Our team looks at a lot of research throughout the day. Here are a handful that we think are contributing to investor activity , from rate expectations to growth drivers to government spending and comparisons of foreign markets to ours. Enjoy!

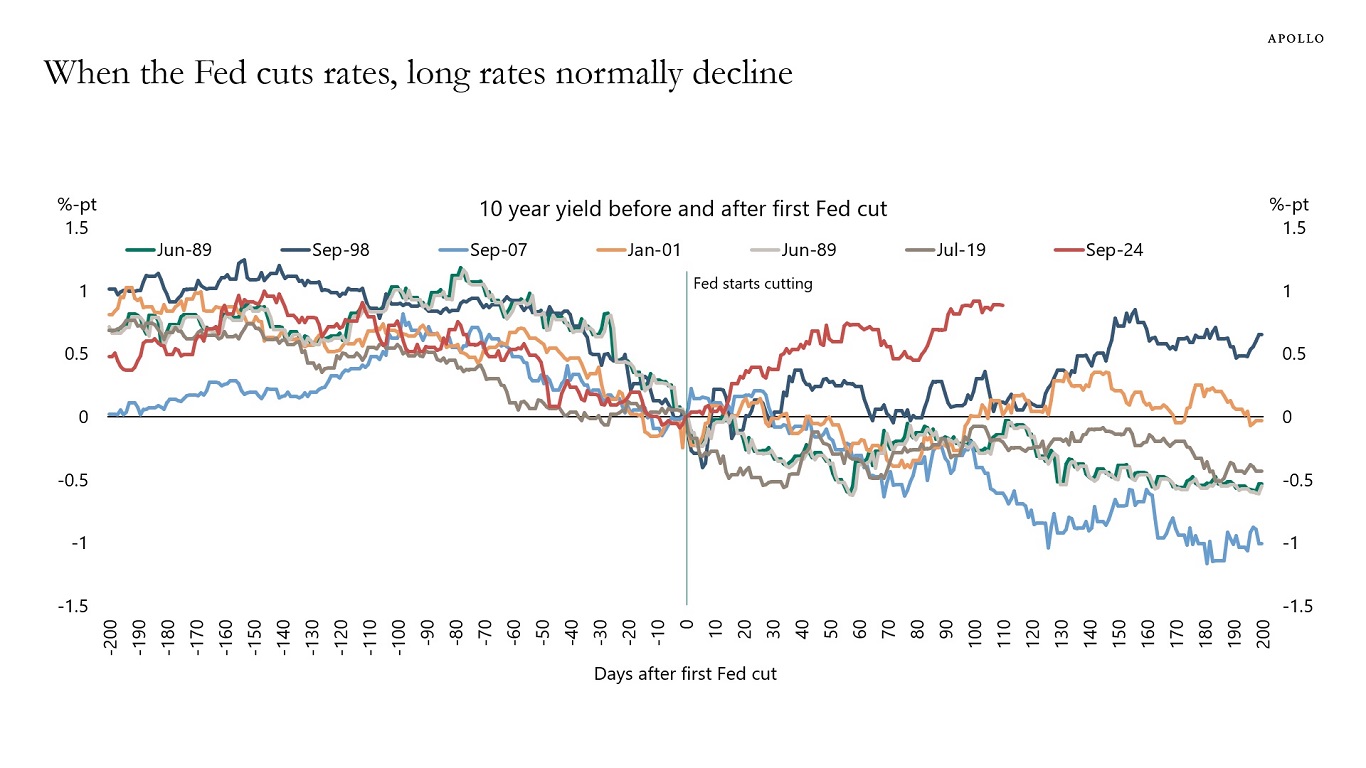

John Luke: As everyone knows, long-term rates have bucked their usual trend of falling during rate-cutting cycles

Source: Apollo as of 01.07.2025

Source: Apollo as of 01.07.2025

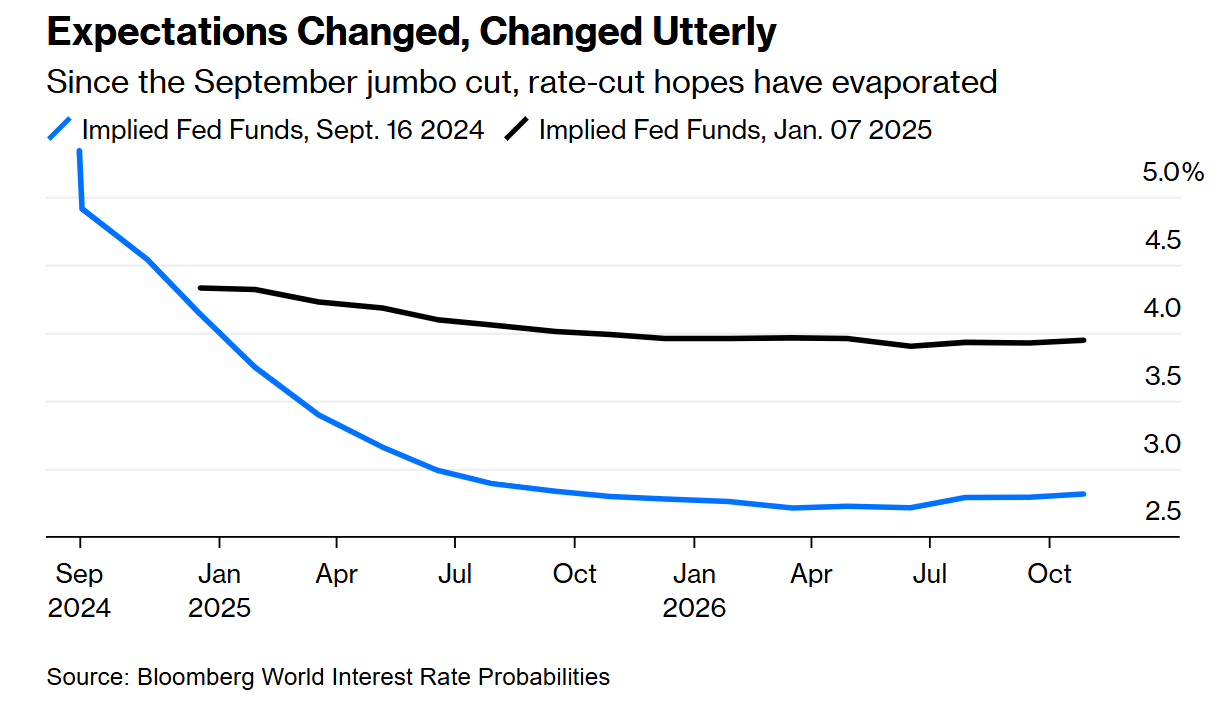

John Luke: and expectations for the terminal Fed Funds rate stopped falling as soon as the first cut took place

Data as of 01.08.2025

Data as of 01.08.2025

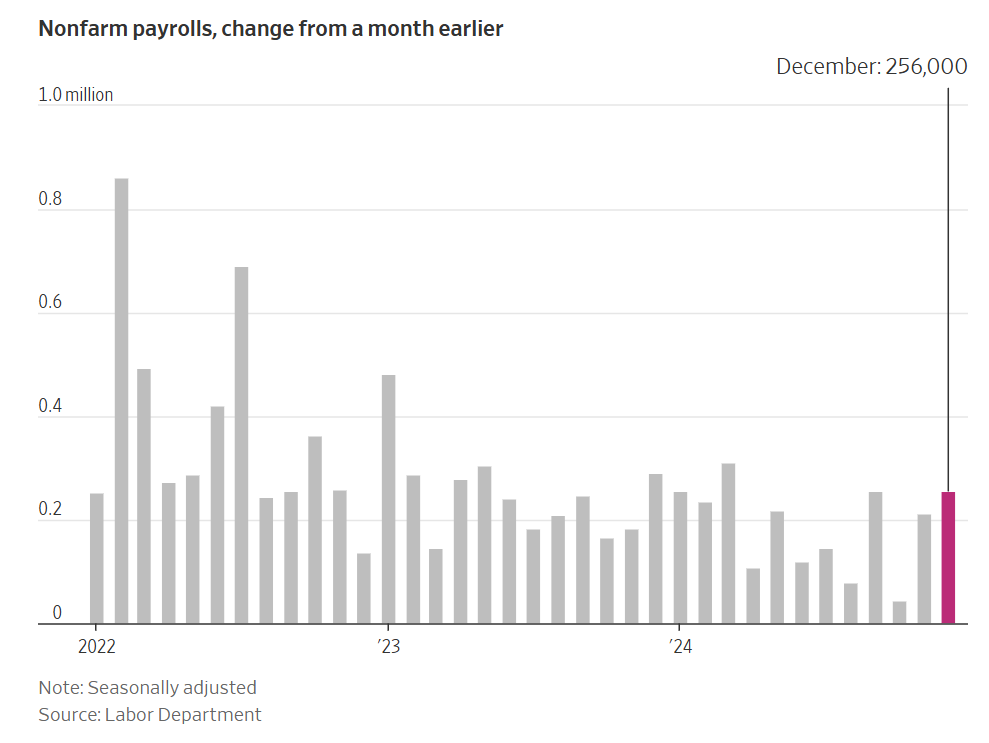

Beckham: This week’s Nonfarm Payroll report is adding to evidence of a stable to strong economy

Data as of 01.10.2025

Data as of 01.10.2025

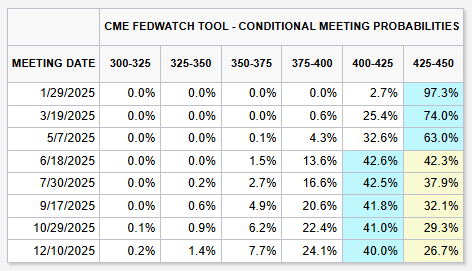

Brett: and confirmed market expectations that 2025 rate cuts are turning into (maybe) one cut

Source: CME FedWatch Tool as of 01.10.2025

Source: CME FedWatch Tool as of 01.10.2025

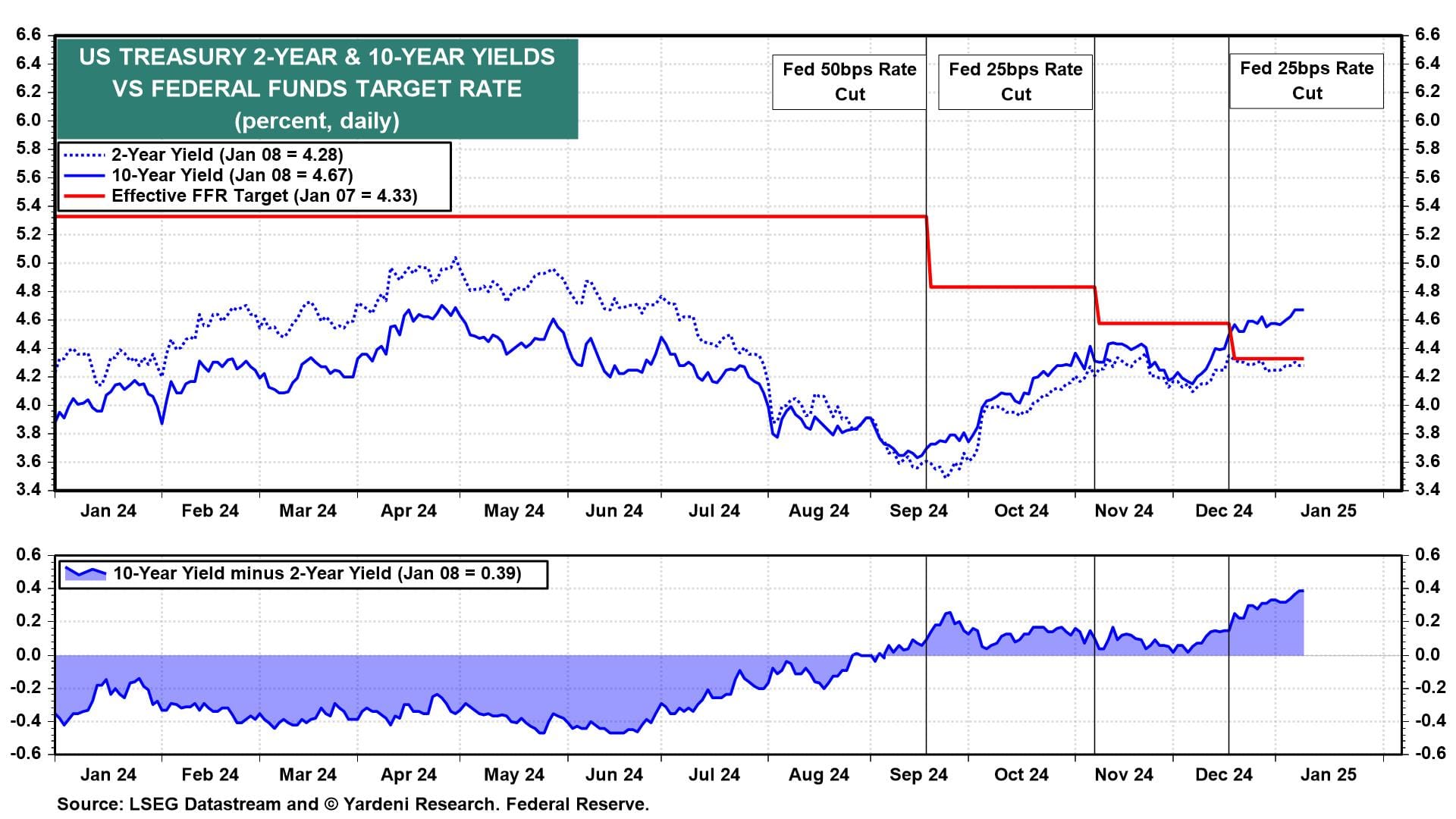

Brian: The long-inverted yield curve has steepened aggressively since the last FOMC rate cut

Data as of 01.08.2025

Data as of 01.08.2025

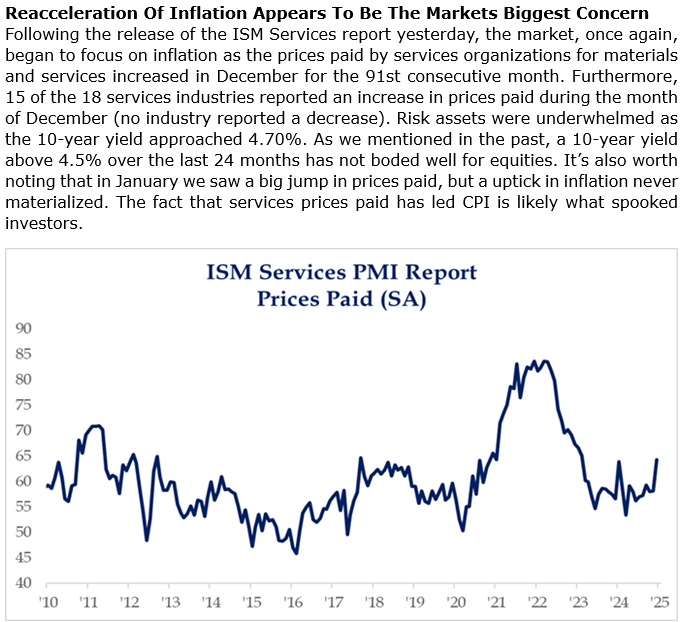

Brad: and investors are getting hit with continued evidence that last year’s disinflation has ended

Source: Strategas as of 01.08.2025

Source: Strategas as of 01.08.2025

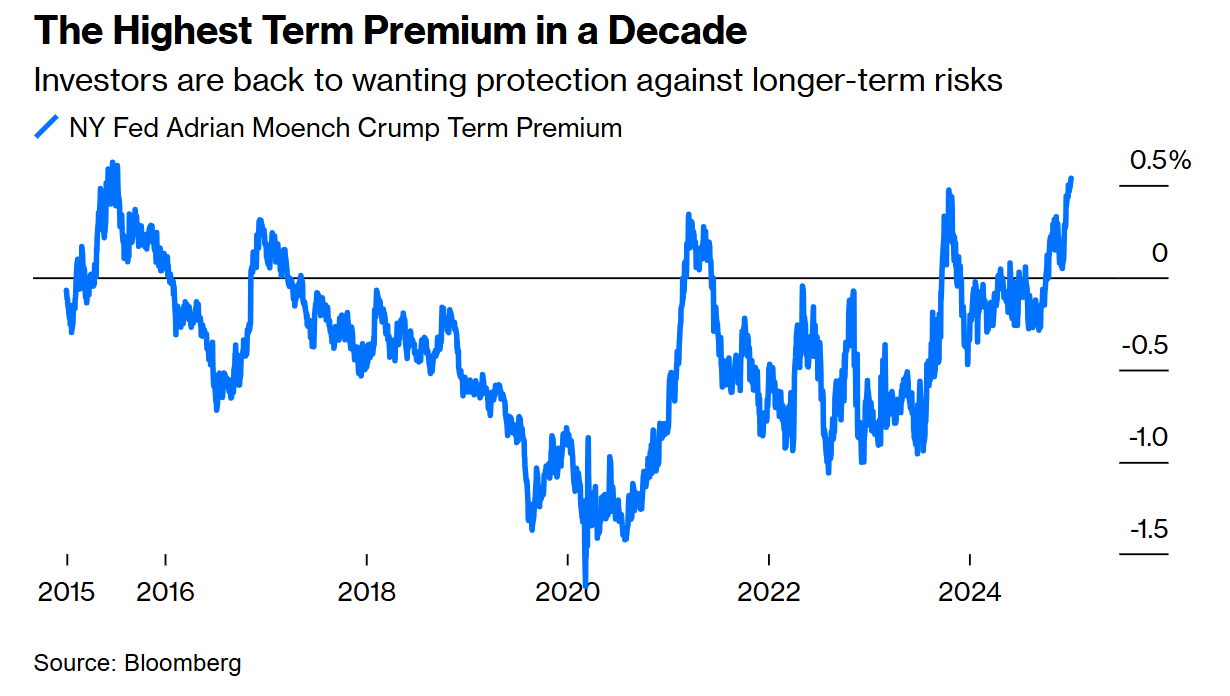

Joseph: The huge government debt, and prospect of resurgent inflation, is prompting fixed income investors to demand more compensation for buying long-term US Treasuries

Data as of 01.08.2025

Data as of 01.08.2025

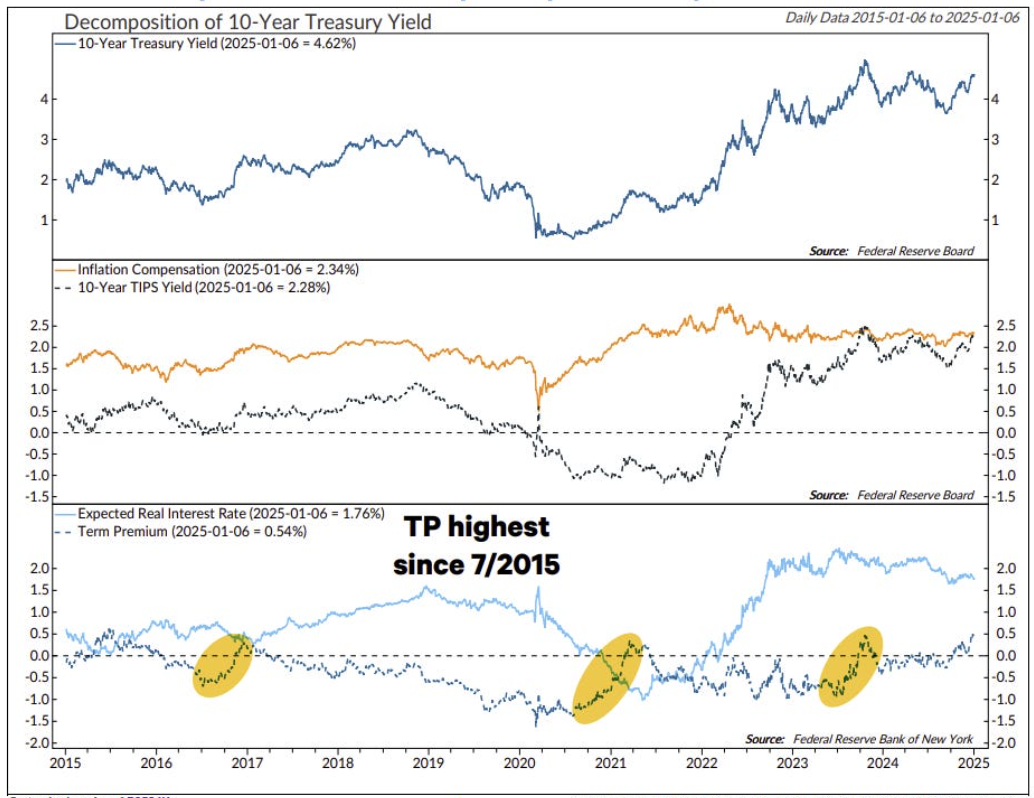

John Luke: similar to other periods since the global financial crisis

Source: Ned Davis Research as of 01.06.2025

Source: Ned Davis Research as of 01.06.2025

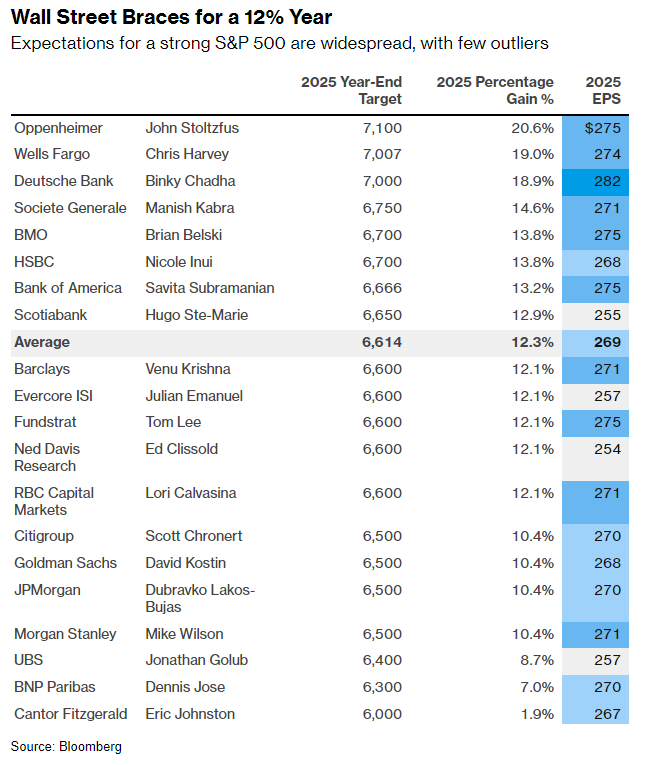

Dave: After two years of falling far short of S&P 500 prices, strategists are far more aggressive with their 2025 targets

Data as of 01.06.2025

Data as of 01.06.2025

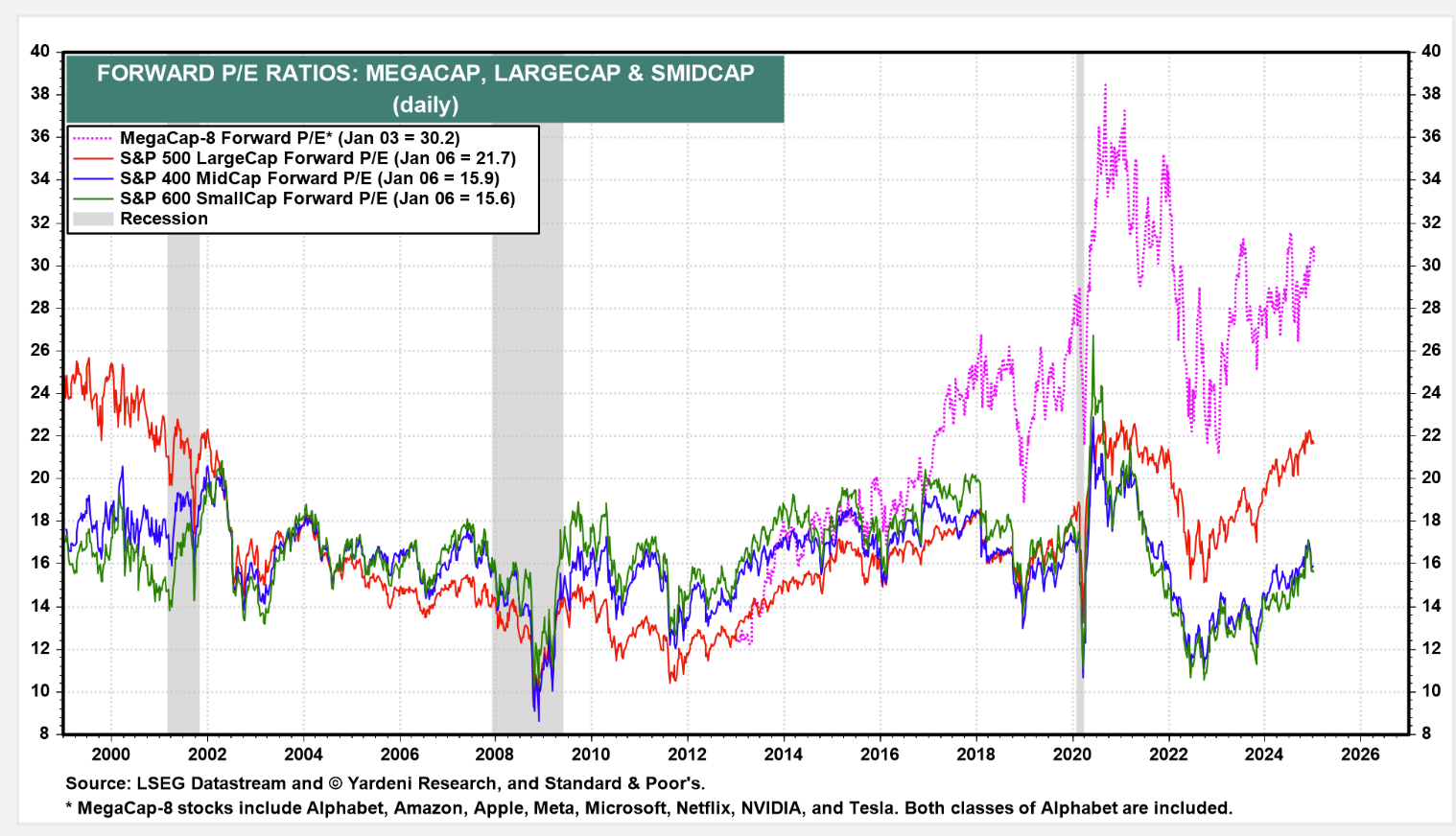

Brian: though perhaps investors should be looking for opportunities beyond the cap-weighted S&P 500

Data as of December 2024

Data as of December 2024

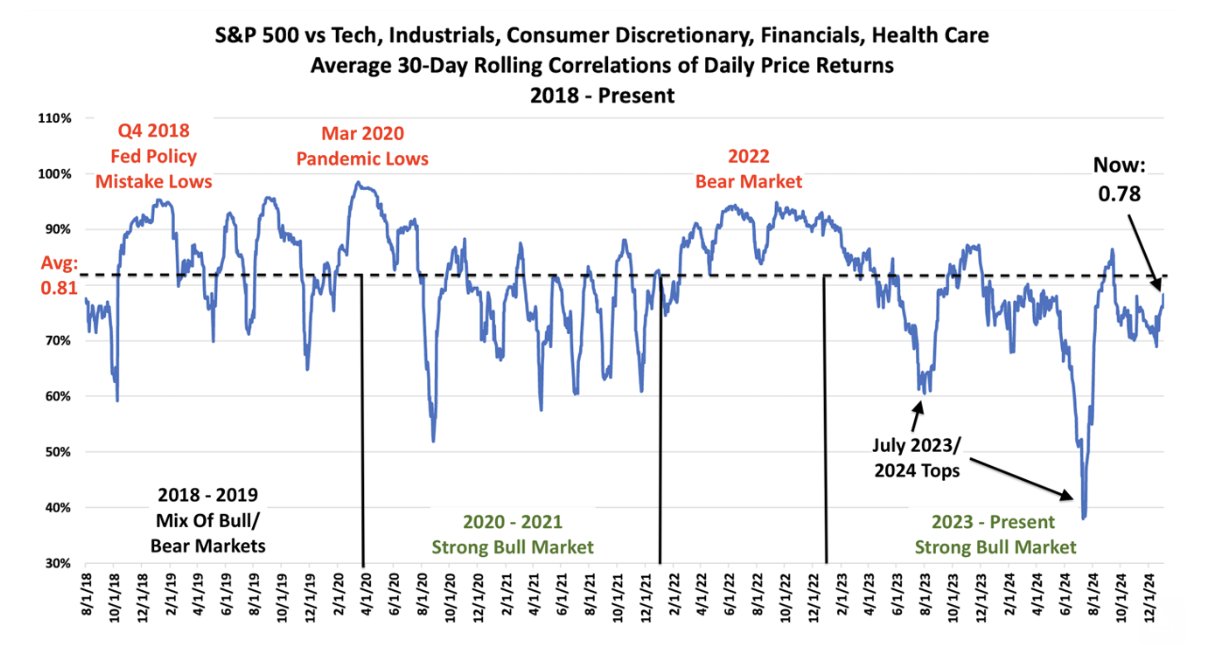

Brett: especially now that sector correlations have returned to a state more reflective of typical markets

Source: DataTrek as of 01.07.2025

Source: DataTrek as of 01.07.2025

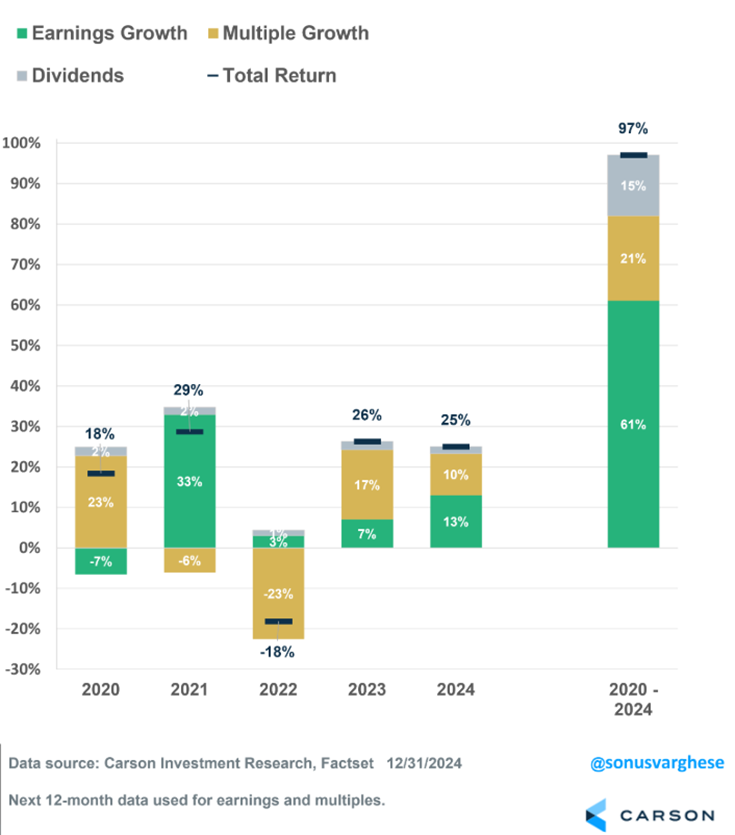

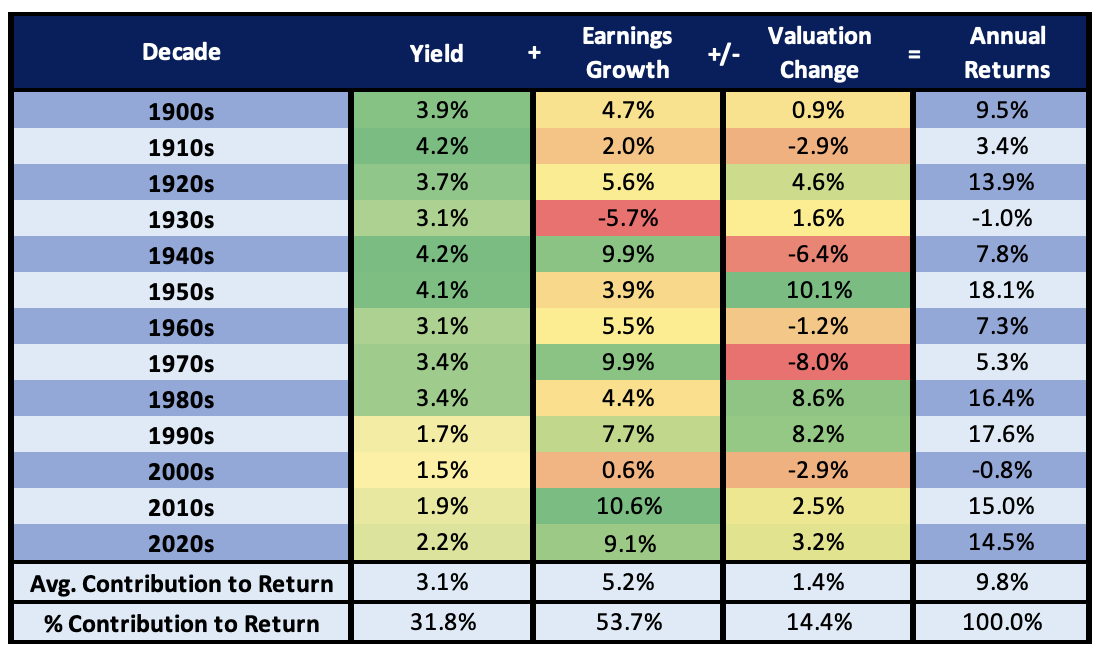

Joseph: Expanded valuations have played a role, but earnings growth has contributed a large portion of the fuel behind the gains of recent years

Dave: matching the historical pattern of earnings growth as a primary driver of stock market gains

Source: Aptus Capital, John Bogle, and Robert Shiller as of 11.30.2024

Source: Aptus Capital, John Bogle, and Robert Shiller as of 11.30.2024

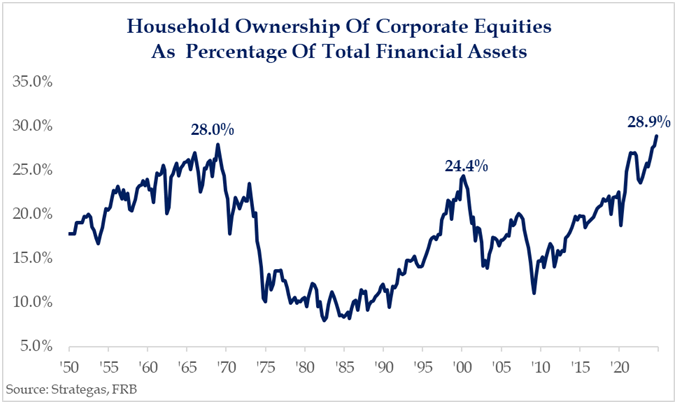

Brad: Steady gains since the financial crisis have contributed to high levels of equity ownership by individual households

Data as of December 2024

Data as of December 2024

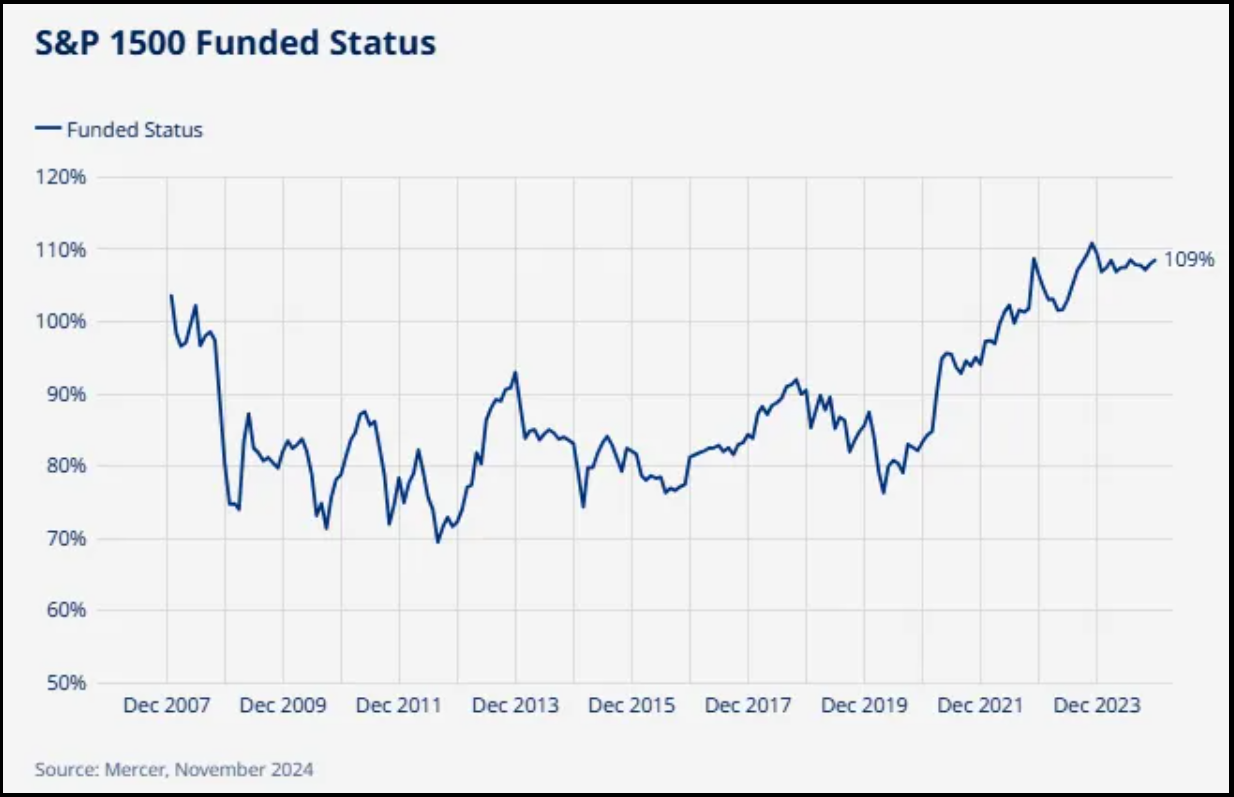

Arch: combined with higher interest rates, the equity rally has put large public company pensions in their best position in decades

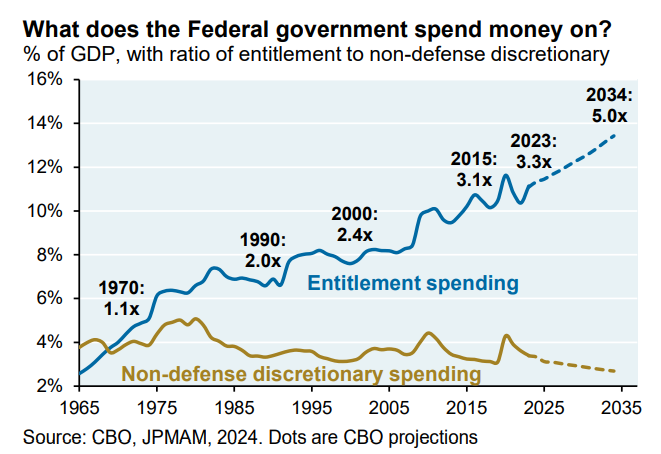

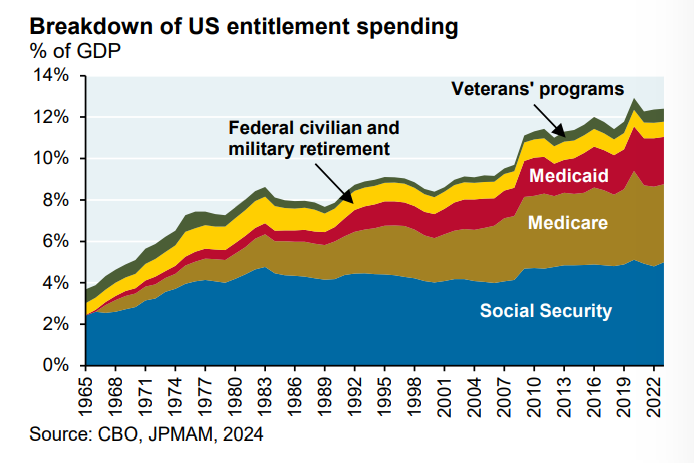

JD: Less secure is the US government, with not only high levels of spending but most of it hard to control without unpopular policy changes

JD: and expecting politicians to fight these battles seems unlikely

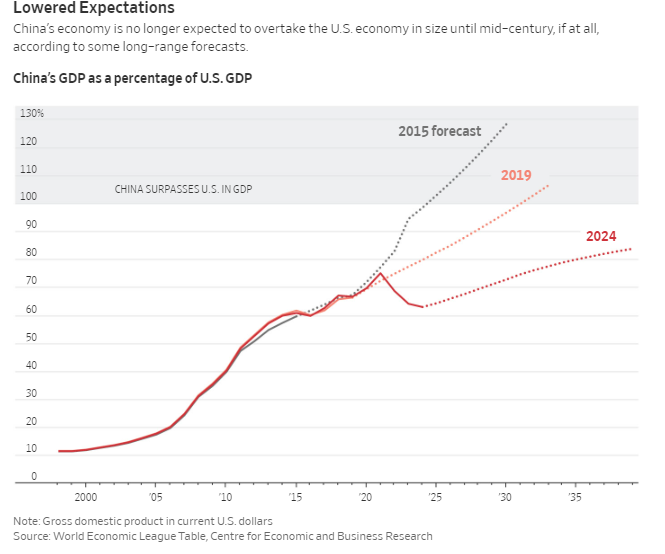

John Luke: Like Japan coming out of the 1980s, it appears that worries about China racing past the U.S. in economic status may have been misplaced

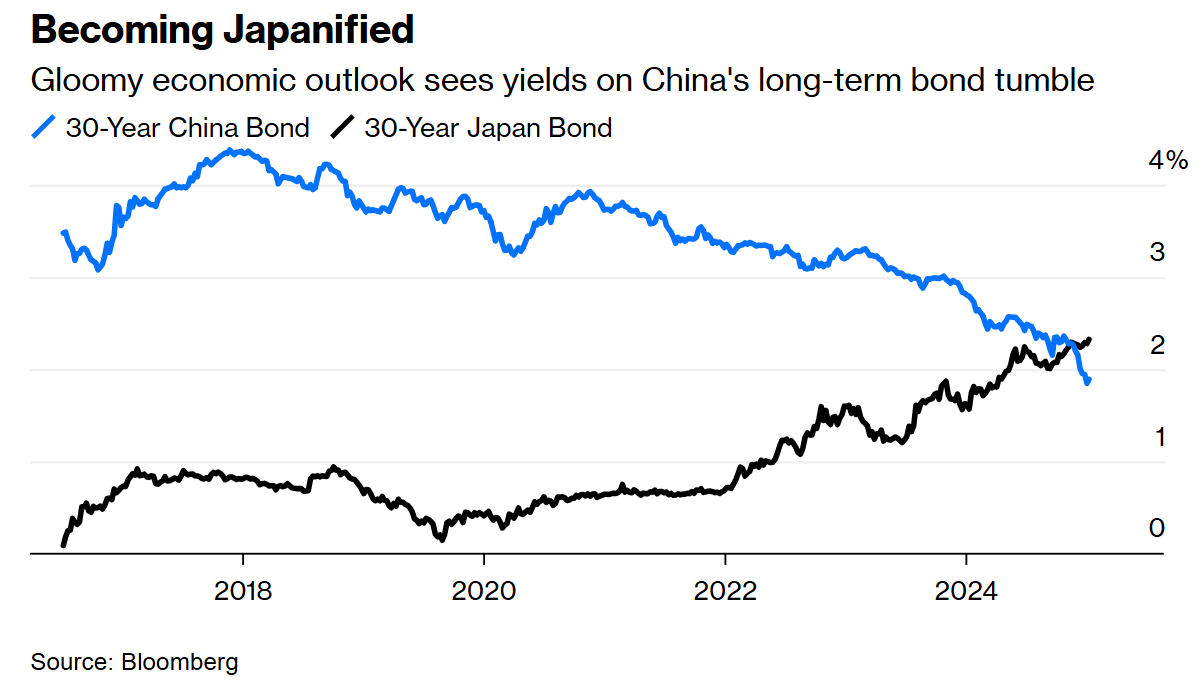

Beckham: and speaking of Japan and China, they’ve been going in opposite directions when it comes to interest rates

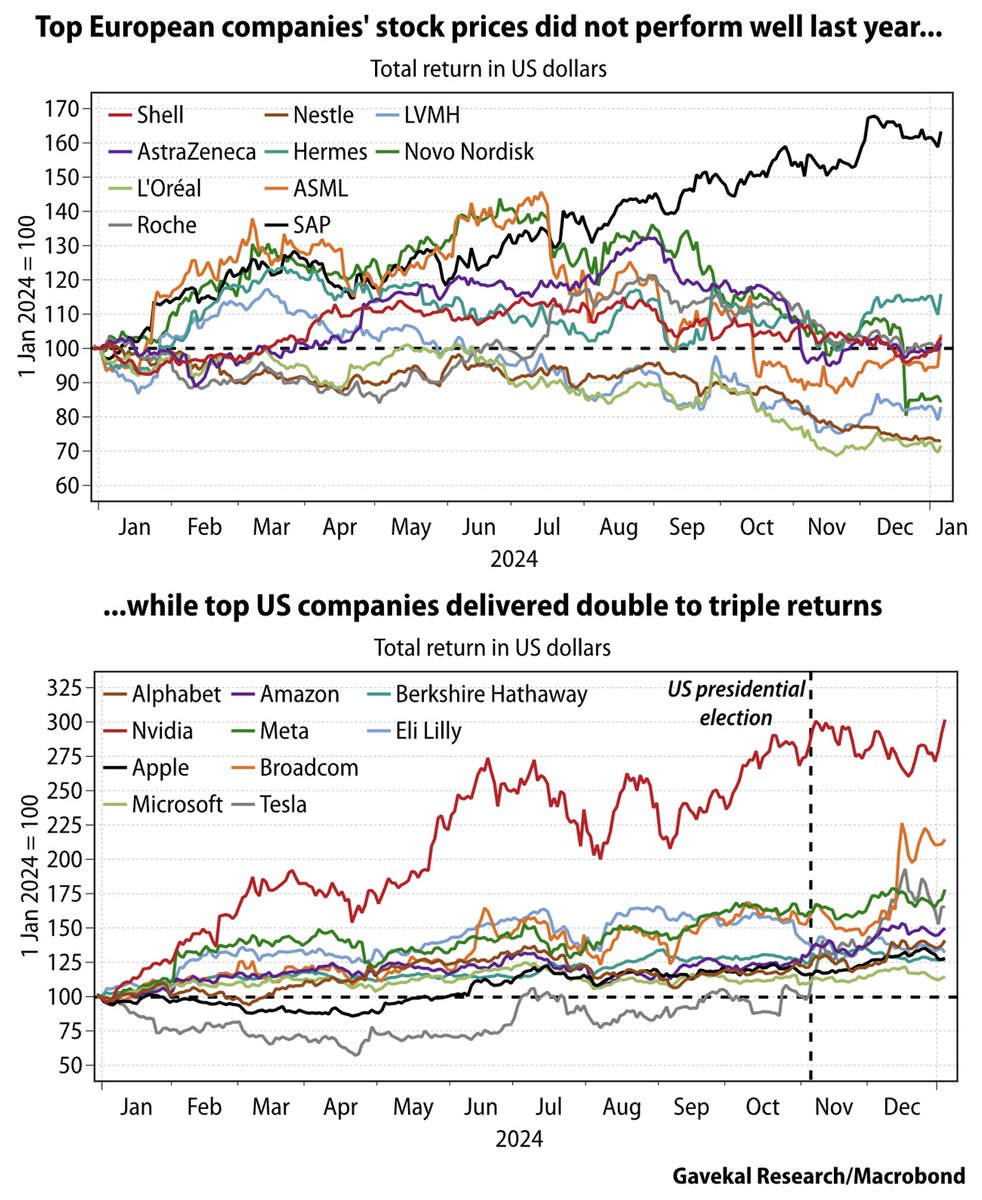

Arch: Compared to the U.S., it was a terrible year for European stocks even among its premier companies

Data as of 01.08.2025

Data as of 01.08.2025

This set of charts paints an evolving picture of where we’ve been and where we might go. As always, we’ll continue monitoring and interpreting the evidence to help navigate what’s ahead.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2501-22.