Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

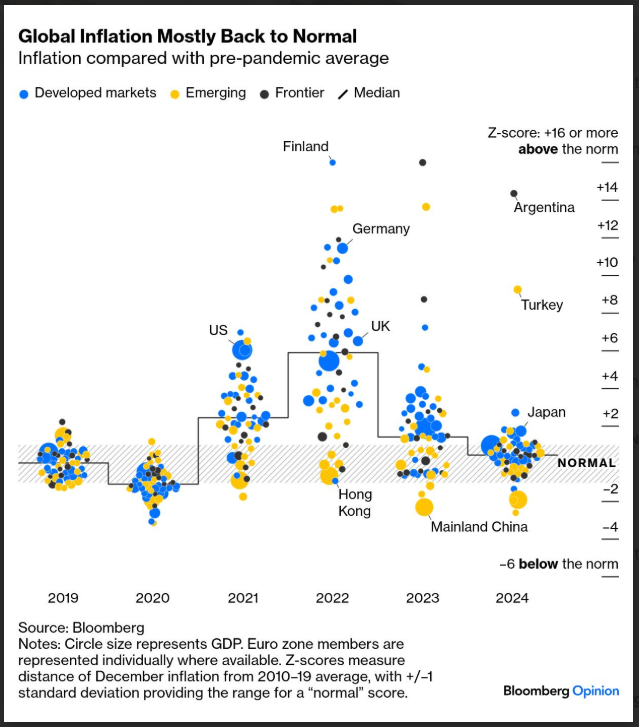

Beckham: Inflation has made it back to the general range accepted by most central bankers

Data as of November 2024

Data as of November 2024

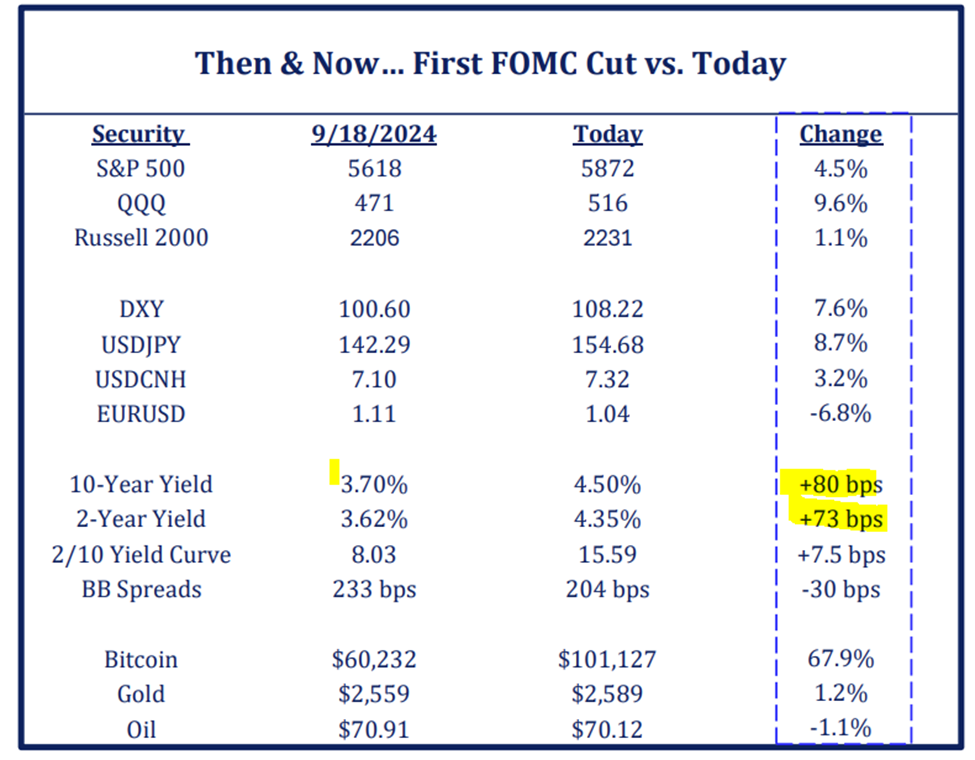

John Luke: though long-term and short-term rates have significantly diverged since the FOMC decided to start cutting rates

Source: Strategas as of 12.20.2024

Source: Strategas as of 12.20.2024

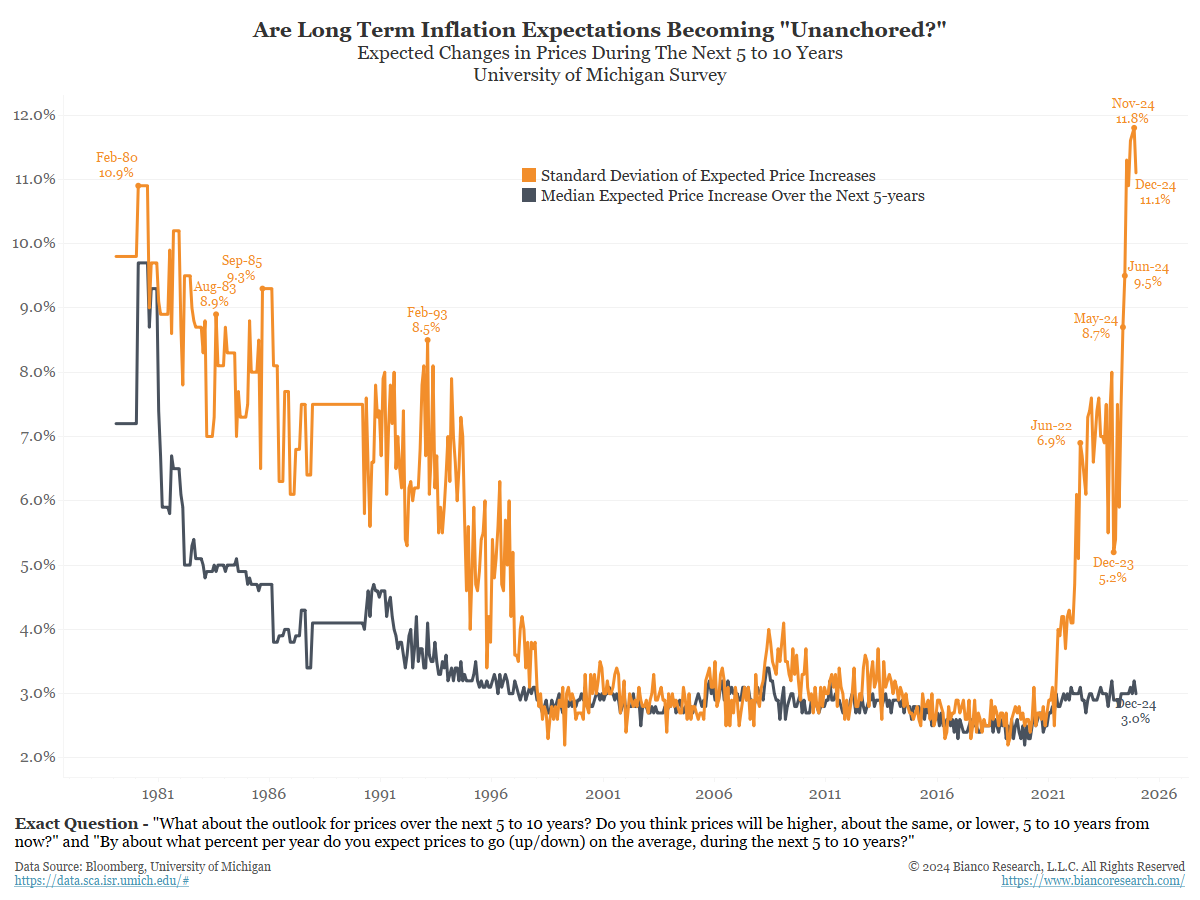

John Luke: and consumer outlooks for inflation are far from settled

Data as of 12.23.2024

Data as of 12.23.2024

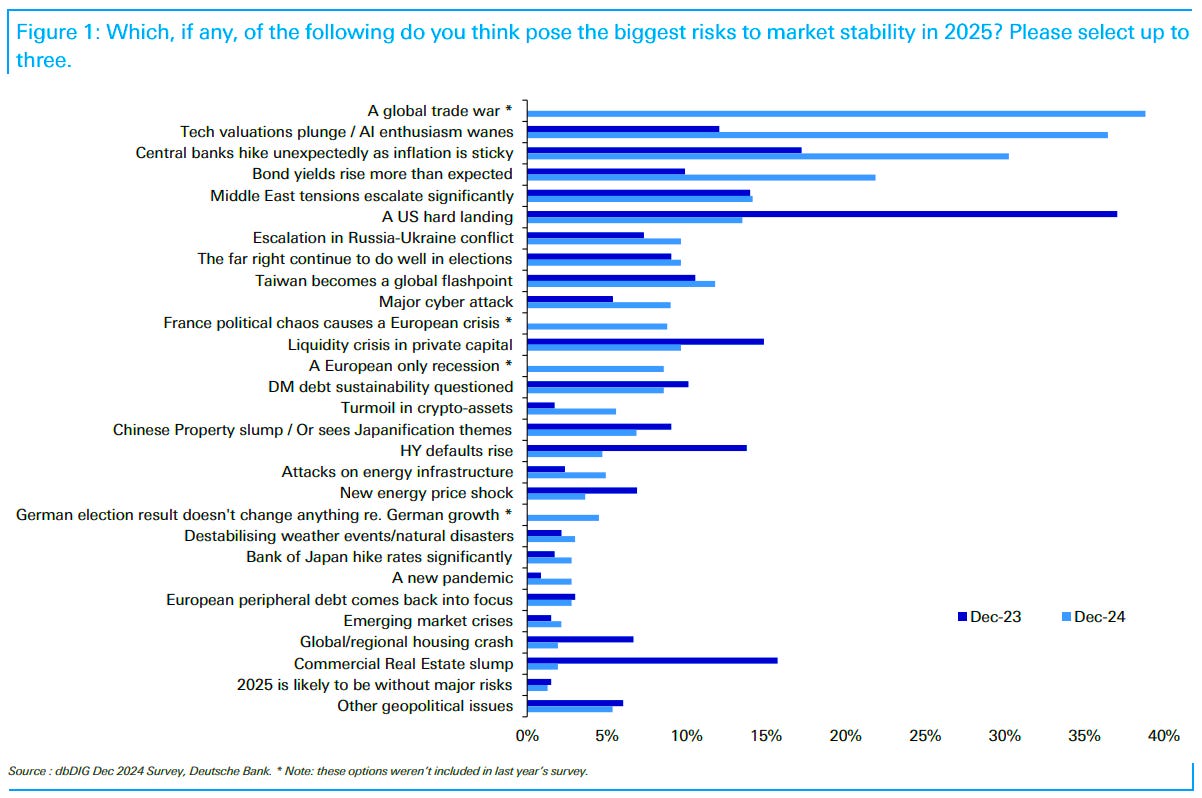

Brett: There’s always something for investors to fear, though it changes over time and is usually not the resulting market catalyst (see 2023 “hard landing”

Data as of 12.17.2024

Data as of 12.17.2024

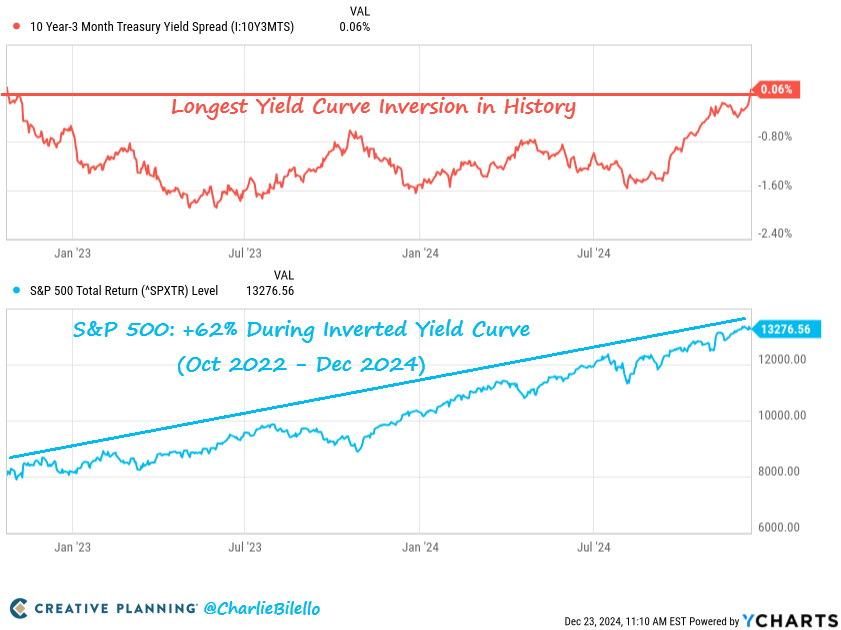

Joseph: and market “rules” often break (see inverted yield curve -> hard landing)

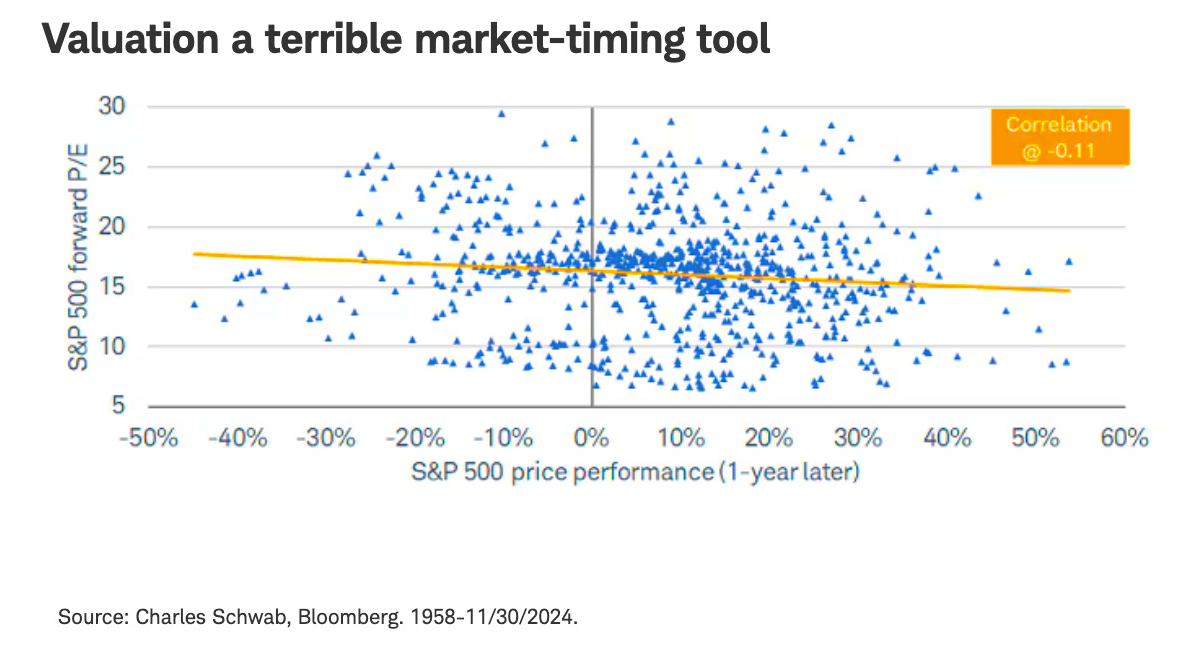

Brett: Popularly quoted indicators are often not only wrong but often based on stories not data

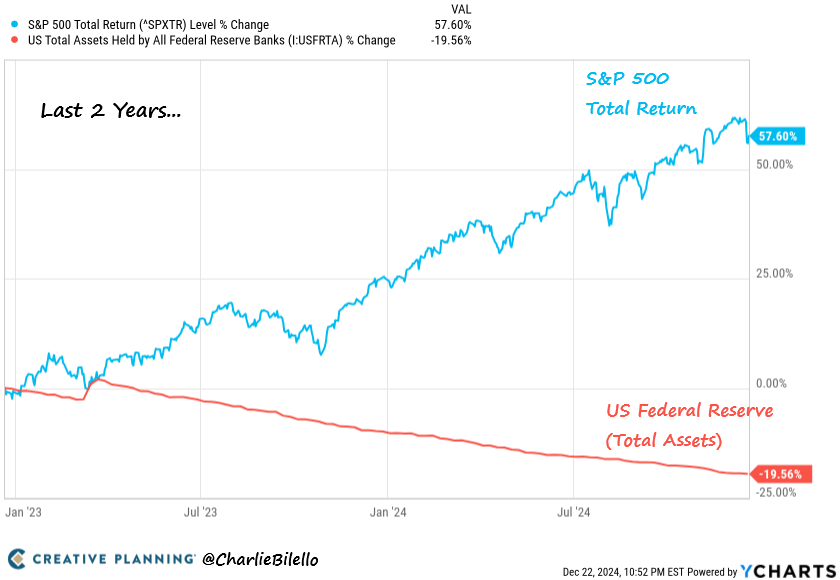

Brad: and the supposedly tight connection between the Fed balance sheet and equity performance

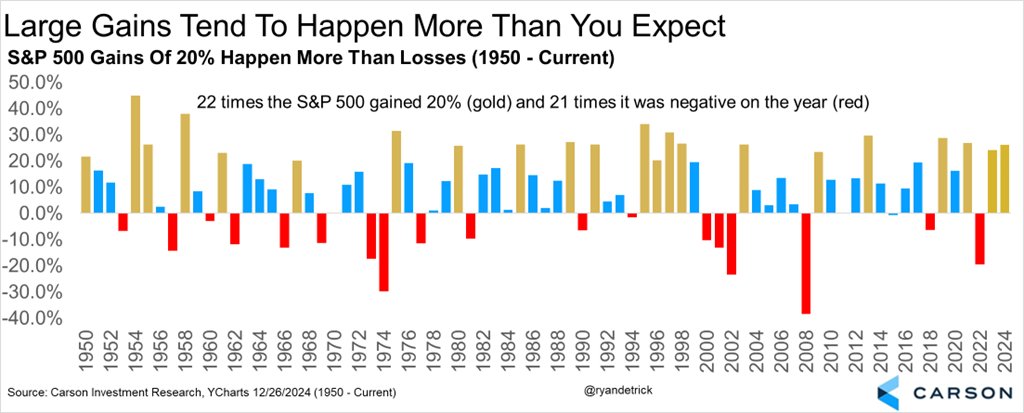

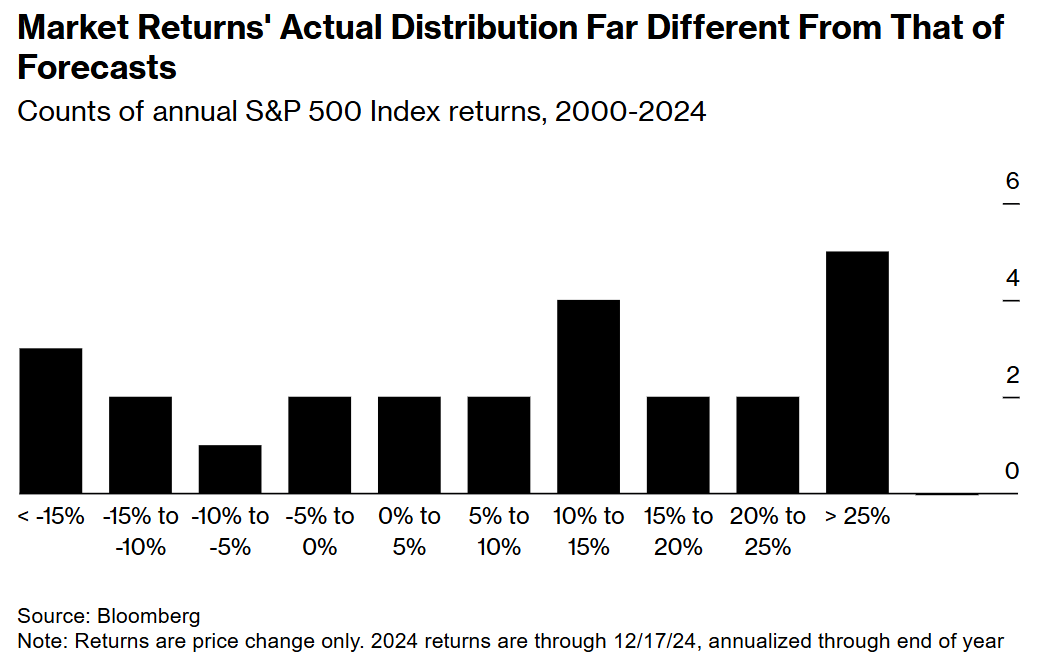

John Luke: Contrary to popular belief, big up years for stocks (like 2023/2024) occur more often than even small down years

Brian: shown another way, many miss the (positive) right tails by worrying too much about the (negative) left tails

Arch: But here we are, with strategists regularly taking the safe formula of (Current price + 5 to 10%)

Data as of November 2024

Data as of November 2024

JD: and after last year’s overly conservative outlooks, they’re ratcheting back to the old formula

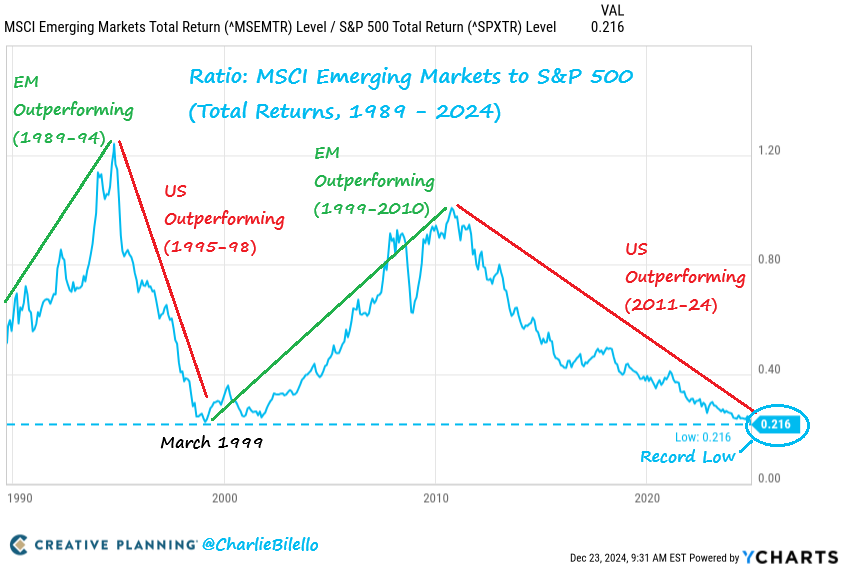

Brad: Emerging markets have been the ugly duckling of portfolios in recent years

Brad: Emerging markets have been the ugly duckling of portfolios in recent years

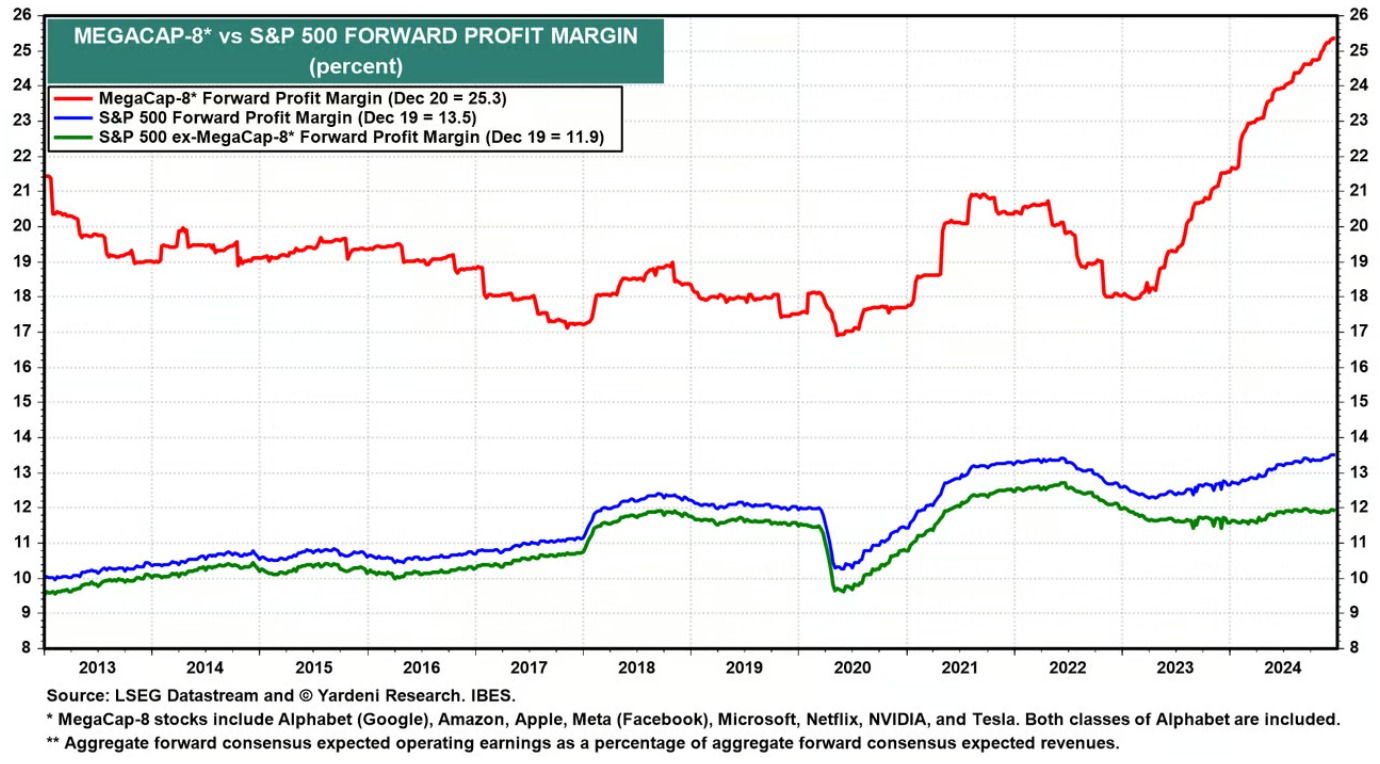

Dave: and like most equity diversifiers, completely stomped by the superior profitability of megacap US tech companies

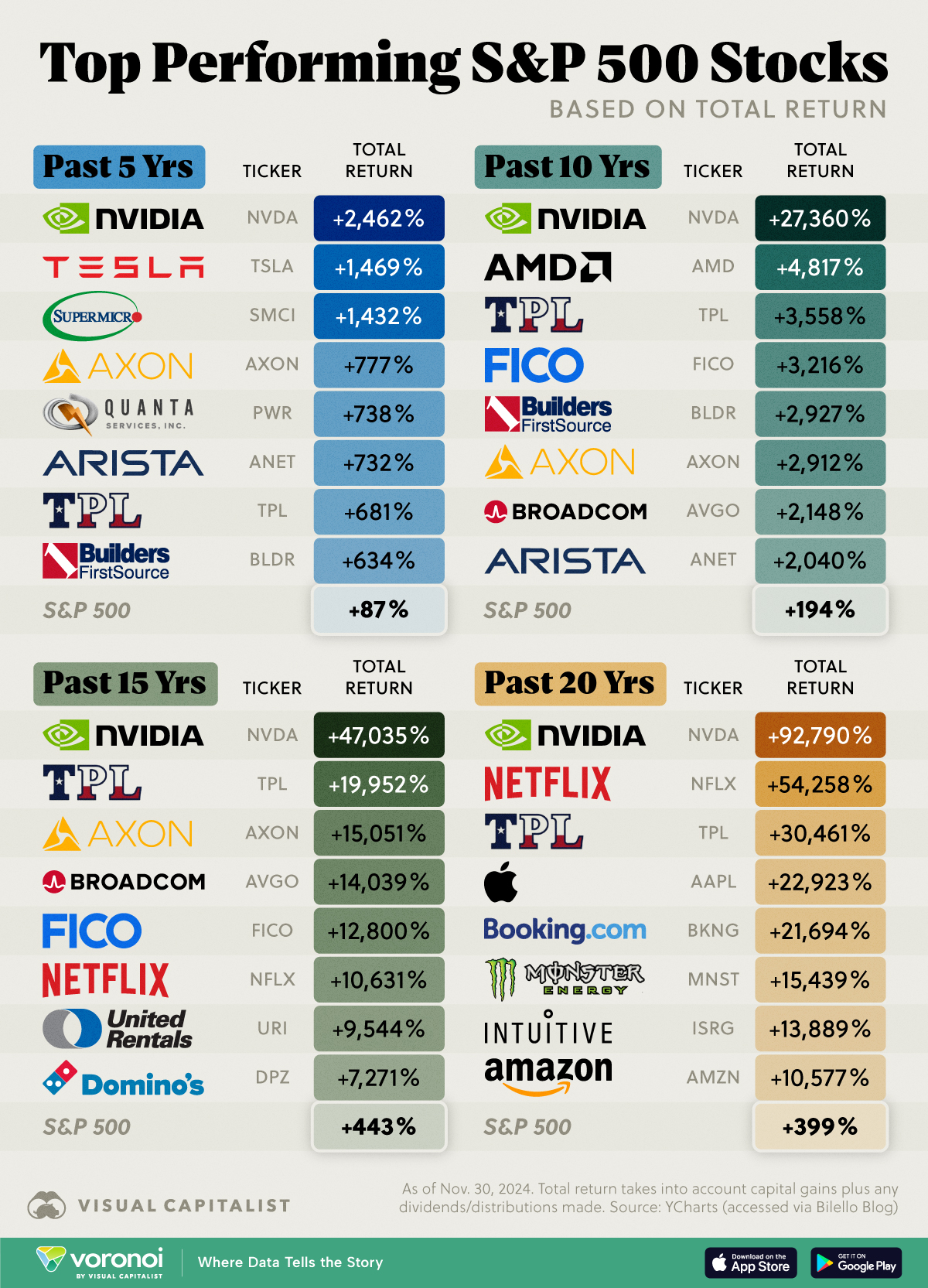

Brad: The handful of stocks that change lives are much more obvious in the rearview mirror than they were through the windshield

Data as of November 2024

Data as of November 2024

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2412-19.