Hope that everyone has been enjoying some warmer weather this past week. It was a tough winter; the U.S. has been experiencing its coldest winter in ~15 years and amongst the coldest in over 100 years across large swaths of the country, while the Flu season is likely the worst in at least 15 years – so hoping that Spring comes sooner than expected for most of us.

In Cincinnati, OH, Punxsutawney Phil doesn’t dictate when Winter is over and Spring begins. That duty belongs to the Cincinnati Bock Beer Festival that occurs in less than two weeks, a festival that was created by the Hudepohl-Schoenling Brewing Company to celebrate the introduction of a new style of bock beer. In fact, my great-great-grandfather, Ludwig Hudepohl II, started the Hudepohl Brewing Company in 1885, so this festival has been celebrated by my friends for years. The festival includes a parade led by a goat pulling a keg along with the previous year’s reigning Sausage Queen and the official parade marshal. Our highlight tends to be the singing of the official Bock beer song:

🎵 Winter’s Gone;

Spring is Here;

Cincinnati is Full of Cheer;

Let’s have Another Cold Bock Beer. 🎵

But, before we begin, let’s quote the late Gene Hackman: “75% of being successful as an actor is pure luck. The rest is just endurance.” I think you could replace actors with a lot of professions, and the quote would be equally valid. Given the political backdrop and emotional volatility that comes with it, we all may need an extra dose of endurance this year.

Nonetheless, the S&P 500 is starting to see its first pullback of 2025. On the surface, the S&P is -5% off the highs, but there have been dramatic moves underneath the hood of the index. The point here is that much of the motion looks driven by “positioning unwinds” versus “fundamental distress”. And looking at this past quarter’s earnings season helps us validate that thought.

Q4 2024 Earnings Season

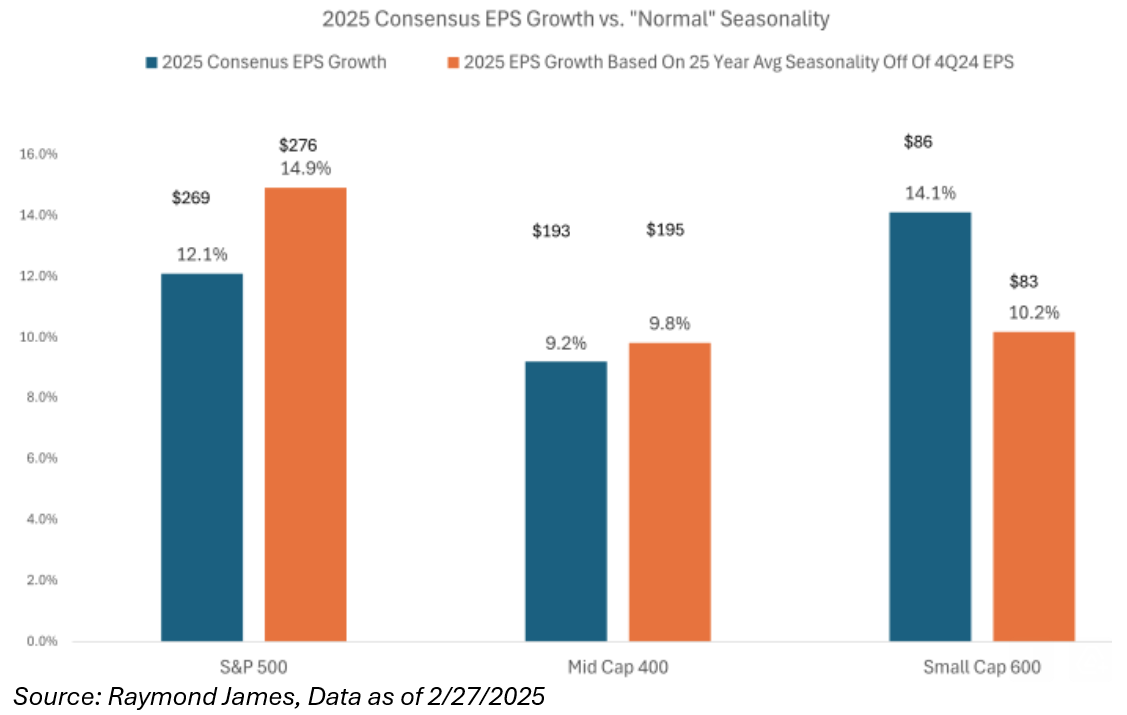

It was the third straight year that U.S. Large Caps had stronger growth than U.S. Small Caps, but it was much narrower. The final tally was +15% for the S&P 500, while Small and Mid grew by ~5%. Here are our overall thoughts:

Outsized investments in capex and R&D have supported the exceptional performance of US stocks during the past decade. In 2025, the Magnificent 7 companies will boost their capex by 31% Year over Year (YoY) to $331B. If you simply rewind history to October, just four months ago, these companies were “only” expected to spend $263B on capex (+13%).

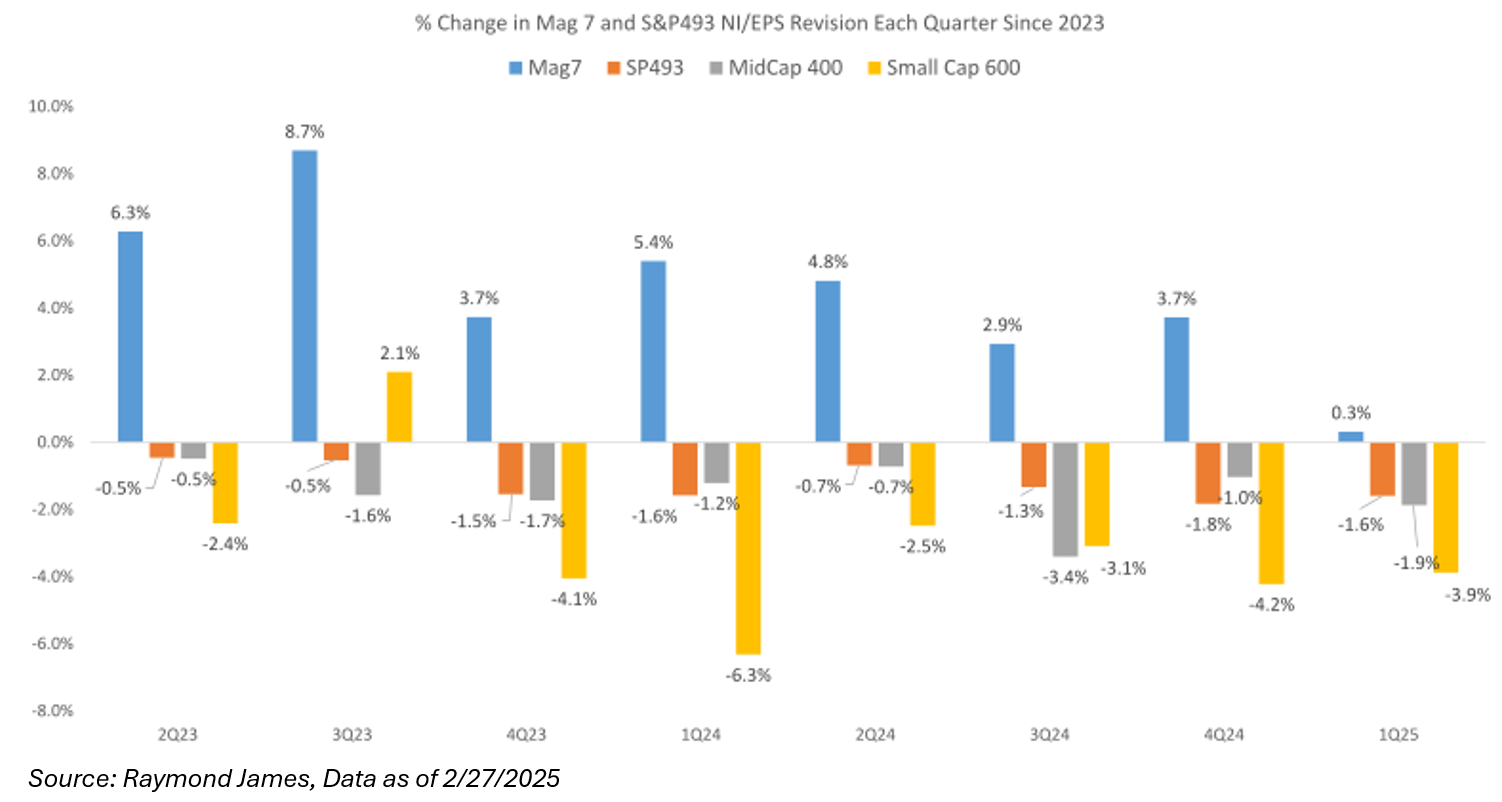

The superior earnings growth and returns of the Magnificent 7 relative to the S&P 493 should mathematically continue to narrow. The excess earnings growth of the Magnificent 7 relative to the S&P 493 declined to 19% in Q4, the narrowest gap since Q1 2023.

The market has been rewarding backward-looking EPS beats less than usual and punishing misses more than usual. For example, firms that beat EPS estimates outperformed the S&P 500 by just 0.14% the day after reporting (vs. 1.01% historical average), while those that missed underperformed by 2.79% (vs. 2.11% historically).

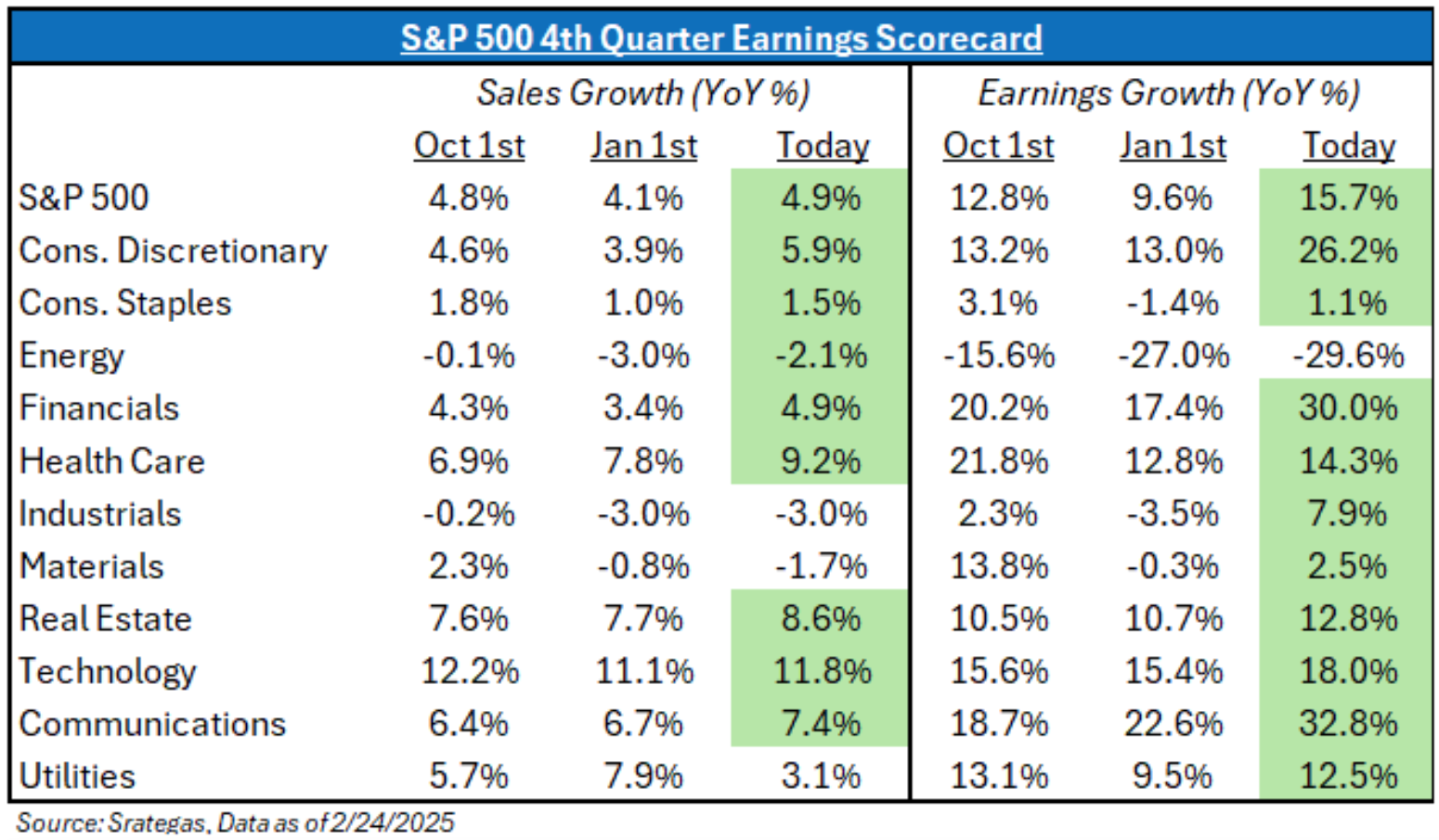

More specifically, S&P 500 companies demonstrated healthy corporate fundamentals during Q4 2024. Aggregate EPS grew 15.7% YoY, beating the consensus expectation of 8% growth at the beginning of the reporting season. The median stock grew earnings by a more modest 7%, which is better than previous periods.

All in all, I’m wondering if earnings season is driving the rotation in stocks outperforming year-to-date.

-

- First, earnings revisions for the Magnificent 7 have been coming down in 2025 after 7 straight quarters of unbelievably positive revisions,

-

- Secondly, the S&P 493 and S&P 400 had positive YoY growth, and although Small Cap 600 was still slightly negative, it’s getting materially better, and the breadth of YoY EPS growth should continue to improve through 2025.

I would state that Q1 2025 EPS estimates have started to come in a bit, but that doesn’t worry me. Analysts lowered Magnificent 7 estimates by 0.7% and S&P 493 estimates by 1.1% since mid-December, resulting in a 1.0% negative revision to overall S&P 500 2025 EPS.

Here’s why:

1. When you get periods of times when EPS beats expectations by a wide margin, you tend to see EPS growth for the next quarter to come in a bit, as many believe that it was a demand pull-forward period. The market tends to have the ability to look through these types of revisions, and;

2. It appears that some consumer spending has been weak to start the year. I’d attribute more of this to the weather and flu season than weakness in the consumer.

After listening to a slew of earnings calls, it seems that tariffs are the key downside risk to S&P 500 EPS right now. For a point of reference, Goldman Sachs estimates that for every 5% increase in the US tariff rate, they would reduce the 2025 S&P 500 EPS estimate by roughly 1-2%. Let’s take that in context; the S&P 500 has been outkicking its weight class in EPS growth over the past few years and is expected to grow earnings by 14% – 15% in 2025.

Bringing it all together, the Magnificent 7 has been a pillar of S&P 500 sales and earnings growth during the last few years, but the magnitude of surprises has declined, and participation from the other 493 stocks has broadened. I would expect this narrative to continue into the future and I remain optimistic about the earnings landscape for 2025

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2502-22.