Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

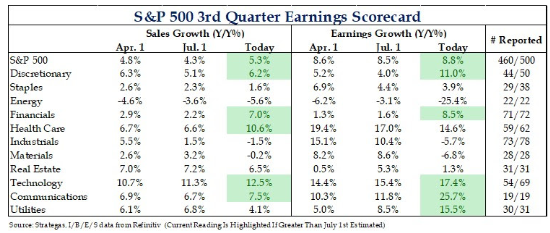

Dave: Q3 earnings are generally behind us and the general tone was solid

Data as of 11.18.2024

Data as of 11.18.2024

Dave: with overall growth slightly ahead of incoming expectations

Source: Strategas as of 11.18.2024

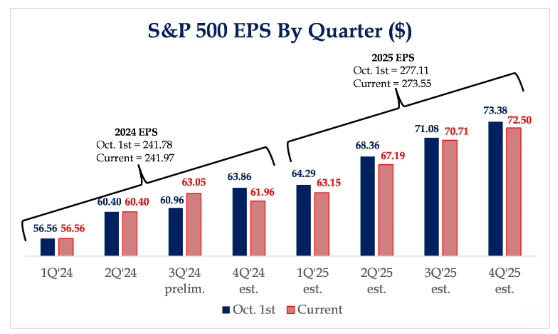

Dave: but slight downward revisions in future quarters

Source: Strategas as of 11.18.2024

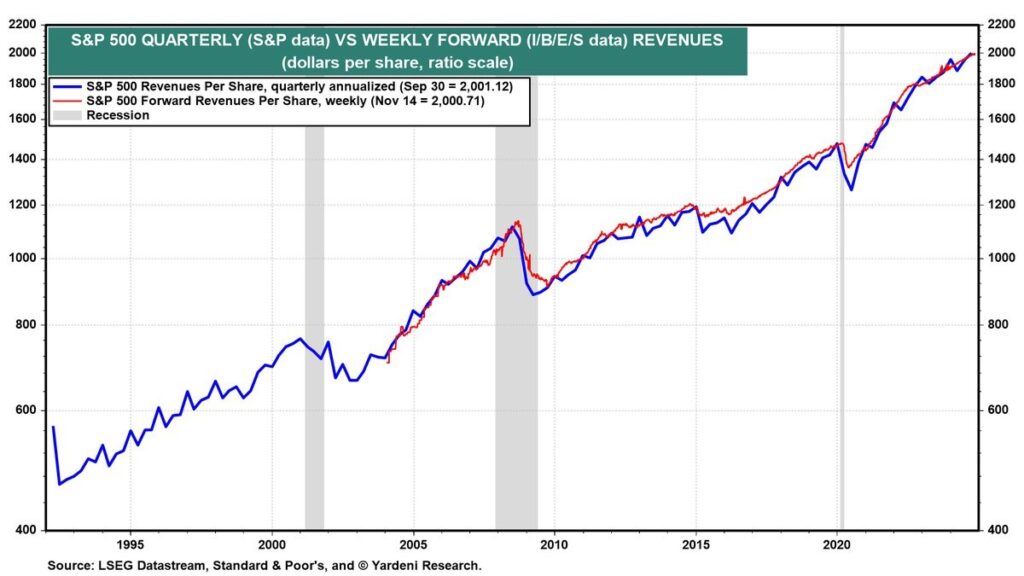

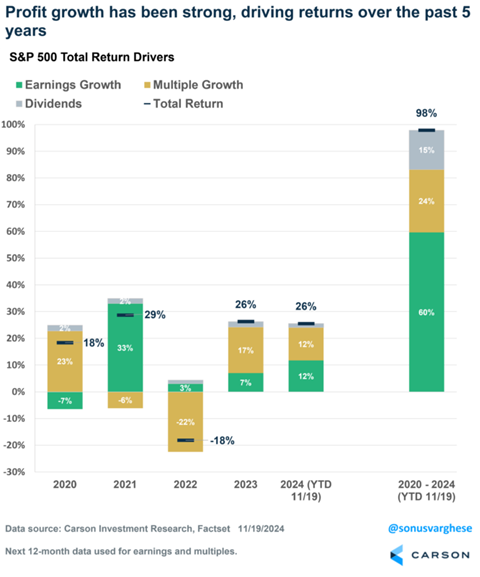

Beckham: and overall, a continued push higher in the great American growth story

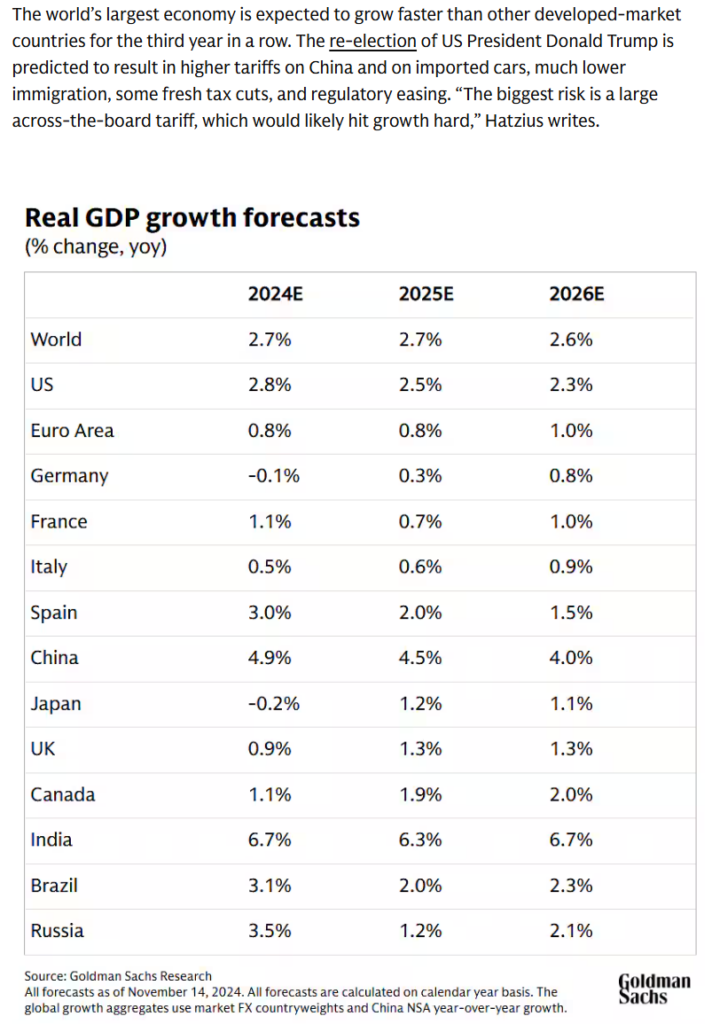

Brett: There is hope that economies across the globe are set for at least some growth in the next 12-24 months

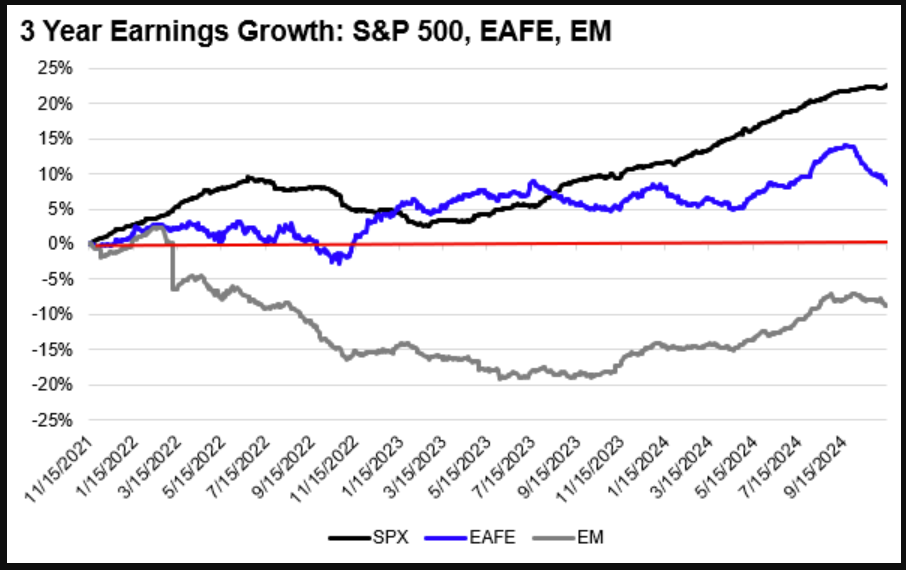

Arch: but in general, foreign companies have not grown at even close to the same levels as the U.S.

Source: New Edge as of 11.14.2024

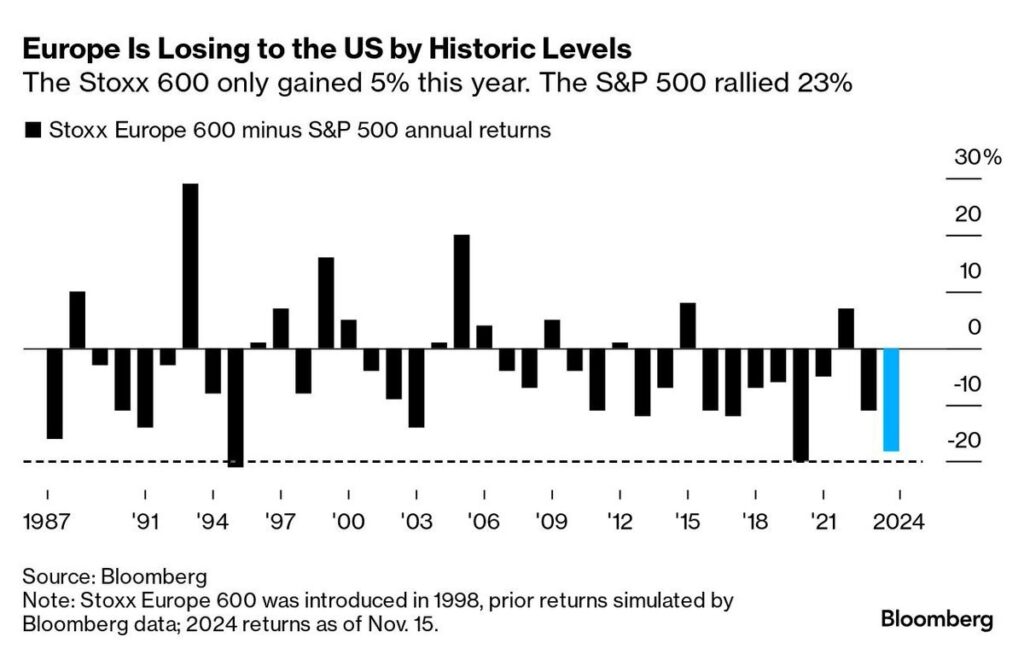

Joseph: which has led to dramatic underperformance in Europe and elsewhere

Brian: again showing that growth is the ultimate driver of long-term equity performance

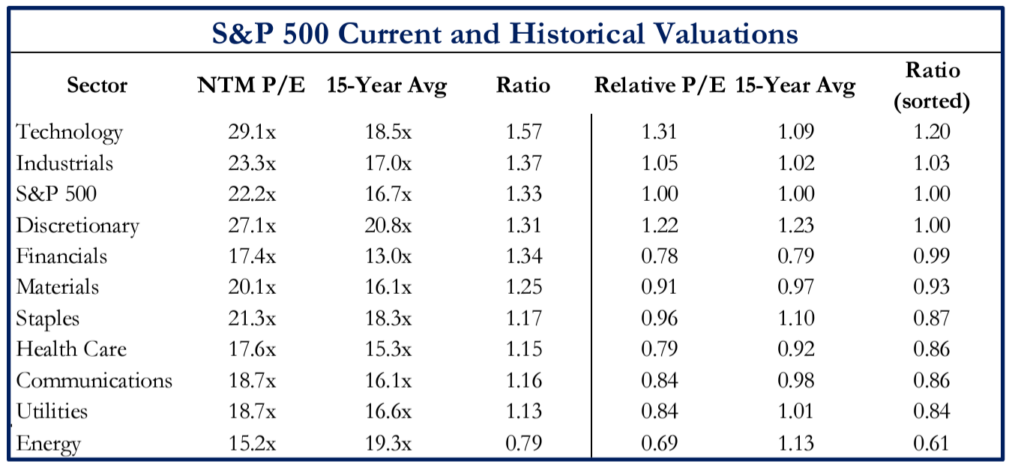

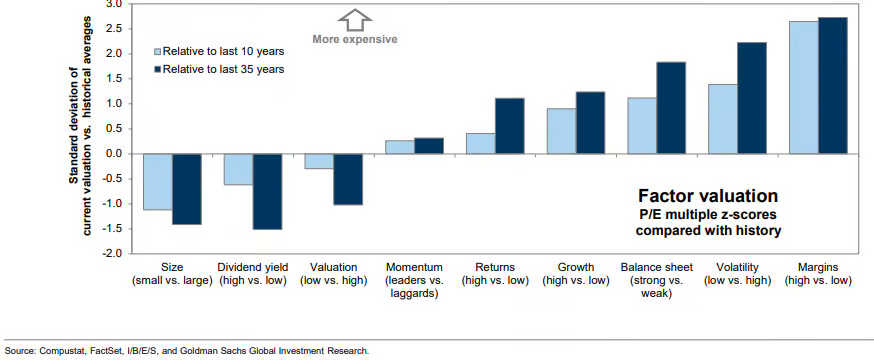

Dave: Even within the U.S. itself, we see dramatic differences in the valuations rewarded to higher-growing companies

Source: Strategas as of 11.15.2024

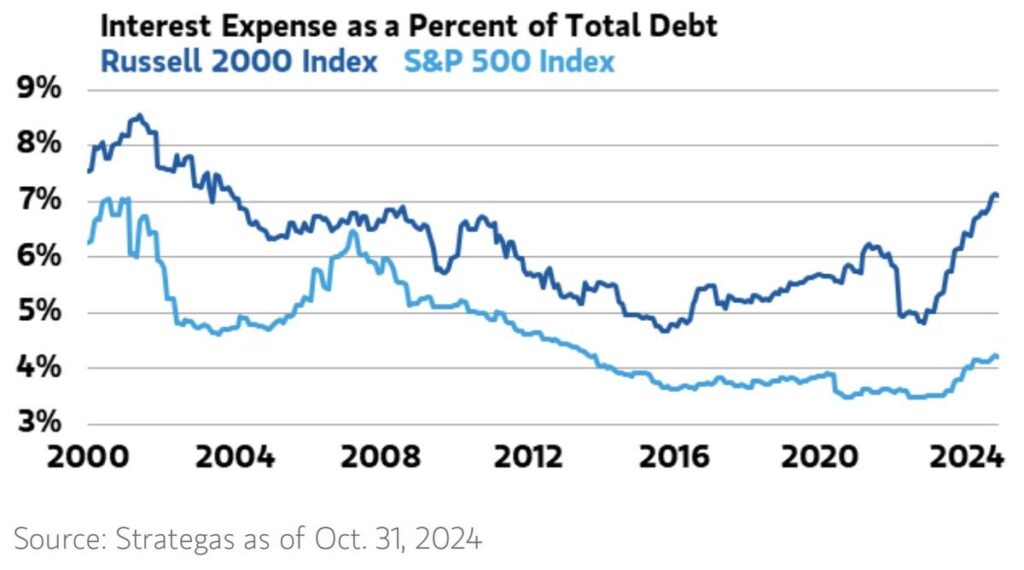

John Luke: with profit margins and overall quality rewarded at the expense of smaller, slower-growing companies

Data as of 11.19.2024

John Luke: and the inability of those companies to secure as much low-rate debt coming out of COVID

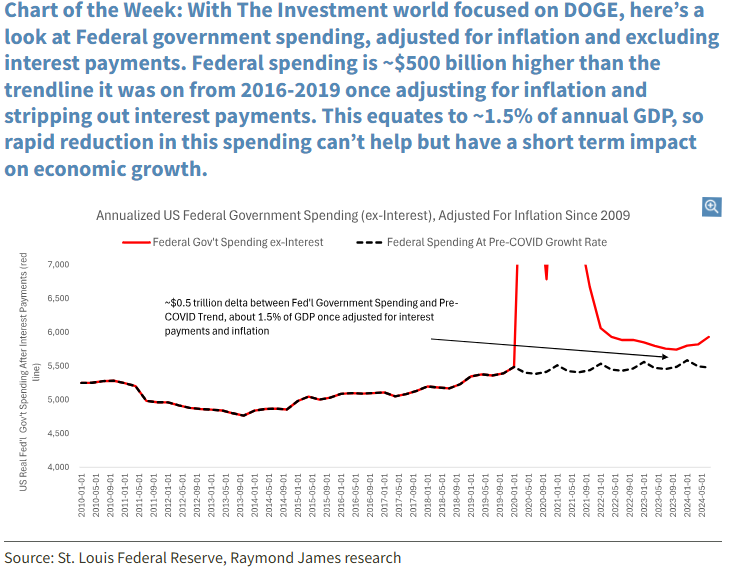

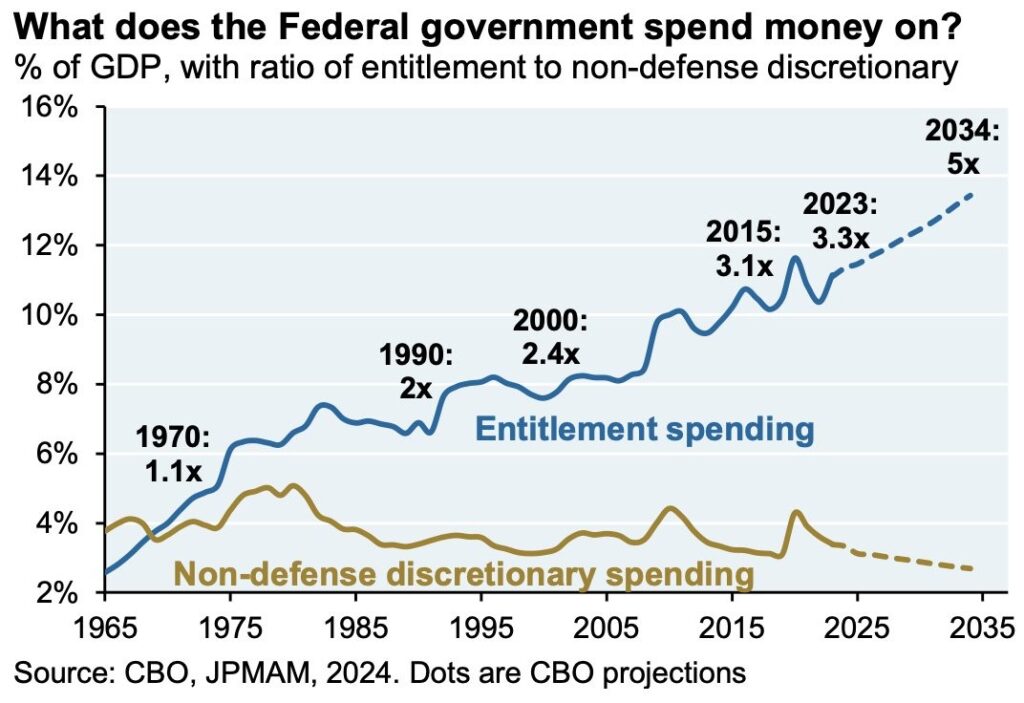

Dave: Speaking of debt, our federal government holds a ton, and many are hopeful that the incoming administration can slow the runaway spending

Data as of 10.31.2024

JD: and while that may reduce overall growth rates, the truth is that much of the path of federal spending is locked in unless someone is willing to accept public revolt

Data as of September 2024

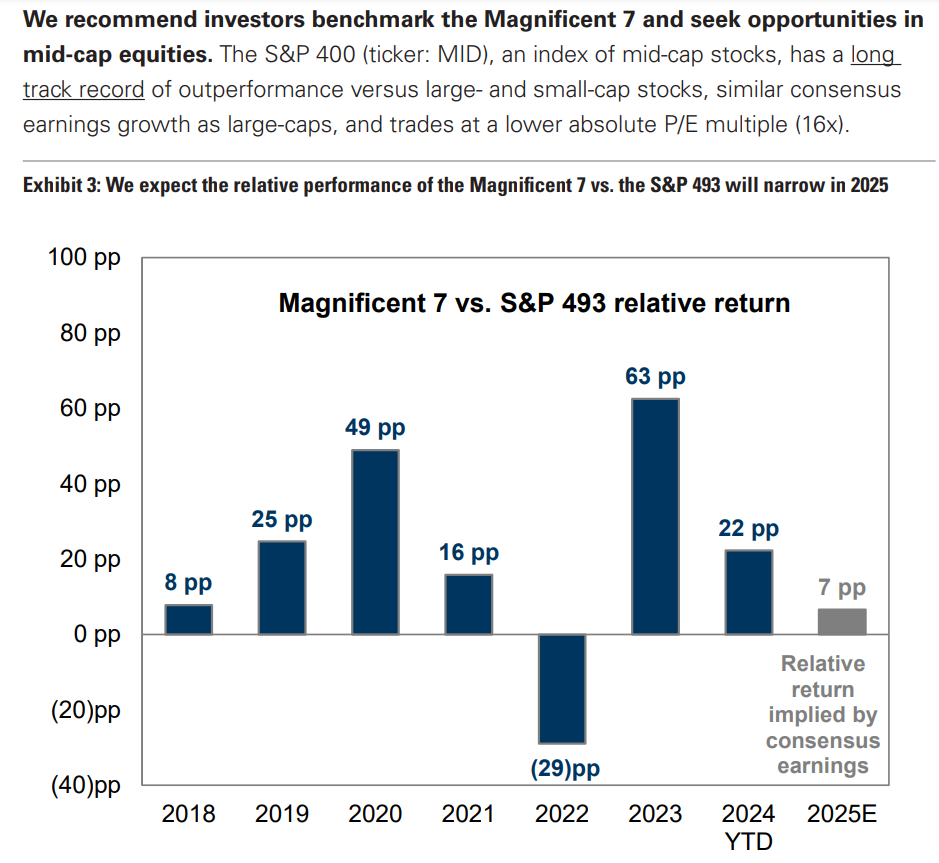

Dave: As much as investors slam the market as driven by a few big tech names, it’s been mostly explained by their fundamental performance

Source: Goldman Sachs as of 11.15.2024

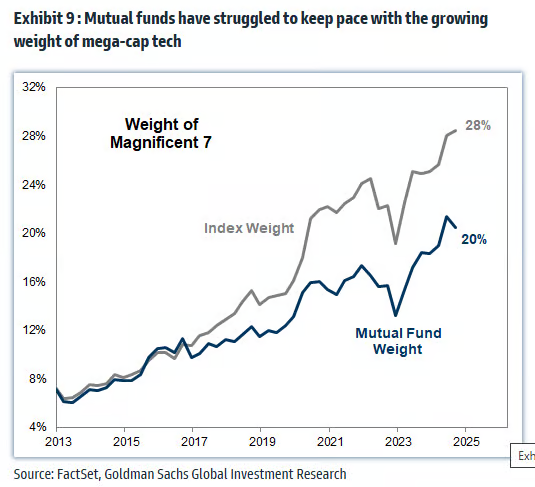

Brad: yet active funds as a whole have found themselves frustratingly underweight the glamour names

Data as of 11.20.2024

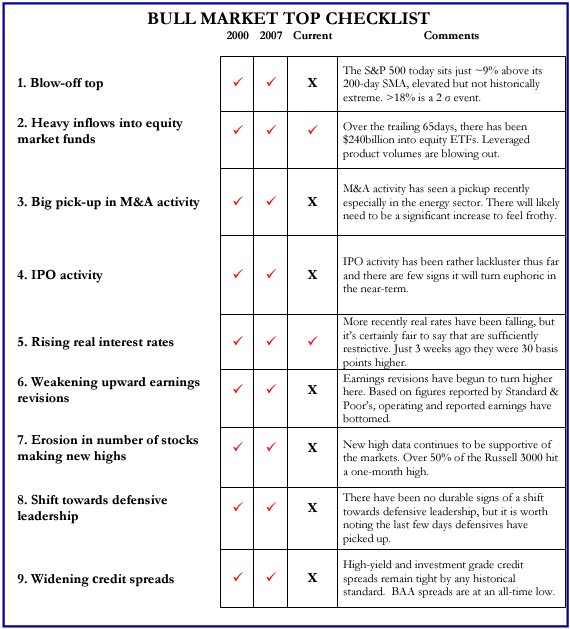

Brad: Despite the run, a checklist of common attributes of a market top shows very few are actually in place

Source: Strategas as of 11.21.2024

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2411-22.