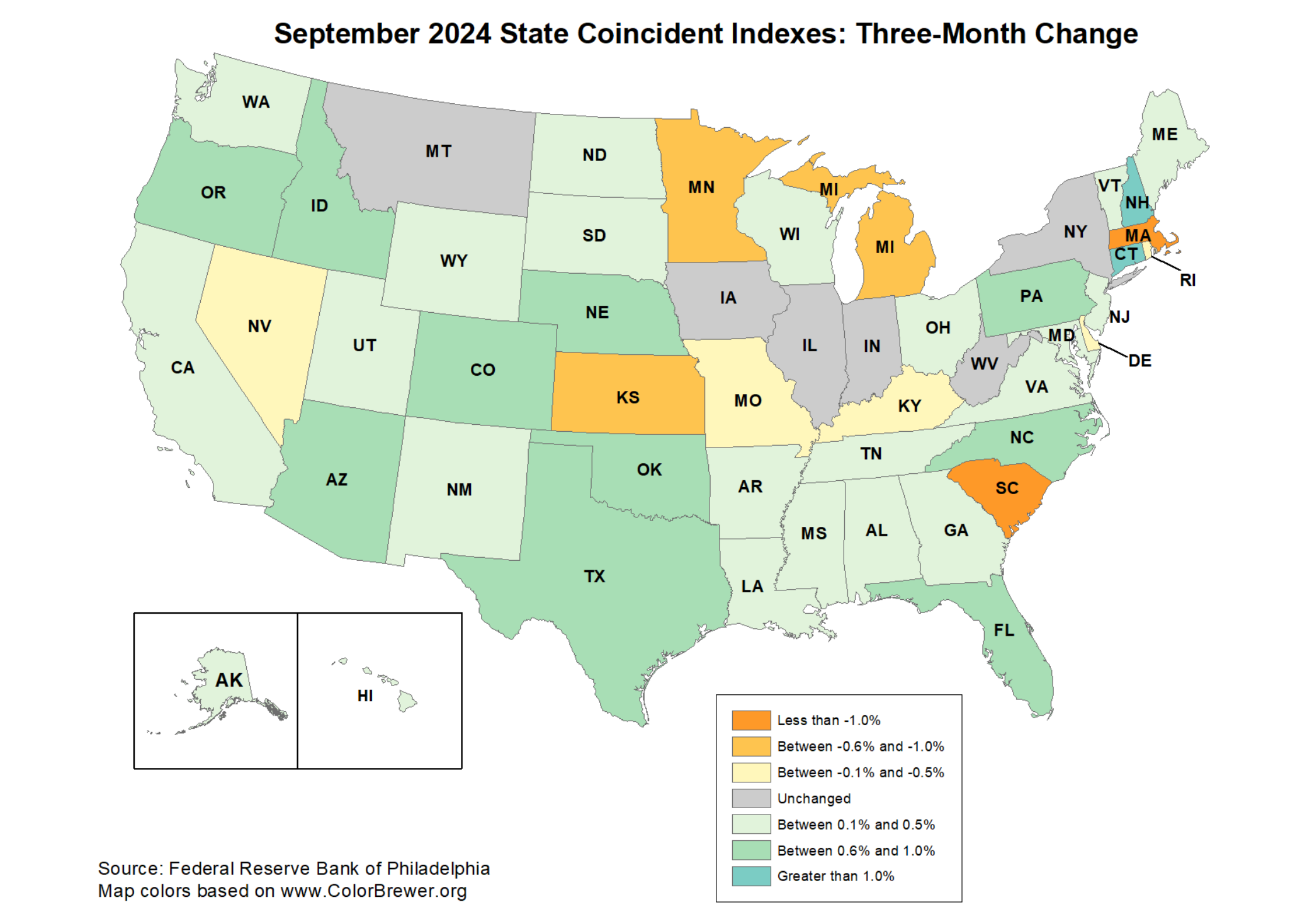

John Luke: and the strength has been pretty broad across most parts of the country

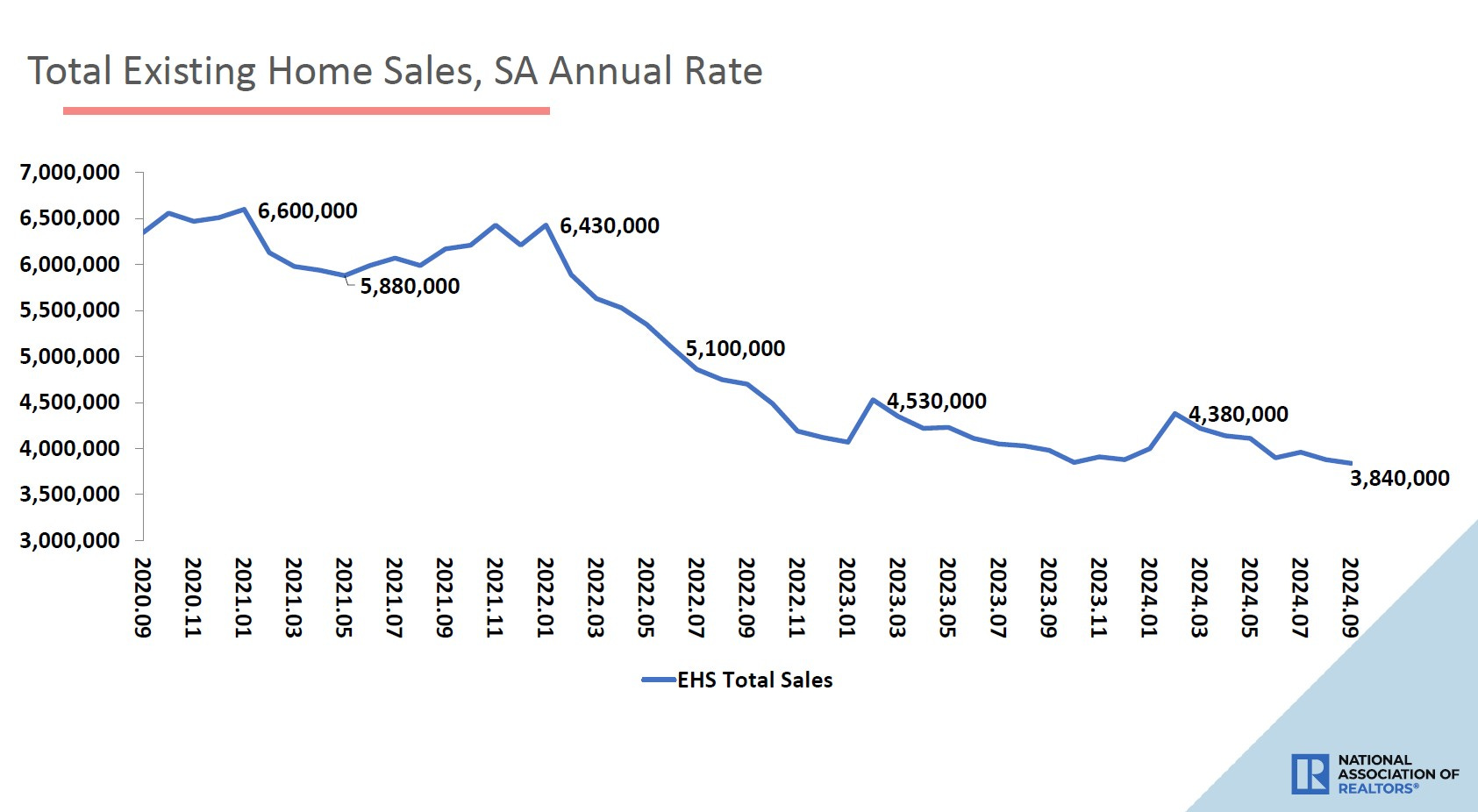

Brad: The one area of consumer weakness has been in the home resale market

Data as of October 2024

Data as of October 2024

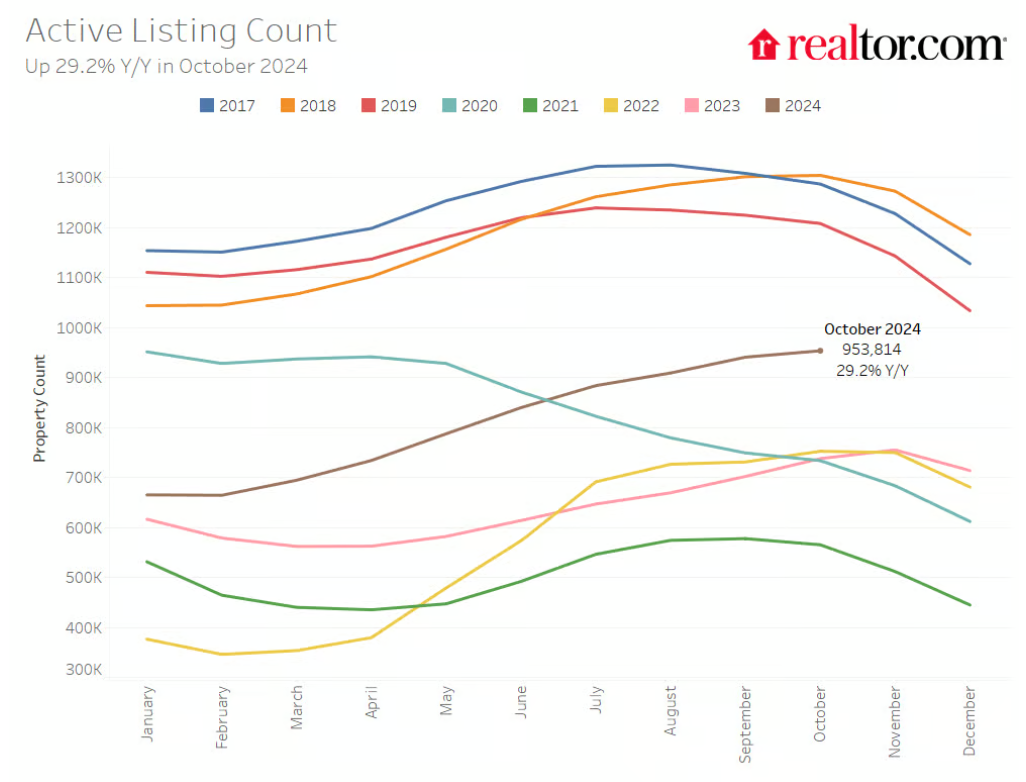

JD: with inventories starting to rebuild after a period of historically low listings

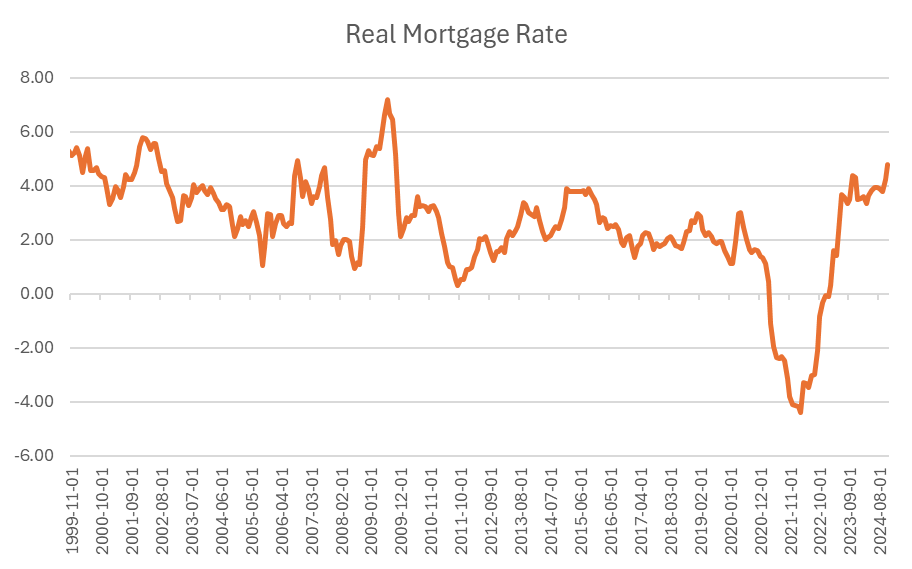

Brian: and potential buyers still anchoring to the absurdly low mortgage rates being offered in the post-COVID period

Source: Aptus via FRED as of October 2024

Source: Aptus via FRED as of October 2024

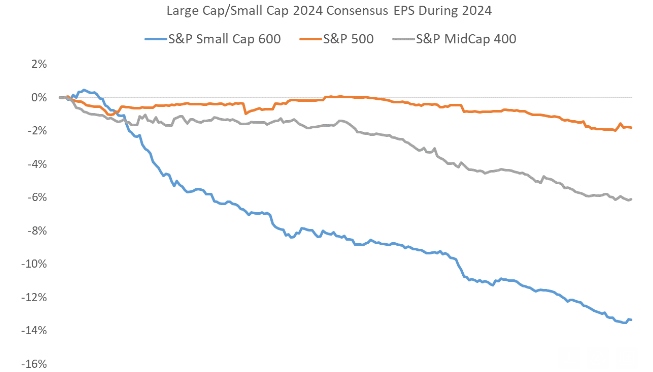

Dave: Q3 earnings season is coming to an end, and for the most part large-cap companies have performed better than expected a few months back

Dave: but the outlooks for smaller companies have not been nearly as strong

Source: Raymond James as of 11.07.2024

Source: Raymond James as of 11.07.2024

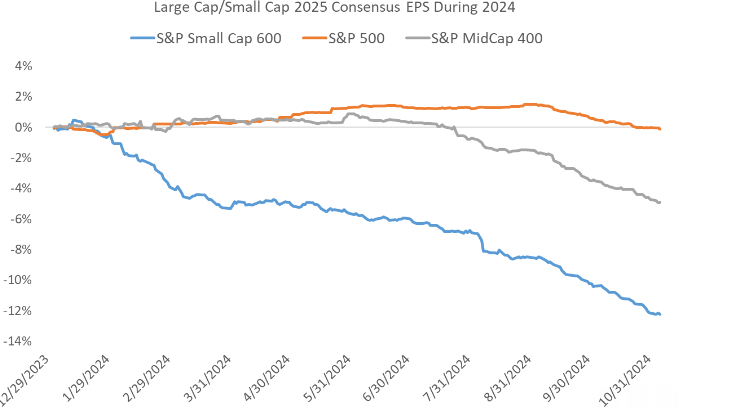

Dave: and the weakness is spilling over into 2025 estimates

Source: Raymond James as of 11.07.2024

Source: Raymond James as of 11.07.2024

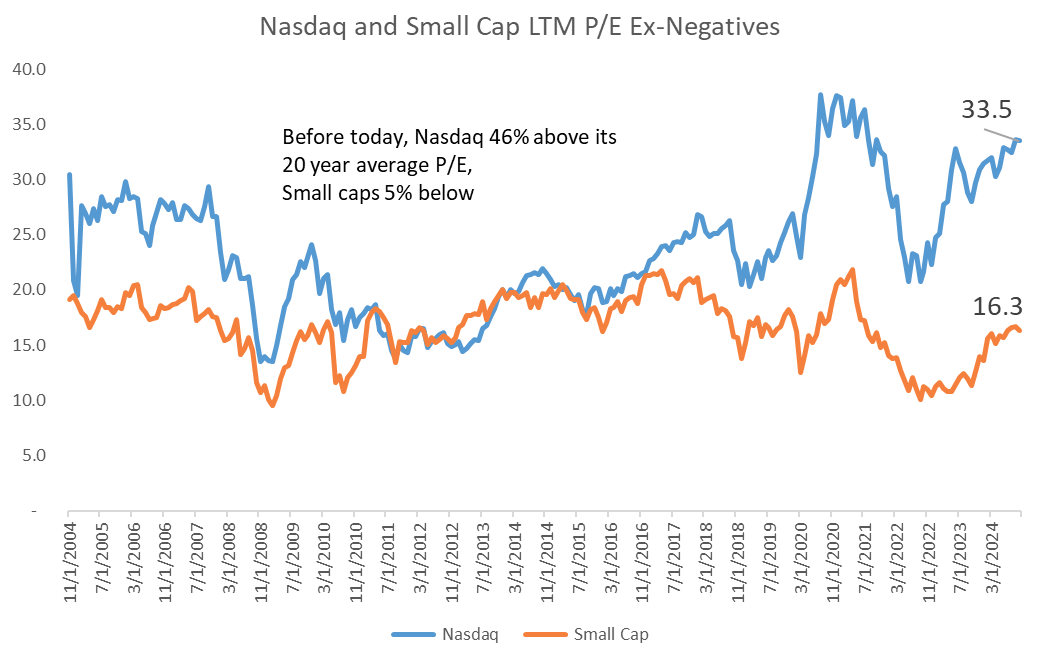

Joseph: This weakness is surely a contributing factor to the widening valuation gap between small and large caps

Source: Raymond James as of 11.06.2024

Source: Raymond James as of 11.06.2024

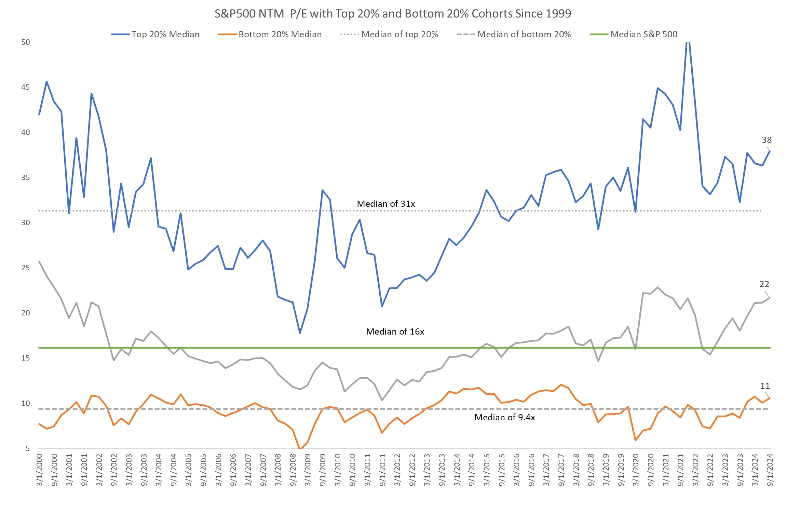

Joseph: but even in the S&P 500, the past decade has seen a widening gap between “cheap” and “expensive” stocks and sectors

Source: Raymond James as of 11.06.2024

Source: Raymond James as of 11.06.2024

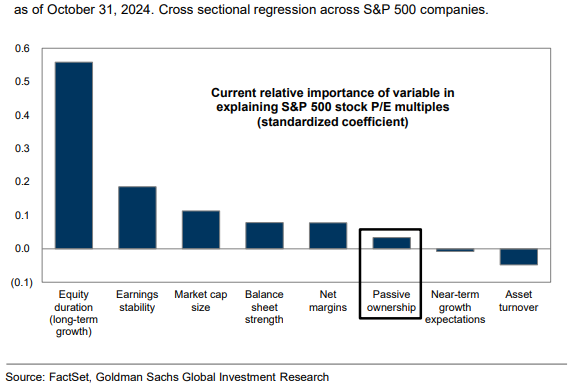

Brad: and while some blame the rise of passive investing, there are a number of contributors to this trends, with company growth seemingly the overwhelming leader

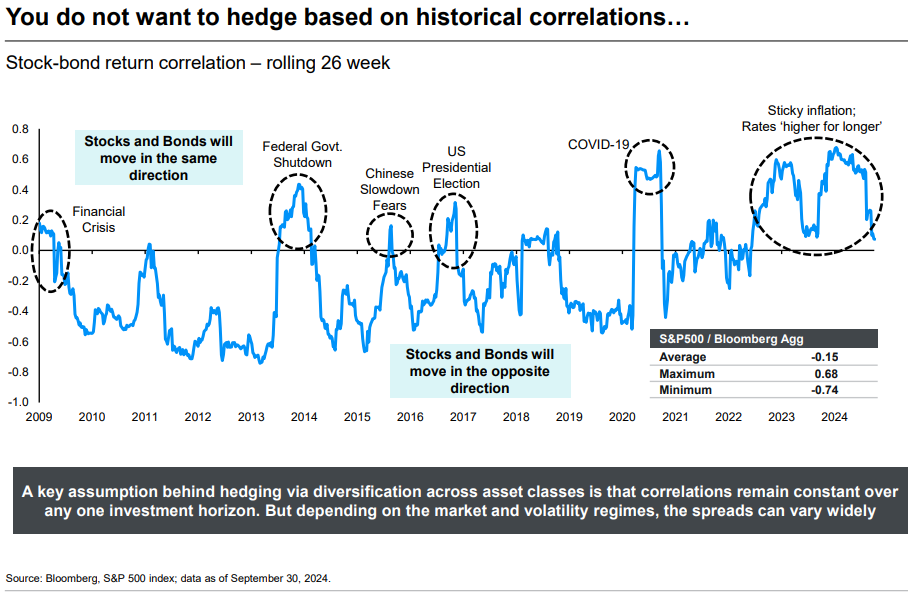

John Luke: Remember, correlations across stocks and bonds are (widely) moving targets

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2411-14.