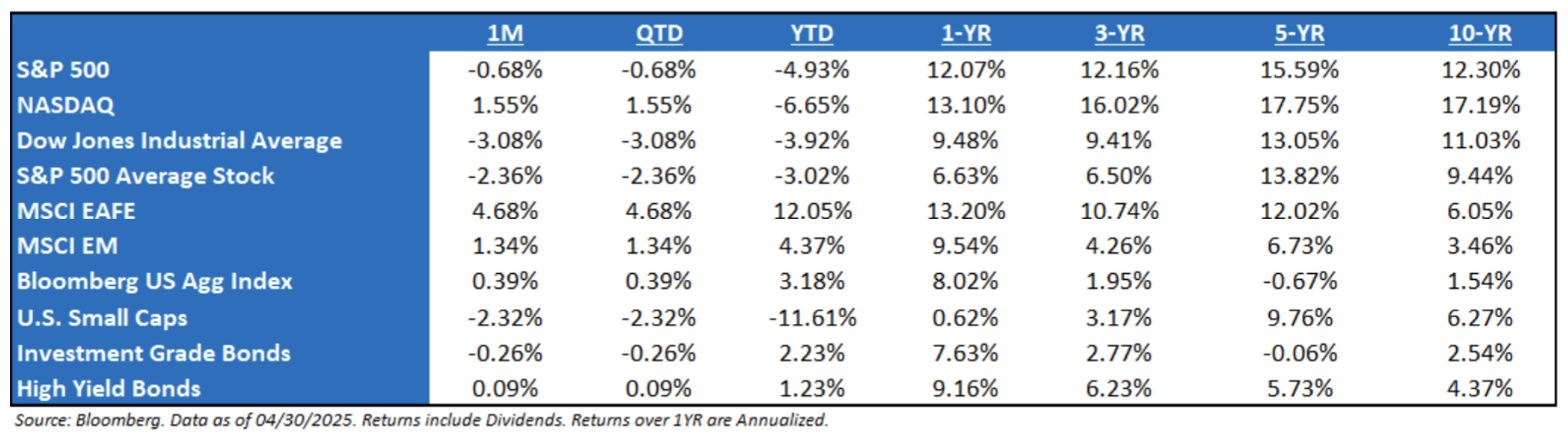

Market Recap – April 2025: The S&P 500 rallied to a one-month high in the last week of the quarter, rising nine straight trading days and recouped virtually all of the post-April 2, “Liberation Day” declines. First and foremost, the Trump administration has seriously backtracked on the April 2 announcement, including a delay, while negotiations take place and exempting major categories of imports (chips, electronics, pharma, autos). Additionally, the Q1 earnings season (which is not effectively over) was better than feared, and most analysts still have 2025 S&P 500 EPS between $260-$270. Finally, while sentiment data has been awful, “hard” economic data has held up well, including the recent (and important) Non-Farm Payroll Jobs report. Bottom line, the reality of the past month post “Liberation Day” hasn’t been as bad as feared and the market has recouped those losses. It should be noted that international markets have performed really well year-to-date, outperforming on the downside, but also during the recent upswing. The market has a lot to digest up until the July tariff extension – earnings growth and the labor market will likely determine the near-term direction.

Tariffs → Uncertainty Remains: The rules of engagement have officially been announced, but that does not mean that this will create certainty in the market. The focus turns to the downstream effects, from a sentiment perspective on what will happen to consumers’ spending habits. The base is a 10% tariff on all imported goods. Originally, the aim was to address trade imbalances. Outside of spending, the other big question is whether the more business-friendly policies, i.e., taxes and deregulation, will be able to trump the effects of tariffs in the near term. It would be a mistake to think the tariffs announced on April 2nd will not affect the US economy. The 2018 tariffs on China (one trade partner, albeit a big one) caused a significant, though short-lived, economic slowdown. This time, the economic impact will be bigger. The inflation impact will be different this time, too. The Commerce Department is right that the 2018 tariffs did not cause significant inflation, but that was at least in part because the US quickly switched from Chinese suppliers for many goods to other international suppliers. But for now, political, emotional, and likely market volatility may remain.

The Root of Market Hesitancy: The single biggest obstacle in the market that remains is uncertainty. Tariff and trade policy is a total unknown and headlines are volatile, major government institutions are being gutted or outright closed, and administration officials are openly acknowledging the possibility of a recession. This cocktail of uncertainty has hit consumer and business confidence, slowing economic momentum. Combine that with elevated earnings and a lot of bullish optimism entering the quarter, and you’ve got the recipe for a correction, which we saw in the S&P 500 during Q1. For now, it seems like earnings season has helped some of these fears.

Earnings Season Update – Q1 2024: The S&P 500 has declined by ~5% year-to-date (“YTD”) and has fully recovered all the losses since the April 2nd tariff announcements, yet consensus S&P 500 EPS estimates for 2025 have only declined by 2% YTD. Analysts expect 2025 S&P 500 EPS to grow by 9%, a lower bar relative to previous quarters and down from an expectation of 11% growth at the start of the year. For 2026, analysts are still calling for 14% growth – a number that hasn’t really changed this year.

Fed Update: The Federal Reserve left rates unchanged in a 4.25%-4.50% range, with the interest rate on reserve balances at 4.4%. In the statement, the Fed noted the economy “continued to expand at a solid pace. The unemployment rate has stabilized at a low level in recent months, and labor market conditions remain solid. Inflation remains somewhat elevated.”. The bottom line is that the Fed left policy unchanged but slowed the pace of Treasury roll-off by 80%. The implication is a significant increase in Fed reinvestment starting in April. The Fed’s new forecast suggests heightened uncertainty this year, with growth expected to be weaker, but inflation is momentarily higher. The Fed updated its projections:

-

- Gross Domestic Product: The median GDP forecast was cut from 2.1% to 1.7% this year, from 2.0% to 1.8% next year and from 1.9% to 1.8% in 2027.

- Core PCE Inflation (The Fed’s Preferred Measure of Inflation): Revised from 2.5% to 2.8% this year; unrevised at 2.2% and 2.0%, respectively, in 2026-27, suggesting the FOMC believes tariffs will cause short-run price increases but no lasting inflation.

Politics and Markets: The market is not political. It doesn’t care about draining swamps, political retribution, woke or anti-woke campaigns or DEI initiatives. The market only cares about policies that:

-

- Increase (or decrease) earnings, and

- Support growth (or hinder it).

Any political movement or agenda that is viewed by the market as getting in the way of better earnings and growth will be viewed as negative and be a headwind on risk assets, regardless of whether those policies are from Republicans or Democrats. This is the way we must view political coverage over the next year (and likely four years), and this will help us cut through the noise and stay focused on the policies that will impact markets.

S&P 500 EPS: ’25 (Exp.) EPS = $264.00 (+7.7%). ‘24 EPS = $245.16 (+11.5%). 2023 = $220 (+8.6%). 2022 = $219 (+0.5%). 2021 = $204.*

Valuations: S&P 500 Fwd. P/E (NTM): 20.4x, EAFE: 14.6x, EM: 12.0x, R1V: 16.5x, and R1G: 25.2x.*

*Source: Bloomberg and FactSet, Data as of 4/30/25

Disclosures

Aptus Capital Advisors, LLC is a Registered Investment Advisor (RIA) registered with the Securities and Exchange Commission and is headquartered in Fairhope, Alabama. Registration does not imply a certain level of skill or training. For more information about our firm, or to receive a copy of our disclosure Form ADV and Privacy Policy call (251) 517-7198 or contact us here. Information presented on this site is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy.

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

The S&P 500® is widely regarded as the best single gauge of large-cap U.S. equities. There is over USD 11.2 trillion indexed or benchmarked to the index, with indexed assets comprising approximately USD 4.6 trillion of this total. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

The Nasdaq Composite Index measures all Nasdaq domestic and international based common type stocks listed on The Nasdaq Stock Market. To be eligible for inclusion in the Index, the security’s U.S. listing must be exclusively on The Nasdaq Stock Market (unless the security was dually listed on another U.S. market prior to January 1, 2004 and has continuously maintained such listing). The security types eligible for the Index include common stocks, ordinary shares, ADRs, shares of beneficial interest or limited partnership interests and tracking stocks. Security types not included in the Index are closed-end funds, convertible debentures, exchange traded funds, preferred stocks, rights, warrants, units and other derivative securities.

The Dow Jones Industrial Average® (The Dow®), is a price-weighted measure of 30 U.S. blue-chip companies. The index covers all industries except transportation and utilities.

The MSCI EAFE Index is an equity index which captures large and mid-cap representation across 21 Developed Markets countries*around the world, excluding the US and Canada. With 902 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

The MSCI Emerging Markets Index captures large and mid-cap representation across 26 Emerging Markets (EM) countries*. With 1,387 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

Investment-grade Bond (or High-grade Bond) are believed to have a lower risk of default and receive higher ratings by the credit rating agencies. These bonds tend to be issued at lower yields than less creditworthy bonds.

Non-investment-grade debt securities (high-yield/junk bonds) may be subject to greater market fluctuations, risk of default or loss of income and principal than higher-rated securities.

Nasdaq-100® includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. This includes Treasuries, government-related and corporate securities, mortgage-backed securities, asset-backed securities, and collateralized mortgage-backed securities. ACA-2505-6.