Our team looks at a lot of research throughout the week. Here are a handful that we think are contributing to investor activity, from AI panic to Fed plans to bull and diverging markets. Enjoy!

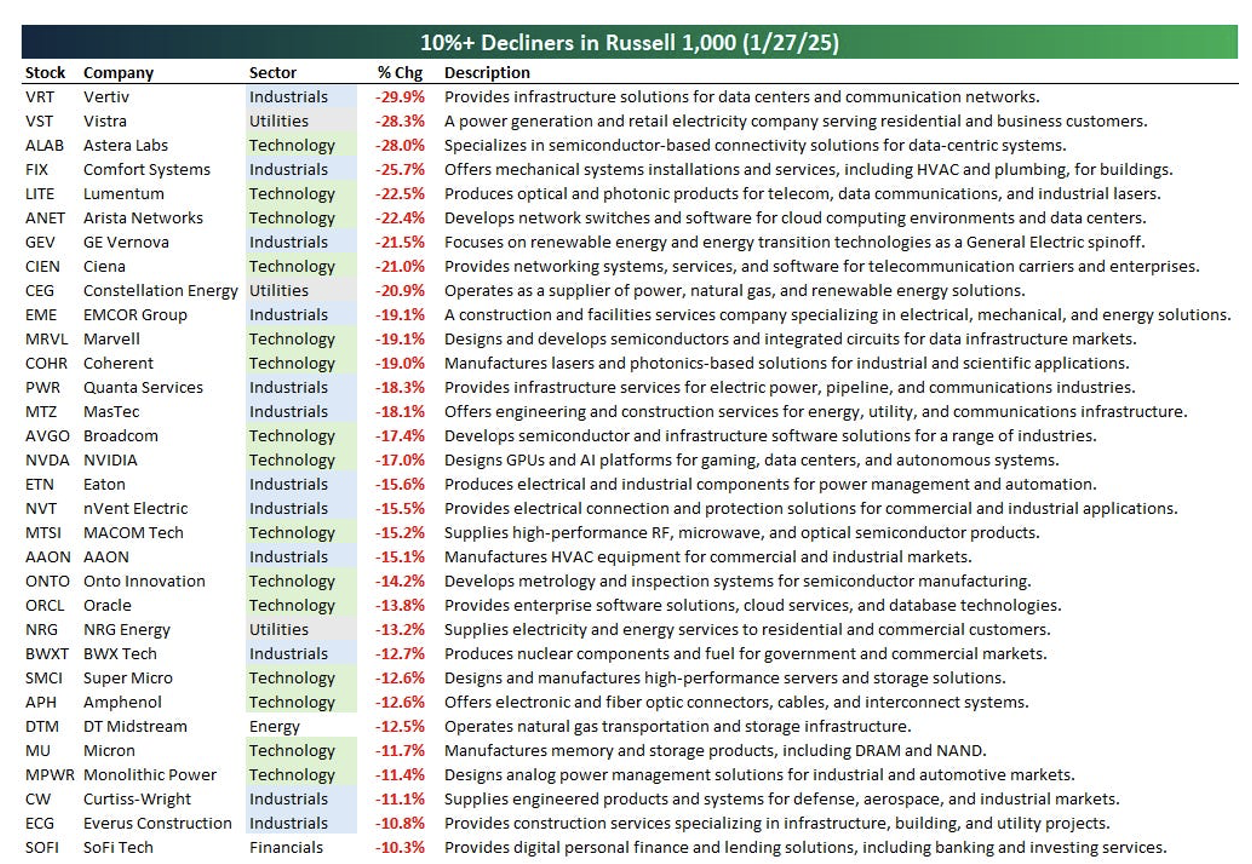

Brad: If you were wondering which large companies are most tied to Artificial Intelligence (AI), the DeepSeek session made it clear

Source: Bespoke as of 01.27.2024

Source: Bespoke as of 01.27.2024

Mark: after thinking it through, most traders see a modest ongoing impact from DeepSeek

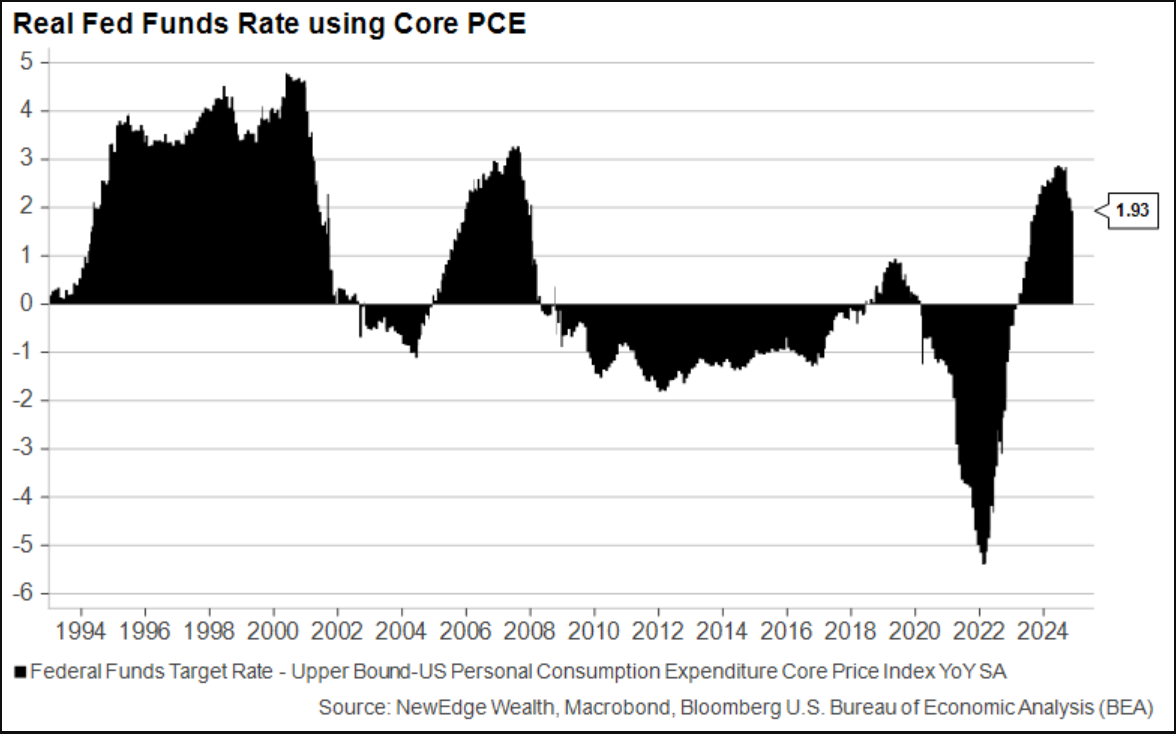

Brian: It’s been quite a shift in Fed policy since peak accommodation

Data as of December 2024

Data as of December 2024

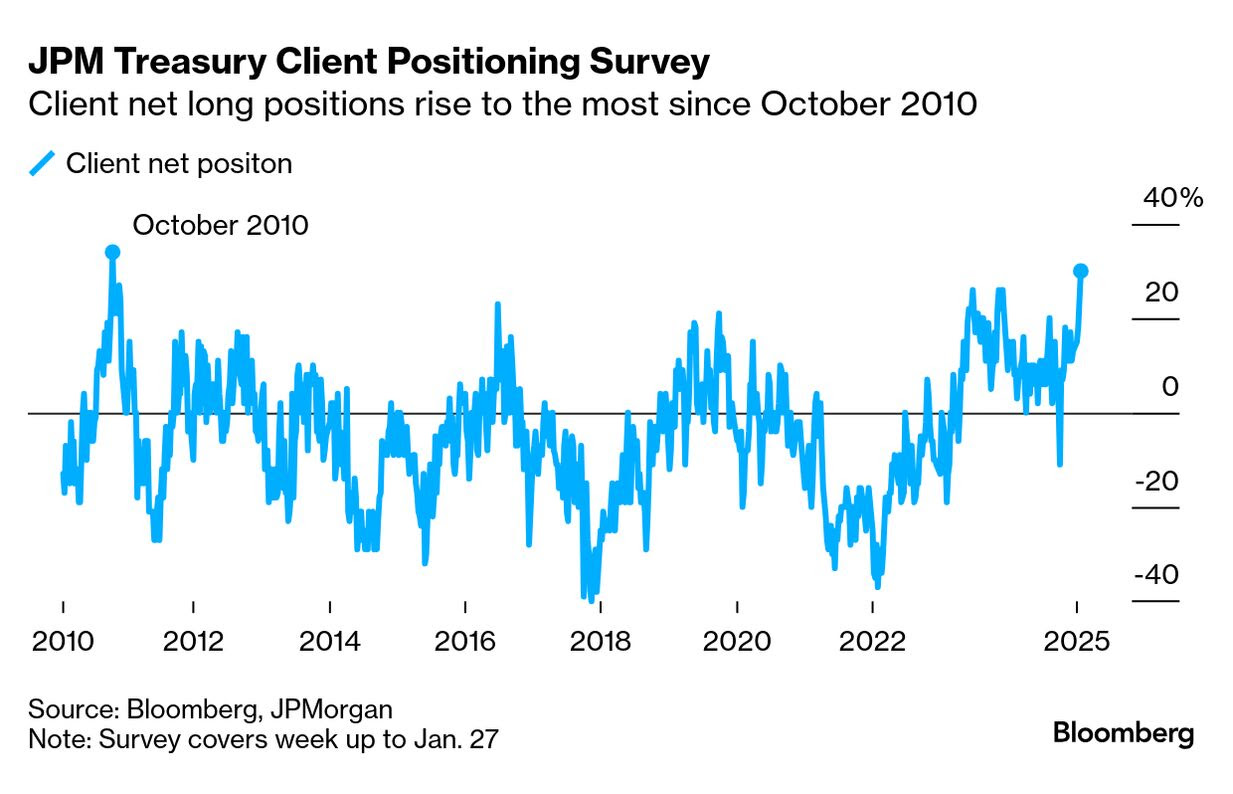

Brett: and institutions can’t resist the return to a positive real return environment

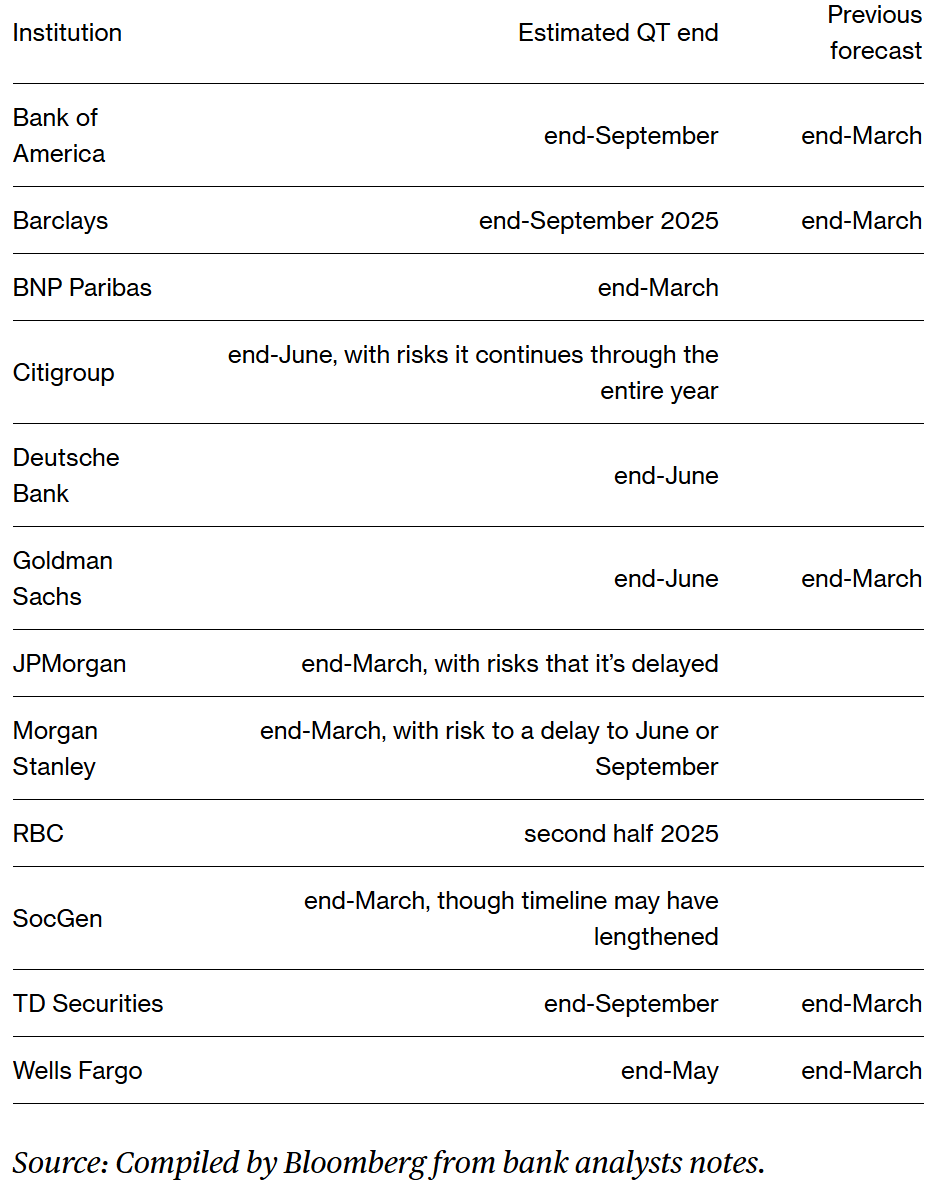

John Luke: but there is much debate about when the Fed ends its quantitative tightening

Data as of 01.17.2025

Data as of 01.17.2025

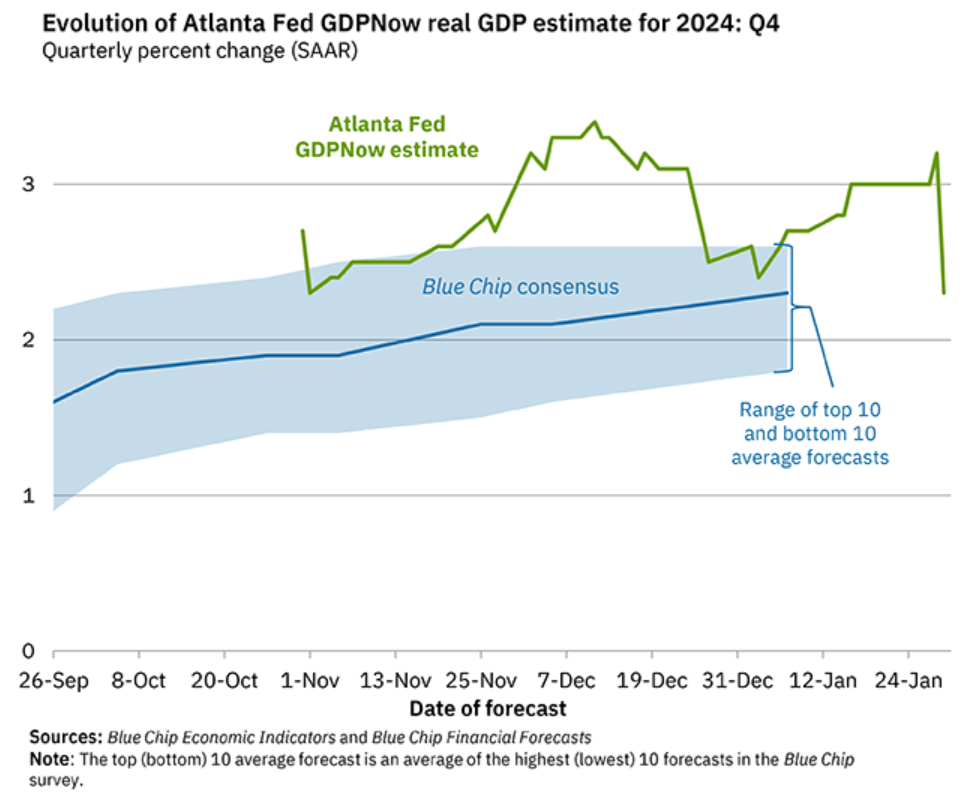

Joseph: The Atlanta Fed’s economic tracker took an odd turn down this week, on soft inventory and trade data

Data as of 01.30.2025

Data as of 01.30.2025

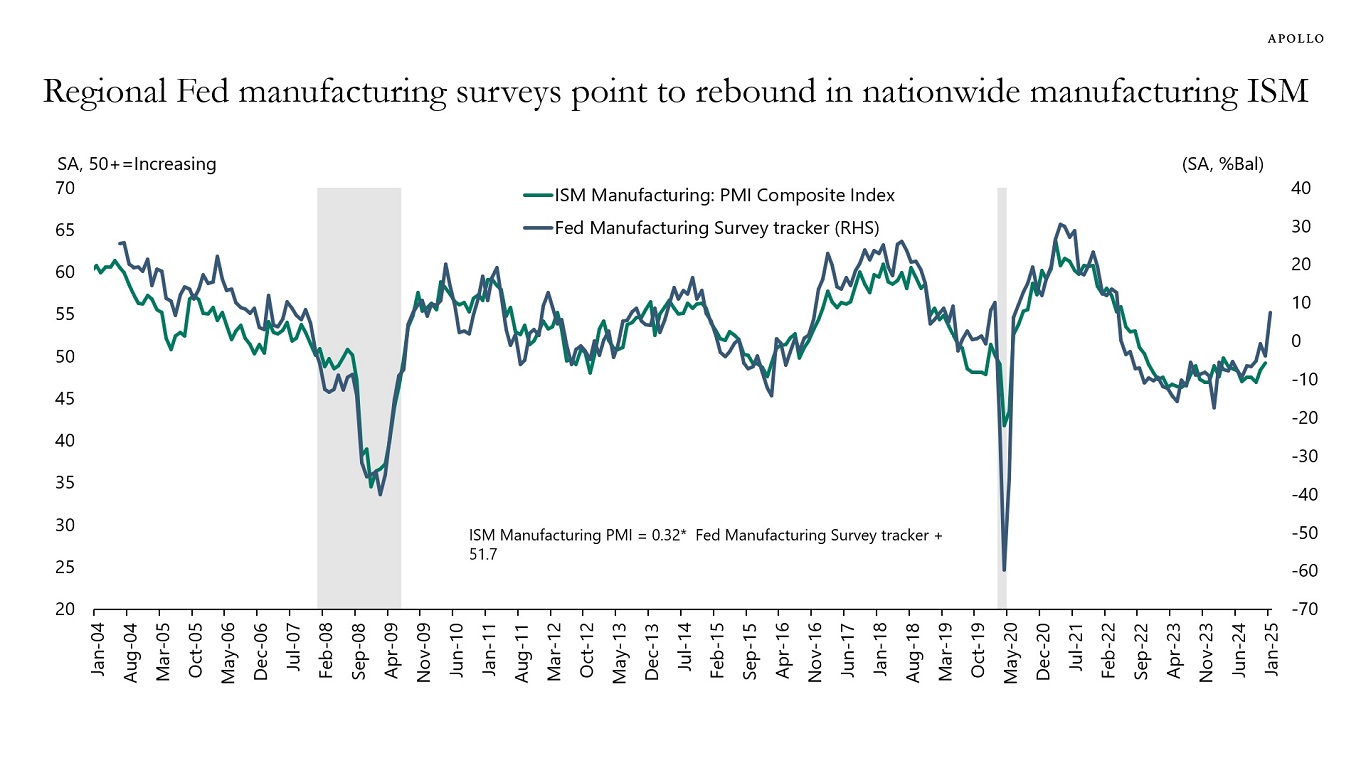

Beckham: but summarizing survey data from individual regions shows underlying strength

Source: Apollo as of 01.31.2025

Source: Apollo as of 01.31.2025

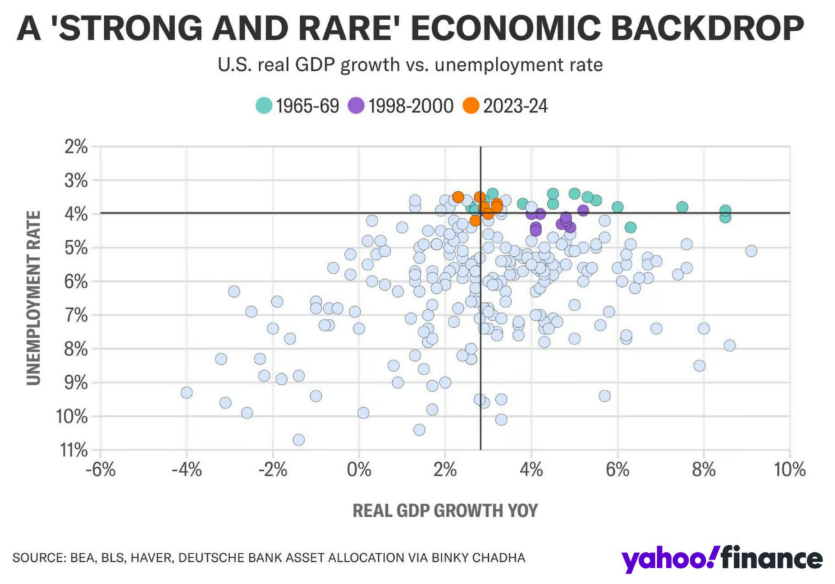

Brett: and the overall economic backdrop is historically healthy

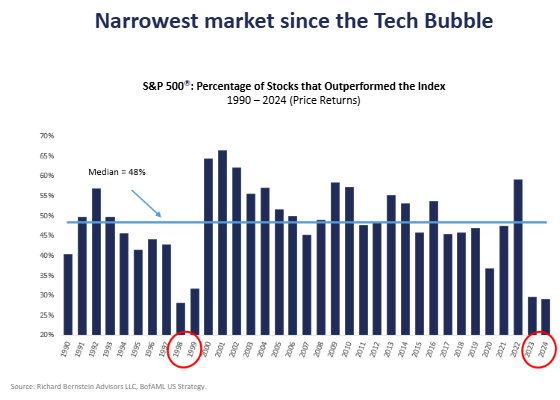

Brad: The past two years have both seen ultra-low numbers of stocks keeping up with the index

Data as of 12.31.2024

Data as of 12.31.2024

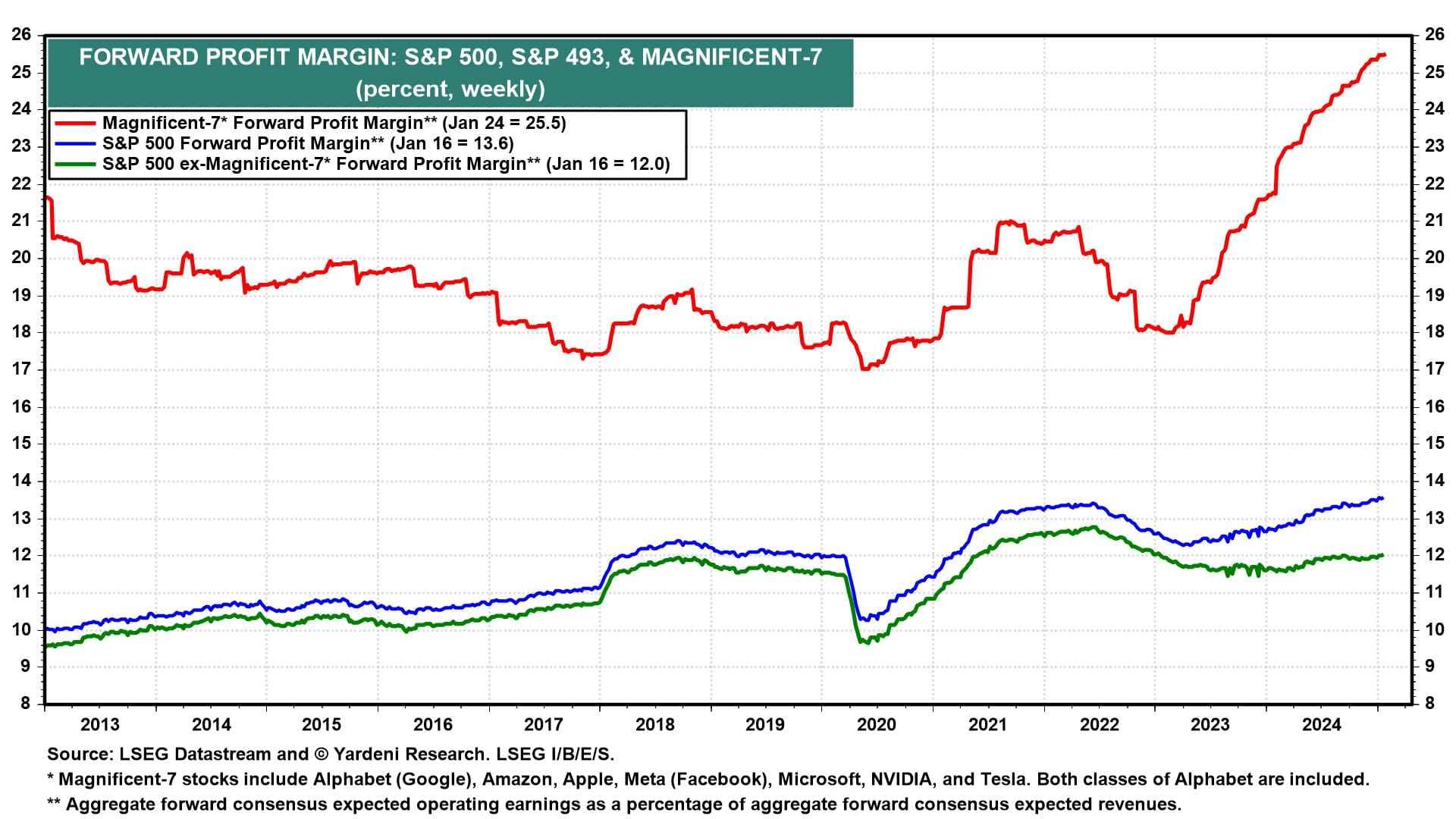

Dave: much of which has been justified by higher Mag 7 profit margins driven by positive operating leverage

Data as of 01.24.2025

Data as of 01.24.2025

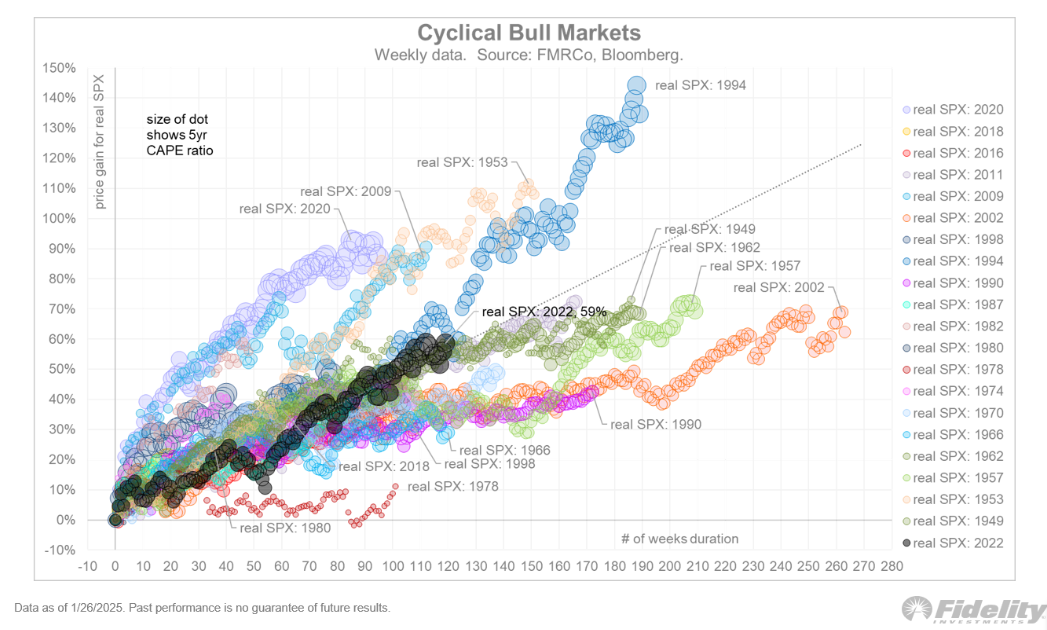

Brian: We’re two years into this cyclical bull market, here’s how it stacks up to the others of the past 70 years

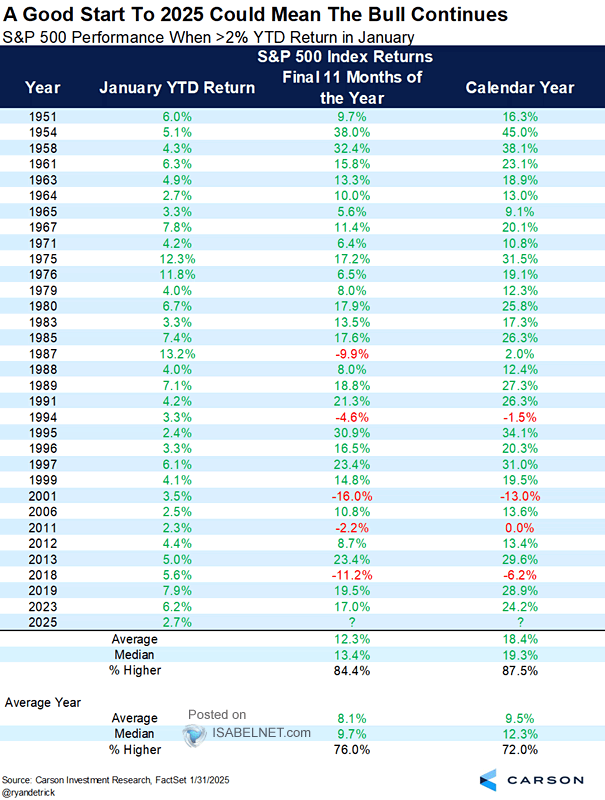

Dave: and there has been a general tendency for good Januarys to result in good years

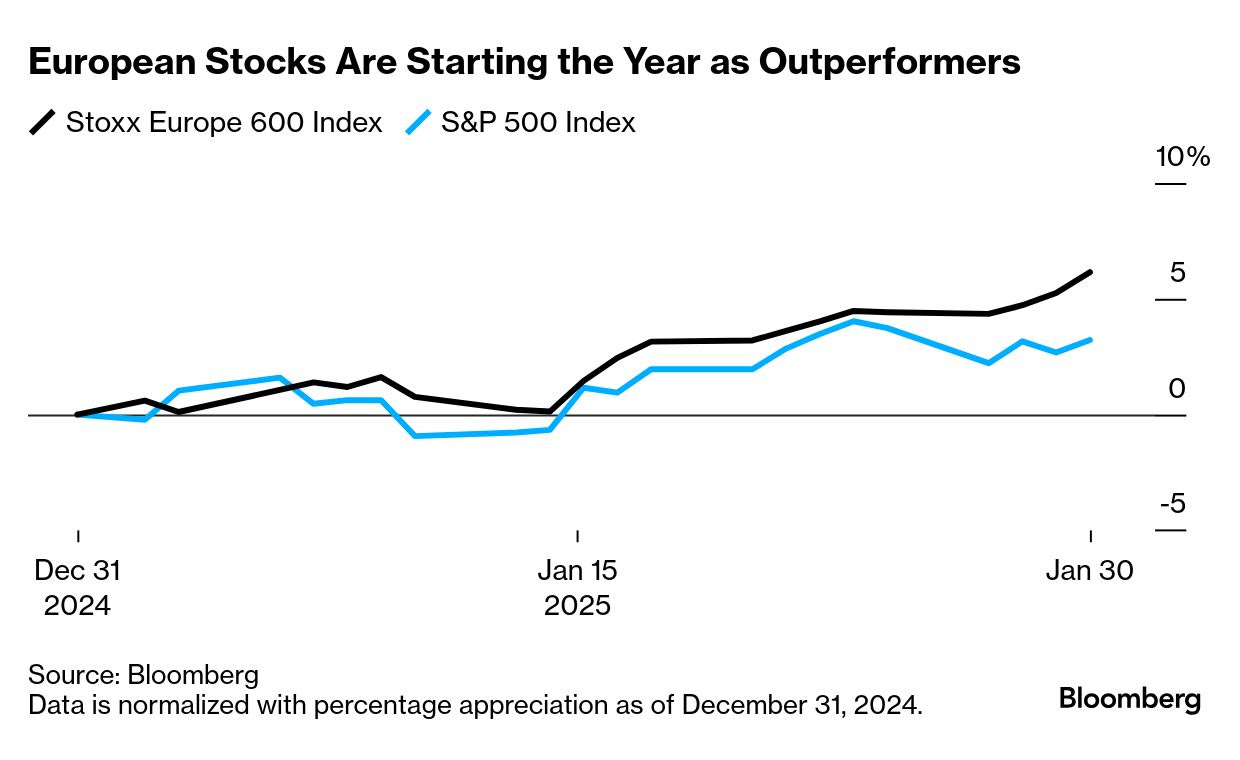

Beckham: It was a strong month for stocks in Europe

Arch: and while value-seekers have looked at “cheap” overseas markets for years, foreign stock indices are mismatched with US stocks when trying to compare valuations

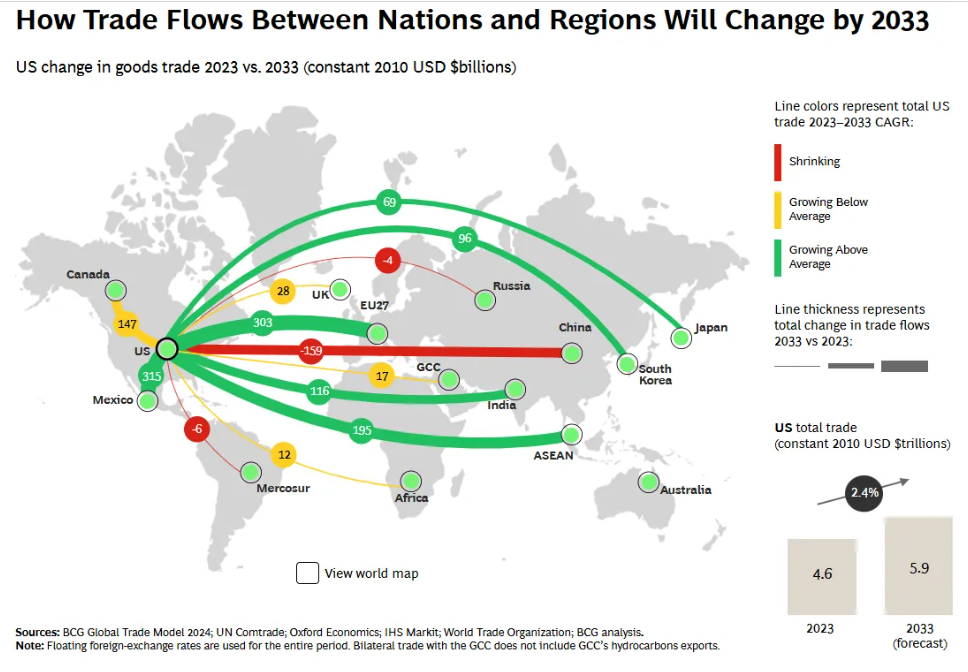

Joseph: Trade is a big topic right now, and the only thing we know for sure is that existing patterns will change

Data as of March 2024

Data as of March 2024

These charts paint an evolving picture of where we’ve been and where we might go. As always, we’ll continue monitoring and interpreting the evidence to help navigate what’s ahead.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2501-45.