Our team looks at a lot of research throughout the day. Here are a handful that we think are contributing to investor activity , from rate expectations to growth drivers to government spending and comparisons of foreign markets to ours. Enjoy!

Inflation and Interest Rates

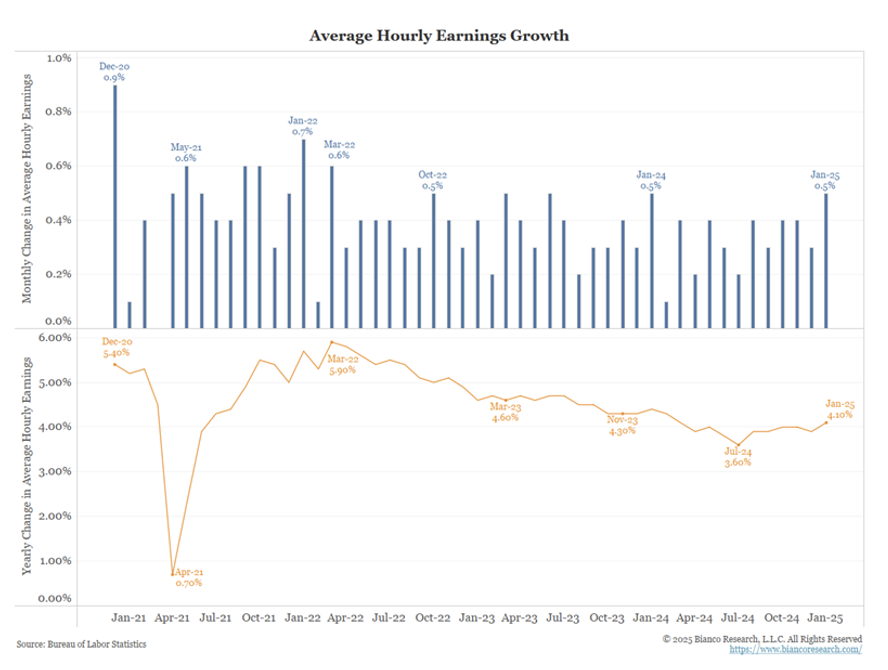

John Luke: Wage growth remains a key factor in the Fed’s inflation fight, with current levels still elevated beyond the Fed’s comfort zone

Wages rose 0.5% month-over-month and 4.1% year-over-year. The Fed has indicated that wage growth closer to 3% would be more aligned with its 2% inflation target, suggesting inflationary pressures may persist.

Source: Bianco Research as of 1-31-25

Source: Bianco Research as of 1-31-25

JD: After trending lower for most of the past three years, the 5-year breakeven inflation rate is moving higher again, signaling renewed inflation concerns

Breakeven inflation rates, which reflect market expectations for future inflation, had been declining since 2021 but have recently reversed course. Investors are now pricing in a more persistent inflationary environment.

Source: Federal Reserve as of 1.31.25

Source: Federal Reserve as of 1.31.25

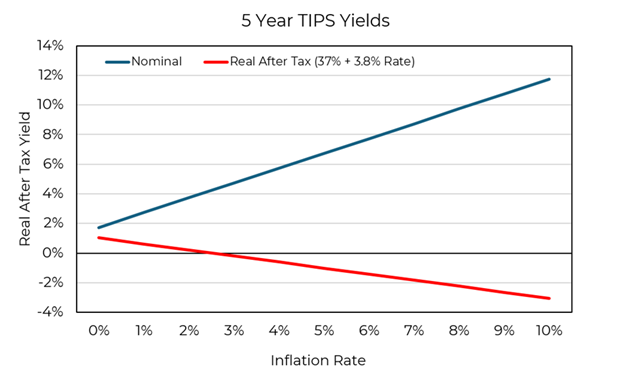

Brian: TIPS real yields remain well into positive territory despite the uptick in inflation expectations, but they’re taxed on nominal yield—meaning any inflation offsets real returns post-tax

While TIPS yields remain attractive in real terms, their taxation on nominal yields means inflation-driven increases in returns can erode after-tax performance.

Source: Treasury, Aptus as of 1.31.25

Source: Treasury, Aptus as of 1.31.25

Market Leadership and Earnings Growth

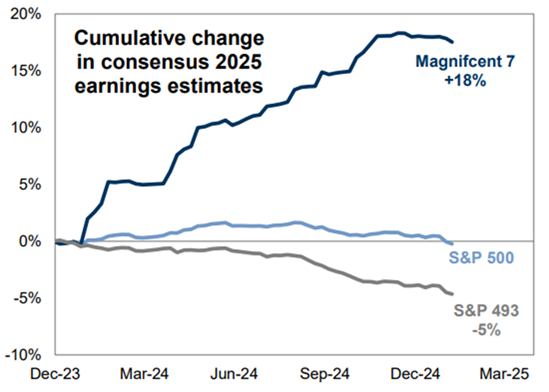

Beckham: Investors remain focused on the MAG 7 as drivers of the broader market. In 2025, consensus still expects them to be the primary engine of earnings growth within the S&P 500

MAG 7 earnings estimates for 2025 have increased 18% since the end of 2023, while the S&P 500 excluding MAG 7 has seen downward revisions of 5%.

Source: Goldman Sachs as of 2.10.25

Source: Goldman Sachs as of 2.10.25

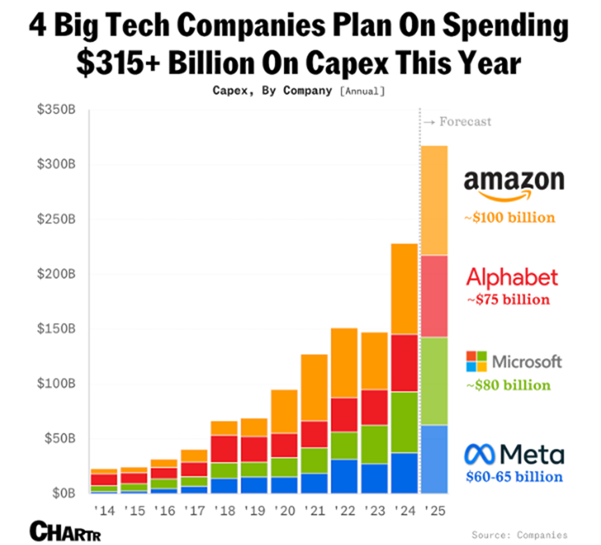

Brett: The largest tech companies aren’t just driving earnings, they’re also making massive capital investments in 2025

With megacaps dominating in revenue and profitability, their spending on AI, cloud infrastructure, and expansion plans will remain a key focus for investors.

Source: Chartr as of 1-31-25

Source: Chartr as of 1-31-25

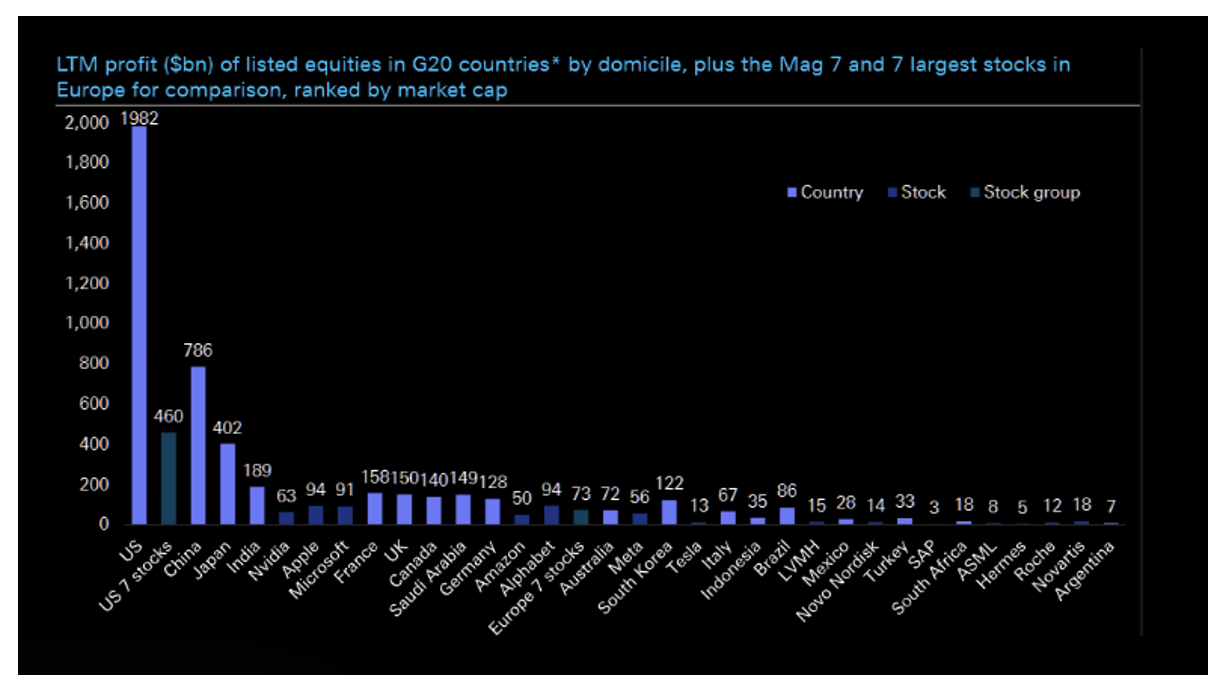

Joseph: The scale of MAG 7 earnings cannot be understated. If they were a country, they would rank among the largest economies in the world

MAG 7 earnings have reached an unprecedented scale, reinforcing their role in shaping overall market dynamics.

Source: Deutsche Bank as of 12.31.24

Source: Deutsche Bank as of 12.31.24

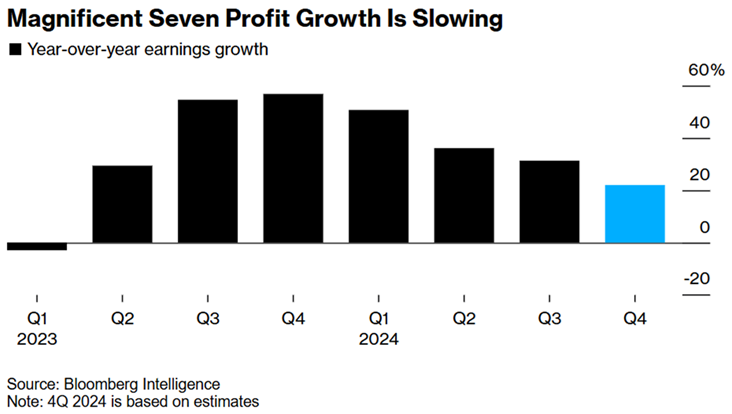

Derek: That said, despite their dominance, growth has slowed in recent years

While the MAG 7 continues to outpace the broader market, their growth rate has decelerated as scale effects kick in.

Source: Bloomberg as of 1.31.25

Source: Bloomberg as of 1.31.25

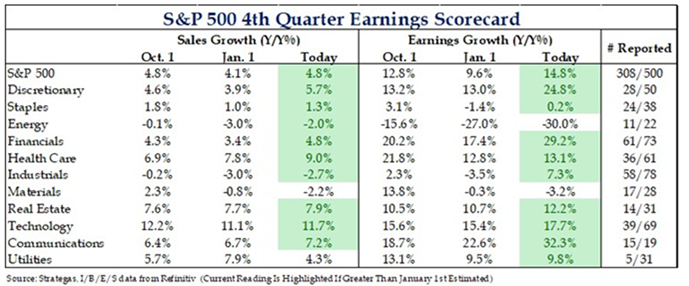

Dave: Recapping Q4, companies largely delivered strong top- and bottom-line growth, with tech and communications leading while materials and energy lagged—what else is new?

Sector performance has remained predictable, with growth stocks continuing to outshine cyclical and commodity-driven industries.

Source: Strategas as of 1.31.25

Source: Strategas as of 1.31.25

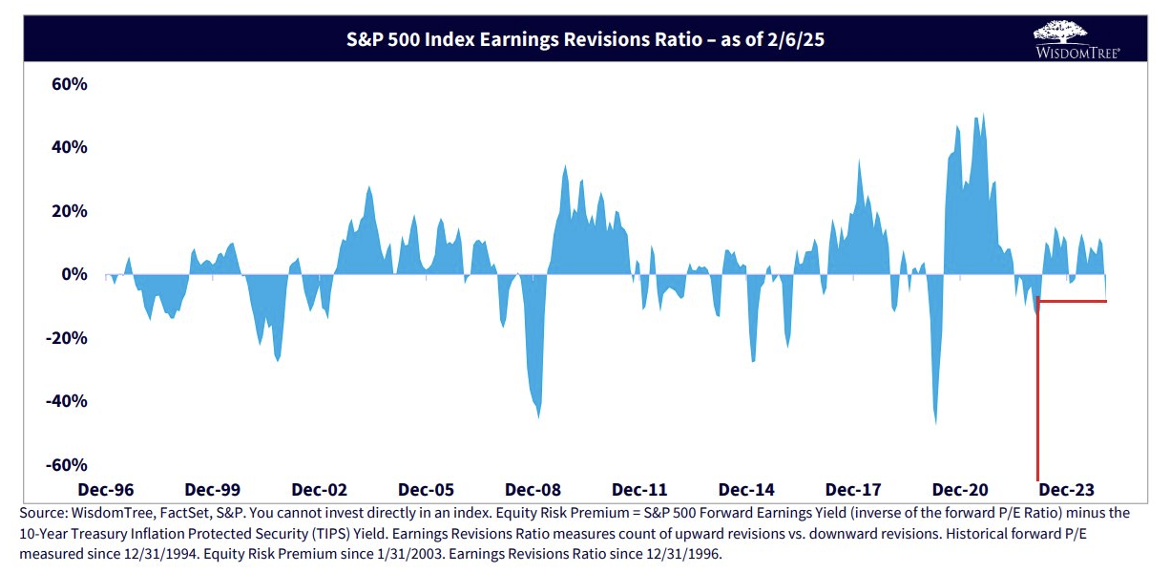

Brad: S&P 500 earnings revisions have seen their largest downward adjustments in two years

While overall earnings expectations remain positive, downward revisions indicate caution heading into 2025.

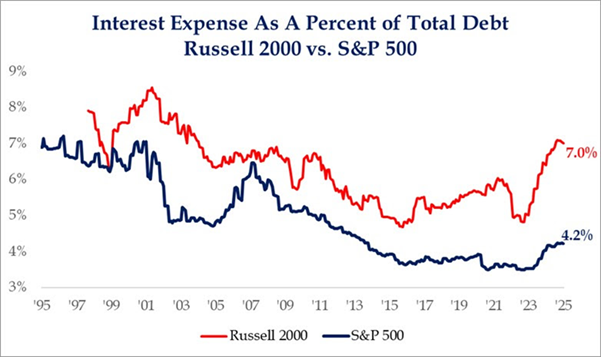

The Russell 2000’s higher interest expense compared to the S&P 500 continues to weigh on small-cap performance, especially in a high-rate environment.

Source: Wisdomtree

Source: Wisdomtree

Market Sentiment and Small-Cap (Struggles)

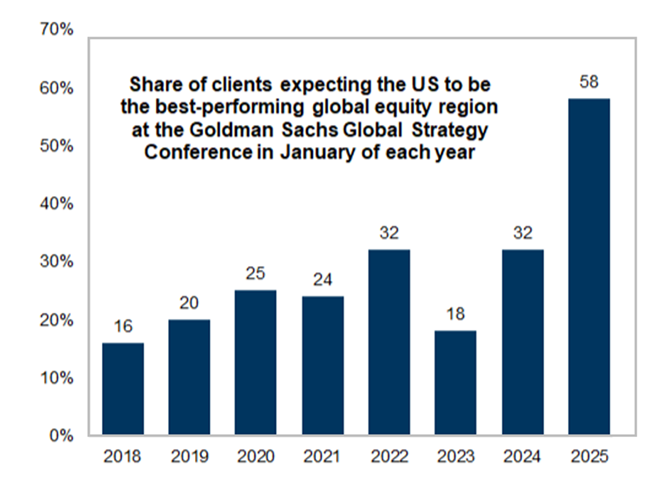

Arch: Almost 60% of investors at a recent Goldman strategy conference believe the U.S. will be the best-performing global equity region. Is this just recency bias, or do the fundamentals truly support the optimism?

Despite relative strength in U.S. equities, questions remain about whether this is justified or simply a reflection of recent dominance.

Source: Goldman as of 1.31.25

Source: Goldman as of 1.31.25

John Luke: Smaller-cap companies tend to have higher debt levels and borrowing costs, making them more interest rate-sensitive than large caps

The Russell 2000’s higher interest expense compared to the S&P 500 continues to weigh on small-cap performance, especially in a high-rate environment.

Source: BoA Merrill as of 1.31.25

Source: BoA Merrill as of 1.31.25

Global Trade and Policy Uncertainty

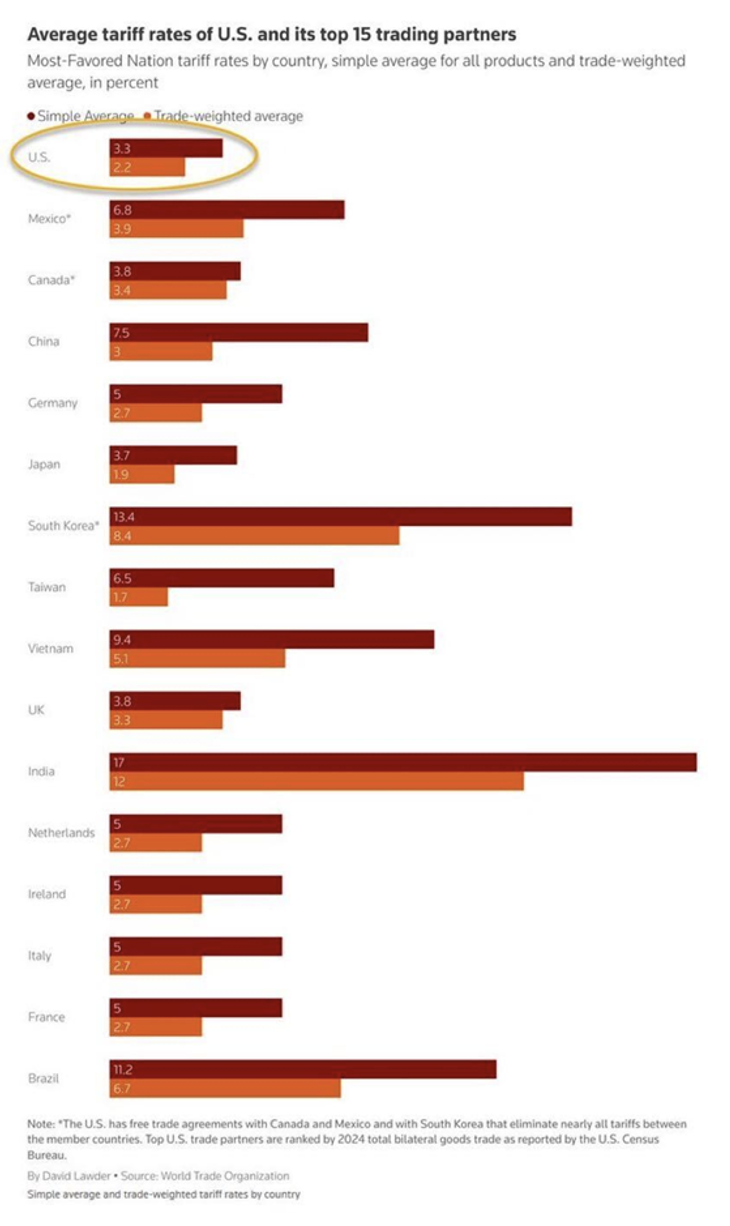

John Luke: Despite all the rhetoric, the U.S. has some of the lowest tariffs applied to trading partners globally.

Despite frequent discussions of tariffs in political discourse, U.S. trade barriers are likely to remain relatively low compared to global peers.

Source: World Trade Organization as of 12/31/24

Source: World Trade Organization as of 12/31/24

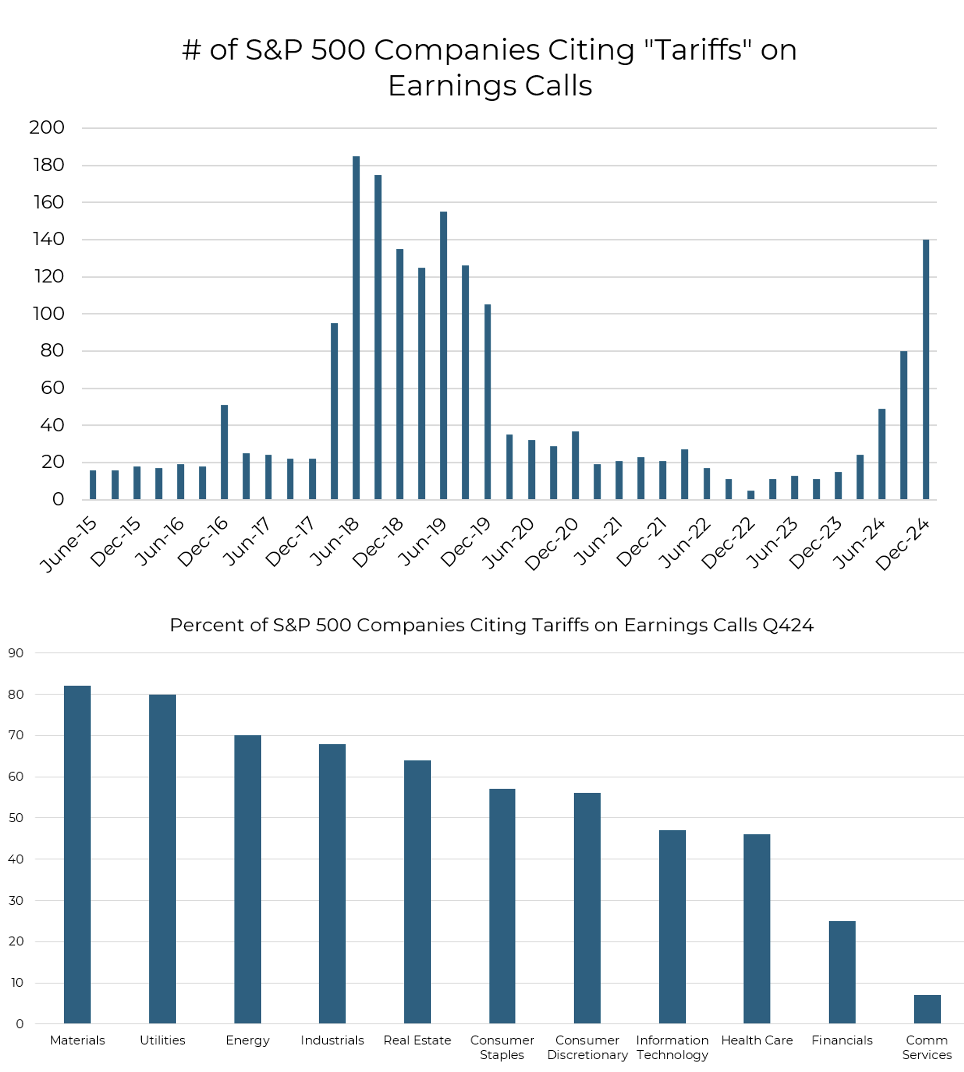

Brett: While existing tariffs may be low, policy uncertainty is affecting corporate planning. Mentions of tariffs on earnings calls have spiked, particularly in materials and industrials

Executive concerns about tariffs have risen sharply, reflecting uncertainty in supply chains and global trade relationships.

Source: Factset as of 1-31-25

Source: Factset as of 1-31-25

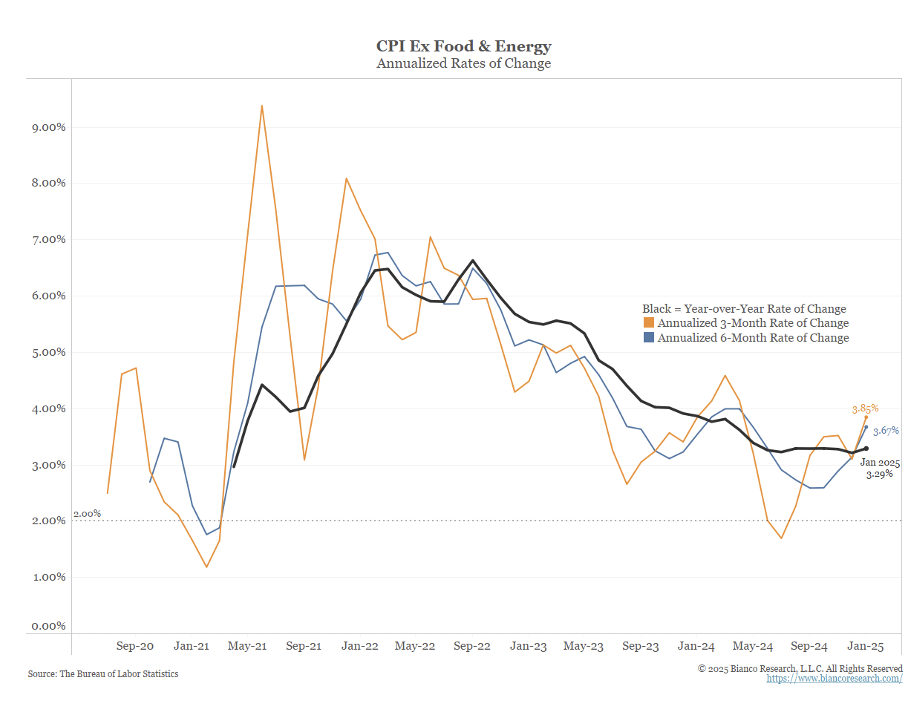

JD: While core CPI has been steadily declining over the past year, shorter-term trends tell a different story—three- and six-month inflation rates are ticking higher, which could complicate the Fed’s path to rate cuts

The longer-term trend suggests progress in bringing inflation down, but the recent acceleration in shorter-term inflation measures raises concerns that disinflation may be stalling. If this persists, it could challenge market expectations for aggressive rate cuts in 2025.

Source: Bianco as of 02.12.2025

Source: Bianco as of 02.12.2025

These charts paint an evolving picture of where we’ve been and where we might go. As always, we’ll continue monitoring and interpreting the evidence to help navigate what’s ahead.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2502-14.