Our team looks at a lot of research throughout the day. Here are a handful that we think are good summations of investor activity, from rare timing setups and market breadth to the economy, earnings, and US/foreign market exposures. Enjoy!

What a Month

JD: At one point, the S&P 500 was down over 10% intra-month, only to finish less than 1%. A reminder of how quickly sentiment and positioning can shift, as well as a very tough outcome for those who sold into the early weakness.

Source: Bloomberg as of 4.30.2025

Source: Bloomberg as of 4.30.2025

Still Plenty of Strength Beneath the Surface

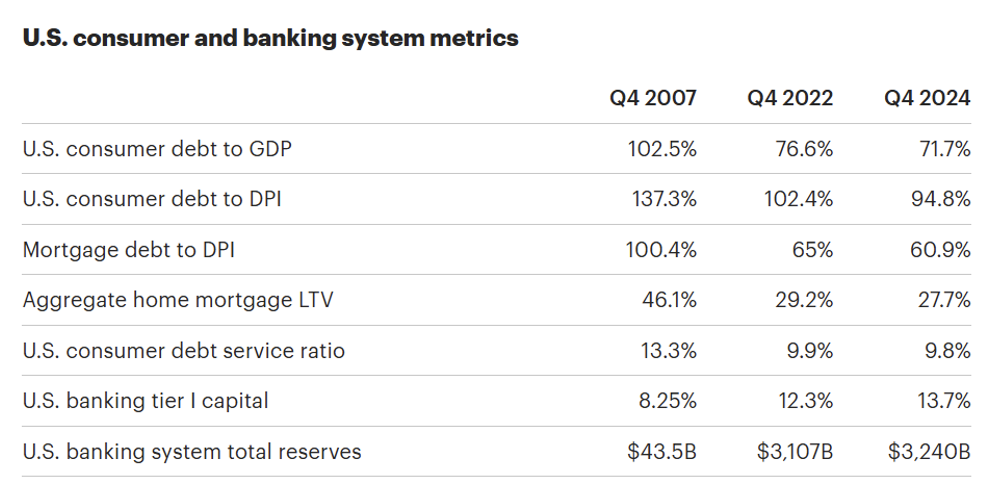

John Luke: While we can’t ignore the public debt overhang, the U.S. consumer and banking system are in far better shape than during the Global Financial Crisis (or even the brief banking hiccups we experienced a few years ago). That resilience could provide an important buffer for the consumer over the short run if growth does slow.

Source: FS Investments as of 4.17.2025

Source: FS Investments as of 4.17.2025

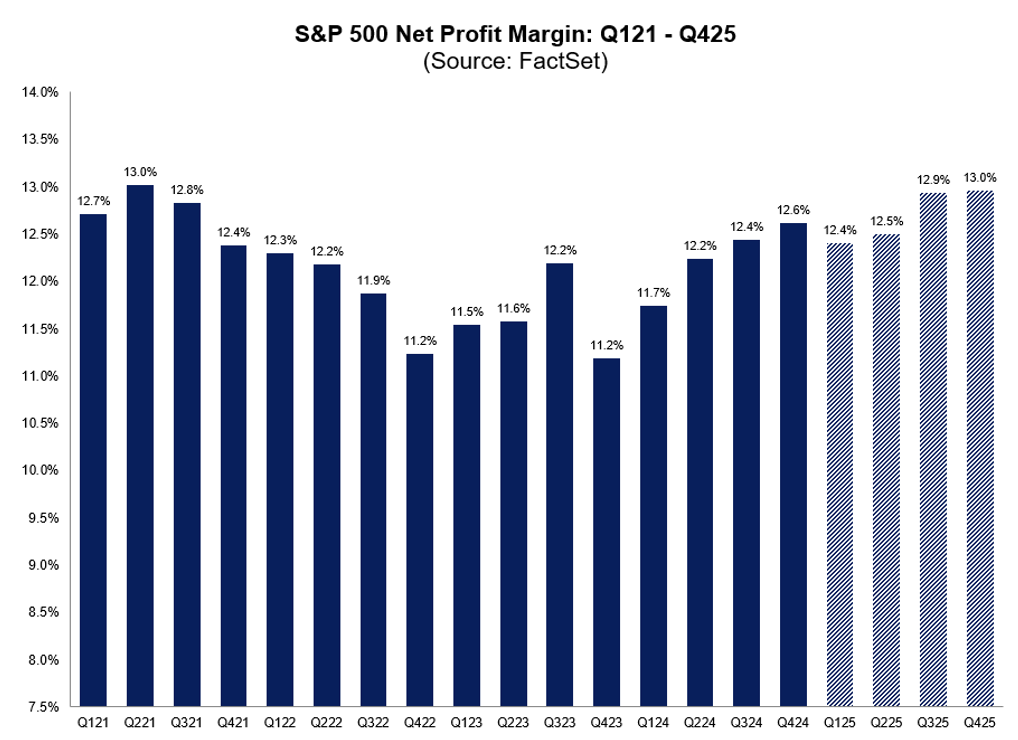

Dave: Despite the headlines, Q1 earnings and margins are holding up better than expected with profit margin anticipated to be above 12% for the 4th straight quarter and higher margin forecasts throughout 2025.

Source: FactSet as of 4.28.2025

Source: FactSet as of 4.28.2025

It’s Not All Rosy: Energy Does Not Just Have Short-Term Challenges

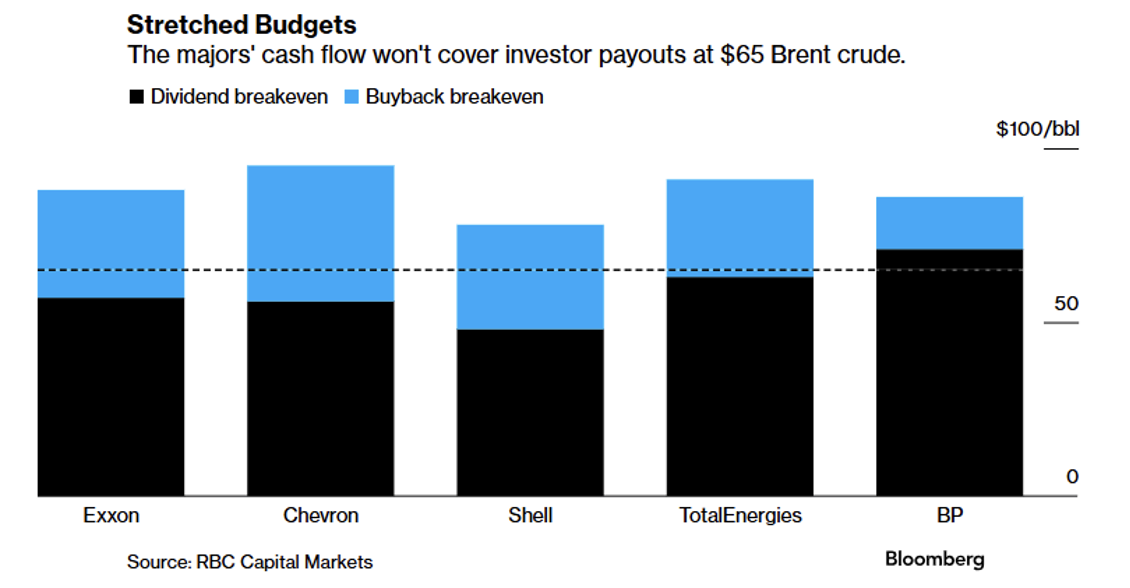

Joseph Sykora: At $65 Brent crude oil, most major oil companies aren’t generating enough free cash flow to cover shareholder payouts. The sector remains stuck between tepid demand and ample supply, which makes it tough to justify long-term exposure without a clearer path forward.

Source: RBC, Bloomberg as of 4.25.2025

Source: RBC, Bloomberg as of 4.25.2025

GDP: Economic Noise or Signal?

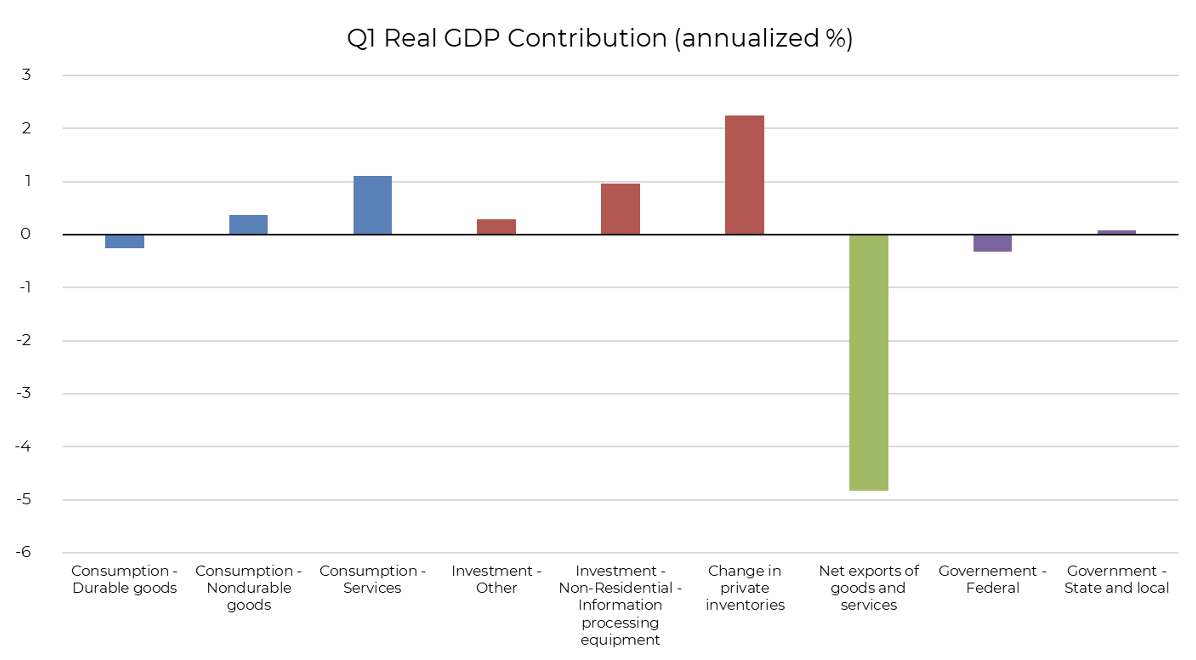

Brian: Q1 GDP fell -0.3% annualized, mainly due to a spike in imports ahead of tariffs. Consumer demand remained strong, and understated inventories suggest likely upward revisions. The key Q2 question is if inventories aren’t replenished, will the production and employment situation slow?

Source: BEA as of 4.30.2025

Source: BEA as of 4.30.2025

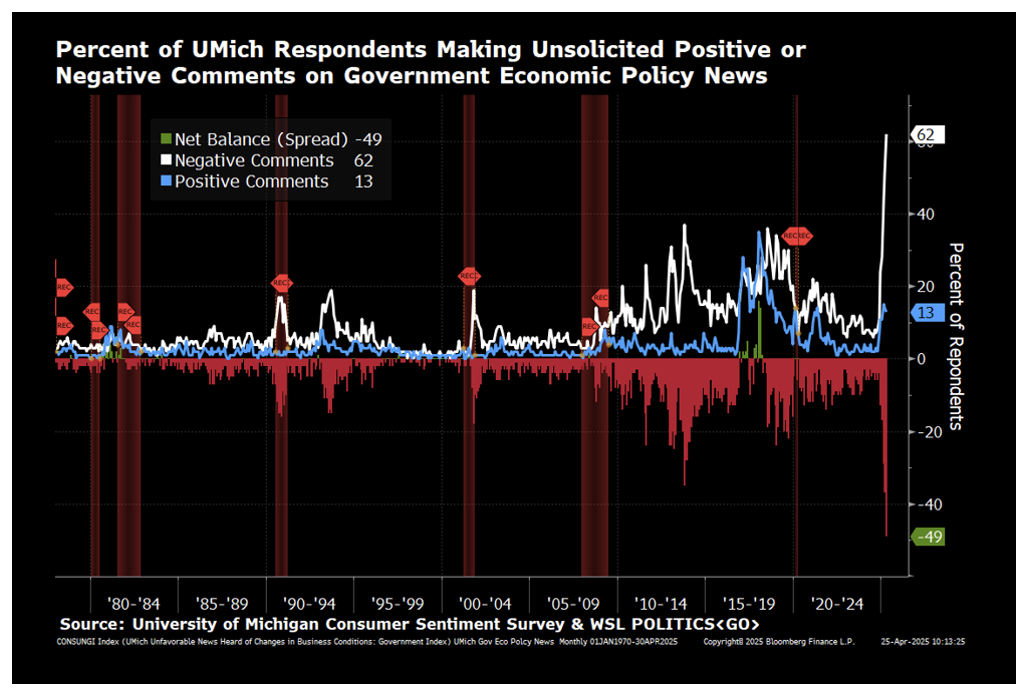

Arch: Despite consumer strength, consumer sentiment has taken a hit. Most notably through record-high unsolicited negative comments on government economic policy, according to the University of Michigan survey. That shift likely reflects the tariff impact and brings up the question of whether sentiment may eventually impact spending.

Source: University of Michigan, Bloomberg as of 4.24.2025

Source: University of Michigan, Bloomberg as of 4.24.2025

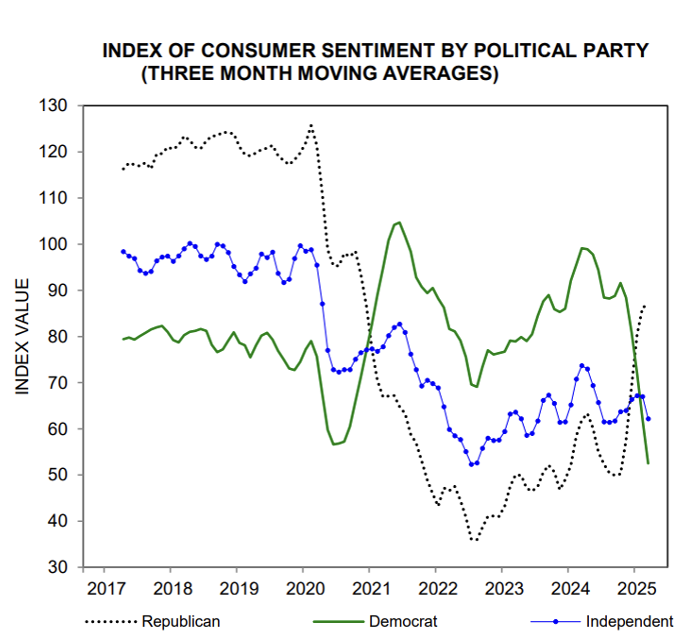

Dave: Sentiment data like this should be taken with caution. Surveys increasingly reflect political leanings more than actual financial conditions.

Source: University of Michigan as of 4.24.2025

Source: University of Michigan as of 4.24.2025

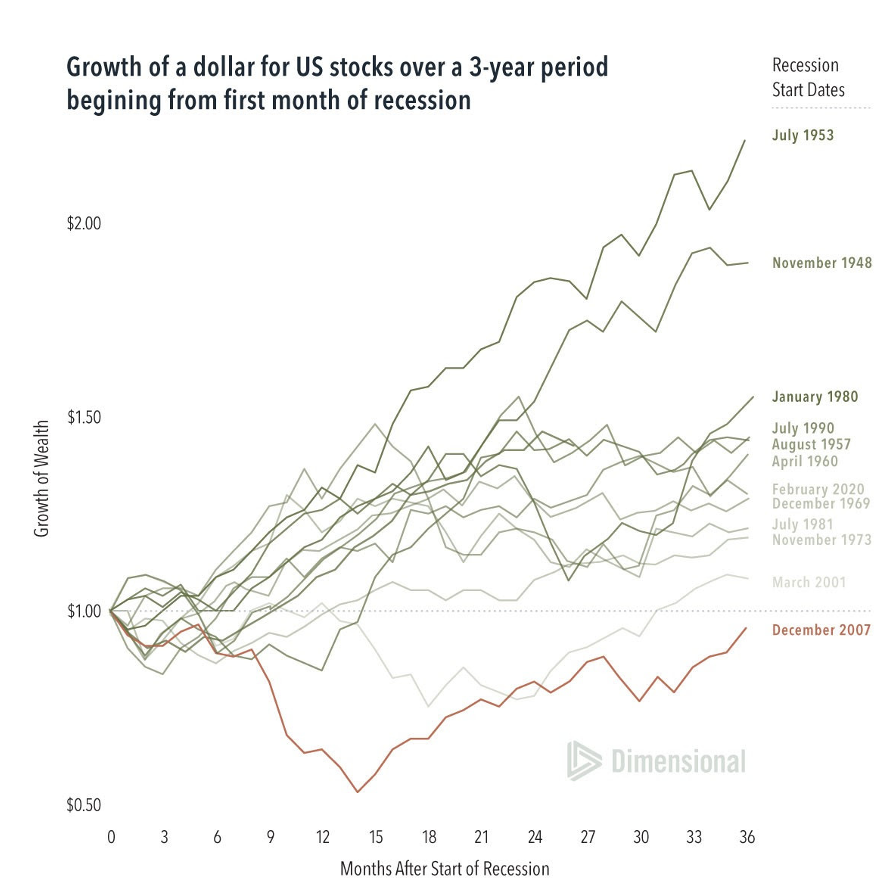

Beckham: Even if economic growth is sluggish or the small contraction does flow into Q2, it doesn’t guarantee poor equity performance. History shows that stocks often rebound sharply after recessionary bottoms. The market tends to look forward.

Source: Dimensional as of 4.24.2025

Source: Dimensional as of 4.24.2025

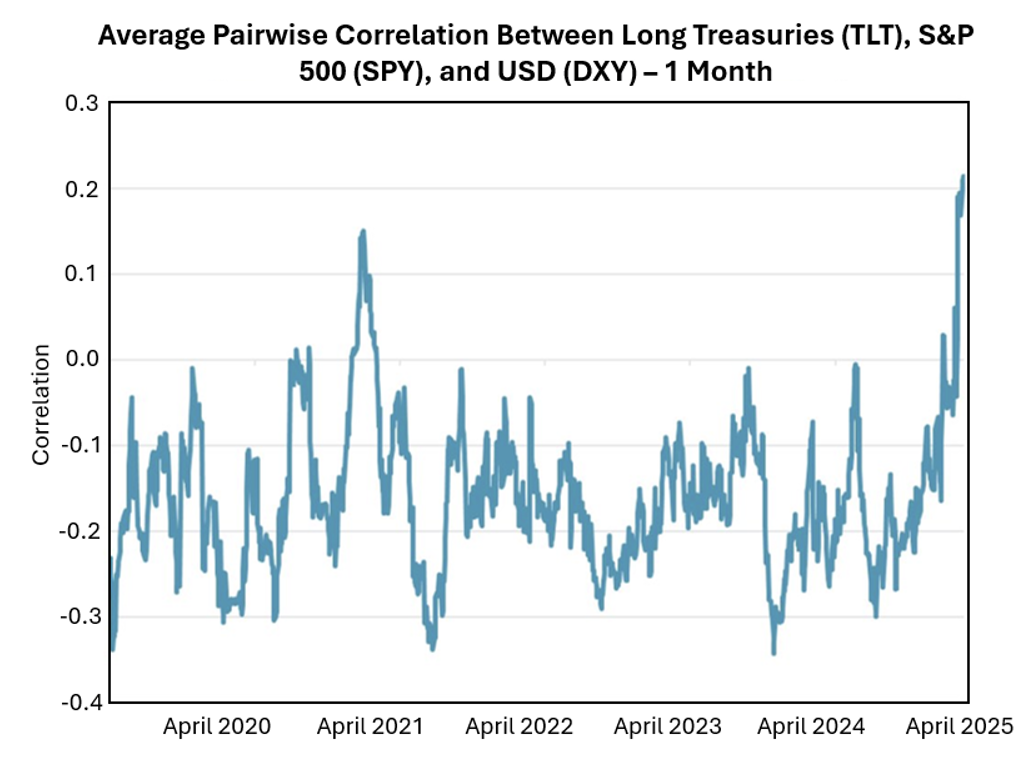

Why Asset Class Diversification Felt Broken

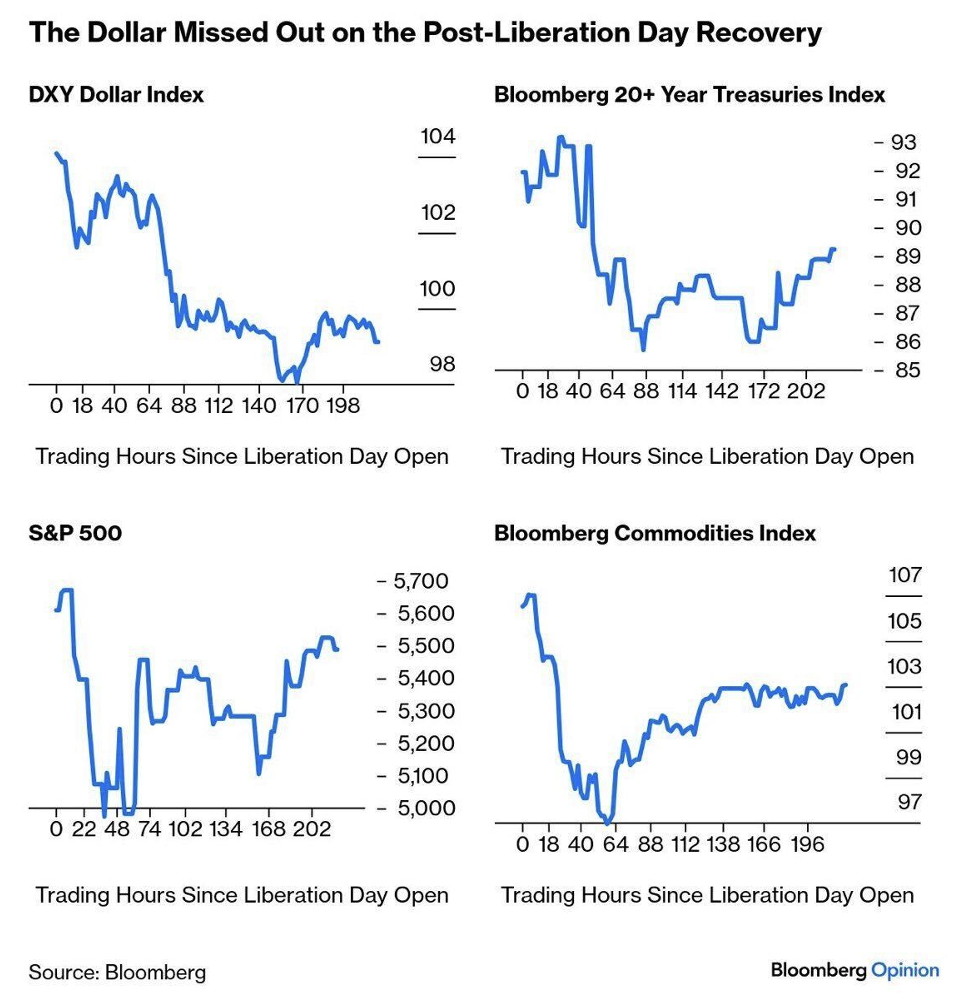

Arch: The recent selloff has challenged U.S.-centric portfolios. Stocks (SPY), long-term bonds (TLT), and the dollar (DXY) have all declined together, reducing the benefits of traditional diversification. It’s a reminder of the value of hedging and alternative exposures.

Source: Piper Sandler as of 4.28.2025

Source: Piper Sandler as of 4.28.2025

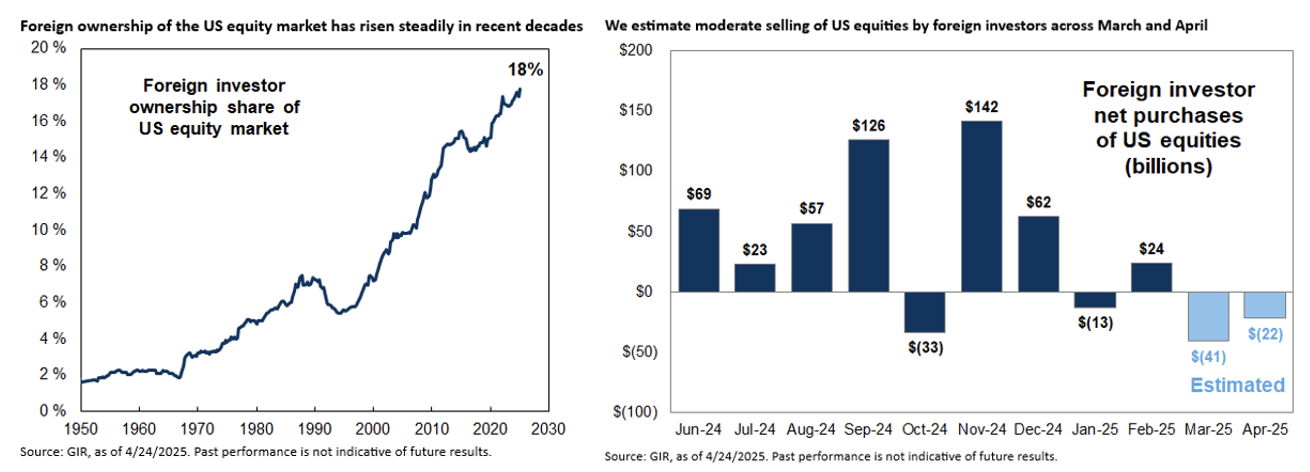

Derek: Part of the pressure has come from a reversal in foreign demand for U.S. assets. After years of steady inflows, foreign investors have become net sellers.

Source: GIR as of 4.24.2025

Source: GIR as of 4.24.2025

Ten: That shift in flows may have contributed to the market’s recent decline. The S&P 500’s 19% drop (albeit short-lived) marks the 19th time since 1950 we’ve seen a 15%+ drawdown.

Source: Goldman Sachs as of 4.8.2025

Source: Goldman Sachs as of 4.8.2025

Dollar Dollar Bill Yall

Brian: Stocks, bonds, and commodities all bounced in the past month. But the dollar hasn’t. Are we entering a new regime for the dollar, or is it just lagging while markets await further tariff clarity?

Source: Bloomberg as of 4.28.2025

Source: Bloomberg as of 4.28.2025

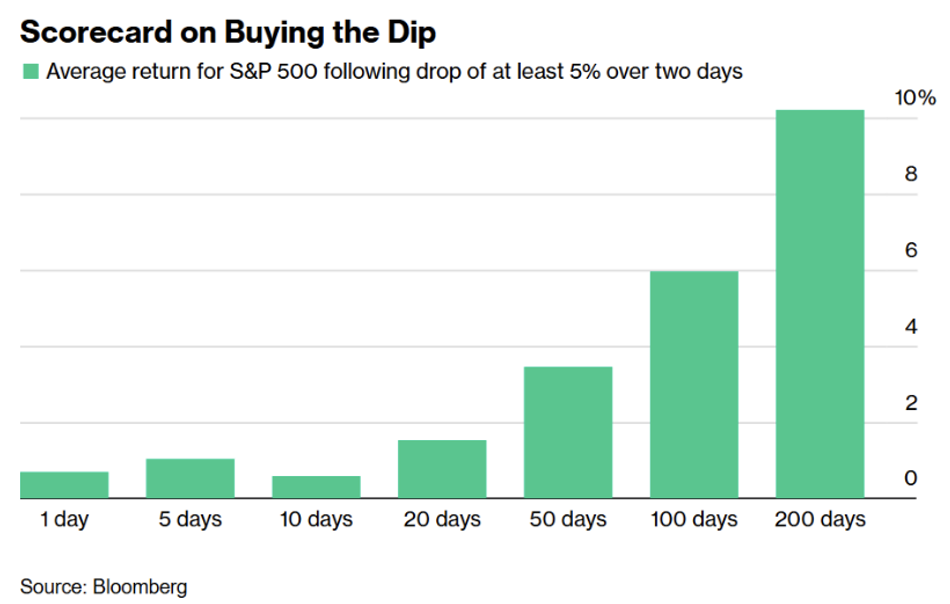

Jake: Once again, investors who bought the dip have been rewarded. It’s a pattern that’s held time and again, despite the noise.

Source: Bianco Research as of 4.24.2025

Source: Bianco Research as of 4.24.2025

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2505-1.