Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

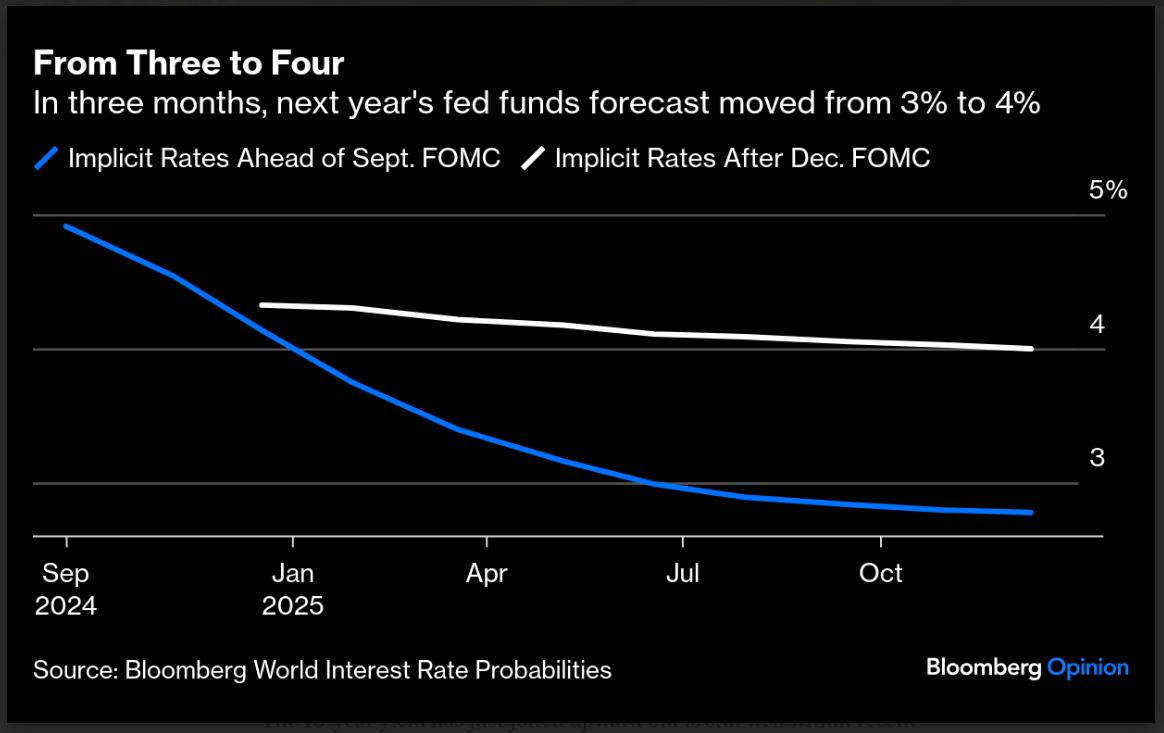

Joseph: The FOMC confirmed what the market had started to price in, that rates wouldn’t be cut as quickly as had been expected earlier in the year

Data as of 12.19.2024

Data as of 12.19.2024

Beckham: and the members have moved slightly higher in their estimates for the neutral rate

Source: @LizThomasStrat as of 12.18.2024

Source: @LizThomasStrat as of 12.18.2024

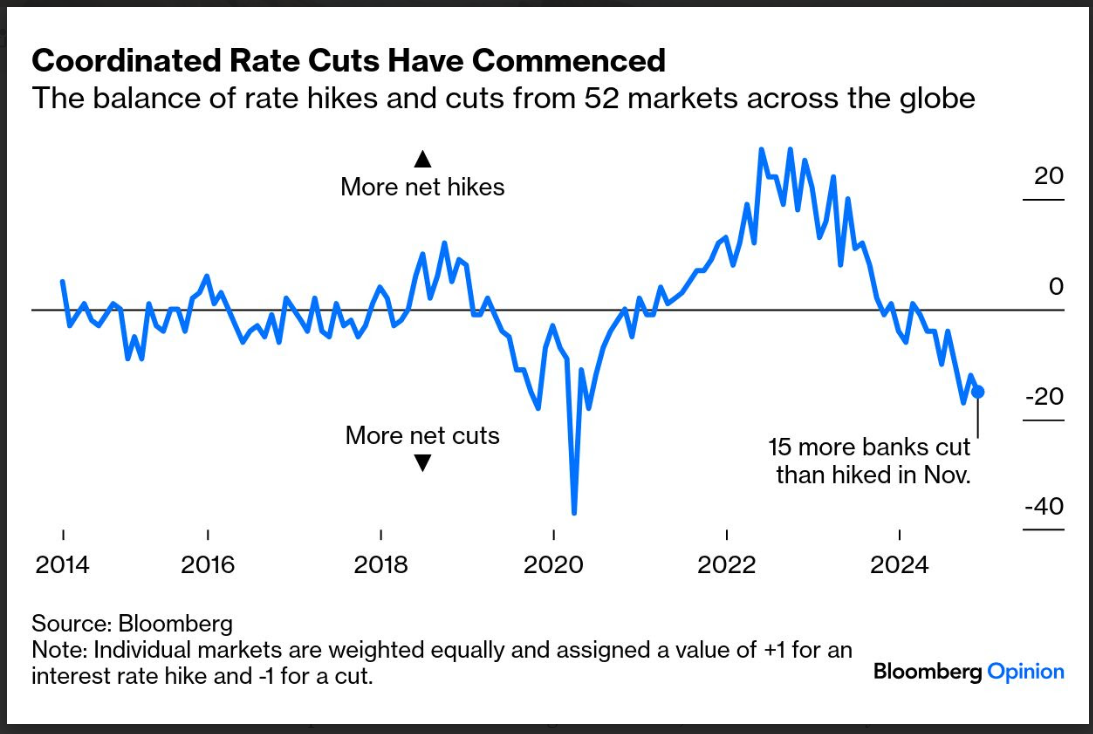

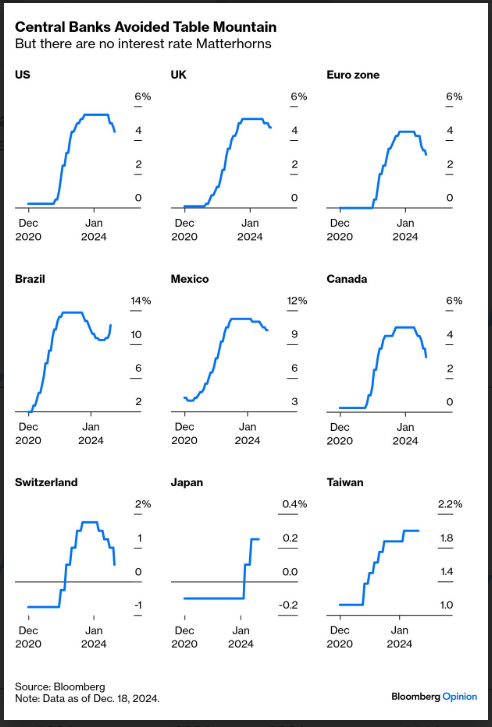

Brett: The US is not alone in cutting, as central banks around the world are doing the same

Arch: but it doesn’t look like the downslope will take us anywhere near as low as the previous zero interest rate policies

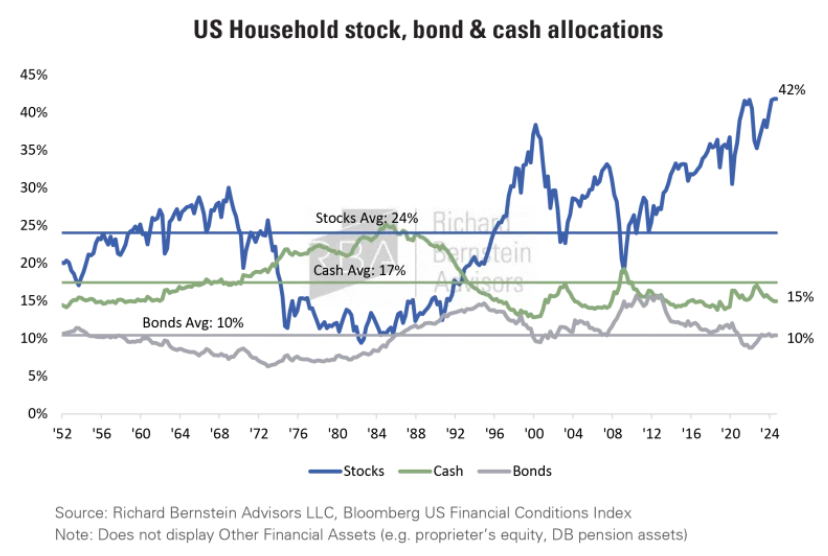

Brett: Despite headlines of “cash on the sidelines”, US investor have generally let their equity allocation drift higher with the move in stocks

Data as of November 2024

JD: though in general, investors have suffered from persistently low expectations for equities

Data as of November 2024

Data as of November 2024

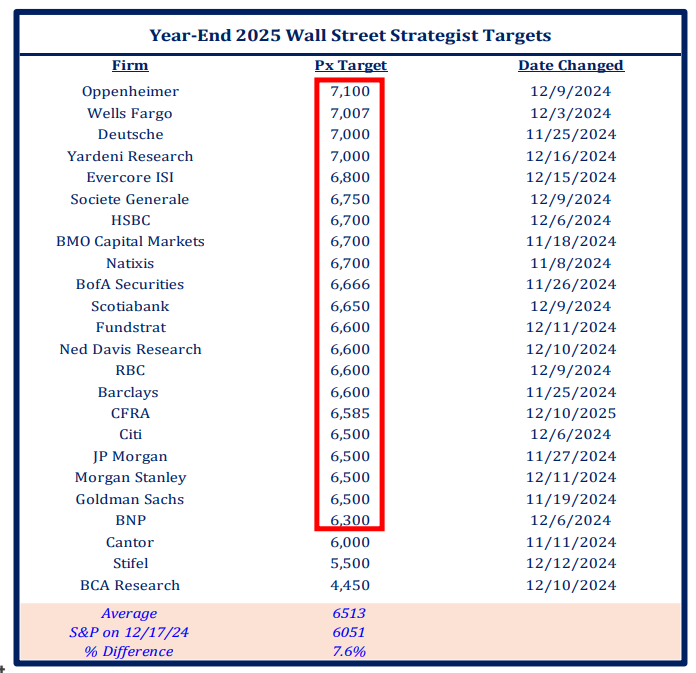

John Luke: strategists, too…though this year they’re trying to catch up

Source: Strategas as of 12.17.2024

Source: Strategas as of 12.17.2024

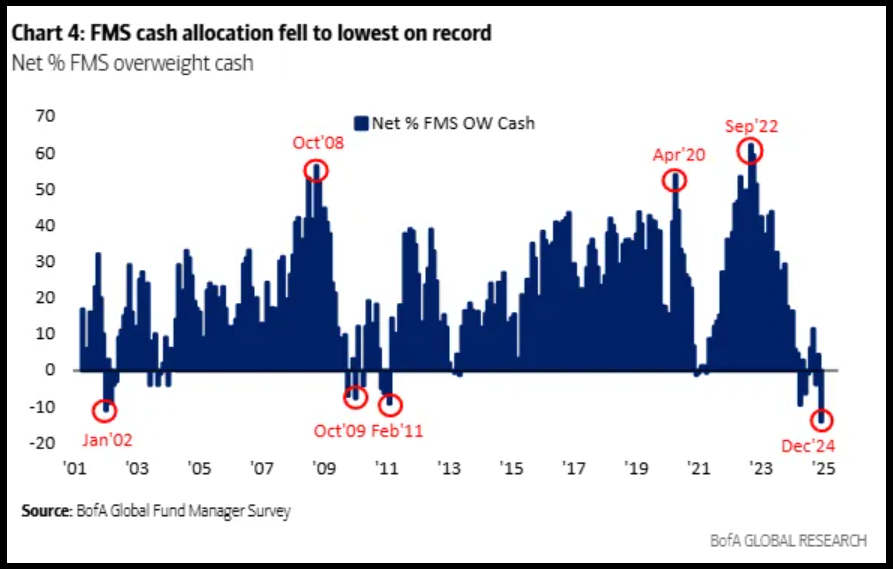

Brad: Fund managers have become averse to cash despite higher yields

Data as of 12.13.2024

Data as of 12.13.2024

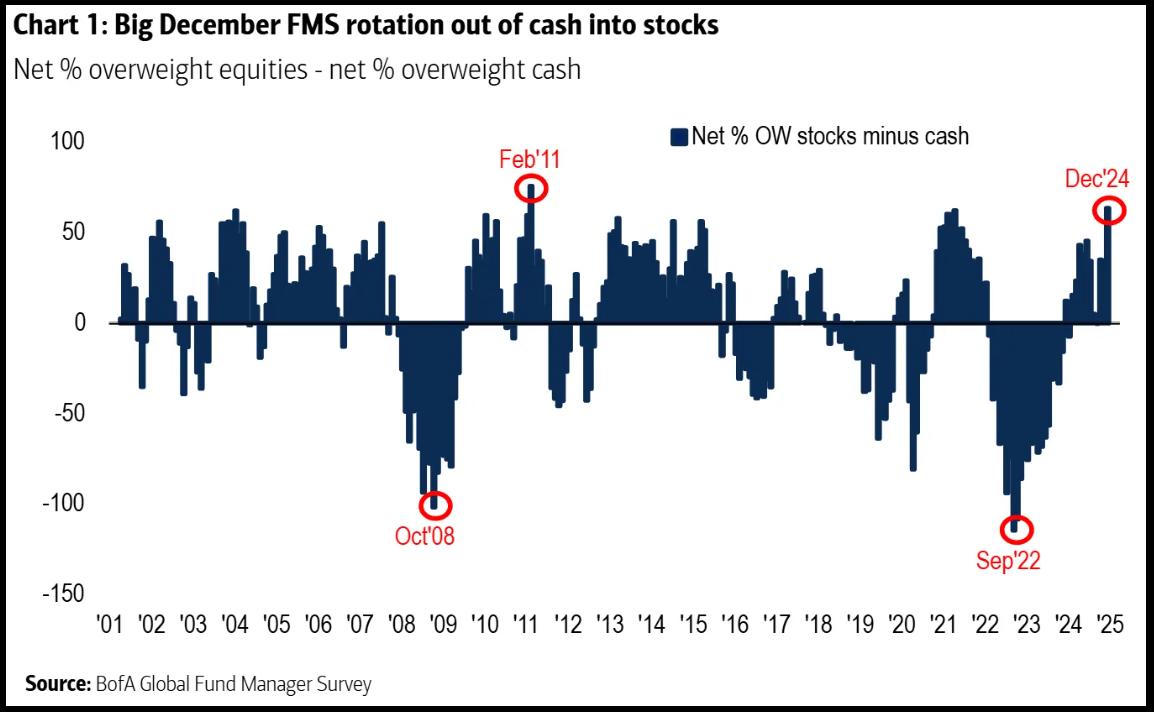

Brad: and are putting that cash to work in stocks

Data as of 12.13.2024

Data as of 12.13.2024

Dave: Recent earnings calls have seen higher mentions of positive consumer sentiment

Data as of 12.13.2024

Data as of 12.13.2024

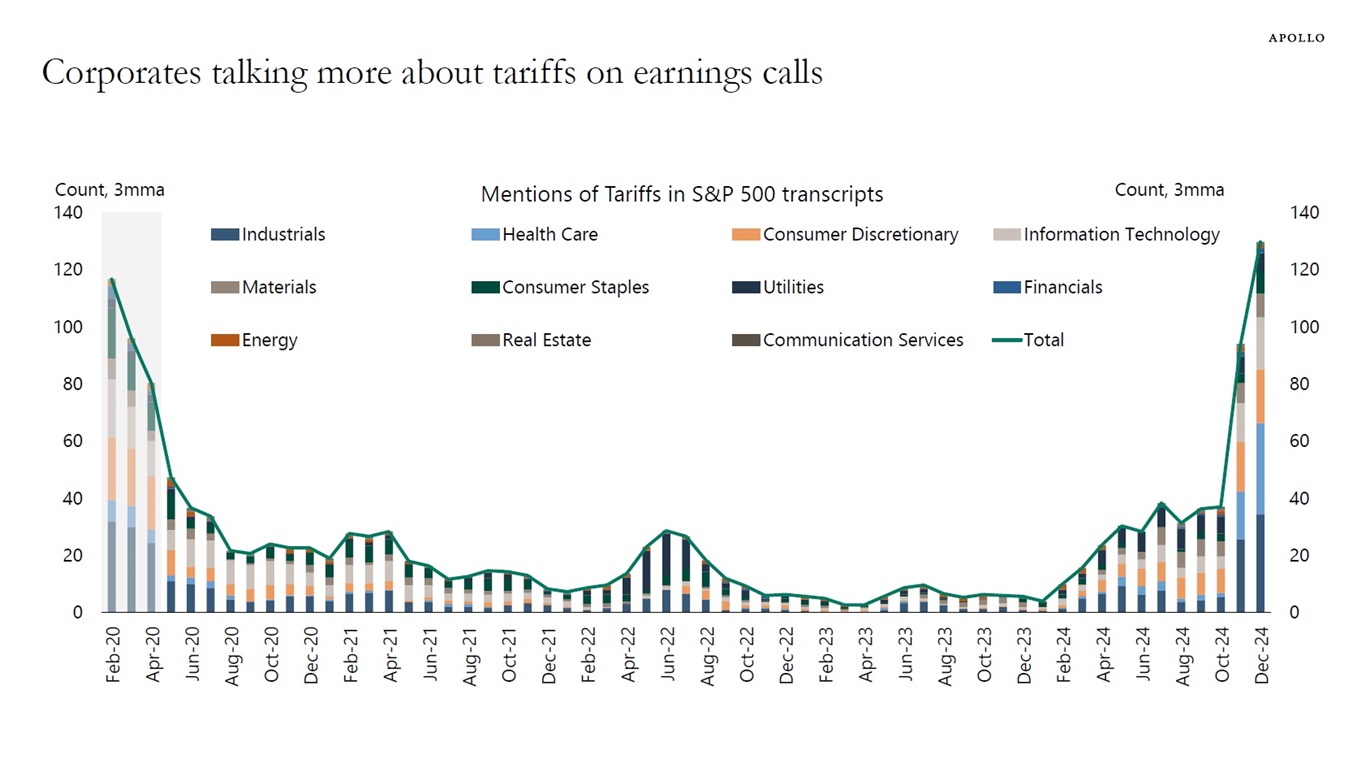

Dave: though company leaders have been mentioning the possible impact of tariffs in recent calls

Source: Apollo as of 12.09.2024

Source: Apollo as of 12.09.2024

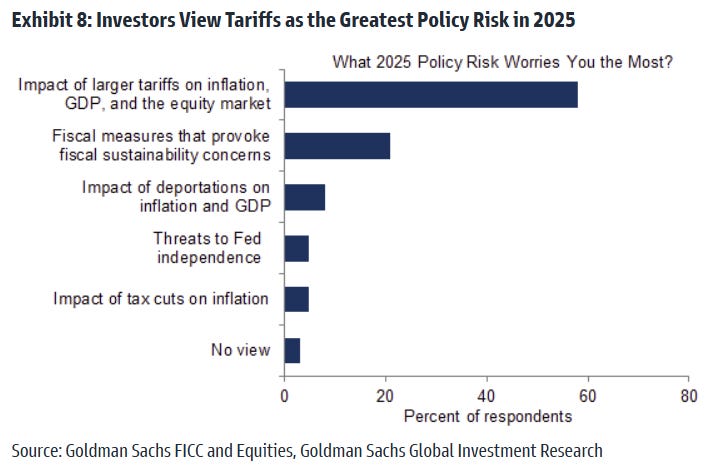

Brad: Investors are equally concerned with the potential impact of tariffs

Data as of November 2024

Data as of November 2024

Dave: Speaking of tariffs, in general the size across most geographies (exluding China) has been negligible

Joseph: Earnings drive stocks over the long-term, but of late prices had detached themselves a bit higher

Chart via NewEdge

Chart via NewEdge

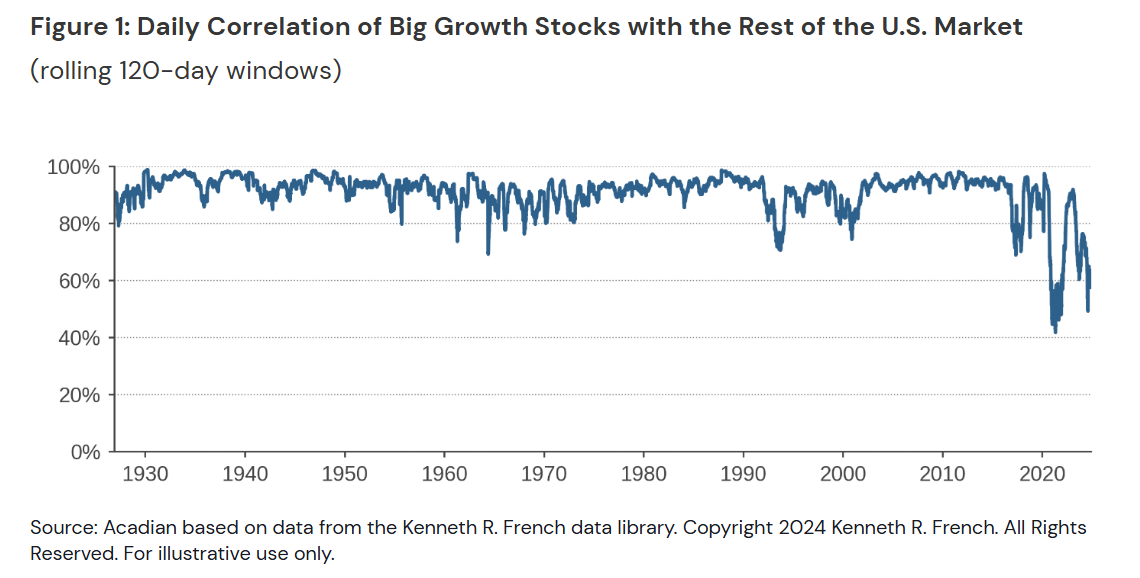

Brian: and speaking of detachment, Mag 7 stocks have recently carved out their own path separate from the rest of the market

Data as of November 2024

Data as of November 2024

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2412-18.