Our team looks at a lot of research throughout the day. Here are a handful that we think are good summations of investor activity, from the US dollar to bonds to the economy to US and foreign stock markets. Happy Easter to you!

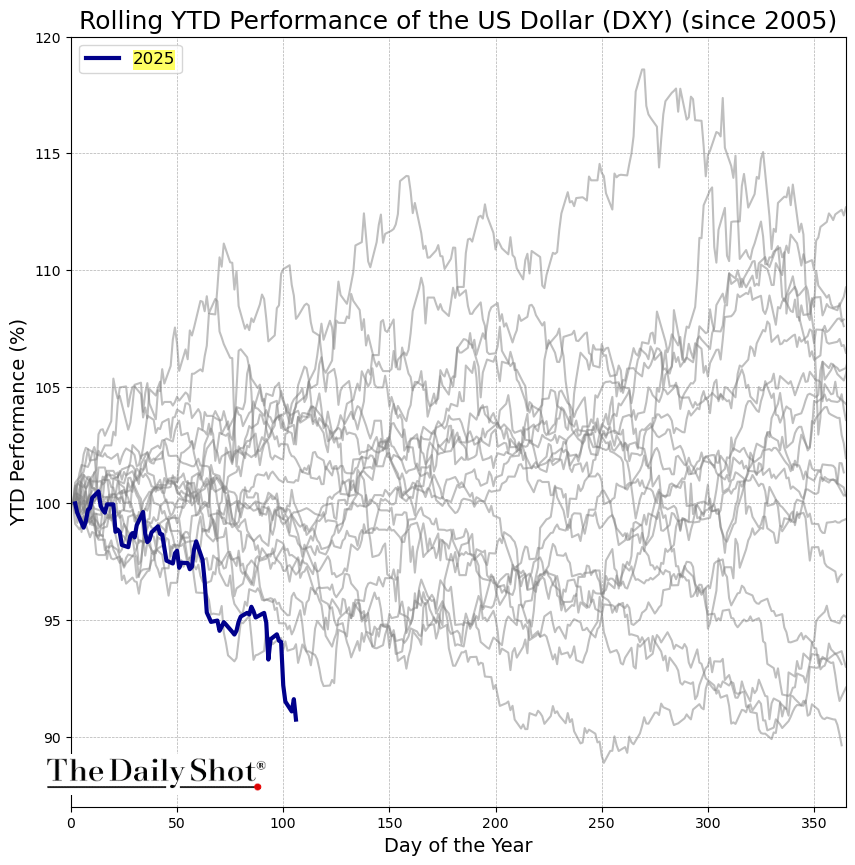

Brett: The value of the US dollar is off to its weakest start of the past 20 years

Data as of 04.16.2025

Data as of 04.16.2025

John Luke: The dollar weakness is also feeding into the rise in Treasury yields

Data as of 04.14.2025

Data as of 04.14.2025

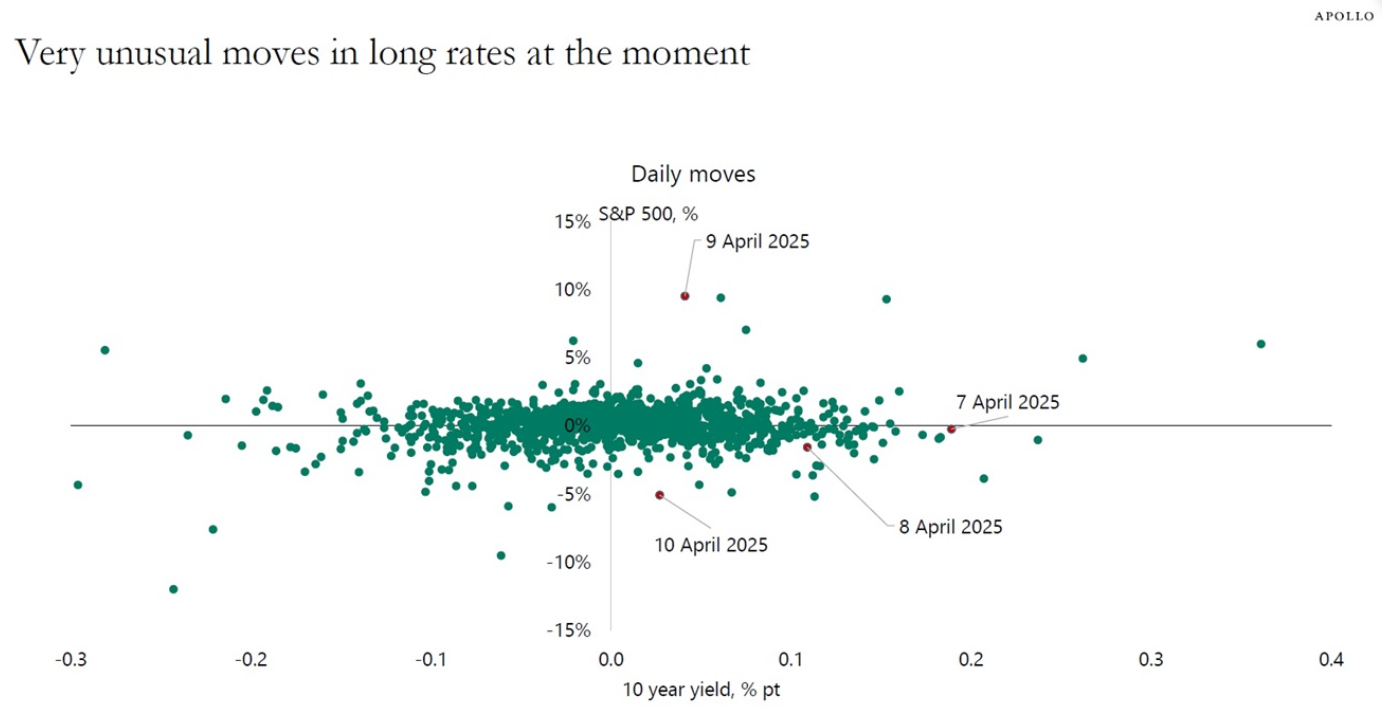

Arch: and is likely tied to the extraordinary moves in the bond market in recent weeks

Source: Apollo as of 04.10.2025

Source: Apollo as of 04.10.2025

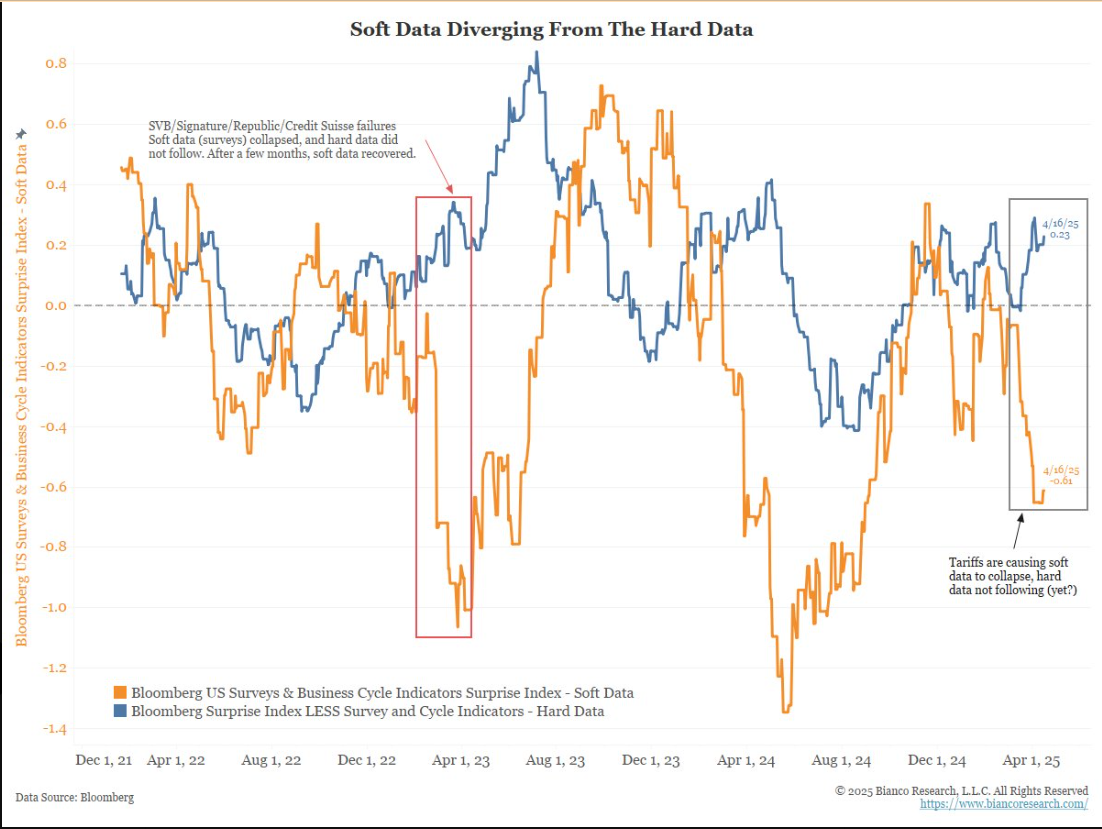

John Luke: Investors and economists are trying to evaluate the timing and validity of soft vs. hard data, meaning surveys vs. actual output

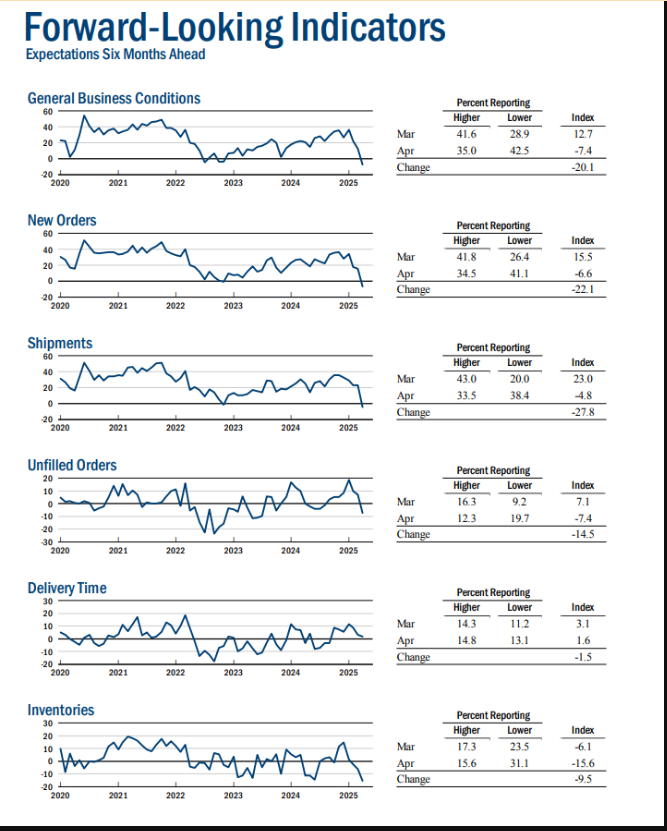

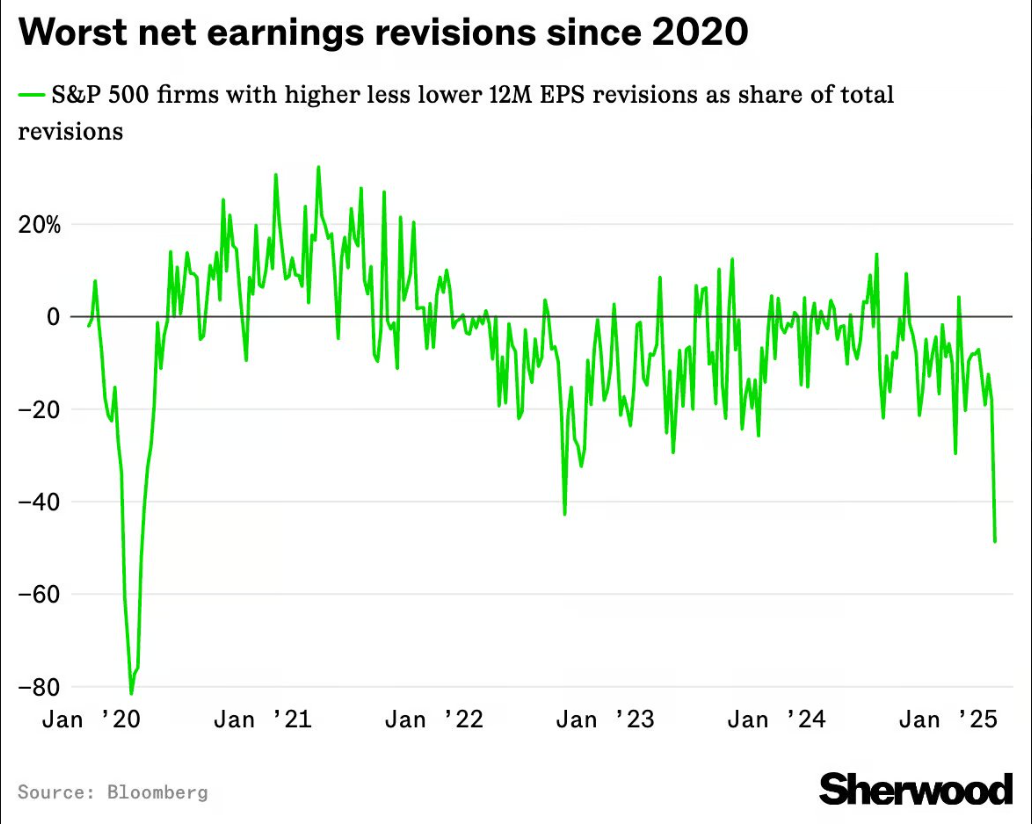

Brian: Survey data has turned unequivocally lower on tariff uncertainty

Source: @thestalwart as of 04.16.2025

Source: @thestalwart as of 04.16.2025

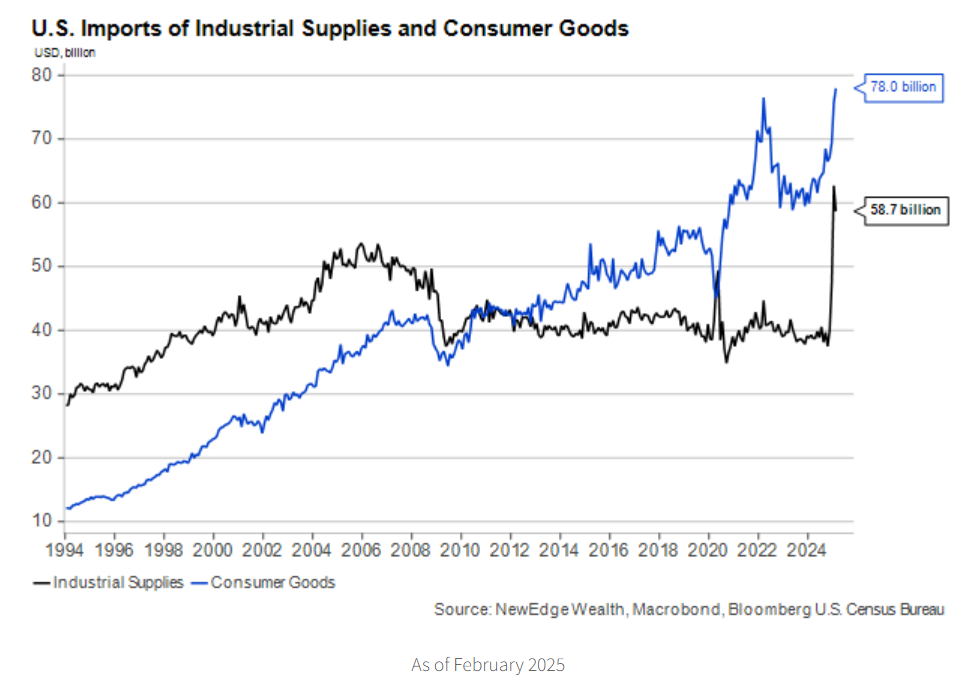

Joseph: while output data has stayed strong, perhaps due to buyers getting out in front of tariffs

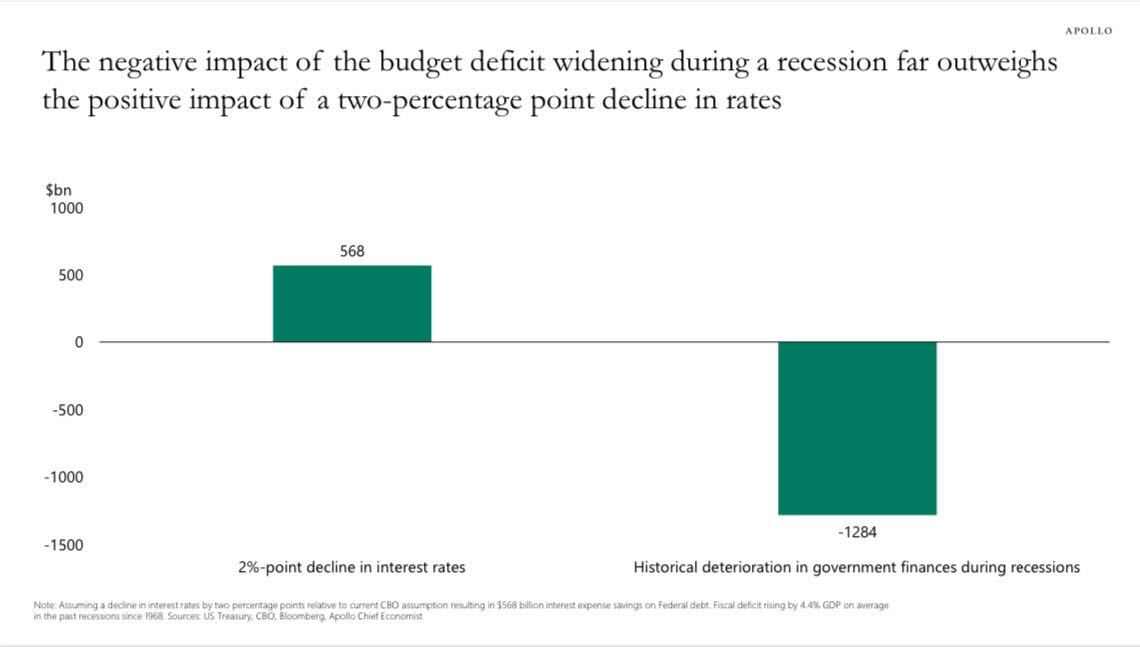

Jake: either way, pronounced economic weakness would be likely to do more harm than good to deficit reduction efforts

Data as of 04.15.2025

Data as of 04.15.2025

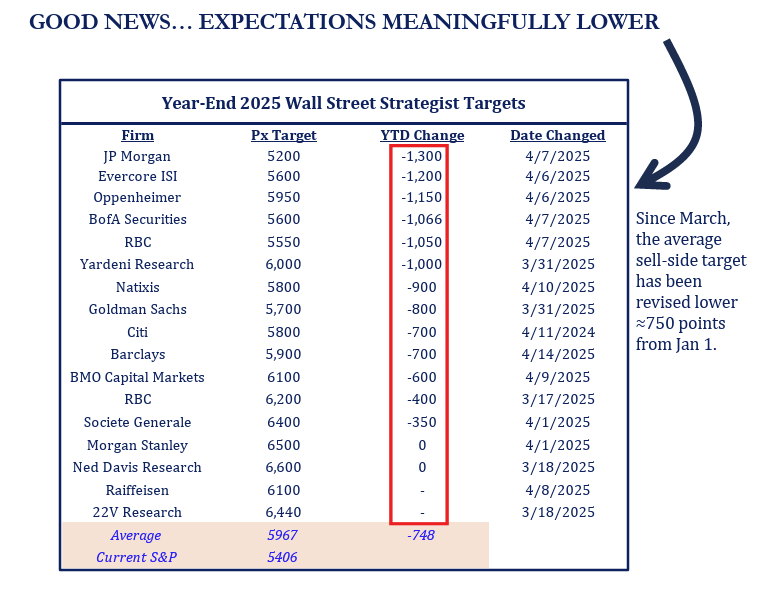

John Luke: Strategist targets are predictably being chased lower

Source: Strategas as of 04.14.2025

Source: Strategas as of 04.14.2025

Ten: and we’re now in a volatility zone from which prices have historically shown higher potential

Joseph: Developed economy growth estimates are coming down at a pretty good clip

Data as of 04.13.2025

Data as of 04.13.2025

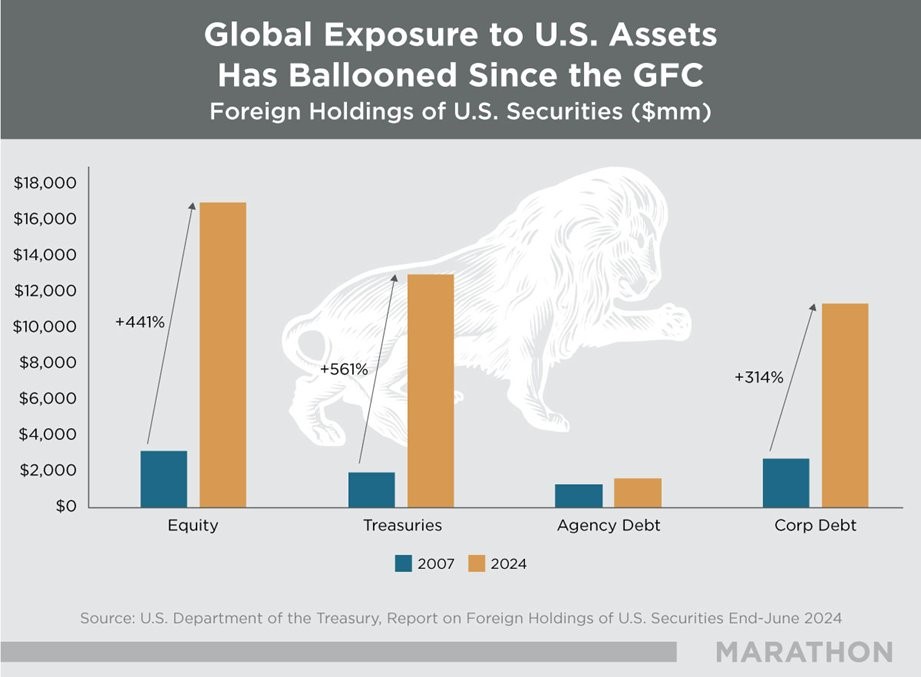

Arch: given the higher exposure to US assets, our markets are more a bit more prone to an unwinding

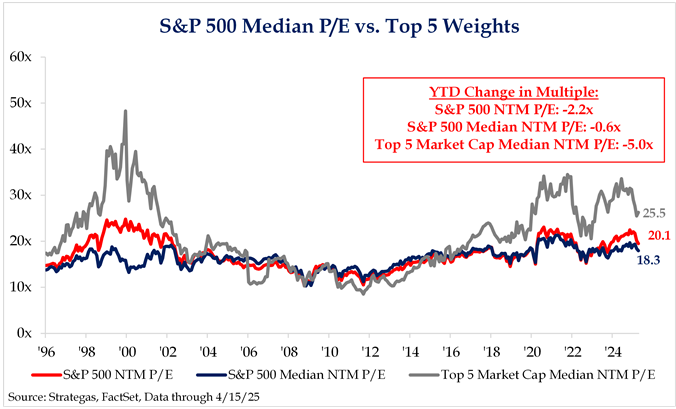

Brad: As we head into earnings season, the correction in prices means lower valuations especially for the formerly popular Mag 7 names

Brett: the question is, have expectations fallen enough to allow for relief rallies as earnings pass

Data as of 04.14.2025

Data as of 04.14.2025

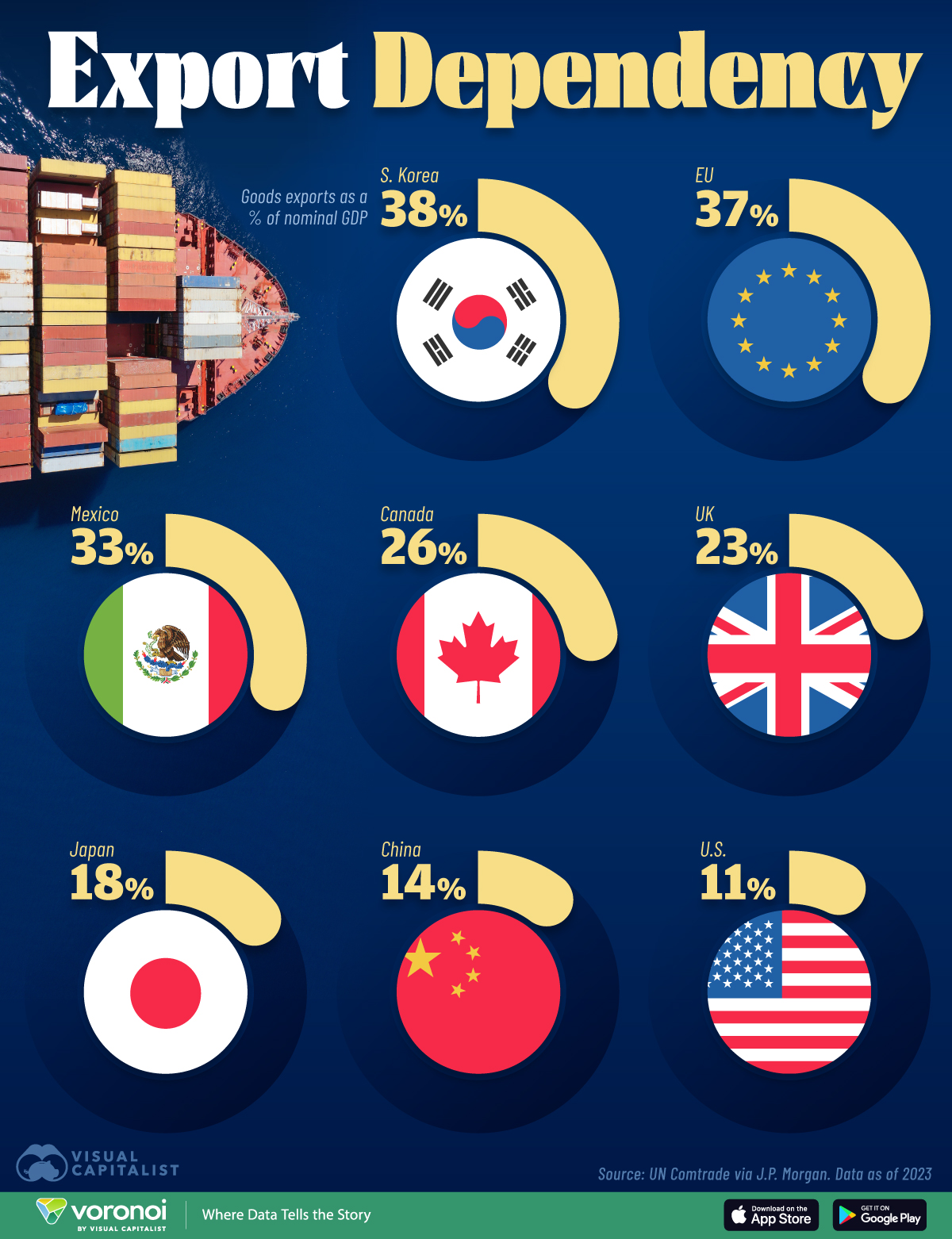

Brad: One hope for the US economy vs. others is its lighter reliance on trade as a portion of the economy

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2504-24.