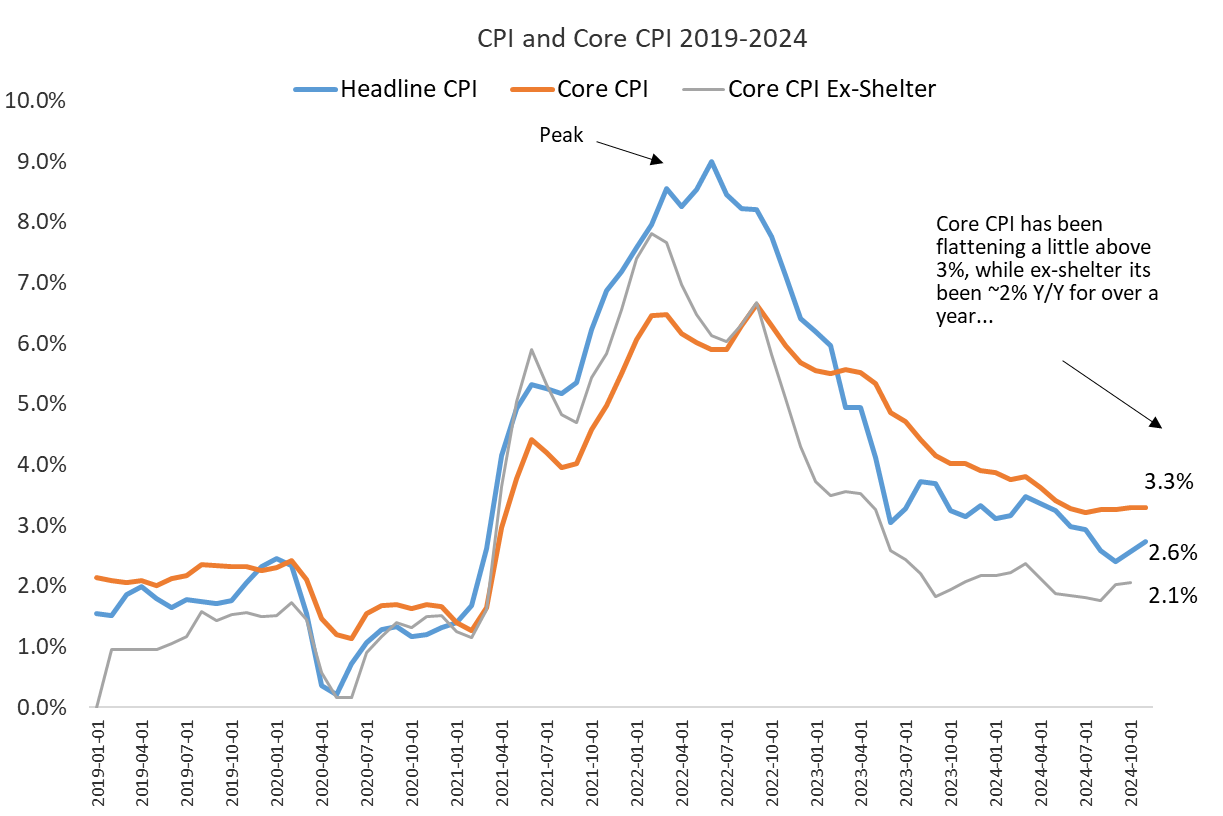

Dave: Government inflation measures are trying to settle into the 2-3% range

Source: Raymond James as of 12.11.2024

Source: Raymond James as of 12.11.2024

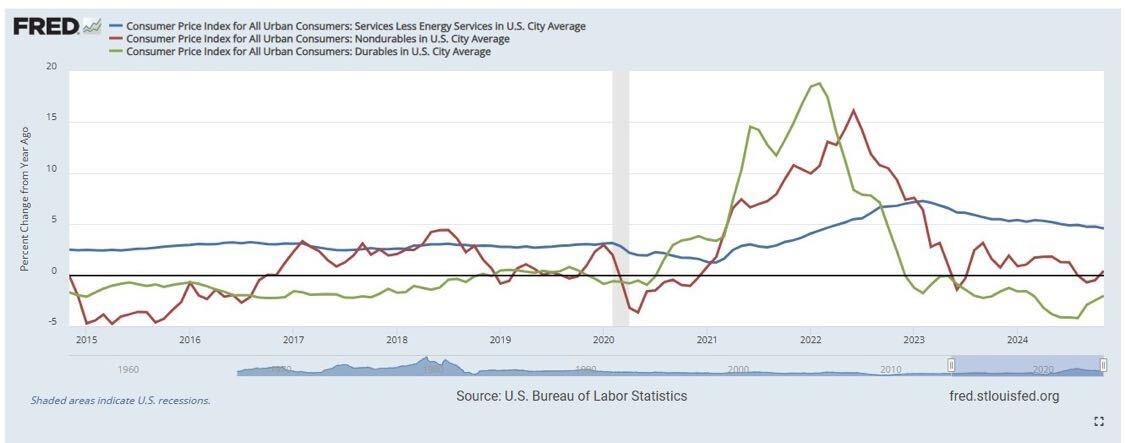

Brian: with services the entire source of inflation now that the price of goods has gone flat year-over-year

Data as of 12.11.2024

Data as of 12.11.2024

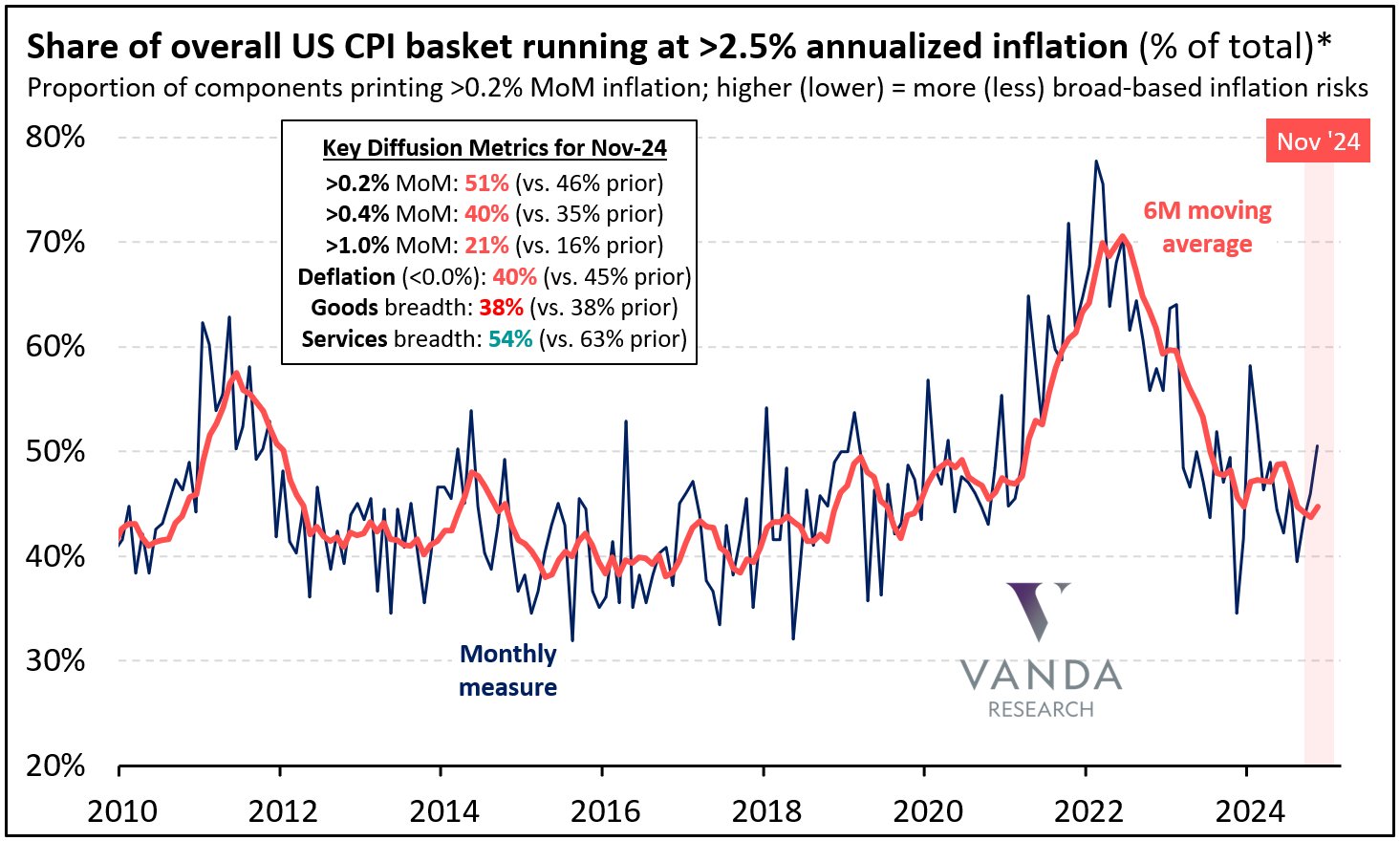

John Luke: that said, the % of inputs undergoing disinflation is no longer expanding

Source: Vanda Research as of 12.11.2024

Source: Vanda Research as of 12.11.2024

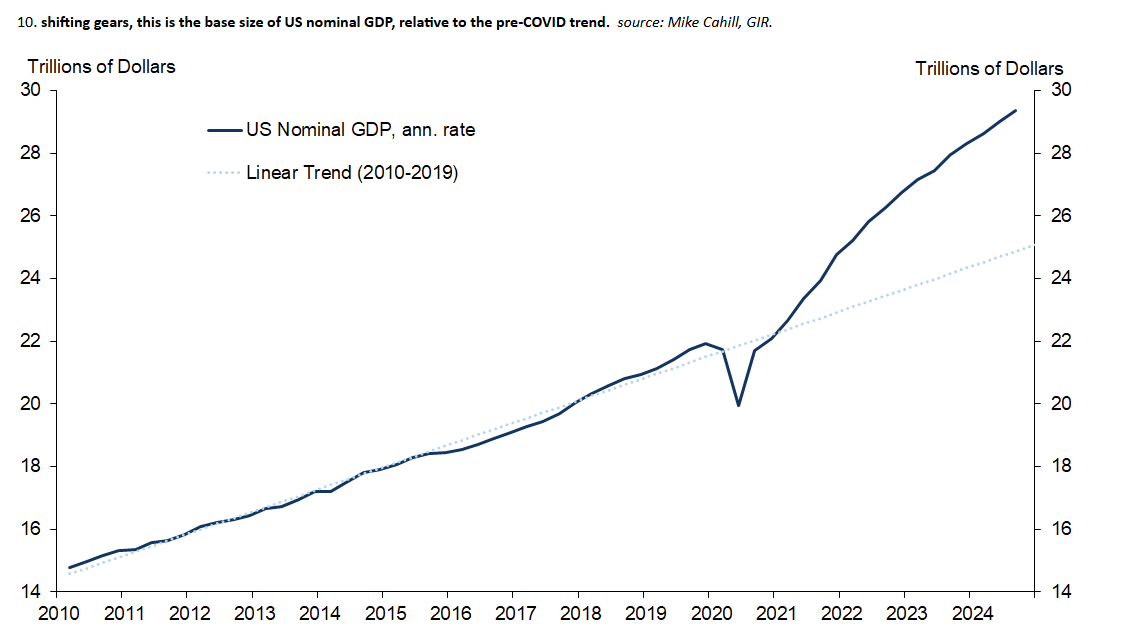

John Luke: The US economy is still feeling the impact of COVID-era fiscal stimulus

Source: Goldman Sachs as of November 2024

Source: Goldman Sachs as of November 2024

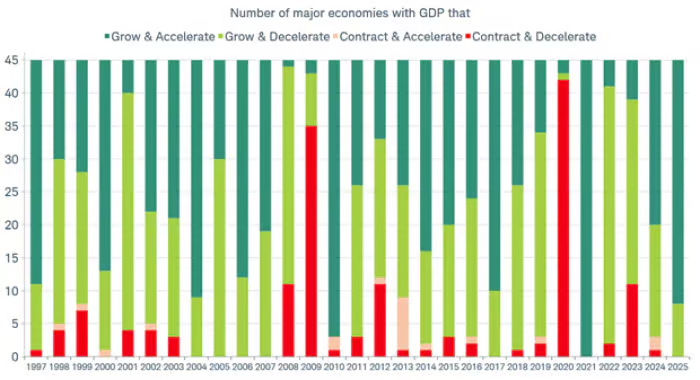

Brett: part of the reason there are no developed economies expecting a recession in 2025

Source: Schwab as of 12.10.2024

Source: Schwab as of 12.10.2024

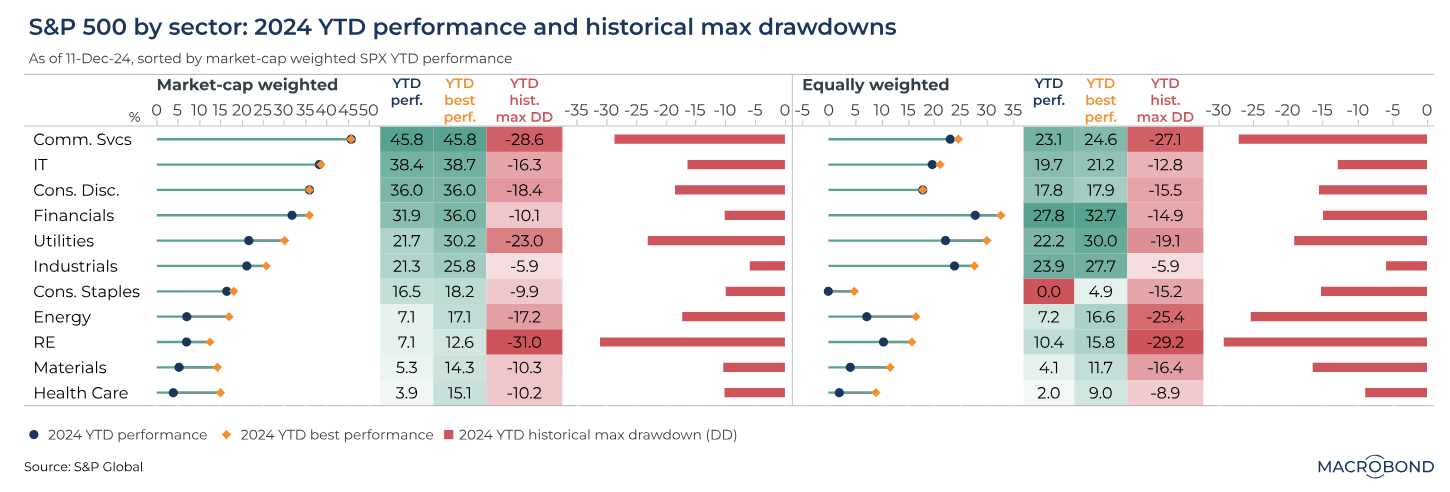

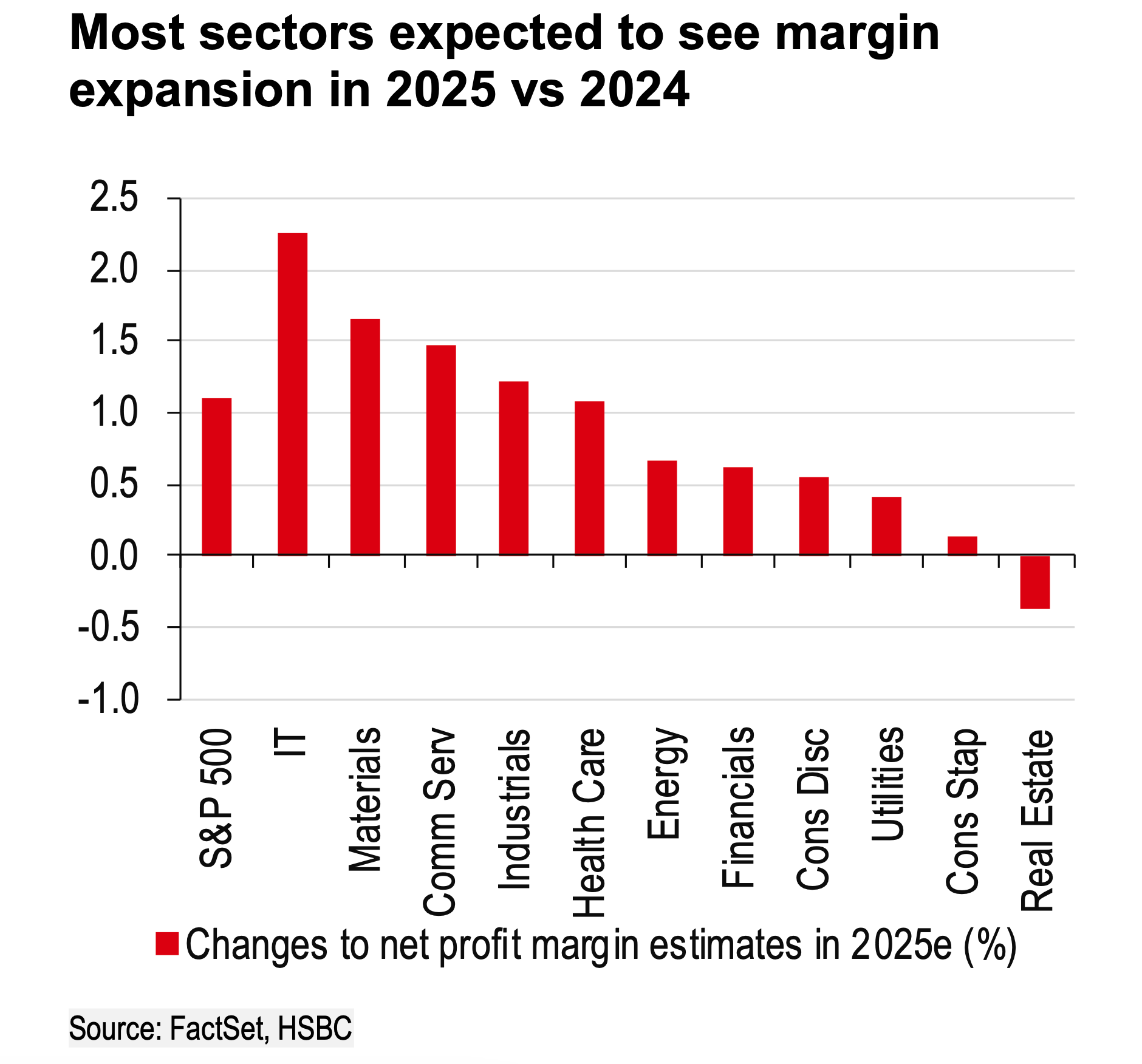

Beckham: We all know tech has been a great performer, but all sectors have had some degree of upside in 2024

Joseph: partly due to the expectation that profit margins will continue to rise

Data as of 12.09.2024 via Tker

Data as of 12.09.2024 via Tker

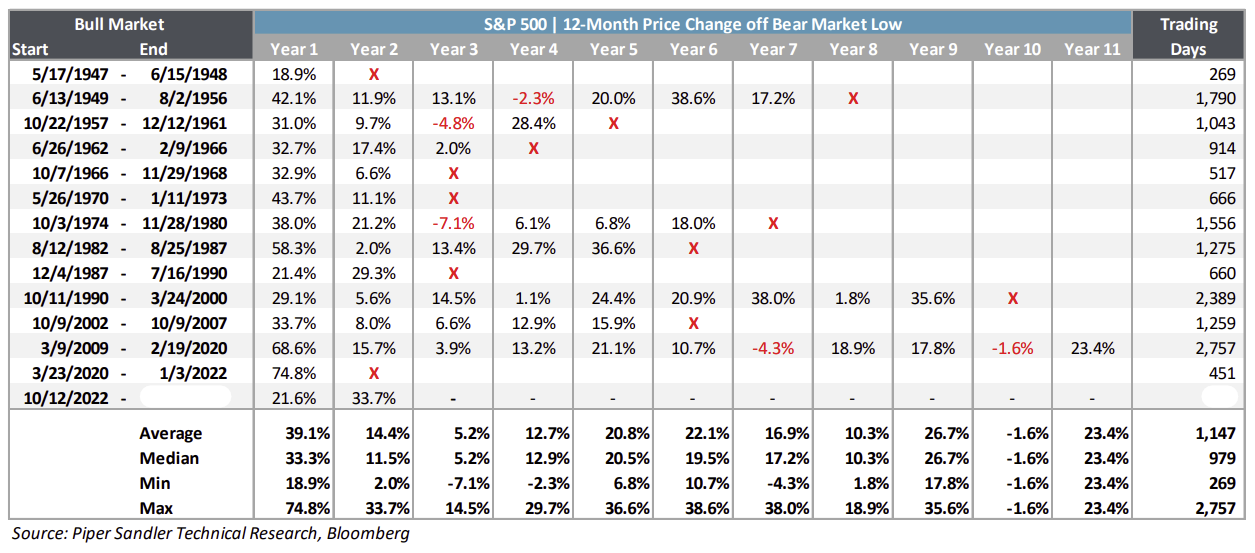

Brad: Good reference for comparing this move to past moves from bear market lows

Data as of 12.09.2024

Data as of 12.09.2024

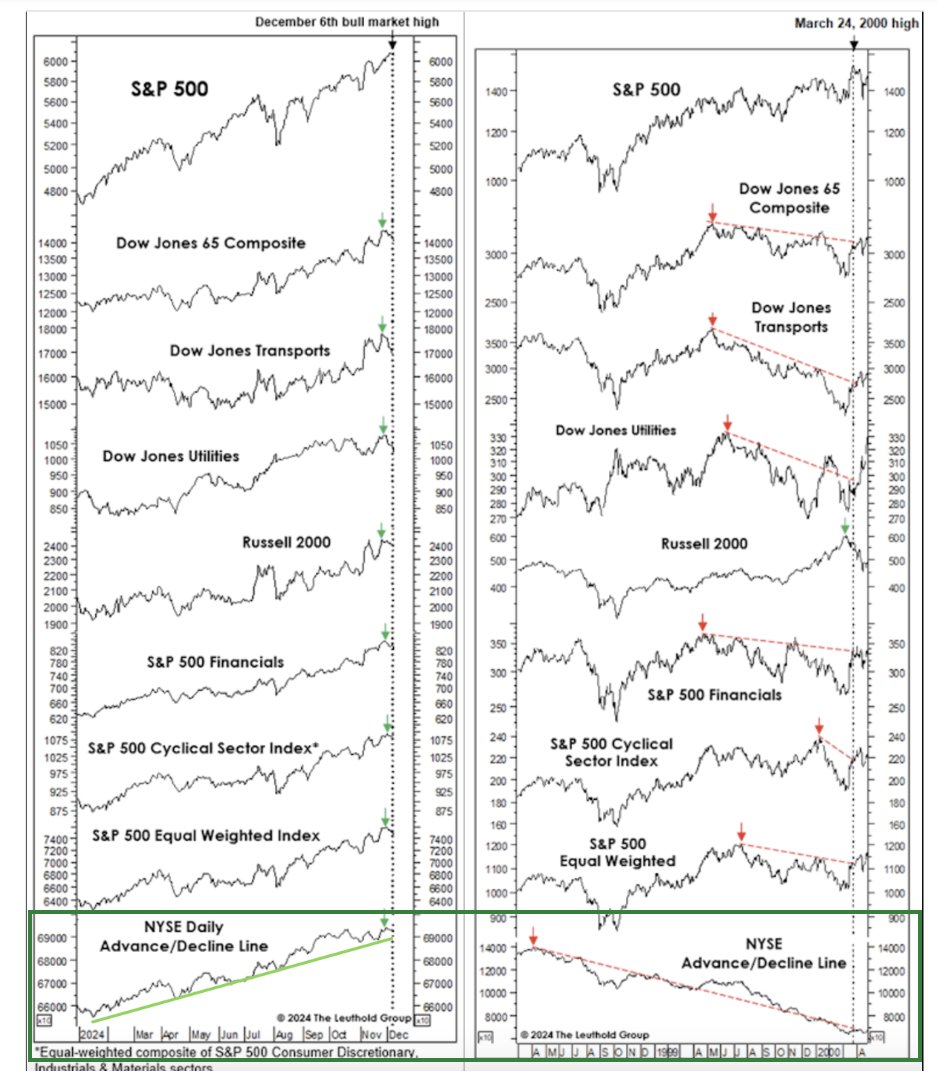

Arch: and regardless of the future path, comparisons to the 2000 top look downright silly

Source: @SethCL as of 12.06.2024

Source: @SethCL as of 12.06.2024

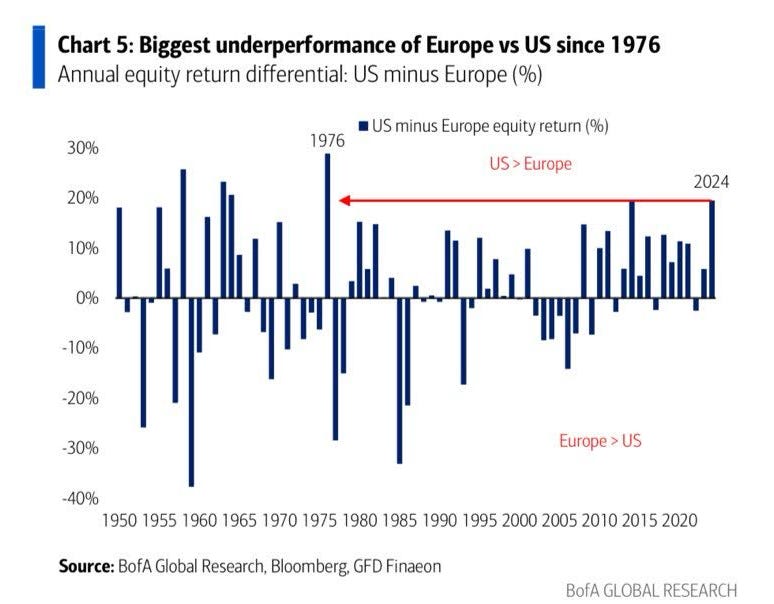

JD: It’s been another tough year for European stocks, one of the worst relative to the US

Data as of 12.06.2024

Data as of 12.06.2024

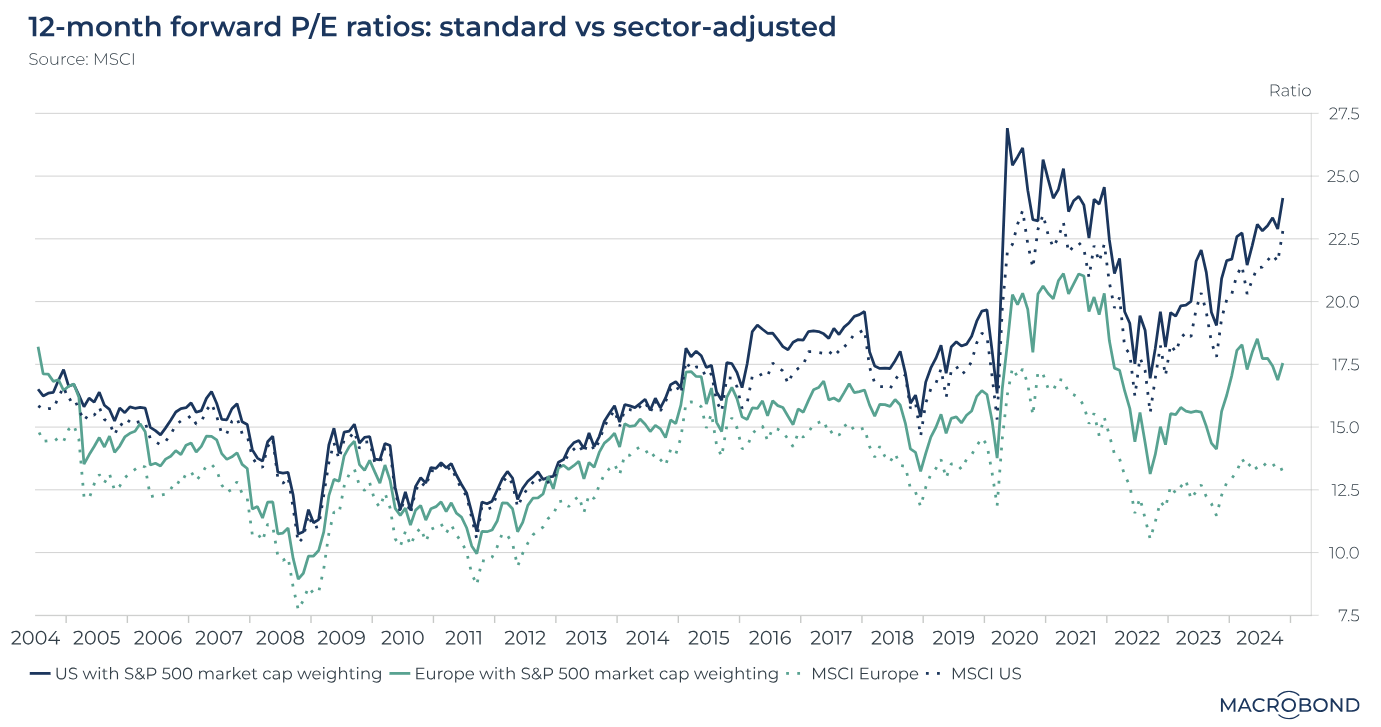

Beckham: and while the valuation discount has been a reason some have bought international stocks, once you adjust for sector composition the discount hasn’t yet been enough to stem the tide

Data as of 12.12.2024

Data as of 12.12.2024

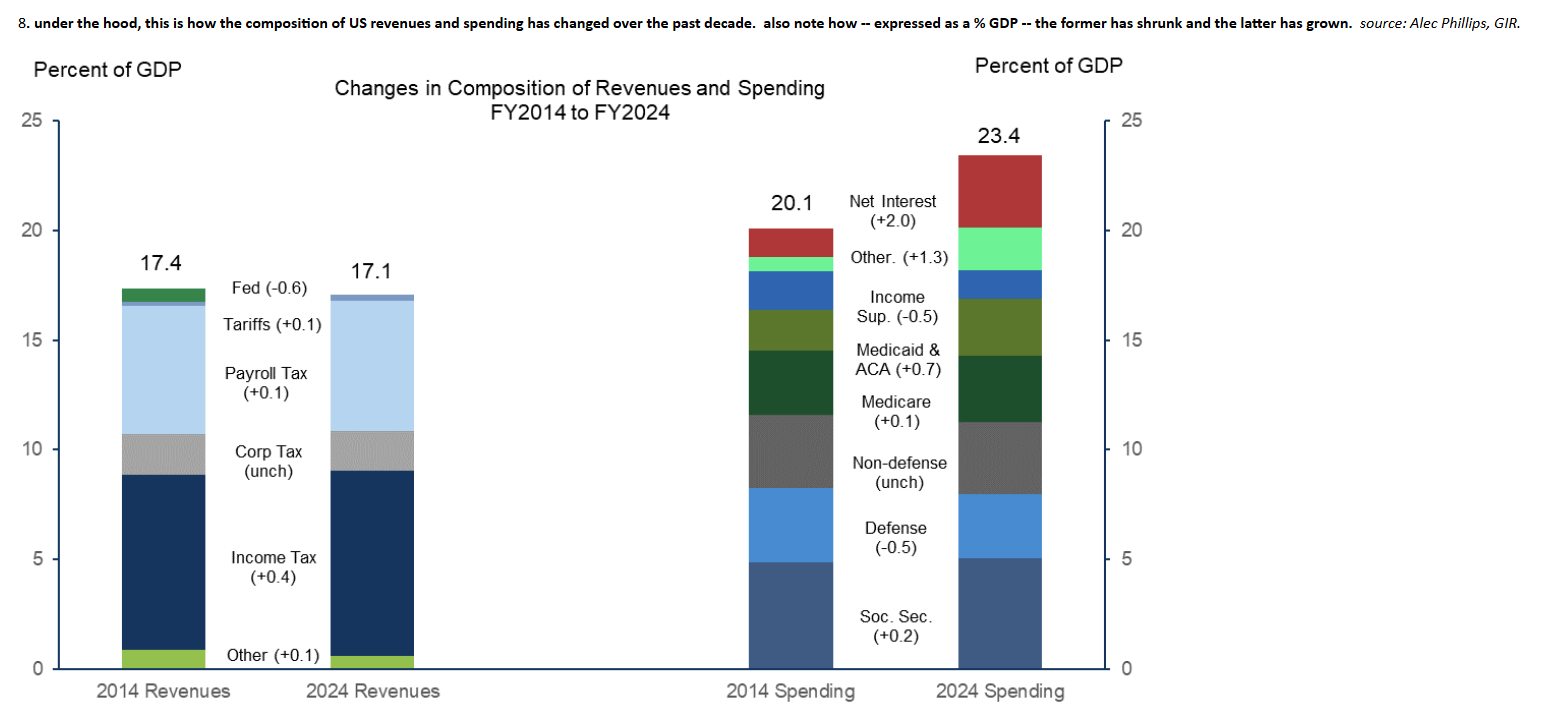

John Luke: It’s the money going out that’s expanding the government deficits, not the money coming in

Source: Goldman Sachs as of 12.06.2024

Source: Goldman Sachs as of 12.06.2024

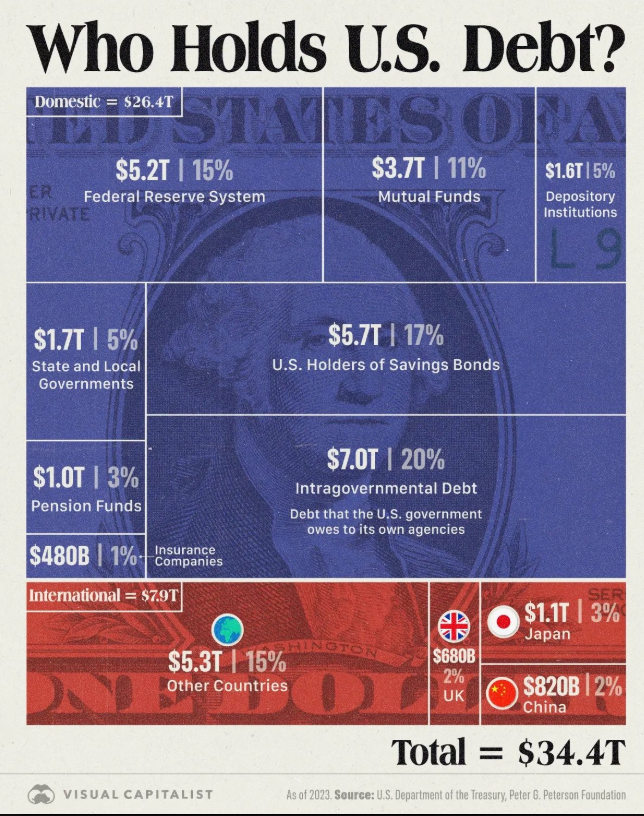

John Luke: and the expanding debt burden is increasingly falling on domestic holders

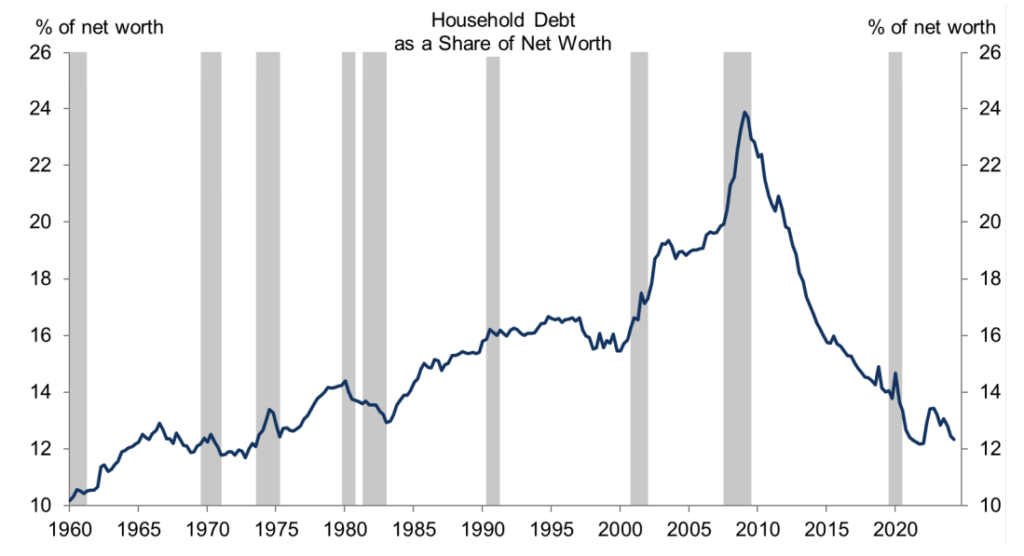

Dave: Meanwhile, US consumers as a whole are thriving and reducing debt burdens

Source: Goldman Sachs as of November 2024

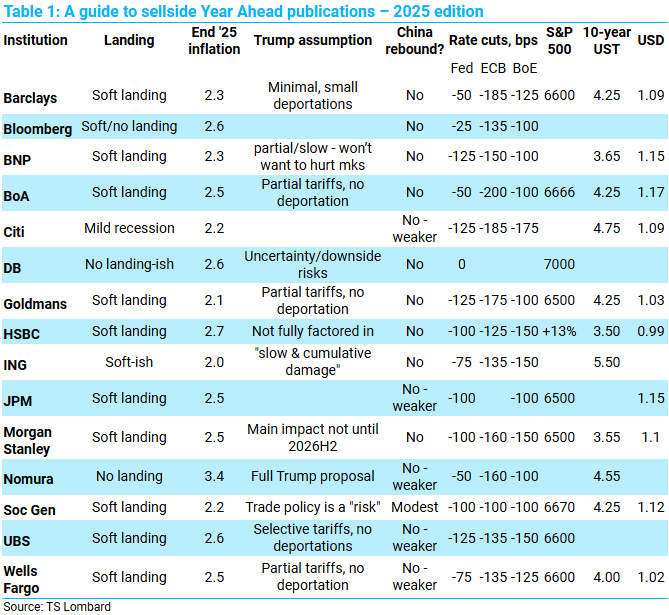

Joseph: After being caught flat-footed into the 2023 and 2024 equity rallies, strategists are getting more aggressive with 2025 price targets

Data as of 12.12.2024

Data as of 12.12.2024

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2412-11.