Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

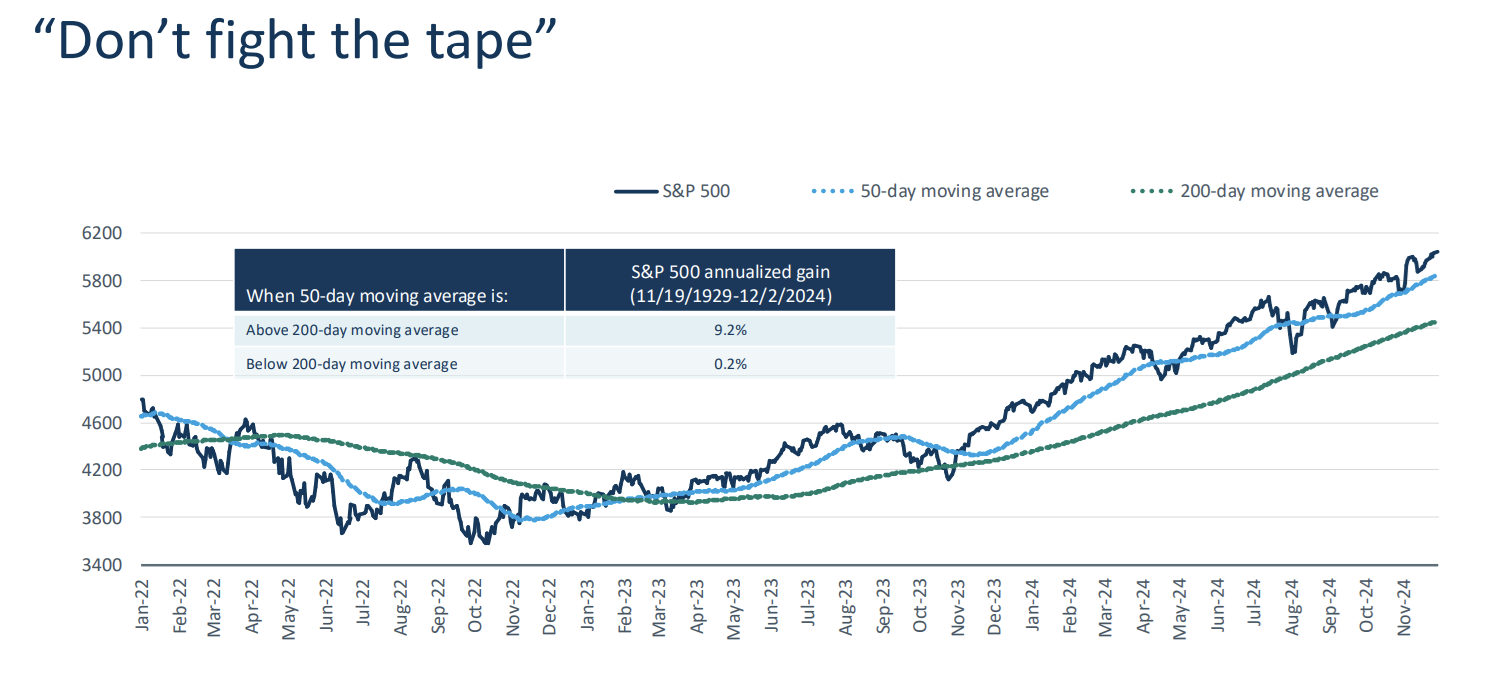

Derek: The trend remains your friend—history shows that when the S&P 500 is above its 200-day moving average, annualized gains are significantly higher.

Momentum continues to dominate market dynamics, with historical data pointing to significantly higher annualized returns when the S&P 500 trends above its 200-day moving average. This sets a constructive tone as we enter the new year.

Source: Schwab Market Outlook as of 11.30.2024

Source: Schwab Market Outlook as of 11.30.2024

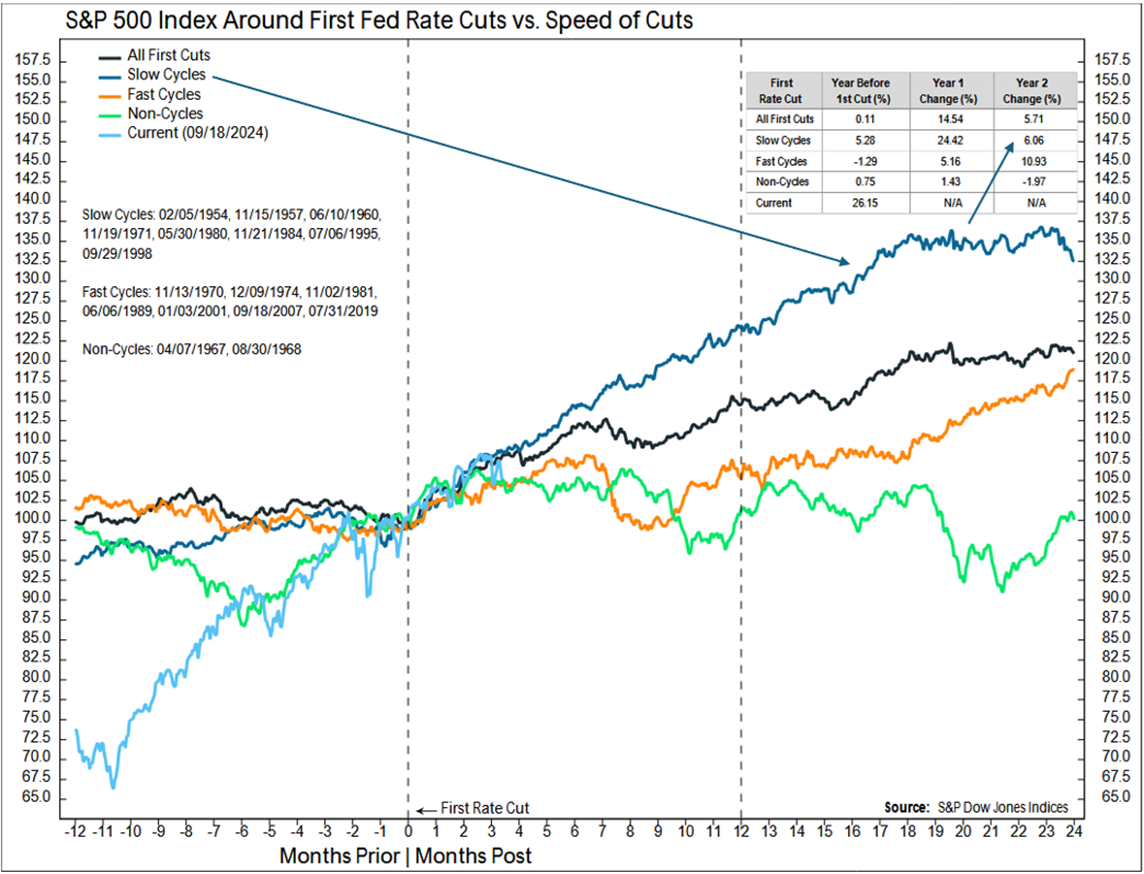

John Luke: With the Fed past peak hawkishness, the early stages of easing cycles often present extended multi-year opportunities for market gains.

Historical performance around the first rate cut is clear: slow easing cycles have historically delivered substantial returns, with Year 1 and Year 2 gains averaging 24.42% and 6.06%, respectively. As markets navigate the Fed’s shift, opportunities may abound.

Source: S&P Dow Jones Indices as of 9.29.2024

Source: S&P Dow Jones Indices as of 9.29.2024

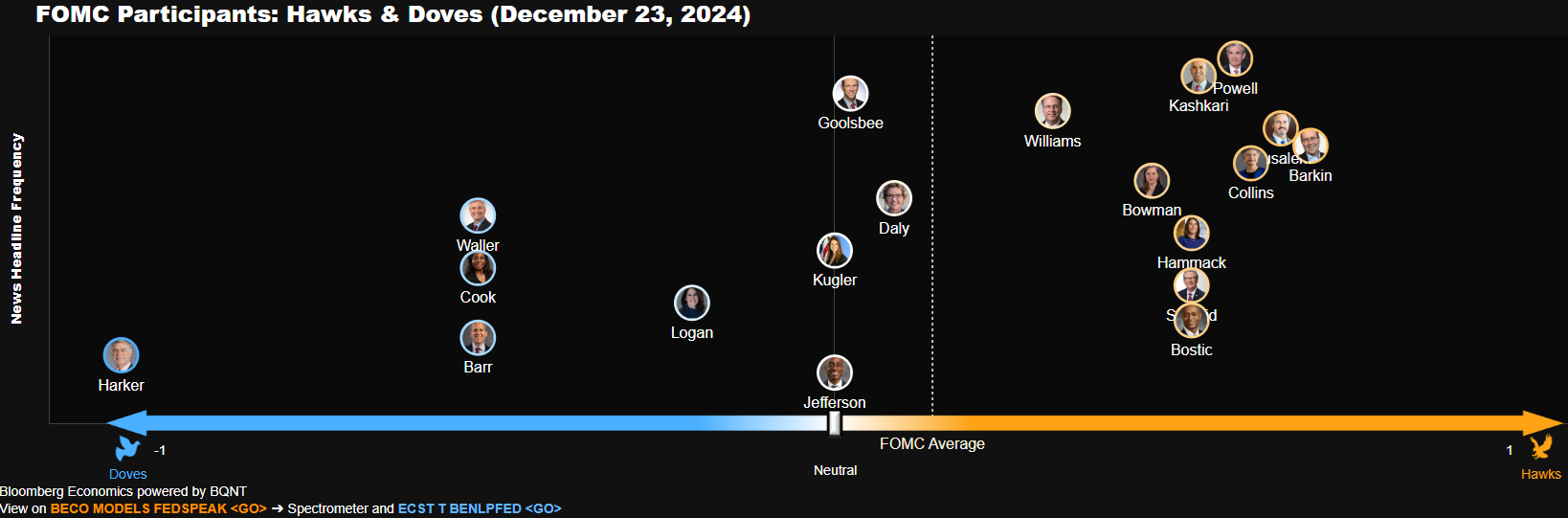

Arch: The new year brings new faces to the FOMC, and with it, a potential for nuanced changes in tone and decision-making, particularly in response to evolving inflation trends.

A reshuffled Federal Open Market Committee may influence the policy direction this year, with inflation and rate cuts likely remaining at the forefront of discussions.

Source: FOMC as of 12.23.2024

Source: FOMC as of 12.23.2024

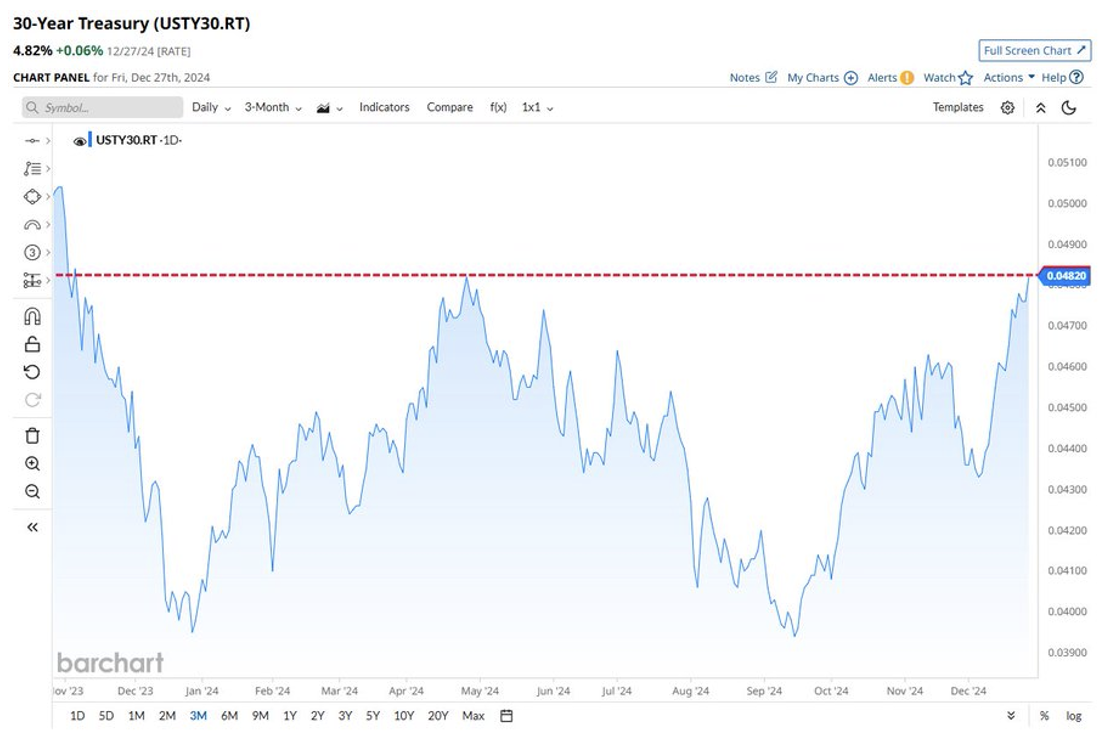

Joseph: Long-term and short-term rates remain significantly diverged, as long rates have moved abruptly higher since the Fed started cutting rates.

The abrupt divergence between long-term and short-term rates adds another layer of complexity to the fixed-income landscape, underscoring the importance of adapting to rapid shifts in yield curves.

Source: Barchart as of 12.27.2024

Source: Barchart as of 12.27.2024

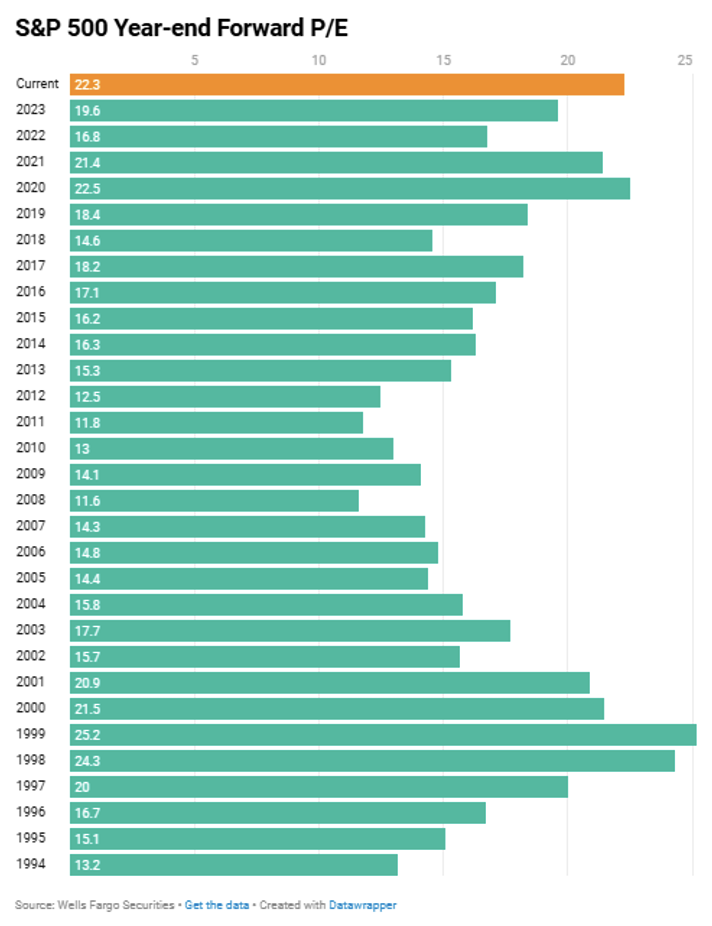

Brian: Valuations are back in focus, with forward P/E ratios climbing to levels not seen in years—a reflection of optimism, but also a warning sign.

The S&P 500’s forward P/E ratio has reached its highest level since the dot-com bubble. While this reflects confidence in future earnings, it also raises questions about sustainability, especially in an environment of higher rates.

Source: Wells Fargo Securities as of 11.30.2024

Source: Wells Fargo Securities as of 11.30.2024

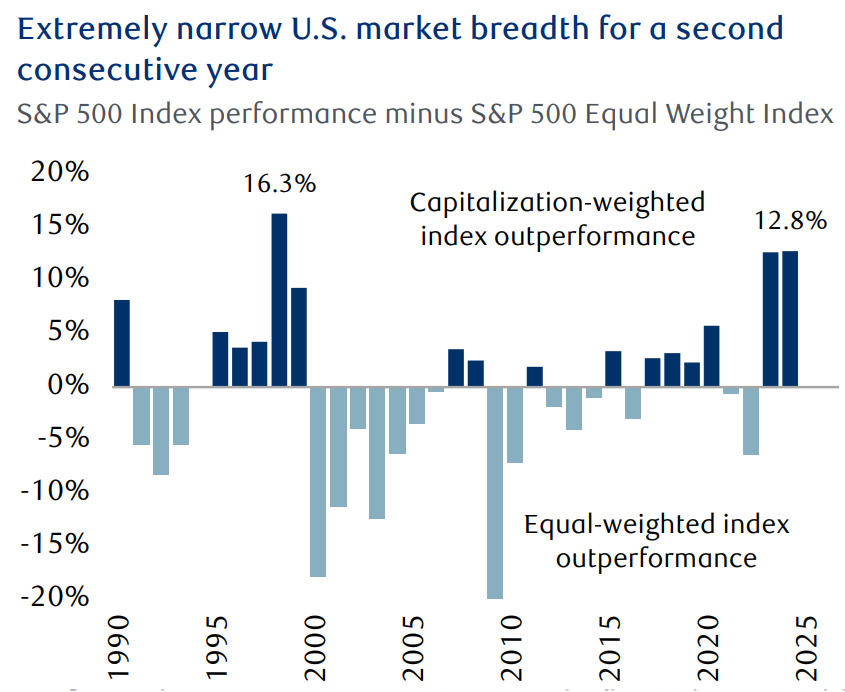

John Luke: The S&P 500’s narrow breadth tells a clear story: 2024 was dominated by a few standout names for the second consecutive year highlighting the dominance of a small group of mega-cap stocks.

Market performance continues to be driven by a handful of mega-cap stocks, as evidenced by the massive outperformance of capitalization-weighted indices over their equal-weighted counterparts.

Source: Special Situations Research as of 11.30.2024

Source: Special Situations Research as of 11.30.2024

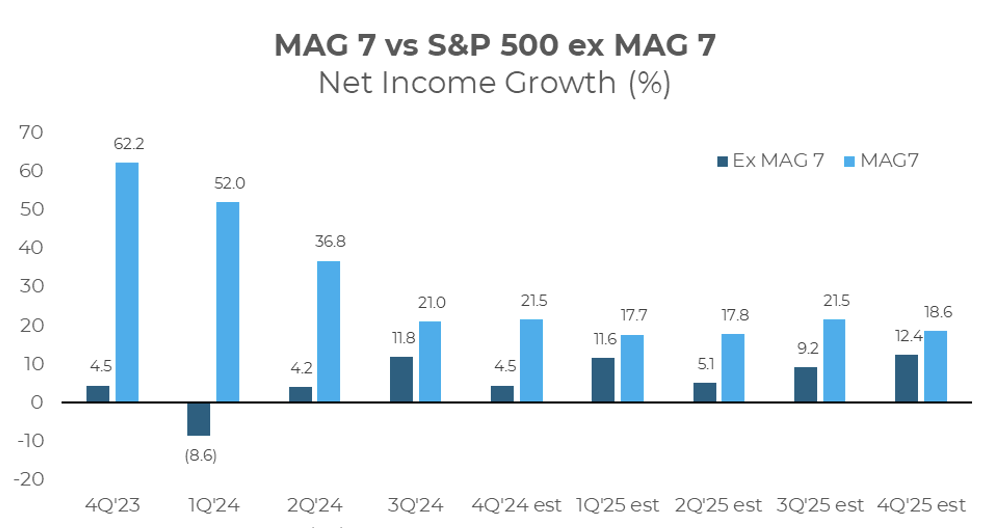

Dave: The dominance of the MAG 7 continues to overshadow the rest of the market, with staggering differences in net income growth.

Meta, Apple, Google, Microsoft, Amazon, Nvidia, Tesla continues to post outsized net income growth; concentration remains a defining feature of the market landscape.

Source: Strategas as of 12.31.2024

Source: Strategas as of 12.31.2024

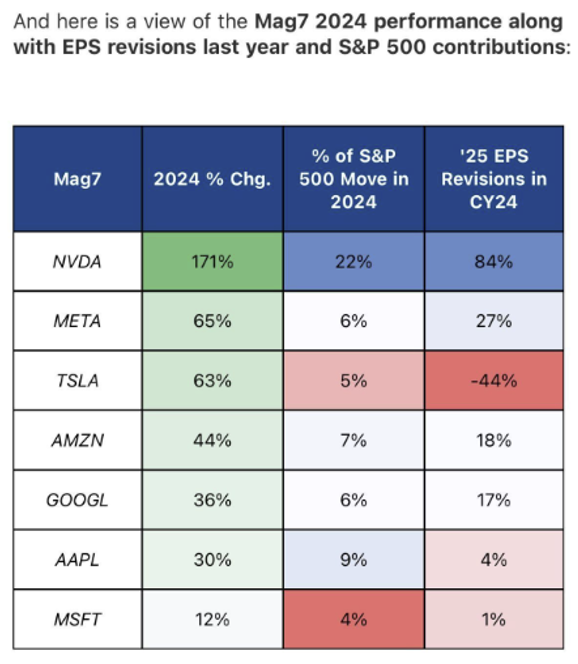

Beckham: While MAG 7 dominated in 2024, not just with outsized returns but with significant contributions to the S&P 500 and strong EPS revisions, Tesla appears to be an outlier in terms of fundamentals.

NVIDIA’s remarkable 171% return was driven by an 84% EPS revision, while TSLA’s return was despite a negative EPS revisions.

Data as of 12.31.2024

Data as of 12.31.2024

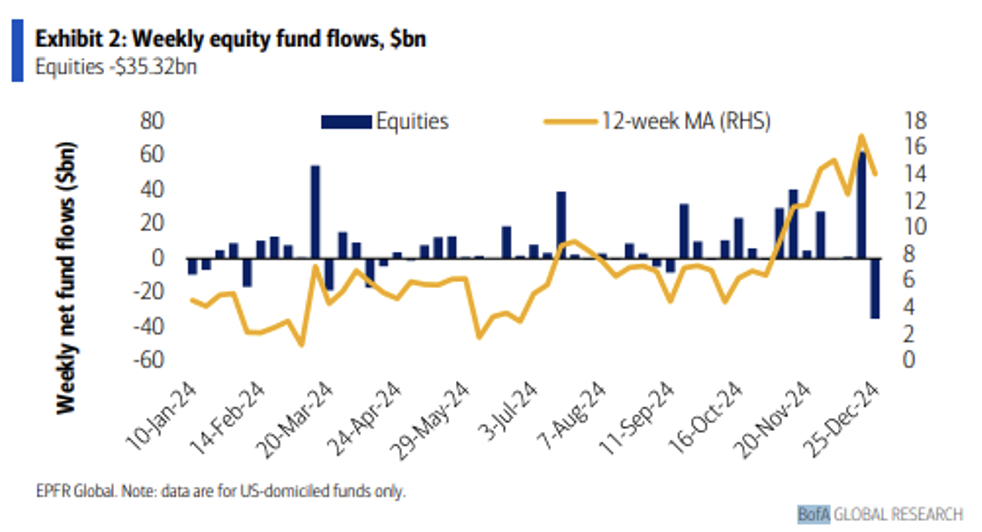

Brian: Equities experienced their largest outflow in two years during Christmas week. Whether it signals broader risk-off sentiment or a temporary seasonal anomaly remains to be seen.

The largest equity outflows since 2021 hint at lingering caution among investors, though whether this marks the start of a broader trend remains to be seen.

Source: BoAML as of 12.25.2024

Source: BoAML as of 12.25.2024

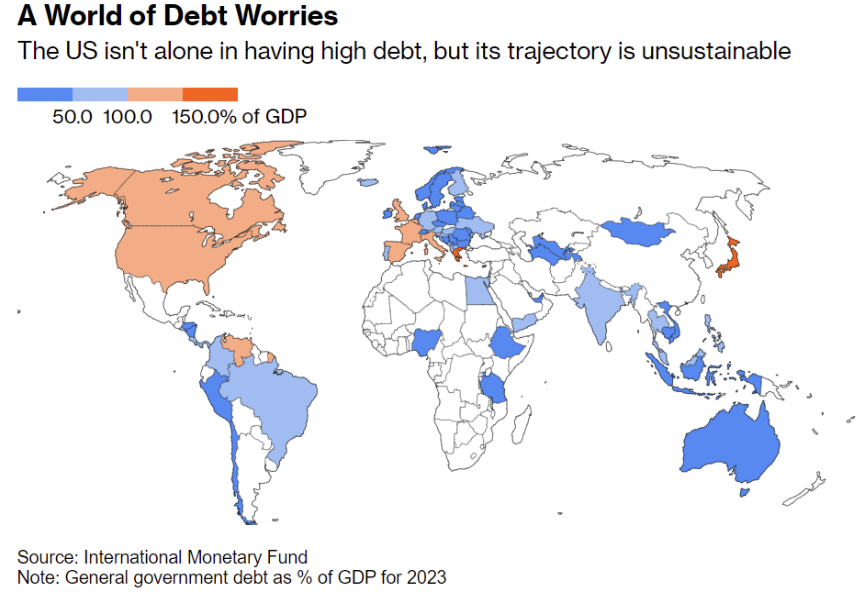

Brad: While the U.S. isn’t alone in carrying a heavy debt burden, its trajectory raises questions about long-term sustainability.

Global debt remains a pressing issue, with the U.S. standing out, a challenge that policymakers cannot ignore.

Source: IMF as of 12.31.2023

Source: IMF as of 12.31.2023

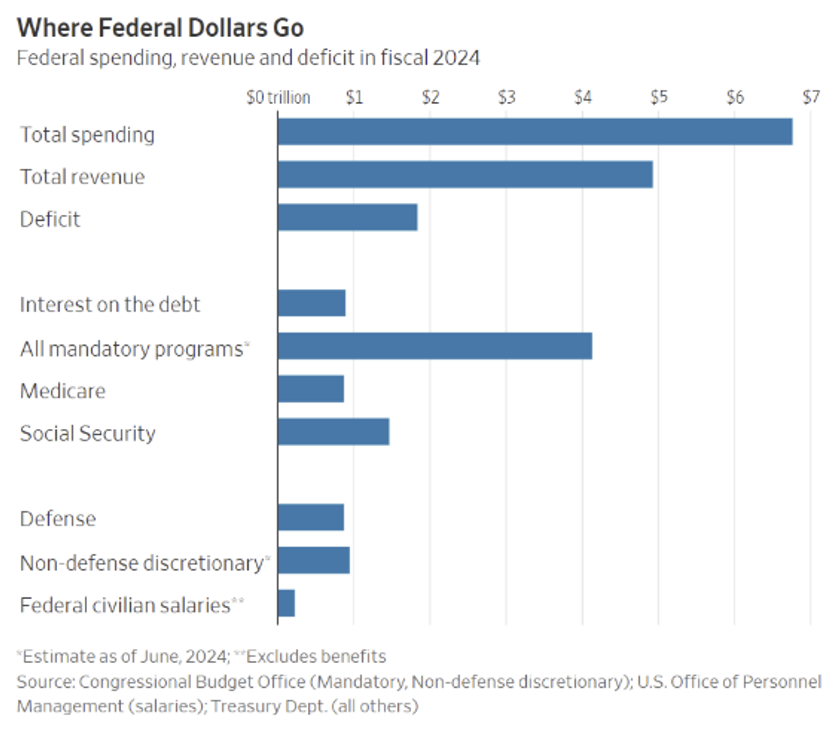

Derek: Federal spending is a stark reminder that much of the budget is non-negotiable, leaving little room for significant cuts despite political rhetoric.

With mandatory programs like Social Security and Medicare dominating the federal budget, hopes of deficit reduction through spending cuts alone appear less realistic.

Source: CBO as of 6.30.2024

Source: CBO as of 6.30.2024

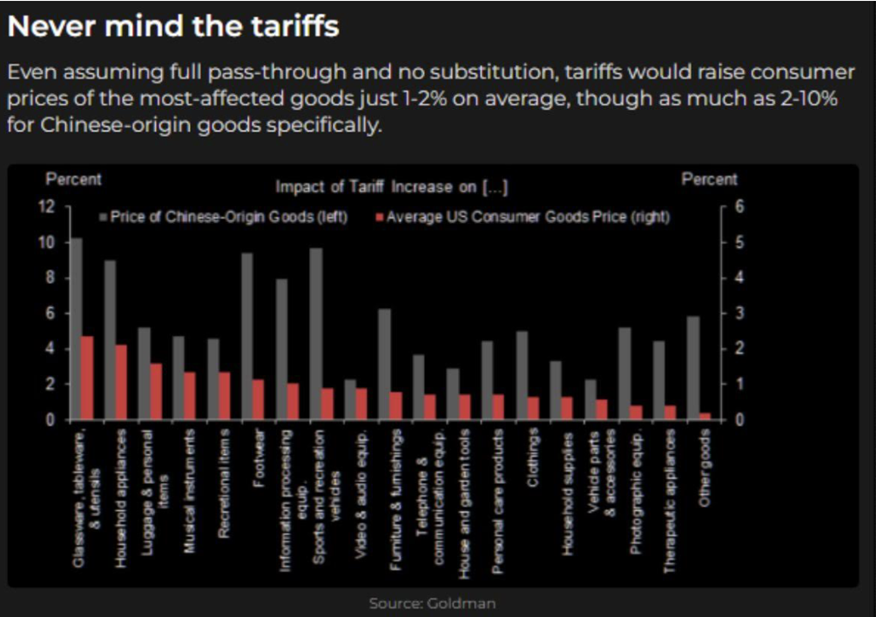

Dave: Data shows the direct impact of tariffs on consumer prices may be more limited than many fear.

Even with full pass-through, tariffs would raise consumer prices by just 1–2% on average, with Chinese-origin goods seeing slightly higher impacts. This evidence tempers fears of tariffs causing broader market disruptions.

Source: Goldman Sachs as of 11.30.2024

Source: Goldman Sachs as of 11.30.2024

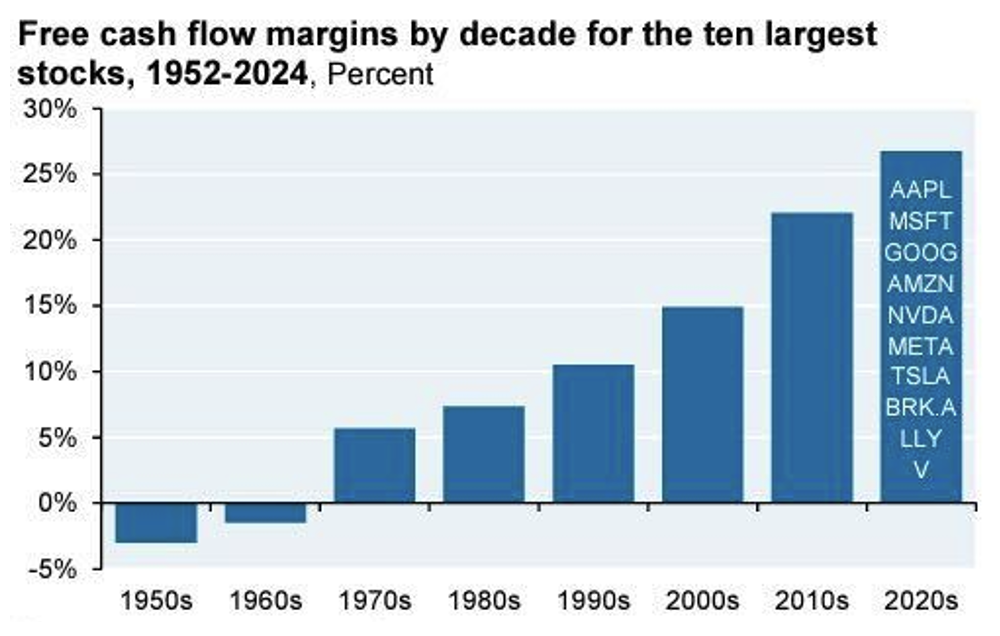

Brad: The rise of free cash flow margins over the decades is a testament to the increasing dominance and efficiency of the companies, especially the largest technology companies.

Free cash flow margins for the largest companies have surged to record highs, reflecting the operational efficiencies and profitability of mega-cap firms like Microsoft and Apple.

Source: Empirical Research as of 11.30.2024

Source: Empirical Research as of 11.30.2024

This diverse set of charts paints a compelling picture of where we’ve been and where we might be headed. From inflation and FOMC dynamics to investor sentiment and emerging markets, 2025 promises to be another year of challenges and opportunities. As always, we’ll continue monitoring and interpreting the evidence to help navigate what’s ahead.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2501-6.