Our team looks at a lot of research throughout the day. Here are a handful that we think are contributing to investor activity, from earnings to sentiment to the economy and comparisons of foreign markets to ours. Enjoy!

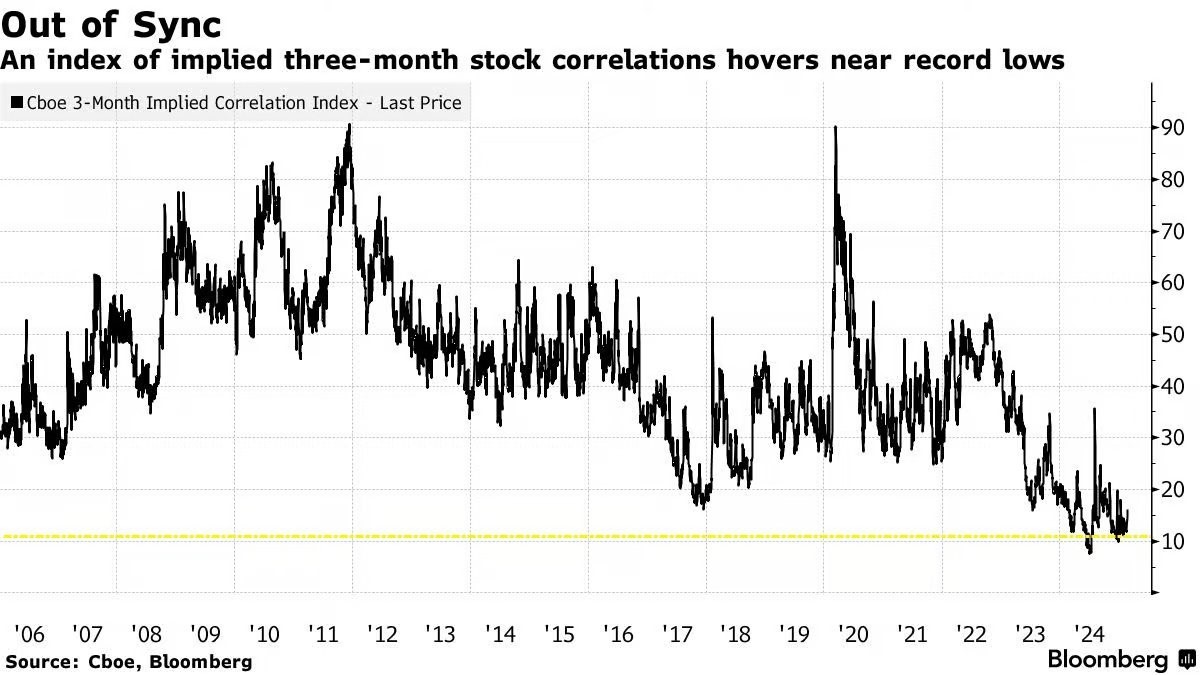

Brad: The correlation between individual stocks has fallen to extreme levels

Data as of 02.26.2025

Data as of 02.26.2025

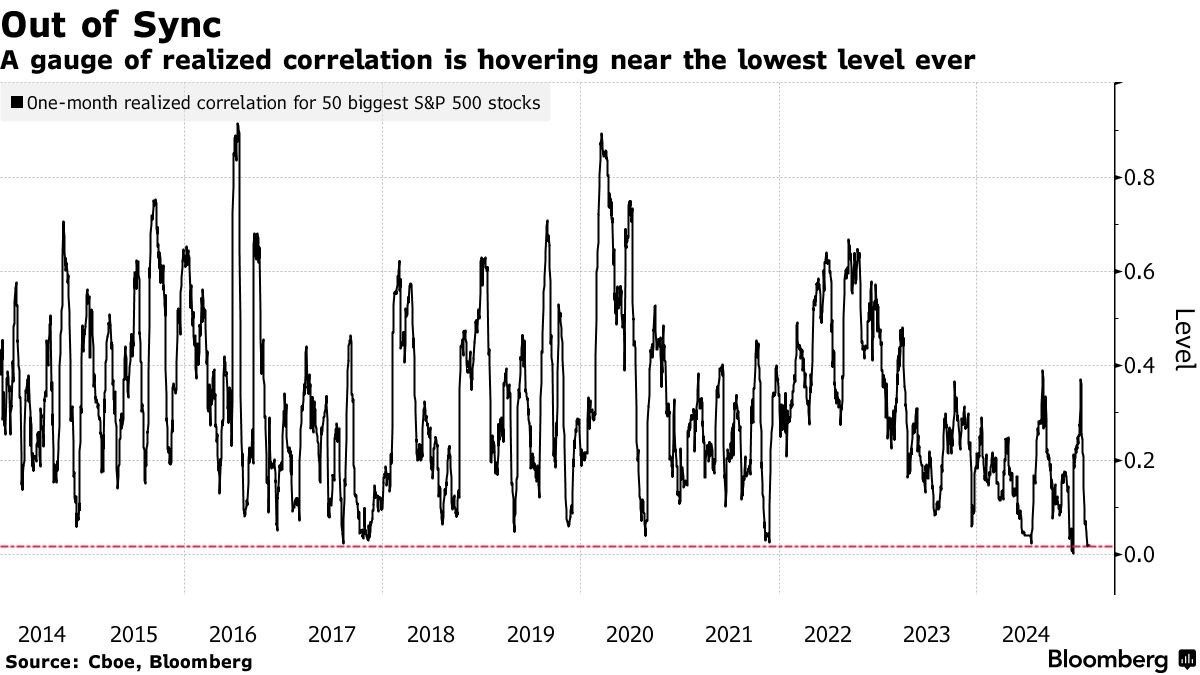

Brad: and it’s not just small-caps driving the dispersion of returns, it’s even true across the largest stocks

Data as of 02.26.2025

Data as of 02.26.2025

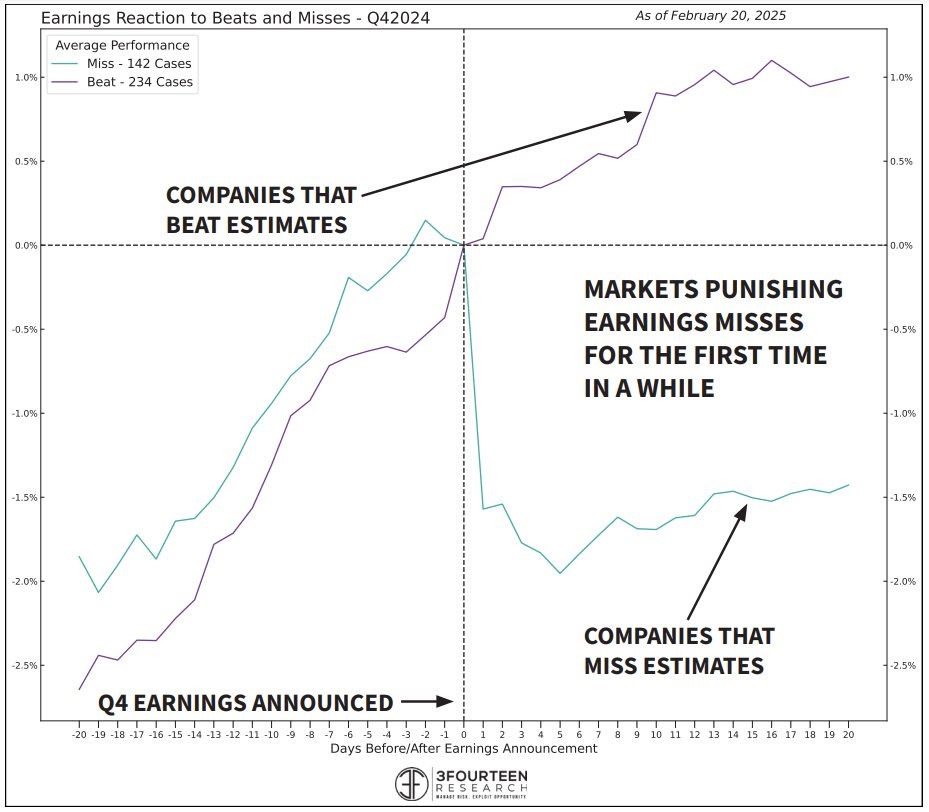

Dave: The downside for earnings misses has far outweighted the upside for beats

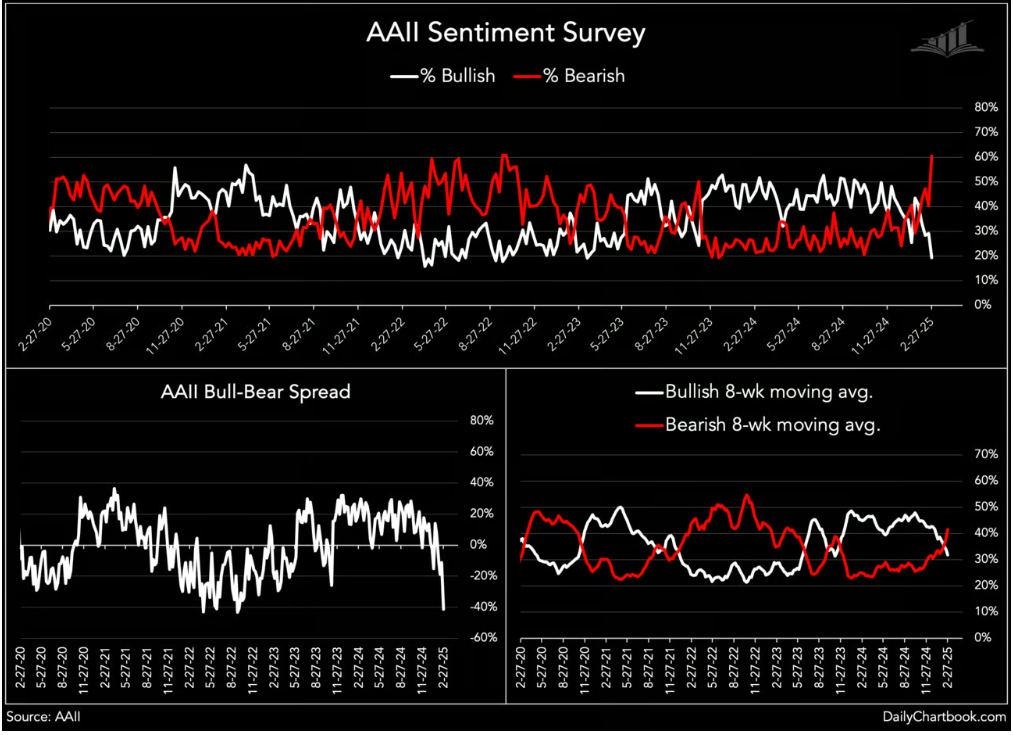

Arch: probably feeding into the growing bearish sentiment amongst individual investors

Data as of 02.27.2025

Data as of 02.27.2025

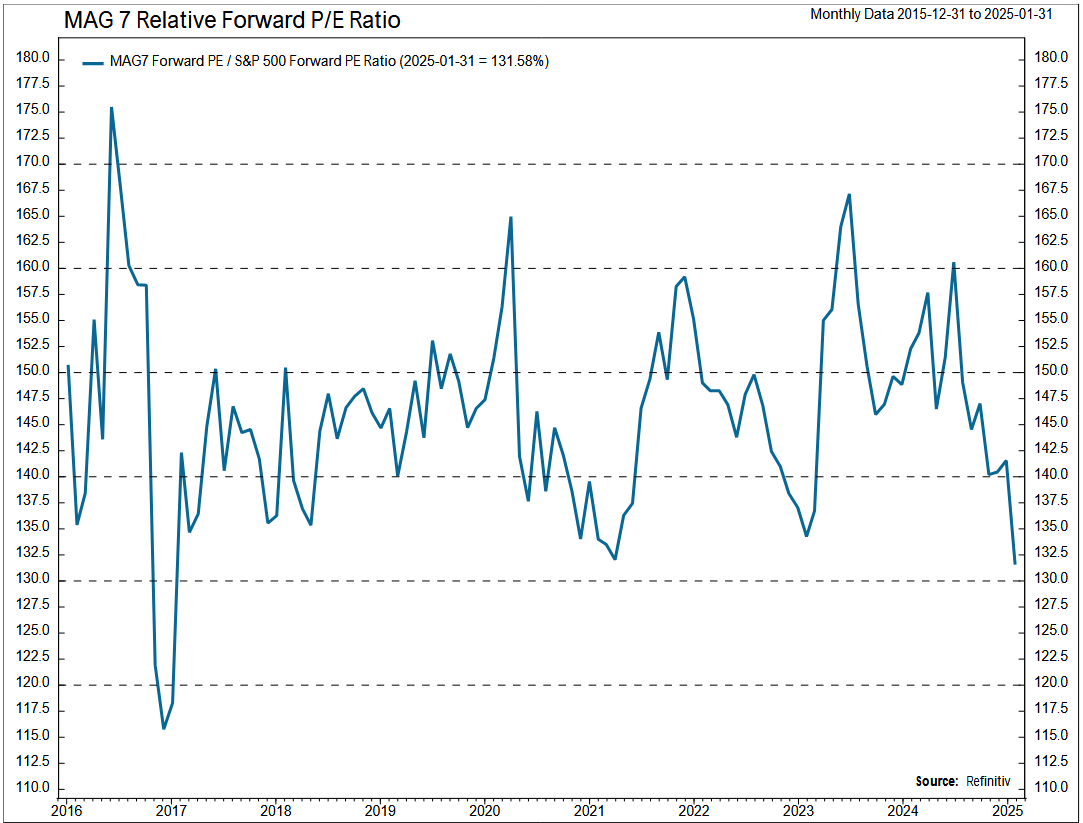

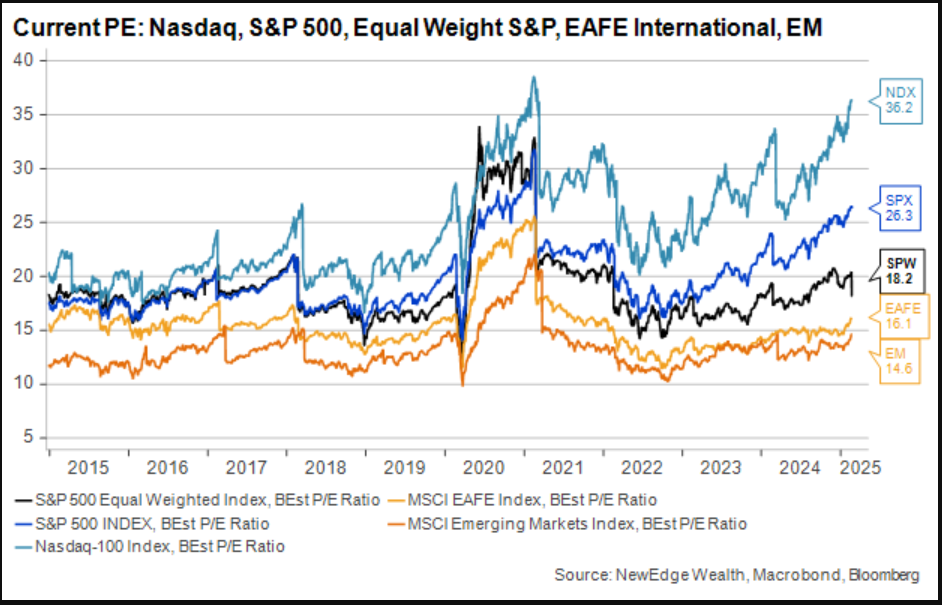

John Luke: Megacap techs have been popular targets of “overvaluation” calls, but their valuation relative to the market is actually normalizing through strong earnings

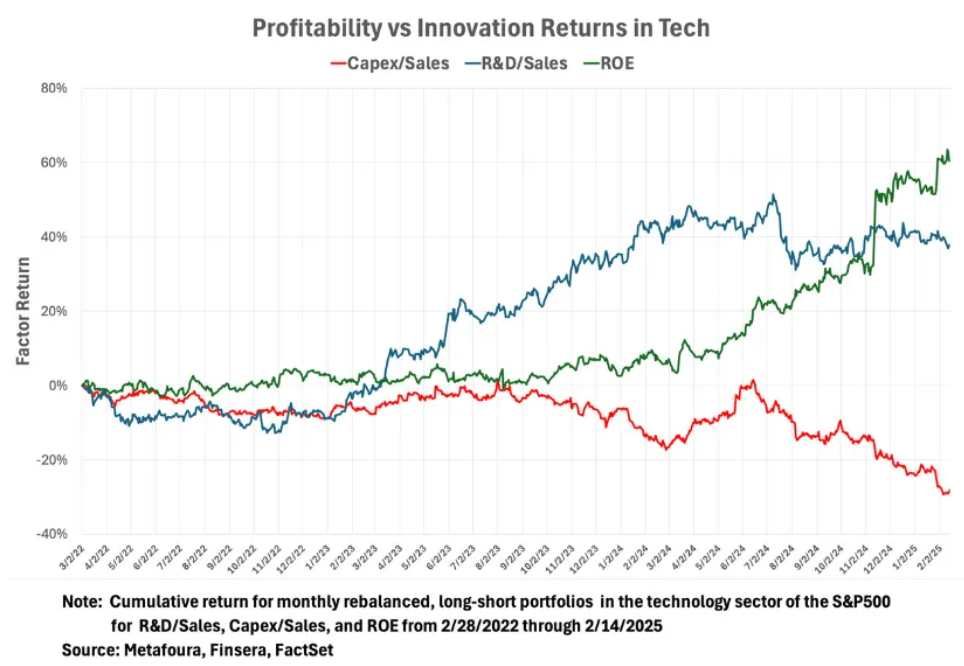

Brian: and investors are getting more discriminating when it comes to company profitability

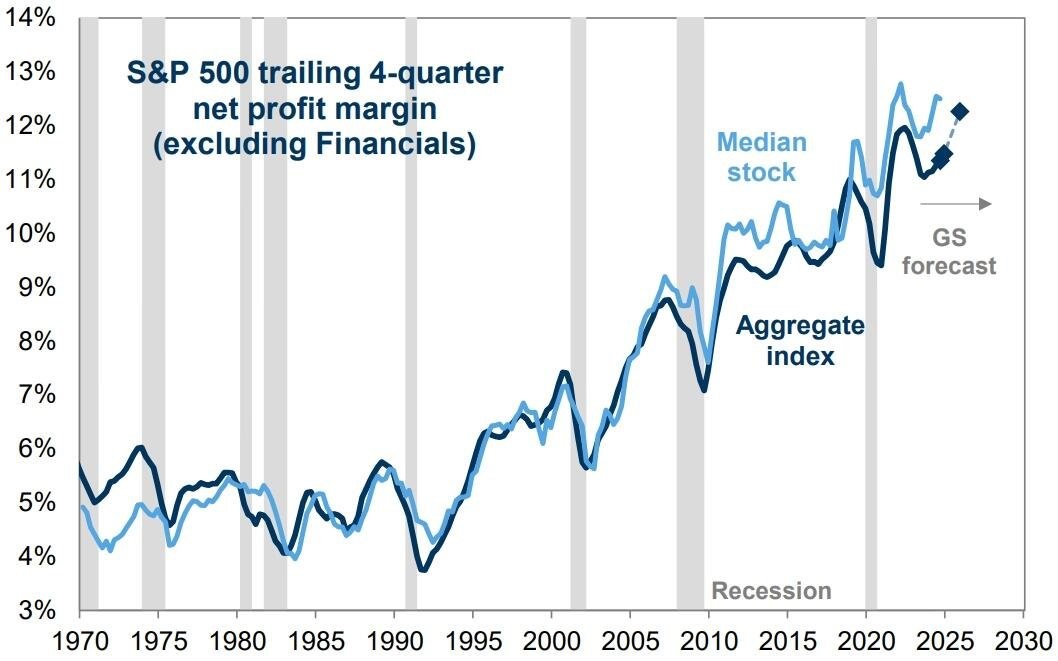

Joseph: with profit margins a primary driver of US equity dominance

Source: Goldman Sachs as of 02.24.2025

Source: Goldman Sachs as of 02.24.2025

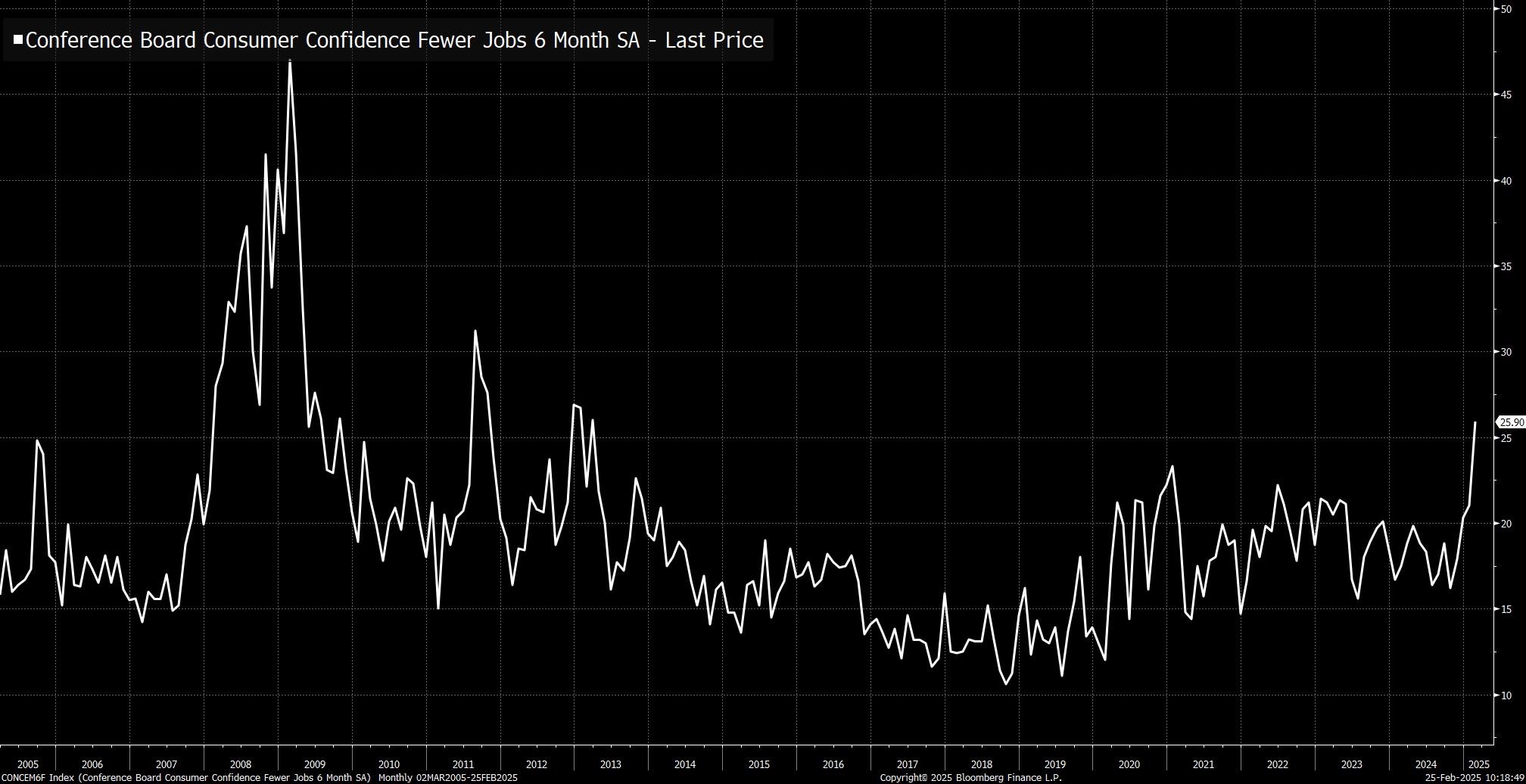

Brett: US consumers are feeling anxious about the outlook for jobs

Source: @thestalwart as of 02.25.2025

Source: @thestalwart as of 02.25.2025

Joseph: and weak results are showing up in many “soft” surveys, in contrast to stronger data for actual results

Data via @DanGreenhaus

Data via @DanGreenhaus

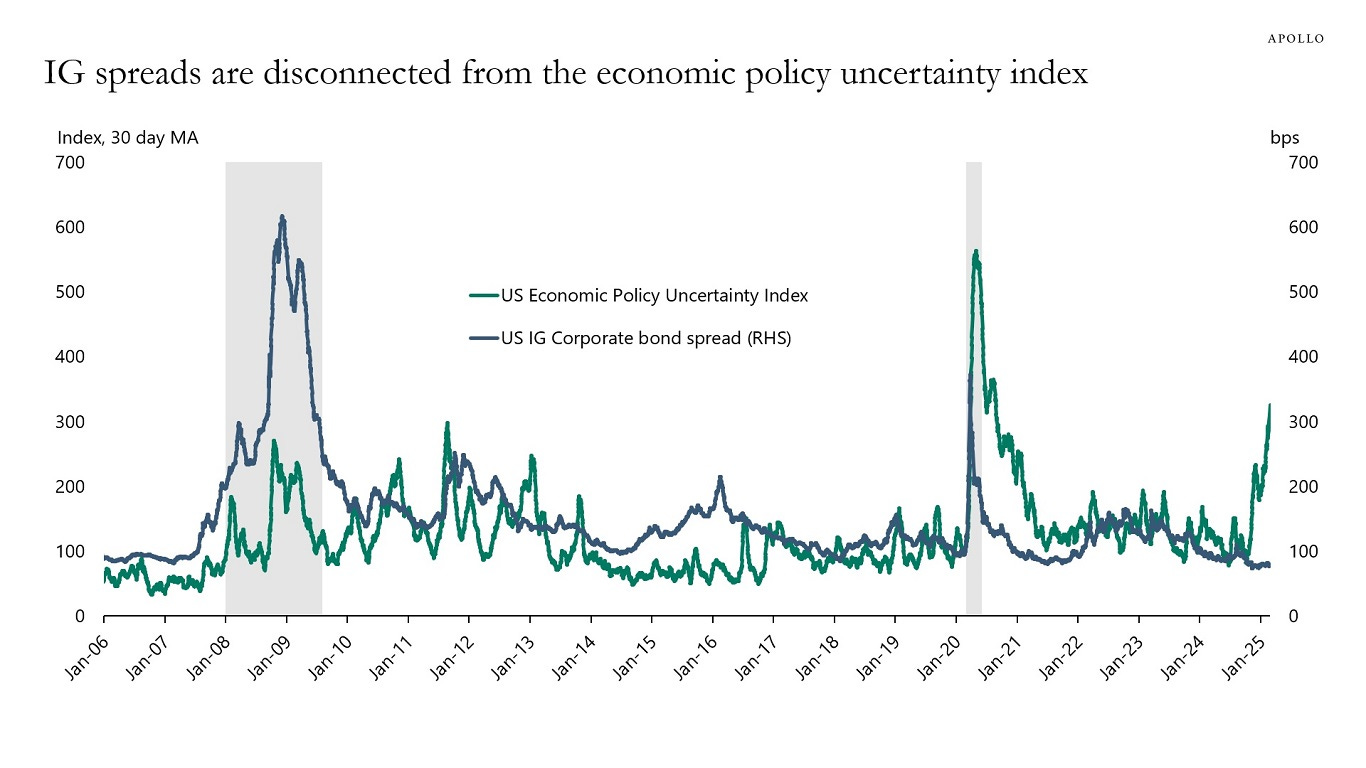

Beckham: and there’s been no sign of such softness in real-world credit spreads

Source: Apollo as of 02.24.2025

Source: Apollo as of 02.24.2025

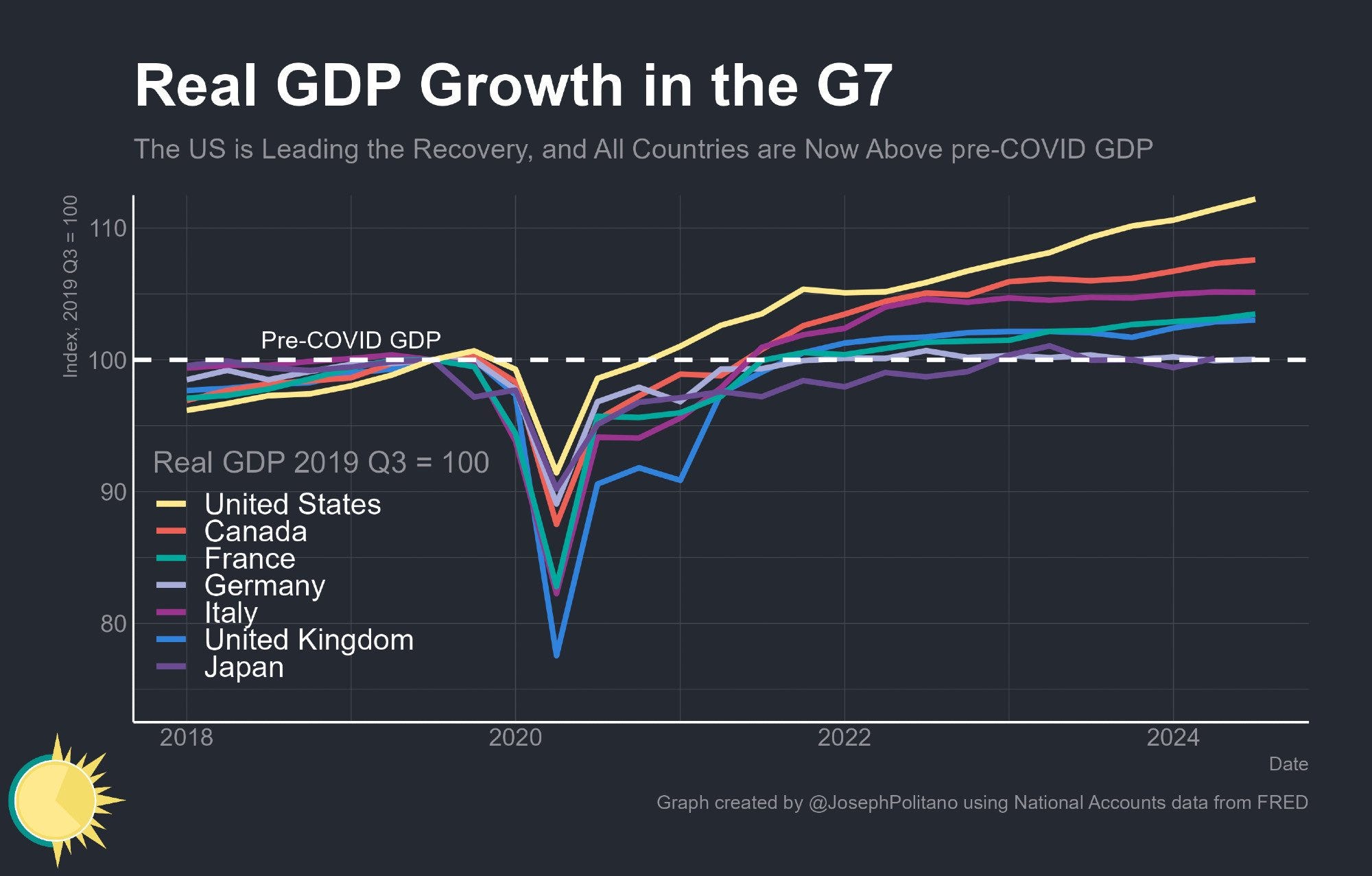

John Luke: The US economy has far outperformed its peers through the COVID era and beyond

Data as of January 2025

Data as of January 2025

Dave: which has not only increased earnings but widened valuation gaps between the US and foreign indices

Data as of 02.22.2025

Data as of 02.22.2025

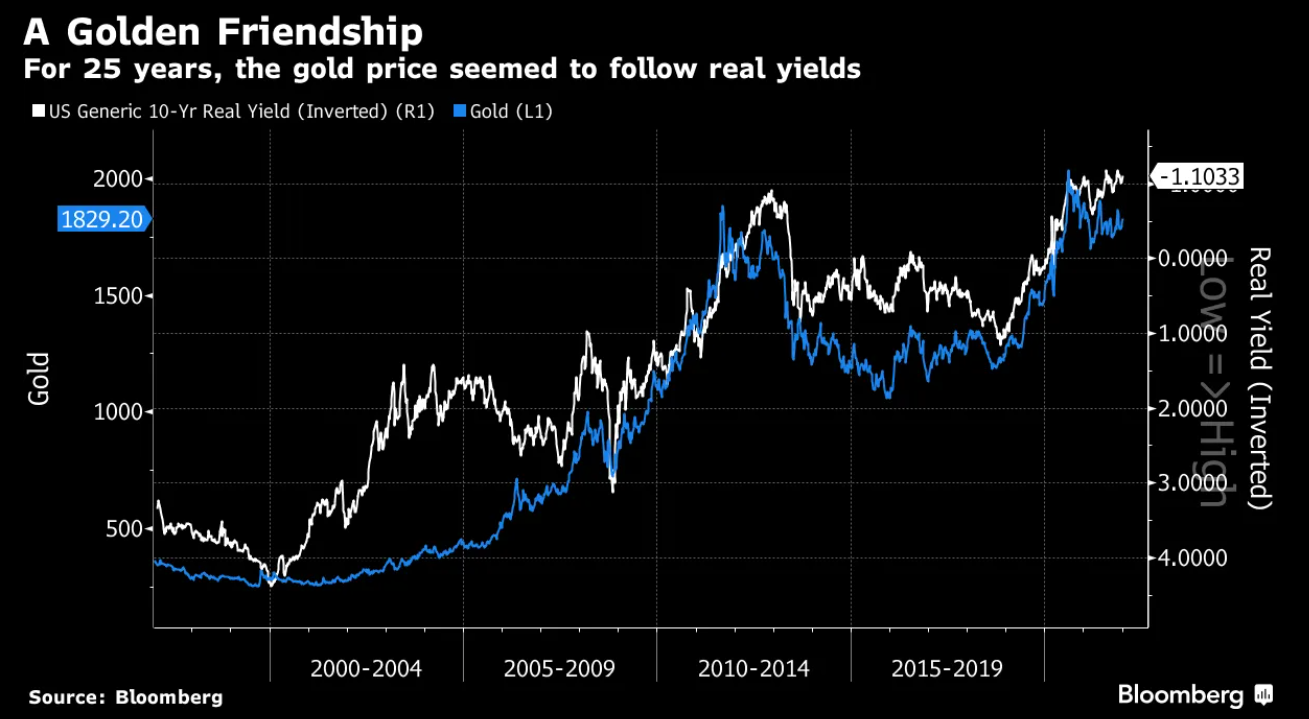

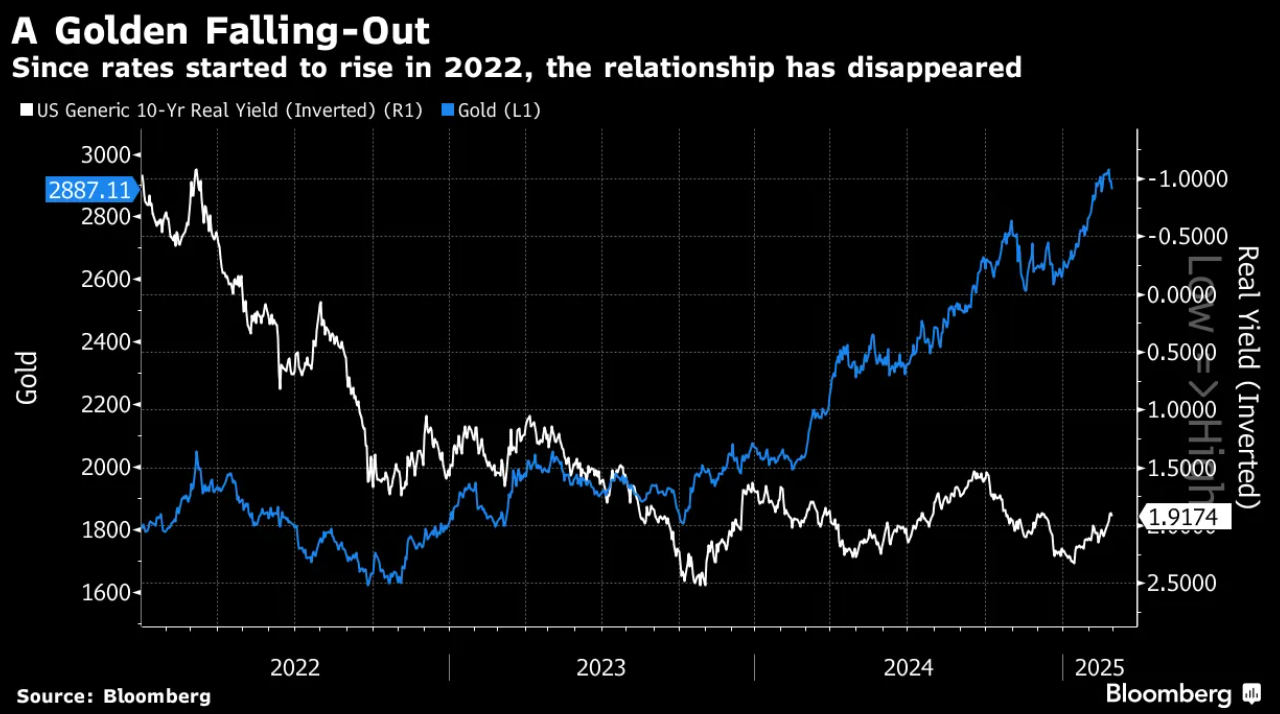

John Luke: For years, the price of gold followed closely along with real yields

Data as of December 2024

Data as of December 2024

John Luke: but in recent years, the price kept rising despite the rise in real yields

Data as of 02.27.2025

Data as of 02.27.2025

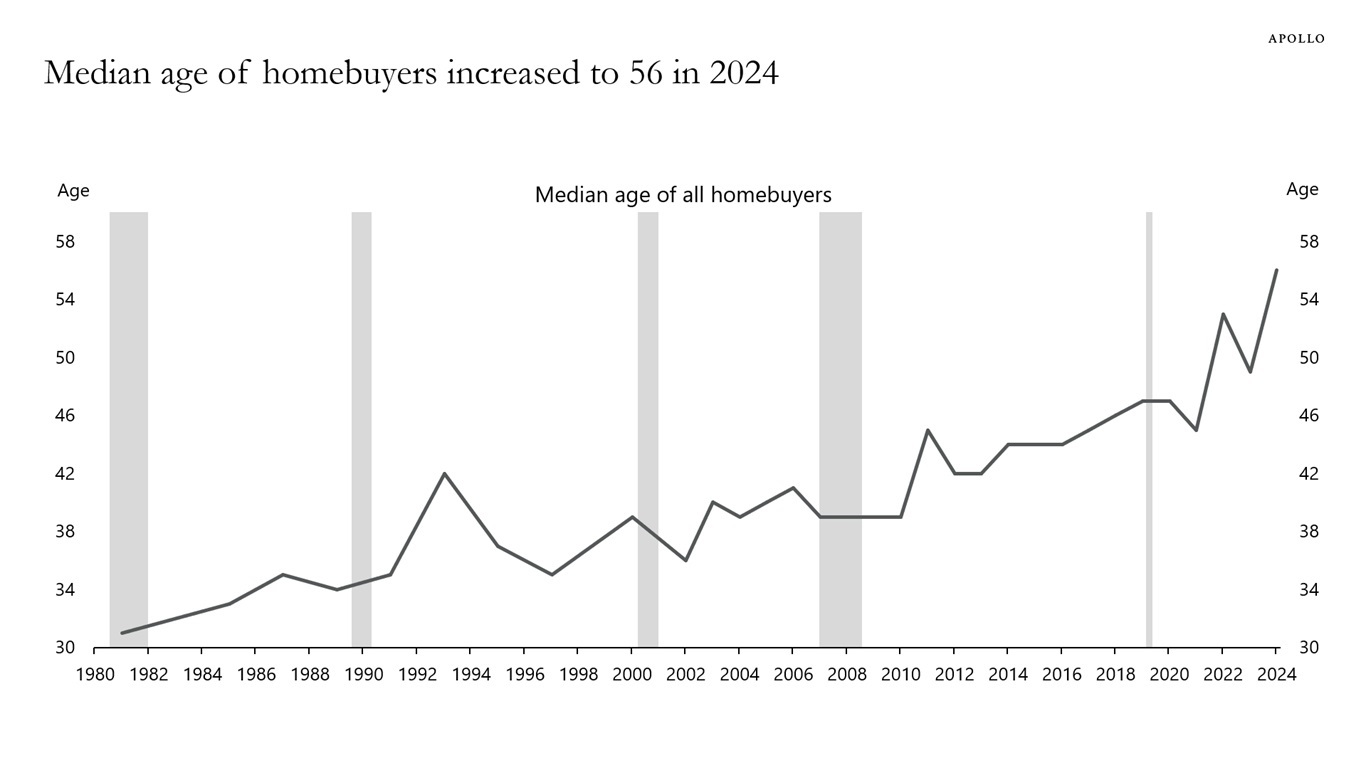

JD: Younger buyers are getting squeezed out of the housing market by higher rates and higher prices

Source: Apollo as of 02.20.2025

Source: Apollo as of 02.20.2025

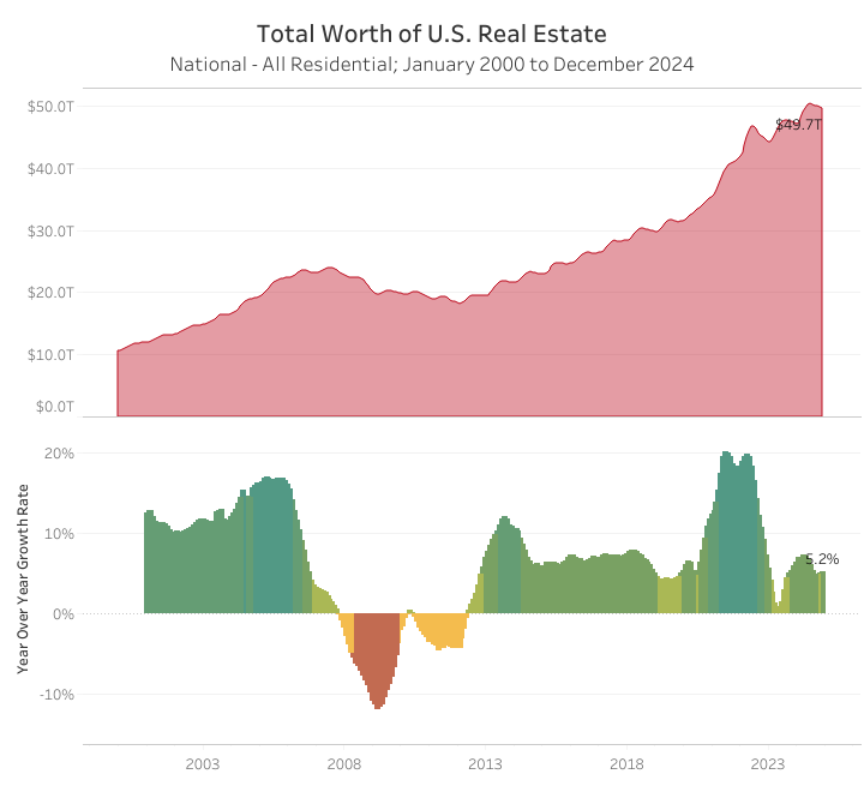

Beckham: but despite affordability challenges, the overall wealth in housing is still huge and growing

Source: Redfin as of January 2025

Source: Redfin as of January 2025

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2502-23.