Our team looks at a lot of research throughout the day. Here are a handful that we think are good summations of investor activity, from the equity market correction to the economy and inflation and, of course, tariffs. Enjoy!

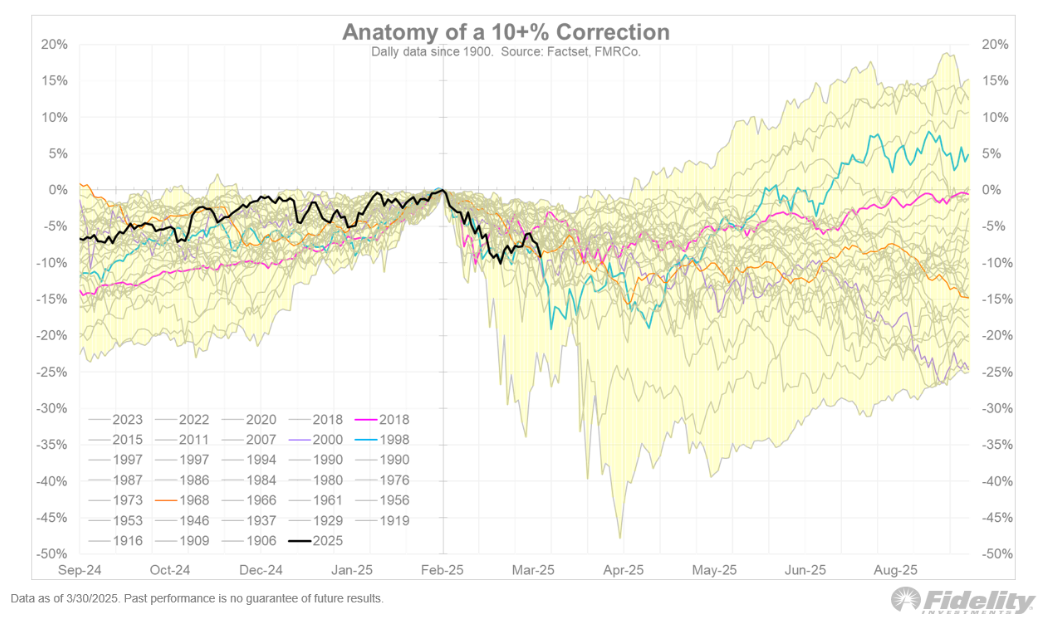

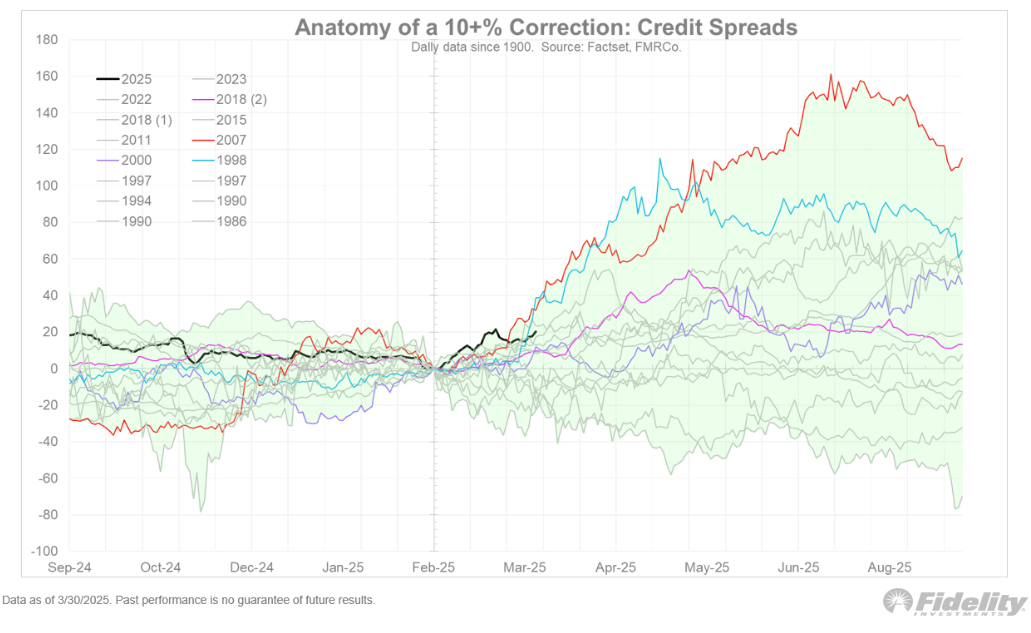

Beckham: Anyone who claims a crystal ball to future outcomes is either naïve or lying; corrections may rhyme, but they rarely repeat

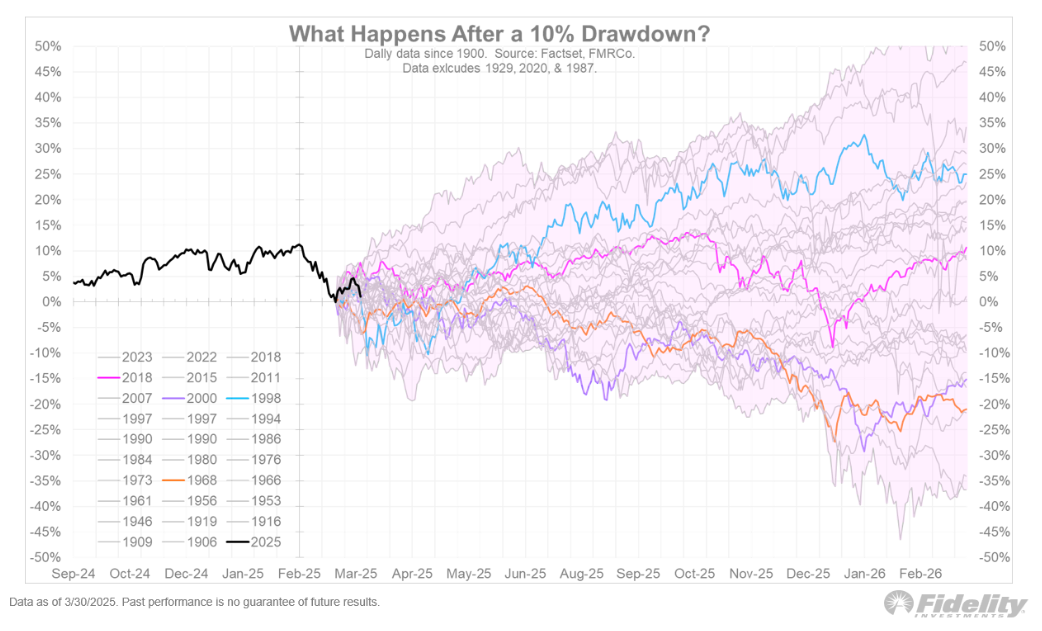

Brett: and if you hone in on just the history after the 10% threshold has been reached, it’s even more clear how different the path of each outcome can be

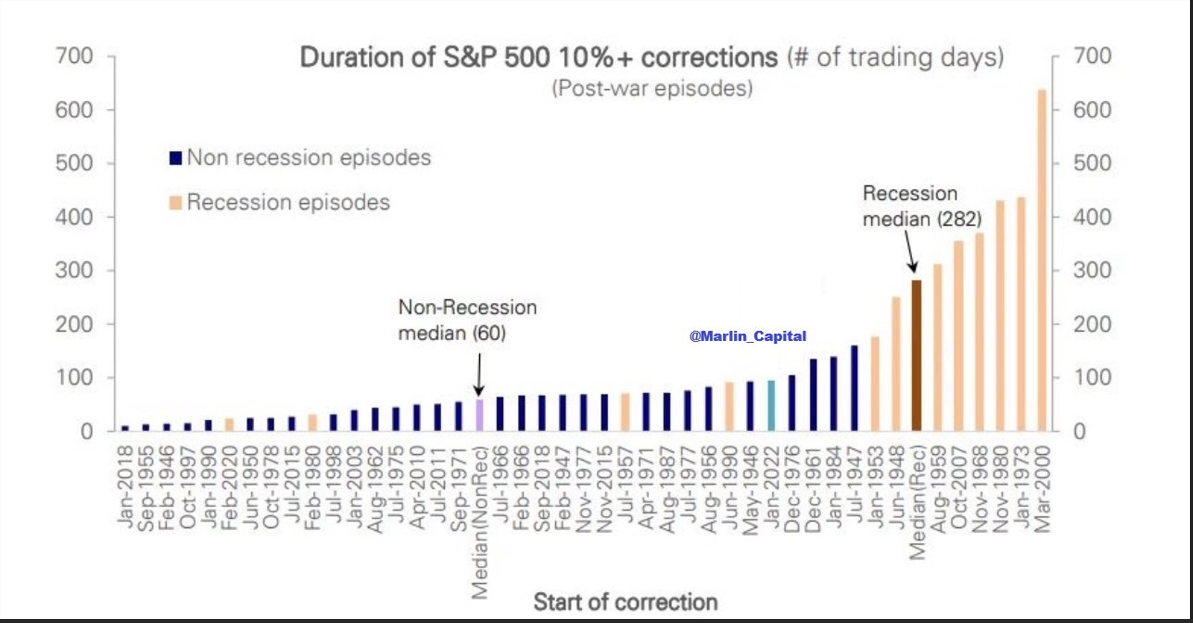

Arch: Not only are the end points different in price, but they vary quite a bit in time as well

Data as of 04.01.2025

Data as of 04.01.2025

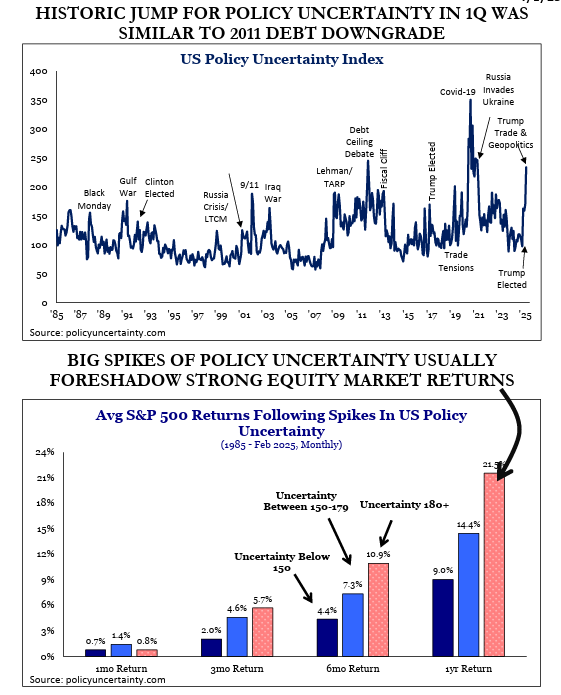

John Luke: and with policy uncertainty readings already on par with the most memorable episodes in recent history, it’s important to remember that widespread anxiety often sets the table for higher prices

Source: Strategas as of 04.02.2025

Source: Strategas as of 04.02.2025

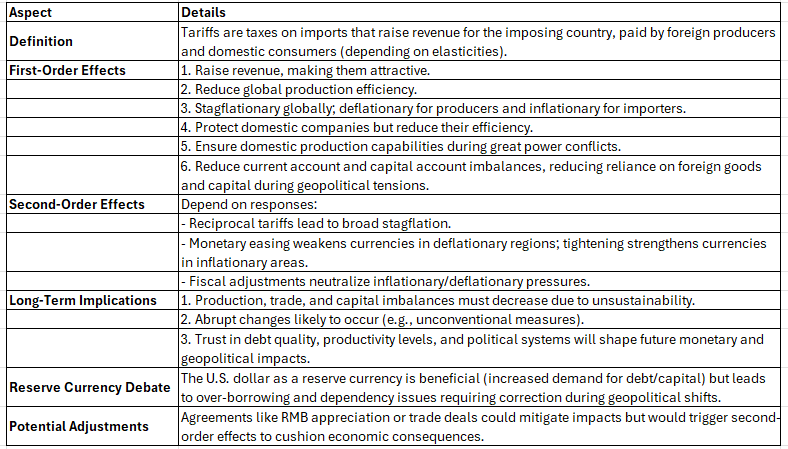

John Luke: Tariffs are obviously grabbing every headline, here’s a summary of pros and cons from Bridgewater founder Ray Dalio

Source: @AllioCapital as of 04.02.2025

Source: @AllioCapital as of 04.02.2025

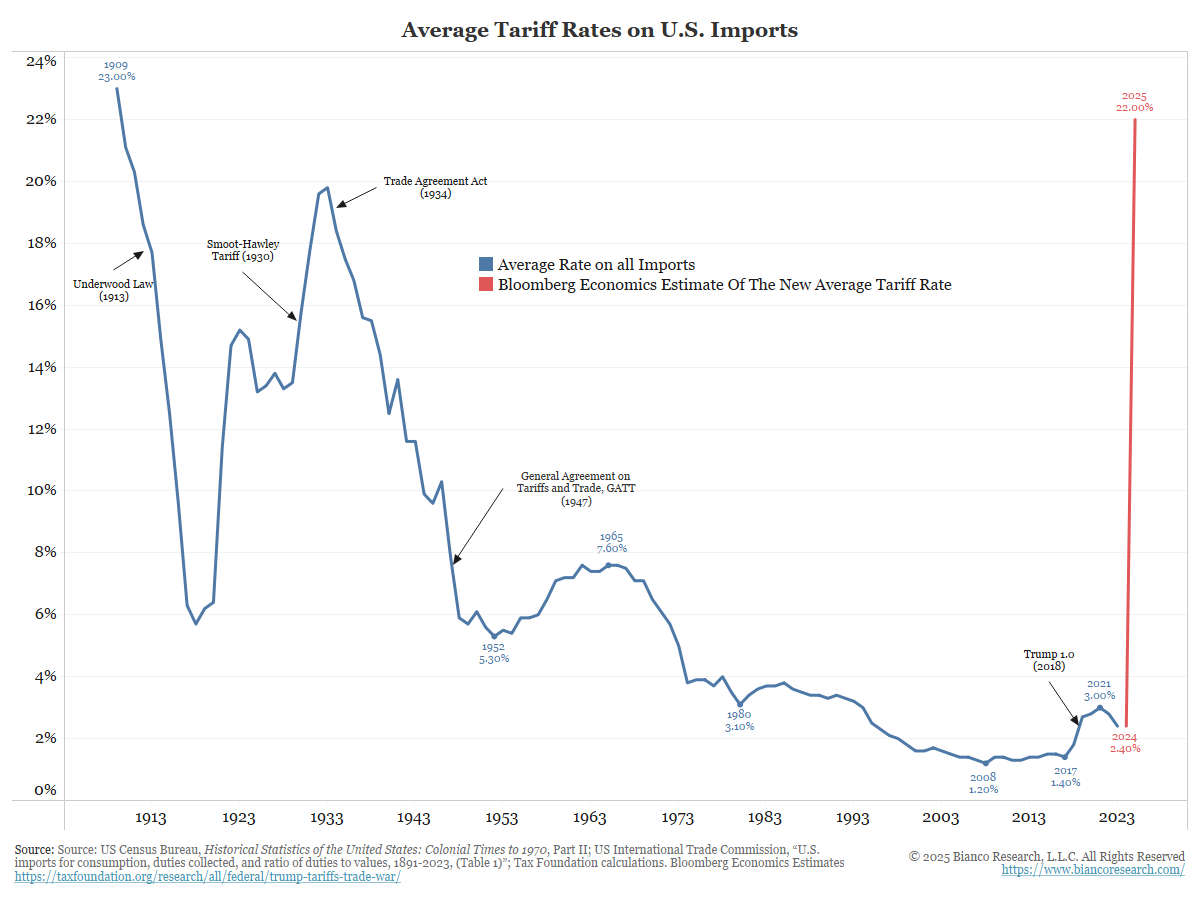

John Luke: and an estimate of the initially proposed tariff rates relative to US trade history

Data as of 04.03.2025

Data as of 04.03.2025

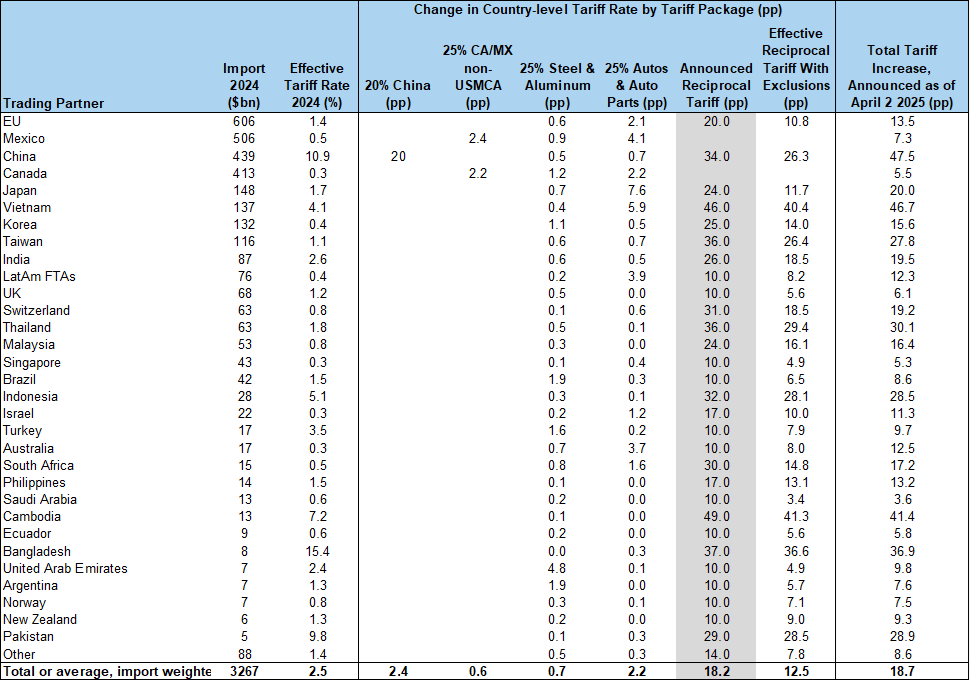

Joseph: Here is a decent summary of the before and after tariff rates across the largest exporters to the U.S.

Source: Goldman Sachs as of 04.03.2025

Source: Goldman Sachs as of 04.03.2025

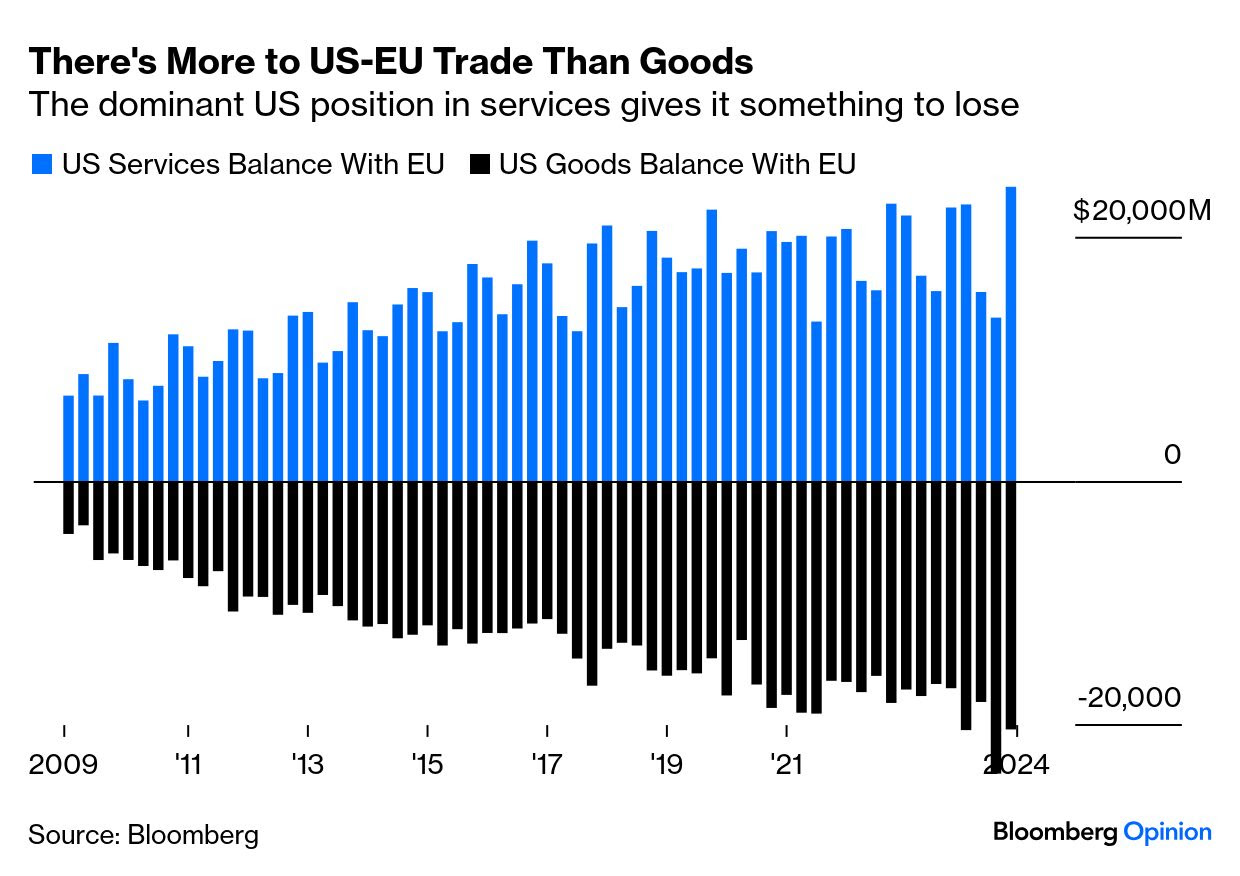

Ten: It’s important to note that the proposed tariffs apply only to imported goods, not services

Data as of March 2025

Data as of March 2025

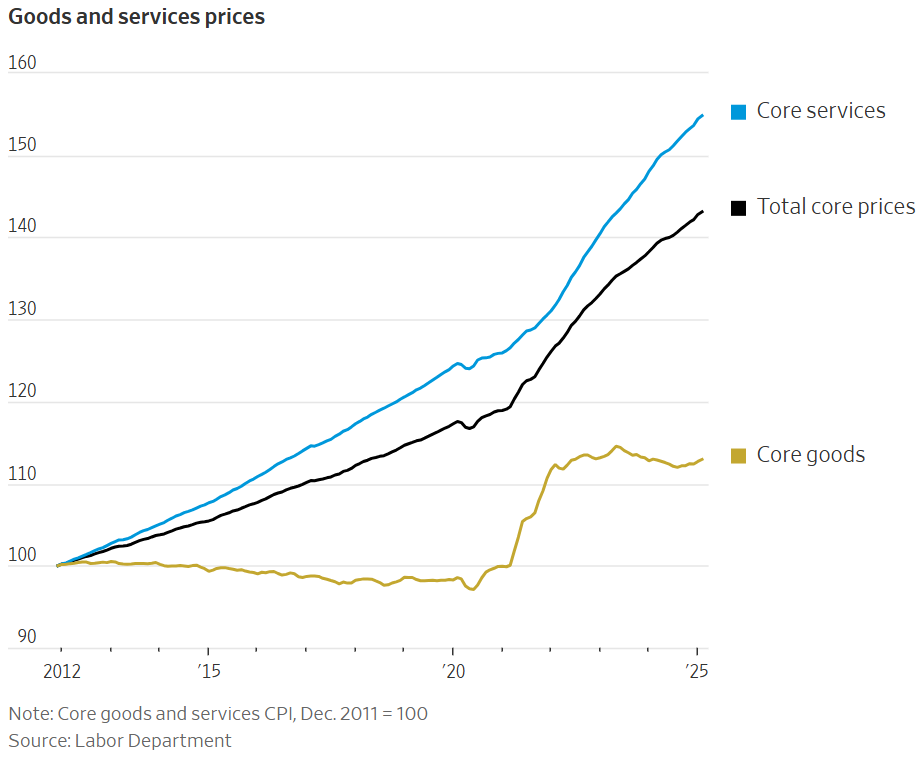

John Luke: that split between goods and services is also prominent in tracking inflation figures

Source: WSJ as of 04.01.2025

Source: WSJ as of 04.01.2025

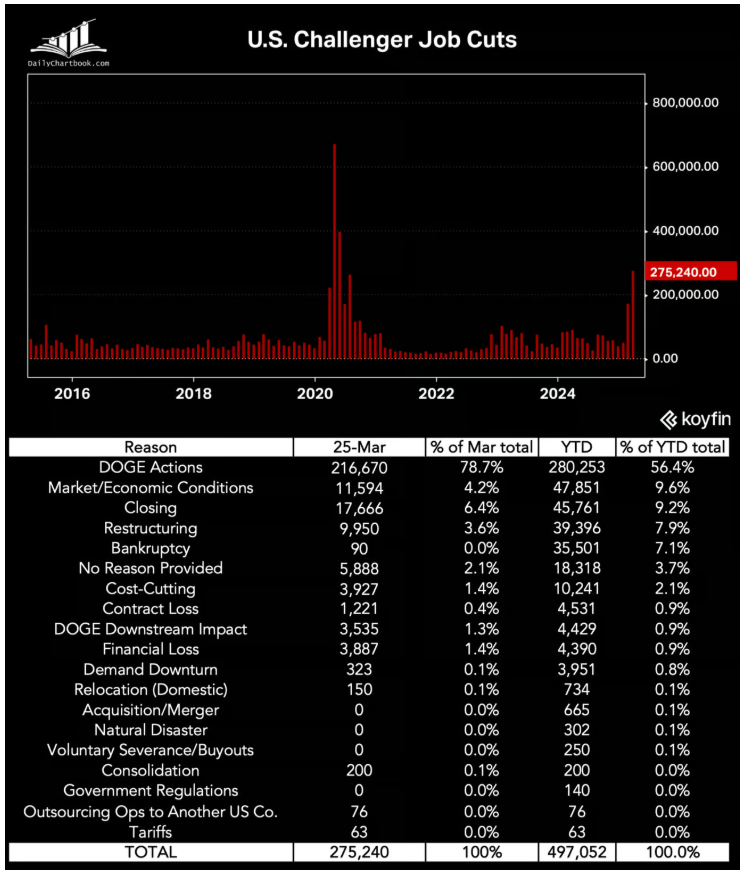

Jake: Moving to jobs, we’ve seen large DOGE-driven cuts, but it’s not yet spilled over into the private sector

Source: Koyfin via Daily Chartbook as of 04.01.2025

Source: Koyfin via Daily Chartbook as of 04.01.2025

Brad: and while market lore says credit markets always sniff out trouble before equities, it’s not always the case

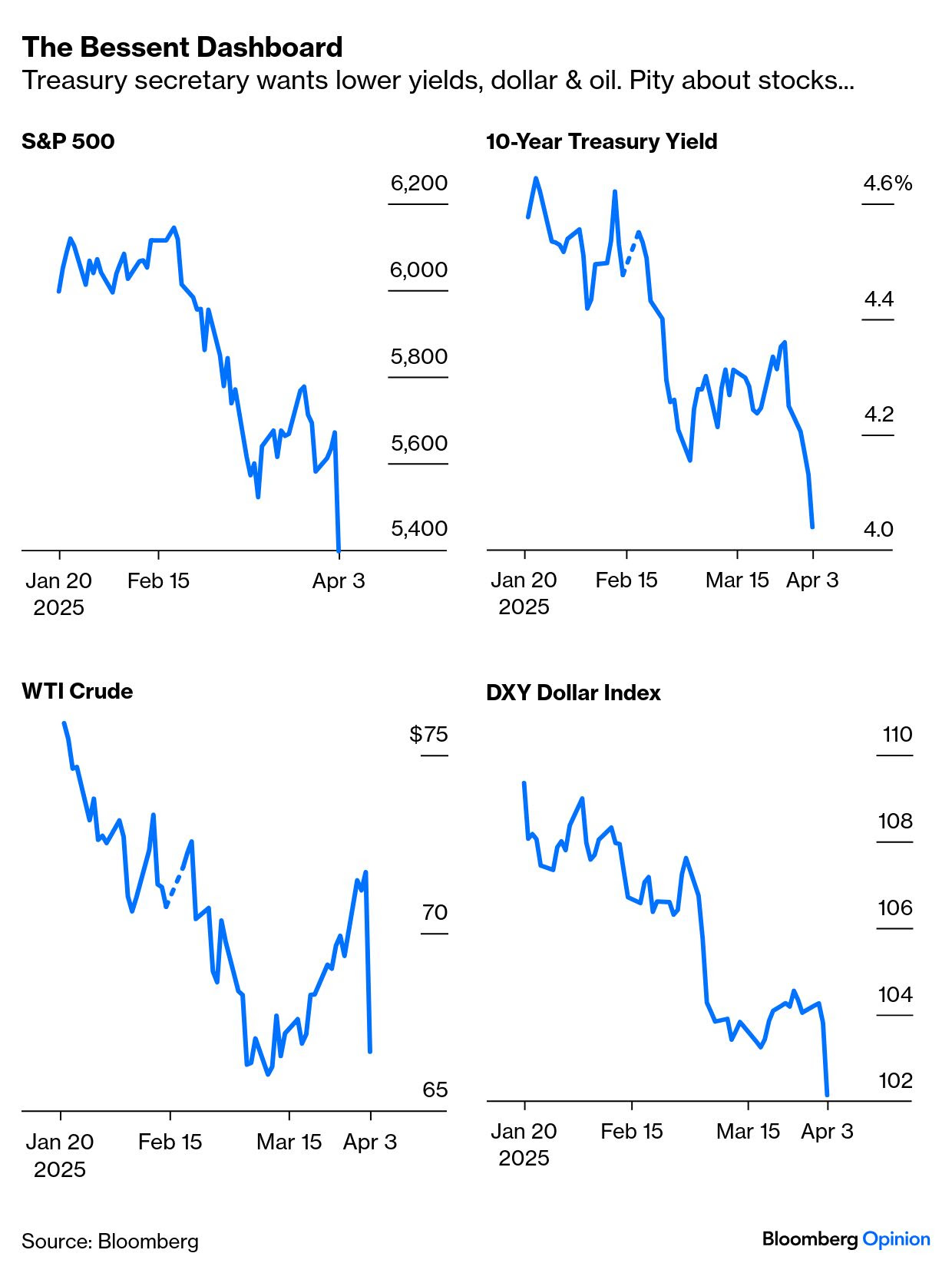

Brian: We can’t guess at the full range of policy goals, but Treasury Secretary Bessent was clear on his desire for lower rates, oil prices, and US dollar

Data as of 04.03.2025

Data as of 04.03.2025

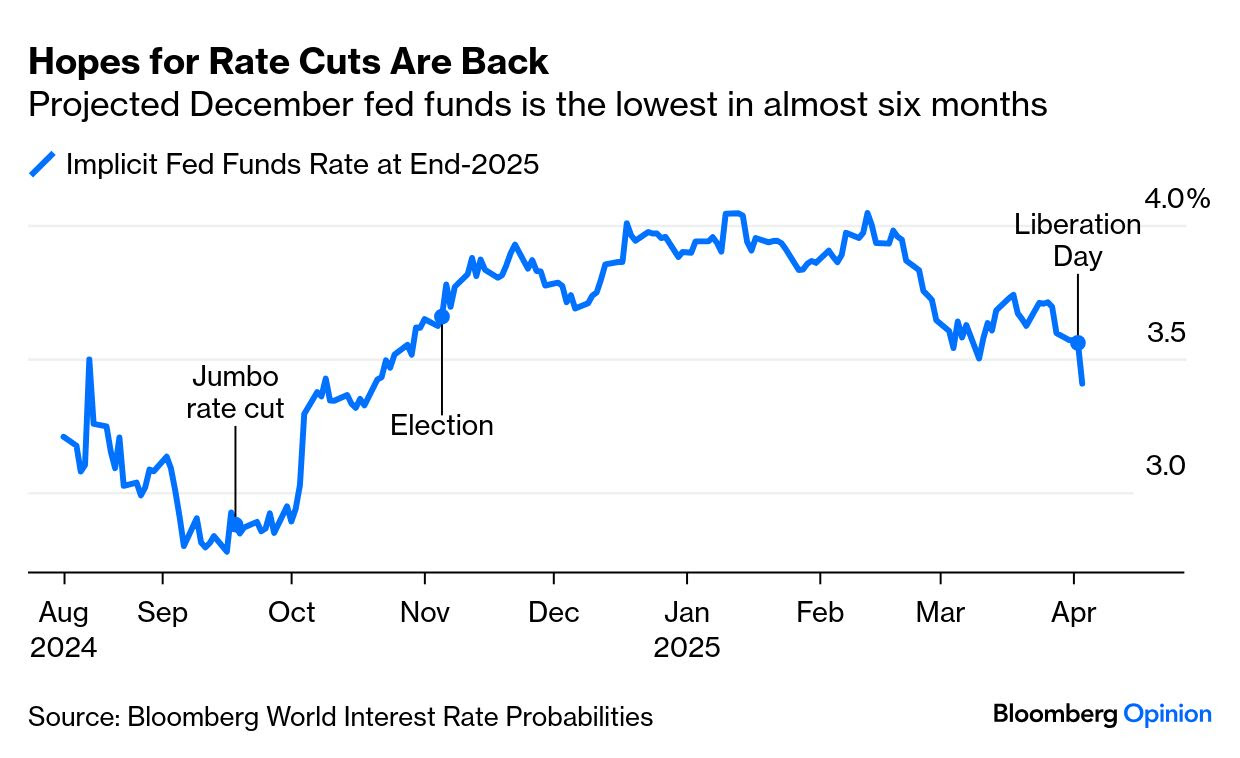

JD: and as markets fall we’ll soon find out whether the “Fed Put” is still a thing

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2504-12.